1. Introduction

Covid-19 brings a significant shock to almost every industry. Due to the pandemic, it triggered a prolonged global economic crisis, even impacting to 2024, that most industries are in a downturn period. During this period, many companies went bankrupt because of the break of the capital chain. For the retail industry, the decreasing income and large scale lay off reduce people’s consumption demand; however, at the same time, the pandemic also brings unprecedented transformation and trend. More specifically, since covid-19, online spending is up to 77.8 percent, indicating the craze of online shopping/e-commerce [1]. In response to this uncertain environment and transformation, a good capital structure is important for companies to cope well with financial decisions for better prospects. It is a direct factor determining a company's fate and the ability to adjust business management for unexpected situations and transformation. Maximizing the enterprise value is the goal of an optimal capital structure. A good capital structure and amount of cash holding is often a controversial topic that people discuss for long. Many research papers discuss cashing holding and capital structure separately when evaluating enterprise value. In my research paper, capital structure and cash holding will be analyzed together in assessing enterprise value because there is an indispensable relationship between these two. The research that Tiago Loncan and Joao Caldeira study can better explain the relationship. According to Tiago Loncan and Joao Caldeira, they found the inverse relationship between cash holding and the amount of debt, that is higher amounts of debt are associated with lower amounts of cash holdings [2]. Thus, analyzing cashing holding and capital structure together can give a more comprehensive explanation of enterprise value. In the retail industry, different from some largest companies, such as Walmart, Target, utilizing a combination of debt and equity to finance their operations, the capital structure of Bed Bath and Beyond (BBBY) is more interesting to delve into, which mainly consists of substantial cash and almost no debt. This conservative capital structure can better embody the role of cashing holding and capital structure playing in the enterprise value. This paper critically examines how cash holding and its capital structure of BBBY will affect its enterprise value and competitiveness through lenses of opportunity cost, Agency Theory, Modigliani and Miller's Proposition (MM) and other researchers’ empirical results. The paper's format includes literature reviews discussing theoretical and empirical studies, an introduction to Bed Bath & Beyond and its financial strategies, an analysis of its capital structure and cash holdings, followed by a conclusion.

2. Literature Review

Modigliani and Miller (MM) theory, 1958: In a perfect market economy where there is no tax, transaction cost and cost of financial distress, the value of the company is unaffected by how it is financed [3].

Modigliani and Miller (MM) Propositions theory, 1963: With corporate income taxes, a company’s value can be augmented through leverage, since debt interest is tax-deductible. That is, from proposition I, the valuation of a leveraged company equals that of a non-leveraged company plus the present value of tax shields derived from debt, which means that the enterprise value of a leveraged company surpasses that of a non-leverage company [3].

From proposition II, the cost of equity of leverage firms is equal to the cost of equity of an unleveraged firm plus the risk premium depending on the level of debt [3].

Modigliani and Miller(MM) Propositions theory, 1977: When considering both corporate income taxes and personal tax, there is an optimal mix of debt and equity that maximizes firm value by balancing the tax benefits of debt against the higher personal taxes on debt income [3].

Agency cost theory: Jensen and Meckling in 1998 proposed the differences of interest between two parties that lead to conflicts, which are the conflict between shareholder and management team. Agency costs arise from conflicts of interest between principal and agents. These costs include monitoring cost (principal in overseeing agent actions), bonding costs and residual loss in companies’ operation. This problem occurs because the management team acts in their personal interest not shareholders’ interests [4].

Many studies mention the relationship between firm value, cash holding, and leverage. Loncan and Caldeira in their study mentioned that leverage can lead to a reduction in the perceived value of a company, while cash holding is generally seen as positive by investors, but only to a certain extent. Exceeded to a given level, the enterprise value of a firm would decrease on cash holding; in other words, excessive cash holding could impact a firm's valuation negatively. Thus, we can say that authors find a more negatively linear relationship between leverage and firm’s value; and an inverted U-shape curved relationship between cash holding and company’s value. They also mention that leverage and cash holding are negatively correlated, which are also mentioned in my introduction part. More specifically, higher levels of cash are associated with lower levels of debt, aligning with the idea of pecking order theory, that firms first prefer financing with retained earnings, then choose to finance with debt when run out of cash [5].

Cristina Martinez Sola and Pedro J. Garcia Teruel stand in line with Loncan and Caldeira about the relationship between cash holdings and firm value, confirming a concave relationship. Excessive cash can lead to decreased firm value due to the opportunity cost of holding non-productive assets and potential agency costs, insufficient cash limit firm’s to be able to finance operations and growth [6].

However, James A. Brander and Tracy R. Lewis highlight the significant role of the relationship between a company's debt level and its value, particularly noting the "limited liability effect" of debt in oligopolistic industries. They point out that as companies increase their leverage, they generally shift towards more aggressive production strategies. Leveraging more incentivized shareholders to favor more aggressive business strategies, including higher investment in risky projects. This is because shareholders benefit more from the upside, and the downside of the failure is mainly borne by the debt holder. By adopting aggressive strategies, leverage firms can achieve higher returns, enhancing the firm’s value from equity holders’ perspective. At the same time, leveraging more also increases the financial risk and the potential of financial distress. Different from other articles, Brander and Lewis also mention oligopolistic interaction that the financial decision of one firm can significantly influence the competitive strategies of others [7].

Another article written by Christopher Parsons and Sheridan Titman complement how the consequence of high levels of debt impacts competitive strategy that James and Tracy do not mention much. They found that high leverage can limit a firm's ability to engage in competitive pricing because the need to service debt can restrict available cash flow for such aggressive strategies. They emphasize that highly leveraged companies might be less aggressive in pricing due to the increased financial risk associated with having substantial debt [8]. Li Li and Zixuan Wang share a similar idea with Parsons and Titman that high debt levels hinder firms’ competitiveness. Noticeably, they further specify and consider industry’s characteristics when deciding firms’ capital structure. That is, in highly concentrated industries, firms with high leverage and slow leverage growth are at a disadvantage compared to firms in less concentrated industries when it comes to maintaining or enhancing their competitiveness. The reason behind is that high leverage restricts firms’ ability in high concentrated industries to quickly adapt or invest in new opportunities due to stable but rigid market dynamics; whereas firms in low concentration industries can handle higher leverage more effectively as the industry is more dynamic and the need for agility and aggressive strategies [9].

3. Results and Analysis

3.1. BBBY capital structure

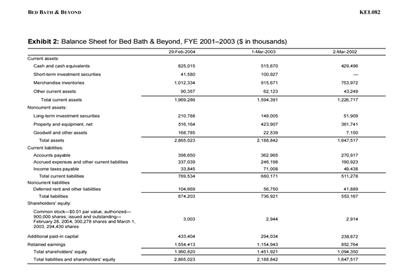

Figure 1: balance sheet of BBBY from 2002-2004 [10]

As shown in Figure 1: For the fiscal year 2002, 2003, and 2004, it appears that BBBY has very little or no long-term debt. The liability listed under “Noncurrent liability” primarily consists of deferred rent and other liabilities, which do not include any significant debt components.

Cash is increasing from 2002 to 2004, indicating that BBBY has accumulated more liquidity.

As shown in Figure 2, the liabilities portion is decreasing over years, this is because total assets are growing at a rate that diminishes the relative proportion of liabilities.

Figure 2: pie charts of capital structures

Cash percentage in the total asset for BBBY:

For 2002 in the equation (1):

(429,496 / 1,647,517) × 100 ≈ 26.07% (1)

For 2003 in the equation (2):

(515,670 / 2,188,842) × 100 ≈ 23.56% (2)

For 2004 in the equation (3):

(825,015 / 2,865,023) × 100 ≈ 28.80% (3)

Use Walmart’s balance sheet as benchmark for comparison:

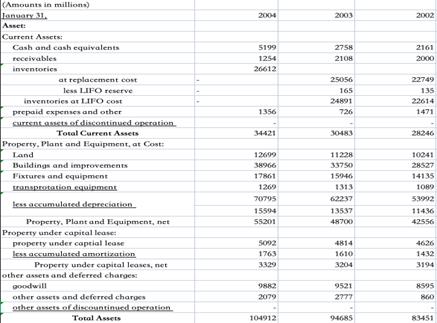

Figure 3: Balance sheet for Walmart from 2002 - 2004

As shown in Figure 3:

For 2002 in the equation (4):

(2161/83451) × 100 ≈ 2.59% (4)

For 2003 in the equation (5):

(2758/94685) × 100 ≈ 2.91% (5)

For 2004 in the equation (6):

(5199/104912) × 100 ≈ 4.95% (6)

Walmart holds a dominant and leading position in the retail industry. Compared with Walmart cash percentage, BBBY cash percentage is way higher than those of Walmart, which we can say that BBBY might hold too much cash.

3.2. Analysis of BBBY’s capital structure on firms value and competitiveness

First of all, BBBY holding giant cash on hand is an action of wasting resources in the long term, impacting the firm value and being less competitive. As mentioned by Cristina Martinez Sola and Pedro J. Garcia Teruel, the excessive cash that BBBY holds may exceed the optimal level of cash holding [6]. Continuing preserving this conservative action involves significant opportunity costs. To be more specific, holding large cash on hand is too costly in the long term due to inflation. Holding cash on hand without doing anything to grow will erode its real value and the company's purchasing power over time. If the cash interest rate earned is lower than the inflation rate, the companies will effectively lose value on these cash reserves. This erosion of value represents a direct cost to BBBY, as these funds could have been employed in profitable investment or business expansion to stay competitive. Thus, while cash provides immediate liquidity, considering inflation factor, over reliance on internal funding restricts the total available capital for larger investment or expansions that could lead to significant growth.

Second, even though BBBY avoids the costs associated with debt, such as financial distress and bankruptcy risk, this approach at the same time gives up significant opportunities to increase market value. According to MM theory 1958 mentioned in the literature review, the value of a firm is theoretically independent of its capital structure under perfect market conditions, which include no taxes, no transaction costs, and no financial frictions [3]. However, these ideal conditions rarely exist in real-world settings. In practical situations, as described by Modigliani and Miller theory 1963, incorporating taxes shifts the scenario considerably. MM2 theorizes that the valuation of a leveraged company equals that of a non-leveraged company plus the present value of tax shields derived from debt [3]. This is because interest payment on debt lowers the taxable income and thus relieve the tax obligations of the company. Each dollar of interest paid not only decreases the amount of tax owed but also effectively lowers the firm's overall cost of capital. This reduction in tax liability can significantly enhance firm value, making debt a useful tool for financial management. Moreover, based on the findings by other authors mentioned in the literature review, the effect of debt level on firm value is an inverted u shape trend. In other words, as long as there is not too much debt, the firm value would probably not be harmed by debt. Moreover, looking at the industry that BBBY is in, competition is relatively high with significant players like Walmart, Amazon and specialty stores exerting pressure in the home goods segment. Thus, it leans toward a lower concentration industry where competitive pressures are significant. Based on the finding by Li and Wang, firms in low market concentration are less affected by high levels of debt and slow increases in terms of competitiveness compared to those in highly concentrated markets [9]. Thus, given that BBBY maintains substantial cash reserves and almost no debt, utilizing a reasonable level of debt could enable the company to further leverage these reserves is beneficial to BBBY’s firm value. For instance, BBBY could deploy the additional capital to do share repurchases, a strategy that can increase shareholders’ value by decreasing the number of shares outstanding, thus potentially increasing the stock price. However, by maintaining a minimal debt ratio, BBBY misses out on these strategic opportunities to use tax-efficient debt financing to boost overall firm value.

Combined with the first point and the second point, the conservative capital structure can significantly hinder long-term potential growth and limit the company’s ability to respond swiftly to market opportunities, thus affecting its competitiveness. In the rapidly evolving retail landscape, swiftness is crucial. Companies need to be sensitive to the market trend and keep up the renewal pace; in other words, they need to effectively invest in customer service, marketing promotion and upgrade technologies to stay ahead. However, BBBY’s over reliance on internal funding, coupled with its avoidance of debt-financed capital and not utilization of large cash reserves, hampers its ability to respond quickly to these market dynamics. This lack of responsiveness might cause BBBY to fall behind competitors, such as Walmart, who can quickly mobilize financial resources through a balanced use of equity and debt. Since competitors enhance their offerings and adapt to consumer demands more rapidly, BBBY's delayed response could diminish its market presence and erode competitive standing in the long term.

Finally, BBBY’s conservative capital structure could lead to dissatisfaction with shareholders, particularly if these reserves are seen as excessive cash to the company’s operational and strategic needs, slowering the company’s growth prospects. This scenario raises concerns from the perspective of Agency theory, which explains the potential misalignment and of interests between the company’s management team and shareholders. According to the Corporate Finance Institute, Agency theory explores how disparities in priorities and information between a company’s management (agents) and its shareholders (principals) can lead to conflicts of interest [11]. For BBBY’s capital structure, large unutilized cash reserves can lead to shareholders' concern that the company’s executive is not capable of efficiently leveraging the company asset to do profitable investment, which align with Agency theory’s concerns about the efficiency of agents in maximizing shareholder value. If shareholders perceive that the cash is not being deployed to maximize returns, it could lead to the demand of increased dividends from shareholders. Furthermore, based on the agency theory, agents may prioritize personal corporate goals over shareholder return. So, the shareholders of BBBY would be skeptical about management level motives of holding giant cash. Over time, this skepticism can erode their confidence in the management team, making it more challenging for BBBY to raise capital in the equity market if and when needed. Also, misalignment of interest would incite shareholder activism and desire to realign company strategy and structure, and such intervention can lead to disruption and shift in company leadership, affecting company’s growth.

4. Conclusion

In conclusion, it is true that holding significant amounts of cash can ensure company’s operation stability and their financial flexibility, especially in the economic downturn, but overemphasis on internal financing could be detrimental in the long run. In order to thrive in such a competitive market, companies not only need to maintain stability, but also need to think about how to effectively utilize the source to scale and maximize the company value and operation effectiveness, particularly during the period of economic expansion. For BBBY, since they can ensure liquidity to encounter emergencies due to large cash reserves and no debt, this capital structure may imbalance the interest between shareholders and management team, limit them to enhance firms value and swiftly do investment on innovation, technology, and customer service, which are important to stay competitive. Since they have a strong cash base, it is possible for them to divide out an appropriate amount of money to do debt for larger capital or make a profitable investment.

References

[1]. Brannen, S., Ahmed, H., & Newton, H. (2020). Covid-19 Reshapes the Future. Center for Strategic and International Studies (CSIS). http://www.jstor.org/stable/resrep25198

[2]. Loncan, T., & Caldeira, J. (2013). Capital structure, cash holdings and firm value: A study of Brazilian listed firms. *Revista Contabilidade & Finanças*. Retrieved from https://ssrn.com/abstract=2329346

[3]. Ferdous, L. T. (2019). Capital Structure Theories in Finance Research: A Historical Review. Australian Finance & Banking Review, 3(1), 11-19. https://doi.org/10.46281/afbr.v3i1.244

[4]. Feng, W. (2022). Determinant factors of capital structure of firms—An empirical analysis based on evidence from Chinese listed retail companies. *Management Studies, 10*(1), 32-43.

[5]. Feng, N. W. (2022). Determinant Factors of Capital Structure of Firms—AnEmpirical Analysis Based on Evidence From Chinese Listed Retail Companies. Management Studies, 10(1). https://doi.org/10.17265/2328-2185/2022.01.004

[6]. Martínez-Sola, C., García-Teruel, P. J., & Martínez-Solano, P. (2011). Corporate cash holding and firm value. Applied Economics, 45(2), 161–170. https://doi.org/10.1080/00036846.2011.595696

[7]. Brander, J. A., & Lewis, T. R. (1986). Oligopoly and Financial Structure: The Limited Liability Effect. The American Economic Review, 76(5), 956–970. http://www.jstor.org/stable/1816462

[8]. Christopher Parsons and Sheridan Titman (2009), "Empirical Capital Structure: A Review", Foundations and Trends® in Finance: Vol. 3: No. 1, pp 1-93. http://dx.doi.org/10.1561/0500000018

[9]. Li L, Wang Z (2019) How does capital structure change product-market competitiveness? Evidence from Chinese firms. PLoS ONE 14(2): e0210618. https://doi.org/10.1371/journal.pone.0210618

[10]. Raviv, A., & Thompson, T. (2005). Bed Bath & Beyond: The Capital Structure Decision. Kellogg School of Management, Northwestern University. Retrieved from http://www.kellogg.northwestern.edu/faculty/research/researchdetail?guid=b27c4b49-859f-4f84-8276-6fdaa46dd270

[11]. [1] Corporate Finance Institute. (2022). Agency theory. Retrieved, June 7, 2024, from https://corporatefinanceinstitute.com/resources/esg/agency-theory/#:~:text=Agency%20theory%20is%20a%20concept,can%20result%20in%20fluctuating%20outcomes.

Cite this article

Wei,H. (2024). Capital Structure and Its Effect on Firms Value and Competitiveness in the Market: The BBBY Example. Advances in Economics, Management and Political Sciences,114,169-175.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Innovative Strategies in Microeconomic Business Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Brannen, S., Ahmed, H., & Newton, H. (2020). Covid-19 Reshapes the Future. Center for Strategic and International Studies (CSIS). http://www.jstor.org/stable/resrep25198

[2]. Loncan, T., & Caldeira, J. (2013). Capital structure, cash holdings and firm value: A study of Brazilian listed firms. *Revista Contabilidade & Finanças*. Retrieved from https://ssrn.com/abstract=2329346

[3]. Ferdous, L. T. (2019). Capital Structure Theories in Finance Research: A Historical Review. Australian Finance & Banking Review, 3(1), 11-19. https://doi.org/10.46281/afbr.v3i1.244

[4]. Feng, W. (2022). Determinant factors of capital structure of firms—An empirical analysis based on evidence from Chinese listed retail companies. *Management Studies, 10*(1), 32-43.

[5]. Feng, N. W. (2022). Determinant Factors of Capital Structure of Firms—AnEmpirical Analysis Based on Evidence From Chinese Listed Retail Companies. Management Studies, 10(1). https://doi.org/10.17265/2328-2185/2022.01.004

[6]. Martínez-Sola, C., García-Teruel, P. J., & Martínez-Solano, P. (2011). Corporate cash holding and firm value. Applied Economics, 45(2), 161–170. https://doi.org/10.1080/00036846.2011.595696

[7]. Brander, J. A., & Lewis, T. R. (1986). Oligopoly and Financial Structure: The Limited Liability Effect. The American Economic Review, 76(5), 956–970. http://www.jstor.org/stable/1816462

[8]. Christopher Parsons and Sheridan Titman (2009), "Empirical Capital Structure: A Review", Foundations and Trends® in Finance: Vol. 3: No. 1, pp 1-93. http://dx.doi.org/10.1561/0500000018

[9]. Li L, Wang Z (2019) How does capital structure change product-market competitiveness? Evidence from Chinese firms. PLoS ONE 14(2): e0210618. https://doi.org/10.1371/journal.pone.0210618

[10]. Raviv, A., & Thompson, T. (2005). Bed Bath & Beyond: The Capital Structure Decision. Kellogg School of Management, Northwestern University. Retrieved from http://www.kellogg.northwestern.edu/faculty/research/researchdetail?guid=b27c4b49-859f-4f84-8276-6fdaa46dd270

[11]. [1] Corporate Finance Institute. (2022). Agency theory. Retrieved, June 7, 2024, from https://corporatefinanceinstitute.com/resources/esg/agency-theory/#:~:text=Agency%20theory%20is%20a%20concept,can%20result%20in%20fluctuating%20outcomes.