1. Introduction

At this stage, there has been significant progress in the study of property bubbles, and research in this area involves not only theoretical discussions but also practical applications and policy recommendations. The main research topic of this paper is the relationship between the housing bubble and monetary policy in Spain. Ultimately, it wants to explore whether the Spanish property bubble was caused by some of the monetary policies it adopted. The research methodology of this paper includes a literature research method, and a case study method. These research methods will be reflected in the following. The significance of this study includes many aspects. Theoretically, it is possible to understand the mechanism of bubble formation; for example, it is possible to gain a deeper understanding of how the property market receives stimulus under loose monetary policy and expands rapidly, thus forming a bubble. Second, it can reveal financial stability risks. The bursting of real estate bubbles is often accompanied by turbulence in the financial system, and the study of the role of monetary policy in it can reveal the path of monetary policy's impact on financial stability. Thirdly, it can enrich macroeconomic theories. Through the study of the relationship between property bubbles and monetary policy, it can enrich and improve the theories in related fields and enhance the scientificity and effectiveness of policy formulation. In practice, it can guide policy formulation, prevent financial crises, and promote healthy economic development.

2. The Introduction of Spain’s Housing Bubble

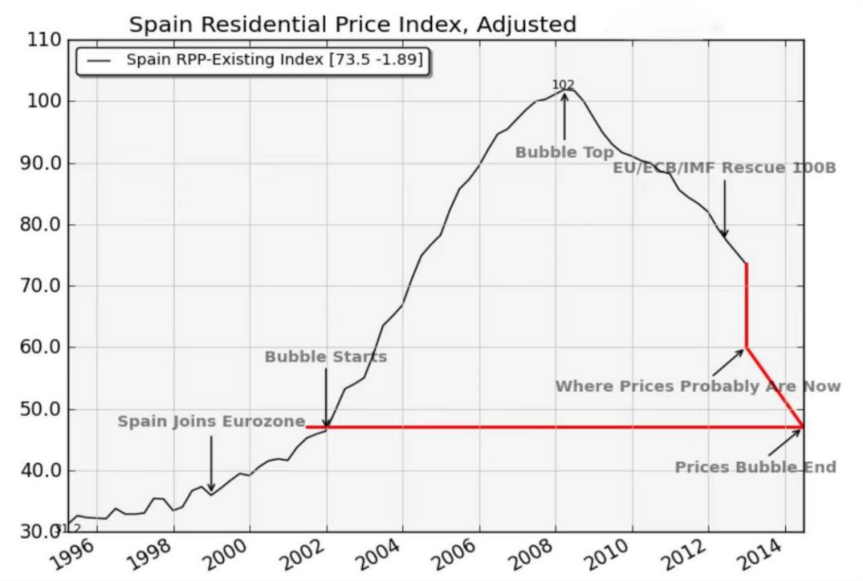

Starting in the 1990s, Spain experienced rapid economic growth and soon became one of the fastest growing economies in Europe. However, the Spanish real estate sector has been overdeveloped, More than 80% of families live in their own house. Real estate accounts for between 60% and 70% of Spanish households’ total assets and for the collateral of a most sizable proportion of their liabilities [1], creating a real estate bubble. And the economic crisis in Spain has been more severe than in other European Union countries due to the effects of the property bubble [2]. The Spanish housing bubble can be broadly divided into four phases: the first phase was from 1997 to 2006, during which, as can be seen in Figure 1, house prices rose dramatically, and the second phase was from 2005 to 2008, when house prices reached their peak, presenting the illusion of a boom that was caused by overabundance of cheap credit, speculative investment in real estate, and policies that promoted home ownership that led to an increase in demand for housing. Here is the surprise: housing prices increased by 150% in normal terms between 1997 and 2006. Then, the third phase from 2008 to 2013 is the crisis and its aftermath. The global financial crisis erupted in 2008; for Spain, it is the beginning of the end. Spanish house prices dropped by 37% during this period. And with it, a surge in bad loans and significant financial losses for banks. By 2010, private debt in Spain had reached 1 trillion euros. The final phase is the slow recovery from 2013 to 2015. The aftermath of the housing bubble saw a slow and painful recovery process. Both high unemployment and economic growth have declined. By 2015, there were some signs of stabilization, although the market had not fully recovered to pre-crisis levels.

Figure 1: Market Oracle [3].

3. Monetary Policies in Spain

After rejoining theEurozone, Spain's monetary policy, which is set by the European Central Bank and not implemented by its own central bank, is exceptional. The reasons for the formation of the Spanish property bubble share some characteristics with EU countries such as the UK and the US. For example, credit expansion, liberalization of the mortgage market, etc. [4].

3.1. Quantitative Easing

A series of monetary policies adopted by the Bank of Spain were instrumental in stimulating the formation of its property bubble. The first is the policy of quantitative easing, which is designed to increase the money supply in the economy. Usually through the purchase of long-term assets. For example, treasury bonds are used to increase the money supply in order to lower long-term interest rates and stimulate economic growth. And the low long-term interest rates that came with it lowered the cost of borrowing. To some extent, this encourages people to buy homes. Especially after 1999, when the euro was launched, real interest rates in Spain fell sharply. In the real estate market, average mortgage borrowing rates in Spain have continued to fall as a result of the liberalization of the mortgage market and increased competition among financial institutions. And this just reinforces consumers' expectations of low interest rates in the future. Therefore, most Spanish home buyers are choosing to purchase their homes using variable interest rates, which are likely to remain low, rather than fixed rates. This makes the Spanish property market particularly sensitive to interest rates. As a result, when the financial crisis hit, variable mortgage rates.

3.2. Loose Credit Policy

The second is a loose credit policy. Pages and Maza find that the relaxation of credit constraints, evidenced by growth in housing loans and declines in nominal mortgage rates, accounted for a substantial portion of house price growth in Spain from 1976 to 2002 [5]. As a union, the European currency is in a unique predicament. The European Central Bank sets a uniform interest rate for all countries belonging to the Union rather than setting different standards according to the different economic development of different countries. However, it is precisely because the level of economic development of individual countries is different that, under the harmonized standards set by the European Union, there may be some countries with a looser monetary policy and others with a more appropriate one. In the environment of loose monetary policy, a large amount of capital pours into the real estate market, pushing up the housing price. In a tight monetary policy environment, capital withdrew from the real estate market, leading to a decline in house prices.In the case of Spain, the harmonized interest rate set by the European Central Bank is much lower than the rate that should actually be set. Under this loose credit policy, it is easier for banks to provide loans to people. Accordingly, as a result of the easy credit conditions, the demand for housing will increase greatly, and the high demand will bring about a rapid rise in property prices, and a large influx of capital will make the property market more prosperous than ever before. Builders will also build a lot of houses to meet people's demand. The result is that when an economic crisis hits, the property market bears the brunt. But because of the pre-existing overdevelopment, its collapse would be devastating to society as a whole.

In general, the European Monetary Union (EMU) has eased financial constraints on Spain and has adopted an easy credit policy. At the same time, Spain has made some concessions in order to join the EMU. Prior to joining EMU, the Bank of Spain's monetary policy was focused on the state of the national economy and it could adjust interest rates and the money supply independently. After joining the EMU, the Bank of Spain lost its power to adjust interest rates and the money supply independently due to the EMU's unified monetary policy [6]. This is coupled with Spain's particular domestic situation. These have accelerated its property market towards the abyss.

4. Comparison of Spanish and German Monetary Policy

There are many reasons for choosing Spain and Germany as a comparison. On the one hand, both countries are large and economically significant EA members. On the other hand, Germany belongs to what has been referred to as the “core”, while Spain belongs to the “periphery” [7]. After the economic crisis, core and peripheral countries have been frequently mentioned. Therefore, it makes sense to compare one country from each of the two groups.

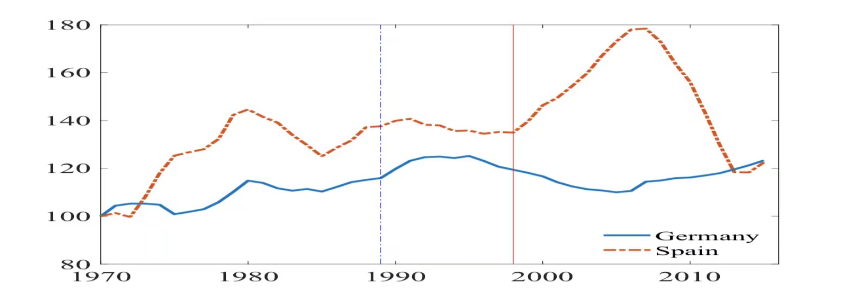

Below is Figure 2, showing residential investment in Spain and Germany. It can be seen that the housing investment situation in Germany has been relatively stable, while in Spain it has remained high and peaked around the time of the financial crisis in 2008. And in the aftermath of the financial crisis, the fall in property investment trousers.

Figure 2: Residential Investment—Spain vs Germany[8].

The reason for this is related to the monetary policies adopted by the two countries. Spain’s monetary policy of low interest rates and credit expansion both stimulate economic growth. Under the environment of loose monetary policy, banks have provided a large number of low-interest and long-term loans to the real estate industry and individual home buyers. This credit expansion has provided an ample source of funding for the property market, driving up housing prices. So, in the environment of loose monetary policy, a large amount of capital pours into the real estate market, pushing up the housing price. In a tight monetary policy environment, capital withdrew from the real estate market, leading to a decline in house prices.

Compared with Spain, Germany's monetary policy before the housing bubble may have been more sound and prudent. The primary objective of German monetary policy is to maintain monetary stability and prevent inflation. This long-term objective has led the Bundesbank to place greater emphasis on balancing economic growth and price stability in the formulation of monetary policy. With a prudent credit policy, banks may be more prudent in granting loans and strictly examine the credit status and repayment ability of borrowers to avoid the accumulation of risks caused by excessive lending. At the same time, Germany emphasizes fiscal discipline and has strict controls on public debt and fiscal deficits. This fiscal robustness provided Germany with greater policy space in the economic crisis, enabling it to respond more effectively to shocks.

5. Consequences and Lessons Learned

The financial crisis that began in August 2007 has been the most severe of the post-World War II [9]. Spain's economic growth has slowed down and even become negative, with adverse effects on its export trade. The second was high unemployment, which had risen sharply in Spain in the wake of the economic crisis, with serious consequences for social stability. The financial crisis also exposed problems in the Spanish financial system, leading to a contraction of financial markets and a decline in investor confidence. On top of that, the Spanish property market collapsed in the wake of the crisis. The bursting of the property bubble led to a sharp fall in house prices and the bankruptcy of a large number of developers and investors. The financial sector, which is linked to the property market, was also affected.

On the other hand, Germany, thanks to its prudent monetary policy, has been able to achieve economic recovery relatively quickly after the crisis, with its GDP growth rate gradually picking up. At the same time, Germany's unemployment rate has remained at a relatively low level, helping to maintain social stability.

The first lesson learned from the financial crisis is to be wary of flaws in financial products. Given an example, subprime lending often took the form of hybrid loans, with low initial rates and resets after two or three years to market rates, and borrower income was ignored or not checked [10]. For financial institutions, subprime lending increases their credit risk, and lending money to borrowers who themselves have low creditworthiness and weak repayment ability increases credit risk. And the subprime mortgage crisis in the United States is a typical case of triggering global financial risks. Therefore, one must be alert to the defects of some financial products. At the same time, when granting loans or making investments, financial institutions must prudently assess the repayment ability of the borrower and the feasibility of the project so as to avoid a situation in which the borrower is unable to repay the money.

The second lesson is that consumers should raise their awareness of risks. It is important to invest rationally and set up a correct view of investment, and not to ignore the risks because of the pursuit of high interest rates. Secondly, it is necessary to diversify investments, spread risks through diversified investments, and avoid concentrating risks on one financial product. Finally, it is important to pay close attention to financial market trends and invest prudently.

The third lesson is that regulators need to improve the regulatory system to ensure that the regulatory rules can adapt to the development and changes in the financial market. Supervision should also be strengthened, and the business activities of financial institutions should be more strictly regulated in order to prevent the accumulation and spread of risks. Finally, international cooperation should be strengthened. In the context of globalization, financial regulation requires international cooperation to jointly address transnational financial risks.

6. Conclusion

The United States, the origin of the financial crisis, has been hit hard by its economy with soaring unemployment and a collapsing housing market. The economic outlook for Europe is even bleaker than that of the United States because of the non-integrated nature of its economy and its compartmentalized economic policies, as well as the rigidity of its labor market and the aging of its population. The purpose of this paper, which takes Spain as the object of study, is to examine the relationship between the Spanish property bubble and the monetary policy it implemented. Spain was chosen for this study because it is a member of the European Union. Secondly, before this financial crisis, the Spanish property market was booming at an incredible rate of expansion. And in the crisis, it has been more severely affected compared to other EU countries. Spain is therefore a more typical and good comparison. And after collecting information and then comparing it with Germany, it was found that the real estate bubble in Spain was caused by monetary policy. Nowadays, the property bubble is the main cause of financial crises, so some research in this field can be helpful for the prevention of property bubbles. There are also some shortcomings in the writing of this paper; the data and information in the paper are mainly from the collation of previous generations. Because of the limitations of the conditions, there is a lack of first-hand information collected by ourselves. Finally, based on the results and limitations of the current study, it may be useful in the future to delve more deeply into what mechanisms in monetary policy lead to property bubbles and what are the deeper principles involved.

References

[1]. Martínez Pagés, J., & Matea, M. D. L. L. (2002). The housing market in Spain. Economic Bulletin, (OCT), 75-84.

[2]. You Ting. (2016). Brief discussion on the economic crisis in Spain. Technology and Enterprise, (8), 73-74..

[3]. ZARCO, J., & Shelly, D. A. L. Y. (2015). The global economic crisis: Spain’s housing bubble. Expert Journal of Finance, 3(1),40-44.

[4]. Zhang Jian. (2010). Lessons from the bursting of the Spanish real estate bubble. International information, 6

[5]. Eyfried, W. (2010). Monetary policy and housing bubbles: A multinational perspective. Research in Business and Economics Journal, 2, 1.

[6]. Arghyrou, M. G., & Gadea, M. D. (2012). The single monetary policy and domestic macro-fundamentals: Evidence from Spain. Journal of Policy Modeling, 34(1), 16-34.

[7]. Allinger, K. (2014). The ECB's Dilemma in View of the European Monetary Union: The Case of Germany and Spain. Lund University, Master Thesis, 1-76.

[8]. Guinea, L., Puch, L. A., & Ruiz, J. (2019). News-driven housing booms: Spain vs. Germany. Faculty of Economics and Business Sciences. Complutense Institute of Economic Analysis (ICAE); 1-77.

[9]. Bernanke, B. S. (2010). Monetary policy and the housing bubble. YPFS Resource Library, 1-37.

[10]. Scott, K. E. (2010). The financial crisis: causes and lessons. Journal of Applied Corporate Finance, 22(3), 22-29.

Cite this article

Chen,X. (2024). Analysis of the Monetary Policy and Housing Bubble in Spain. Advances in Economics, Management and Political Sciences,132,19-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Martínez Pagés, J., & Matea, M. D. L. L. (2002). The housing market in Spain. Economic Bulletin, (OCT), 75-84.

[2]. You Ting. (2016). Brief discussion on the economic crisis in Spain. Technology and Enterprise, (8), 73-74..

[3]. ZARCO, J., & Shelly, D. A. L. Y. (2015). The global economic crisis: Spain’s housing bubble. Expert Journal of Finance, 3(1),40-44.

[4]. Zhang Jian. (2010). Lessons from the bursting of the Spanish real estate bubble. International information, 6

[5]. Eyfried, W. (2010). Monetary policy and housing bubbles: A multinational perspective. Research in Business and Economics Journal, 2, 1.

[6]. Arghyrou, M. G., & Gadea, M. D. (2012). The single monetary policy and domestic macro-fundamentals: Evidence from Spain. Journal of Policy Modeling, 34(1), 16-34.

[7]. Allinger, K. (2014). The ECB's Dilemma in View of the European Monetary Union: The Case of Germany and Spain. Lund University, Master Thesis, 1-76.

[8]. Guinea, L., Puch, L. A., & Ruiz, J. (2019). News-driven housing booms: Spain vs. Germany. Faculty of Economics and Business Sciences. Complutense Institute of Economic Analysis (ICAE); 1-77.

[9]. Bernanke, B. S. (2010). Monetary policy and the housing bubble. YPFS Resource Library, 1-37.

[10]. Scott, K. E. (2010). The financial crisis: causes and lessons. Journal of Applied Corporate Finance, 22(3), 22-29.