1.Introduction

The concept of ESG (Environmental, Social, and Governance) was first proposed by the United Nations in 2004, placing greater emphasis on environmental protection, corporate social responsibility, and social governance. Since its inception, developed countries in Europe and the United States have led the way in promoting ESG disclosure among domestic companies, establishing comprehensive ESG evaluation systems, and achieving positive outcomes [1]. As an investment philosophy and corporate evaluation standard, ESG focuses more on the comprehensive performance of companies in environmental protection, social responsibility, and governance, rather than solely on financial data. This approach serves as an effective path to reduce employment pressure and achieve sustainable development for Chinese enterprises [2].

ESG has rapidly developed worldwide and has attracted widespread attention from scholars both domestically and internationally. Relevant research mainly focuses on the impact of ESG on corporate performance or corporate value [3]. ESG ratings help alleviate financing constraints [4], enhance financial performance [5], improve corporate value [6], and accelerate the green transition, thereby achieving sustainable development [7]. However, because ESG practices may increase corporate resource consumption, they could potentially negatively affect financial performance, leading to competitive disadvantages [8]. Currently, scholars primarily examine the impact of ESG on employment from different perspectives. However, whether the implementation of ESG strategies has accelerated employment market output efficiency has not yet been verified. Additionally, the employment output pathways of Chinese listed companies under ESG cannot be simply judged using linear models. Numerous studies focusing on linear discrimination only validate the relationship between explanatory variables and the explained variables. Therefore, building on previous research methods and findings, this study explores the employment output effects, pathways, and efficiency of ESG ratings by utilizing data from A-share listed companies in the Shanghai and Shenzhen stock markets from 2009 to 2022, employing both fuzzy-set qualitative comparative analysis (fsQCA) and Data Envelopment Analysis (DEA).

2.Theoretical Analysis

2.1.The Output Effects of ESG Ratings on Labor Force

Human resource management is a crucial aspect of ESG governance, and corporate ESG disclosure can effectively promote labor employment output. Companies with ESG advantages can optimize the structure of employment skills during their active fulfillment of social responsibilities [9], thereby enhancing employment levels [10]. Companies implementing ESG programs possess advantages such as being environmentally friendly, socially responsible, and having standardized governance, which helps attract job seekers, especially young employees, further increasing the scale of talent recruitment [11]. Companies with strong ESG performance are better able to retain employees and reduce talent turnover rates [12].

According to the theory of economies of scale, production costs decrease as production scale expands, thereby gaining cost advantages and forming specialized production [13]. Therefore, when companies reach a certain production stage, they often choose to expand their production scale to improve economic benefits, which in turn enhances employment levels. On the other hand, the endogenous growth theory indicates that the economy can achieve sustained growth through endogenous mechanisms without relying on external forces. This theory emphasizes that human capital is an important driving force for economic growth [14]. Companies with good ESG performance pay more attention to enhancing human capital and technological innovation. They attract and retain employees by establishing fairer compensation and benefits systems as well as performance incentive policies, promoting endogenous economic growth, further expanding production and operations, and thereby increasing labor demand [15].

2.2.Labor Signals Released by Corporate ESG Ratings

The signaling theory [16] posits that in a market with information asymmetry, corporate ESG disclosure can send signals of being “active ESG actors” to the market, thereby enhancing investors’ and job seekers’ confidence in the company’s sustainable development, resulting in economic benefits [17]. Compared to private enterprises, state-owned enterprises are more capable of conveying a responsible corporate image through ESG disclosure, which attracts more job seekers and further expands employment scale [18]. Additionally, the theory of financing constraints suggests that information asymmetry and transaction costs are the two main causes of financing constraints. As “quasi-governmental entities,” state-owned enterprises integrating ESG issues benefit from being perceived as sustainable development companies that bring long-term benefits to shareholders and society, thereby enhancing investor confidence and significantly alleviating financing constraints. By actively practicing ESG information disclosure, state-owned enterprises seek larger financing investments, further expanding employment scale and creating more job opportunities.

3.Methodology Selection

3.1.fsQCA

Traditional regression analysis methods focus on exploring linear relationships between independent variables, dependent variables, and mediating variables, neglecting the interactive matching effects of antecedent conditions on outcome variables. Therefore, this study employs fuzzy-set qualitative comparative analysis (fsQCA) to select appropriate antecedent conditions for measurement based on fundamental regression results, deepening the explanation of the output pathways of ESG advantages. In fsQCA, data calibration is a necessary process for assigning case memberships. This study utilizes the direct calibration method, setting the 95th percentile, 50th percentile, and 5th percentile of the explained variable, core explanatory variables, and control variables as points of complete membership, crossover, and complete non-membership, respectively. The calibration results are shown in Table 1.

Table 1: Calibration Results

|

variable |

Obs |

5%Q |

50%Q |

95%Q |

|

Inemploy |

36,327 |

5.704 |

7.556 |

9.888 |

|

ESG |

36,327 |

2.250 |

4.000 |

5.750 |

|

size |

36,327 |

20.362 |

21.952 |

24.648 |

|

age |

36,327 |

1.000 |

9.000 |

25.000 |

|

wage |

36,327 |

7.555 |

9.644 |

11.112 |

|

soe |

36,327 |

0.000 |

0.000 |

1.000 |

The result variable\( {Inemploy_{it}} \)represents corporate employment, indicated by the logarithm of the number of employees in publicly listed company\( i \)in year\( t \). The conditional variables include company size\( size \), measured by the natural logarithm of total assets; company age\( age \), measured by the difference between the current year and the year the company was established; and company wage level\( wage \), measured by the logarithm of the ratio of employee compensation to the number of employees. The ownership type\( soe \)is coded as 1 if the company is state-owned and 0 otherwise. In addition, this study controls for firm fixed effects\( {φ_{i}} \)and year fixed effects\( {μ_{i}} \), with\( {ε_{it}} \)representing the random error term.

3.2.Data Envelopment Analysis (DEA)

Data Envelopment Analysis (DEA) is a method for evaluating the efficiency of decision-making units of the same type and calculating their relative efficiency, commonly applied to input-output efficiency problems. The fuzzy-set qualitative comparative analysis (fsQCA) has computed the output pathways of ESG employment advantages in publicly listed companies; this study continues to analyze the output pathways of ESG employment advantages based on fsQCA and basic regression. Since the scale returns of ESG employment advantages in listed companies may vary, this study selects the BCC model in DEA. Under the condition of variable returns to scale, the comprehensive technical efficiency of the ESG advantages of listed companies can be divided into pure technical efficiency and scale efficiency. Each indicator’s values are distributed between 0 and 1. If the comprehensive technical efficiency, pure technical efficiency, and scale return efficiency are all equal to 1, it indicates that DEA is effective and that the ESG employment output effect of the listed company is good, demonstrating full compliance with corporate social responsibility. If the comprehensive technical efficiency and scale efficiency are both less than 1 while pure technical efficiency equals 1, DEA is weakly effective, indicating that the ESG employment output of the listed company is average and that resource allocation to solve employment issues through ESG is unreasonable. If all three efficiencies are less than 1, it indicates that the listed company has not addressed employment issues through ESG allocation and has failed to fulfill corporate social responsibility.

3.3.Data Sources

This study uses A-share listed companies from China’s Shanghai and Shenzhen stock exchanges as the research sample. The data is sourced from the CSMAR database and the Wind database, covering the period from 2009 to 2022. To avoid the influence of abnormal samples, this study follows existing research practices by excluding financial industry data (due to the special nature of the asset-liability structure and regulatory policies), excluding data from listed companies at risk of delisting, discarding samples with critical variable omissions, and eliminating samples that do not comply with accounting standards.

4.Results

4.1.fsQCA Analysis Results

According to the research steps of the fuzzy-set qualitative comparative analysis (fsQCA), it is necessary to test whether there are individual conditional variables that influence the occurrence of outcomes. If the consistency of an individual condition is below 0.9, it is considered that there is no necessity condition for the occurrence of the outcome. Since total asset utilization and debt-to-asset ratio were found to be unrelated in the basic regression results, these variables were excluded from the fsQCA analysis. This study sets the sample frequency threshold at 1 and the original solution consistency threshold at 0.8.

Table 2: Necessity Analysis of ESG Employment Advantage Conditional Variables

|

conditional variable |

Consistency |

Coverage |

|

ESG |

0.632107 |

0.715030 |

|

~ESG |

0.688417 |

0.632770 |

|

size |

0.846609 |

0.830019 |

|

~size |

0.507601 |

0.533199 |

|

age |

0.722121 |

0.717828 |

|

~age |

0.561574 |

0.581311 |

|

wage |

0.630725 |

0.658683 |

|

~wage |

0.699889 |

0.689936 |

|

tobinQ |

0.652396 |

0.595869 |

|

~tobinQ |

0.668074 |

0.761672 |

|

soe |

0.678490 |

0.768097 |

|

~soe |

0.756533 |

0.694957 |

Note: “~” represents “not” in logical operations.

This study employs the fsQCA 4.0 software to conduct a necessity analysis of the data, as shown in Table 2. The conditional variables for ESG employment advantages are all below the threshold of 0.9, indicating that there are no necessary conditions for the occurrence of the outcome. This suggests that the employment advantages of ESG do not rely on a single conditional variable but are the result of the combined effects of multiple conditional variables.

Table 3: Configurations Closely Related to ESG Employment Advantages

|

variable |

The output path of ESG employment advantages |

|||

|

1 |

2 |

3 |

4 |

|

|

ESG |

● |

|||

|

size |

● |

|||

|

age |

||||

|

wage |

● |

★ |

||

|

tobinQ |

★ |

|||

|

soe |

★ |

★ |

★ |

★ |

|

consistence |

0.835121 |

0.891743 |

0.815404 |

0.836911 |

|

Original coverage |

0.576099 |

0.678882 |

0.589403 |

0.456684 |

|

Unique coverage |

0.005996 |

0.013206 |

0.010939 |

0.013334 |

|

Coverage of solutions |

0.735423 |

|||

|

Coverage of solutions |

0.768437 |

|||

Note: ● indicates the presence of a core condition, ★ indicates the absence of a core condition, and a blank space indicates that the condition may or may not exist.

As shown in Table 3, a total of four configurations affecting the output path of ESG employment advantages were obtained through the calculations, with a consistency of 0.768437 and a coverage of 0.735423. This indicates that all related configurations have a high degree of consistency. The output of ESG employment advantages is categorized into economies of scale, talent attraction, and ESG types. Among these, enterprise size, wage levels, and ESG ratings can all serve as core conditions for employment levels.

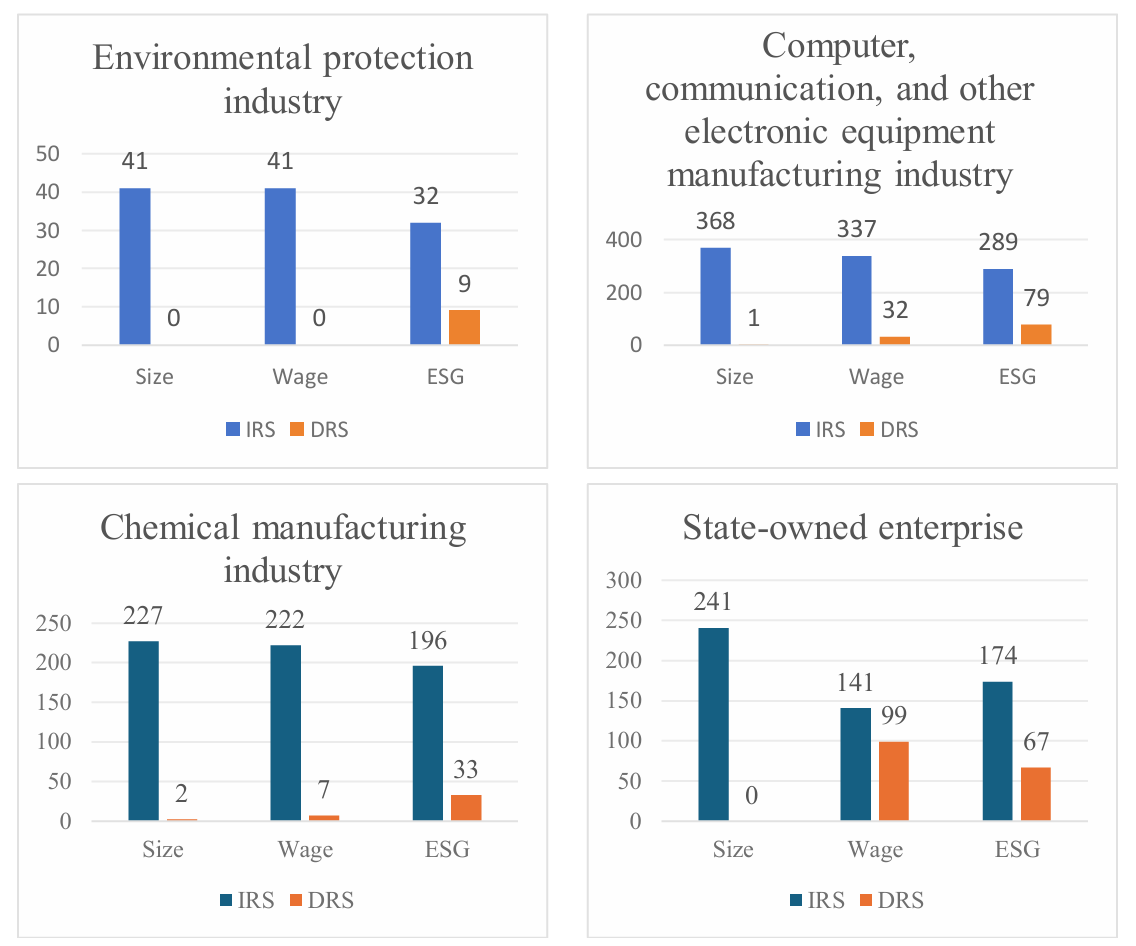

4.2.Further DEA Analysis

Due to the relatively large sample size, this study mainly selects sample data from 2022 to compare the differences in comprehensive technical efficiency, pure technical efficiency, scale efficiency, scale effects, and DEA effectiveness between the ecological protection and environmental governance industry and the manufacturing industries of computers, communications, and other electronic equipment, as well as chemical raw materials and chemical products. Additionally, this study examines the output situation of ESG employment effects in state-owned enterprises. Furthermore, enterprise size, wage levels, and ESG ratings are used as input variables to measure the efficiency of the three output paths for employment levels based on the fsQCA analysis results.

Figure 1: Changes in Scale Returns

As shown in Figure 1, IRS represents increasing returns to scale, while DRS represents decreasing returns to scale. When the ESG rating is used as the main input variable, the data identified as firms with decreasing returns to scale begin to increase in the DEA model, especially among state-owned enterprises.

5.Conclusions and Management Implications

After the COVID-19 pandemic, China’s economy has been sluggish, leading to large-scale layoffs in enterprises while universities continue to expand enrollment, resulting in a high number of job seekers and prominent structural employment issues. As the largest economic entity responsible for addressing employment and livelihoods, does the social responsibility consciousness reflected in ESG ratings by enterprises have actual significance for promoting employment? This study takes A-share listed companies in China’s Shanghai and Shenzhen stock markets from 2009 to 2022 as the research sample, utilizing fuzzy-set qualitative comparative analysis (fsQCA) and Data Envelopment Analysis (DEA) to evaluate the employment output effects of ESG ratings. The following key conclusions were drawn: ESG ratings help improve employment levels, but their output efficiency is relatively low, far below the economies of scale output effects. This indicates that listed companies have not effectively addressed employment issues or fulfilled their social responsibilities through ESG configuration. The implications for enterprise management and reform are as follows:

(1) Strengthen Human Resource Management. As major contributors to GDP, enterprises should actively fulfill their social responsibilities and enhance corporate governance levels [19]. Optimizing recruitment processes and standards, establishing scientific performance evaluation mechanisms, reasonably formulating compensation and benefit policies, and motivating employees’ work enthusiasm and creativity can improve employee work efficiency and satisfaction, thereby promoting corporate development and enhancing employment levels [20]. At the same time, developing innovative environmental technologies and integrating ESG into various business operations can create more ESG-related positions and improve employment rates [21].

(2) Accelerate State-Owned Enterprise Reform. Since 1978, China’s state-owned enterprise reform has been moving towards marketization, diversification, and modernization. However, due to the institutional drawbacks inherent in state-owned enterprises, the reform effects over nearly 50 years have not been significant [22]. One of the major issues that must be addressed in the current state-owned enterprise reform is how to adapt to the trends of the times and keep pace with the development of China’s socialist market economy. First, introduce shareholding systems. The shareholding system is one of the corporate organizational forms adopted by many developed countries. Marx once pointed out that the shareholding system is one of the production methods leading human society to a new stage of development [23]. Introducing a shareholding system in state-owned enterprises, focusing on fulfilling corporate social responsibilities, and enhancing employee compensation and benefits can effectively address issues of low efficiency and insufficient work enthusiasm. Second, introduce asset management methods to reduce the asset-liability ratio of state-owned enterprises. Influenced by the planned economy period, Chinese state-owned enterprises typically exhibit high asset-liability ratios and low asset appreciation rates. Although multiple policies have been implemented to alleviate the asset-liability pressures on state-owned enterprises, excessively high asset-liability ratios continue to hinder their development [24]. By learning from the advanced practices of developed countries, introducing professional asset management institutions or teams, and performing asset allocation and diversified investment according to enterprise needs and market conditions, maximum asset appreciation and benefits can be achieved.

(3) Improve the ESG Rating System. As a benchmark and model for developing countries globally, China should accelerate the improvement of ESG information disclosure standards, enhance the ESG indicator evaluation system, and strengthen ESG supervision of enterprises. Formulating green development policies and regulations, encouraging enterprises to practice environmental protection concepts, promoting green economic development, and actively addressing global energy shortages [25] and environmental crisis issues are crucial. Learning from the advanced experiences of developed countries, establishing employment and human rights protection policies, focusing on the working environment, physical health, and compensation of the employed population, can enhance the positive employment effects of ESG, increase employee happiness and sense of gain, and narrow income gaps [26].

The limitations of this study lie primarily in the insufficient richness of sample data, as the Huazheng Company has not disclosed specific ESG indicators and rating methods, which may overlook the impact of the rating method on research results. Additionally, analyzing data from only one rating agency may lack rigor. Currently, China’s rating standards are inconsistent, the evaluation process is opaque, the evaluation indicators are subjective, and the evaluation results are distorted [27]. Future research could consider integrating data from multiple authoritative rating agencies, comparing ESG indicator details across different companies, and selecting variables that have a more significant impact on corporate employment to further explore the employment output effects of ESG ratings.

References

[1]. Li, T. T., Wang, K., Sueyoshi, T., & Wang, D. D. (2021). ESG: Research progress and future prospects. Sustainability, 13(21), 11663.

[2]. Lian, Y., Li, Y., & Cao, H. (2023). How does corporate ESG performance affect sustainable development: A green innovation perspective. Frontiers in Environmental Science, 11, 430.

[3]. Cannas, C., Dallocchio, M., & Pellegrini, L. (2022). Environmental, social, and governance issues: An empirical literature review around the world. Climate Change Adaptation, Governance and New Issues of Value: Measuring the Impact of ESG Scores on CoE and Firm Performance, 107-124.

[4]. Li, K., Huang, L., Zhang, J., Huang, Z., & Fang, L. (2023). Can ESG Performance Alleviate the Constraints of Green Financing for Chinese Enterprises: Empirical Evidence from China’s A-Share Manufacturing Companies. Sustainability, 15(14), 10970.

[5]. Zheng, J., Khurram, M. U., & Chen, L. (2022). Can green innovation affect ESG ratings and financial performance? evidence from Chinese GEM listed companies. Sustainability, 14(14), 8677.

[6]. Cheng, R., Kim, H., & Ryu, D. (2023). ESG performance and firm value in the Chinese market. Investment Analysts Journal, 1-15.

[7]. Wang, Z., Chu, E., & Hao, Y. (2024). Towards sustainable development: How does ESG performance promotes corporate green transformation. International Review of Financial Analysis, 91, 102982.

[8]. Ruan, L., & Liu, H. (2021). Environmental, social, governance activities and firm performance: Evidence from China. Sustainability, 13(2), 767.

[9]. Noe, R. A. (1996). Is career management related to employee development and performance?. Journal of organizational behavior, 17(2), 119-133.

[10]. Friedman, R. A., & Holtom, B. (2002). The effects of network groups on minority employee turnover intentions. Human Resource Management: Published in Cooperation with the School of Business Administration, The University of Michigan and in alliance with the Society of Human Resources Management, 41(4), 405-421.

[11]. Garsaa, A., & Paulet, E. (2022). ESG Disclosure and Employee Turnover. New Evidence from Listed European Companies. Relations industrielles/Industrial Relations, 77(4).

[12]. Lee, C. C., Luppi, J. L., Simmons, T., Tran, B., & Zhang, R. (2023). Examining the impacts of ESG on employee retention: A study of generational differences. Journal of Business and Management, 29(1), 1-22. Retrieved from

[13]. Helpman, E. (1981). International trade in the presence of product differentiation, economies of scale and monopolistic competition: A Chamberlin-Heckscher-Ohlin approach. Journal of international economics, 11(3), 305-340.

[14]. Aghion, P., Howitt, P., Brant-Collett, M., & García-Peñalosa, C. (1998). Endogenous growth theory. MIT press.

[15]. Philip, T. R. (2023). Two essays on the influence of performance-based environment, social, and governance (ESG) vesting provisions in executive compensation. (Order No. 30574923, The University of Texas at San Antonio). ProQuest Dissertations and Theses, , 164. Retrieved from

[16]. Morris, R. D. (1987). Signalling, agency theory and accounting policy choice. Accounting and business Research, 18(69), 47-56.

[17]. Seow, R. Y. C. Determinants of environmental, social, and governance disclosure: A systematic literature review. Business Strategy and the Environment.

[18]. Zahid, R. A., Saleem, A., & Maqsood, U. S. (2023). ESG performance, capital financing decisions, and audit quality: empirical evidence from Chinese state-owned

[19]. Mai, Y., Zheng, W., Wu, Y. J., & Dong, T. P. (2023). Impact of Entrepreneurial Team Contractual Governance on New Venture Resilience: The Mediating Role of Resource Bricolage. Sustainability, 15(4), 3518.

[20]. Chen, D., Zhu, Y., Zhou, N., & Xing, M. (2023). Impacts of environmental uncertainty on degree of enterprise financialization and the moderating role of executive incentives. Frontiers in Environmental Science, 11, 531.

[21]. Nekhili, M., Boukadhaba, A., Nagati, H., & Chtioui, T. (2021). ESG performance and market value: The moderating role of employee board representation. The International Journal of Human Resource Management, 32(14), 3061-3087.

[22]. Hassard, J., Morris, J., Sheehan, J., & Yuxin, X. (2010). China’s state‐owned enterprises: economic reform and organizational restructuring. Journal of Organizational Change Management, 23(5), 500-516.

[23]. Qiang, Q. (2003). Corporate governance and state-owned shares in China listed companies. Journal of Asian Economics, 14(5), 771-783.

[24]. Li, M. H., Cui, L., & Lu, J. (2018). Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. State-Owned Multinationals: Governments in Global Business, 175-210.

[25]. Asif, M., & Muneer, T. (2007). Energy supply, its demand and security issues for developed and emerging economies. Renewable and sustainable energy reviews, 11(7), 1388-1413.

[26]. Rukh, L., Choudhary, M. A., & Abbasi, S. A. (2015). Analysis of factors affecting employee satisfaction: A case study from Pakistan. Work, 52(1), 137-152.

[27]. Ju, B., Shi, X., & Mei, Y. (2022). The current state and prospects of China’s environmental, social, and governance policies. Frontiers in Environmental Science, 10, 999145.

Cite this article

Cheng,M.;Li,T. (2024). A Study on the Impact of Corporate ESG Ratings on Employment Output from the Configurational Perspective. Advances in Economics, Management and Political Sciences,132,62-69.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, T. T., Wang, K., Sueyoshi, T., & Wang, D. D. (2021). ESG: Research progress and future prospects. Sustainability, 13(21), 11663.

[2]. Lian, Y., Li, Y., & Cao, H. (2023). How does corporate ESG performance affect sustainable development: A green innovation perspective. Frontiers in Environmental Science, 11, 430.

[3]. Cannas, C., Dallocchio, M., & Pellegrini, L. (2022). Environmental, social, and governance issues: An empirical literature review around the world. Climate Change Adaptation, Governance and New Issues of Value: Measuring the Impact of ESG Scores on CoE and Firm Performance, 107-124.

[4]. Li, K., Huang, L., Zhang, J., Huang, Z., & Fang, L. (2023). Can ESG Performance Alleviate the Constraints of Green Financing for Chinese Enterprises: Empirical Evidence from China’s A-Share Manufacturing Companies. Sustainability, 15(14), 10970.

[5]. Zheng, J., Khurram, M. U., & Chen, L. (2022). Can green innovation affect ESG ratings and financial performance? evidence from Chinese GEM listed companies. Sustainability, 14(14), 8677.

[6]. Cheng, R., Kim, H., & Ryu, D. (2023). ESG performance and firm value in the Chinese market. Investment Analysts Journal, 1-15.

[7]. Wang, Z., Chu, E., & Hao, Y. (2024). Towards sustainable development: How does ESG performance promotes corporate green transformation. International Review of Financial Analysis, 91, 102982.

[8]. Ruan, L., & Liu, H. (2021). Environmental, social, governance activities and firm performance: Evidence from China. Sustainability, 13(2), 767.

[9]. Noe, R. A. (1996). Is career management related to employee development and performance?. Journal of organizational behavior, 17(2), 119-133.

[10]. Friedman, R. A., & Holtom, B. (2002). The effects of network groups on minority employee turnover intentions. Human Resource Management: Published in Cooperation with the School of Business Administration, The University of Michigan and in alliance with the Society of Human Resources Management, 41(4), 405-421.

[11]. Garsaa, A., & Paulet, E. (2022). ESG Disclosure and Employee Turnover. New Evidence from Listed European Companies. Relations industrielles/Industrial Relations, 77(4).

[12]. Lee, C. C., Luppi, J. L., Simmons, T., Tran, B., & Zhang, R. (2023). Examining the impacts of ESG on employee retention: A study of generational differences. Journal of Business and Management, 29(1), 1-22. Retrieved from

[13]. Helpman, E. (1981). International trade in the presence of product differentiation, economies of scale and monopolistic competition: A Chamberlin-Heckscher-Ohlin approach. Journal of international economics, 11(3), 305-340.

[14]. Aghion, P., Howitt, P., Brant-Collett, M., & García-Peñalosa, C. (1998). Endogenous growth theory. MIT press.

[15]. Philip, T. R. (2023). Two essays on the influence of performance-based environment, social, and governance (ESG) vesting provisions in executive compensation. (Order No. 30574923, The University of Texas at San Antonio). ProQuest Dissertations and Theses, , 164. Retrieved from

[16]. Morris, R. D. (1987). Signalling, agency theory and accounting policy choice. Accounting and business Research, 18(69), 47-56.

[17]. Seow, R. Y. C. Determinants of environmental, social, and governance disclosure: A systematic literature review. Business Strategy and the Environment.

[18]. Zahid, R. A., Saleem, A., & Maqsood, U. S. (2023). ESG performance, capital financing decisions, and audit quality: empirical evidence from Chinese state-owned

[19]. Mai, Y., Zheng, W., Wu, Y. J., & Dong, T. P. (2023). Impact of Entrepreneurial Team Contractual Governance on New Venture Resilience: The Mediating Role of Resource Bricolage. Sustainability, 15(4), 3518.

[20]. Chen, D., Zhu, Y., Zhou, N., & Xing, M. (2023). Impacts of environmental uncertainty on degree of enterprise financialization and the moderating role of executive incentives. Frontiers in Environmental Science, 11, 531.

[21]. Nekhili, M., Boukadhaba, A., Nagati, H., & Chtioui, T. (2021). ESG performance and market value: The moderating role of employee board representation. The International Journal of Human Resource Management, 32(14), 3061-3087.

[22]. Hassard, J., Morris, J., Sheehan, J., & Yuxin, X. (2010). China’s state‐owned enterprises: economic reform and organizational restructuring. Journal of Organizational Change Management, 23(5), 500-516.

[23]. Qiang, Q. (2003). Corporate governance and state-owned shares in China listed companies. Journal of Asian Economics, 14(5), 771-783.

[24]. Li, M. H., Cui, L., & Lu, J. (2018). Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. State-Owned Multinationals: Governments in Global Business, 175-210.

[25]. Asif, M., & Muneer, T. (2007). Energy supply, its demand and security issues for developed and emerging economies. Renewable and sustainable energy reviews, 11(7), 1388-1413.

[26]. Rukh, L., Choudhary, M. A., & Abbasi, S. A. (2015). Analysis of factors affecting employee satisfaction: A case study from Pakistan. Work, 52(1), 137-152.

[27]. Ju, B., Shi, X., & Mei, Y. (2022). The current state and prospects of China’s environmental, social, and governance policies. Frontiers in Environmental Science, 10, 999145.