1. Introduction

Microsoft is a leader in the global technology industry, with its core businesses covering software development, technical services, and electronic equipment. The company has always been committed to leading the development of the industry through technological innovation, which has not only greatly improved people's quality of life and work efficiency but also made significant contributions to the development of the global information technology field. The technology industry market is full of fierce competition. Microsoft can become the industry leader in such an uncertain market environment through its excellent innovation capabilities and strong brand influence, which makes Microsoft successfully stand out from many competitors.

Microsoft can maintain its leading position in such a market environment because its innovation ability is essential. However, besides innovation capabilities, what is more important is its keen insight into market changes and its ability to adapt. Porter's five forces model provides a valuable perspective on this. This article provides a detailed analysis of Microsoft Corporation using Porter's five forces model, providing a comprehensive perspective on the various external factors that influence the company's performance, including the impact of the global environment on the company's performance, the various internal and external factors that affect the company's profitability, and the strategies and policies adopted to remain competitive in a changing global economy.

This article closely examines how these factors work together to drive Microsoft's global success, how the global market environment shapes Microsoft's business strategy and how the company responds to critical issues such as market competition, potential new entrants, and the threat of substitute products. In addition, this article will explore how Microsoft leverages its innovation capabilities and market strategies to maintain its market leadership in changing global economic conditions and the potential impact of these strategies on the company's future development.

Through in-depth analysis and evaluation, this article aims to reveal the critical factors behind Microsoft's industry leadership and explore the company's main challenges and opportunities to provide a reference for future business decisions and strategic development.

2. Methodology

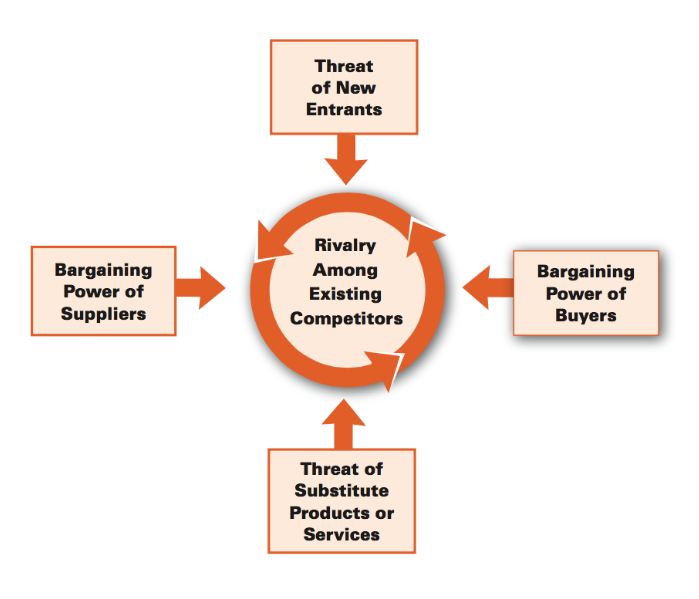

The Porter's Five Forces model, proposed by Michael Porter in 1979, is used to analyze the competitive intensity and profit potential of industries. This model consists of five basic forces that together determine an industry's competitive environment and a company's strategic positioning within that industry. These five forces include: Rivalry among existing competitors, Threat of new entrants, Threat of substitute products or services, Bargaining power of suppliers, Bargaining power of buyers.

Figure 1: Porter's Five Forces Model

The Porter's Five Forces model helps businesses identify and evaluate various forces in the external environment to develop effective competitive strategies, thereby enhancing their market position and profitability. This model is widely used in strategic management and market analysis. It provides a framework for Microsoft to comprehensively analyze its competitive environment and strategic position in the industry. By assessing competition within the industry, the threat of potential new entrants, the impact of substitutes, and the bargaining power of suppliers and buyers, Microsoft can identify key competitive dynamics and market opportunities. This analysis helps Microsoft to devise and adjust strategies to enhance its market position, manage costs and supply chain risks, improve customer satisfaction, and ultimately maintain its competitive advantage and leadership in the global technology market. Research by Karagianopoulos, G.D et.al [1] suggests that Michael Porter's arguments for the new economy provide a useful starting point in the analysis of the environment. His arguments are based on exaggerated phenomena. Factors that determine a sector's profitability could be enriched with the innovation that prevails in the particular sector. This is great for analyzing Microsoft Corporation.

3. Analysis

The global environment profoundly impacts Microsoft's structure and performance, involving multiple aspects. Although not directly considered by Porter's Five Forces model, the global environment affects the company's external macro environment, indirectly influencing how these five forces work. Their intensity: Research by Jia, J., & Li, Z. [2] shows that climate change, economic policy, and political instability negatively affect firms' sustainability performance. This finding aligns with the real options theory that uncertainty in an external environment discourages firms' long-term investment.

1. Economic factors: Global economic fluctuations and market trends affect Microsoft's sales and profits. A global economic recession may reduce corporate and consumer spending, while economic growth could increase demand for Microsoft's products and services. Financial factors also influence firms' growth opportunities and investment needs, while financial developments influence firms' external financing constraints. As mentioned in the paper by Gochoco‐Bautista, M. S., Sotocinal, N. R., & Wang, J. [3], these effects are asymmetric, being more vital during the onset of the global financial crisis and weaker during the subsequent recovery.

2. Political and legal factors: The policies, regulations, and international trade agreements of governments around the world significantly impact Microsoft's global operations. For example, data protection laws, intellectual property laws, and antitrust regulations dictate Microsoft's behavior in different markets.

3. Technological factors: Technological innovations and changes determine the direction of Microsoft's product development. Global technology trends, such as the development of cloud computing, artificial intelligence, and the Internet of Things, prompt Microsoft to adjust its product and service portfolio continuously to stay competitive.

3.1. Rivalry Among Existing Competitors

In the context of Porter’s Five Forces, making strategic positioning for their competitors, Microsoft must achieve success. Across Microsoft’s various markets, there are numerous competitors. Warner argued in 2019 that tech giants like Google, Amazon, Apple, Facebook, and Microsoft are all in the same competitive environment, and everyone needs to remain vigilant[4]. Ferguson also believes that some products are more accessible to switch between than others, but in most cases, switching costs are not too high. Therefore, companies must constantly strive to retain their customers[5]. The company stands out through its innovative, expansive, and integrated product ecosystem and its high focus on cloud computing, artificial intelligence, and other emerging technologies. Microsoft leverages its extensive R&D to improve and diversify its products continually, making it difficult for competitors to keep up.

Furthermore, its strategy of building a comprehensive cloud infrastructure and service platform has made it a leader in enterprise and consumer markets. Microsoft also adopts a hybrid strategy of competitive pricing, bundling sales, and partnership relationships to enhance its market position and customer loyalty, thereby reducing the effectiveness of price competition from competitors. This combination of technological leadership, ecosystem integration, and strategic market positioning enables Microsoft to maintain a competitive advantage, mitigate the intensity of competition, and ultimately secure its profitability and market share. Thus, Dobbs pointed out in 2014 that Microsoft can differentiate itself from competitors through non-price factors, reducing profit erosion caused by price competition[6].

3.2. Threat of New Entrants

The third question is: "To what extent does the threat of potential entry or actual entry erode the profitability of the firm?" We can further analyze this through the "Threat of New Entrants" component of Porter's Five Forces model. This part of the analysis is mainly divided into two sections: barriers to industry entry and switching costs for consumers of corporate brands.

Firstly, Shao indicated in his 2023 paper that Microsoft holds a solid market position in its main business areas[7], attributed to the complex array of software ecosystems developed by Microsoft and its close collaboration with various computer hardware manufacturers. These factors have helped Microsoft construct high-level barriers to entry within the industry. These barriers are not limited to the existing actual threats of entry, such as the complexity of various software ecosystem technologies and their inherent brand effects, but also include potential threats of entry, such as the substantial economic costs required for developing new technologies and the significant expenses for market promotion and marketing. These expenses include but are not limited to technology research and development, product production, and product promotion and sales.

Secondly, Vömel and Freiling believe that thanks to Microsoft's early establishment and entry into the industry, it has already gained a broad and mature customer base[8], which has made it difficult for users who have been utilizing Microsoft products for an extended period to break away from their dependence on Microsoft products. This dependence directly leads to higher switching costs for users if they wish to switch to products from other companies. He and others pointed out that such switching costs are a significant competitive advantage for Microsoft, indirectly forming a solid loyalty among Microsoft customers[9].

Undoubtedly, the two points mentioned above increase the difficulty for new entrants competing in the market. Therefore, the theoretical potential or actual entry of new entrants could pose a particular threat to Microsoft's profitability. However, the extent of this threat is minimal, attributed to the high barriers to entry and the limitation of the threat from new entrants by Microsoft's highly loyal customer base, as analyzed above.

3.3. Threat of Substitute Products or Services

Regarding the fourth question: "To what extent do competing products from outside the company erode the profitability of the firm?" we can further analyze through the "Threat of Substitute Products or Services" component of Porter's Five Forces model. In the following paragraphs, the analysis will mainly focus on two of Microsoft's key business areas: computer operating systems and office software.

Firstly, concerning operating systems, Apple's macOS can be considered a major substitute for Microsoft's Windows system. Apple's macOS has demonstrated competitive advantages in the design industry relative to other systems. Additionally, Siahaan found that Apple also has a strong user base, and with the company's continued significant investment in user experience, its products are becoming increasingly popular worldwide [10]. In the future, more users may choose the macOS system to assist with their daily office work, which could lead to a decrease in the market share of the Windows system. A reduction in market share would subsequently have a negative impact on Microsoft's profitability.

Secondly, in the realm of office software, Microsoft has long maintained a leading position in the industry. The well-known Microsoft Office is one of Microsoft's main profit-generating products. However, as Google continues to improve its Google Workspace office software suite, Microsoft Office's dominant position in the market has been somewhat challenged. Google Workspace offers a suite of tightly integrated office software, including Google Docs, Gmail, Google Slides, etc. The collaborative synergy among these integrated software solutions facilitates efficient and close communication and collaboration among employees in enterprises, meeting the needs of organizations that require real-time communication and collaboration. Although Microsoft also offers Outlook for office communication, Google's threat in this area is significant, posing a negative impact on Microsoft's profitability.

3.4. Bargaining Power of Suppliers

In various companies, the power of suppliers in the industry generally ranges from low to medium. Suppliers, providing essential inputs (materials, software, labor, etc.) necessary to produce goods or services, are influenced significantly by critical inputs, high differentiation, supplier concentration, and switching costs. Microsoft has effectively weakened the power of suppliers by establishing strategic partnerships, vertical integration, and expanding a diversified supplier base, thereby reducing the bargaining power of suppliers in transactions with Microsoft. Microsoft has reduced reliance on any single supplier by developing key components internally or purchasing from multiple suppliers and enhanced its negotiating strength. Substantial R&D investments enable Microsoft to surpass suppliers in innovation, reducing dependence on external technologies.

While some argue that the demand for specific materials could increase the influence of suppliers, the strong market position of Microsoft and its competitors means that suppliers are unwilling to risk losing such essential clients. For example, Pegatron, which manufactures the Microsoft Surface series of personal computers, highly depends on the computing industry. This implies that Pegatron is unlikely to take any actions that would damage its relationship with Microsoft when the costs of switching suppliers are low. On the other hand, as Garreffa mentioned, Samsung's dominance in the OLED display market means that its influence on specific customers might be slightly more significant than that of Pegatron's influence on Microsoft [11]. Warner suggested that through these strategies, combined with its large scale, Microsoft can negotiate more favorable terms, thereby helping to maintain its market leadership and innovation advantage [4].

3.5. Bargaining Power of Buyers

The bargaining power of buyers determines their ability to influence pricing, quality, and terms of sale, which is primarily affected by factors such as the concentration of buyers, switching costs, and the ease of obtaining substitutes. Large enterprises and government agencies typically possess more substantial bargaining power because they can make bulk purchases and seek discounts. Warner pointed out that Microsoft's bargaining power with buyers is moderate [4]. The company's strategy to diminish buyers' purchasing power revolves around creating a sticky ecosystem of products and services. By offering integrated solutions, such as a combination of Windows, Office, and Azure, Microsoft increases the switching costs for consumers and businesses. The company's focus on cross-platform services strengthens users' dependency on its ecosystem, making it difficult for buyers to negotiate lower prices due to the high value and uniqueness of Microsoft's product offerings.

This integrated approach, combined with continuous innovation, ensures that Microsoft's products remain indispensable and irreplaceable to its users, thereby maintaining its ability to charge a premium. The likelihood of customers switching away from a company's services if different providers offer value is also relatively low. For example, customers seeking a cloud service platform with more features might lean towards Microsoft rather than Google. However, after a series of analyses, Harvey found that if these customers need a cloud service platform with industry-leading AI or data analytics tools, they might prefer Google [12]. In summary, Microsoft's strong market position and brand influence across multiple domains give it an economic base to charge higher prices to some extent.

4. Strategies to stay competitive

In order to maintain the competitiveness of the company, Microsoft has taken many steps:

Step 1: Product differentiation and innovation

Microsoft maintains its competitive advantage by continuously innovating and launching differentiated products and services, e.g. launching products such as operating systems, Office suite, cloud computing (Azure), and developing artificial intelligence. By providing unique technological solutions, Microsoft can meet the needs of different consumers and business customers, thus expanding the market and increasing market competitiveness and market share.

Step 2: Competitive Pricing Strategy

Microsoft employs flexible pricing strategies to accommodate different market and customer needs. For example, Ramesh and others found that its cloud service, Azure, uses a pay-as-you-go pricing model, charging fees based on customer type and actual usage [13]. This approach provides price competitiveness in the highly competitive cloud computing market. Then there was the time around 2010 when, Microsoft cut the price of new versions of Windows significantly and introduced a less powerful, ad-supported, free version.

Step 3: Market structure adaptation

Microsoft is a leader in several markets, and the company defends itself against the threat of new entrants by maintaining its strong market share in these areas and by entering new markets or strengthening its position in existing ones through acquisitions and partnerships.

5. Policy Impact

As a preeminent multinational company in the industry, Microsoft's business operations and strategic decisions are also affected by some external policies, such as global privacy policies, antitrust laws, and other policies that have a significant impact on Microsoft's operations.

5.1. Global data protection policy

Crockett and others found that in recent years, data protection policies such as the EU's GDPR have had a significant impact on Microsoft [14]. These policies require companies to adhere to stricter regulations when handling personal data, increasing compliance costs, and potentially limiting some of Microsoft's business models. Microsoft has responded to this challenge by not only complying with local legal requirements, but also by raising the privacy and data protection standards of its products and services worldwide, seeking to use privacy compliance as a competitive advantage.

5.2. Antitrust Laws and Enforcement

As a leader in its industry market, Microsoft has been subject to antitrust scrutiny by several governments. Antitrust laws have restricted Microsoft from certain market behaviours, particularly those related to market dominance in operating systems and office software. In response, Microsoft has taken a variety of measures to adjust its business practices to comply with national antitrust regulations, including through a more open licensing policy to promote greater market competition.

In summary, these policies have had a profound and significant impact on Microsoft.

6. Conclusion

From the foregoing analysis of Microsoft's success story, the following critical conclusions can be drawn.

Microsoft's success is due to its excellence in product differentiation, innovation, market adaptation and strategic adaptation to the global environment. It has met the needs of a wide range of consumers and businesses through technological innovation and the introduction of unique product offerings. In addition, its flexible pricing strategy and sensitive response to global changes have further strengthened its market position. The application of Porter's Five Forces model enables Microsoft to effectively assess the competitive environment and formulate competitive strategies.

Nonetheless, through the previous analyses, we can identify that Microsoft has some challenges in maintaining its competitiveness in the market. First, global economic fluctuations and rapid technological changes require Microsoft to constantly innovate and adapt its business strategies to maintain its position. Additionally, the emergence and growth of many new technology companies has increased the complexity of competition in the marketplace.

In terms of competition, although Microsoft holds leading positions in several markets, it still faces stiff competition from technology giants such as Google, Amazon and Apple. These competitors continue to introduce innovative products in areas such as cloud computing, artificial intelligence and mobile devices that threaten Microsoft's market share. In addition, emerging technology companies are offering alternative products and services, further complicating the competitive landscape.

Microsoft's success story highlights the importance of continuous innovation, flexibility in responding to market changes, adaptation to the global environment and appropriate policy responses. However, Microsoft faces challenges related to sensitivity to substitutes, the impact of global policies, supply chain management, and the bargaining power of consumers and business buyers, and although Microsoft excels in a number of areas, these challenges require the company to adopt strategies to address them in order to maintain its leading position.

References

[1]. Karagiannopoulos, G.D ; Georgopoulos, N ; Nikolopoulos, K. (2005). Fathoming Porter’s five forces model in the internet era. Info, 7(6), 66–76. https://doi.org/10.1108/14636690510628328

[2]. Jia, J., & Li, Z. (2020). Does external uncertainty matter in corporate sustainability performance? Journal of Corporate Finance, 65, 101743. https://doi.org/10.1016/j.jcorpfin.2020.101743

[3]. Gochoco‐Bautista, M. S., Sotocinal, N. R., & Wang, J. (2014). Corporate investments in Asian Markets: financial conditions, financial development, and financial constraints. World Development, 57, 63–78. https://doi.org/10.1016/j.worlddev.2013.11.017

[4]. Warner, J. P. (2019). Microsoft: A Strategic Audit. https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1153&context=honorstheses

[5]. Ferguson, E. (2017). Microsoft Corporation’s five forces analysis (Porter’s model) & recommendations. Panmore Institute. Retrieved from https://panmore.com/microsoft-corporation-five-forces-analysis-porters-recommendations

[6]. Dobbs, M. E. (2014). Guidelines for applying Porter’s five forces framework: a set of industry analysis templates. Competitiveness Review, 24(1), 32–45.https://doi.org/10.1108/CR-06-2013-0059

[7]. Shao, F. (2023). The economic impact of monopolistic Advantage: A case study of Microsoft. Highlights in Business Economics and Management, 8, 196–204. https://doi.org/10.54097/hbem.v8i.7190

[8]. Vömel, S., & Freiling, F. C. (2011). A survey of main memory acquisition and analysis techniques for the windows operating system. Digital Investigation, 8(1), 3–22. https://doi.org/10.1016/j.diin.2011.06.002

[9]. He, W., Li, M., & Zheng, J. (2023). Switching cost, network externality and platform competition. International Review of Economics & Finance, 84, 428–443. https://doi.org/10.1016/j.iref.2022.11.037

[10]. Siahaan, M. (2024). Analysis and Evaluation of the Business Innovation Strategy: a case study of Apple Inc. Enigma in Economics, 1(2), 42–48. https://doi.org/10.61996/economy.v1i2.30

[11]. Garreffa, A. (2018). Samsung has 93% of the smartphone OLED display market. TweakTown. Retrieved from https://www.tweaktown.com/news/64232/samsung-93-smartphone-oled- display-market/index.html

[12]. Harvey, C. (2023). AWS vs Azure vs Google Cloud: Top Cloud Provider Comparison. Datamation. https://www.datamation.com/cloud/aws-vs-azure-vs-google-cloud/

[13]. Ramesh, A., Pradhan, V., & Lamkuche, H. (2021). Understanding and Analysing Resource Utilization, Costing Strategies and Pricing Models in Cloud Computing. Journal of Physics. Conference Series, 1964(4), 42049-. https://doi.org/10.1088/1742-6596/1964/4/042049

[14]. Crockett, K., Goltz, S., & Garratt, M. (2018). GDPR Impact on Computational Intelligence Research. 2018 International Joint Conference on Neural Networks (IJCNN), 1–7. https://doi.org/10.1109/IJCNN.2018.8489614

Cite this article

Feng,Y. (2024). Microsoft's Strategic Advantage: An In-depth Analysis Based on Porter's Five Forces Model. Advances in Economics, Management and Political Sciences,122,96-103.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Karagiannopoulos, G.D ; Georgopoulos, N ; Nikolopoulos, K. (2005). Fathoming Porter’s five forces model in the internet era. Info, 7(6), 66–76. https://doi.org/10.1108/14636690510628328

[2]. Jia, J., & Li, Z. (2020). Does external uncertainty matter in corporate sustainability performance? Journal of Corporate Finance, 65, 101743. https://doi.org/10.1016/j.jcorpfin.2020.101743

[3]. Gochoco‐Bautista, M. S., Sotocinal, N. R., & Wang, J. (2014). Corporate investments in Asian Markets: financial conditions, financial development, and financial constraints. World Development, 57, 63–78. https://doi.org/10.1016/j.worlddev.2013.11.017

[4]. Warner, J. P. (2019). Microsoft: A Strategic Audit. https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1153&context=honorstheses

[5]. Ferguson, E. (2017). Microsoft Corporation’s five forces analysis (Porter’s model) & recommendations. Panmore Institute. Retrieved from https://panmore.com/microsoft-corporation-five-forces-analysis-porters-recommendations

[6]. Dobbs, M. E. (2014). Guidelines for applying Porter’s five forces framework: a set of industry analysis templates. Competitiveness Review, 24(1), 32–45.https://doi.org/10.1108/CR-06-2013-0059

[7]. Shao, F. (2023). The economic impact of monopolistic Advantage: A case study of Microsoft. Highlights in Business Economics and Management, 8, 196–204. https://doi.org/10.54097/hbem.v8i.7190

[8]. Vömel, S., & Freiling, F. C. (2011). A survey of main memory acquisition and analysis techniques for the windows operating system. Digital Investigation, 8(1), 3–22. https://doi.org/10.1016/j.diin.2011.06.002

[9]. He, W., Li, M., & Zheng, J. (2023). Switching cost, network externality and platform competition. International Review of Economics & Finance, 84, 428–443. https://doi.org/10.1016/j.iref.2022.11.037

[10]. Siahaan, M. (2024). Analysis and Evaluation of the Business Innovation Strategy: a case study of Apple Inc. Enigma in Economics, 1(2), 42–48. https://doi.org/10.61996/economy.v1i2.30

[11]. Garreffa, A. (2018). Samsung has 93% of the smartphone OLED display market. TweakTown. Retrieved from https://www.tweaktown.com/news/64232/samsung-93-smartphone-oled- display-market/index.html

[12]. Harvey, C. (2023). AWS vs Azure vs Google Cloud: Top Cloud Provider Comparison. Datamation. https://www.datamation.com/cloud/aws-vs-azure-vs-google-cloud/

[13]. Ramesh, A., Pradhan, V., & Lamkuche, H. (2021). Understanding and Analysing Resource Utilization, Costing Strategies and Pricing Models in Cloud Computing. Journal of Physics. Conference Series, 1964(4), 42049-. https://doi.org/10.1088/1742-6596/1964/4/042049

[14]. Crockett, K., Goltz, S., & Garratt, M. (2018). GDPR Impact on Computational Intelligence Research. 2018 International Joint Conference on Neural Networks (IJCNN), 1–7. https://doi.org/10.1109/IJCNN.2018.8489614