1. Introduction

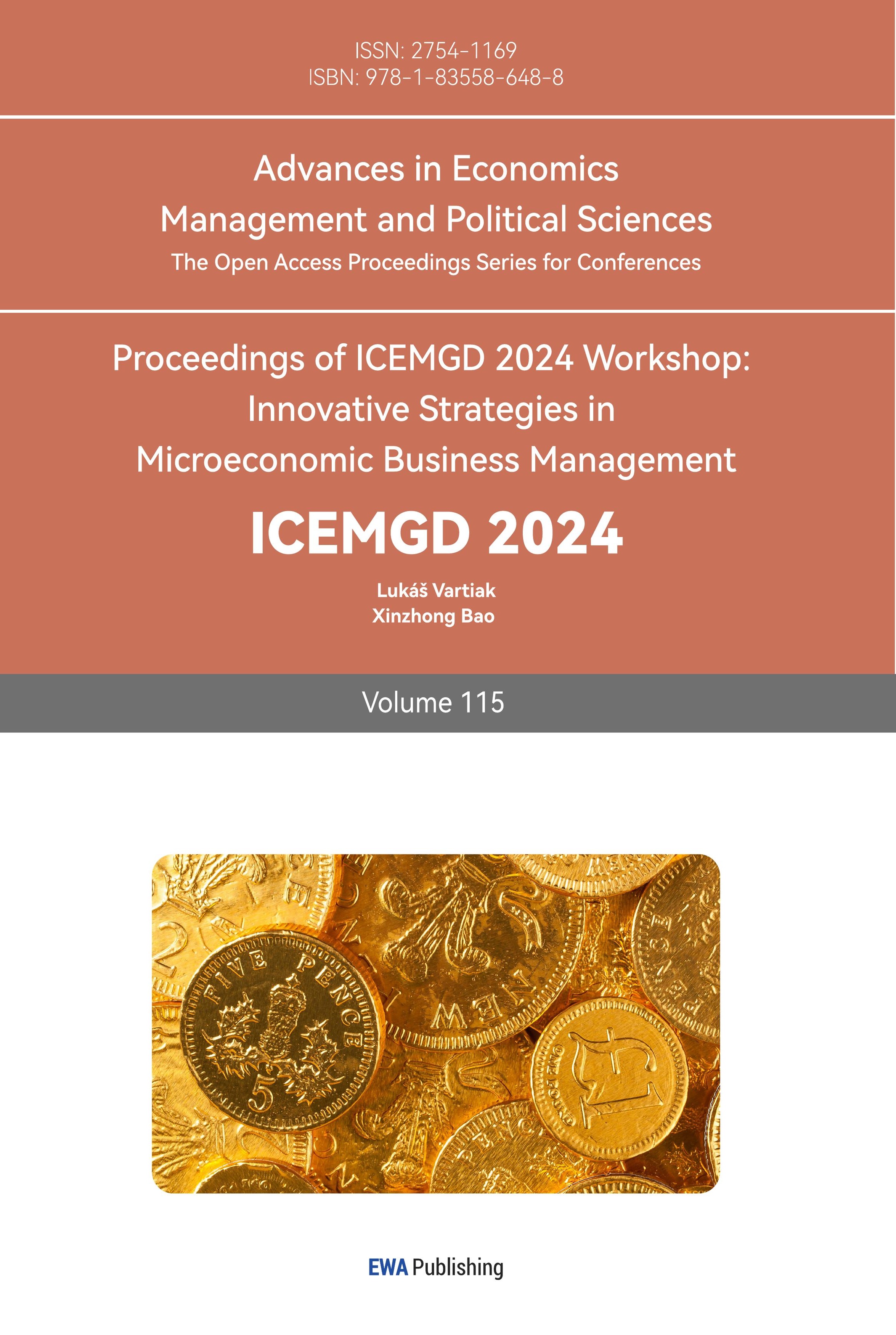

The trend of environmental change from the beginning of the 21st century to the present is both worrying and has far-reaching impacts. As shown in Figure 1, the global average temperature continues to rise, and extreme weather events occur frequently, leading to serious consequences such as glacier melting and sea level rise [1].

|

Figure 1: Global Temperature change from 1850 to 2023 |

Photo credit: National Centers for Environmental Information [1] |

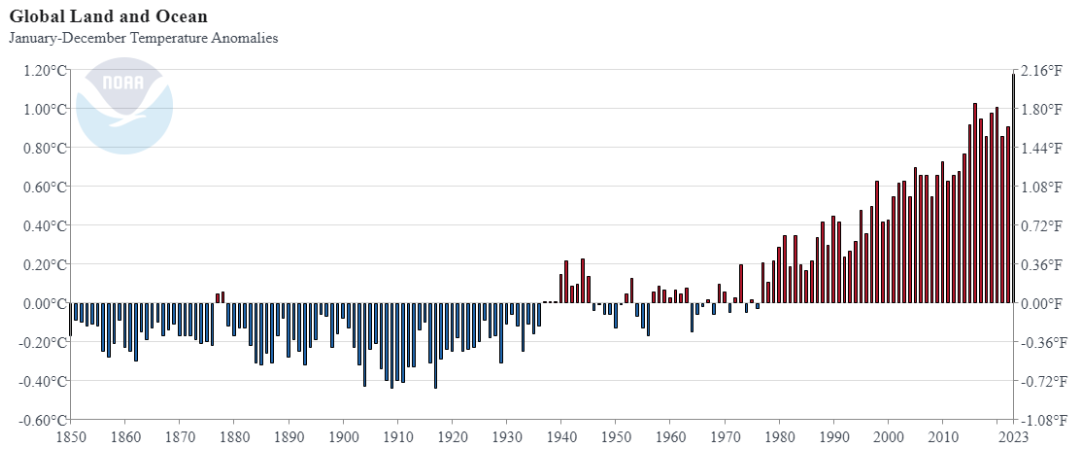

Figure 2 shows that biodiversity is being lost at an unprecedented rate by climate change, with ocean acidification affecting coral reefs and shellfish [2].

|

Figure 2: How the climate change influence ocean |

Photo credit: Ocean & Climate Platform [2] |

Besides that, Air [3] and water [4] pollution remain major global issues. These changes not only have significant impacts on the natural environment, but also pose severe challenges to global economic and social development.

In recent years, people have gradually begun to pay attention to environmental issues, and renewable energy and sustainable development have become hot topics worldwide. Many scientists are dedicated to researching renewable energy, while governments around the world are also studying policies for sustainable development. China government already set up Eco-industrial parks to reduce pollution [5], and Norway government is pushing electric vehicles promotion [6].

In order to cope with the rampant destruction of the environment by humans, many countries have begun to impose carbon taxes as a response. Sweden has been imposing a carbon tax since 1991 [6]. The basic principle is to internalize the environmental cost of carbon emissions, so that emitters pay an economic price for their emission behavior, thereby reducing carbon emissions and encouraging enterprises to adopt low-carbon technologies or shift towards renewable energy sources.

Studying carbon taxes is to understand their effectiveness in reducing greenhouse gas emissions, addressing climate change, and promoting sustainable economic development. By taxing carbon emissions, carbon taxes encourage organizations and individuals to lessen their environmental impact and support the use of renewable energy and technology. Meanwhile, carbon tax policies can also influence consumer behavior and support the government's goals in environmental protection and public health.

The remaining sections of this essay are arranged as follows: The justifications for the creation of the carbon tax will be covered in section 2, the impact of its implementation will be examined in part 3, along with its potential benefits to the national economy, and the paper's conclusion will be provided in section 4.

2. Carbon emissions and new energy developments

2.1. Global warming (greenhouse effect)

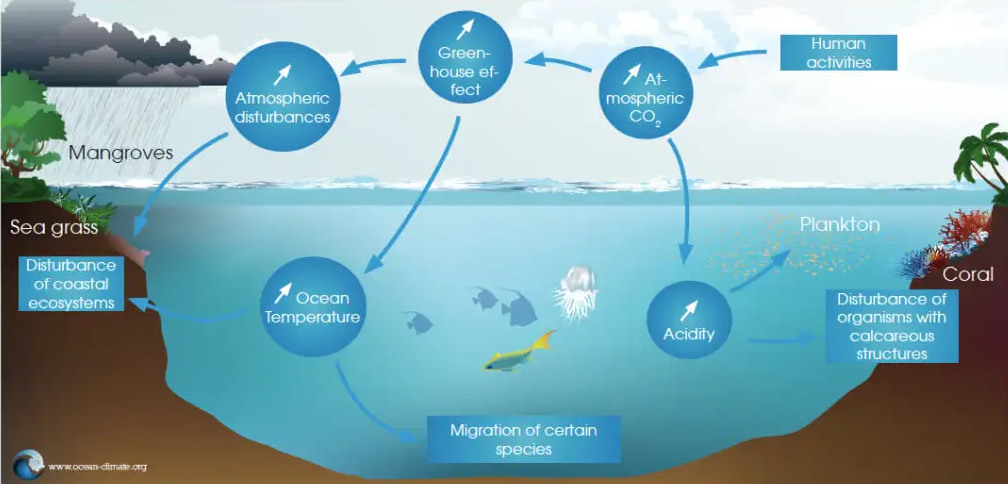

According to Figure 3, the phenomenon known as the "greenhouse effect" occurs when heat from the surface of the Earth is absorbed and reradiated by emissions of greenhouse gases in the surrounding environment, raising the temperature of the Earth's surface.

|

Figure 3: Global GHG emissions for 1990 to 2019 and estimates for 2020 |

Photo credit: Rhodium Group [7] |

Global warming has been caused by human activity since the Industrial Revolution, particularly the burning of fossil fuels, which has greatly increased the concentration of greenhouse gases [8–9]. The environment and human society are in great risk due to the negative effects of climate change, which include increasing sea levels, extreme weather, and ecosystem degradation.

Carbon tax is one of the important economic measures to address greenhouse effect and climate change. The fundamental idea is to tax carbon emissions in order to internalize the external costs of those emissions and hold emitters financially accountable. The implementation of a carbon tax raises the financial burden associated with the utilization of fossil fuels. This, in turn, motivates both enterprises and individuals to actively decrease their carbon emissions, transition to cleaner sources of energy, and adopt energy-efficient technology. Consequently, this leads to a notable reduction in greenhouse gas emissions. Through this market mechanism, carbon tax effectively reduces the intensification of greenhouse effect and slows down the speed and degree of global climate change. Singapore have implemented new policies and confirmed that carbon taxes have indeed reduced greenhouse gas emissions [10]. Therefore, carbon tax, as a policy tool, directly affects greenhouse gas emissions through economic means, thus playing a key role in controlling the greenhouse effect and addressing climate change.

2.2. Promote technological innovation and energy transformation

Technological innovation promotes energy transformation by driving the development of clean energy and energy-saving technologies. With the advancement of technology, the cost of producing and using clean energy continues to decrease, making the implementation of carbon taxes more feasible. The emergence of new technologies not only improves energy efficiency, but also increases the market share of renewable energy, making the implementation of carbon tax policies smoother and more effective.

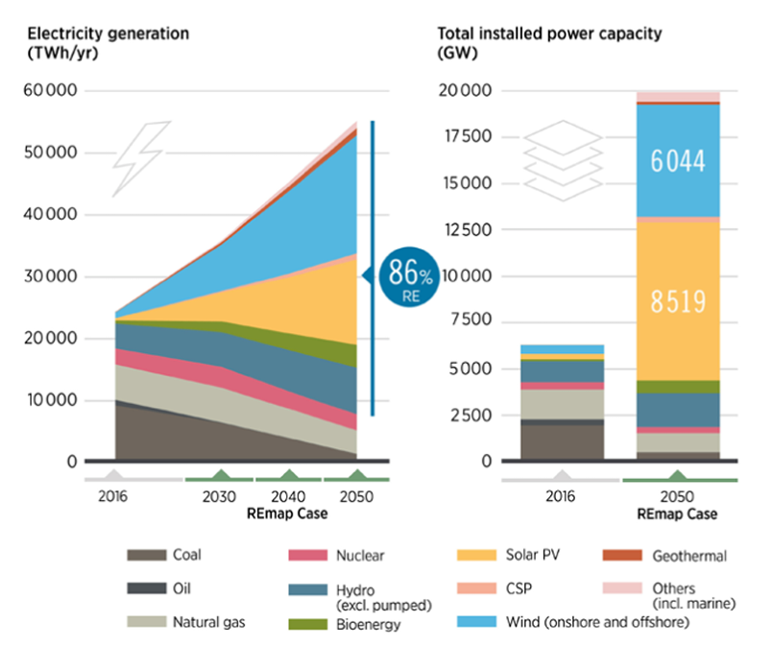

Additionally, the term "energy transformation" describes the process of moving away from reliance on fossil fuels like coal and oil and toward low-carbon and renewable energy sources like nuclear power and solar and wind energy. According to data analysis before 2022 [11], it can be found that the proportion of energy storage provided by wind and solar energy is constantly increasing, and it can be predicted that wind and solar energy will become very critical new energy sources in the future. As shown in Figure 4, at only 3.6%, solar energy—including concentrated solar power (CSP) and photovoltaic (PV) solar energy—contributes overall to the world's electrical output. But in comparison to other renewable energy technologies, it has solidified its place; as of 2022, it accounted for around 31% of all installed renewable energy capacity, making it the second largest installed renewable energy resource behind hydropower [11].

|

Figure 4: The contribution of energy sources |

Photo credit: ScienceDirect [11] |

In this process, the use of fossil fuels is reduced, and greenhouse gas emissions are lowered. This transformation gradually highlights the social cost-benefit ratio of carbon tax policies, making them more attractive. When renewable energy and low-carbon technologies become more economically competitive, the cost and burden of introducing carbon taxes by the government are relatively reduced, as the costs brought about by the transformation are effectively reduced.

3. Effects

3.1. Environmental effect

By imposing taxes on carbon emissions, carbon taxes effectively increase the cost of fossil fuels, thereby incentivizing businesses and individuals to reduce carbon emissions and shift towards clean energy. This helps to slow down global warming, reduce extreme weather and natural disaster events [12], improve air quality, and alleviate pressure on ecosystems, protecting key industries such as agriculture [13] and fisheries [14].

3.2. The economic effects of policies

Carbon tax incorporates the environmental costs of carbon emissions into market prices, corrects market failures through internalizing externalities, and makes the prices of goods and services more accurately reflect their impact on the environment (equaling more social demand and social supply).

In [15] shows that Through the coordinated operation of internal and external cycles, the research has successfully obtained an optimized carbon tax subsidy mechanism, which can ensure the sustained and sustainable improvement of the energy system.

The government can use carbon tax revenue to subsidize low-income households, help them cope with the impact of rising energy prices, and promote social equity. In addition, it can also be used to invest in public transportation, renewable energy, energy-saving projects, etc., improve public infrastructure, and promote the development of green economy. In nowadays, Sweden, Finland, United Kingdom, and Canada is using carbon tax revenue to subsidize households or help other renewable energy markets. The carbon price strategy implemented in Sweden is often regarded as one of the most effective globally.

4. Conclusion

With the intensification of global climate change, governments and international organizations are increasingly focusing on reducing greenhouse gas emissions to achieve sustainable development goals. This paper evaluates the factors that led to the creation of carbon taxes, which act as a useful market mechanism to encourage organizations and people to cut their emission levels, motivate the advancement of clean energy and low-carbon technology, and simultaneously slow down global warming by levying a tax on carbon emissions. It is significant to analyze the carbon emission reduction effect using data from countries that are implementing carbon taxes.

Based on the above findings, governments of various countries should focus more on the following three aspects of carbon tax policies:

The first is to implement a revenue neutral carbon tax policy, with a tax level that benefits people's livelihoods and avoids significant negative impacts on the economy.

The second is to increase investment in clean energy technologies. For example, increasing the subsidy ratio in the case of existing subsidies for the new energy industry. Or strengthen public facilities, such as transportation systems. This can reduce dependence on fossil fuels.

The third is to strengthen public awareness and education. Raise public awareness of carbon taxes and low-carbon lifestyles, promote active participation from all sectors of society, and create a favorable atmosphere of public support.

References

[1]. National Centers for Environmental Information. (2023). Annual 2023 Global Climate Report. Www.ncei.noaa.gov. https://www.ncei.noaa.gov/access/monitoring/monthly-report/global/202313.

[2]. Ocean and Climate Platform. (2015, March 16). The decline of marine biodiversity. Ocean & Climate Platform. https://ocean-climate.org/en/awareness/the-decline-of-marine-biodiversity/.

[3]. Manisalidis, I., Stavropoulou, E., Stavropoulos, A., & Bezirtzoglou, E. (2020). Environmental and health impacts of air pollution: A review. Frontiers in Public Health, 8(14), 1–13. NCBI.

[4]. Babuji, P., Thirumalaisamy, S., Duraisamy, K., & Periyasamy, G. (2023). Human Health Risks Due to Exposure to Water Pollution: A Review. Water, 15(14), 2532. https://doi.org/10.3390/w15142532

[5]. Wu, J., Nie, X., & Wang, H. (2024). Does industrial sustainable development policy act as a booster for urban economic growth? Evidence from China’s eco‐industrial parks. Sustainable Development, 1-16(0968-0802). https://doi.org/10.1002/sd.3039.

[6]. Gustav Martinsson, László Sajtos, Per Strömberg, & Thomann, C. (2024). The Effect of Carbon Pricing on Firm Emissions: Evidence from the Swedish CO2 Tax. Review of Financial Studies, 37(0893-9454).

[7]. Rivera, A., Movelia, S., Pitt, H., & Larsen, K. (2021, December 23). Preliminary 2020 Global Greenhouse Gas Emissions Estimates. Rhodium Group. https://rhg.com/research/preliminary-2020-global-greenhouse-gas-emissions-estimates/.

[8]. Upadhyay, P., Prajapati, S. K., & Kumar, A. (2023). Impacts of riverine pollution on greenhouse gas emissions: A comprehensive review. Ecological Indicators, 154(1470-160X), 110649.

[9]. YUE, X.-L., & GAO, Q.-X. (2018). Contributions of natural systems and human activity to greenhouse gas emissions. Advances in Climate Change Research, 9(4), 243–252.

[10]. Finkelstein Shapiro, A., & Metcalf, G. E. (2023). The macroeconomic effects of a carbon tax to meet the U.S. Paris agreement target: The role of firm creation and technology adoption. Journal of Public Economics, 218(0047-2727), 104800.

[11]. Pourasl, H. H., Reza Vatankhah Barenji, & Khojastehnezhad, V. M. (2023). Solar energy status in the world: A comprehensive review. Energy Reports, 10(2352-4847), 3474–3493. https://doi.org/10.1016/j.egyr.2023.10.022

[12]. Teng, X., Chang, T., Liu, F., & Chiu, Y. (2024). Policy choices for China to reduce carbon emissions in coping with extreme weather: Applying a dynamic two-stage undesirable non-radial directional distance function. The Science of the Total Environment, 939(0048-9697), 173590–173590.

[13]. Hesam Kamyab, Morteza SaberiKamarposhti, Hashim, H., & Yusuf, M. (2023). Carbon dynamics in agricultural greenhouse gas emissions and removals: a comprehensive review. Carbon Letters, 34, 265–289.

[14]. Andersen, N. F., Cavan, E. L., Cheung, W. W. L., Martin, A. H., Saba, G. K., & Sumaila, U. R. (2024). Good fisheries management is good carbon management. Npj Ocean Sustainability, 3(1), 1–6.

[15]. Nima Shafaghatian, Seyed Hadi Hosseini, & Reza Noroozian. (2024). An Investigation of Optimized Carbon Tax-subsidy Mechanism to Enhance Power System Sustainability Considering Wind Power Penetration. IEEE Access, 12(1), 1–1.

Cite this article

Zheng,X. (2024). The Facts, Causes and Effects of Carbon Tax. Advances in Economics, Management and Political Sciences,115,9-14.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Innovative Strategies in Microeconomic Business Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. National Centers for Environmental Information. (2023). Annual 2023 Global Climate Report. Www.ncei.noaa.gov. https://www.ncei.noaa.gov/access/monitoring/monthly-report/global/202313.

[2]. Ocean and Climate Platform. (2015, March 16). The decline of marine biodiversity. Ocean & Climate Platform. https://ocean-climate.org/en/awareness/the-decline-of-marine-biodiversity/.

[3]. Manisalidis, I., Stavropoulou, E., Stavropoulos, A., & Bezirtzoglou, E. (2020). Environmental and health impacts of air pollution: A review. Frontiers in Public Health, 8(14), 1–13. NCBI.

[4]. Babuji, P., Thirumalaisamy, S., Duraisamy, K., & Periyasamy, G. (2023). Human Health Risks Due to Exposure to Water Pollution: A Review. Water, 15(14), 2532. https://doi.org/10.3390/w15142532

[5]. Wu, J., Nie, X., & Wang, H. (2024). Does industrial sustainable development policy act as a booster for urban economic growth? Evidence from China’s eco‐industrial parks. Sustainable Development, 1-16(0968-0802). https://doi.org/10.1002/sd.3039.

[6]. Gustav Martinsson, László Sajtos, Per Strömberg, & Thomann, C. (2024). The Effect of Carbon Pricing on Firm Emissions: Evidence from the Swedish CO2 Tax. Review of Financial Studies, 37(0893-9454).

[7]. Rivera, A., Movelia, S., Pitt, H., & Larsen, K. (2021, December 23). Preliminary 2020 Global Greenhouse Gas Emissions Estimates. Rhodium Group. https://rhg.com/research/preliminary-2020-global-greenhouse-gas-emissions-estimates/.

[8]. Upadhyay, P., Prajapati, S. K., & Kumar, A. (2023). Impacts of riverine pollution on greenhouse gas emissions: A comprehensive review. Ecological Indicators, 154(1470-160X), 110649.

[9]. YUE, X.-L., & GAO, Q.-X. (2018). Contributions of natural systems and human activity to greenhouse gas emissions. Advances in Climate Change Research, 9(4), 243–252.

[10]. Finkelstein Shapiro, A., & Metcalf, G. E. (2023). The macroeconomic effects of a carbon tax to meet the U.S. Paris agreement target: The role of firm creation and technology adoption. Journal of Public Economics, 218(0047-2727), 104800.

[11]. Pourasl, H. H., Reza Vatankhah Barenji, & Khojastehnezhad, V. M. (2023). Solar energy status in the world: A comprehensive review. Energy Reports, 10(2352-4847), 3474–3493. https://doi.org/10.1016/j.egyr.2023.10.022

[12]. Teng, X., Chang, T., Liu, F., & Chiu, Y. (2024). Policy choices for China to reduce carbon emissions in coping with extreme weather: Applying a dynamic two-stage undesirable non-radial directional distance function. The Science of the Total Environment, 939(0048-9697), 173590–173590.

[13]. Hesam Kamyab, Morteza SaberiKamarposhti, Hashim, H., & Yusuf, M. (2023). Carbon dynamics in agricultural greenhouse gas emissions and removals: a comprehensive review. Carbon Letters, 34, 265–289.

[14]. Andersen, N. F., Cavan, E. L., Cheung, W. W. L., Martin, A. H., Saba, G. K., & Sumaila, U. R. (2024). Good fisheries management is good carbon management. Npj Ocean Sustainability, 3(1), 1–6.

[15]. Nima Shafaghatian, Seyed Hadi Hosseini, & Reza Noroozian. (2024). An Investigation of Optimized Carbon Tax-subsidy Mechanism to Enhance Power System Sustainability Considering Wind Power Penetration. IEEE Access, 12(1), 1–1.