1. Introduction

As the global climate and environment deteriorate, the new energy industry, as a key area for accelerating energy conservation and emission reduction, has received strong support from many countries. The "Development Plan for the New Energy Vehicle Industry (2021-2035)" released by the General Office of the State Council of China in November 2020 emphasizes the need to better leverage the government's role in strategic planning, assist the new energy vehicle industry in enhancing technological innovation, shaping new industrial forms, and improving infrastructure. In recent years, the market size of the new energy vehicle industry has seen substantial growth. As a typical representative of the new energy vehicle industry, BYD's sales volume of new energy vehicles has been increasing year by year. In 2023, BYD sold 3,024,417 vehicles, a year-on-year increase of 61%. Simultaneously, BYD's stock price has been consistently rising, garnering significant attention from investors.

New energy enterprises, represented by BYD, have actively responded to the call, utilizing green bond financing for low cost and high efficiency, and have achieved a good reputation [1]. Meanwhile, BYD's engineers specialize in intelligent driving technology and have achieved certain accomplishments, becoming the first automotive enterprise in the country to obtain an L3-level test license [2]. Under the dual effects of the current economic downturn and subsidy reduction policies, BYD has demonstrated strong resilience and development potential, yet there remain issues of inefficiency. [3] Through analysis of the usage patterns among its electric vehicle users, it is evident that BYD's electric vehicles suffer from significant shortcomings, including poor safety performance and inadequate charging infrastructure. As the market continues to grow and segments emerge, a diversified development strategy for electric vehicles will become the focal point of BYD's future growth [4]. In terms of investment management, the company faces challenges with its fund management systems, necessitating the formulation of appropriate risk prevention and control measures [5].

Regarding investment value, the Ideal Automobile Company needs to optimize its supplier management practices [6] and enhance competitiveness through a combination of strategic cooperation and technological innovation [7]. Tesla Motors needs to increase communication with upstream and downstream enterprises, address product quality issues [8], continue with precise market positioning and innovative marketing strategies, and prioritize consumer demand [9]. Weilai Company should promptly establish a financing risk management system and enhance the management of accounts receivable and inventory [10]. Moreover, small and medium-sized new energy automobile enterprises such as Xiaopeng and Zero Run should implement comprehensive fund management and strengthen financial performance evaluation [11].

Based on existing literature research, this article adopts three methods SWOT analysis, financial analysis, and valuation analysis for analysis. Through these studies, reference can be provided for investor decision-making and enterprise development issues. At the same time, it can also further supplement important research on BYD and investment value-related fields.

2. Method

2.1. SWOT

SWOT analysis was proposed by American scholar Albert S. Humphrey in the 1960s. SWOT is the acronym for Strengths, Weaknesses, Opportunities, Threats, and Strengths refers to the internal strengths and advantageous factors of a company or individual, including unique skills, resources, brand reputation, etc.; Weaknesses refers to the internal weaknesses and shortcomings of a company or individual, which may help achieve goals and gain competitive advantages; Weaknesses refers to the internal weaknesses and shortcomings of a company or individual, which may help achieve goals and gain competitive advantages. Strength refers to the internal advantages and advantageous factors, including unique skills, resources, brand reputation, etc., which can help to achieve goals and achieve competitive advantage; Weaknesses refers to the internal weaknesses and shortcomings of the enterprise or individual, which may hinder the realization of goals or lead to competitive disadvantages, including poor management, shortage of resources, technological backwardness, etc.; Opportunities refers to the external environment. Favorable conditions and opportunities that exist in the external environment, can be used to take advantage of existing strengths and resources, and seize the opportunity to achieve the development and growth of the individual or organization; Threats refer to the disadvantages and potential threats that exist in the external environment, which may pose a threat to the development and survival of the enterprise or individual in terms of various factors. Using SWOT analysis BYD can analyze the strengths, weaknesses, opportunities, and threats of the internal and external environments, which can help it to comprehensively solve its situation, including internal resources and capabilities as well as the influencing factors of the external environment. At the same time, SWOT analysis can also provide an important reference for strategy development. By identifying its strengths and opportunities, it can formulate smarter development strategies; at the same time, by recognizing its weaknesses and threats, it can take corresponding countermeasures to solve problems and improve competitiveness.

2.2. Financial analysis

Financial analysis is a process of quantitative and qualitative analysis of an enterprise's financial condition, operating performance, and future development trends. By collecting, organizing, analyzing, and interpreting the financial statements and other financial data of an enterprise, financial analysis mainly adopts profitability indicators, operating ability indicators, and solvency indicators to analyze to assess the profitability, solvency, operating efficiency, and growth potential of an enterprise and to provide decision-makers with information and suggestions about the enterprise's business management, investment, and financing.

2.3. Valuation analysis

Valuation analysis refers to the process of determining the reasonable market value or intrinsic value of an enterprise, asset, or investment project through quantitative and qualitative analysis. This analysis is usually based on financial data, market conditions, industry outlook, and other factors, and uses different valuation methods and models, such as the discounted cash flow method, price-earnings ratio method, price-net ratio method, etc., to assess the value of the object being analyzed. Valuation analysis is widely used in scenarios such as investment decisions, asset pricing, M&A transactions, and equity incentives to help investors and business managers make rational decisions.

3. Results and Discussion

3.1. SWOT analysis results

3.1.1. Strengths

This paper analyzes the strengths of BYD and finds three areas of strengths, which include vertical integration and cost analysis, market leadership on a global scale, and leading technological capabilities.

(1) Vertical integration and cost advantage. BYD owns and operates its entire supply chain, reducing the complexity of price increases and negotiations related to external suppliers, to solve problems faster and flexibly adapt to market demand. This vertical integration not only cuts costs but also gives BYD absolute control over quality and consistency, reducing the risk of component defects or production bottlenecks.

(2) Global market leadership. In terms of EV sales in the last quarter of 2023, BYD surpassed Tesla, selling a record 526,000 pure battery vehicles. Market leadership gives BYD brand recognition and prestige. Consumers around the world equate the brand with advanced EV technology and reliability, which increases trust and willingness to buy. This reputation facilitates entry into new markets and attracts potential customers and investors.

(3) Leading technical capabilities. BYD devotes significant resources to internal research and development, with greater control and flexibility in innovation. Numerous R&D centers work with leading academic institutions to foster a progressive culture. BYD's patent portfolio is impressive, especially in battery technology. One of BYD's most important technological achievements is the blade battery, a lithium iron phosphate (LFP) battery with higher safety, longer service life, and higher energy density. This innovation not only reduces production costs but also improves vehicle range and safety, providing consumers with a convincing advantage.

3.1.2. Weaknesses

The three main aspects of its vulnerability analysis are brand image related to the perception of low quality in China, over-reliance on the domestic market, and reliance on government subsidies.

(1) Brand image is related to the perception of low quality in China. The negative image of low cost and low quality associated with the quality of Chinese manufacturing has been deeply rooted in the minds of global consumers. This is a significant barrier to BYD's efforts to establish itself as a premium EV brand, especially in developed markets. This perception could lead to initial skepticism among potential buyers, which could influence purchasing decisions.

(2) Overdependence on the domestic market. the Chinese EV giant derives 70.43% of its revenues from the domestic market in 2021, and its dependence on the domestic market further increases to 78.43% in 2022. The company's over-reliance on the domestic market is a potential weakness. Over-reliance on a single market carries inherent risks. China's domestic economic volatility could severely impact BYD's performance while creating geopolitical vulnerabilities. Tensions between China and other countries could lead to trade barriers or restrictions that could disrupt BYD's supply chain or access to export markets. Overdependence on a single market makes BYD vulnerable to external factors beyond its control.

(3) Dependence on Chinese government subsidies for electric vehicles. From the beginning, government subsidies have played a key role in BYD's success. These financial incentives artificially lowered the cost of electric vehicles. In addition, the subsidies have helped BYD invest heavily in R&D, driving its technological progress and consolidating its leadership position in the domestic market. However, such subsidies to the government are not guaranteed to last forever. Changes in government policies or economic priorities may lead to a reduction or even complete elimination of subsidies which would seriously affect BYD's profitability and competitiveness.

3.1.3. Opportunities

There are three main areas of opportunity: international market expansion, the growing popularity of electric vehicles, and technological advances.

(1) International market expansion. With environmental concerns and policy support, the global EV market is booming, offering lucrative opportunities outside of China's saturated market. By entering new markets, BYD can gain access to millions of potential customers and significantly increase its sales, driving its global market share and brand awareness. In addition, different markets provide insights into different consumer preferences and driving conditions, enabling BYD to customize its products and develop new models that meet the needs of specific regions. In addition, international expansion can diversify BYD's revenue streams and reduce the risk of relying solely on the Chinese market. Geopolitical tensions or an economic downturn within China could have a significant impact on its domestic performance.

(2) Electric cars are increasingly popular. Growing environmental awareness among global consumers has fueled demand for cleaner alternatives like electric cars, creating a huge and expanding market. BYD already has a reputation for innovation and sustainability and is well-positioned to capitalize on this growing demand. BYD's focus on clean energy solutions and its commitment to reducing emissions have resonated with environmentally conscious consumers, boosting its brand image and sales numbers. In addition, the policies of governments around the world are actively promoting the adoption of electric vehicles. The policy has further stimulated consumer demand and encouraged automakers to invest in the development of electric vehicles. With its existing infrastructure and advanced technology, BYD can easily adapt to these policy changes and benefit from the government's efforts to promote the widespread adoption of electric vehicles.

(3) Technology Advancement. Embracing cutting-edge technology provides BYD with a once-in-a-lifetime opportunity to solidify its position as a global leader in the electric vehicle race. Advances in battery technology are the cornerstone of BYD's future growth. Its proprietary blade batteries offer greater safety, longevity, and energy density than traditional lithium-ion batteries. Continued research and development in this area, exploring solid-state batteries and other next-generation solutions, is critical to maintaining a competitive edge and extending range while reducing charging time. Investing in robust battery management systems that optimize performance and lifetime will further improve the efficiency and attractiveness of the overall electric vehicle.

3.1.4. Threats

The main threats are the procurement of key components and the global economic slowdown.

(1) Procurement of key components. Although BYD is vertically integrated and produces batteries and semiconductors in-house, it still relies on external suppliers for key components such as chips, rare earth minerals, and battery materials. Shortages and price volatility in these areas could significantly impact production costs and schedules, potentially derailing BYD's ambitious growth plans. The issue is also affected by several factors. The global chip shortage continues, affecting the global industry, including electric vehicles. Geopolitical tensions, particularly between the United States and China, further complicate the issue and could disrupt access to key minerals and technologies. In addition, the growing global demand for electric vehicles is putting enormous pressure on the limited supply of key materials, pushing up prices and creating bottlenecks.

(2) Global economic slowdown. The global economic slowdown, characterized by reduced consumer spending and business investment, could have a significant impact on BYD's growth trajectory. Consumers facing tighter budgets may delay purchasing luxury items such as electric vehicles, which would directly impact BYD's sales. Companies tightening their belts may delay fleet electrification plans, further dampening demand. The impact of the downturn is not limited to direct sales. Access to capital may become more difficult, which will hinder BYD's investment in R&D, which is critical to maintaining its technological edge. Rising interest rates could increase the debt burden, affecting profitability and limiting expansion plans.

3.2. Financial analysis results

3.2.1. Profitability analysis (benefit analysis)

This paper uses the proportion of accounts receivable in business income to analyze BYD's profitability, as shown in table 1, over the past three years, BYD's proportion of accounts receivable in business income has gradually declined, indicating that the company's business income has gradually become faster and faster, and also reflects the company's strict credit policy; It can be seen that the proportion of accounts receivable in operating income of the company is less than 10% in 2022 and 2023, which proves that the financial situation is better.

Table 1: Proportion of accounts receivable in operating income from 2021-2023

unit:%

Project | 2021 | 2022 | 2023 |

The proportion of accounts receivable in operating income | 17.92 | 8.85 | 8.36 |

3.2.2. Analysis of operating capacity (efficiency analysis)

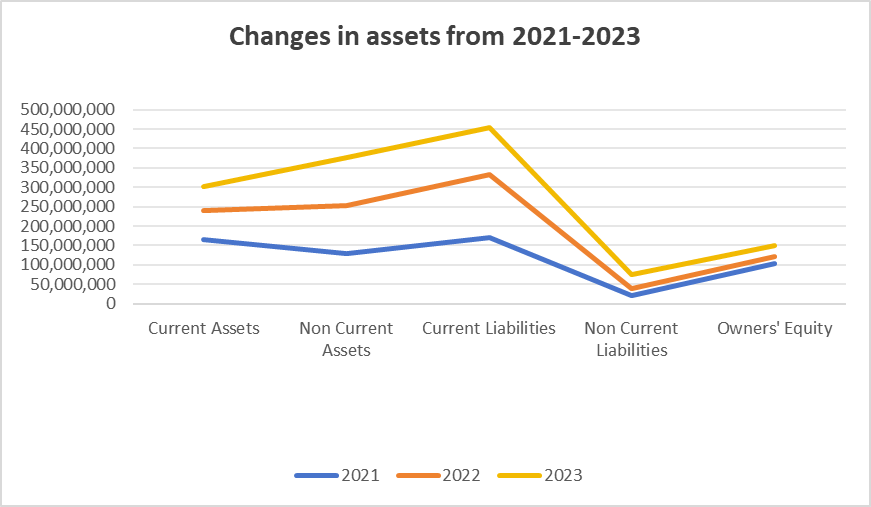

As shown in figure 1, over the three years, BYD's current assets and part of its non-current assets are financed by current liabilities, and the other part of its non-current assets are financed by non-current liabilities and owner's equity. In other words, that is, short-term assets and some long-term assets are financed by short-term funds, and some other long-term assets are financed by long-term funds. It indicates that BYD belongs to the adventurous asset-liability term structure. It is characterized by the fact that since the cost of short-term funding is usually low and the risk is relatively high, this matching using more short-term funding is a riskier choice, making the company's return and risk higher.

Figure 1: Changes in assets from 2021-2023

3.2.3. Solvency analysis

Short-term solvency analysis

Factors affecting the company's liquidity and short-term solvency include current assets, current liabilities, working capital, and cash flow. This paper mainly analyzes the quick ratio and cash flow.

(i) Quick ratio (acid test ratio)

As shown in table 2, over the past three years, BYD's quick ratio has been declining year by year, and the annual average quick ratio is 0.56, indicating that BYD's short-term solvency is weaker; similar to the current ratio, the company's quick ratio may be artificially manipulated as well, therefore, it should be carefully identified during the analysis, and once manipulation is found to exist, adjustments should be made to recalculate the quick ratio.

Table 2: Proportion of quick ratio from 2021-2023

unit:%

Project | 2021 | 2022 | 2023 |

Quick Ratio | 0.72 | 0.49 | 0.47 |

(ii) Cash flow ratio

As shown in table 3, in the past three years, BYD's cash flow ratio is not high, and first rises and then will be no more than 1. From the point of view of cash flow to current liabilities, BYD's short-term solvency situation is not very satisfactory;

Table 3: Cash flow ratios from 2021-2023

unit:%

Project | 2021 | 2022 | 2023 |

Cash Flow Ratio | 0.38 | 0.42 | 0.37 |

3.3. Valuation results

In this paper, we use the price-earnings ratio method, price-to-book ratio, and price-to-sales ratio to analyze the valuation of BYD Company. The results are shown in table 4.

Table 4: Analysis results of BYD's P/E ratio, P/B ratio, and P/S ratio on September 30, 2022

2022.9.30 | P/E Ratio | P/B Ratio | Sales Ratio |

BYD | BYD's P/E ratio is 134.20, the rolling P/E ratio of the automotive industry is 28.91, and the median rolling P/E ratio of Listed Companies in the automotive industry is 41.97. Compared with industry data, BYD's valuation is relatively high. However, because the automobile sector is a traditional industry, the valuation of new energy vehicles can not be evaluated only by the P/E ratio, but also by the future automobile delivery volume. Now BYD is facing a critical period of upgrading, with large fluctuations in profits. It is not known whether it can maintain high growth in sales and double growth in revenue and profits in the future. If its high growth trend is unsustainable, BYD's valuation may be sharply lowered. | As of September 30, 2022, BYD's P/B ratio was 7.59, the automotive industry's P/B ratio was 2.18, and the median P/B ratio of Listed Companies in the automotive industry was 2.27. Compared with industry data, BYD's investment value is relatively low. | BYD's market-to-sales ratio is 2.66. The market-to-sales ratio can be used to determine the value of stocks relative to past performance, but it is difficult to reflect changes in costs. BYD has developed rapidly in recent years, investing a lot of costs in scientific and technological research and development, and judging its valuation only by the market sales rate is somewhat one-sided. |

4. Conclusion

In conclusion, this paper uses the methods of SWOT analysis, financial analysis, and financial analysis to analyze the investment value of BYD. The results show that in the SWOT analysis, its main advantages are vertical integration of supply chain and cost advantage, leadership in the new energy market, leading technological capabilities and internal development of resources, weak brand image and low-quality stereotypes in China, excessive dependence on the domestic market and dependence on Chinese government subsidies. The opportunities include the expansion of the international market for new energy, the improvement of the popularity of electric vehicles and technological progress, as well as the threats of key parts procurement and the slowdown of the global economy; From the perspective of financial performance, we can see that its profitability is strong, its financial situation is good, and its operating capacity situation is good. However, due to the risky choice of short-term capital cooperation, the company's earnings and risks are high. Through the analysis of quick ratio and cash flow ratio, we can see that BYD's short-term solvency is weak; From the valuation analysis, it shows a state of high valuation in the industry as a whole.

The results of this paper have two main implications: the first is to provide investors with a clearer and comprehensive understanding of BYD's financial indicators, operating conditions, and industry environment, to provide corresponding reference for them to make investment decisions; Another enlightenment is that for BYD itself, it can help it look at its problems more objectively and fully, to provide reference and reference for improving and enhancing its ability to cope with challenges and threats and increasing market share in the follow-up operation.

Although BYD has a more comprehensive analysis through SWOT analysis, financial analysis, and valuation analysis, this paper only analyzes from the micro perspective, such as the environment faced by the enterprise itself, and considers less from the macro perspective, such as the trend of the whole economic market, macroeconomic factors and so on. In the follow-up research, it needs to be further expanded.

References

[1]. Yao Yiyu. Motivation and performance of corporate green bond financing under the background of double carbon - Taking BYD as an example. Modern enterprise, 2024 (02): 167-169

[2]. Chen Qi. The vehicle intelligence mentioned in "BYD Dream Day 2024" depends on technology and hard work. automobiles and accessories, 2024 (z1): 57

[3]. Yuan Kangyang. Financial strategy choice and effect analysis of new energy automobile enterprises - Taking BYD as an example. Economic Research Guide, 2024 (02): 90-94

[4]. Chen Lifan. BYD electric vehicle marketing status survey and marketing strategy analysis. Modern business, 2024 (01): 11-14. Doi: 10.14097/j.cnki. 5392/2024.01.032

[5]. Zhang Zhihong. Problems and Countermeasures in Enterprise Investment and Financing Decision-making - Taking BYD as an example. National circulation economy, 2024 (02): 112-115. Doi: 10.16834/j.cnki. Issn1009-5292.2024.02.003

[6]. He Sihuan.Research on the supplier management strategy of ideal auto parts company. Hebei University of science and technology, 2023. Doi: 10.27107/d.cnki. Ghbku. 2023. 000932

[7]. Wu Mengting.Research on the development strategy of new energy vehicles of ideal automobile company. Shanghai University of Finance and Economics, 2023. Doi: 10.27296/d.cnki. Gshcu.2021.001589

[8]. Li Xiumin, Chen Chong. Tesla strategic cost management research. China storage and transportation, 2023 (11): 168-169. Doi: 10.16301/j.cnki. Cn12-1204/f.2023.11.092

[9]. Li Xin, Yang Hengdong, Liu Chen, et al. Research on the marketing strategy of the Tesla automobile brand in China [J]. Times Automobile, 2024 (07): 151-153

[10]. Zhou Bingjun. Research on profit model risk of new energy automobile enterprises - Take the Weilai automobile company as an example.. National circulation economy, 2023 (21): 92-95. Doi: 10.16834/j.cnki. Issn1009-5292.2023.21.003

[11]. Zheng Nanping. Analysis of Working Capital Management for Small and Medium sized New Energy Vehicle Enterprises - Taking NIO, Xiaopeng, Ideal, and Zero Run New Power Vehicle Enterprises as Examples. Financial Management Research, 2024 (01): 47-53

Cite this article

Ning,Z. (2024). Research on the Investment Value of BYD Based on SWOT, Financial, and Valuation Methods. Advances in Economics, Management and Political Sciences,112,176-183.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yao Yiyu. Motivation and performance of corporate green bond financing under the background of double carbon - Taking BYD as an example. Modern enterprise, 2024 (02): 167-169

[2]. Chen Qi. The vehicle intelligence mentioned in "BYD Dream Day 2024" depends on technology and hard work. automobiles and accessories, 2024 (z1): 57

[3]. Yuan Kangyang. Financial strategy choice and effect analysis of new energy automobile enterprises - Taking BYD as an example. Economic Research Guide, 2024 (02): 90-94

[4]. Chen Lifan. BYD electric vehicle marketing status survey and marketing strategy analysis. Modern business, 2024 (01): 11-14. Doi: 10.14097/j.cnki. 5392/2024.01.032

[5]. Zhang Zhihong. Problems and Countermeasures in Enterprise Investment and Financing Decision-making - Taking BYD as an example. National circulation economy, 2024 (02): 112-115. Doi: 10.16834/j.cnki. Issn1009-5292.2024.02.003

[6]. He Sihuan.Research on the supplier management strategy of ideal auto parts company. Hebei University of science and technology, 2023. Doi: 10.27107/d.cnki. Ghbku. 2023. 000932

[7]. Wu Mengting.Research on the development strategy of new energy vehicles of ideal automobile company. Shanghai University of Finance and Economics, 2023. Doi: 10.27296/d.cnki. Gshcu.2021.001589

[8]. Li Xiumin, Chen Chong. Tesla strategic cost management research. China storage and transportation, 2023 (11): 168-169. Doi: 10.16301/j.cnki. Cn12-1204/f.2023.11.092

[9]. Li Xin, Yang Hengdong, Liu Chen, et al. Research on the marketing strategy of the Tesla automobile brand in China [J]. Times Automobile, 2024 (07): 151-153

[10]. Zhou Bingjun. Research on profit model risk of new energy automobile enterprises - Take the Weilai automobile company as an example.. National circulation economy, 2023 (21): 92-95. Doi: 10.16834/j.cnki. Issn1009-5292.2023.21.003

[11]. Zheng Nanping. Analysis of Working Capital Management for Small and Medium sized New Energy Vehicle Enterprises - Taking NIO, Xiaopeng, Ideal, and Zero Run New Power Vehicle Enterprises as Examples. Financial Management Research, 2024 (01): 47-53