1. Introduction

A bubble generally refers to a situation where asset prices exceed their true value. The earliest recorded economic bubble was the ‘Tulip Mania’. In the 17th century, tulips became highly popular among the Dutch [1]. However, as demand outstripped supply, tulip prices became exorbitant. Speculative activities further drove prices sharply upward, far beyond their actual value, forming a bubble. However, in 1637, when some began to realize that the prices had lost their meaning, people started to sell off their tulips at lower prices, causing market panic. Confidence plummeted, leading to mass sell-offs, which ultimately caused the market to collapse, with tulip prices plummeting as the bubble burst [2].

Similarly, speculative behavior led to the real estate bubble in Japan from the 1980s to the 1990s [3]. Rapid urbanization and increasing urban populations drove up housing demand. However, Japan’s limited land area led people to believe that land prices would only rise. Consequently, large amounts of capital flowed into the housing market, causing housing prices to soar far above their actual value, resulting in a bubble. The government’s implementation of financial liberalization and quantitative easing policies accelerated the bubble’s inflation and eventual collapse [4].

Later, in 2001, the U.S. government implemented an expansionary monetary policy, cutting interest rates from 6% to 1% through multiple rate reductions to stimulate economic growth, which led to rising housing prices and the formation of a bubble [5]. Simultaneously, banks overestimated the liquidity of real estate collateral and underestimated the risks of subprime mortgages. From 2004 to 2006, the Federal Reserve began raising interest rates, gradually restoring the rate to 5.25% [6]. The higher interest rates made it difficult for many people to repay their mortgages, leading to increased foreclosures, property depreciation, and eventually, the bubble burst. The widespread mortgage defaults also caused bank failures, ultimately triggering a global financial crisis [7].

With the growth of China’s economy and urbanization, the real estate industry rapidly grew, with speculative activities leading to continuous increases in housing prices and the formation of a bubble. According to data released by China Daily, in 2023, housing sales accounted for 24% of China’s GDP. This revealed high housing demand and exorbitant housing prices, which most ordinary families could not afford. Even though housing prices have declined somewhat in recent years, the significant gap between income and housing prices has made homeownership unaffordable for many families.

This paper, focusing on the issue of excessively high real estate prices, studied the price changes in four Chinese cities: Beijing, Shanghai, Guangzhou, and Shenzhen, and the factors contributing to the real estate bubble. Furthermore, the paper analyzed the current state of the real estate market and explored ways to reduce housing prices to slow down the bubble’s expansion. The paper aimed to better understand the current state of China’s real estate market and explore methods to curb the bubble’s growth.

2. Current State of Real Estate in First-Tier Cities in China

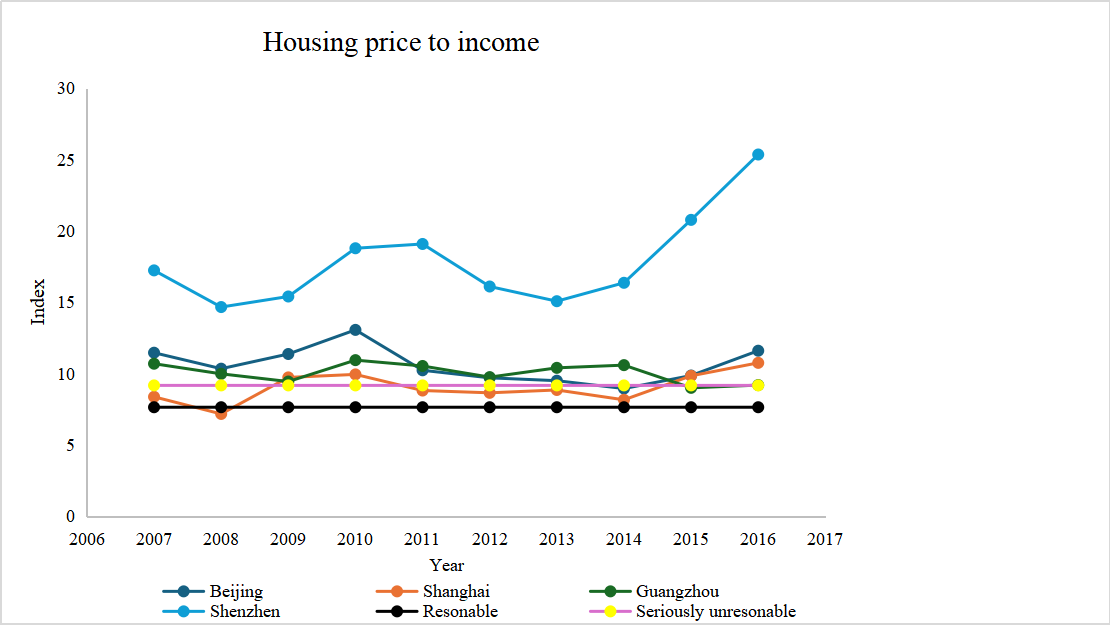

Figure 1 shows the changes in the price-to-income ratios in Beijing, Shanghai, Guangzhou, and Shenzhen from 2007 to 2016.

Figure 1: Price-to-Income Ratio in Beijing, Shanghai, Guangzhou, and Shenzhen

The data indicated that the price-to-income ratio in Shenzhen had the most significant increase, consistently exceeding that of Beijing, Shanghai, and Guangzhou since 2007. The price-to-income ratios in the four cities decreased from 2007 to 2008 but began rising again in 2009. With economic development, the ratio in Beijing, Shanghai, and Guangzhou fluctuated slightly from 2009 to 2016. However, Shenzhen’s ratio surged significantly starting in 2013. By 2016, Shenzhen’s price-to-income ratio reached 25.35, far surpassing the other three cities: Beijing and Shanghai stood at 11.6 and 10.75, respectively, with Guangzhou having the lowest at 9.19. Furthermore, data from the National Bureau of Statistics suggested that a price-to-income ratio below 7.64 is considered reasonable, while a ratio above 9.17 is deemed severely unreasonable. As shown in the figure, the price-to-income ratios in all four cities generally fell within the severely unreasonable range, with only Shanghai remaining in the moderately unreasonable range from 2011 to 2014, while Shenzhen exceeded the severely unreasonable standard by nearly three times in 2016. These data reflected the severe bubble conditions still present in China’s real estate market.

3. Factors Contributing to the Real Estate Bubble in First-Tier Cities

Housing bubbles are typically caused by excessive demand and insufficient supply. The early stages of China’s real estate bubble can be traced back to the 1980s. The contributing factors are as follows:

3.1. Government

Firstly, the formulation of government policies was closely tied to housing price fluctuations. The housing policy reforms marked the beginning of the rapid increase in housing prices. With the development of urbanization in China, the urban population gradually increased, thereby increasing the demand for housing. However, housing at that time was provided by the government and state-owned enterprises at extremely low prices, leaving little incentive for private enterprises to invest in the real estate sector, ultimately leading to a housing shortage. Thus, in 1988, the Chinese government implemented a series of housing reform policies, promoting real estate privatization to encourage the growth of the real estate industry. Consequently, China’s housing sector shifted from a planned economy to a market economy, aiming to encourage more private home purchases and real estate investments. As most private enterprises aimed to maximize profits, they raised prices to achieve this, ultimately contributing to the real estate bubble. After implementing this policy, local government revenues declined significantly, with local fiscal revenue as a proportion of the national budget revenue dropping from 77.98% in 1993 to 44.3% in 1994 [8].

Secondly, to address the shortfall in fiscal revenue, local governments began selling land rights at high prices to generate income. More importantly, the scarcity of land resources and the monopolistic position of local governments further drove up housing prices. Local governments exacerbated the real estate bubble by selling land at high prices to increase fiscal revenue.

Thirdly, expansionary monetary policies also contributed to the rise in housing prices [9]. In response to the sharp decline in housing prices following the 2008 global financial crisis, the Chinese government injected 4 trillion yuan into the economy to prevent economic downturns and continued declines in housing prices. Subsequently, housing prices stopped falling and began to rise.

Finaly, to prevent economic decline and stimulate economic growth, the central bank repeatedly lowered base interest rates between 2008 and 2015 [10]. According to the data that from the National Bureau of Statistics, the base interest rate dropped from 4.14% to 1.50%. This measure reduced the cost of financing for enterprises and households, encouraging more investment by enterprises and home purchases by households, thereby driving up housing prices. The central bank also reduced the quantitative easing, allowing banks to lend more funds, increasing money supply in the market. Since the financial market was underdeveloped, real estate became the primary destination for capital inflows. As a result, numerous amounts of capital flowed into the real estate market, rapidly driving up housing prices and exacerbating the real estate bubble.

3.2. Economy

First, increases in disposable income per capita and China’s population growth contributed to the rise in housing prices [11-12]. As incomes increased, people’s demand for housing also increased. Homeownership in China is largely associated with an individual’s marital value and family formation. Traditionally, Chinese people consider owning a house a prerequisite for marriage, as it symbolizes certain assets and responsibilities, ensuring stability in married life. Additionally, in Chinese culture, a home symbolizes reunion and a sense of belonging [8]. According to data from the National Bureau of Statistics of China, in 2023, disposable income per capita grew by 6.3% compared to 2022, and China’s population reached 1.4 billion in 2024. Therefore, more people would likely choose to buy houses, driving up housing prices. Secondly, compared to the stock market’s uncertainties, real estate investment was considered a relatively safe and stable way for Chinese citizens to make money, driven by speculative activities [10]. Due to speculative activities, market demand drove prices higher, leading many to believe that real estate assets were highly valuable and appreciated quickly, with little risk of depreciation. As a result, many families chose to buy homes to increase their savings. This also led many businessmen to view real estate investment as a quick and profitable way to make money. Consequently, more businessmen engaged in speculative activities, purchasing homes and trading them repeatedly to earn the price difference. Ultimately, this led to a rapid rise in housing prices and the formation of a bubble.

4. The Impact of Property Tax on Curbing Speculative Home Purchases

The occurrence and subsequent bursting of real estate bubbles have had negative impacts on a nation’s economic development and social stability. In China, current property prices have significantly exceeded their intrinsic value. Therefore, implementing appropriate measures has not only been critical for economic development but also for ensuring sustainable development and maintaining social order.

The introduction of a property tax has been identified as a potential method to curb speculative home purchases. China’s existing tax system has levied property taxes since 1986; however, non-commercial residential properties were exempted, which limited the effectiveness of this policy in deterring speculative activities. As the economy developed, speculative behavior intensified, driving property prices far beyond their real value and making homeownership unaffordable for many households. In response, on January 28, 2011, China introduced a new property tax in Shanghai, extending the tax to non-commercial residential properties. The tax targeted homes purchased after the implementation date by both residents and non-residents. According to a statement from China Daily, the initial tax rate was calculated at 70% of the transaction price of the property [5]. This policy increased the cost of homeownership for families and raised the cost of speculative activities, as property purchases became taxable. Consequently, the higher the property value, the more tax was required, which significantly reduced demand for homes and speculative buying, particularly in first-tier cities where property prices were already high. The decrease in demand subsequently led to a decline in prices, thus mitigating the expansion of the bubble. Empirical evidence demonstrated that property taxes effectively suppressed speculative home purchases [13]. Following this, China began to implement property taxes on a broader scale nationwide, further curbing speculative activities and slowing the expansion of the real estate bubble.

5. Conclusion

This study found that the real estate bubble in China's first-tier cities remains significant. It also identified the factors that contributed to rising housing prices in China. By analyzing the price-to-income ratios in Beijing, Shanghai, Guangzhou, and Shenzhen, it was observed that all four cities had ratios far above reasonable levels, particularly Shenzhen, where the ratio significantly exceeded those of the other three cities. This finding underscored the severity of the real estate bubble in China. The study categorized the factors contributing to the bubble into two main groups: policy-related and economic. Policy-related factors included government housing reforms, monetary easing policies, and reductions in both the benchmark interest rate and the reserve requirement ratio. These policies collectively fueled the increase in housing prices. Additionally, local governments further exacerbated the bubble by selling land-use rights at high prices to offset fiscal deficits, which drove up land and housing prices. On the economic side, factors such as the growth in per capita disposable income and speculative behavior played crucial roles. As the income levels of Chinese residents increased, coupled with the traditional importance placed on homeownership, the demand for housing rose, leading to higher prices. Moreover, real estate speculation, viewed as a relatively stable investment, intensified, further inflating the bubble. Given the potential negative impacts of a large and bursting real estate bubble on China's economic and social environment, this study also analyzed how a property tax could mitigate speculative buying behavior. The findings suggested that a property tax could effectively curb speculative activities by increasing the cost of purchasing homes, which could reduce the demand and slow the expansion of the bubble.

This research contributed to raising awareness about the extent to which real estate prices in China have exceeded their actual value and sheds light on the underlying factors driving such high prices. It also provides a foundation for people to implement more targeted methods to curb the expansion of the bubble. However, the also included certain limitations. It focused solely on first-tier cities in China, which might not fully reflect the nationwide real estate market. Additionally, the study did not sufficiently consider the impact of global economic fluctuations on China's real estate market. Future research could broaden the scope to include a wider range of cities and further explore the long-term effects of global economic conditions on China's real estate bubble, providing policymakers with more comprehensive insights for decision-making.

References

[1]. Liang, P., Willett, T. D., and Zhang, N. (2010). The Slow Spread of The Global Crisis. Journal of International Commerce, Economics and Policy, 1(01), 33-58.

[2]. Efremidze, L., Rutledge, J., and Willett, T. D. (2016) Capital Flow Surges as Bubbles: Behavioral Finance and McKinnon’s Over-borrowing Syndrome Extended. The Singapore Economic Review, 61(02), 1640023.

[3]. Hu, Y., and Oxley, L. (2018) Bubble Contagion: Evidence from Japan’s Asset Price Bubble of the 1980-90s. Journal of the Japanese and International Economies, 50, 89-95.

[4]. Okina, K., Shirakawa, M., and Shiratsuka, S. (2001) The Asset Price Bubble and Monetary Policy: Japan’s Experience in The Late 1980s and The Lessons. Monetary and Economic Studies, 19(2), 395-450.

[5]. Gjerstad, S., and Smith, V. L. (2009) Monetary Policy, Credit Extension, and Housing Bubbles: 2008 and 1929. Critical Review, 21(2), 269-300.

[6]. Craine, R., and Martin, V. L. (2009) Interest Rate Conundrum. The BE Journal of Macroeconomics, 9(1), 1-12.

[7]. Acharya, V. V., and Richardson, M. (2009). Causes of The Financial Crisis. Critical review, 21(2), 195-210.

[8]. Jacob, A., and Nair, S. (2022) The Historical Political Economy of Chinese Housing Regulation and Price Speculation. Journal of Student Research, 11(4), 20-26.

[9]. Xu, X. E., and Chen, T. (2012) The Effect of Monetary Policy on Real Estate Price Growth in China. Pacific-Basin Finance Journal, 20(1), 62-77.

[10]. Zhao, Z. (2024) Analysis on Housing Price Using Macroeconomic Indicators in China. Highlights in Business, Economics and Management, 24, 1627-1633.

[11]. Li, J., Xu Y., and Chiang Y. (2014) Property Prices and Housing Affordability in China: A Regional Comparison. Journal of Comparative Asian Development, 13(3), 405-435.

[12]. He, L., and Wen X. (2017) Population Growth, Interest Rate, and Housing Tax in The Transitional China. Physica A: Statistical Mechanics and its Applications, 469, 305-312.

[13]. Zheng, H., and Zhang, Q. (2013) Property Tax in China: Is It Effective in Curbing Housing Price? Economics Bulletin, 33(4), 2465-2474.

Cite this article

Chen,Y. (2024). The Current Situation of the Housing Market Bubble in China’s First-tier Cities . Advances in Economics, Management and Political Sciences,117,94-99.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liang, P., Willett, T. D., and Zhang, N. (2010). The Slow Spread of The Global Crisis. Journal of International Commerce, Economics and Policy, 1(01), 33-58.

[2]. Efremidze, L., Rutledge, J., and Willett, T. D. (2016) Capital Flow Surges as Bubbles: Behavioral Finance and McKinnon’s Over-borrowing Syndrome Extended. The Singapore Economic Review, 61(02), 1640023.

[3]. Hu, Y., and Oxley, L. (2018) Bubble Contagion: Evidence from Japan’s Asset Price Bubble of the 1980-90s. Journal of the Japanese and International Economies, 50, 89-95.

[4]. Okina, K., Shirakawa, M., and Shiratsuka, S. (2001) The Asset Price Bubble and Monetary Policy: Japan’s Experience in The Late 1980s and The Lessons. Monetary and Economic Studies, 19(2), 395-450.

[5]. Gjerstad, S., and Smith, V. L. (2009) Monetary Policy, Credit Extension, and Housing Bubbles: 2008 and 1929. Critical Review, 21(2), 269-300.

[6]. Craine, R., and Martin, V. L. (2009) Interest Rate Conundrum. The BE Journal of Macroeconomics, 9(1), 1-12.

[7]. Acharya, V. V., and Richardson, M. (2009). Causes of The Financial Crisis. Critical review, 21(2), 195-210.

[8]. Jacob, A., and Nair, S. (2022) The Historical Political Economy of Chinese Housing Regulation and Price Speculation. Journal of Student Research, 11(4), 20-26.

[9]. Xu, X. E., and Chen, T. (2012) The Effect of Monetary Policy on Real Estate Price Growth in China. Pacific-Basin Finance Journal, 20(1), 62-77.

[10]. Zhao, Z. (2024) Analysis on Housing Price Using Macroeconomic Indicators in China. Highlights in Business, Economics and Management, 24, 1627-1633.

[11]. Li, J., Xu Y., and Chiang Y. (2014) Property Prices and Housing Affordability in China: A Regional Comparison. Journal of Comparative Asian Development, 13(3), 405-435.

[12]. He, L., and Wen X. (2017) Population Growth, Interest Rate, and Housing Tax in The Transitional China. Physica A: Statistical Mechanics and its Applications, 469, 305-312.

[13]. Zheng, H., and Zhang, Q. (2013) Property Tax in China: Is It Effective in Curbing Housing Price? Economics Bulletin, 33(4), 2465-2474.