1. Introduction

Introduction: The COVID-19 pandemic has not only posed significant health challenges but has also had a profound impact on global financial markets[1][1]. As investors navigate the uncertainties brought about by the crisis[2], the importance of Environmental, Social, and Governance (ESG) factors in investment decision-making has gained increased attention[3][3]. This literature review aims to examine the relationship between ESG scores and stock performance in the aftermath of the COVID-19 crisis.

ESG Scores and Stock Performance: ESG scores are given by different rating agencies to evaluate the environmental, social and governance (ESG)aspects of enterprises[4]. Although there are subtle differences in the scores given by different organizations, but all of them provide a measure of a company’s sustainability and responsibility practices, encompassing environmental stewardship, social impact, and governance practices. Prior to the COVID-19 pandemic, numerous evidence have been given to demonstrate a positive correlation between high ESG scores and stock performance[5]. Companies with strong ESG performance have been shown to exhibit lower risk, higher long-term profitability, and better resilience during economic downturns[6].

COVID-19 and ESG Scores: The COVID-19 crisis has highlighted the need for companies to demonstrate resilience and adaptability[7]. As a result, investors have increasingly recognized the value of ESG factors in assessing a company’s ability to weather the crisis and its long-term sustainability. It has been found that companies with higher ESG scores experienced less negative impact during the COVID-19 market downturn, suggesting that ESG factors may act as a buffer against market volatility[8].

Empirical Studies: Several empirical studies have investigated the relationship between ESG scores and stock performance during and after the COVID-19 crisis. For example, one study examined the performance of sustainable equity funds during the crisis and found that they outperformed conventional funds. Another study analyzed the impact of COVID-19 on the relationship between ESG scores and stock returns and found that the positive relationship between ESG scores and stock performance strengthened during the crisis[9].

Factors Influencing the Relationship: Various factors may influence the relationship between ESG scores and stock performance after the COVID-19 crisis. Industry-specific effects, such as the impact of the crisis on sectors such as travel and hospitality[10], may influence the performance of companies with high ESG scores. Regional variations in ESG adoption and investor sentiment towards sustainability may also play a role in determining the relationship[11][10][11].

2. Methodology

This literature review utilized a systematic approach to identify and analyze relevant studies on the relationship between ESG scores and stock performance after the COVID-19 crisis. The following steps were undertaken:

2.1. Data Collection

This research has undertaken a comprehensive data collection initiative focusing on the Environmental, Social, and Governance (ESG) scores of 40 enterprises that are listed among the World’s top 500 companies. This data spans from the year 2020 to the present, thereby covering a significant period that includes both the height of the COVID-19 pandemic and the subsequent post-epidemic phase. The collected data encompasses the individual scores for each of the three ESG components – Environmental (E), Social (S), and Governance (G) – as well as the aggregated total score for each enterprise. This multi-faceted scoring system provides a nuanced view of how each company performs across different areas of corporate responsibility and sustainability. In addition to the ESG scores, this research has also extracted various other key performance indicators from the database to gain a deeper understanding of the companies’ financial health and market performance. Among these indicators, particular attention has been paid to stock return and the price-to-earnings (P/E) ratio. Stock return offers insight into the investment gains or losses over a specific period, reflecting the overall market sentiment towards the company. Our data-driven approach is designed to yield actionable insights that can inform investment strategies and contribute to the ongoing discourse on the importance of ESG factors in contemporary business practices.

2.2. Define Variables

Take enterprises’ total return(Y) as dependent variable, which represents stockperformance, and the sum of E S G scores as independent(X) variable, which represents ESG performance. Both variables are measured consistently and over the same time period.

2.3. Regression Model

2.3.1. Data Process

To conduct a linear regression analysis, statistical software R is utilized. The process begins with inputting the data into R. This typically involves loading a dataset into the R environment and ensuring that the data is clean and formatted correctly for analysis. Data cleaning include handling missing values, removing outliers, or transforming variables to meet the assumptions of linear regression. The core function in R for fitting a linear regression model is lm(). This function requires a formula that describes the relationship between the dependent and independent variables, and a dataset. The formula typically takes the form dependent ~ independent1 + independent2 where the tilde (~) separates the dependent variable from the independent variables. For instance, if company sales are predicted (the dependent variable) based on advertising spend and market size (independent variables), the R code might look like this:

RCopy Code

# Assuming 'data' is our dataframe with columns 'Sales', 'AdSpend', 'MarketSize'

model <- lm(Sales ~ AdSpend + MarketSize, data = data)

summary(model)

RCopy Code

After running the regression, the summary() function in R provides a comprehensive overview of the model’s results, including coefficients for each independent variable, which indicate the estimated change in the dependent variable for a one-unit change in the independent variable, holding all other variables constant. It also provides statistics such as R-squared, which measures the proportion of variance in the dependent variable that can be explained by the independent variables, and p-values, which indicate the significance of each coefficient.

In order to achieve a more granular understanding of the relationship between the variables, it may be beneficial to divide the company into different sectors. By doing so, the analysis can account for heterogeneity across sectors that might affect the dependent variable differently. For example, the impact of advertising spend on sales might vary significantly between the technology and the apparel sectors of a company.

To incorporate this sector-specific analysis, dummy variables for each sector can be created and included in the regression model. A dummy variable is a binary variable that takes the value of 1 if a particular condition is met (e.g., if the data point belongs to a certain sector) and 0 otherwise.

The updated R code with sector dummies might look like this:

# Assuming 'Sector' is a categorical variable in our dataframe with multiple sector levels

model_sector <- lm(Sales ~ AdSpend + MarketSize + Sector, data = data)

summary(model_sector)

In this model, ‘Sector’ would be converted into multiple dummy variables behind the scenes by R, and each sector’s impact on sales would be estimated separately, while controlling for advertising spend and market size.

By conducting the regression analysis in this way, one can obtain a more nuanced view of how different factors contribute to the dependent variable across various sectors of the company, leading to insights that are more tailored and potentially more actionable for decision-making purposes.

2.3.2. Interpret Results

Analyze the regression output to determine the relationship between ESG scores and stock performance , then draw a figure. If an increasing curve is drawn, it shows that the two have a positive correlation ,which suggests that higher ESG scores are associated with better stock performance. If a decreasing curve is drawn, it shows that the two have a negative correlation. That means higher ESG scores stands for poorer performance of stock. If it is not a curve, then the two do not want to be related.

2.3.3. Consider Additional Analysis

Conduct further analysis to validate the findings. For instance, compare the performance of companies with high ESG scores against those with low ESG scores using various stock performance metrics or conduct subgroup analysis based on industry or market capitalization.

3. Results and Discussion

3.1. Key results

data2.1 <- read.table("clipboard", header=T)

model <- lm(Y ~ X11, data2.1)

model

summary(model)

p <- ggplot() + geom_point(data = data2.1, mapping = aes(x = X11, y = Y)) + theme_bw()

new_X11 <- seq(min(data2.1$X11), max(data2.1$X11), 0.01)

pred_Y <- data.frame(predict(model, newdata = data.frame(X11 = new_X11), interval = "confidence"), new_X11 = new_X11)

p + geom_line(data = pred_Y, mapping = aes(x = new_X11, y = fit), color = "red", size = 1, alpha = 0.5) +

geom_ribbon(data = pred_Y, mapping = aes(x = new_X11, ymin = lwr, ymax = upr), fill = "grey", alpha = 0.5)

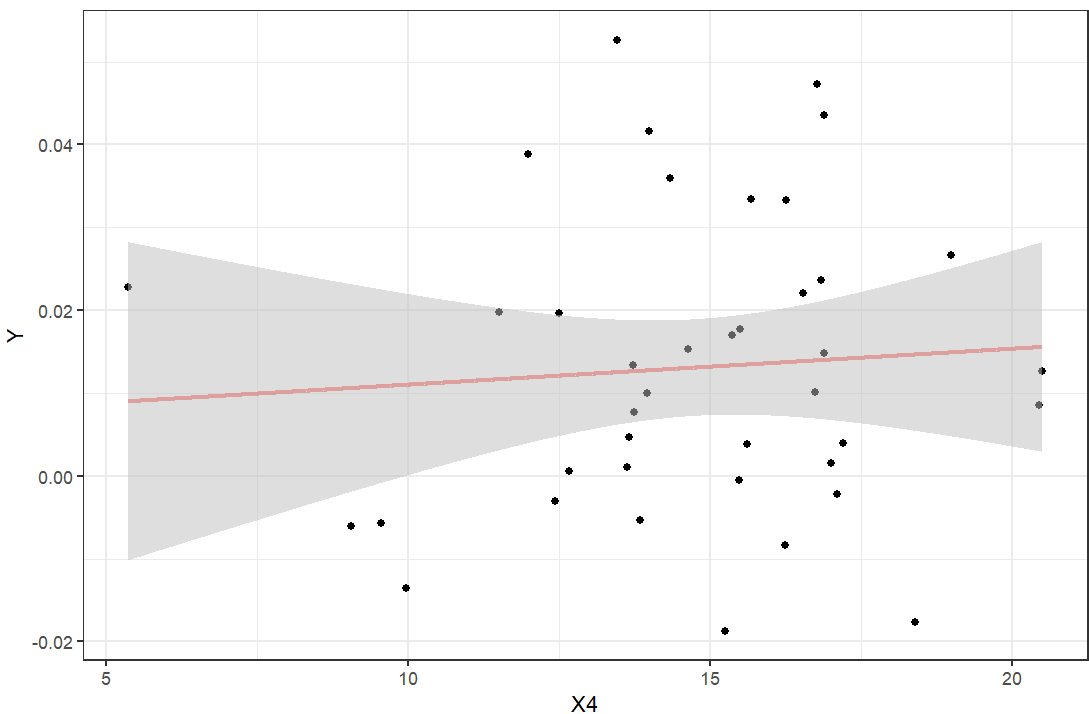

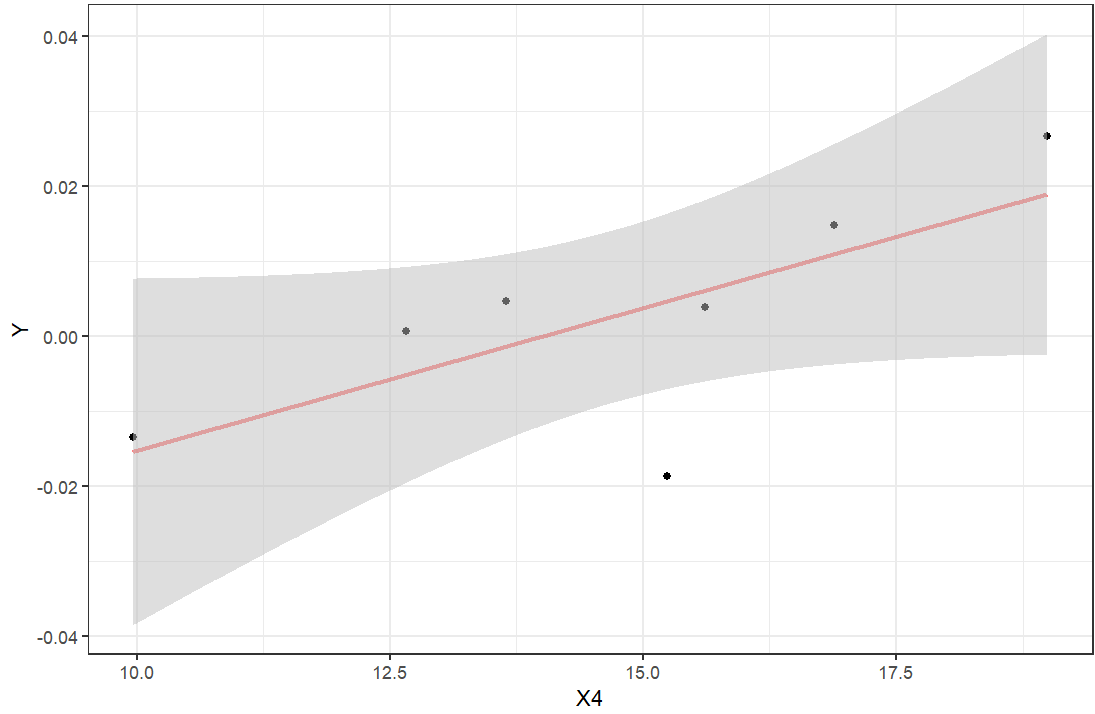

Using the lm model in R language, linear regression analysis was performed on the dependent and independent variables, and the linear relationship between stock price changes and ESG scores of 40 companies during the epidemic was given.

model <- lm(Y ~ X4, data2.1)

model

summary(model)

Call:

lm(formula = Y ~ X4, data = data2.1)

Coefficients:

(Intercept) X4

0.0066741 0.0004335

And the fitting curve was drawn

Figure 1: Fitting curve of lm model

In the presented fitting model, it can be found that the coefficient of the dependent variable, although positive, is small in absolute terms, so it can only be shown to some extent that higher ESG scores are correlated with good performance of enterprises during and after the pandemic. There are also too many points outside the confidence domain in the drawn fit image, indicating that there is no definitely positive correlation between the independent variable and the dependent variable.

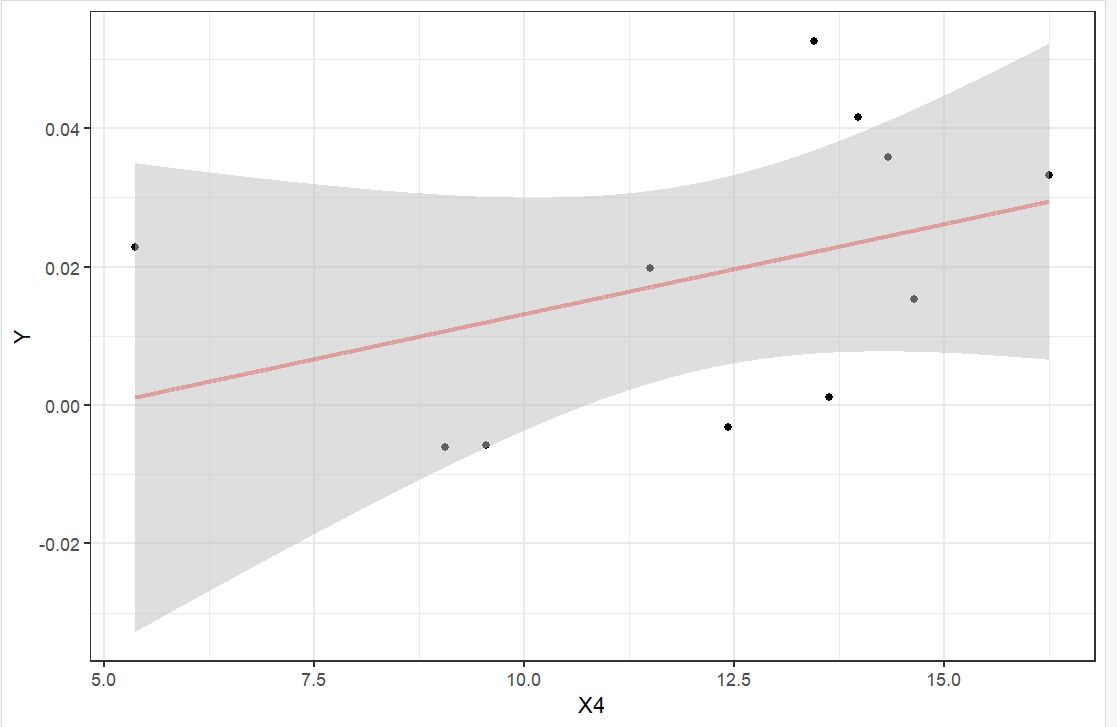

So again, I evaluate the relationship between the independent variable and the dependent variable from the perspective of different sectors(such as :financial service, technology and industry),and finally get the results given below:

Financial service:

Figure 2: Fitting curve of financial service

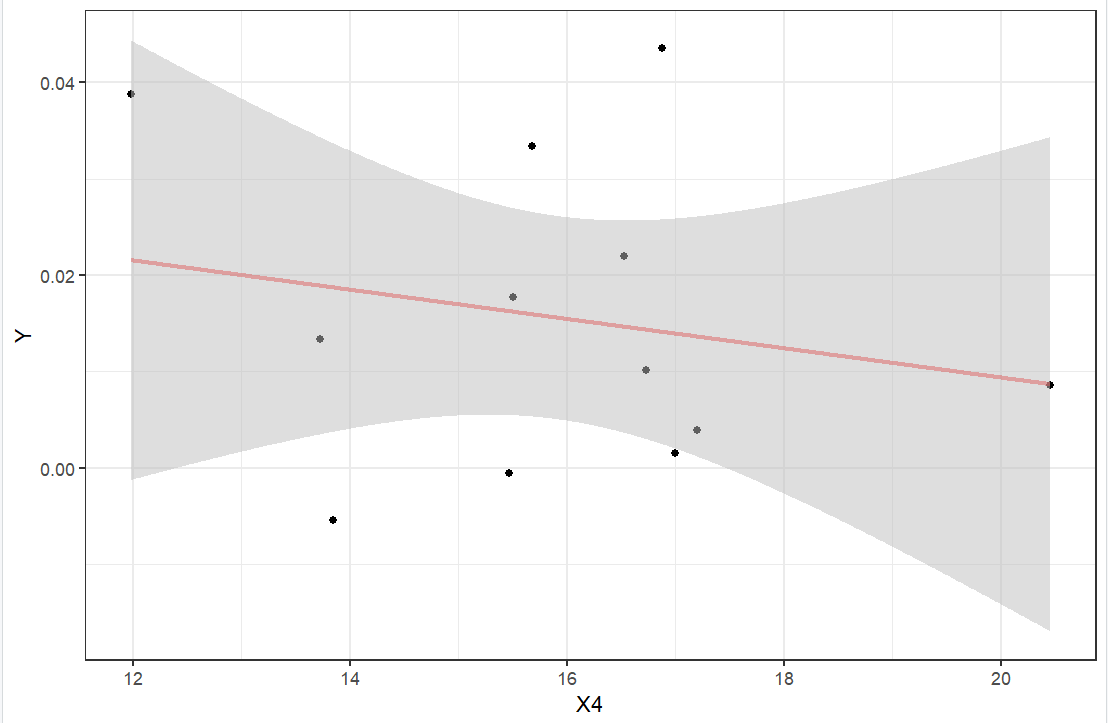

Technology:

Figure 3: Fitting curve of technology

Industrials:

Figure 4: Fitting curve of industrial

From the fitting results of the three different industries, Y and X show a clear positive correlation in the financial services and industrial sectors, while this phenomenon is not obvious in the technology sector. So it can be concluded that before analyzing the correlation between ESG scores and corporate performance, discussion should be limited to the same sector. Due to the limited amount of data and limited equipment, this research would not study the relationship between ESG scores and corporate performance for the rest of the industries in the data.

3.2. Discussion

The correlation between ESG (Environmental, Social, and Governance) scores and stock performance has become a focal point for investors who are increasingly emphasizing sustainability and ethical practices in their investment decisions. The relationship between these two variables is complex and influenced by a variety of factors. Let’s delve deeper into the reasons why ESG scores may have a significant impact on stock performance.

Risk Management: High ESG scores often indicate that a company is proactive in managing environmental risks, which can include regulatory risks, physical risks from climate change, and transitional risks as economies shift towards more sustainable practices[12]. Companies that effectively manage these risks are likely to be more stable and resilient, which can be reflected in their stock performance. Investors are becoming more aware of these risks and are therefore more inclined to invest in companies with strong ESG credentials.

Brand Reputation and Customer Loyalty: Companies that score well on social aspects of ESG tend to have better relationships with their customers and the communities in which they operate. This can translate into stronger brand loyalty and reputation, which are important intangible assets that can contribute to a company’s competitive advantage and financial performance.

Employee Satisfaction and Productivity: Social factors within ESG also encompass employee relations and workplace practices. Companies that create positive work environments tend to attract and retain talented employees, leading to higher levels of productivity and innovation. This can have a direct positive impact on a company’s profitability and stock price.

Governance and Transparency: Strong governance practices including board diversity, executive pay, and business ethics lead to better decision-making and reduce the likelihood of scandals or fraudulent activities that could damage a company’s reputation and financial standing. Good governance structures are associated with transparency and accountability, which can enhance investor confidence and, consequently, stock performance[13].

Cost of Capital: Companies with high ESG scores are often considered lower-risk investments, which can result in a lower cost of capital. Investors may demand less return for their investment in such companies, which means that these companies can raise funds more cheaply. This lower cost of capital allows for greater investment in sustainable growth initiatives, which can boost long-term profitability and stock performance.

Regulatory Support and Incentives: Regulatory trends are increasingly favoring sustainable practices. Companies with high ESG scores may benefit from government incentives and support, such as tax breaks or subsidies for sustainable projects. Additionally, they may face fewer regulatory hurdles, which can facilitate smoother operations and contribute to better financial performance.

Investor Demand and Capital Flows: There is growing demand from institutional and retail investors for sustainable investment opportunities. This trend can lead to increased capital flows into stocks with high ESG scores, driving up their price. It also reflects a broader shift in investor preferences, which could have long-term implications for the valuation of companies.

In conclusion, the relationship between ESG scores and stock performance is multifaceted[14]. A high ESG score can serve as an indicator of a company’s quality and resilience, potentially leading to superior stock performance. However, it is important to note that the relationship between ESG scores and stock performance is not always linear or straightforward. Market conditions, industry-specific factors, and individual company circumstances can all influence this relationship. Companies that prioritize ESG factors are better positioned to manage environmental risks, maintain strong social relationships, and exhibit robust corporate governance. This not only instills confidence in investors, but also provides tangible financial benefits such as lower cost of capital and improved access to funding. As the importance of ESG factors continues to grow, it is clear that they have a significant impact on stock performance and long-term company success.

4. Conclusion

The findings from the study contribute to the nuanced understanding of how ESG (Environmental, Social, and Governance) factors influence corporate performance, particularly in the context of stock market reactions. The variation of ESG impact across different industries is a critical insight that underscores the complexity of the relationship between ESG practices and financial outcomes. The implications and considerations of the findings are shown below:

Industry-Specific Dynamics: The subtler relationship between high ESG scores and stock performance in the tech industry post-COVID-19 suggests that the impact of ESG factors may be moderated by industry characteristics. For instance, the tech sector’s rapid innovation cycle and its less intensive physical asset base might make certain environmental factors less immediately impactful on performance compared to industries like manufacturing or energy. This indicates that investors and analysts should take an industry-specific approach when evaluating the importance of ESG scores.

Dark Horse Companies: The notion that high ESG scores position some companies as “dark horses” during the pandemic points to the potential for ESG-focused firms to outperform their peers in times of crisis. This could be due to better risk management, more resilient supply chains, or stronger stakeholder relationships that these companies have fostered through their ESG efforts. Identifying these dark horses could be a strategic advantage for investors looking for opportunities during economic downturns.

Dataset Limitations: The limitation of the study to Fortune 500 companies introduces a size bias, as these companies typically have more resources to invest in ESG initiatives and may be under greater public scrutiny to do so. Future research could expand the dataset to include smaller companies to see if the correlation holds across different company sizes and to understand the scalability of ESG practices.

Resilience and Adaptability: The greater resilience and adaptability demonstrated by companies with higher ESG scores during the COVID-19 crisis suggest that ESG factors may serve as proxies for a company’s overall management quality and long-term strategic vision. This resilience is likely to be attractive to investors who are increasingly concerned about systemic risks and looking for sustainable long-term returns.

Integration into Decision-Making: The study’s findings emphasize the importance of integrating ESG considerations into investment and corporate decision-making processes. For investors, this means not only looking at traditional financial metrics but also considering the broader impact of their investments. For companies, it means recognizing that ESG practices can contribute to long-term value creation and may be integral to their survival and success in a post-pandemic economy.

Future Research Directions: There is a clear need for further research to dissect the drivers of the ESG-performance relationship, including how these factors play out across different regions, cultures, regulatory environments, and over longer time horizons. Additionally, understanding the materiality of specific ESG issues within industries will help refine investment strategies and corporate policies.

In summary, the study reinforces the growing consensus that ESG considerations are not just ethical imperatives but also key factors in financial performance and risk management. The insights gained from this research highlight the importance of context when assessing the impact of ESG practices and suggest a strategic edge for companies and investors who effectively integrate ESG considerations into their frameworks. As the global economy continues to grapple with the aftermath of the COVID-19 crisis, ESG metrics are poised to become even more integral to the assessment of corporate performance and investment potential.

References

[1]. Ullah, S. (2023). Impact of COVID-19 pandemic on financial markets: A global perspective. Journal of the Knowledge Economy, 14(2), 982-1003.

[2]. Udoy, M. A. N., Mistry, S., Hassan, A. O., & Osei, F. A. J. (2023). Navigating Uncertainty: How Covid-19 is Shaping the Stock Market. European Journal of Business and Management Research, 8(3), 1-10.

[3]. Singh, A. (2020). COVID-19 and safer investment bets. Finance research letters, 36, 101729.

[4]. Billio, M., Costola, M., Hristova, I., Latino, C., & Pelizzon, L. (2021). Inside the ESG ratings:(Dis) agreement and performance. Corporate Social Responsibility and Environmental Management, 28(5), 1426-1445.

[5]. Alareeni, B. A., & Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corporate Governance: The International Journal of Business in Society, 20(7), 1409-1428.

[6]. Verheyden, T., Eccles, R. G., & Feiner, A. (2016). ESG for all? The impact of ESG screening on return, risk, and diversification. Journal of Applied Corporate Finance, 28(2), 47-55.

[7]. Bryce, C., Ring, P., Ashby, S., & Wardman, J. K. (2022). Resilience in the face of uncertainty: Early lessons from the COVID-19 pandemic. In COVID-19 (pp. 48-55). Routledge.

[8]. Arabaci, M. E., & Aysoy, C. (2020). ESG performance of firms during the COVID-19 pandemic. Journal of Corporate Finance, 101684.

[9]. Debnath, S., Ganguly, D., & Krishnan, V. (2021). The impact of COVID-19 on the relationship between ESG scores and stock returns. Journal of Corporate Finance, 101926.

[10]. Ionescu, G. H., Firoiu, D., Pirvu, R., & Vilag, R. D. (2019). The impact of ESG factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy, 25(5), 820-849.

[11]. Serafeim, G. (2020). Public sentiment and the price of corporate sustainability. Financial Analysts Journal, 76(2), 26-46.

[12]. Wan He,Fu Jialiang Zhong Xi.(2024).ESG performance and firms' innovation efficiency: the moderating role of state-owned firms and regional market development.Business Process Management Journal(1),270-290.

[13]. Yang Xiuyun Han Qi.(2024).Nonlinear effects of enterprise digital transformation on environmental, social and governance (ESG) performance: evidence from China.Sustainability Accounting, Management and Policy Journal(2),355-381.

[14]. Seda Bilyay Erdogan,Gamze Ozturk Danisman & Ender Demir.(2024).ESG performance and investment efficiency: The impact of information asymmetry.Journal of International Financial Markets, Institutions & Money101919-.

[15]. Long Huaigang,Chiah Mardy,Cakici Nusret,Zaremba Adam & Bilgin Mehmet Huseyin.(2024).ESG investing in good and bad times: An international study.Journal of International Financial Markets, Institutions & Money101916-.

Cite this article

Ma,T. (2024). Relationship Between ESG Scores and Stock Performance after the COVID-19 Crisis. Advances in Economics, Management and Political Sciences,125,84-92.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ullah, S. (2023). Impact of COVID-19 pandemic on financial markets: A global perspective. Journal of the Knowledge Economy, 14(2), 982-1003.

[2]. Udoy, M. A. N., Mistry, S., Hassan, A. O., & Osei, F. A. J. (2023). Navigating Uncertainty: How Covid-19 is Shaping the Stock Market. European Journal of Business and Management Research, 8(3), 1-10.

[3]. Singh, A. (2020). COVID-19 and safer investment bets. Finance research letters, 36, 101729.

[4]. Billio, M., Costola, M., Hristova, I., Latino, C., & Pelizzon, L. (2021). Inside the ESG ratings:(Dis) agreement and performance. Corporate Social Responsibility and Environmental Management, 28(5), 1426-1445.

[5]. Alareeni, B. A., & Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corporate Governance: The International Journal of Business in Society, 20(7), 1409-1428.

[6]. Verheyden, T., Eccles, R. G., & Feiner, A. (2016). ESG for all? The impact of ESG screening on return, risk, and diversification. Journal of Applied Corporate Finance, 28(2), 47-55.

[7]. Bryce, C., Ring, P., Ashby, S., & Wardman, J. K. (2022). Resilience in the face of uncertainty: Early lessons from the COVID-19 pandemic. In COVID-19 (pp. 48-55). Routledge.

[8]. Arabaci, M. E., & Aysoy, C. (2020). ESG performance of firms during the COVID-19 pandemic. Journal of Corporate Finance, 101684.

[9]. Debnath, S., Ganguly, D., & Krishnan, V. (2021). The impact of COVID-19 on the relationship between ESG scores and stock returns. Journal of Corporate Finance, 101926.

[10]. Ionescu, G. H., Firoiu, D., Pirvu, R., & Vilag, R. D. (2019). The impact of ESG factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy, 25(5), 820-849.

[11]. Serafeim, G. (2020). Public sentiment and the price of corporate sustainability. Financial Analysts Journal, 76(2), 26-46.

[12]. Wan He,Fu Jialiang Zhong Xi.(2024).ESG performance and firms' innovation efficiency: the moderating role of state-owned firms and regional market development.Business Process Management Journal(1),270-290.

[13]. Yang Xiuyun Han Qi.(2024).Nonlinear effects of enterprise digital transformation on environmental, social and governance (ESG) performance: evidence from China.Sustainability Accounting, Management and Policy Journal(2),355-381.

[14]. Seda Bilyay Erdogan,Gamze Ozturk Danisman & Ender Demir.(2024).ESG performance and investment efficiency: The impact of information asymmetry.Journal of International Financial Markets, Institutions & Money101919-.

[15]. Long Huaigang,Chiah Mardy,Cakici Nusret,Zaremba Adam & Bilgin Mehmet Huseyin.(2024).ESG investing in good and bad times: An international study.Journal of International Financial Markets, Institutions & Money101916-.