1. Introduction

1.1. Background

Since the industrial revolution, global warming has intensified. Temperature increases due to rising greenhouse gas concentrations [1]. There are recurring droughts, floods and heat waves. It will affect millions of people and cause billions of dollars in damage [2]. Recognizing the magnitude of the problem, countries have signed the Paris Agreement, which sets the goal of limiting global warming to a maximum of 1.5℃ [3]. Governments around the world have taken a range of measures to reduce carbon emissions in order to achieve this goal, including carbon taxes and emissions trading. Market-based mechanisms such as reducing carbon emissions are used not only for macroeconomic policies but also for reducing global carbon emissions. The current analysis, however, shows that national commitments and actions have had little impact on carbon emissions, whereas global carbon emissions are still increasing [4]. There is an urgent need to improve this framework if large reductions in greenhouse gas emissions are to be achieved. In this paper, we focus on China's energy sector and explore ways in which future efforts to reduce greenhouse gas emissions can be improved.

1.2. China's present situation

China plans to reverse this trend by formally establishing a national carbon market on 16 July 2021 and developing pilot local carbon markets in parallel with the national carbon market. The current carbon market, however, only covers half of the domestic market and faces issues such as unreasonable carbon prices and illiquidity [5]. Many researchers have identified benefits such as broad coverage of carbon taxes, another important tool for reducing emissions [6], but these still suffer from shortcomings and have not been implemented in China. China's carbon emission reduction measures have not yet been completed.

1.3. Reason for focusing on China's energy sector

China is the world's largest carbon dioxide emitter, accounting for one-quarter of the world's carbon dioxide emissions [7] and emissions are still increasing [8]. As of 2020, the energy sector, which relies primarily on the burning of fossil fuels to generate electricity, will account for approximately 40% of the total emissions of carbon dioxide [9]. In the course of the debate at the 75th UN General Assembly, President Xi Jinping announced that China would increase its national contribution and take stronger policy steps to achieve a 2030 peak in CO2 emissions and a 2060 increase in carbon neutrality [10]. The Chinese government also aims to reach carbon neutrality by the year 2060.

1.4. Research subject

For the energy sector, we will assess two mechanisms, the carbon tax and the carbon trade, based on the current state of China's domestic decarbonization measures, and study a balanced carbon trading and carbon taxation mechanism appropriate to the energy sector, including the short- and long-term potential and effectiveness of carbon taxes and carbon trading. That is, the goal is to combine the two mechanisms, with a focus on carbon tax policy in the short run and emissions trading policy in the long run. This would encourage China to significantly reduce its carbon emissions, as well as help it reach peak carbon and carbon neutrality more rapidly.

2. Literature review

2.1. Current situation of emission reduction policy in power industry in China

2.1.1. Development status of carbon tax in power industry

Climate change is a pressing global concern, prompting widespread attention and emphasizing the significance of cultivating a low-carbon economy and achieving a sustainable societal development. Current statistics reveal that the power industry contributes 40% of global CO2 emissions, followed by 23% from daily transportation and 22% from sources like cement plants, oil refineries, and steel mills [11]. Electric power, as a secondary energy source, plays a vital role in the economic growth and industrial production, experiencing substantial demand worldwide. Notably, in 2015, fossil energy accounted for approximately 89% of China's total primary energy demand [12], and 83.4% in 2022. Disturbingly, as of July 2017, an alarming 79.8% of China's total power generation originated from coal-fired power plants [13]. Despite the improvement, illustrated by the statistics of 71.13% in 2021 and 65.6% in 2022, it is crucial to reevaluate and adjust China's power industry energy structure. The reduction of greenhouse gas emissions becomes a pressing imperative for the country's power sector and a necessary step towards globally restructuring the energy production system.

The carbon tax policy is currently advocated and adopted as the most effective means in order to reduce carbon emissions among various climate protection strategies, with many countries implementing it in different forms. Extensive research has been conducted on the carbon tax and its implications. Studies demonstrate that the clean power industry would experience significant positive impacts once a carbon tax is imposed. In the short term, this policy can dramatically influence oil prices, leading businesses to curtail oil demand to manage costs [14]. Zhang examines China's carbon reduction policy using a recursive dynamic CGE model [15]. The findings also suggest that recycling carbon tax revenue can help alleviate the effects of implementing such a policy, especially in the short term. The implementation of a carbon tax is poised to exert a significant influence on China's power industry, leading to a diversified development of renewable energy sources to varying extents. China has the plan to increase the share of non-fossil energy in consumption in the future, hoping that by 2025, 2030 and 2060, the proportion of non-fossil energy will reach to about 20%, 25% and 80%. According to research, a substantial reduction of CO2 emissions can be reached in as early as 2030 to 2040. Through the adoption of a medium-level carbon tax as proposed in this study, the power industry can effectively meet emission reduction targets while minimizing associated costs. The medium carbon tax emerges as a potent and efficient tool for fostering environmental and economic sustainability [16].

2.1.2. Development status of carbon trading in power industry

In response to growing environmental concerns and climate change, China promised to be carbon neutral by 2060. While it is difficult to achieve carbon neutrality, it appears that carbon trading, as a means of improving energy efficiency and reducing emissions, is an important policy option for the promotion of carbon neutrality. As of July 26, 2023, the number of transactions in the pilot market in China has reached 241 million tonnes, and the total value of the total transaction is RMB 1.107 billion. However, China's carbon trading market is still at an exploratory stage [17]. Therefore, it is very important to perfect the implementing methods of carbon trading policy in China.

Currently, China's carbon emission trading system has been put into operation, and all pilot projects have essentially integrated the power industry into the carbon emission control [18], Which reflects the importance of implementing carbon trading policies in the power industry. The power industry is China's biggest carbon emitter and a major participant in the carbon market. As a result, more and more attention has been paid to the implementation of carbon trading in the power industry, and it has been proved that China's carbon emission trading policy has played an important role in reducing emissions [19]. With the deepening of the research, some scholars [20] used The TIMES model for quantitative scenario analysis and found that for the long-term goal of carbon dioxide emission reduction, the incremental cost attached to carbon trading policy is relatively low, and the use of carbon dioxide emission allowances has more advantages than carbon tax [21]. Some subsequent studies have found that some enterprises in the power industry mainly focus on reducing their output in the short term, rather than R&D and investment in emission reduction technologies [22], which is contrary to the purpose of carbon emission policy. Moreover, in the initial phase of China's carbon trading policy, only coal and gas generation units are included, which cannot cover all sectors.

2.1.3. Literature summary

In the short term, the carbon tax can solve the problem that the electricity supply can't satisfy the demand. However, in the long term, it is more efficient for carbon trading to reduce carbon emission in power industry. Therefore, exploring the balance mechanism of carbon tax and carbon trading in power industry will be the main problem to be solved. Former research has not discussed the topic in the perspective of combing long-term and short-term effects to propose a possible solution, and our paper will attempt to adapt this perspective.

In this study, we will try to put forward possible suggestions that we believe are viable and suitable for a better picture in reducing carbon emission in Chinese power industry.

3. Current status of carbon pricing mechanism in China

3.1. Current status of China’s carbon emission

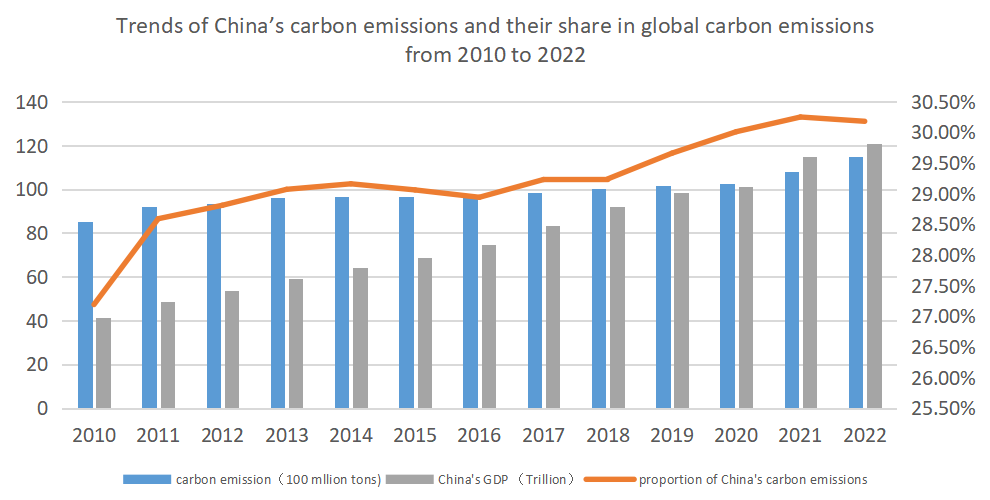

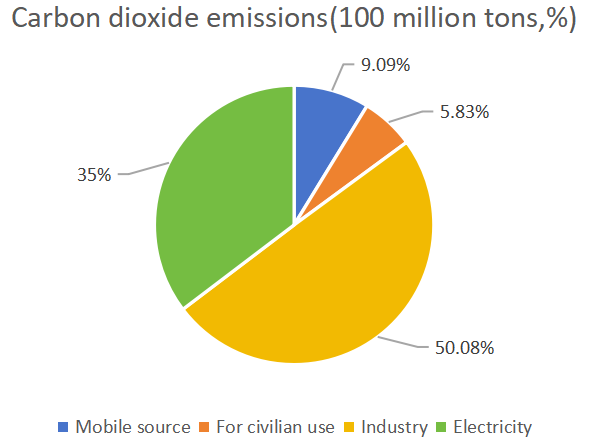

As can be seen from the figure 1, China's carbon emissions have shown an increasing trend over the years, and the proportion of the total global emissions is still stable at about 28%, and is on the rise. With the rapid development of China's national economy, electricity consumption is also increasing. Based on 2020 carbon emissions, the amount of emissions from coal-fired power stations reached 3.539 billion tonnes, accounting for more than one-third, 34.11%, and is the largest carbon emission industry. In terms of industry categories, as shown in figure 2, the power sector ranks after industry, with carbon dioxide emissions of 3.666 billion tons, accounting for 35%. China is a country with a large population and huge consumption of resources, and although carbon emissions are increasing, China's GDP is also growing. In addition, the growth rate of GDP is significantly faster than the growth rate of carbon emissions, which indicates that China has adopted policies to reduce carbon emissions, but the Chinese government still needs to further adopt efficient and correct emission reduction policies to prevent the continuous occurrence of extreme climate and the further deterioration of climate.

Figure 1: Trends of China’s carbon emissions and their share in global carbon emissions from 2010 to 2022

Figure 2: Proportion of China's carbon emissions by industry

3.2. Temporal analysis for the effectiveness of carbon tax and carbon trading

Based on the Table 1, it shows that the carbon tax is sufficiently effective in cutting carbon emissions worldwide. In the part of carbon emission reduction, different countries succeeded in decreasing carbon emission by practising carbon tax. In Denmark, 1.15 million tons of carbon dioxide was reduced. In Sweden, the carbon emission declined by 8% from 1990 to 2006. In America, the $10 carbon tax would cut carbon emissions by 1.39 to 1.55 billion tons per year, generating a net income of $106.47 to $118.33 billion. Thus, carbon tax is a strong method for the government to decrease the domestic carbon dioxide.

Table 1: Time dimension analysis table

Country | Carbon tax | Environmental effect |

Denmark | 1992: $17.38/t 1999: €12.1/t | The carbon emission of companies decreased 2.3 million tons in 2005. Half of the reduction was contributed by carbon tax. |

Netherland | 1995: $2.88/t | The carbon emission reduction in 2000 was 1.7-2.7 million tons. |

Finland | 1990: $1.62/t 2008: €20/t | From 1990 to 1998, carbon emission dropped by 7% per year compared with the situation without carbon tax. |

Sweden | 1991: $37.7/t 2009: $158.32/t | The carbon emission in 2006 was 8% less than that in 1990. |

Norway | 1995:Gasoline $19.72/t, Diesel $61.01/t 2013: $4.76/t-$71.46/t | From 1991 to 1993, the emission of carbon dioxide declined by 3%-4%. |

Britain | Gas: $16.87/t Coal: $9.08/t Electricity: $18.17/t | The reduction of carbon emission from 2001 to 2005 was 58 million tons. |

Canada | 2008: C$10/t 2012: C$30/t | From 2008 to 2011, the emission of CO2 per capita in British Columbia decreased by 10%. |

In China, carbon trading had been practised since 2021, and the national carbon dioxide emissions per unit of GDP in 2021 fell by 3.8% compared with 2020, or 50.8% compared with 2005. From 2021 to 2023, the cumulative trading volume of carbon emission quota is about 240 million tons, and the total number of transactions is about 11.03 billion yuan. Based on the data above, carbon trading presents a great effect on carbon emission reduction.

4. Feasibility analysis of two carbon pricing mechanisms

4.1. Feasibility analysis of carbon tax

Rob Dellink, an Irish scholar, once studied the impact of the implementation of carbon tax policy on the national economy based on the CGE model and took the economy of Ireland as the research object. In addition, a general equilibrium model of carbon tax is established, and it is concluded that carbon emissions can be reduced by 25% when the carbon tax rate is at the level of 10 euros /tC [23]. The imposition of carbon tax changes the cost of emitters, so emitters have to adjust their production behavior, thus limiting the listing of high energy consumption products and the effective mechanism of energy price fluctuations, can promote the generation and use of energy to achieve an effective balance, and further promote economic and social development and progress. According to the existing research theory and implementation results, carbon tax is proved to be feasible. First, there are international carbon tax experience that can be used for reference. Many countries and regions have adopted tax policies to control carbon emissions, enabling enterprises to enhance environmental awareness and reduce carbon emissions, and have achieved remarkable results. Second, there are already successful practice cases of similar taxes in China for reference. And as a mandatory content based on state rights, efficiency can also be fully guaranteed [24]. Finally, in recent years, China is increasing its efforts to realize the exploration of science and technology and the research and development of equipment, and a large number of talents in related fields have emerged, and carbon detection technology is gradually maturing. It provides guarantee for the effective implementation of carbon tax system.

The implementation cost of carbon emission trading and carbon tax mainly refers to the initial cost consumed when the emission reduction mechanism is actually put into operation. For the power sector, the implementation costs of emissions trading are relatively complex compared to carbon taxes. On the one hand, the determination of emission rights will take more time to adjust due to policy obstacles. Emissions trading, on the other hand, would require a completely different set of infrastructure, all of which, given China's current situation, is fraught with uncertainty [25]. On the contrary, all the actions of a carbon tax could be implemented based on the existing tax system, which is more suitable for short-term implementation. In order to achieve the goal of carbon neutrality and carbon peaking as soon as possible, starting from China's power industry, the carbon tax policy can be prioritized in the short term, starting from a low tax rate, constantly changing the collection method according to the actual situation, and gradually completing the carbon tax system.

4.2. Feasibility analysis of carbon trading

China's Emissions Trading Policy (CETP) and other countries' emissions trading rights policies have become global strategies to address the long-term 1.5 ° C target [26]. The implementation of China's CETP has great global benefits for reducing global carbon emissions and achieving the Paris Agreement's long-term objectives. As one of the major energy consuming industries in the country and the emission of pollutants, high-carbon power companies purchase emission permits from the carbon market, whereas low-carbon companies can sell the rest of the permits on the carbon market to make a profit. In the long run, it is conducive to the expansion of the living space of enterprises, effectively push forward the whole process of reducing carbon emissions in electric power industry, and enhance energy efficiency.

In practice, first of all, China's total carbon market is large. CDM projects focus on renewable energy, and China ranks first in the world. As of April 1, 2021, the registered projects are mainly concentrated in wind, hydropower, solar energy and other fields, of which the number of projects in China is 3,861, accounting for 45.9%, ranking first in the world. Second, coverage continues to grow. Currently, it is relatively easy to build a national carbon market, and the trading entities of the power industry only have key emission units. Once the power industry's carbon market operates stably, it is planned to expand its market trading units and trading products in an orderly manner, further expand the coverage of the country's carbon market to include more high-emitting industries. The plan calls for a nationwide carbon market to include eight energy intensive industries, including power generation, steel, building materials, nonferrous metals, petrochemical, chemical, paper and aviation, including about 8,500 carbon emission enterprises, and the carbon emissions under control will be around 70% of the country's total energy-related carbon emissions.

All in all, China's carbon trading system is in line with the Paris Agreement's long-term objectives. The implementation of ETS improves market liquidity, reduces price volatility and, most importantly, incentives companies in the industry to achieve emissions reduction targets more effectively.

5. Conclusion

Under the background of global carbon emission reduction, this article mainly analyzes the Chinese power industry according to the status quo, discusses the implementation effect of two mainstream related policies -- carbon tax and carbon trading, and makes suggestions for the formulation of future policies. Through the analysis of China's total carbon emissions, power industry carbon emissions data, and economic growth data, this paper analyzes the reasonable carbon emission reduction policy, and its importance. Based on the opinions of other scholars and policy implementation, academic analysis; pointed out the advantages and characteristics of carbon tax and carbon trading in the long and short term; proposed that the future carbon reduction in the short term and on carbon trading in the long term. The article hopes to add a force to carbon emission reduction through the analysis of advantages and disadvantages.

Acknowledgement

Jiayi Zhou, Luqi Wang, Nina Cai, Hanlu Sun and Xinyan Hu contributed equally to this work and should be considered co-first authors.

References

[1]. United Nations.(2023).Peace, dignity and equality on a healthy planet.https://www.un.org/zh/global-issues/climate-change

[2]. World Meteorological Organization.(2022).The WMO State of the Global Climate report 2022.

[3]. United Nations.(2015).Paris Agreement.

[4]. Un environmental progrmme.(2022).Emissions Gap Report 2022: The Closing Window.

[5]. IEA (2023), CO2 Emissions in 2022, IEA, Paris https://www.iea.org/reports/co2-emissions-in-2022, License: CC BY 4.0

[6]. The Jiusan Society.(2022).Proposal to study the introduction of a carbon tax as soon as possible.

[7]. Chang, Y.(2023).Duopoly with Limited Rationality in Carbon Market: A Comparison of Carbon Quota Trading and Carbon Tax System. Available at SSRN: https://ssrn.com/abstract=4395650

[8]. Zhang,D,Y.Huang,T.(2021).China's carbon emissions in 6charts.https://wri.org.cn/insights/data-viz-6-graphics-ghg-emissions-china

[9]. BBC Fact-checking team.(2021).Climate Summit COP26: What are big emitters like China, the United States, India, Russia and the European Union doing to reduce emissions?https://www.bbc.com/zhongwen/simp/science-59119218

[10]. Yuan,J,H.Kang,J,J.Zhang,J.(2021).Pathways and Policy for Peaking CO2 Emissions in China’s Power Sector

[11]. Department of International Cooperation of the National Development and Reform Commission. (2017). Construction scheme of the national Emission Trading System (power sector).https://zfxxgk.ndrc.gov.cn/web/iteminfo.jsp?id=2944.

[12]. Dong, L., Wang, Z., Zhang, Y., Lu, J., Zhou, E., Duan, C., & Cao, X. (2019). Study on pyrolysis characteristics of coal and combustion gas release in Inert Environment. Journal of Chemistry, 2019, 1–9. https://doi.org/10.1155/2019/1032529

[13]. Du, Q., Dong, Y., Li, J., Zhao, Y., & Bai, L. (2022). Assessing the impacts of carbon tax and improved energy efficiency on the construction industry: Based on CGE model. Buildings, 12(12), 2252. https://doi.org/10.3390/buildings12122252

[14]. Jia, L., Fan, B., Yao, Y., Han, F., Huo, R., Zhao, C., & Jin, Y. (2018). Study on the elemental Mercury adsorption characteristics and mechanism of iron-based modified Biochar Materials. Energy & Fuels, 32(12), 12554–12566. https://doi.org/10.1021/acs.energyfuels.8b02890

[15]. Liu, X., Du, H., Brown, M. A., Zuo, J., Zhang, N., Rong, Q., & Mao, G. (2018). Low-carbon technology diffusion in the decarbonization of the Power Sector: Policy Implications. Energy Policy, 116, 344–356. https://doi.org/10.1016/j.enpol.2018.02.001

[16]. Shen, H., Huang, N., & Liu, L. (2017). A study of the micro-effect and mechanism of the carbon emission trading scheme. Journal of Xiamen University (Arts & Social Sciences), (01), 13-22. (in Chinese)

[17]. Yu, Y., Jin, Z., Li, J., & Jia, L. (2020). Research on the impact of carbon tax on CO2 Emissions of China’s power industry. Journal of Chemistry, 2020, 1–12. https://doi.org/10.1155/2020/3182928

[18]. Zhang N, He S T, Wang J F, Chen Y & Kang L. (2018). Carbon emission intensity and baseline of Tianjin electric ower industry in the context of carbon trading. Research in Environmental Sciences (01),187-193. (in Chinese)

[19]. Zhang, W., Li, J., Li, G., & Guo, S. (2020). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy, 196, 117117. https://doi.org/10.1016/j.energy.2020.117117

[20]. Zhang, Z. (2015). Crossing the river by feeling the stones: The case of carbon trading in China. Environmental Economics and Policy Studies, 17(2), 263–297. https://doi.org/10.1007/s10018-015-0104-7

[21]. Zhang, Z. X. (1998). Macroeconomic effects of CO2 emission limits: A computable general equilibrium analysis for China. Journal of Policy Modeling, 20(2), 213–250. https://doi.org/10.1016/s0161-8938(97)00005-7

[22]. Zhou, Z.-J., Liu, X.-W., Zhao, B., Chen, Z.-G., Shao, H.-Z., Wang, L.-L., & Xu, M.-H. (2015). Effects of existing energy saving and air pollution control devices on Mercury removal in coal-fired power plants. Fuel Processing Technology, 131, 99–108. https://doi.org/10.1016/j.fuproc.2014.11.014

[23]. Xu, J., & Lu, L. (2020). Research on the application of carbon tax model in China's energy industry - a case study of power industry. Energy Reports, 6, 1516-1523.

[24]. Zhang, Y., & Wang, Y. (2019). Impact analysis and development suggestions of electric power enterprises under the background of carbon tax. Energy Policy, 129, 359-366.

[25]. Wang, Y., & Liu, Y. (2020). Applicability analysis of carbon tax and carbon trading in China's power industry. Applied Energy, 279, 115517.

[26]. IPCC. (2018). Global warming of 1.5° C. An IPCC special report on the impacts of global warming of 1.5° C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. Geneva, Switzerland: IPCC.

Cite this article

Zhou,J.;Wang,L.;Cai,N.;Sun,H.;Hu,X. (2024). Comparative Analysis of Carbon Tax and Carbon Emission Trading Policies in the Context of Carbon Emission Reduction: Based on the Perspective of the Power Industry. Advances in Economics, Management and Political Sciences,106,65-72.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. United Nations.(2023).Peace, dignity and equality on a healthy planet.https://www.un.org/zh/global-issues/climate-change

[2]. World Meteorological Organization.(2022).The WMO State of the Global Climate report 2022.

[3]. United Nations.(2015).Paris Agreement.

[4]. Un environmental progrmme.(2022).Emissions Gap Report 2022: The Closing Window.

[5]. IEA (2023), CO2 Emissions in 2022, IEA, Paris https://www.iea.org/reports/co2-emissions-in-2022, License: CC BY 4.0

[6]. The Jiusan Society.(2022).Proposal to study the introduction of a carbon tax as soon as possible.

[7]. Chang, Y.(2023).Duopoly with Limited Rationality in Carbon Market: A Comparison of Carbon Quota Trading and Carbon Tax System. Available at SSRN: https://ssrn.com/abstract=4395650

[8]. Zhang,D,Y.Huang,T.(2021).China's carbon emissions in 6charts.https://wri.org.cn/insights/data-viz-6-graphics-ghg-emissions-china

[9]. BBC Fact-checking team.(2021).Climate Summit COP26: What are big emitters like China, the United States, India, Russia and the European Union doing to reduce emissions?https://www.bbc.com/zhongwen/simp/science-59119218

[10]. Yuan,J,H.Kang,J,J.Zhang,J.(2021).Pathways and Policy for Peaking CO2 Emissions in China’s Power Sector

[11]. Department of International Cooperation of the National Development and Reform Commission. (2017). Construction scheme of the national Emission Trading System (power sector).https://zfxxgk.ndrc.gov.cn/web/iteminfo.jsp?id=2944.

[12]. Dong, L., Wang, Z., Zhang, Y., Lu, J., Zhou, E., Duan, C., & Cao, X. (2019). Study on pyrolysis characteristics of coal and combustion gas release in Inert Environment. Journal of Chemistry, 2019, 1–9. https://doi.org/10.1155/2019/1032529

[13]. Du, Q., Dong, Y., Li, J., Zhao, Y., & Bai, L. (2022). Assessing the impacts of carbon tax and improved energy efficiency on the construction industry: Based on CGE model. Buildings, 12(12), 2252. https://doi.org/10.3390/buildings12122252

[14]. Jia, L., Fan, B., Yao, Y., Han, F., Huo, R., Zhao, C., & Jin, Y. (2018). Study on the elemental Mercury adsorption characteristics and mechanism of iron-based modified Biochar Materials. Energy & Fuels, 32(12), 12554–12566. https://doi.org/10.1021/acs.energyfuels.8b02890

[15]. Liu, X., Du, H., Brown, M. A., Zuo, J., Zhang, N., Rong, Q., & Mao, G. (2018). Low-carbon technology diffusion in the decarbonization of the Power Sector: Policy Implications. Energy Policy, 116, 344–356. https://doi.org/10.1016/j.enpol.2018.02.001

[16]. Shen, H., Huang, N., & Liu, L. (2017). A study of the micro-effect and mechanism of the carbon emission trading scheme. Journal of Xiamen University (Arts & Social Sciences), (01), 13-22. (in Chinese)

[17]. Yu, Y., Jin, Z., Li, J., & Jia, L. (2020). Research on the impact of carbon tax on CO2 Emissions of China’s power industry. Journal of Chemistry, 2020, 1–12. https://doi.org/10.1155/2020/3182928

[18]. Zhang N, He S T, Wang J F, Chen Y & Kang L. (2018). Carbon emission intensity and baseline of Tianjin electric ower industry in the context of carbon trading. Research in Environmental Sciences (01),187-193. (in Chinese)

[19]. Zhang, W., Li, J., Li, G., & Guo, S. (2020). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy, 196, 117117. https://doi.org/10.1016/j.energy.2020.117117

[20]. Zhang, Z. (2015). Crossing the river by feeling the stones: The case of carbon trading in China. Environmental Economics and Policy Studies, 17(2), 263–297. https://doi.org/10.1007/s10018-015-0104-7

[21]. Zhang, Z. X. (1998). Macroeconomic effects of CO2 emission limits: A computable general equilibrium analysis for China. Journal of Policy Modeling, 20(2), 213–250. https://doi.org/10.1016/s0161-8938(97)00005-7

[22]. Zhou, Z.-J., Liu, X.-W., Zhao, B., Chen, Z.-G., Shao, H.-Z., Wang, L.-L., & Xu, M.-H. (2015). Effects of existing energy saving and air pollution control devices on Mercury removal in coal-fired power plants. Fuel Processing Technology, 131, 99–108. https://doi.org/10.1016/j.fuproc.2014.11.014

[23]. Xu, J., & Lu, L. (2020). Research on the application of carbon tax model in China's energy industry - a case study of power industry. Energy Reports, 6, 1516-1523.

[24]. Zhang, Y., & Wang, Y. (2019). Impact analysis and development suggestions of electric power enterprises under the background of carbon tax. Energy Policy, 129, 359-366.

[25]. Wang, Y., & Liu, Y. (2020). Applicability analysis of carbon tax and carbon trading in China's power industry. Applied Energy, 279, 115517.

[26]. IPCC. (2018). Global warming of 1.5° C. An IPCC special report on the impacts of global warming of 1.5° C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. Geneva, Switzerland: IPCC.