1. Introduction

In the age of globalization and sustainable development, investors are increasingly focussing on companies' ESG performance [1]. ESG reports help companies communicate non-financial success and analyze long-term risks. ESG reporting must be transparent. Companies' sustainability records in transparent ESG reports may impact investment choice [2]. Interest in ESG performance has recently grown, and proper ESG reporting is vital to maintaining investor confidence. Transparency is encouraged, but its precise impact on investors remains uncertain. This research examines how ESG report transparency affects investor behavior to close these gaps. This study involves a literature review, data collection, empirical analysis, and case studies. The study will thoroughly evaluate the literature on ESG disclosure and investor behavior, including an overview of signal theory, information asymmetry theory, and the study's theoretical framework. The literature review will reveal study gaps like how openness affects institutional vs. individual investors.

A representative sample of firms will be used to collect data following the literature review. Major corporations listed on global stock exchanges will be selected for assessing ESG report transparency. ESG transparency will be evaluated using ratings from MSCI and Sustainalytics. Stock trading volumes, price volatility, and mood surveys from Bloomberg and Thomson Reuters show investor behavior. The data will enable a comprehensive analysis of the relationship between ESG transparency and investor behavior. ESG transparency and investment activities will be assessed empirically using regression analysis. To isolate the impact of ESG disclosure on investment choices, the research will control for market and macroeconomic conditions. Data should show how openness influences investor stock purchases, sales, and ownership. In-depth case studies of ESG-open enterprises will be part of the empirical study. Case studies will demonstrate the impact of ESG reporting transparency on investors. These case studies will show how transparency influences trust, risk assessment, and investment strategies. This study holds both theoretical and practical significance. The study supports ESG reporting and investor behavior theory, especially signal and information asymmetry. Researchers expand the theoretical framework by analyzing investor openness and information asymmetry.

2. Literature Review

In recent decades, ESG reporting has become essential to firm governance and investor decision-making [3]. ESG reporting comprises corporate governance social, and environmental performance. Environmentally concerned corporations traditionally reported ESG voluntarily. As the world prioritizes sustainability and responsible investing, ESG reporting is becoming standard. Investors, regulators, and others seek non-financial risk and opportunity management transparency and accountability. ESG reporting's growth has made it an essential tool for assessing a company's long-term worth and risk, influencing investment choices [4].

Corporate transparency impacts ESG and performance disclosure [5]. Corporate ESG reports may include all ESG operations or just selected performance measures. Transparency shows a company's sustainability initiatives and dangers, which investors like. ESG reporting openness is crucial for investor trust and decision-making. Public ESG reports help investors evaluate a company's sustainability claims and risks [6].

Signal and Information Asymmetry Theories explain ESG transparency and investor behavior [7]. Signal Theory states that corporations use ESG reporting to demonstrate their sustainability and ethics to investors and stake holders. Clear ESG reports indicate that the company is confident in its sustainability performance and prepared to be held responsible [8]. Poor or selective disclosure may indicate issues or a lack of commitment, hurting investor impressions. Instead, knowledge Asymmetry Theory emphasizes the knowledge gaps between investors and corporations. ESG reporting openness reduces information asymmetry and offers investors decision-making data [9]. Transparent ESG disclosures improve security pricing and capital allocation by informing investors about the company's risks and potential.

In conclusion, few ESG openness and firm performance studies address how disclosure levels impact investor psychology and decision-making. How institutional vs. individual investors react to ESG disclosure is uncertain [10]. Regular investors may depend on disclosure clarity and comprehensiveness, but institutional investors have more significant resources and skills to analyze ESG data. The effect of ESG transparency on sectors is unclear without comparing high-risk and low-risk companies. These gaps require further research on ESG reporting's effects on investor behavior across transparency levels, investor types, and sectors [11].

3. Research Methodology

Systematic research examines how ESG report openness influences investor behavior. The quantitative research approach is complemented by qualitative insights from a single organization case study. This mixed-methods approach allows statistical and in-depth examination of transparency and investor behavior in real-world firms. In addition to quantitative research, a complete Unilever case study will examine how ESG reporting transparency influences investor behavior. The case study will analyze how Unilever's transparency/lack thereof affects investor trust, risk assessment, and decision-making. Focussing on Unilever, the study may explore how investors comprehend ESG information and how it influences their investment strategy. The qualitative component will enrich the quantitative findings and give a more nuanced and practical understanding of ESG reporting transparency. Quantitative and qualitative methods are used to evaluate how ESG report transparency influences investor behavior. The paper examines Unilever in-depth and contextually to teach business practitioners and investors about sustainable investment and corporate governance.

3.1. Data Collection

Empirical data will be collected from a prominent and representative company. World-renowned consumer goods company Unilever was chosen for its sustainability and ESG reporting. Unilever's open ESG disclosures, which cover various environmental, social, and governance issues, make it a desirable study subject. Unilever allows for a focused study of how high ESG reporting transparency influences investor behavior, which may apply to other industrial companies. MSCI and Sustainalytics ESG data in recent 5 years will provide comprehensive transparency metrics for Unilever [12] . These groups assess Unilever's ESG report transparency with detailed grades and criteria. Transparency depends on information richness, consistency, and clarity. The study will collect Unilever investor behavior data such as stock trading volumes, price volatility, and mood surveys in addition to ESG data. Bloomberg and Thomson Reuters data will inform the study.

3.2. Case Studies

This case study and empirical research examine how ESG report transparency influences investor behavior. The major case study was Unilever, a worldwide sustainability and ESG leader with unambiguous ESG reporting. For its thorough ESG disclosures, global consumer product impact, and sustainability benchmark position, Unilever was chosen. A transparent business shows how thorough and accessible ESG reporting affects investor trust, decision-making, and involvement.

ESG transparency analysis uses Signal and Information Asymmetry Theories. ESG disclosures demonstrate the market corporations value ethics and sustainability, explains Signal Theory. Investors seek openness for better performance and lower risk [13]. However, information Asymmetry Theory suggests openness minimizes investor-company knowledge gaps. Transparent firms improve investor choices and asset values.

The case study will examine Unilever's transparency's impact on stock performance and investor perception. Investor sentiment, stock trading volume, and price volatility will evaluate ESG transparency. Thorough research reveals how ESG reporting openness influences investor behavior in real-world scenarios, teaching other firms and sectors.

4. Results

Statistics show that openness to ESG reports improves investor behavior. This section will discuss the main conclusions of the empirical analysis and the qualitative findings of the Unilever case study.

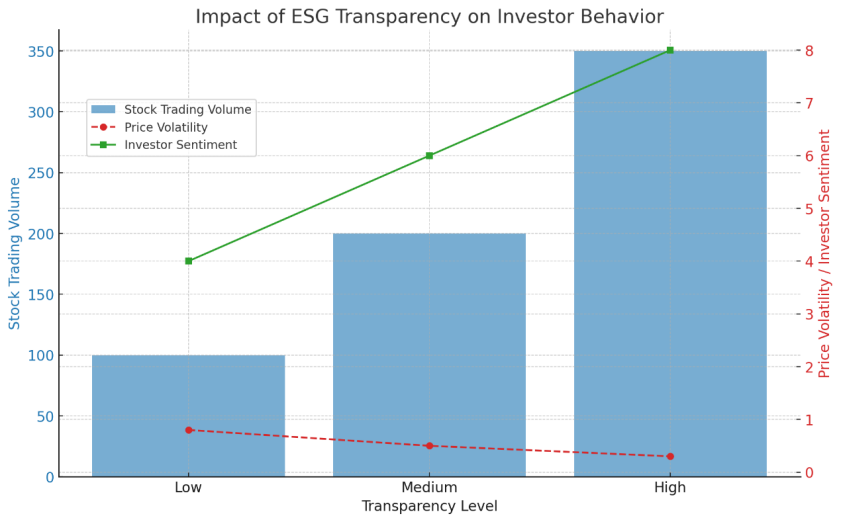

Figure 1 shows the relationship between investing behavior and ESG transparency. "Levels of ESG Transparency," from selective to entire disclosure, run horizontally left to right. The vertical axis shows "Investor Behavior," which includes stock trading volumes, investor confidence, and price stability. Openness boosts investor trading volumes and price stability. Institutional investors' line slope is steeper, indicating ESG transparency influences their choices. Institutional investors may respond better to ESG transparency enhancements since they have greater resources to review disclosures. Individual investors may show a comparable but less obvious rise in good behaviors with openness. This suggests that individual investors respond to openness based more on general perceptions of sustainability than on detailed ESG data.

Figure 1: Impact of ESG transparency on investor behavior

The empirical research employed regression models to examine how ESG disclosure affects stock trading volumes, price volatility, and investor sentiment. ESG transparency, like Unilever, increases trading volumes and reduces price volatility, making investors more likely to trust such companies. This correlation was higher among institutional investors, who can interpret ESG data better. Institutional investors preferred ESG-disclosed companies for transparency and lower risk. While transparency benefitted individual investors, they tended to rely more on general perceptions of the company's sustainability commitment than on the specific details within the ESG report.

The statistical finding of transparency-based investor behavior was significant. Moving from selective to complete disclosures benefitted investor behavior, the research showed. Thus, even tiny ESG reporting enhancements may boost investor confidence and participation. The findings revealed that transparency depends on the quality, relevance, and quantity of the disclosed information. To make informed judgments, institutional investors preferred extensive, clear, and accessible ESG data.

In addition to the empirical findings, the Unilever case study highlighted the practical implications of ESG transparency. Unilever's industry-leading ESG reporting standards demonstrate how openness may change investor behavior. The case study found that Unilever's reporting openness frequently affected investor confidence and risk assessment. Unilever's constant and unambiguous ESG disclosure allayed investor fears amid market instability, stabilizing its stock prices better than competitors [14, 15].

The case study stressed investor relations transparency's strategic value. ESG reporting helps Unilever gain investor confidence. This technique has attracted long-term, socially conscious, sustainable investors to the firm. According to qualitative studies, transparent ESG reporting may help organizations stand out in sustainability-focused businesses. Investor behavior in the case study was similarly influenced by another level of transparency. Due to Unilever's rigorous sustainability and governance strategy and detailed ESG disclosures, several institutional investors bought more shares, reducing risk. The case study showed transparency's drawbacks. Unilever's sustainability disclosure caused short-term stock price volatility as investors anticipated the worst. Transparency informed investors and supported the company's long-term strategic objectives.

In conclusion, empirical research and case studies show that ESG disclosure affects investor behavior. Transparency boosts investor confidence, reduces volatility, and attracts institutional investment. Unilever illustrates that openness may improve market positioning and investor relations. These findings suggest that enterprises seeking investors should emphasize ESG reporting transparency to fulfil escalating regulatory requirements and build long-term capital market trust and stability.

5. Discussion

This study validates and extends earlier data that ESG disclosure boosts investor confidence and reduces market volatility. These findings support the Signal Theory since ESG-disclosing companies like Unilever attract more informed and engaged investors. ESG reporting transparency reduces the information gap between firms and investors, enhancing security pricing and investment choices, thus supporting knowledge of Asymmetry Theory. These results could help companies prioritize transparency in ESG reporting by encouraging the provision of clear disclosures. Sustainable methods, clear goals, and frequent reporting may be needed. Policymakers should mandate comprehensive and detailed ESG disclosure to create a more level playing field in the market. Corporate ESG reporting is optimized by regulation, enhancing investor understanding and sustainable finance.

Despite its limitations, this research sheds light on the influence of ESG transparency on investor behavior, although examples like Unilever are limited. This method is detailed but may not apply to other sectors. ESG disclosure and investor behavior may vary in high-risk areas like energy and technology. The short-term statistics may not reflect how openness affects long-term investment plans and organizational success. MSCI and Sustainalytics ESG data dependency is another concern. ESG performance assessments and interpretations vary between industries; therefore, these comprehensive sources may influence transparency outcomes. Investor attitudes toward transparency may be influenced by qualitative factors like corporate culture and communication strategies, which this research may have overlooked. A future study should cover companies from diverse sectors and countries to investigate how ESG disclosure affects investor behavior. Comparing countries can show how government, culture, and market affect transparency and investor confidence. Long-term consequences of ESG openness on investor loyalty, organizational value, and sustainability should be investigated. Explore these criteria to show ESG transparency's strategic relevance in global financial markets.

6. Conclusion

ESG reporting openness boosts investor confidence, reduces market volatility, and engages investors. According to empirical research and a Unilever case study, comprehensive ESG disclosures improve investor decisions, especially for institutional investors who value accurate information. The results demonstrate transparency's value as a compliance measure and a strategy for firms to attract investors and compete in competitive marketplaces. ESG reporting transparency helps firms and investors price securities, allocate money and make better decisions. The research suggests that, beyond investor behavior, ESG transparency plays a role in enhancing corporate governance and sustainable development. ESG disclosure may boost stakeholder trust, risk management, and sustainability. As ESG problems rise, openness, robust policy, and investor behavior research are essential. According to this research, ESG reporting disclosure criteria must be robust to promote openness, accountability, and sound corporate governance. Finally, corporate governance and ESG reporting transparency are critical factors that influence business sustainability and financial markets. Firms and governments must recognize that openness is crucial to sustained economic growth, especially as responsible investment becomes more prevalent.

References

[1]. Sciarelli, M., Cosimato, S., Landi, G., & Iandolo, F. (2021). Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. The TQM Journal, 33(7), 39-56. https://www.emerald.com/insight/content/doi/10.1108/TQM-08-2020-0180/full/html

[2]. Jonsdottir, B., Sigurjonsson, T. O., Johannsdottir, L., & Wendt, S. (2022). Barriers to using ESG data for investment decisions. Sustainability, 14(9), 5157. https://www.mdpi.com/2071-1050/14/9/5157

[3]. Sridharan, V. (2018). Bridging the disclosure gap: investor perspectives on environmental, social & governance (ESG) disclosures. Social & Governance (ESG) Disclosures (May 11, 2018). https://core.ac.uk/download/pdf/219378367.pdf

[4]. Oprean-Stan, C., Oncioiu, I., Iuga, I. C., & Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 12(20), 8536. https://www.mdpi.com/2071-1050/12/20/8536

[5]. Young-Ferris, A., & Roberts, J. (2023). ‘Looking for something that isn’t there’: a case study of an early attempt at ESG integration in investment decision making. European Accounting Review, 32(3), 717-744. https://www.tandfonline.com/doi/abs/10.1080/09638180.2021.2000458

[6]. Almeyda, R., & Darmansya, A. (2019). The influence of environmental, social, and governance (ESG) disclosure on firm financial performance. IPTEK Journal of Proceedings Series, (5), 278-290. http://iptek.its.ac.id/index.php/jps/article/download/6340/4185

[7]. Candelon, B., Hasse, J. B., & Lajaunie, Q. (2021). Esg-washing in the mutual funds industry? from information asymmetry to regulation. Risks, 9(11), 199. https://www.mdpi.com/2227-9091/9/11/199

[8]. Oprean-Stan, C., Oncioiu, I., Iuga, I. C., & Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 12(20), 8536. https://www.mdpi.com/2071-1050/12/20/8536

[9]. Usman, B., Bernardes, O. T. F., & Kananlua, P. S. (2020). On the nexus between CSR practices, ESG performance, and asymmetric information. Gadjah Mada International Journal of Business, 22(2), 151-177. https://pdfs.semanticscholar.org/a81b/827ca7c986244630124aa7894ca78c980676.pdf

[10]. Reber, B., Gold, A., & Gold, S. (2022). ESG disclosure and idiosyncratic risk in initial public offerings. Journal of Business Ethics, 179(3), 867-886. https://link.springer.com/article/10.1007/s10551-021-04847-8

[11]. Pillai, R., Islam, M. A., Sreejith, S., & Al-Malkawi, H. A. (2024). Comparative analysis of environmental, social and governance (ESG) ratings: do sectors and regions differ?. Journal of Management and Governance, 1-41. https://link.springer.com/article/10.1007/s10997-023-09692-7

[12]. Sustainalytics ESG data. Sustainalytics. https://www.sustainalytics.com/esg-rating/unilever-plc/1007986724

[13]. Huang, D. Z. X. (2022). Environmental, social and governance factors and assessing firm value: Valuation, signalling and stakeholder perspectives. Accounting & Finance, 62, 1983-2010. https://espace.library.uq.edu.au/view/UQ:c00aed8/UQc00aed8_OA.pdf

[14]. Adrian Murdoch November 2, 2023. Unilever plays with ESG smoke and mirrors https://www.capitalmonitor.ai/analysis/unilever-plays-with-esg-smoke-and-mirrors/

[15]. Rob Davies. Fri 19 Apr 2024. Unilever to scale back environmental and social pledges. https://www.theguardian.com/business/2024/apr/19/unilever-to-scale-back-environmental-and-social-pledges

Cite this article

Zheng,Z. (2024). The Impact of ESG Report Transparency on Investor Behavior. Advances in Economics, Management and Political Sciences,129,151-156.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sciarelli, M., Cosimato, S., Landi, G., & Iandolo, F. (2021). Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. The TQM Journal, 33(7), 39-56. https://www.emerald.com/insight/content/doi/10.1108/TQM-08-2020-0180/full/html

[2]. Jonsdottir, B., Sigurjonsson, T. O., Johannsdottir, L., & Wendt, S. (2022). Barriers to using ESG data for investment decisions. Sustainability, 14(9), 5157. https://www.mdpi.com/2071-1050/14/9/5157

[3]. Sridharan, V. (2018). Bridging the disclosure gap: investor perspectives on environmental, social & governance (ESG) disclosures. Social & Governance (ESG) Disclosures (May 11, 2018). https://core.ac.uk/download/pdf/219378367.pdf

[4]. Oprean-Stan, C., Oncioiu, I., Iuga, I. C., & Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 12(20), 8536. https://www.mdpi.com/2071-1050/12/20/8536

[5]. Young-Ferris, A., & Roberts, J. (2023). ‘Looking for something that isn’t there’: a case study of an early attempt at ESG integration in investment decision making. European Accounting Review, 32(3), 717-744. https://www.tandfonline.com/doi/abs/10.1080/09638180.2021.2000458

[6]. Almeyda, R., & Darmansya, A. (2019). The influence of environmental, social, and governance (ESG) disclosure on firm financial performance. IPTEK Journal of Proceedings Series, (5), 278-290. http://iptek.its.ac.id/index.php/jps/article/download/6340/4185

[7]. Candelon, B., Hasse, J. B., & Lajaunie, Q. (2021). Esg-washing in the mutual funds industry? from information asymmetry to regulation. Risks, 9(11), 199. https://www.mdpi.com/2227-9091/9/11/199

[8]. Oprean-Stan, C., Oncioiu, I., Iuga, I. C., & Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 12(20), 8536. https://www.mdpi.com/2071-1050/12/20/8536

[9]. Usman, B., Bernardes, O. T. F., & Kananlua, P. S. (2020). On the nexus between CSR practices, ESG performance, and asymmetric information. Gadjah Mada International Journal of Business, 22(2), 151-177. https://pdfs.semanticscholar.org/a81b/827ca7c986244630124aa7894ca78c980676.pdf

[10]. Reber, B., Gold, A., & Gold, S. (2022). ESG disclosure and idiosyncratic risk in initial public offerings. Journal of Business Ethics, 179(3), 867-886. https://link.springer.com/article/10.1007/s10551-021-04847-8

[11]. Pillai, R., Islam, M. A., Sreejith, S., & Al-Malkawi, H. A. (2024). Comparative analysis of environmental, social and governance (ESG) ratings: do sectors and regions differ?. Journal of Management and Governance, 1-41. https://link.springer.com/article/10.1007/s10997-023-09692-7

[12]. Sustainalytics ESG data. Sustainalytics. https://www.sustainalytics.com/esg-rating/unilever-plc/1007986724

[13]. Huang, D. Z. X. (2022). Environmental, social and governance factors and assessing firm value: Valuation, signalling and stakeholder perspectives. Accounting & Finance, 62, 1983-2010. https://espace.library.uq.edu.au/view/UQ:c00aed8/UQc00aed8_OA.pdf

[14]. Adrian Murdoch November 2, 2023. Unilever plays with ESG smoke and mirrors https://www.capitalmonitor.ai/analysis/unilever-plays-with-esg-smoke-and-mirrors/

[15]. Rob Davies. Fri 19 Apr 2024. Unilever to scale back environmental and social pledges. https://www.theguardian.com/business/2024/apr/19/unilever-to-scale-back-environmental-and-social-pledges