1. Introduction

FedEx Corporation is an international courier group founded in 1971 and headquartered in Memphis, Tennessee, USA. It is one of the world's largest express transportation companies and one of the world's largest air cargo carriers [1]. FedEx is one of the world's four largest express carriers, along with DHL Air Cargo, UPS, and the United States Postal Service (USPS). It offers overnight express, ground express, heavy freight transportation, document copying, and logistics services. It also provides a full range of services for transportation, e-commerce, and business operations. FedEx occupies an important business in international business. In 2020, FedEx's international business parcel volume amounted to 3,178,000 packages per day, of which 74% of the international local business volume accounted for 29% of the revenue. There are two types of services in FedEx, the first service is FedEx IP. It refers to FedEx Priority service, the time limit is a little faster, and the price is relatively higher than the ordinary one. The second service is FedEx IE, which refers to FedEx Economy service, which is slower than FedEx IP, but relatively cheaper. In fact, in the end, it is the difference between the time limit and the price, FedEx IP time limit is fast and the price is high, FedEx IE time limit is slow and the price is low. Customers can choose FedEx IP service if their goods are in a hurry, and they can choose FedEx IE service if their goods are not in a hurry, and they can save part of the freight. Now FedEx has to serve 3 million customers in 210 cities every day, and its main competitors include DHL Air Cargo, UPS and the United States Postal Service (USPS), and TNT in the Netherlands. FedEx now has transshipment centers in Asia, Europe, and Latin America, and it also has a global air and land transportation network. So even cross-border courier can be delivered in one to two days. FedEx has about 215,000 employees worldwide, and FedEx every working day to transport about 3.3 million packages. FedEx is currently operating the world's largest cargo fleet. With 654 aircraft, FedEx is the world's fifth-largest airline by number of aircraft, and the largest operator of A300, A310, Boeing 757, ATR42, Cessna 208, McDonnell Douglas MD-10, and McDonnell Douglas MD-11 aircraft. FedEx has annual revenue of $93.512 billion in 2020 and reported adjusted operating profit of $1.42 billion on revenue of $22.2 billion for the second fiscal quarter of 2023 on December 20, 2023.Total revenue for the third quarter of 2023-2024 was $21.738 billion. It is ranked No. 1 inside its industry. Next, the SWOT analysis of FedEx will be carried out from the following four aspects: strengths, weaknesses, opportunities and threats.

2. SWOT Analysis

Founded on October 2, 1997, FedEx Corporation is the world's largest express transportation company, providing scheduled delivery services to more than 220 countries and territories, connecting markets that account for more than 90 percent of the world's gross domestic product. FedEx is part of the U.S.-based FedEx Group, which provides a full range of transportation, e-commerce and business operations services to customers and businesses [2]. FedEx Corporation has six key strengths. They are reputation, extensive global coverage, speed and reliability, diverse services, customer support and reliable security. FedEx is one of the most trusted and respected companies in the world and the FedEx brand is a powerful sales and marketing tool. (Reputation) FedEx has a large and well-established global network that enables it to provide international express and logistics services to many countries and regions [3]. This enables users to send and receive packages and shipments conveniently. (Extensive Global Coverage) Known for its efficient operations and advanced transportation technology, FedEx is committed to ensuring that shipments are delivered quickly and provides real-time tracking and notification services to keep users informed of the status of their shipments. (Fast and Reliable) FedEx offers many types of services, including domestic and international express, ground and air transportation, cargo warehousing and supply chain management. Both individual users and corporate customers can find a service that suits their needs. (Diversified Services) FedEx focuses on the customer experience, providing dedicated customer support teams to answer questions and handle complaints. FedEx also offers online platforms and mobile apps that make it easy for users to track shipments, schedule pickups and manage their accounts. (Customer Support) FedEx prioritizes security and takes every measure to ensure the safety of shipments. FedEx has dedicated security teams and processes to prevent shipments from being lost, damaged or stolen. (Reliable Security)

FedEx has four weaknesses. They are high costs, possible delays, package restrictions and requirements, and possible customer service issues. FedEx's quality of service and coverage comes with correspondingly high costs [4]. Compared to its competitors, FedEx's shipping costs are generally high, especially for large or heavy packages. FedEx also has higher shipping costs outside of North America, Europe, and Southeast Asia. FedEx surcharges are more frequent and heavier-than-actual shipments need to be costed on a volumetric weight basis (L*W*H/5000). (High Cost) Although FedEx is committed to providing fast and reliable delivery services, shipments may be delayed under certain circumstances, such as inclement weather, customs inspections and other force majeure factors. This may affect users' schedules and plans. (Possible Delays) FedEx has certain limitations and requirements on the size, weight and content of packages. Packages exceeding these limits may be subject to additional charges or may not be shipped. Many specialty items will be refused. (Package Limits and Requirements) Although FedEx has a dedicated customer support team, in some cases, users may experience communication problems or difficulties in handling complaints. (Possible Customer Service Issues)

There are four opportunities for FedEx Corporation. They are globalization, technological innovation, diversified services and sustainability [5]. As the global demand for international logistics and express delivery grows, FedEx can capitalize on its strengths to provide better services and meet the various needs of customers in different countries. (Globalization) FedEx is able to innovate and improve on existing technologies to respond to changing market needs. For example, FedEx can invest in automation, artificial intelligence, and big data analytics, which not only improves efficiency, but also reduces labor and avoids errors. In the long run, it can significantly reduce costs. (Technological innovation) FedEx can provide customers with customized logistics solutions, cross-border e-commerce services, order articulation and other special services to meet the different needs of different customers. (Diversified services) Nowadays, the whole world is very concerned about environmental protection, and FedEx can make a difference in this regard. For example, adopting a more low-carbon mode of transportation, changing the way of customs clearance and transportation, reducing the use of packaging materials and improving the utilization rate of energy, all these measures can reduce the impact on the environment and provide a guarantee for the sustainable development of the enterprise. (Sustainable development)

There are six threats to FedEx: (1)Many of FedEx's advantages will be lost once direct flights are fully opened up to the other three international couriers. (2)FedEx's market position is very similar to that of UPS. However, FedEx has no obvious advantage over UPS. (3)China's express market is characterized by the fact that it does not need a very high level of service, as long as it is suitable. (4)Hong Kong's express companies have seized the express business in South China, providing cheap international express and international air transportation services. (5)Federal Express in North America and Asia's logistics and express advantage, as well as in the United States sales on the economic win slump, affecting the development of Federal Express business [6]. (6)Federal provides insurance coverage for certain costs incurred during transportation, and the cost of insurance and reimbursement could have an undue material adverse effect on it.

3. Valuation

FedEx is a giant express delivery industry in the United States, and its competitors are United Parcel Service (UPS), CH Robinson Worldwide Incorporation (CH Robinson), J.B Hunt Transport Services (J.B Hunt). With the analysis of FedEx's financial ratio table below, it is beneficial to know more about this company and help potential investors to make better investment decisions.

3.1. Ratio Analysis

Table 1: Financial ratios of FedEx and its competitors.

|

FedEx |

CH Robinson |

J.B HUNT |

UPS |

Share Price |

$266.74 |

$70.26 |

$163.74 |

$144.85 |

EPS Growth Rate |

11.3% |

-1.6% |

10.5% |

-7.1% |

Revenue Growth Rate |

-2.2% |

0.03% |

2.5% |

2.3% |

TTM P/E |

17.82 |

21.82 |

25.99 |

16.50 |

NTM P/E |

16.01 |

22.16 |

23.53 |

17.75 |

PEG Ratio |

1.58 |

NA |

2.48 |

NA |

GP/A |

62.4% |

49.8% |

61.6% |

95.5% |

The NTM P/E ratio of FedEx is 16.01 and its PEG ratio is 1.58 which is the lowest among these four corporations. The GP/A ratio of UPS is 95.5%, much higher than FedEx, however, the PEG ratio of UPS is negative, so it would not be computed. Similarly, CH Robinson not only has a negative PEG ratio, but also the second highest TTM P/E ratio and NTM P/E ratio, so it would not be calculated as well.

Although FedEx has a lower PEG ratio than J.B Hunt, it has a negative revenue growth rate, which may lead to decline in EPS growth rate in the future. Meanwhile, J.B Hunt has both positive EPS and revenue growth rates, 10.5% and 2.5% respectively, meaning that it would bring considerable benefits in the future. Therefore, J.B Hunt is preferred to FedEx. On the other hand, J.B Hunt has the highest TTM P/E ratio and NTM P/E ratio, 25.99% and 23.53% independently, so it is more expensive per unit of growth rate compared to FedEx. Additionally, FedEx has a much higher GP/A ratio than J.B Hunt. Thus, from this point of view, FedEx is preferred to J.B Hunt. Therefore, it is truly necessary to compare their annual and quarterly gross margin next.

3.2. Annual and Quarterly Gross Margin Comparison

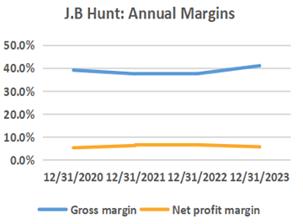

Gross margin for FedEx has higher decrease from peak COVID-19 period (see Figure 1(a)). However, gross margin for FedEx is overall higher than J.B Hunt and more stable from 2020 to 2023 (see Figure 1(b)). FedEx is about 60 percent annually while J.B Hunt is only closed to 40 percent. In addition, Net profit margin for FedEx has higher increase from peak Covid years, which is 2.5 percent larger than 0.4 percent for J.B Hunt. All of them above illustrate FedEx would like to have higher earnings in the future.

Compared to FedEx, J.B Hunt is more steadily in spite of the low rate of return (see Figure 2(a)). It is obvious that both gross profit margin and net profit margin for J.B Hunt has higher increase from peak COVID-19 period (see Figure 2(b)). Furthermore, J.B Hunt has higher and more stable net profit margin than FedEx on the whole despite of a little of fluctuation. In other words, to determine which stock is a better investment, further analyzing the quarterly change in gross margin table is significant.

|

|

(a) FedEx |

(b) J.B Hunt |

Figure 1: Annual profit margin ratios (Photo/Picture credit: Original).

|

|

(a) Annual gross margin |

(b) Annual net profit margin |

Figure 2: Comparison of annual profit margin ratios between FedEx and J.B Hunt (Photo/Picture credit: Original).

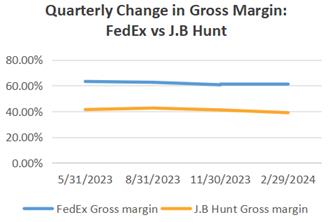

From Figure 3, it is more clearly to identify the distinction between FedEx and J.B Hunt. Obviously, FedEx is higher than J.B Hunt in quarterly change in gross margin. Both two curves depict a slight downward trend, one near 60% and the other one around 40%, showing a nearly parallel with their annual gross margin. Thus, the quarterly change in gross margin table also demonstrates FedEx have better yields than J.B Hunt, which may bring high rate of return in the near future.

Figure 3: Quarterly change in gross margin of FedEx and J.B Hunt (Photo/Picture credit: Original).

4. Risk Assessment

FedEx current negative revenue growth rate may affect the stock valuation negatively and the decline in revenue and EPS growth rates in the future may also have a great impact on their stock price. Because they are high and they support high P/E ratio for the stock. Thus, if they decline, P/E ratio may decline, which will lead to lower returns.

In addition, FedEx transportation businesses are affected by the price and availability of jet and vehicle fuel [7]. As jet and vehicles are truly vital materials in logistics companies and FedEx must purchase large quantities of fuel to operate their aircraft and vehicles, but the price and availability of fuel is beyond their control and can be highly volatile [8]. Therefore, if they are unable to maintain or increase their fuel surcharges because of competitive pricing pressures or some other reason, fuel costs could adversely affect their operating results.

Additional changes in international trade policies and relations could significantly reduce the volume of goods transported globally and adversely affect FedEx business and results of operations [7]. Nowadays, the U.S. government has taken certain actions that have negatively affected U.S. trade, including imposing tariffs on certain goods imported into the U.S. Additionally, several foreign governments have imposed tariffs on certain goods imported from the U.S. [9]. These actions contributed to weakness in the global economy that adversely affected FedEx results of operations in recent years. Any further changes in U.S. or international trade policy, including tariffs, export controls, quotas, embargoes, or sanctions, could trigger additional retaliatory actions by affected countries, resulting in “trade wars” and further increased costs for goods transported globally, which may reduce customer demand for these products if the parties having to pay tariffs or other anti-trade measures increase their prices, or in trading partners limiting their trade with countries that impose such measures [10]. Political uncertainty surrounding international trade and other disputes could also have a negative effect on business and consumer confidence and spending. Such conditions could have an adverse effect on FedEx business, results of operations, and financial condition, as well as on the price of FedEx common stock.

5. Conclusion

As discussed above in this paper, it would be intriguing to pick a stock between FedEx and its competitors, especially compared to J.B Hunt. This is because the financial ratios between these two enterprises are so close that even though FedEx has a slight advantage, it is still difficult to determine who is the best investment decision. Therefore, it depends on the investor's decision. If investors would like to choose a cautious, conservative investment, J.B Hunt is preferred to FedEx as its data is relatively stable and would not fluctuate drastically. On the contrary, FedEx is better for investors who pursue a high rate of return and are not afraid of taking certain risks, high profits naturally coming with high risks.

This paper recommends FedEx stock for investors. Based on the overall trend of economic globalization in the future, with the development of science and technology and the progress of economy, the trend of economic globalization is inevitable, and international logistics companies play an irreplaceable role in trade between countries and countries, so the international logistics business will be more and more recognized, and the lives of people are more and more inseparable from it. Furthermore, according to the reality, the main business of FedEx is more inclined to global logistics delivery, while J.B Hunt is more focused on truck delivery, so this is one of the reasons why FedEx is more suitable than J.B Hunt to invest. But the investors also have to consider the risks FedEx faces. As mentioned above, the logistics industry is facing the volatility and uncertainty of jet and fuel prices, which is now experiencing negative EPS growth due to large fluctuations in fuel prices, so it may lead to decrease in further stock price of FedEx. This is also a vital point that this paper recommends investors to pay attention to when choosing to consider investing in FedEx stock.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Popescu, A., Keskinocak, P., & Mutawaly, I. A. (2010). The air cargo industry. Intermodal transportation: Moving freight in a global economy, 209-237.

[2]. Kang, H., & Huh, C. (2017). Exploration of the sources of competitive advantage: UPS vs. FedEx. Journal of Management Cases, 5.

[3]. Ling, T. K., Lee, C. K., & Ho, W. (2009). The analysis and case studies of successful express logistics companies. International Journal of Value Chain Management, 3(1), 20-35.

[4]. Birla, M. (2013). FedEx Delivers: How the World's Leading Ship** Company Keeps Innovating and Outperforming the Competition. John Wiley & Sons.

[5]. Pu, Y. (2023). FedEx air cargo sustainability optimization analysis, Haaga-Helia University of Applied Sciences.

[6]. Wan, Y., & Zhang, A. (2018). Air cargo transport and logistics in Hong Kong and Southern China. Routledge Handbook of Transport in Asia, 378-401.

[7]. FedEx Corporation. (2024). FedEx Corporation Form 10-K for the Fiscal Yeat Ended May 31, 2023. https://s21.q4cdn.com/665674268/files/doc_financials/2023/q4/FedEx-FY23-10-K.pdf

[8]. Huertas, J. I., Serrano-Guevara, O., Díaz-Ramírez, J., Prato, D., & Tabares, L. (2022). Real vehicle fuel consumption in logistic corridors. Applied Energy, 314, 118921.

[9]. Beverelli, C., & Ticku, R. (2022). Reducing tariff evasion: The role of trade facilitation. Journal of Comparative Economics, 50(2), 534-554.

[10]. Fetzer, T., & Schwarz, C. (2021). Tariffs and politics: evidence from Trump’s trade wars. The Economic Journal, 131(636), 1717-1741.

Cite this article

Chen,S.;Luo,Z. (2024). A Financial Analysis and Valuation of FedEx Corporation. Advances in Economics, Management and Political Sciences,102,211-217.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Decoupling Corporate Finance Implications of Firm Climate Action

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Popescu, A., Keskinocak, P., & Mutawaly, I. A. (2010). The air cargo industry. Intermodal transportation: Moving freight in a global economy, 209-237.

[2]. Kang, H., & Huh, C. (2017). Exploration of the sources of competitive advantage: UPS vs. FedEx. Journal of Management Cases, 5.

[3]. Ling, T. K., Lee, C. K., & Ho, W. (2009). The analysis and case studies of successful express logistics companies. International Journal of Value Chain Management, 3(1), 20-35.

[4]. Birla, M. (2013). FedEx Delivers: How the World's Leading Ship** Company Keeps Innovating and Outperforming the Competition. John Wiley & Sons.

[5]. Pu, Y. (2023). FedEx air cargo sustainability optimization analysis, Haaga-Helia University of Applied Sciences.

[6]. Wan, Y., & Zhang, A. (2018). Air cargo transport and logistics in Hong Kong and Southern China. Routledge Handbook of Transport in Asia, 378-401.

[7]. FedEx Corporation. (2024). FedEx Corporation Form 10-K for the Fiscal Yeat Ended May 31, 2023. https://s21.q4cdn.com/665674268/files/doc_financials/2023/q4/FedEx-FY23-10-K.pdf

[8]. Huertas, J. I., Serrano-Guevara, O., Díaz-Ramírez, J., Prato, D., & Tabares, L. (2022). Real vehicle fuel consumption in logistic corridors. Applied Energy, 314, 118921.

[9]. Beverelli, C., & Ticku, R. (2022). Reducing tariff evasion: The role of trade facilitation. Journal of Comparative Economics, 50(2), 534-554.

[10]. Fetzer, T., & Schwarz, C. (2021). Tariffs and politics: evidence from Trump’s trade wars. The Economic Journal, 131(636), 1717-1741.