1. Introduction

The mobile payment system combines cyberspace, mobile devices, and financial companies to allow people to make digital payments through mobile third-party payment platforms. The global COVID-19 outbreak occurred at the end of 2019, the epidemic in China lasted from 2020 to 2022, and the period after 2023 is considered post-epidemic.

Before the epidemic, mobile payment had become the leading force in the development of the Chinese economy, with the number of users and transaction amounts rising steadily. During the pandemic, China's tourism industry was paralyzed, people's offline consumption was restricted, and China's economy began to decline. What impact did Chinese mobile payment have on the economy after the epidemic?

This article studies the changes in the number of people who are using mobile payment systems and transaction amounts after the epidemic, the impression of mobile payment on Chinese residents' consumption, the role of mobile payments in restoring the tourism industry, and the changes in the perception of mobile payment users. This essay refers to literature and database on how mobile payment impacts Chinese economics, the connection between the mobile payments system and household consumption, the number of people who are using mobile payment systems, the annual report of the mobile payment system, travel expenses using mobile payment in 2024 and 2019, the satisfaction of mobile payment user questionnaires, as well as the forecast in Chinese mobile payment market.

2. Literature Review

In recent years, the Chinese government has vigorously developed the digital economy and promoted inclusive finance, which is why China's mobile payment development is ahead of the world.

Research shows that mobile payments generated 16% of China's household consumption growth in 2017. The scale of Chinese online travel booking users reached 440 million at the end of 2018. The scale of China's mobile payment users reached 633 million by December 2019. Mobile payment users were 73.4% of mobile Internet users in 2019. It follows that mobile payment patterns played an essential role in increasing residents' consumption levels before the pandemic. This development tendency enabled residents to transition their offline demand to online consumption due to the lockdown during the pandemic. Mobile payment platforms such as Alipay and WeChat are becoming increasingly popular, and this convenient and efficient payment method can be found everywhere in China. For example, it only need to take out mobile phones to scan the QR code, and the money can be transferred to others digitally without needing paper money. What has mobile payments' effect in China since the recent pandemic?

This study analyses the people paying with smartphone’s user scale, the sum of mobile payment consumption, travel spending paid via mobile payment platforms, and the perception of mobile payment users in China after the epidemic. The data includes the number of people paying with a smartphone in China, the proportion of young mobile payment users in China, annual mobile payment business statistics of the People's Government, the scale of online travel booking users, travel expenses via mobile payment by Alipay and WeChat report, 2019 and 2024 Spring Festival holiday travel mobile payment data, and mobile payment user online questionnaire survey.

This essay examines the changes in user Numbers and the total amount of mobile payments after the epidemic, the consumption level from mobile payment platforms after the epidemic, the role of mobile payments in the recovery and development of the tourism economy, and the influence of the pandemic on mobile payment user’s perceptions.

3. Analytical Framework

Mobile payment is more convenient, faster and safer. Businesses can receive and pay money quickly, and older people can solve offline consumption problems through mobile payment. Governments can utilize mobile payment platforms to stimulate consumption and promote economic growth in the post-epidemic era [1]. The Household Consumption Regression Modeling indicates that online shopping, digital payment, and digital financial products are household consumption's primary response variables [2]. Besides, Chinese people can maintain and improve their social relationships through the WeChat digital payment system ‘Hongbao’, especially during festivals.

After the pandemic, the number of users paying via smartphone and the total amount of mobile payment transactions in China have increased and are higher than the pre-epidemic level. It has an active influence on stimulating consumption and can help vulnerable groups solve consumption demand. Due to the impact of the pandemic, Chinese people are more reliant on and satisfied with mobile payments. Tourism’s mobile payment data shows the massive scale of travel expenses paid through mobile payment. The efficient mobile payment service has enabled the tourism industry to return to its pre-epidemic level and set a historical high.

Mobile payment has been used for government affairs, education, transportation, medical care, shopping, catering, domestic and foreign tourism, and other industries; it breaks the "face-to-face" consumption restrictions and mitigates the negative impact of the pandemic [3].

3.1. Consumption

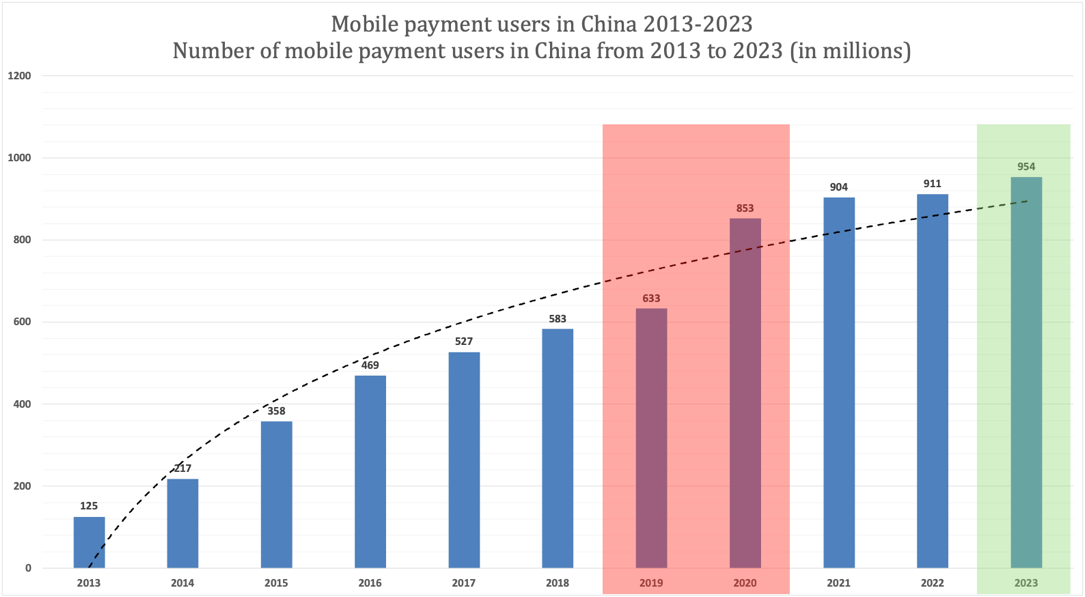

Figure 1 indicates that mobile payment users had relatively stable growth before 2019. At the beginning of the pandemic, the red color part shows that mobile payment successfully assisted residents’ offline demand in conversion to online consumption due to the lockdown restriction, which made a sharp rise from 2019 to 2020. In 2023, the green color means the number of people paying via smartphone reached 954 million, an increase of 50.7% over 2019.

Figure 1: Mobile payment users in China (in millions) (Data from Statista database).

Table 1 shows the number of Chinese youth mobile payment users between 20 and 40. This indicates that the proportion of Chinese people using mobile payment systems increased by 6% in 2023 compared to 2019, and the number of users increased by 240 million. This means that young people are the leading force in the Chinese mobile payments market. The proportion of Chinese people over 60 using mobile payment systems is also growing, but this information is useless because China's ageing population is increasing.

Table 1: Number of Chinese youth (20-40 ages) mobile payment users.

Proportion of young people using mobile payment | The scale of young people’s mobile payment users (100 million people) | |

2019 | 58% | 3.8 |

2023 | 64% | 6.2 |

Data source: Payment and Clearing Association of China.

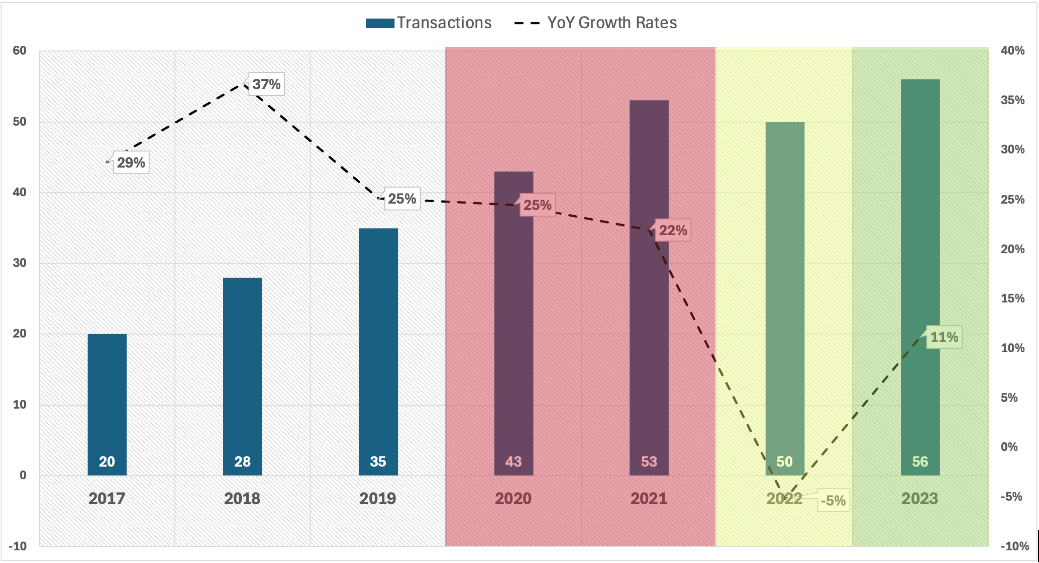

Figure 2 shows the Chinese People's Government's annual mobile payment statistics. Overall, the data shows an upward trend in the total mobile payment transactions from 2017 to 2023. However, the YoY Growth rate fell slightly in 2021, then dropped sharply in 2022, and rose quickly by 16% in 2023.

Figure 2: Mobile payment transaction total amount (in trillions) (Data from Statista database).

An economic recession appeared in 2022 because of the long-term supply shortage, income reduction, and consumption decline caused by the epidemic. The Chinese government stimulated residents' consumption by issuing mobile payment coupons to recover the mobile payment consumption level [4]. The mobile payment coupons were helpful, as the total amount of mobile payment transactions and the YoY Growth rate increased in 2023, and the online retail sales amount reached 15 trillion yuan in 2023. In addition, mobile payments have positively impacted rural household consumption by reducing transaction costs, easing liquidity constraints, and expanding the variety of shopping products [5].

3.2. Tourism

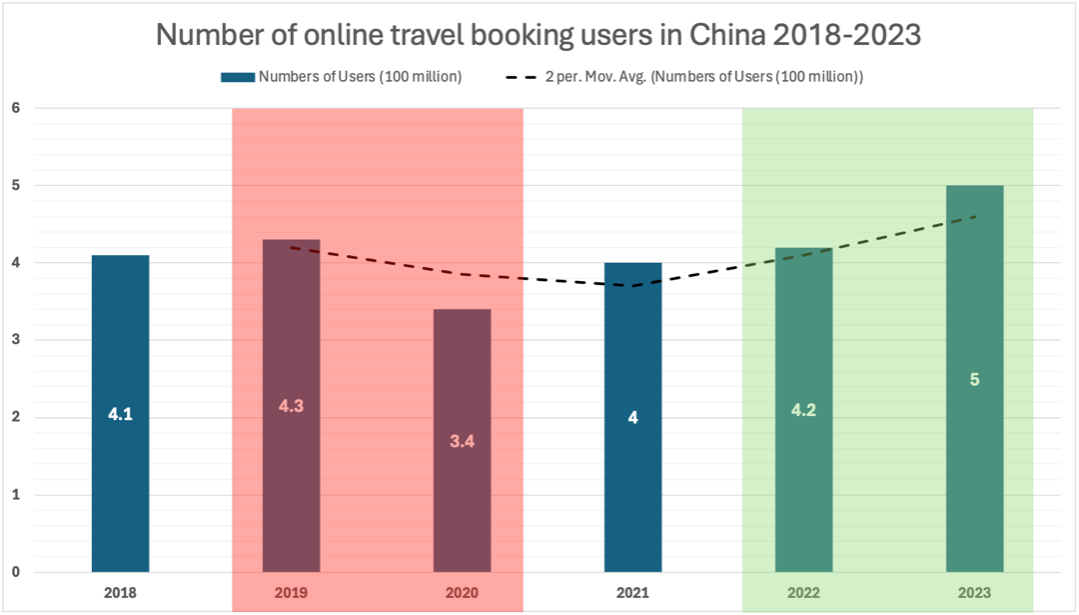

Figure 3 shows that the number of online travel booking users decreased significantly at the beginning of the 2020 epidemic. In contrast, the number of mobile phone-based travel trip online reservation users increased even more than before the outbreak in 2023. The People's Bank of China's online payments during the Spring Festival holiday in 2024 totaled 15.38 billion transactions, a 15.8% increase compared with 2019. The total transaction amount was 774 million yuan, a 10.1% increase compared with 2019, mainly from consumption such as catering, accommodation, tourism, retail, film, and television entertainment.

Figure 3: Number of online travels booking users (in 100 million) (Data from Statista database).

During the 2024 Chinese Spring Festival holiday, the number of overseas travel consumption transactions on the mobile payment platform Alipay increased by 107% compared to 2019, and catering consumption increased by 70% with a continuous upward trend. The number of overseas travel consumption transactions on the mobile payment platform Alipay in Hong Kong increased by 45% compared to 2019, and the total transaction amount of mobile payments in Macau increased by 130%.

WeChat Pay report during the 2024 Spring Festival shows that the number of people using smartphone transactions for overseas travel consumption transactions increased by nearly 2.4 times compared with 2019, mainly in Southeast Asia; the number of overseas travel consumption transactions on mobile payments by Hong Kong residents in the mainland increased by almost five times year-on-year, and the total amount exceeded three times! For example, the number of overseas travel consumption transactions on mobile payments for catering and hotels increased 36% and 19% year-on-year, respectively. As mentioned in this article, a more convenient, faster, and safer mobile payment system can provide a fantastic service for travelers worldwide. Mobile payment services' high efficiency and low cost can enhance tourists' travel experience.

3.3. User Perception

Regarding mobile payment user perception, Chinese people have more trust in mobile payment platforms than before the pandemic [6]. For example, WeChat online survey data proves that even if WeChat mobile payment users are aware of the potential transaction risks, they will not stop using WeChat payment [6]. The questionnaire also pointed out that the WeChat digital "red envelope" function of mobile payment can help people better maintain and improve social relationships [6]. In addition, 2024 Travel News mentioned that many foreign tourists said China's mobile payment is excellent [6].

4. Result

China's Internet penetration rate is the world's number one. The Chinese government and state-owned enterprises are actively building communication infrastructure and striving to popularize telecommunications technology for every household. For example, the "Cliff Village" villagers in Sichuan, one of the poorest areas in China, can use 5G network services! China has achieved the world's largest telecommunications universal service project, allowing every Chinese person to trade with the world.

In the post-epidemic era, mobile payment systems can reduce residents' deposits and stimulate consumption to improve economic growth in China [7]. The efficiency of mobile payment services can help the tourism industry restore the market equilibrium to the potential level faster and move forward. Mobile payments can eliminate currency and language barriers that tourists encounter when travelling abroad. Mobile payment can enhance users' happiness and provide a more straightforward payment method for older people, people with low education levels, and people living in rural areas [8]. Mobile payment still plays a vital role in the Chinese economy and social development, whether in the epidemic or post-epidemic era. However, mobile payments may suffer from personal financial account risks and excessive consumption by minors [9].

5. Limitation and Outlook

The results of this study need to be further improved due to limited data resources and knowledge. For example, more data on users aged 20 to 40 is required from 2020 to 2022, and the population's age distribution needs to be more consistent in various data. Data on elderly users over 60 and Chinese online travel booking users are not available in large quantities in 2019 and 2024. This study could not calculate the proportion of transaction amount paid using smartphones in China’s total GDP, nor was relevant data found. In addition, only some documents on China's mobile payments research are available on authoritative academic websites, resulting in limited content selection.

The number of mobile payment users has increased rapidly from 2019 to 2023, which means that mobile payment has become the primary approach and the largest group of consumption in China. Mobile payment has become a lifestyle and is deeply integrated into the daily lives of Chinese people [3]. The expansion of network infrastructure construction indicates that the dimension of China's mobile payment market will further increase, and the annual compound growth rate is expected to reach 12% from 2024 to 2029.

Whether in China or worldwide, people have realised that mobile payment has the benefits of low cost, high convenience, good service, and comprehensive coverage. Mobile payment could attract more foreign travel to China and accelerate the frequency of Chinese outbound travel.

In the next few years, the volume of online travel booking users and mobile payment travel transactions in China will continue to rise.

However, mobile payment also has adverse effects, such as users' financial security, information security, personal privacy security, and excessive consumption caused by non-cash payments.

In China, mobile payment technology will continue to improve, which may lead to the problem of overspending among minors. Suppose China wants to strengthen the impact of the mobile payment system. In that case, it should strengthen the control of third-party platforms, improve the online consumption monitoring system, and eliminate the drawbacks of digital finance. In the future, mobile payment will continue to drive the high-quality development of China's economy [10].

6. Conclusion

In conclusion, the study of mobile payments' impact on consumption, tourism, and user perceptions in China's post-epidemic era explains that mobile payments can mitigate the negative effect of the epidemic on the Chinese consumption level and the tourism economy. Mobile payments can enhance users' satisfaction and happiness from the advantages of low costs, good security, and convenience.

The user scale and the total transaction number of mobile payments are growing, and mobile payment platforms have become an important tool to stimulate consumption levels and reduce deposits. Mobile payment techniques can attract more tourists to China and restore the equilibrium in the tourism industry.

After the pandemic, mobile payment has been applied to almost all regions, populations, and industries in China and has become an integral part of people’s lives. Therefore, the Chinese government should continue improving service quality and funding security protection of mobile payment platforms. The mobile payment social penetration rate could reach 90% in the next few years. However, one thing should be noted: people should consume rationally and avoid over-consumption on mobile payment platforms.

This study is significant because it proves that mobile payment positively affects consumption level, tourism economy, and user perception of the post-epidemic era in China. The results included the growth rates of user numbers and transaction amounts, residents' consumption levels, the correlation between mobile payment services and the tourism economy, and Alipay and WeChat payments user perceptions.

References

[1]. Xi, W.Z., et al. (2023) Digital Financial Inclusion and Quality of Economic Growth. Heliyon, 9, 9.

[2]. Li, J., Wu, Y., Xiao, J.J. (2020) The Impact of Digital Finance on Household Consumption: Evidence from China. 86, 317-326.

[3]. Qiu, H.Q. (2024) WeChat & Alipay: Leading the New Wave of Digital Payment. First Look, 1, 52-25.

[4]. People's Bank of China. (2020) The Overall Operation of the Annual Payment System. 2017-2023, 1-7.

[5]. Yang W., Yang, P., Shi, H. and Sun, W. (2023) Mobile Payment Application and Rural Household Consumption -Evidence from China Household Finance Survey. Sustainability, 15, 341.

[6]. Tinmaz, H. and Doan, V.P. (2023) User Perceptions of WeChat and WeChat Pay in China, Global Knowledge, Memory and Communication, 72, 797-812.

[7]. Zhao, J. and Zhao, L. (2022) Mobile Payment Adoption and the Decline in China’s Household Savings Rate. Empir Econ, 63, 2513-2537.

[8]. Zhao, C., Li, X. and Yan, J. (2024) The Effect of Digital Finance on Residents' Happiness: The Case of Mobile Payments in China. Electron Commer Res, 24, 69-104.

[9]. Ye, N.Y. and Zhao, Z.Y. (2024) The Reform of Consumer Protection in Mobile Payment Services in China: Legislation, Regulation, and Dispute Resolution, Computer Law & Security Review, 54, 1-10.

[10]. Liu, P.J. (2024) The Inevitability and Future Trends of Digital Currency Issuance. Shanxi Caishui, 1, 47-29.

Cite this article

Wang,Y. (2024). The Impact of Mobile Payments in the Post-epidemic Era in China: Consumption, Tourism, and User Perception. Advances in Economics, Management and Political Sciences,127,51-57.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xi, W.Z., et al. (2023) Digital Financial Inclusion and Quality of Economic Growth. Heliyon, 9, 9.

[2]. Li, J., Wu, Y., Xiao, J.J. (2020) The Impact of Digital Finance on Household Consumption: Evidence from China. 86, 317-326.

[3]. Qiu, H.Q. (2024) WeChat & Alipay: Leading the New Wave of Digital Payment. First Look, 1, 52-25.

[4]. People's Bank of China. (2020) The Overall Operation of the Annual Payment System. 2017-2023, 1-7.

[5]. Yang W., Yang, P., Shi, H. and Sun, W. (2023) Mobile Payment Application and Rural Household Consumption -Evidence from China Household Finance Survey. Sustainability, 15, 341.

[6]. Tinmaz, H. and Doan, V.P. (2023) User Perceptions of WeChat and WeChat Pay in China, Global Knowledge, Memory and Communication, 72, 797-812.

[7]. Zhao, J. and Zhao, L. (2022) Mobile Payment Adoption and the Decline in China’s Household Savings Rate. Empir Econ, 63, 2513-2537.

[8]. Zhao, C., Li, X. and Yan, J. (2024) The Effect of Digital Finance on Residents' Happiness: The Case of Mobile Payments in China. Electron Commer Res, 24, 69-104.

[9]. Ye, N.Y. and Zhao, Z.Y. (2024) The Reform of Consumer Protection in Mobile Payment Services in China: Legislation, Regulation, and Dispute Resolution, Computer Law & Security Review, 54, 1-10.

[10]. Liu, P.J. (2024) The Inevitability and Future Trends of Digital Currency Issuance. Shanxi Caishui, 1, 47-29.