1.Introduction

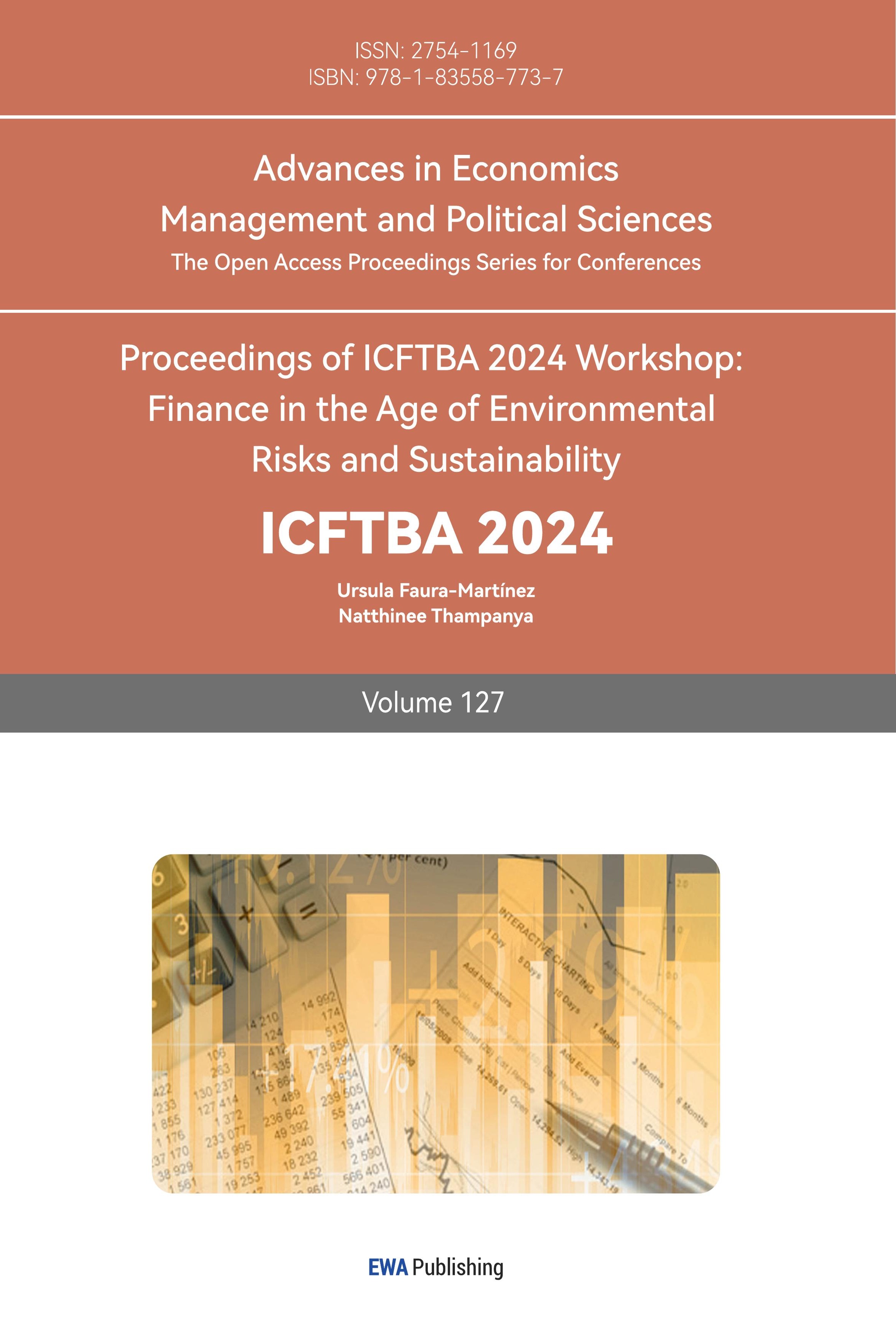

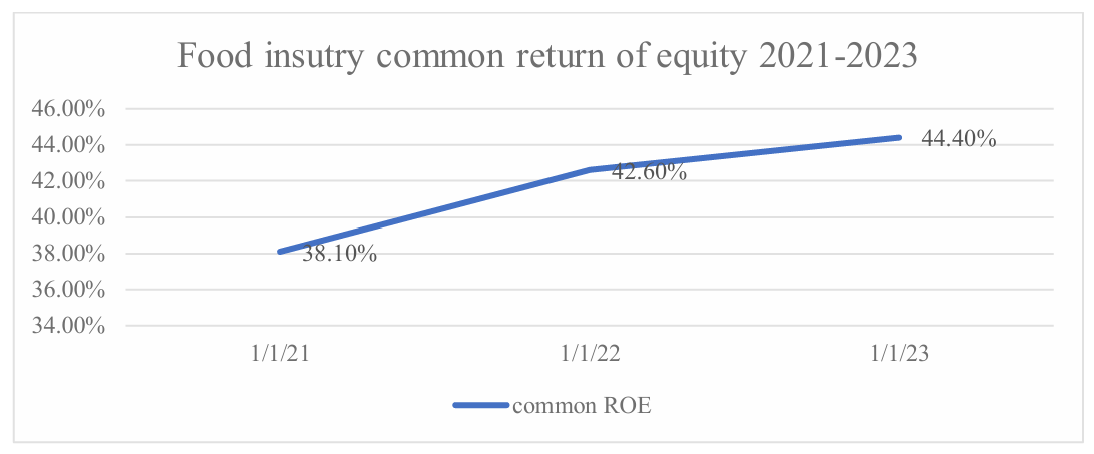

The COVID-19 pandemic has had a significant impact on the food business, leading to a decrease in the market due to the rise in home cooking. As of March 2021, a total of 21 restaurants and franchisees had filed for bankruptcy [1]. Between 2021 and 2023, the food industry saw a steady recovery from COVID-19, as indicated by an increase in profitability measured by their return on common equity. According to Figure 1, the return on equity (ROE) was 38.1% at the beginning of 2021 [2]. It experienced an approximate 4% growth in the first year and a 2% increase in the second year, ultimately reaching 44.4% by January 1, 2023. McDonald's, aiming to be a top player in the business, has observed a contrasting pattern with a declining return on equity (ROE) and a rising beta [2]. According to Figure 2, McDonald's had a negative return on equity (ROE) of -0.59 in 2021 [3]. However, this value sharply declined to -1.2 in 2022 [3]. Following a minor fluctuation in the subsequent year, the ROE plummeted once more and eventually stabilized at approximately -1.8. Conversely, the beta value, depicted in Figure 3, exhibited a general rise from around 0.6 to 0.7 [3].

Figure 1: Food industry common ROE 2021-2023 [2].

(Data Source: https://finbox.com/NYSE:QSR/explorer/roe/)

Figure 2: McDonald’s ROE 2021-2024 [3].

(Data source: https://www.zacks.com)

Figure 3: McDonald’s beta 2021-2024 [3].

(Data source: https://www.zacks.com)

For the catering industry's profit, ROE has always been a crucial factor. Naturally, the academic community also shares this concern. Several researchers have conducted studies on ROE and have reported their findings. For instance, Tamuntuan conducted a study on the impact of ROE on the share price of food and beverage companies in the Indonesian market [4]. They did this by regressing share price against ROE and several other control variables [4]. By analyzing the coefficient of ROE, they concluded that there was no significant effect of ROE itself on share price [4]. Lombardo also studied the effect of ROE on the value of companies that manufacture food and beverages [5]. The heteroskedasticity test of firm value on ROE, along with an analysis of the significance of the coefficients, suggests that ROE impacts the firm value. This effect becomes more pronounced when combining ROE with net profit margin and debt-to-equity ratio [5]. De aimed at presenting several ways that variables can affect ROE [6]. Three possible effects, including the influence of falling private benefits, a reduction in auditing expenses, and a better legal environment on equilibrium ROE, are explained and listed by figures [6]. It is concluded that the magnitude of that effect will also depend on the nature of the market, namely whether it is segmented or not [6].

Previous researchers have conducted several studies on ROE, but they have not developed the relationship between ROE and beta. How can companies use beta to forecast ROE, and by analyzing the way in which beta affects ROE, how can businesses therefore increase the ROE of a company? This article aimed to find such a relationship and provide companies with certain ways to improve ROE, which can be helpful for firms that want to improve their profitability.

This paper will, for example, take McDonald's and formulate the linear relationship between its ROE and betas during the years 2021–2024, then, based on several previous studies and combining them with the case, propose some of the possible reasons that lead to such a relationship. Eventually, the paper will present several suggestions on how this company can enhance its ROE.

2.Case Description

Burgers are the main attraction at McDonald's, a United States-founded company that opened its first restaurant in 1940. It is one of the world's largest fast-food restaurant chains, with around 69 million daily customers in more than 100 countries. The company had a revenue of 5124.6 million dollars on 03/31/2021 and reached 6169 million by 03/31/2024. The gross profit also sees a rise from 9752 million dollars at the start of 2021 to 14562.5 by the start of 2024 [3]. This paper will primarily focus on the company's ROE and beta, as well as further research. Table 1 below lists the quarterly beta and ROE of McDonald's from 2021–2024.

Table 1: Beta and ROE 2021-2024 [2]

|

Time |

Beta |

ROE |

|

03/31/2024 |

0.71 |

-1.8074 |

|

12/31/2023 |

0.7064 |

-1.7196 |

|

09/30/2023 |

0.6536 |

-1.5719 |

|

06/30/2023 |

0.6388 |

-1.3957 |

|

03/31/2023 |

0.6276 |

-1.2487 |

|

12/31/2022 |

0.634 |

-1.201 |

|

09/30/2022 |

0.5939 |

-1.234 |

|

06/30/2022 |

0.5517 |

-1.299 |

|

03/31/2022 |

0.6104 |

-1.312 |

|

12/31/2021 |

0.5972 |

-1.11962 |

|

09/30/2021 |

0.6096 |

-0.99 |

|

06/30/2021 |

0.6263 |

-0.8398 |

|

03/31/2021 |

0.6224 |

-0.5901 |

(Data source: https://www.zacks.com)

Between 2021 and 2024, Figures 2 and 3 demonstrate that McDonald's declined in its ROE from -0.58 to around -1.81, which is over three times greater than the value in 2021. The average ROE is -1.26, with a standard deviation of 0.043. Simultaneously, this company's beta rose from 0.62 to 0.71, with an average of -1.26 and a standard deviation of 0.336. Figure 4 shows the results of taking the log value of the betas, running a simple linear regression of ROE on the log of betas, and testing the correlation between ROE and betas [7].

Figure 4: McDonald's Cost of capital 2021-2024 [7]

(Data source: https://www.alphaspread.com)

The regression analysis results indicate that if Lnbeta is zero, this firm's ROE should be -2.54, as evidenced by the constant value of -2.54. The Lnbeta coefficient is -2.77, indicating that a one-unit increase in beta results in a 2.77% decrease in the projected ROE value. The R2 value in Table 2 quantifies the degree to which the model accurately fits the data by comparing the explained variance to the overall variance. The model employed in this paper can account for approximately 31.3% of the variation in beta values around their average. This model has a p-value of 0.047. Since the value is less than 0.05, it can be inferred that it is statistically significant. The correlation coefficient between beta and ROE is -0.58 (Table 3), indicating a negative association between these two variables. This means that as beta increases, ROE tends to decrease.

Table 2: Regression results of ROE on Lnbeta

|

ROE |

Coefficient |

Std.err |

t |

p>\( |t| \) |

|

Lnbeta |

-2.770715 |

1.238856 |

-2.24 |

0.047 |

|

cons |

-2.544879 |

0.5818774 |

-4.37 |

0.001 |

Table 3: Correlation between beta and ROE

|

Beta |

ROE |

|

|

Beta |

1 |

|

|

ROE |

-0.5810 |

1 |

3.Analysis

3.1.Reason on Aggressive Measures

A high beta indicates that a company is more volatile than the market as a whole and therefore has a higher risk. When a corporation experiences a loss, specifically a negative ROE, it may pursue a more aggressive investment strategy in order to repair the situation. If this technique fails, it may increase the company's risk and reduce its ROE.

Since 2021, McDonald's ROE has been negative. Since 2020, the corporation has proclaimed its goal of 'accelerating the arches', indicating a desire to extend the brand. Using such radical tactics can have two effects: on the one hand, it will raise the company's beta as a result of increased risk; on the other hand, if such a strategy fails to stimulate profitability, it will result in a simultaneous drop in ROE, demonstrating the phenomenon that ROE and beta move in opposite directions.

Bowman once articulated a similar argument [8]. Data analysis from industries like food manufacturing and computers reveals a negative relationship between beta and ROE, attributed to riskier decisions made by less successful and currently troubled firms [8]. Feigenbaum also concluded that the relationship between beta and ROE exhibits a U-shape pattern, indicating that when a company's performance is below a certain return level, there is a negative relationship between the two variables [9].

3.2.Reason on Diversified Strategies

Another possible explanation for such a risk-return paradox is that it is a result of the company's diversified strategies. This can be interpreted as more choices of products offered by the company or a more internal, more constant change of strategies used by the managers. When a firm aims to create and promote new products, it may end up increasing expenditure on research, development, and advertising. As a result of rising costs and other cash flow issues, the company may experience financial strain, leading to higher risk and beta levels. With a higher cost and an unpredictable future return, the overall ROE can indeed fall. From 2021 to 2024, the company will launch approximately ten new items annually, which equates to nearly one item per month. The total expenditure on advertising is on a slightly downward trend, accounting for at least 5% of revenue, which remains a significant burden for the firm.

In the article, Bettis tests this result by separately applying regressions of asset return to diversified and less diversified companies [10]. This approach reveals that companies that diversify their products in more related areas experience higher profitability compared to those in more isolated areas [10]. Another article by Bettis makes a similar argument, demonstrating that a company's use of diversified strategies, which involve higher risk and increase beta, does not guarantee a higher return [11].

In fact, the outcome of such a strategy is unknown, whereas in this case at McDonald's, it is a falling ROE and a rising beta. I also used regression models to evaluate the effect of innovation on a firm's performance. Focusing on the pharmaceutical industry in China revealed a negative relationship between innovation, reflecting higher risks, and the expected return [12]. The idea that innovation brings more profits relies on the assumption that it succeeds, although this may not always be the case. As a result, this paper expects the beta and ROE to have negative correlations in the event of a failed innovation.

3.3.Reason on Rising Cost of Capital

When a company's beta consistently rises, it indicates an increase in the company's risk, leading investors to either avoid this asset or seek higher returns to counterbalance the increased risks, thereby increasing the firm's cost of capital. Therefore, ROE will decrease if the total profit level does not show a significant improvement.

According to the data presented in Figure 4, McDonald's' cost of equity was around 4.83% at the start of 2021; it rose to around 7.51% at the start of 2024 [7]. Though some fluctuations occurred through these years, the increasing trend is obvious. The increase in the cost of equity can act as a consequence of the rising beta and, in turn, reduce the ROE.

Gordon tests the relationship between systematic risks, represented by beta, and the cost of capital using data from both mail and non-mail firms [13]. After conducting risk calculations, this paper discovered that mail businesses pose less risk than non-mail businesses, with the former exhibiting a lower average cost of capital compared to the latter. This indicates a negative correlation between systematic risks (represented by beta) and the cost of capital, implying that riskier companies tend to procure funds at a higher cost. When investigating potential variables that influence the cost of capital, Hussain draws a similar conclusion, and his analysis of various Asian manufacturing firms consistently reveals a significant positive impact of systematic risk on the cost of capital [14].

4.Suggestion

4.1.Suggestion on Aggressive Measures

Based on the analyzing reason, McDonald's should choose a more cautious strategy in response to the difficulties presented by aggressive measures. This may entail adopting a more conservative approach to managing working capital and employing financing tactics, such as maintaining a higher proportion of current assets compared to total assets. By adopting this approach, the company is anticipated to have reduced liquidity worries, resulting in access to more affordable capital and ultimately enhancing its profitability.

4.2.Suggestion on Diversified Strategies

To address the issue arising from the application of diversified strategies, McDonald's could consider concentrating more on their standard and traditional products instead of solely focusing on the creation of new ones. Instead of dedicating a significant portion of their investment to the creation and promotion of new products, McDonald's could focus on enhancing customer loyalty towards their classic products. It is a fact that McDonald's has expanded its business from food to coffee markets, opening new restaurants domestically and abroad in addition to its license market. Reducing diversification and focusing on their strongest competitive advantage may help fix these expansions' profit decline.

Boddington, who was previously a beer producer in the United Kingdom and then expanded their business to include breweries, wholesalers, and pubs, can be instructive [15]. After their expansion, they discovered that they were not as competitive as other large players in these areas. Consequently, they decided to divest from their hotels, restaurants, and nursing homes, concentrating primarily on managing pubs. Such a transformation was painful, but it ultimately resulted in a significant increase in shareholder value. Therefore, McDonald's can adjust and implement relevant strategic policies, as Boddington did.

4.3.Suggestion on Rising Cost of Capital

To address the issue of a rising cost of capital, which arises from people losing confidence in holding assets and exiting the market when the firm's beta is high and continuously rising, McDonald's should consider adjusting their announcement style, particularly when it comes to adverse news. They can attempt to downplay the severity of the news to a certain degree, thereby preventing any unwarranted panic among investors.

The same results were proposed by Bird [16]. According to the article, reactions to positive and bad news are asymmetric, with people tending to overreact when the sentiment of the announcement is high and underreact when it is low [16]. A superficial announcement of a rising beta may reduce the number of people refusing to further provide funds for the company and probably alleviate the negative effect to some extent [16].

5.Conclusion

In light of the pandemic's decreasing impact on the fast-food industry, this paper uses McDonald's as an example to investigate the relationship between its ROE and beta as well as the potential causes of this relationship. This study conducted a straightforward regression between the ROE and the logarithm of beta, revealing a negative correlation between these two variables: McDonald's ROE is declining, but its beta is increasing. Using beta as an indicator of the company's systematic risks and ROE as a measure of its profitability, this paper conducted an analysis that suggests that companies that experience negative equity returns and high beta values may opt for riskier strategies. Moreover, investors may be hesitant to invest in a company with a rising beta, indicating higher risk. This reluctance can increase the company's cost of capital, which in turn can lower the ROE unless there is a significant profit increase. Finally, this paper came to the conclusion that, in the case of McDonald's, the ROE will fall when the beta rises. The results of this paper provide firms in similar situations with an understanding of the phenomenon's cause and possible steps they can take to improve.

However, the limited data of this paper has included and the regression's use of only one independent variable may lead to the omission of several variables not explicitly mentioned or discussed. This paper only included a single company, McDonald's, which may not represent all possible instances of this phenomenon. So further research on other firms experiencing analogous situations might extend the explanation for such a relationship.

References

[1]. National Restaurant News, (2021) Retrieved from: https://www.nrn.com

[2]. Return on Common Equity for Restaurant Brands International Inc. Retrieved from https://finbox.com

[3]. McDonald's Fundamental Charts Return on Equity (TTM). Retrieved from https://www.zacks.com

[4]. Tamuntuan, U. (2015). Analyzing the effect of return on equity, return on assets and earnings per share toward share price: an emperical study of food and beverage companies listed on indonesia stock exchange. Journal Berkala Ilmiah Efisiensi, 15(5).

[5]. Lombardo, D., & Pagano, M. (2006). Legal determinants of the return on equity. Corporate and institutional transparency for economic growth in Europe, 1, 235-270.

[6]. De Wet, J. H. V. H., & Du Toit, E. (2007). Return on equity: A popular, but flawed measure of corporate financial performance. South African Journal of Business Management, 38(1), 59-69.

[7]. MCD Cost of Equity. Retrieved from https://www.alphaspread.com/security/nyse/mcd/discount-rate

[8]. Bowman, E. H. (1982). Risk seeking by troubled firms. Sloan Management Review (pre-1986), 23(4), 33.

[9]. Fiegenbaum, A., & Thomas, H. 1988. Attitudes toward risk and the risk-return paradox: Prospect theory explanations. Academy of Management Journal, 31: 85–106.

[10]. Bettis, R. A. (1981). Performance differences in related and unrelated diversified firms. Strategic Management Journal, 2(4), 379-393.

[11]. Bettis, R. A., & Mahajan, V. (1985). Risk/Return Performance of Diversified Firms. Management Science, 31(7), 785–799.

[12]. Li, X., & Vermeulen, F. (2021). High risk, low return (and vice versa): the effect of product innovation on firm performance in a transition economy. Academy of Management Journal, 64(5), 1383-1418.

[13]. Gordon, M. J., & Halpern, P. J. (1974). Cost of Capital for a Division of a Firm. The Journal of Finance, 29(4), 1153–1163.

[14]. Hussain, H. I., Ghani, E. K., & Razimi, M. S. A. (2019). SYSTEMATIC RISK AND DETERMINANTS OF COST OF CAPITAL: AN EMPIRICAL ANALYSIS OF SELECTED CASE STUDIES. Journal of Security & Sustainability Issues, 9(1).

[15]. Afza, T., & Nazir, M. S. (2007). Is it better to be aggressive or conservative in managing working capital. Journal of quality and technology management, 3(2), 11-21

[16]. Bird, R., & Yeung, D. (2012). How do investors react under uncertainty? Pacific-Basin Finance Journal, 20(2), 310-327

Cite this article

Ni,S. (2024). Investigating the Effectiveness of Beta on Return on Equity. Advances in Economics, Management and Political Sciences,127,17-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. National Restaurant News, (2021) Retrieved from: https://www.nrn.com

[2]. Return on Common Equity for Restaurant Brands International Inc. Retrieved from https://finbox.com

[3]. McDonald's Fundamental Charts Return on Equity (TTM). Retrieved from https://www.zacks.com

[4]. Tamuntuan, U. (2015). Analyzing the effect of return on equity, return on assets and earnings per share toward share price: an emperical study of food and beverage companies listed on indonesia stock exchange. Journal Berkala Ilmiah Efisiensi, 15(5).

[5]. Lombardo, D., & Pagano, M. (2006). Legal determinants of the return on equity. Corporate and institutional transparency for economic growth in Europe, 1, 235-270.

[6]. De Wet, J. H. V. H., & Du Toit, E. (2007). Return on equity: A popular, but flawed measure of corporate financial performance. South African Journal of Business Management, 38(1), 59-69.

[7]. MCD Cost of Equity. Retrieved from https://www.alphaspread.com/security/nyse/mcd/discount-rate

[8]. Bowman, E. H. (1982). Risk seeking by troubled firms. Sloan Management Review (pre-1986), 23(4), 33.

[9]. Fiegenbaum, A., & Thomas, H. 1988. Attitudes toward risk and the risk-return paradox: Prospect theory explanations. Academy of Management Journal, 31: 85–106.

[10]. Bettis, R. A. (1981). Performance differences in related and unrelated diversified firms. Strategic Management Journal, 2(4), 379-393.

[11]. Bettis, R. A., & Mahajan, V. (1985). Risk/Return Performance of Diversified Firms. Management Science, 31(7), 785–799.

[12]. Li, X., & Vermeulen, F. (2021). High risk, low return (and vice versa): the effect of product innovation on firm performance in a transition economy. Academy of Management Journal, 64(5), 1383-1418.

[13]. Gordon, M. J., & Halpern, P. J. (1974). Cost of Capital for a Division of a Firm. The Journal of Finance, 29(4), 1153–1163.

[14]. Hussain, H. I., Ghani, E. K., & Razimi, M. S. A. (2019). SYSTEMATIC RISK AND DETERMINANTS OF COST OF CAPITAL: AN EMPIRICAL ANALYSIS OF SELECTED CASE STUDIES. Journal of Security & Sustainability Issues, 9(1).

[15]. Afza, T., & Nazir, M. S. (2007). Is it better to be aggressive or conservative in managing working capital. Journal of quality and technology management, 3(2), 11-21

[16]. Bird, R., & Yeung, D. (2012). How do investors react under uncertainty? Pacific-Basin Finance Journal, 20(2), 310-327