1. Introduction

1.1. Research Background and Motivation

Spin-off and listing originated in the European and American markets, which refers to the act of the parent company spinning off part of its business, assets or subsidiaries from the parent company to form an independent entity to be listed in the capital market. In the middle of the 20th century, in order to achieve the diversification of corporate development strategies and the diversification of business risks, many European and American enterprises chose to adopt the method of spin-off and listing to carry out contractionary capital operations, revitalize the capital resources required for the business development of subsidiaries, standardize the operation and governance mechanism of subsidiaries, and reduce the management costs of the entire corporate system, the lack of financing channels, the asymmetry of corporate information, and the low management efficiency [1].

Compared with overseas capital markets, China's spin-offs started relatively late, and they are subject to stricter regulation in various fields. With the establishment of the Science and Technology Innovation Board in 2018 and the promulgation and implementation of the Several Provisions on the Pilot Domestic Listing of Subsidiaries of Listed Companies Spin-off in 2019, the enthusiasm for spin-offs of listed companies in China has been greatly stimulated, and more and more companies have begun to launch spin-off and listing plans.

This paper takes the rationality of the motivation and the possible economic consequences of the spin-off as the starting point, takes the AMPS model, case analysis method and event research method as the main research methods, and makes an in-depth analysis based on the actual case of Ningbo Zhoushan Port's spin-off of Ningbo COSCO. It is hoped that this article can provide valuable theoretical reference and practical guidance for other companies considering spin-offs and listings.

1.2. Literature Review

1.2.1. Motivation for Spin-offs

Nanda believes that the information asymmetry between the company's external investors and internal managers is extremely obvious, and through spin-offs, the positive information that the company's value is undervalued by the market can be successfully transmitted to the market. The research on spin-offs and listings in China started late and has little practical experience, so scholars mainly focus on specific case companies [2]. Xiao Dayong et al. conducted a study on the financial characteristics of Tongfang shares and found that the company's motivation for the spin-off listing was market value management, and the spin-off listing could increase the overall market value of the company [3]. Li Ping conducted a study on the financial characteristics of Kingsoft Office and found that the company's spin-off was driven by a large demand for funds and an urgent need to raise funds quickly and at a lower cost through spin-off and listing [4].

1.2.2. Spin-off Listing Performance

Schipper and Smith first began to analyze 76 companies that were successfully spun off in the U.S. from 1963 to 1984 and found that the parent company's stock price achieved an excess return of 1.83% on the date of the spin-off announcement [2]. For subsidiaries, Prezas et al. began to pay attention to the spin-off and listing companies from 1986 to 1995, and selected a total of 251 spin-off and listing samples, and found that the average return rate of the subsidiaries was 5.83% on the first day and 5.43% in the first week of listing [2]. Wang Huacheng and Cheng Xiaoke systematically analyzed the relationship between the equity value of the spin-off listed company and the parent company based on Tong Ren Tang's spin-off behavior, and pointed out that the stock price of the subsidiary in the early stage of listing reflects that the spin-off has caused a substantial loss in the equity value of the parent company, but in the long run, the spin-off and listing can create income for the parent company [5]. Gan Lei's research pointed out that spin-offs do improve the financial performance of subsidiaries in the short term, but in the long run, whether the spin-off will have an impact on long-term performance also needs to consider whether the company can make good use of the funds raised [6].

Previous studies have been conducted from two perspectives: one is the motivation of spin-offs, and the other is the financial performance response of spin-offs. Due to the different research cases selected by different scholars, the reference standards and quantitative indicators are not uniform, so the actual spin-off effect is different. At the same time, as for the motivation of spin-off and listing, domestic and foreign studies have put forward a variety of motivational theories, including broadening financing channels, market value management and management incentives, implementing core strategies, and obtaining excess investment returns. The spin-off of Ningbo Port and the listing on the main board of Ningbo COSCO are the first case of "A split A" of China's port and shipping enterprises, which has strong demonstration significance. This paper focuses on the motivation and performance of Ningbo Port's spin-off and Ningbo COSCO's listing, and analyzes the influencing factors of spin-offs summarized by previous scholars, so as to provide reference for enterprises attempting spin-offs in China.

1.3. Research Methodology

1.3.1. Literature Research Method

By reading and researching the relevant literature on the motivation, risk and effect of spin-off and listing at home and abroad, the above theoretical research results are summarized, the research ideas and methods of the article are generated, and the research path of the article is constructed based on the relevant theoretical basis.

1.3.2. Incident Research Method

Firstly, the time of December 08, 2022, the spin-off listing date, was selected as the event date, the event window was set as five trading days before and after the event date, and the estimated window was set to 120 trading days before the event date, and the stock price data of Ningbo Port in the above two window periods were collected through the Juchao Information Network, and the expected rate of return, excess rate of return and cumulative excess rate of return of Ningbo Port were calculated by using the market model, and these were analyzed to determine whether the spin-off brought cumulative excess returns to the parent company. Judging by this, how market investors reacted to the spin-off of Ningbo Port.

1.3.3. AMPS Model

Ask the Question: This paper proposes what are the motivations for the spin-off and listing of Ningbo Port Company, and the impact of the spin-off and listing, as the main content of the follow-up research.

Master the Data: This article collects the stock price, financial statements, market analysis reports and related policy documents, news and other data of Ningbo Port before and after the spin-off and listing on websites such as Juchao Information and Oriental Fortune for analysis.

Perform the Analysis: This article analyzes the data using the case study method and the event study method.

Share the Story: This article uses a time series approach to present the data collected above.

2. Case Description

2.1. Company Profile

On March 31, 2008, Ningbo Port Co., Ltd. was established by Ningbo Port Group as the main sponsor and 7 units including China Merchants International. The business scope mainly includes containers, iron ore, crude oil, coal, liquefied products, general cargo and other cargo handling business. On September 28, 2010, with the approval of the China Securities Regulatory Commission, Ningbo Port Co., Ltd. was officially listed on the Shanghai Stock Exchange.

Founded in 1992 and listed on the main board of the Shanghai Stock Exchange on December 8, 2022, Ningbo COSCO is the first listed company in China's port and shipping industry. The company is mainly engaged in international, coastal and Yangtze River route shipping business, shipping agency business and dry bulk freight forwarding business, is one of the few comprehensive shipping companies in China.

2.2. Spin-off and Listing Process

On December 28, 2020, the board of directors of Ningbo Zhoushan Port passed the "Proposal of the Company on Planning the Spin-off and Listing of Subsidiaries", agreed to Ningbo COSCO's planning for spin-off and listing, and authorized the company and the management of Ningbo COSCO to start the preparatory work for the spin-off and listing of Ningbo COSCO. From December 2020 to March 2021, Ningbo Sino-Ocean increased its registered capital from 400 million yuan to 1.178 billion yuan through capital increase and the introduction of strategic investors Zhejiang Fuzhe Capital Management Co., Ltd., Hangzhou Iron and Steel Group Co., Ltd. and Zhejiang Airport Group Co., Ltd. In order to avoid potential competition in the same industry, on March 5, 2021, Ningbo COSCO acquired 100% of the equity of Haigang Shipping held by Zhejiang Seaport Group. On March 23, 2021, Ningbo COSCO completed the share reform and changed to Ningbo Ocean Shipping Co., Ltd., realizing the first step of IPO listing. On April 7, 2021, the board of directors approved the "Plan for Listing on the Main Board of Ningbo COSCO to the Main Board of the Shanghai Stock Exchange", which was officially accepted by the Ningbo Regulatory Bureau of the China Securities Regulatory Commission on April 29. On September 10, 2021, the application materials for the spin-off and listing were submitted to the China Securities Regulatory Commission; On the 17th of the same month, the prospectus (declaration draft) for the initial public offering of shares was disclosed, clarifying that 207.84 million shares were to be issued this time, and the total share capital was changed to 1385.61 million shares after the issuance, and it was officially listed on the Shanghai Stock Exchange on December 8, 2022 [7].

3. Driver Analysis

3.1. Policy Support and External Environment

Since the outbreak of the "black swan event" of the new crown pneumonia epidemic, foreign regions have continued to fall into the epidemic, and the world's demand for Chinese goods is at a historical high. At present, the utilization rate of shipping ships has been as high as 95%, and shipbuilding takes a long time and cannot be completed overnight [8].

The continuous recurrence of the epidemic has caused a box to be hard to find. In this context, the Baltic Index has hit a new high, rising from about 700 points before 2019 to 3 000 - 4 000 points, and the shipping market has shown explosive growth.

At the same time, thanks to the support of the national "Belt and Road" policy, the Regional Comprehensive Economic Partnership (RCEP) implemented in 2022, and the continuous expansion of China's international market demand, the company's future financial position and profitability prospects are good, and the spin-off of Ningbo Zhoushan Port and the listing of Ningbo COSCO will help seize the development opportunities of the industry [7].

3.2. Internal Factors

Before the spin-off and listing, due to the wide range of business scope of the parent company and the lack of clarity in the business boundaries of the parent and subsidiary, the information of the subsidiary will not be fully disclosed, resulting in a large deviation in the valuation of the subsidiary in the market and cannot reflect its actual value [9].

After the spin-off and listing, Ningbo COSCO, as an independent entity, is obliged to make timely and comprehensive disclosure of the company's financial status, operating results, investment and financing and other data in accordance with relevant laws and regulations, so that the market can have a timely and comprehensive understanding of the company's operation and revise the valuation of the subsidiary in the capital market.

On the first day of the spin-off and listing, the total market value of Ningbo COSCO reached about 15.494 billion yuan, and the price-earnings ratio reached 22.97 times, which shows that as a high-quality subsidiary of the group, the spin-off and listing effectively released the true value of Ningbo COSCO and reduced the impact of information asymmetry on its valuation [10].

4. Performance Analysis

4.1. Market Reflection Analysis Based on Event Research Method

4.1.1. Determination of the Event Date and Window Period

Taking Ningbo COSCO, a spin-off of Ningbo Port, as the research event, using the excess rate of return (AR) and cumulative excess rate of return (CAR) as the measurement indicators, the listing date of December 8, 2022 was set as the event date (t=0), and the 5 trading days before and after the event date [-5, 5] were selected as the event window period to observe the market reaction. To calculate the excess rate of return (AR), the 120 trading days [-126, -6] before the event date are selected as the estimated period of expected return.

4.1.2. Build an Estimated Model of Expected Rate of Return

In this paper, the capital asset pricing model is selected to estimate the expected rate of return, as follows:

\( \text{R}_{\text{it}}\text{=α+β}\text{R}_{\text{mt}} \) (1)

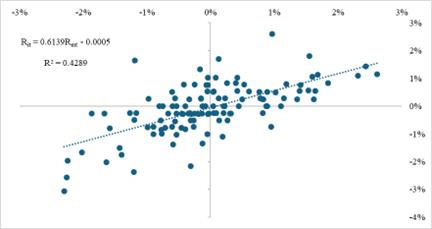

Where is the \( \text{ }\text{R}_{\text{it}}\text{ } \) actual rate of return of Ningbo Port on day t; \( \text{ }\text{R}_{\text{mt}}\text{ } \) is the market rate of return on day t; \( \text{α} \) \( \text{α} \) is a constant term; 𝛽 is the regression coefficient. Searching for the return of individual stocks and the return of the Shanghai Composite Index 120 days before the event date, and using Excel to perform a linear regression of the actual return of the estimation period [-126,-6] and the return of the Shanghai Composite Index, it can obtain the scatter plot of the regression equation for the estimation period (Figure 1). is a constant term; \( \text{β } \) \( \text{β } \)

The regression equation is:

\( \text{R}_{\text{it}}\text{=0.6139*}\text{R}_{\text{mt}}\text{-0.0005} \) (2)

Figure 1: Event day regression equation fitting diagram

Data source: Juchao Information Network

4.1.3. Calculate the Abnormal Rate of Return and the Cumulative Rate of Return

According to the regression relationship obtained in the estimation period, the AR and CAR of Ningbo Port in the window period are calculated, as shown in Table 1

Table 1: Excess Return on Stocks, AR and Cumulative Excess Return CAR during the window period

Time point t |

Yield of the Shanghai Composite Index

|

Ningbo Port yield |

Expected rate of return |

Excess Rate of Return (AR)

|

Cumulative Excess Rate of Return (CAR)

|

-5 |

0.45% |

-0.54% |

0.23% |

-0.77% |

-0.77% |

-4 |

-0.30% |

-0.82% |

-0.23% |

-0.58% |

-1.35% |

-3 |

1.76% |

2.74% |

1.03% |

1.71% |

0.36% |

-2 |

0.02% |

0.00% |

-0.04% |

0.04% |

0.39% |

-1 |

-0.40% |

-0.80% |

-0.30% |

-0.50% |

-0.11% |

0 |

-0.07% |

1.34% |

-0.09% |

1.44% |

1.33% |

1 |

0.30% |

-2.12% |

0.13% |

-2.26% |

-0.93% |

2 |

-0.87% |

-0.81% |

-0.58% |

-0.23% |

-1.16% |

3 |

-0.09% |

1.64% |

-0.10% |

1.74% |

0.58% |

4 |

0.01% |

-1.34% |

-0.05% |

-1.30% |

-0.71% |

5 |

-0.25% |

-0.82% |

-0.20% |

-0.61% |

-1.33% |

Data source: Juchao Information Network

According to Table 1, it can be found that the excess rate of return (AR) of Ningbo Port is basically in a state of fluctuating between (-2.3% and 1.8%), with 3 days of positive value and the remaining 7 days of negative value during the event window. It is not difficult to find that at t=-3, the AR value has increased significantly, and it is much higher than the expected rate of return of Ningbo Port at that time, and at the same time, it also shows an upward trend on the announcement day, so it can be judged that there may be a situation where the information of the spin-off listing is leaked to outsiders in advance [10].

At the same time, the cumulative excess rate of return (CAR) showed a downward trend, fluctuating around 0 before the announcement day, and showing an upward trend on the announcement day, but the overall downward trend after the announcement date. Combined with the sharp increase in the price-earnings ratio of Ningbo COSCO on the day of listing, check the company's announcement and find that Ningbo Port held a total of 90% of the shares of Ningbo COSCO before the spin-off and listing, and held a total of 81% of the shares after the spin-off and listing. It reflects that the market has a wait-and-see attitude towards the occurrence of this event in the short term.

4.2. Financial Performance Analysis

4.2.1. Solvency

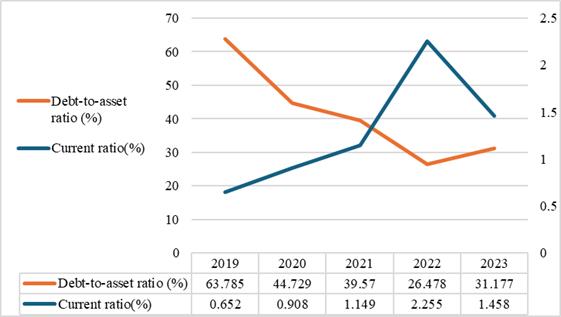

Ningbo COSCO's current ratio increased significantly in the year of spin-off and listing, with a year-on-year increase of 96.26%, which was due to the fact that Ningbo COSCO obtained about 6.2 billion yuan from the capital market through equity financing through spin-off and listing, and its current assets increased significantly and its current liabilities also decreased significantly, which significantly increased its current ratio and provided sufficient financial support for the company's long-term development and strategic layout. In the year of the spin-off and listing, Ningbo COSCO broadened its financing channels and a large amount of funds flowed into the company, which reduced the asset-liability ratio to 26.478%, reduced the financial risk, and made it possible for the company's asset-liability structure to be further improved [11].

As can be seen from Figure 2, on the whole, the spin-off and listing increased the current ratio and decreased the asset-liability ratio, indicating that the spin-off and listing significantly improved the solvency of Ningbo COSCO.

Figure 2: Changes in Ningbo COSCO's solvency index

Data source: Juchao Information Network

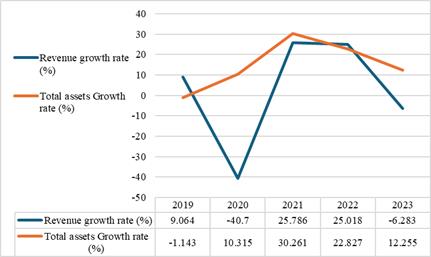

4.2.2. Development of Capacity

The growth rate of Ningbo COSCO's operating income reached 25.018% in the year of spin-off and listing, due to the diversified development of Ningbo COSCO's business segment after the spin-off and listing, which has a certain competitive advantage in the port industry. The growth rate of total assets reached a peak in the year of spin-off and listing, which was due to the fact that after being listed in the capital market, a large amount of capital flowed into the enterprise, which greatly increased the total assets, resulting in an increase in the growth rate [12]. The decline in various indicators in 2023 may be due to the gradual liberalization of the epidemic and the increase in customer choices, which led to a decline in some businesses and an impact on its total assets (Figure 3).

Figure 3: Changes in Ningbo's COSCO development capacity index

Data source: Juchao Information Network

4.2.3. Profitability

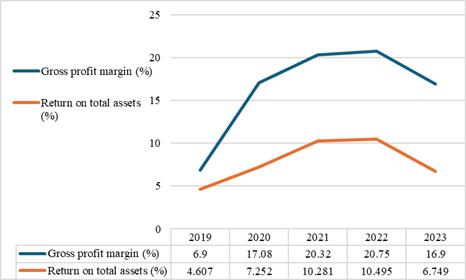

Ningbo COSCO's gross profit margin and return on total assets both increased slightly in the year of spin-off and listing compared with the previous year, but the growth rate slowed down significantly, and both declined in the second year, indicating that the spin-off and listing have boosted the company's profitability in the short term, but in the long run, it is still determined by the company's operating conditions (Figure 4).

Figure 4: Changes in Ningbo COSCO's profitability indicators

Data source: Juchao Information Network

4.2.4. Operational Capacity

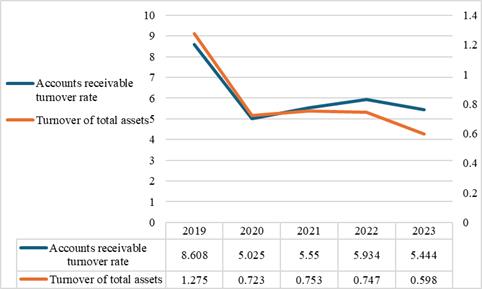

As can be seen from Figure 5, the accounts receivable turnover rate of Ningbo COSCO rebounded in the year of spin-off and listing compared with the previous year, reaching 5.934 times/year, but decreased in the following year, indicating that Ningbo COSCO spin-off and listing is optimistic about the market in the short term, but the market outlook is not optimistic in the long run. The total asset turnover ratio was basically the same as the previous two years, and then gradually declined, indicating that the spin-off listing has improved the sales level of Ningbo Port in the short term, but the long-term promotion effect is not significant.

Figure 5: Changes in Ningbo COSCO's operating capacity indicators

Data source: Juchao Information Network

To sum up, Ningbo COSCO has greatly improved its solvency after the spin-off and listing, reflecting that a large amount of capital has entered the enterprise in the market after its spin-off and listing, which has produced a positive effect on the operation of the enterprise. The positive effect of accounts receivable turnover rate, inventory turnover rate and total asset turnover rate is mostly reflected in the one year after the spin-off and listing, that is, from a long-term perspective, the promotion role of the spin-off and listing is not obvious, coupled with the impact of the general environment in the past two years, the overall development level of the industry has been limited to a certain extent, but in the short term, the management and governance level of Ningbo COSCO is still enhanced to a certain extent.

5. Suggestion

To sum up, after the spin-off and listing, Ningbo COSCO has improved its operating efficiency and corporate influence to a certain extent in the short term, and has produced positive results for the company's operation. However, from a long-term perspective, the promotion effect of spin-offs and listings is not obvious. At the same time, the spin-off and listing event did not make the parent company Ningbo Port obtain more obvious excess returns, which may be due to investors' concern that the parent company's control over the subsidiary has decreased, reflecting the market's wait-and-see attitude towards the occurrence of the event in the short term. Coupled with the impact of the general environment in the past two years, the overall development level of the industry has been limited to a certain extent. Before spin-off and listing, enterprises should comprehensively consider the operating conditions of the enterprise, combine their own operating conditions, clarify the overall strategic layout of the enterprise, correct the motivation for spin-off and listing, and at the same time correctly assess the development potential of the subsidiary and the development prospects of the industry in which it is located, and choose high-quality subsidiaries to spin off and list, rather than blindly following the trend of spin-off and listing, so as to create greater benefits for shareholders and investors.

6. Conclusion

This paper first introduces the theory of spin-off, then introduces the case, and finally analyzes the motivation and performance of the spin-off and listing of Ningbo Port. This paper uses a single case study method to analyze the changes in the financial performance of spin-off subsidiaries, so as to reflect the impact of spin-offs on the value of subsidiaries, and analyzes the overall effect of spin-offs and listings in combination with the short-term response of the capital market.

Since it is an analysis of a single case, the conclusions drawn are relatively limited and may not be applicable to all enterprises or industries, so there is a lack of a more detailed and comprehensive analysis of the impact on the value of spin-offs. Although Ningbo COSCO, as an excellent enterprise in the shipping field, has achieved a significant value enhancement in this spin-off and listing, it cannot simply be considered that these theories and methods are applicable to all shipping companies, especially other small and medium-sized property management companies. Whether the success of Ningbo COSCO can be effectively used as a reference by other enterprises in the industry needs to be further explored to determine the feasibility in different enterprise environments, and to adjust and optimize it accordingly.

References

[1]. Li Xinwei & Liu Hui. (2024). Research on the motivation and performance of spin-off and listing: A case study of Company J. Modern Marketing (Late Edition) (01), 64-66.

[2]. Zhao Tuanjie, Fu Yuanjiao & Zhang Xiaolu. (2023). Motivation and performance analysis of enterprise spin-off and listing: A case study of China Railway Construction's spin-off of China Railway Construction Heavy Industry. New Accounting (05), 28-32.

[3]. Xiao Dayong, Luo Xin, Deng Siyu & Dong Xue. (2013). Motivation for corporate spin-off and listing: market value management or expansion of financing channels, a case study of the spin-off and listing of the same party. Shanghai Management Science (06), 72-78.

[4]. Li Ping. (2022). Motivation and performance analysis of the spin-off and listing of Kingsoft Office. Investment and Entrepreneurship (07), 74-76.

[5]. Wang Huacheng, Cheng Xiaoke. (2003). Spin-off Listing and Equity Value of Parent Company: An Empirical Analysis of the Listing of "Tong Ren Tang" Spin-off Subsidiaries. Management World (04), 112-121.

[6]. Gan Lei. (2017). Master of Motivation and Performance Analysis of Kangenbei's spin-off of Zuoli Pharmaceutical Co., Ltd. (dissertation, Jiangxi University of Finance and Economics).

[7]. Xia Guanghui. (2022). Research on the spin-off and listing of port enterprises: A case study of the spin-off and listing of Ningbo COSCO in Ningbo-Zhoushan Port. China Ports (02), 24-26.

[8]. Zhang Guofu & Liu Wenkai. (2024). Analysis of the Motivation and Economic Consequences of Enterprise Spin-off and Listing. Mall Modernization (05), 132-134.

[9]. Zhong Zhiyu, Liang Yan & Zou Wenqing. (2021). Research on the Motivation and Economic Consequences of Enterprise Spin-off and Listing: A Case Study of Xinmai Medical. Business Accounting (20), 82-85

[10]. Jiang Xinyi. (2023). The Motivation and Value Impact of Country Garden Services' Spin-off and Listing, Master's Degree (Dissertation, Southwest University).

[11]. Li Tong. (2023). Master of Science on the Impact of Spin-off and Listing on Enterprise Value (Dissertation, Yunnan University of Finance and Economics).

[12]. Liu Bihan. (2023). Master of Science in Motivation, Market Reaction and Risk Research on the Spin-off and Listing of Hualan Biotech (Dissertation, East China University of Political Science and Law).

Cite this article

Guo,S. (2024). Motivation and Performance Analysis of Spin-offs and Listings: A Case Study of Ningbo-Zhoushan Port. Advances in Economics, Management and Political Sciences,98,94-103.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li Xinwei & Liu Hui. (2024). Research on the motivation and performance of spin-off and listing: A case study of Company J. Modern Marketing (Late Edition) (01), 64-66.

[2]. Zhao Tuanjie, Fu Yuanjiao & Zhang Xiaolu. (2023). Motivation and performance analysis of enterprise spin-off and listing: A case study of China Railway Construction's spin-off of China Railway Construction Heavy Industry. New Accounting (05), 28-32.

[3]. Xiao Dayong, Luo Xin, Deng Siyu & Dong Xue. (2013). Motivation for corporate spin-off and listing: market value management or expansion of financing channels, a case study of the spin-off and listing of the same party. Shanghai Management Science (06), 72-78.

[4]. Li Ping. (2022). Motivation and performance analysis of the spin-off and listing of Kingsoft Office. Investment and Entrepreneurship (07), 74-76.

[5]. Wang Huacheng, Cheng Xiaoke. (2003). Spin-off Listing and Equity Value of Parent Company: An Empirical Analysis of the Listing of "Tong Ren Tang" Spin-off Subsidiaries. Management World (04), 112-121.

[6]. Gan Lei. (2017). Master of Motivation and Performance Analysis of Kangenbei's spin-off of Zuoli Pharmaceutical Co., Ltd. (dissertation, Jiangxi University of Finance and Economics).

[7]. Xia Guanghui. (2022). Research on the spin-off and listing of port enterprises: A case study of the spin-off and listing of Ningbo COSCO in Ningbo-Zhoushan Port. China Ports (02), 24-26.

[8]. Zhang Guofu & Liu Wenkai. (2024). Analysis of the Motivation and Economic Consequences of Enterprise Spin-off and Listing. Mall Modernization (05), 132-134.

[9]. Zhong Zhiyu, Liang Yan & Zou Wenqing. (2021). Research on the Motivation and Economic Consequences of Enterprise Spin-off and Listing: A Case Study of Xinmai Medical. Business Accounting (20), 82-85

[10]. Jiang Xinyi. (2023). The Motivation and Value Impact of Country Garden Services' Spin-off and Listing, Master's Degree (Dissertation, Southwest University).

[11]. Li Tong. (2023). Master of Science on the Impact of Spin-off and Listing on Enterprise Value (Dissertation, Yunnan University of Finance and Economics).

[12]. Liu Bihan. (2023). Master of Science in Motivation, Market Reaction and Risk Research on the Spin-off and Listing of Hualan Biotech (Dissertation, East China University of Political Science and Law).