1. Introduction

The majority of the research being done today on the economic ramifications of the conflict between Russia and Ukraine is on the short term, looking at things like interrupted energy supply, spikes in inflation, and the larger macroeconomic effects on the Eurozone. Models such as the IS-PC-MR have been used in studies to examine the dynamics of inflation and the monetary actions of the European Central Bank (ECB). Nonetheless, there are still knowledge gaps, especially when it comes to the long-term effectiveness of the European Central Bank's combined fiscal and monetary policies and the contribution of international cooperation to the reduction of energy dependence and supply chain disruptions. This paper specifically investigates the ECB's strategies to counteract inflation resulting from the Russia-Ukraine conflict. It delves into the multifaceted impact of the conflict on Eurozone economies, the ECB's monetary and fiscal policies, and the role of energy and supply chain management.

This study aims to explore how these measures collectively address the economic challenges posed by the conflict and what gaps might still exist. The core problem discussed is how well the ECB's policies have stabilized the economies of the Eurozone in the face of hitherto unseen inflationary pressures and energy shortages. The importance of this report is in its thorough examination of existing policies, future plans for bolstering economic resilience, and projections for sustained economic stability. This study aims to contribute to policy-making conversations that could direct future actions in comparable crises by analyzing the ECB's responses and offering improvements.

2. The Impact of the Conflict between Russia and Ukraine on the Economies of Eurozone Countries

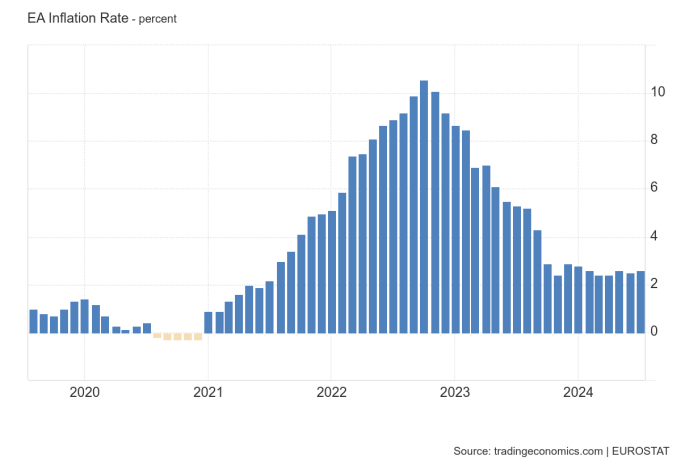

On 24 February 2022, Russia invaded Ukraine in a major escalation of the Russo-Ukrainian War. The invasion, the largest conflict in Europe since World War II [1]. The crisis between Russia and Ukraine has had a significant and lasting effect on the economies of the Eurozone nations, escalating pre-existing weaknesses and posing new difficulties. For example, it can be seen that from Figure 1, the inflation rate kept rising since the conflict between Russia and Ukraine escalated in February, 2022, and it peaked in October of the same year at 10.6% [2].

Figure 1: Euro Area Inflation Rate from EUROSTAT [2]

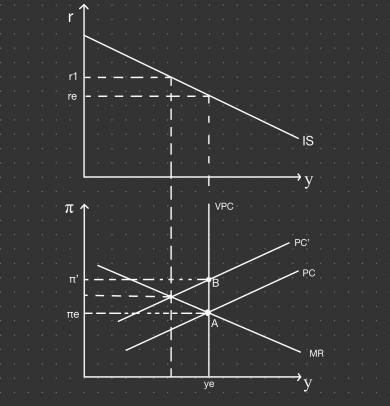

According to the European Investment Bank, Ukraine and Russia are major suppliers of energy and agricultural products. As the war damages production capacities, the price of many core products that are difficult to substitute will rise [3]. Furthermore, unprecedented increases in energy prices were also caused by the European Union's (EU) sanctions against Russia in retaliation for its aggression, as well as Russia's countermeasures, which included reducing and eventually ceasing natural gas deliveries to Europe. The energy shock had an impact on inflation, consumer pricing, industry production, and overall economic stability throughout the economies of the Eurozone. To explain this result, the IS-PC-MR model could be adopted. The IS-PC-MR model was first developed by Wendy Carlin and David Soskice in 2005 to replace the traditional IS-LM-AS model. Wendy and David stated this new model is a simple version of the one commonly used in central banks and captures the forward-looking thinking engaged in by the policymaker [4]. Within the model, IS refers to the curve of investment and saving, and PC represents the Philips Curve, while MR stands for the curve of monetary policy. Let’s suppose the original equilibrium point was at point A, and the Europeans were under adaptive inflation expectation after the outbreak of the conflict between Russia and Ukraine, as shown in Figure 2. The equation for PC curve is \( {π_{t}}=π_{t}^{e}+α({y_{t}}-{y_{e}})+{u_{t}} \) . And the war would be considered a shock as \( {u_{t}} \) , which would influence π directly and shift the PC curve to PC’ curve. As a result, the inflation in the Eurozone would be increased from \( {π_{e}} \) to \( π \prime \) .

Figure 2: The IS-PC-MR model for the Eurozone after the outbreak of Russia-Ukraine Conflict

Moreover, manufacturing and chemical industries, which rely significantly on energy, were severely disrupted. Production costs skyrocketed, which decreased output and made a company less competitive in international markets. Many businesses had to make the tough decision of either absorbing the increases, which would have reduced profit margins and threatened financial stability, or passing the higher prices on to customers and causing higher inflation. Due to their lower financial resilience than larger firms, small and medium-sized enterprises (SMEs) suffered the most, leading to closures and employment losses. The industrial decline exacerbated the economic crisis by spilling over into allied industries. In addition to industrial, the violence presented significant hurdles for the agricultural sector as well. Due to the interruption of farming operations and export routes, Ukraine, dubbed the "breadbasket of Europe", witnessed a sharp decline in its agricultural output. Within the Eurozone, this had a direct effect on food costs. Millions of Europeans' cost of living was impacted by food price inflation as a result of the country's dependency on imports of Ukrainian wheat, maize, and sunflower oil. In certain areas, rising food costs exacerbated social unrest and income inequality by disproportionately affecting lower-income households. As a result, the conflict and its effects on the economy had a significant negative impact on consumer confidence throughout the Eurozone. Reduced consumer spending resulted from energy price volatility and uncertainty, increased food prices, and concerns about a protracted economic slowdown. Due to increased groceries and utility expenditures, households tightened their belts, which had an impact on the retail and service industries. The economic downturn was exacerbated by this fall in consumer spending, which further hindered economic growth and created a negative feedback cycle.

The external trade of the Eurozone was significantly impacted by the conflict as well. There was a serious disruption in trade relations with Russia, which is an important economic partner for many Eurozone countries. Energy imports as well as exports of consumer products, autos, and machinery to Russia were harmed by the sanctions placed on the country. Businesses that depended on the Russian market were impacted by this disruption, which resulted in a drop in trade volumes. The battle also made international trade channels and logistics more expensive and complicated, which put additional pressure on the trade balance of the Eurozone.

These elements combined to cause a notable slowdown in the Eurozone's economic development. Germany and Italy, two nations that rely heavily on Russian energy, were more severely affected than those with a wider range of energy sources. Numerous Eurozone nations accelerated their shift to renewable energy sources and decreased their dependency on Russian fossil fuels as a result of the conflict, which highlighted the significance of energy security and diversity. Much still, this shift came with a high price in terms of time and money, which made the process of economic recovery much more difficult.

3. The ECB's Monetary and Fiscal Policies to Combat Inflation

3.1. The ECB’s Monetary Policies

A series of monetary policy measures targeted at stabilizing the Eurozone economy were implemented by the European Central Bank (ECB) in response to the economic upheaval created by the conflict between Russia and Ukraine. The ECB faced difficult choices in trying to balance promoting economic development and reducing inflation due to the conflict-related energy crisis, supply chain interruptions, and rising prices.

To begin with, addressing the surging inflation rates was one of the ECB's main solutions. The Russia-Ukraine conflict caused energy costs to spike, and as a result, the Eurozone experienced its highest levels of inflation in decades. According to the IS-PC-MR model in Figure 2, it is obvious that the ECB needs to raise the real interest rate from \( {r^{e}} \) to \( {r^{1}} \) in order to gradually reduce the severe inflation within the Eurozone. Since the situation the ECB faced at the time was actually very similar to that in the run-up to the Great Inflation, when inflation expectations rose sharply because of the energy crisis, the ECB should take measures to prevent the same situation from happening again as soon as they perceive the potential threat of conflict between Russia and Ukraine. Clarida et al. suggested one of the main reasons why the Great Inflation happened was that the Fed did not raise nominal interest rates sufficiently in response to increases in expected inflation during the 1970s [4]. Therefore, the European Central Bank decisively raised its key interest rates in response to this. With its first rate increase in almost ten years, the ECB signaled a departure from its ultra-loose monetary policy stance in July 2022. Subsequent rate hikes followed, aimed at tempering inflation expectations and preventing a wage-price spiral. From the table of ECB monetary policy and other measures between April 2021 and December 2023, the ECB has continued to raise the deposit facility rate (DFR) by 4.5% since July 2022 [5]. By making borrowing more costly, these rate rises were intended to reduce demand and subsequently investment and consumer expenditure.

The European Central Bank modified its asset acquisition initiatives in accordance with increases in interest rates. In order to boost the economy during the COVID-19 pandemic, the European Central Bank (ECB) had been purchasing a lot of assets before the conflict through its Pandemic Emergency Purchase Programme (PEPP) and the Asset Purchase Programme (APP). The APP started as part of a package of non-standard monetary policy measures that also included targeted longer-term refinancing operations, and which was initiated in mid-2014 to support the monetary policy transmission mechanism and provide the amount of policy accommodation needed to ensure price stability [6]. However, as inflation became a more pressing concern, the ECB decided to phase out the PEPP and scale back the APP so that there were no reinvestments of redemptions since July 2023. The goal of this tapering—a steady decline in asset purchases—was to tighten financial conditions without suddenly upsetting the market. The ECB underlined that it was prepared to modify or resume these measures in the event that the economy demanded it.

The ECB encountered formidable obstacles in reconciling its twofold mandate of price stability and economic expansion, even with its massive efforts. Even if the sharp rate increases were required to fight inflation, there was a chance that they would hinder economic growth and raise unemployment. Furthermore, the effectiveness of monetary policy alone was constrained by the global character of the inflationary pressures, which were mostly caused by supply-side forces outside of the ECB's control. In order to prevent starting a recession and guarantee that inflation expectations were well-anchored, the ECB's measures had to be carefully calibrated.

3.2. The ECB’s Fiscal Policies

The European Central Bank (ECB) has played a crucial role in developing and influencing fiscal policy responses during the Russia-Ukraine crisis, despite its primary concentration on monetary policy. Strong fiscal measures were required to supplement the ECB's monetary policy initiatives as a result of the conflict's exacerbation of the Eurozone's economic vulnerabilities. The fiscal reaction addressed the immediate effects of the conflict on oil prices, inflation, and public finances while also aiming to preserve long-term stability, encourage economic recovery, and provide targeted relief.

In order to encourage coordinated fiscal action among Eurozone member states, the ECB was a key proponent. The European Central Bank urged for stronger fiscal measures to lessen the impact on the economy, acknowledging that monetary policy was insufficient to address the supply-side shocks and fiscal inequalities brought on by the conflict. The European Union (EU) and national governments were greatly aided by this campaign in putting into action a comprehensive fiscal response.

The Recovery and Resilience Facility (RRF) was created as one of the major budgetary initiatives pushed by the ECB. The goal of the RRF is to address the danger for the sound economic development of the EU and the euro area emanating from increased divergence following the Covid-19 pandemic because of differences in the ability of countries to offset the negative shock [7]. Even so, the RRF became a vital tool in the response to the Russia-Ukraine conflict. In order to lessen the Eurozone's reliance on Russian energy and increase energy security, the ECB encouraged the use of RRF funds to finance investments in energy infrastructure, renewable energy projects, and energy efficiency upgrades. This helped to ease some of the inflationary pressures brought on by energy price shocks.

Additionally, the ECB approved targeted fiscal assistance programs for companies and households in need. Lower-income households experienced severe financial difficulty as food and energy prices rose. To lessen the burden on these households, the ECB encouraged member states to enact temporary tax reductions, direct income support, and energy bill subsidies. The European Community Bank (ECB) promoted grants, low-interest loans, and tax relief for businesses, especially small and medium-sized enterprises (SMEs) that were severely affected by the conflict, in order to maintain operations and safeguard jobs. However, massive subsidies will also cause the government to run a budget deficit. According to the Financial Stability Review, May 2024 from ECB, rising debt service costs are challenging euro area households, firms and sovereigns with weak balance sheets, and the downturn in property markets is, in some cases, compounding household and corporate vulnerabilities [8]. As a result, in order to guarantee long-term budgetary sustainability, the ECB exerted influence over fiscal consolidation initiatives. Sound public finances must be maintained, the ECB said, even as it argued for immediate fiscal stimulus. This required striking a precise balance between preventing unnecessarily high public debt accumulation and offering the required fiscal boost. The ECB collaborated closely with the European Commission and member states to develop budgetary policies that were sustainable over the long run and supportive in the medium term.

3.3. Energy Policy and Supply Chain Management Policy

The governments of the Eurozone need to put strong supply chain and energy management policies into place in order to prevent economic shocks and maintain long-term resilience following the energy price shock brought on by the conflict between Russia and Ukraine. Diversification of energy sources is one important energy policy. Infrastructure for renewable energy sources like wind, solar, and biomass should be invested in more quickly by nations like Germany, which is highly dependent on Russian natural gas. As an example, Germany's Energiewende plan seeks to decrease reliance on imported fossil fuels by boosting the proportion of renewable energy in the country's energy mix. Furthermore, increasing the capacity to import liquefied natural gas (LNG), as demonstrated in Spain and Italy, can offer substitute natural gas sources. To step up LNG imports, Member States have undergone a fast and significant expansion of LNG regasification capacity. This has resulted in an extra capacity addition of 50 bcm since 2022 [9]. Improving energy efficiency is another crucial policy. Energy-saving technologies and practices in homes and businesses should be encouraged by governments. The energy efficiency programs in France are a good example because they provide financial incentives for upgrading buildings and acquiring energy-efficient appliances. These actions cut expenses for both consumers and businesses in addition to reducing energy use.

The Eurozone countries ought to concentrate on fortifying and broadening their supply chains when it comes to supply chain management. For instance, the Netherlands is making investments in digital infrastructure to improve the resilience and transparency of its supply chain. That’s because the government suggested that many opportunities remain unexploited. Examples include the potential role of digitalisation in achieving a sustainable food supply, in the use of renewable energy sources and in the climate transition [10]. To prevent becoming overly dependent on any one nation or area, nations should also diversify their import sources and establish strategic stores of essential minerals. The Eurozone nations may better withstand the financial effects of the conflict and develop more resilient and sustainable economies by putting these energy and supply chain management policies into practice.

4. International Cooperation

Working together to improve energy security, stabilize markets, and foster economic resilience among member states is essential if the Eurozone is to successfully address the energy-price shock brought on by the Russia-Ukraine conflict.

The cooperative acquisition of energy resources is one essential area of collaboration. The members of the Eurozone can lower overall costs and improve energy security by negotiating better terms and prices for energy imports by combining their purchasing power. This strategy is demonstrated by the European Commission's proposal for a unified gas purchasing platform, which seeks to guarantee steady and reasonably priced gas supplies for each and every member state. The creation of an integrated energy infrastructure is another crucial element. The effective distribution of energy resources throughout the region can be facilitated by funding cross-border energy projects, such as the European Green Deal's focus on trans-European energy networks, which represents one of the most ambitious and transformative initiatives undertaken by the European Union (EU) to address the pressing challenges of climate change and environmental degradation. Announced in December 2019 by the European Commission, the Green Deal sets the ambitious target of making Europe the first climate-neutral continent by 2050. [11]. One such example is the Baltic Connector gas pipeline, which improves energy connection and lessens dependency on Russian gas between Finland and Estonia. The Eurozone countries may better handle the energy price shock by strengthening international cooperation, which will provide a more secure, resilient, and sustainable energy future for the area.

5. Conclusion

The crisis between Russia and Ukraine has severely damaged the Eurozone's economy by drawing attention to weaknesses in supply chain resilience and energy dependence. The response from the ECB, which included large fiscal and monetary interventions, demonstrates a thorough strategy for stabilizing the economy. The goal of the ECB's asset purchase plans and interest rate increases was to reduce inflation and boost economic confidence. Even though these monetary measures were required, it was difficult to strike a balance between stabilizing employment and economic growth while controlling inflation. The Recovery and Resilience Facility (RRF), in particular, and other ECB fiscal policies were essential in mitigating both the short- and long-term effects. Reducing reliance on Russian energy required significant investments in energy infrastructure, renewable energy initiatives, and energy efficiency improvements. Targeted fiscal support for SMEs and households also lessened the impact of the economic shock, yet worries about the nation's growing public debt still exist. The management of energy supply chains and energy policy have become crucial domains for guaranteeing economic resilience. Strategies such as increasing energy efficiency, diversifying energy sources, and allocating resources towards digital infrastructure for supply chain transparency are crucial. International collaboration, exemplified by cooperative energy procurement and interconnected energy infrastructure, fortifies the Eurozone's capacity to weather future shocks, including energy price volatility. In conclusion, ongoing cooperation and adaptation are required, even if the ECB's actions have been crucial in controlling the economic effects of the Russia-Ukraine war. To improve economic resilience, future policy should concentrate on resilient supply chains, renewable energy solutions, and integrated fiscal initiatives. This study emphasizes the value of a multimodal approach to crisis management by offering information that can guide future policy choices and guarantee the stability of the Eurozone in the face of uncertainty around the world.

References

[1]. Plokhy, S. (2023). The Russo-Ukrainian War: The return of history. W.W. Norton et Company, New York.

[2]. Euro area inflation rate from https://tradingeconomics.com/euro-area/inflation-cpi

[3]. European Investment Bank. (2022a). How bad is the Ukraine war for the European recovery? ECONOMICS – THEMATIC STUDIES. https://doi.org/10.2867/945503

[4]. Clarida, R., Gali, J., & Gertler, M. (2000). Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory. Quarterly Journal of Economics, London, 115(1), 147-180.

[5]. Lane, P.R. (2024) The 2021-2022 inflation surges and monetary policy in the euro area, in English, B., Forbes, k. and Ubide, Á.(eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press, February, pp. 65-95.

[6]. European Central Bank. (2024). Asset purchase programmes, July 3. https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html

[7]. Watzka, Sebastian; Watt, Andrew. (2020) The macroeconomic effects of the EU recovery and resilience facility: A preliminary assessment, IMK Policy Brief, No. 98, Hans-Böckler-Stiftung, Institut für Makroökonomie und Konjunkturforschung (IMK), Düsseldorf.

[8]. European Central Bank. Financial Stability Review, May 2024. ECB Glossary. ISSN 1830-2025

[9]. European Union Agency for the Cooperation of Energy Regulators. Analysis of the European LNG Market Developments 2024 Market Monitoring Report, 19th April, 2024.

[10]. Netherlands Central Government. (2021). The Dutch Digitalization Strategy 2021.

[11]. Main, H., Lemaster, C. (2024). The European Green Deal: A Pathway to Climate Neutrality by 2050.

Cite this article

Huang,Y. (2024). The ECB's Solution to the Inflation Caused by the Russia-Ukraine Conflict. Advances in Economics, Management and Political Sciences,117,58-64.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Plokhy, S. (2023). The Russo-Ukrainian War: The return of history. W.W. Norton et Company, New York.

[2]. Euro area inflation rate from https://tradingeconomics.com/euro-area/inflation-cpi

[3]. European Investment Bank. (2022a). How bad is the Ukraine war for the European recovery? ECONOMICS – THEMATIC STUDIES. https://doi.org/10.2867/945503

[4]. Clarida, R., Gali, J., & Gertler, M. (2000). Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory. Quarterly Journal of Economics, London, 115(1), 147-180.

[5]. Lane, P.R. (2024) The 2021-2022 inflation surges and monetary policy in the euro area, in English, B., Forbes, k. and Ubide, Á.(eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press, February, pp. 65-95.

[6]. European Central Bank. (2024). Asset purchase programmes, July 3. https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html

[7]. Watzka, Sebastian; Watt, Andrew. (2020) The macroeconomic effects of the EU recovery and resilience facility: A preliminary assessment, IMK Policy Brief, No. 98, Hans-Böckler-Stiftung, Institut für Makroökonomie und Konjunkturforschung (IMK), Düsseldorf.

[8]. European Central Bank. Financial Stability Review, May 2024. ECB Glossary. ISSN 1830-2025

[9]. European Union Agency for the Cooperation of Energy Regulators. Analysis of the European LNG Market Developments 2024 Market Monitoring Report, 19th April, 2024.

[10]. Netherlands Central Government. (2021). The Dutch Digitalization Strategy 2021.

[11]. Main, H., Lemaster, C. (2024). The European Green Deal: A Pathway to Climate Neutrality by 2050.