1.Introduction

The concept of loss aversion dates back to the 1970s, proposed by Daniel Kahneman and Amos Tversky [1]. They discovered through a series of experiments that people tend to exhibit stronger emotional reactions when facing potential losses than when facing equal potential gains. Then they defined the phenomenon as “the response to losses is more extreme than the response to gain. The displeasure associated with losing a sum of money is generally greater than the pleasure associated with winning the same amount.” [2] There is no denying that this concept plays an important role in our daily lives. It is a critical factor in financial market fluctuations, consumer purchasing behavior, and policy-making. It assists economists, psychologists, and policymakers in better understanding the patterns of human behavior in the face of uncertainty, thereby enabling the design of more effective incentive mechanisms and interventions.

By looking through some persuasive essays and experiments, this paper illustrates the applications in two parts. The first part discusses how loss aversion is used in advertisements to attract customers. The second part explains how to use loss aversion in business strategies to persuade the customers. And the conclusion is given in the end.

2.Application 1: Advertisement

The first application is based on an essay titled The Effects of Gain Versus Loss Message Framing and Point of Reference on Consumer Responses to Green Advertising [3].

In this paper, the researchers employed a 2 (Message Framing: Gain vs. Loss) × 2 (Point of Reference: Self vs. Environment) factorial design and the 5-point Likert scale (\( 1 = strongly disagree \),\( 5 = strongly agree \)) to conduct the stastical analysis.

They recruited 241 participants via an online panel tool (61.8% female, mean age 36.67 years, 76.8% White American). Participants were randomly assigned to one of four groups and were instructed to view a green washing machine advertisement for no less than 30 seconds. Then they were interviewed about their viewpoints on advertising, brand attitudes and purchase intentions.

The advertisement’s text was crafted to present messages in two distinct ways: one highlighting the benefits of selecting the suggested product (a gain-framed approach), and the other highlighting the drawbacks of not selecting it (a loss-framed approach). Additionally, the advertisement varied the Point of Reference by focusing on either the personal gains or losses, such as monetary savings or expenses for the consumer (self-focused messaging), or by emphasizing the environmental impact, such as the potential for conservation or the risk of pollution (environment-focused messaging).

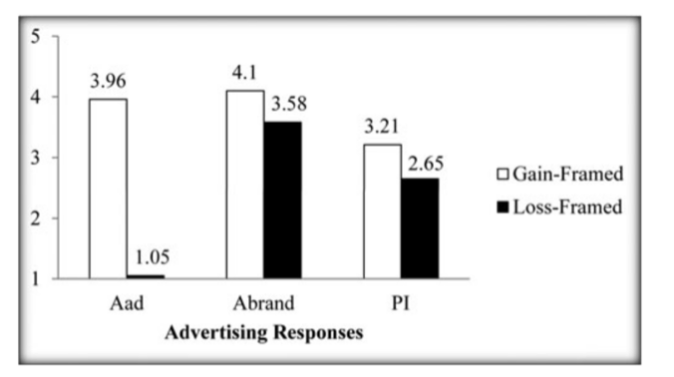

Through several computations, the researchers finally got some figures and one of them is related to the loss aversion, which is listed in Figure 1.

Figure 1: Effects of message framing on advertising responses [3] (Aad: attitude towards the ad; Abrand: attitude towards the brand; PI: the intention to purchase)

Figure 1 illustrates that primary influence of message framing was observed in relation to attitude toward the advertisement (\( F(1, 239) = 47.83 \),\( p \lt .001 \)), attitude toward the brand (\( F(1, 239) = 22.03 \),\( p \lt .001 \)), and the intention to purchase (\( F(1, 239) = 47.83 \),\( p \lt .05 \)). According to this chart, there was a notable increase in the attitude towards the advertisement(\( Mgain = 3.96 \),\( SD = 1.05 \),\( Mloss = 2.92 \),\( SD = 1.26 \)), the brand (\( Mgain = 4.10 \),\( SD = .81 \),\( Mloss = 3.58 \),\( SD = .91 \)), and the intention to purchase (\( Mgain = 3.21 \),\( SD = 1.05 \),\( Mloss = 2.65 \),\( SD = 1.26 \)) among participants in the gain-framed condition compared to those in the loss-framed condition.

The result seemed to be contrary to the loss aversion, as it illustrated that these participants were more willing to see the advertisement under Gain-Framed than under the Loss-Framed.

The researchers made one assumption that the loss-framed message always influences the urgency of giving a response. In contrast, this study is focused on promoting the consumption of a green household product, which is less of urgency, so people approach consumption with a more positive predisposition.

That constitutes one possible answer; however, an alternative perspective is also under our consideration.

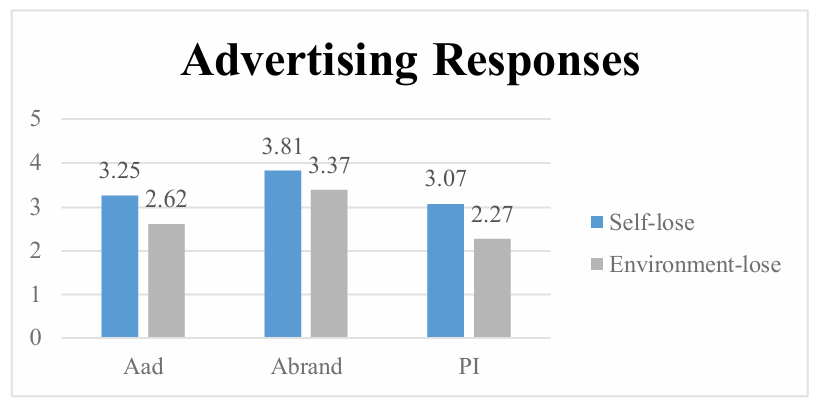

There is another chart serving as a proof.

Figure 2: Effects of self-referencing on advertising responses under the loss frame

Figure 2 showcased that self-focused/loss-framed messages elicited more favorable attitudes toward the advertisement (\( Mself-loss = 3.25 \);\( Menviro-loss = 2.62 \),\( F(1, 237) = 9.35 \),\( p \lt .05 \)), more favorable attitudes toward the brand (\( Mself-loss = 3.81 \);\( Menviro-loss = 3.37 \),\( F(1, 237) = 8.24, \)\( p \lt .05 \)), and greater purchase intention (\( Mself-loss = 3.07 \);\( Menviro-loss = 2.27 \)\( (F (1, 237) = 12.31 \)\( p \lt .05 \)) than environment-focused/loss-framed messages.

In simple terms, when the loss-frame is self-oriented, participants exhibit a much more favorable attitude towards the ad, the brand, and a greater intention to purchase compared to when the focus is on environment. This demonstrates the efficacy of loss aversion in influencing consumer responses.

Therefore, it can be explained as that the loss aversion did have an influence, and what it had done was to make the customers avoid seeing the loss [4]. In this way, we can interpret why the participants’ attitude to the ads is quite lower under loss-frame than under gain-frame.

After analyzing this experiment, we should know that the effect of loss aversion is not as simple as we see. It is not simply said that putting “if you don’t buy, you will out” can always be better than “buy this, then you can gain”. Leading by the loss aversion, customers may avoid to seeing the advertisement which illustrate they will lose something. If customers even do not like to see it, how can they click it? Thus, it is important to find a better sentence we put on the advertisement. For example, maybe we can use “buy this, then you can save something.” This sentence can not only use loss aversion by the words “save”, but also make the customers more willing to see it. But to prove it , more experiments are still needed to be done.

3.Application 2: Business Strategies

In addition to the advertisements, there is another application: Business Strategies.

3.1.Strategy 1

An experiment about hotel choice below is also used as intro, which is extracted from a paper called Loss aversion in hotel choice: PsychoPhysiological evidence [5].

The research was conducted by enlisting participants through a web-based recruitment site, which yielded a group of 109 university students from Macau who were undergraduates. All individuals involved gave their consent in writing, and they were required to make choices across 50 trials, each presenting three attributes (service and food quality, entertaining, atmosphere) and prices for two hotels.

Empatica E4 wristbands were used to measure participants’ electrodermal activity (EDA), and Eprime 2.0 was utilized to present the task on a 21-inch monitor. And EDA data were sampled at 4 Hz, smoothed, and analyzed using continuous deconvolution analysis to extract skin conductance responses (SCR).

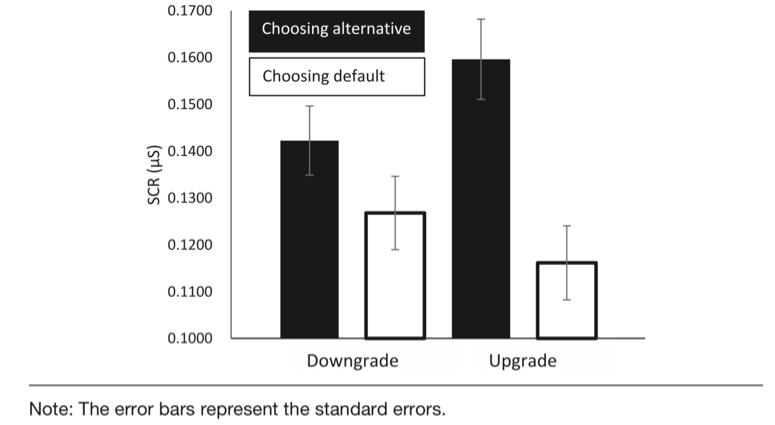

After the experiment, the researchers got the figure

Figure 3: skin conductance response when Participants choose the default versus the alternative option in an upgrade versus downgrade decision [5]

Figure 3 shows the skin conductance responses (SCR) when participants chose between the default and alternative options in both upgrade and downgrade decisions.

The chart reveals that when participants switched from the default to the alternative option, there is a significant increase in SCR, suggesting heightened emotional arousal during the change. And this heightened emotional arousal may be associated with concerns about the additional costs, which will lead to immediate “loss”.

Hence, the paper concludes that when deciding to deviate from the default, the potential for loss alerts the decision-maker by provoking a more intense emotional arousal, which can demonstrate the existence of loss aversion.

Inspired by this phenomenon, some strategies can be proposed to counter or utilize the loss aversion.

Initially, to counter the loss aversion, the change can be made more valuable.

If the choice is downgrade, it can highlights opportunity cost along with the price difference. There is a proof in the paper, saying that The concept of opportunity neglect in psychology can serve as a reference when persuading consumers to shift from a higher-priced, higher-quality default option to more affordable alternatives [6]. The researchers discovered that consumers tend to opt for the lower-priced option when the provider emphasizes the opportunity cost in addition to the price discrepancy.

When it comes to upgraded choice, it can strengthen this price-quality perception as the paper stated that hoteliers might aim to reinforce the association between price and quality to boost consumers' anticipatory enjoyment of the hotel experience, potentially mitigating the impact of loss aversion.

Besides these, we can also utilize loss aversion with the default strategy.

This study can still use the sentences in the paper to prove it. “Striving to become a default choice is particularly important for hotels that are not ‘top-of-the-line.’ Appearing first may offer some protection for these ‘underdogs.’ Empirically, our findings suggest that such default status may give them a boost of choice probability by approximately 5% to 10%.”

3.2.Strategy 2

Then, there is another strategy that comes out of this, namely, the brand loyalty.

We can assume from the previous experiment that when people choose a brand in a new category, they are more likely to choose the same brand next time [7]. As time goes by, the loyalty of the brand forms. And what can also explain brand loyalty in loss aversion is that if we choose another new brand, we will lose the service that the prior one gave us, which will lead to our aversion, even though we can get some new services. This is more evident in electronic products, whose switch costs are high. For example, if our computer is Mac now, we will still buy Mac when we need a new one instead of buying the one with the Windows system, and vice versa. In this way, the switch costs enhance our loss aversion, which further enhances our brand loyalty.

So, the businessmen can use the strategy to improve the switch costs, and what they should do is to innovate [8]. Be more creative and provide the products that other companies cannot provide, in order to let the customers cannot leave them, which is not only beneficial to the customers as they can get more new things, but also beneficial to the whole society.

3.3.Strategy 3

Apart from prior strategies, the last business strategy is about the payment: the Installment.

In November 2023, Iresearch released a document named “Mutual Benefit and Revitalization Growth: A Study on the Value of Installment Payment Tools”. The paper states that nearly 70% of merchants who have used the interest-free installment payment tool have experienced an increase in sales. What’s more, after allowing customers to use Ant credit Pay with interest-free installment, the turnover of the Rongsheng refrigerator flagship store has increased by 15% to 20%, and the turnover of high-end refrigerators has increased more significantly, reaching 30% [9].

The reason behind the result is just the loss aversion. If there must be a loss, it is obvious that we will choose to lose less instead of losing more, so when we pay for something, what we focus more is the immediate loss. The payment by installment decreases the immediate loss we have, which makes us more willing to buy the products [10].

Thus, when it comes to setting the payment strategy, the enterprise can give the customers the option to pay by installment.

4.Conclusion

The exploration of loss aversion within the business context reveals its multifaceted influence on consumer behavior and decision-making. This paper has delved into the intricate ways in which loss aversion can be harnessed to enhance customer engagement and retention. Through the analysis of advertising strategies and business tactics, it becomes evident that loss aversion is not merely a psychological bias but a powerful tool for influencing consumer actions.

In the realm of advertising, the study has demonstrated that while loss-framed messages may not always outperform gain-framed ones, they can significantly influence consumer attitudes and intentions when self-referenced. This insight suggests that advertisers must carefully consider the framing of their messages to resonate with consumers’ inherent aversion to loss.

Moreover, the strategic use of loss aversion in business strategies, such as default options and innovative product offerings, can effectively increase customer loyalty and perceived value.

The installment payment example highlights another dimension of loss aversion, where the immediate reduction in perceived loss can lead to increased sales. This strategy capitalizes on consumers’ preference for minimizing immediate financial outlay, thereby making high-value purchases more palatable.

In conclusion, loss aversion is a pivotal concept that businesses must understand and apply with nuance. By leveraging loss aversion through thoughtful advertising, strategic business practices, and payment options, companies can foster stronger customer relationships and drive long-term success. The strategic application of loss aversion principles is not just about immediate gains; it’s about building a sustainable and loyal customer base that is vital in today’s competitive marketplace. As businesses continue to evolve, the adaptability of loss aversion strategies will be crucial in maintaining consumer engagement and retention.

References

[1]. Corina Paraschiv, Olivier L'Haridon. (n.d.). Loss aversion: origin, components and marketing implications. [J] GREG- HEC University of Paris V, Sorbonne.

[2]. Tversky, A., Kahneman, D. (1981). The framing of decisions and the psychology of choice. [J] Science, 211(4481), 453-458.

[3]. Segev, S., Fernandes, J., Wang, W. (2015). The effects of gain versus loss message framing and point of reference on consumer responses to green advertising. [J] Journal of Current Issues & Research in Advertising, 36(1), 35-51. https://doi.org/10.1080/10641734.2014.912600

[4]. Bertrand, M., Karlan, D., Mullainathan, S., Shafir, E., Zinman, J. (2010). What's advertising content worth? Evidence from a consumer credit marketing field experiment. [J] The Quarterly Journal of Economics, 125(1), 263-302. https://doi.org/10.1162/qjec.2010.125.1.263

[5]. Chark, R., King, B. (2021). Loss aversion in hotel choice: PsychoPhysiological evidence. [J] Journal of Hospitality & Tourism Research.

[6]. Frederick, S., Novemsky, N., Wang, J., Dhar, R., Nowlis, S. (2009). Opportunity cost neglect. [J] Journal of Consumer Research, 36(4), 553-561. https://doi.org/10.1086 /599764

[7]. Hardie, B. G. S., Johnson, E. J., Fader, P. S. (1993). Modeling loss aversion and reference dependence effects on brand choice. [J] Marketing Science, 12(4), 378-394.

[8]. Ndungu, Njeri. (2023). The Evolution of Brand Innovation and its Impact on Consumer Loyalty in a Globalized Economy. [J] Journal of Asian Multicultural Research for Economy and Management Study, 4(4), 25-30.

[9]. iResearch Consulting Group. (2023). Mutual Benefit and Revitalization Growth: A Study on the Value of Installment Payment Tools. 36Kr.

[10]. Welch, N. (2010). A marketer’s guide to behavioral economics. [J] Marketing & Sales Practice.

Cite this article

Zheng,L. (2024). The Power of Loss Aversion: Enhancing Customer Engagement and Retention in Business. Advances in Economics, Management and Political Sciences,128,111-116.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Corina Paraschiv, Olivier L'Haridon. (n.d.). Loss aversion: origin, components and marketing implications. [J] GREG- HEC University of Paris V, Sorbonne.

[2]. Tversky, A., Kahneman, D. (1981). The framing of decisions and the psychology of choice. [J] Science, 211(4481), 453-458.

[3]. Segev, S., Fernandes, J., Wang, W. (2015). The effects of gain versus loss message framing and point of reference on consumer responses to green advertising. [J] Journal of Current Issues & Research in Advertising, 36(1), 35-51. https://doi.org/10.1080/10641734.2014.912600

[4]. Bertrand, M., Karlan, D., Mullainathan, S., Shafir, E., Zinman, J. (2010). What's advertising content worth? Evidence from a consumer credit marketing field experiment. [J] The Quarterly Journal of Economics, 125(1), 263-302. https://doi.org/10.1162/qjec.2010.125.1.263

[5]. Chark, R., King, B. (2021). Loss aversion in hotel choice: PsychoPhysiological evidence. [J] Journal of Hospitality & Tourism Research.

[6]. Frederick, S., Novemsky, N., Wang, J., Dhar, R., Nowlis, S. (2009). Opportunity cost neglect. [J] Journal of Consumer Research, 36(4), 553-561. https://doi.org/10.1086 /599764

[7]. Hardie, B. G. S., Johnson, E. J., Fader, P. S. (1993). Modeling loss aversion and reference dependence effects on brand choice. [J] Marketing Science, 12(4), 378-394.

[8]. Ndungu, Njeri. (2023). The Evolution of Brand Innovation and its Impact on Consumer Loyalty in a Globalized Economy. [J] Journal of Asian Multicultural Research for Economy and Management Study, 4(4), 25-30.

[9]. iResearch Consulting Group. (2023). Mutual Benefit and Revitalization Growth: A Study on the Value of Installment Payment Tools. 36Kr.

[10]. Welch, N. (2010). A marketer’s guide to behavioral economics. [J] Marketing & Sales Practice.