1. Introduction

Facing dual challenges from both domestic and international economic environments in the global economic landscape, China is actively seeking a transformation in its economic growth drivers to achieve high-quality development. [1] This article primarily discusses the roles and strategies of consumption and investment in driving future economic growth in China. It emphasizes that key measures for consumption-led growth include increasing household incomes, improving the consumption environment and cultivating consumption hotspots. The article also analyzes the complementarity and differences between investment and consumption and points out that coordinated development of investment and consumption is crucial for promoting stable economic growth, optimizing economic structure, improving public welfare, and responding to external shocks. Additionally, the article looks forward to the opportunities for China's economic growth presented by continued consumption-led growth, further optimization of investment structure, sustained prosperity of the service sector, and global economic recovery. Overall, the article provides new perspectives and strategies for understanding and advancing China's long-term economic growth.

2. Basic Fact Analysis

Investment, consumption, and export are the three main drivers of economic growth. Based on the experience of developed countries, as the process of industrialization accelerates, the contribution of investment to economic growth continues to increase. Since the reform and opening up, China has maintained a high investment rate, with investment contributing more to economic growth than consumption and export. Recent analyses of GDP components in China show that domestic consumption demand has remained relatively stable, while net exports have contributed less to economic growth due to the impact of the international financial crisis. Therefore, investment remains the main driver of China’s economic growth, but excessive investment can lead to significant economic fluctuations. To ensure stable economic growth, it is necessary to maintain stable investment growth.

2.1. Analysis of Investment-Driven Economic Growth

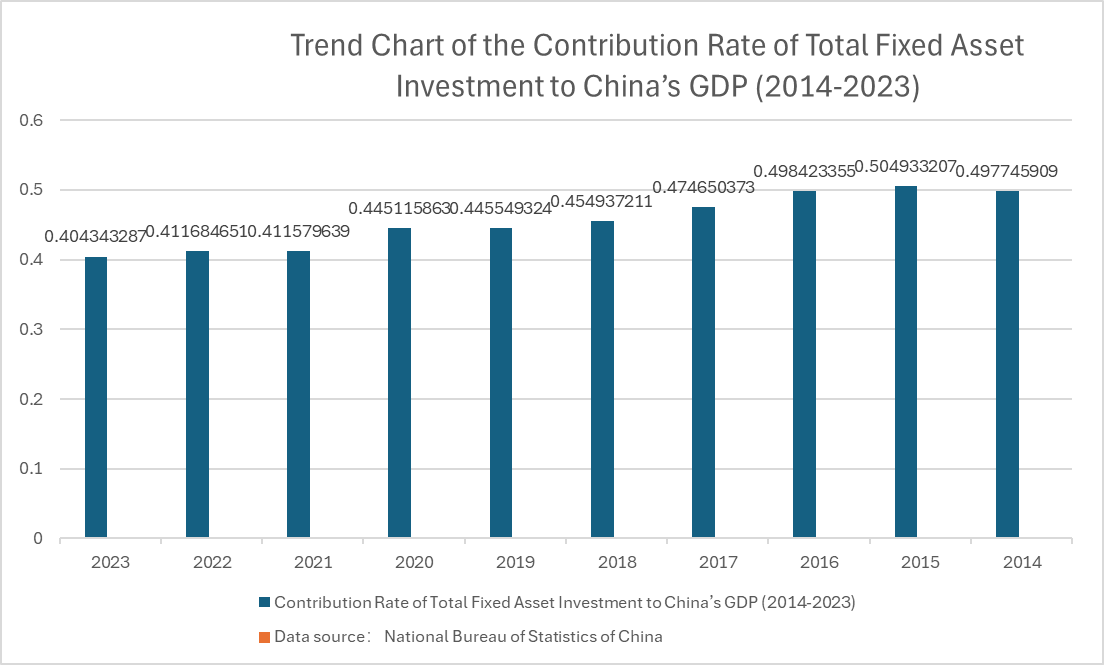

Figure 1: Trend Chart of the Contribution Rate of Total Fixed Asset Investment to China’s GDP (2014-2023), the statistical data comes from the National Bureau of Statistics of China.

From Figure 1, the vertical axis represents the contribution rate of total fixed asset investment to China's GDP (2014-2023), calculated as Total Fixed Asset Investment (2014-2023) / China's GDP (2014-2023) [2]. The horizontal axis represents the years. According to the chart, it can be observed that over the past decade, the contribution rate of total fixed asset investment to China's GDP has been continuously decreasing, indicating that the effect of social investment on driving GDP growth is weakening, and marginal effects are beginning to appear.

2.1.1. Contribution of Investment to Economic Growth

When delving into the driving role of investment in economic growth, we must recognize its multifaceted positive impacts, which extend beyond mere financial indicators to various aspects such as economic structure, social development, and technological innovation.

Capital Accumulation and Production Efficiency

Investment is a core means of capital accumulation. By injecting funds, enterprises can acquire advanced production equipment and expand production scales, thereby achieving significant improvements in production efficiency. For example, in the first half of this year, China attracted nearly 500 billion yuan in foreign investment, and 26,870 new foreign-invested enterprises were established. The actual use of foreign investment in the manufacturing sector increased by 2.4% compared to the same period last year. [3] This data vividly reflects how investment is driving the manufacturing sector towards higher production efficiency. Increased capital accumulation not only promotes internal industrial upgrades but also provides strong support for overall societal economic growth.

Technological Innovation and Industrial Upgrading

Investment plays a crucial role in technological innovation. By investing in research and development, enterprises can develop new technologies, products, and processes, driving the optimization and upgrading of industrial structures. For instance, Jiangsu Province has heavily invested in venture capital to build a globally influential industrial technology innovation center. [4] This initiative has not only attracted a large number of innovative enterprises but also injected strong momentum into local industrial upgrading. In the era of technological innovation, investment has become a key force in driving technological progress and industrial transformation.

Employment and Income Improvement

Investment activities can create a large number of job opportunities, improve labor productivity, and subsequently increase residents' income levels. When enterprises expand production scales or introduce new technologies, they often need to hire more employees to meet production demands. This not only addresses employment issues but also enhances workers' skill levels and income. As residents' incomes rise, consumer demand will also grow, forming a positive cycle of economic growth.

2.1.2. Challenges of Investment-Driven Economic Growth

When analyzing the drivers of China’s economic growth, it is essential to closely examine the potential issues of the investment-driven model. Investment efficiency is a core concern. In recent years, some investments have been characterized by blind and redundant allocation, leading to low investment efficiency and exacerbating resource wastage. Due to a lack of effective planning and regulation, some investment projects have failed to deliver expected economic benefits and instead have increased fiscal burdens, affecting the sustainability of economic growth.

The risk of overcapacity is another critical issue. Excessive investment, particularly in traditional industries and sectors, has led to a growing problem of overcapacity. One notable example is the collapse of the real estate market bubble in China. When there is an oversupply of commercial housing in the real estate market, the value of these properties’ declines. As a result, personal real estate assets (such as primary residences and investment properties) also depreciate. This asset depreciation directly affects the total value of assets on an individual's balance sheet, leading to a reduction in wealth. In cases of real estate depreciation, the market value of a property might fall below the amount of the mortgage taken out for its purchase, resulting in negative equity for the individual, meaning that the value of the assets is less than the amount of debt. This can lead to an excessive financial burden and even the risk of overdue payments. Additionally, a decrease in personal asset value may reduce consumer confidence, leading to lower consumption spending. This reduction in consumption can have a negative impact on the overall economy. [5]

China's current investment structure is highly unbalanced. Development is driven by innovation, but there is currently a shortage of venture capital in China, and there is insufficient financial support for technological development. Investment in technological development constitutes a very small portion of the overall investment fund allocation in the country, which directly leads to the widespread lag in technological development in China. Government funding for technological research and development is inadequate. Additionally, the financial system, pressured by risk concerns, is reluctant to invest, often leaving companies to bear the costs of technological development themselves.

2.1.3. Optimization Paths for Investment-Driven Economic Growth

China's current overcapacity is structural, meaning that not all goods and services are in surplus, but rather the excess is concentrated in sectors that can be industrially produced and traded. While there is overcapacity in large-scale industrial sectors, there remains a shortage in non-tradable sectors such as education, healthcare, and high-tech high-value-added goods and services. [6] Therefore, investment still has practical significance for economic growth today, but there should be a shift from the traditional investment-driven economic growth model to an innovation-driven economic growth model, aiming to promote the optimization and upgrading of the economic structure.

Precisely Targeting Investment in Emerging and High-Tech Industries

High-tech industries, characterized by their intensive knowledge and technology, often offer significant economic and social benefits through the development of key technologies. Therefore, it is crucial to increase investment in these sectors, such as artificial intelligence, biomedicine, and new energy. Breakthroughs in these fields not only facilitate industrial upgrading but also bring societal benefits. Investment directions should be precise to avoid blind following or redundant investments, ensuring the efficient use of funds.

Innovating Investment and Financing Mechanisms to Reduce Financing Costs

To lower financing costs for enterprises, it is necessary to innovate investment and financing mechanisms and develop diversified investment and financing channels. For example, issuing green bonds and setting up industry investment funds can guide social capital towards high-tech and green industries. Optimizing the financial service system, expanding its coverage and convenience, and lowering the barriers for enterprises to obtain financial support are also crucial.

2.2. Analysis of Consumption-Driven Economic Growth

Figure 2: Trend Chart of the Contribution Rate of Household Consumption to China’s GDP (2014-2023), the statistical data comes from the National Bureau of Statistics of China.

From Figure 2, the vertical axis represents the contribution rate of household consumption to China's GDP (2014-2023), calculated as the Household Consumption Price Index (1978=100) (2014-2023) / China's GDP (2014-2023). The horizontal axis represents the years. According to the chart, it can be observed that over the past decade, the contribution rate of household consumption to China's GDP has been continuously increasing, indicating that the effect of consumption on driving China's economic growth has become increasingly evident[7].

2.2.1. Contribution of Consumption to Economic Growth

In the current economic environment, consumption has become an important driving force for economic growth, with its influence and role increasingly evident. Recently, the National Bureau of Statistics of China released the "Q1 Report" for the Chinese economy in 2024. In the first quarter, GDP grew by 5.3% year-on-year, exceeding market expectations. Among this, the contribution of domestic demand to economic growth reached 85.5%.[8] Both investment and consumption showed steady increases, and the endogenous driving force of the economy continued to strengthen.

As the "main engine" of economic growth, consumption's effect on driving domestic demand is significant. With the increase in residents' income levels, consumption demand is becoming more diversified and personalized. For instance, in the consumer goods market, the retail sales of social consumer goods increased by 3.7% year-on-year in the first half of the year, demonstrating strong vitality in the consumption market. Notably, the growth of major consumer goods such as green smart home appliances and new energy vehicles is particularly prominent, which not only drives the development of related industries but also further stimulates market potential. The combination of gourmet food, iconic landmarks, national trend culture, and green ingredients has injected new vitality into the catering industry, with catering revenue growing by 7.9% year-on-year, further proving the significant role of consumption in driving domestic demand.

The impact of consumption growth on employment cannot be ignored. As the consumption market continues to expand, related industries experience rapid development, which in turn leads to an increase in job opportunities. For example, in the home service industry, consumer demand for diversified and professional home services not only promotes the rapid growth of the industry but also creates a large number of job opportunities for society. Additionally, with the upgrading of consumption structures, the demand for specialized and high-quality services is increasing, which also encourages related industries to improve service levels and quality, thus providing consumers with better services.

2.2.2. Challenges of Consumption-Driven Economic Growth

In the current economic environment, China's consumption market faces multiple challenges and opportunities. One of the key factors influencing the domestic consumption market is the level of residents' income. Due to the significant income disparity in China, the purchasing power of low-income groups is limited, which largely constrains the overall increase in consumption levels. In this context, policymakers and businesses should focus on raising the income levels of low-income groups to promote balanced development of the consumption market.

The challenges brought by consumption upgrade are also significant. As consumers' demands for products and services increase, businesses must intensify innovation and research and development efforts to meet the diversified needs of the market. Data from recent years show that large-scale industrial enterprises, especially joint-stock companies, have been increasing their R&D investment year by year. For example, internal R&D expenditure grew from 213.91 billion yuan in 2019 to 250.54 billion yuan in 2022, while external R&D expenditure increased from 14.63 billion yuan to 20.69 billion yuan. [9] This trend reflects that enterprises are actively increasing R&D investment to adapt to market demands in response to consumption upgrade challenges.

2.2.3. Strategies to Promote Consumption-Driven Economic Growth

The various policies we are currently formulating still tend to focus habitually on supply and production, a habit from China’s long history of a shortage economy. However, China’s economy has now advanced to an industrial society where supply and production capacity are no longer issues. The problem now lies on the demand side, which is insufficient consumption. [10]

Increasing residents' income levels is fundamental to boosting consumption capacity. To achieve this, we need to accelerate economic structure transformation, promote industrial upgrading, and create more high-quality job opportunities. At the same time, we should improve the social security system to ensure that residents' basic needs in areas such as pension, healthcare, and education are met, thereby enhancing their consumption confidence. Additionally, deepening income distribution system reform to achieve steady growth in residents' income, particularly by increasing the income levels of low-income groups, is crucial for narrowing income gaps and enhancing overall consumption capacity. [11]

Furthermore, cultivating consumption hotspots is an effective means to unleash consumption potential. As the trend of consumption upgrading intensifies, residents' demands for health, education, and cultural entertainment are increasing. We should keep pace with this trend, strengthen product and service innovation in these areas, and meet consumers' diverse and personalized needs. At the same time, through policy guidance and market promotion, we should nurture competitive consumption hotspots to drive overall market prosperity.

3. Exploration of Coordinated Development between Investment and Consumption

Investment and consumption are merely a cyclical system. Investment is the starting point of production; with production comes the demand for production factors, leading to productive consumption, which in turn drives employment. With employment and income expectations in place, we can talk about consumption. However, the impetus for investment has a prerequisite: the goods produced must be sellable. As long as they can be sold, investment becomes a powerful driving force; if they cannot be sold, this cycle breaks down, resulting in a build-up of debt. Liquidity does not flow to the consumption side, and economic growth comes to a halt [12].

The results of the three-stage least squares estimation show that an increase of 1 unit in the fixed asset investment rate will lead to an increase of 0.064 units in the employment rate. In contrast, an increase of 1 unit in the current residential consumption rate will actually cause a decrease of 0.247 units in the employment rate. Although an increase in consumption will lead to higher employment rates in future economic cycles, the consumption-driven economic growth model cannot suppress the rise in unemployment in the short term. [13] Therefore, to ensure a smooth transition of supply-side reforms, it is essential to coordinate the reasonable allocation of consumption and investment in economic growth and ensure full employment during the process of industrial structure adjustment.

The coordinated development of investment and consumption has a positive impact on economic development at multiple levels. It can not only promote stable economic growth and optimize the economic structure, but also improve people's livelihood and enhance the economy's ability to respond to external shocks. Therefore, policymakers should fully consider the balance and coordination between investment and consumption to achieve comprehensive, healthy, and sustainable economic development.

4. Conclusion

In the ongoing process of China's economic growth, consumption and investment, as the two core driving forces, are exhibiting increasingly strong vitality. With the steady rise in residents' income levels and the continuous optimization of consumption structures, the consumer market is showing unprecedented prosperity. At the same time, the optimization and adjustment of the investment sector are injecting new vitality into economic growth.

Currently, China's consumer market is undergoing profound transformation. The pursuit of high-quality living and increasing attention to green and environmentally friendly products are driving an upsurge in demand for upgrade-oriented goods such as fitness products, green smart home appliances, and new energy vehicles. These changes not only reflect the upgrading of consumer demands but also signal the immense potential of the future consumer market. In the investment sector, China is experiencing a shift from quantitative expansion to qualitative improvement. Notably, the rapid growth of investment in equipment renewal and upgrading has been a major highlight in the first half of the year. This trend reflects both the need for the transformation and upgrading of traditional industries and the significant shift of China's manufacturing sector towards high-quality development. Large-scale equipment updates and renovations are not only advancing the development of advanced manufacturing but also injecting new momentum into economic growth.

References

[1]. Xue Baogui and Liu Zhizhen. "Construction of a Consumption-Driven Economy from the Perspective of Income Distribution." Reform and Strategy 38.01 (2022): 117-128. doi:10.16331/j.cnki.issn1002-736x.2022.01.012. (Accessed at August 10, 2024)

[2]. Data comes from “Annual data”, National Bureau of Statistics of China. https://data.stats.gov.cn/ (Accessed at August 10, 2024)

[3]. Guo Jinhui. Give full play to the driving force of the new type of consumption to expand domestic demand [N]. China economic times, 2024-04-02 (001).

[4]. "Analysis of the Current Market Situation and Future Trends of High-Tech Industrial Parks in China from 2024 to 2030." Industrial Research Network. https://www.cir.cn/3/83/GaoXinJiShuChanYeYuanQuShiChangQianJing.html (Accessed at August 10, 2024)

[5]. Jing Zhongbo, Wang Leyi, Fang Yi. Risk Spillover, Cyclicality, and Systemic Risk in the Chinese Real Estate Market. “Contemporary Economic Science”, 2019, 41(05): 11-23. (Accessed at August 10, 2024)

[6]. Zhao Jian. "Moving Toward a Consumption-Oriented Society and Formulating a National Income Doubling Plan." Baijiahao, July 16, 2024. https://baijiahao.baidu.com/s?id=1804743269315746890&wfr=spider&for=pc (Accessed at August 10, 2024)

[7]. Data comes from “Annual data”, National Bureau of Statistics of China. https://data.stats.gov.cn/ (Accessed at August 10, 2024)

[8]. Shao Penglu and Wang Jin. "85.5% Shows the Coordinated Efforts of Investment and Consumption." China Economic Herald, April 27, 2024 (001). DOI:10.28095/n.cnki.ncjjd.2024.000393. (Accessed at August 10, 2024)

[9]. Liu Kai. "Changing the Economy Mainly Driven by Investment." Science and Technology Information, 2012, (32): 251. DOI:10.16661/j.cnki.1672-3791.2012.32.211. (Accessed at August 10, 2024)

[10]. Zhao Jian. "Moving Toward a Consumption-Oriented Society and Formulating a National Income Doubling Plan." Baijiahao, July 16, 2024. https://baijiahao.baidu.com/s?id=1804743269315746890&wfr=spider&for=pc (Accessed at August 10, 2024)

[11]. Ma Xiaohe. To Move Towards a High-Income Economy, the Issue of Insufficient Consumer Demand Must Be Systematically Addressed [J]. Globalization, 2024, (02): 5-18+134. DOI: 10.16845/j.cnki.ccieeqqh.2024.02.009. (Accessed at August 10, 2024)

[12]. Lin Yifu's Investment and Zhang Weiying's Consumption: What Really Drives China's Economy? Economic Insights, May 11, 2024. https://baijiahao.baidu.com/s?id=1798734811688440770&wfr=spider&for=pc (Accessed at August 10, 2024)

[13]. Qi Hongqian, Liu Yan, and Huang Baomin. "Trends in Residents' Consumption, Investment, and Employment in China and Policy Choices." Exploration of Economic Issues, 2018, (08): 9-17. (Accessed at August 10, 2024)

Cite this article

Zhou,T. (2024). China’s Future Economic Growth Drivers: Investment-Driven or Consumption-Led. Advances in Economics, Management and Political Sciences,113,89-95.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xue Baogui and Liu Zhizhen. "Construction of a Consumption-Driven Economy from the Perspective of Income Distribution." Reform and Strategy 38.01 (2022): 117-128. doi:10.16331/j.cnki.issn1002-736x.2022.01.012. (Accessed at August 10, 2024)

[2]. Data comes from “Annual data”, National Bureau of Statistics of China. https://data.stats.gov.cn/ (Accessed at August 10, 2024)

[3]. Guo Jinhui. Give full play to the driving force of the new type of consumption to expand domestic demand [N]. China economic times, 2024-04-02 (001).

[4]. "Analysis of the Current Market Situation and Future Trends of High-Tech Industrial Parks in China from 2024 to 2030." Industrial Research Network. https://www.cir.cn/3/83/GaoXinJiShuChanYeYuanQuShiChangQianJing.html (Accessed at August 10, 2024)

[5]. Jing Zhongbo, Wang Leyi, Fang Yi. Risk Spillover, Cyclicality, and Systemic Risk in the Chinese Real Estate Market. “Contemporary Economic Science”, 2019, 41(05): 11-23. (Accessed at August 10, 2024)

[6]. Zhao Jian. "Moving Toward a Consumption-Oriented Society and Formulating a National Income Doubling Plan." Baijiahao, July 16, 2024. https://baijiahao.baidu.com/s?id=1804743269315746890&wfr=spider&for=pc (Accessed at August 10, 2024)

[7]. Data comes from “Annual data”, National Bureau of Statistics of China. https://data.stats.gov.cn/ (Accessed at August 10, 2024)

[8]. Shao Penglu and Wang Jin. "85.5% Shows the Coordinated Efforts of Investment and Consumption." China Economic Herald, April 27, 2024 (001). DOI:10.28095/n.cnki.ncjjd.2024.000393. (Accessed at August 10, 2024)

[9]. Liu Kai. "Changing the Economy Mainly Driven by Investment." Science and Technology Information, 2012, (32): 251. DOI:10.16661/j.cnki.1672-3791.2012.32.211. (Accessed at August 10, 2024)

[10]. Zhao Jian. "Moving Toward a Consumption-Oriented Society and Formulating a National Income Doubling Plan." Baijiahao, July 16, 2024. https://baijiahao.baidu.com/s?id=1804743269315746890&wfr=spider&for=pc (Accessed at August 10, 2024)

[11]. Ma Xiaohe. To Move Towards a High-Income Economy, the Issue of Insufficient Consumer Demand Must Be Systematically Addressed [J]. Globalization, 2024, (02): 5-18+134. DOI: 10.16845/j.cnki.ccieeqqh.2024.02.009. (Accessed at August 10, 2024)

[12]. Lin Yifu's Investment and Zhang Weiying's Consumption: What Really Drives China's Economy? Economic Insights, May 11, 2024. https://baijiahao.baidu.com/s?id=1798734811688440770&wfr=spider&for=pc (Accessed at August 10, 2024)

[13]. Qi Hongqian, Liu Yan, and Huang Baomin. "Trends in Residents' Consumption, Investment, and Employment in China and Policy Choices." Exploration of Economic Issues, 2018, (08): 9-17. (Accessed at August 10, 2024)