1. Introduction

The financial markets are characterized by complex interdependencies among various asset classes, particularly between crude oil prices and the performance of major ETFs. Given the global economic significance of crude oil, its price fluctuations can have widespread implications on financial markets, making it a valuable indicator for forecasting ETF performance. This study aims to assess the predictive capability of crude oil prices in forecasting the future prices of major ETFs, providing a useful tool for investors and policymakers. By examining the correlation between crude oil prices and ETFs, this research seeks to uncover patterns and correlations that can help investors anticipate and adapt to market fluctuations, thereby improving their investment strategies and decision-making approaches.

The primary objective of this study is to evaluate the predictive power of crude oil prices in forecasting the performance of key ETFs, including the S&P 500 ETF (SPY), iShares MSCI Emerging Markets ETF (EEM), and several others representing diverse global markets. Additionally, the study examines the correlation between crude oil futures prices and these ETFs. By analyzing historical data and implementing a basic trading strategy, the research aims to determine if crude oil futures can reliably predict ETF returns. Recognizing the intricate connection between crude oil prices and ETF performance, this study aims to provide actionable insights to improve investment strategies, enhance return predictions, and inform economic policies and regulatory frameworks.

Oil prices are widely regarded as indicators of economic health, affecting inflation, interest rates, and overall economic activity. Elevated oil prices can drive inflation and lead to interest rate hikes, while also potentially boosting economic activity [1]. The relationship between oil prices and economic indicators is complex and varies across countries. For instance, oil-exporting countries usually see a positive correlation between oil prices and stock market performance, whereas oil-importing developed countries often experience a negative correlation [2]. The United States shows asymmetric adjustments in this relationship, requiring specific analytical approaches [3].

Several models have been used to explore these relationships. The Asymmetric GARCH model has revealed non-linear relationships for non-energy companies in the Asia Pacific region [4]. The 2008 financial crisis intensified the interconnection between oil prices and other markets, with the US dollar index becoming a significant driver [5]. GARCH models are often effective for volatility forecasting, although nonlinearity in ETFs necessitates advanced approaches [6]. Combining forecasts from multiple models enhances prediction accuracy for various commodities [7]. Sector ETFs, such as Global Financials and Global Industrials, have proven effective hedges, particularly during crises [8]. Additionally, crude oil price predictions play a crucial role in shaping investment strategies and risk management in the energy sector, with investor attention significantly impacting ETF returns [9]. Understanding these dynamics aids policymakers in making informed decisions to mitigate the effects of oil price fluctuations on the economy.

In conclusion, crude oil prices serve as a robust predictor of ETF performance, particularly amidst market uncertainty and economic instability. By examining the historical correlation between oil prices and ETF returns, policymakers can enhance economic resilience and stability, while investors can make well-informed decisions to mitigate risks and optimize returns. The insights from this study carry substantial implications for both investors and policymakers, guiding the development of investment strategies, risk management practices, and policy decisions. Furthermore, the study underscores the significance of integrating crude oil prices into forecasting models to refine market predictions and bolster return projections.

The subsequent sections of this article are organized as follows. Section 2 offers an extensive literature review and articulates our hypotheses, elucidating the theoretical underpinnings that guide our empirical investigation. In Section 3, the paper elaborates on the research design utilized in this study. After that, Section 4 is dedicated to presenting the primary findings of the empirical analysis, accompanied by additional exploratory analyses and robustness checks to fortify the validity and reliability of the results. See section 5 for the conclusion.

2. Literature Review

In this study, we investigate the relationship between crude oil prices and the performance of various ETFs, recognizing the significant impact of oil prices on the global economy and financial markets. We aim to shed light on how oil price fluctuations affect production costs, inflation, consumer spending, and ultimately, a country's GDP and stock market performance.

Crude oil price changes have significant economic implications. Rising prices can increase production costs, constrain consumer spending, and hinder economic growth, while lower prices can stimulate economic activity by reducing costs and increasing disposable income. The impact varies between oil-importing and oil-exporting nations. The impact of crude oil price changes on stock markets is multifaceted, with both direct and indirect effects. Directly, energy stocks may benefit from rising oil prices, while non-energy stocks may suffer from increased production costs. Indirectly, oil price changes influence macroeconomic indicators like inflation, interest rates, and GDP growth, which shape investor sentiment and impact stock market performance.

To capture the complex and nonlinear behaviors of financial markets, we employ GARCH and TAR models to analyze the relationships between crude oil prices and ETF returns. By incorporating these models, we can gain a more accurate understanding of the interactions between these variables, leading to improved forecasting capabilities and more effective investment strategies.

Quantitative strategies such as paired trading and statistical arbitrage rely on identifying relationships between assets to anticipate price movements and generate returns. Using crude oil prices to predict ETF returns is a sophisticated application of these strategies, allowing investors to capitalize on potential mispricing in the market.

We formulate three hypotheses: (1) a significant non-linear relationship exists between crude oil prices and future ETF returns; (2) higher crude oil prices predict lower future returns for ETFs, while lower prices predict higher returns; (3) the impact of crude oil prices on ETF returns varies across different ETFs. This study will initially explore the correlation between the DJIA Crude Oil Index and selected ETFs by visualizing their relationships. We will then implement a basic trading strategy using crude oil futures prices (CL=F) and the SPDR S&P 500 ETF (SPY) to assess the predictive capability of crude oil prices on stock prices. The study will focus on monthly returns of six selected ETFs: SPY, EEM, EWA, EWC, FXI, and VGK.

In the subsequent sections, we will conduct empirical analysis using specified models and variables to test these hypotheses and derive meaningful conclusions.

3. Data and method

3.1. Exploring the Relationship Between ETFs and the Dow Jones Industrial Average Crude Oil Index

The data utilized in this study spans from January 1, 2000, to June 1, 2024, encompassing the prices of various prominent ETFs and the Dow Jones Industrial Average (DJIA) Crude Oil Index. The selected ETFs consist of SPDR S&P 500 ETF (SPY), iShares MSCI Emerging Markets ETF (EEM), iShares MSCI Australia ETF (EWA), iShares MSCI Canada ETF (EWC), iShares China Large-Cap ETF (FXI), and Vanguard FTSE Europe ETF (VGK). Monthly closing prices for each ETF and the DJIA Crude Oil Index were sourced from Yahoo Finance to ensure the dataset's reliability and consistency.

The data processing involved computing monthly returns for each asset using the formula:

\( Return=\frac{Price current}{Price previous}-1 \) (1)

Subsequently, we performed a cross-correlation analysis to evaluate the correlation between the monthly returns of the DJIA Crude Oil Index and each ETF. The cross-correlation function (CCF) was calculated for lags spanning from -12 to +12 months, enabling us to investigate potential lead-lag associations between crude oil prices and ETF returns. Time series plots were generated to depict the price trends, while CCF plots illustrated the correlation at various lags, aiding in the detection of any leading or lagging relationships.

3.2. Predictive Strategy Using Crude Oil Futures and S&P 500 ETF

In conjunction with the correlation analysis, a predictive trading strategy was devised utilizing crude oil futures prices (CL=F) and the SPDR S&P 500 ETF (SPY). Monthly closing prices for crude oil futures and the SPY ETF were obtained from Yahoo Finance, and monthly returns were calculated for both assets. The strategy involved gathering and analyzing historical data for crude oil futures (CL=F) and the S&P 500 ETF (SPY) from January 1, 2020, to July 1, 2024, and computing their monthly returns. Each month, a linear regression was conducted to estimate SPY's expected return based on crude oil returns. If the projected return exceeded the monthly risk-free rate (assumed at 5% annually), SPY was held; otherwise, the investment was kept in cash. This decision-making process was repeated on a monthly basis.

A linear regression model was employed to explore the relationship between crude oil future returns (independent variable) and SPY ETF returns (dependent variable), defined as:

\( SPY Returns =α + β x Crude Oil Futures Returns+ ϵ \) (2)

Using the regression coefficients, the expected returns for SPY based on the monthly returns of crude oil futures were calculated. The trading strategy was executed as follows: when the anticipated return for SPY surpassed the risk-free rate (assumed to be 0.03% monthly), a long position was initiated; conversely, if the expected return fell below the risk-free rate, the position was liquidated.

During the backtesting period from January 1, 2020, to June 1, 2024, with an initial investment of 100,000 USD, the trading strategy was evaluated using Backtrader, an open-source Python library. Key performance metrics such as annual return, annual volatility, Sharpe ratio, and maximum drawdown were computed to evaluate the effectiveness of the strategy.

4. Result Analysis

4.1. Cross-Correlation Analysis Between Crude Oil Prices and ETFs

In the initial phase of our analysis, we examined the relationship between crude oil prices, represented by the Dow Jones Industrial Average (DJIA) Crude Oil Index, and selected ETFs: SPDR S&P 500 ETF (SPY), iShares MSCI Emerging Markets ETF (EEM), iShares MSCI Australia ETF (EWA), iShares MSCI Canada ETF (EWC), iShares China Large-Cap ETF (FXI), and Vanguard FTSE Europe ETF (VGK). To assess the correlation between the monthly returns of the DJIA Crude Oil Index and each ETF, we calculated the cross-correlation function (CCF) over lags ranging from -12 to +12 months.

The CCF analysis revealed a consistent inverse correlation between crude oil prices and ETF returns. Specifically, declines in crude oil prices often preceded increases in ETF returns. This inverse relationship was consistent across all ETFs studied, suggesting that changes in crude oil prices could potentially predict ETF performance. The cross-correlation plots reinforce this finding by showing negative correlation values at various lags, indicating a possible lead-lag effect where shifts in crude oil prices may forecast ETF movements.

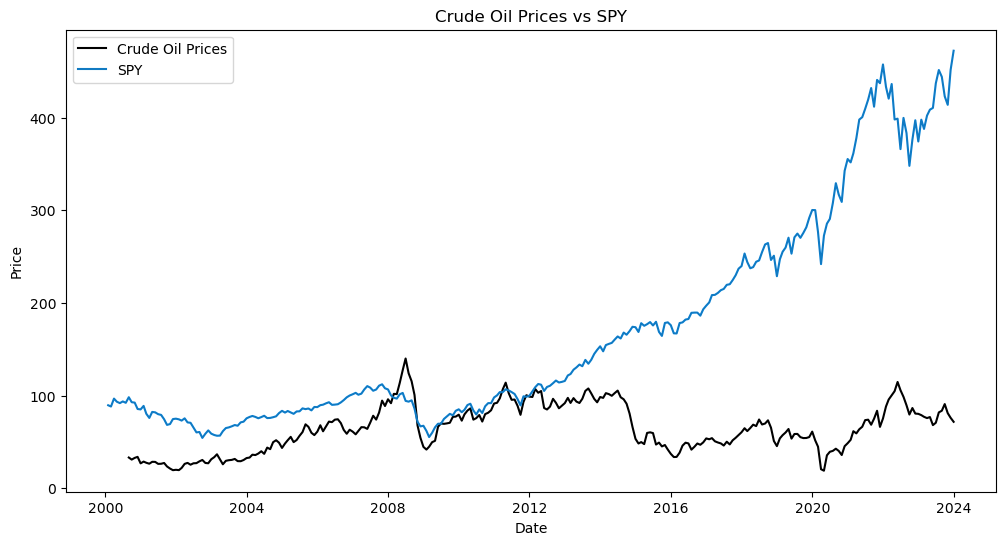

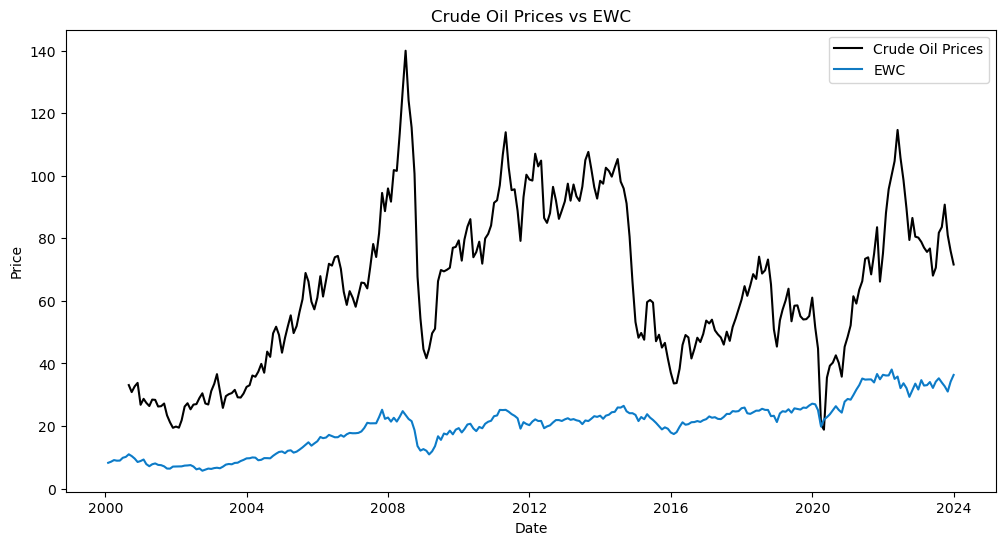

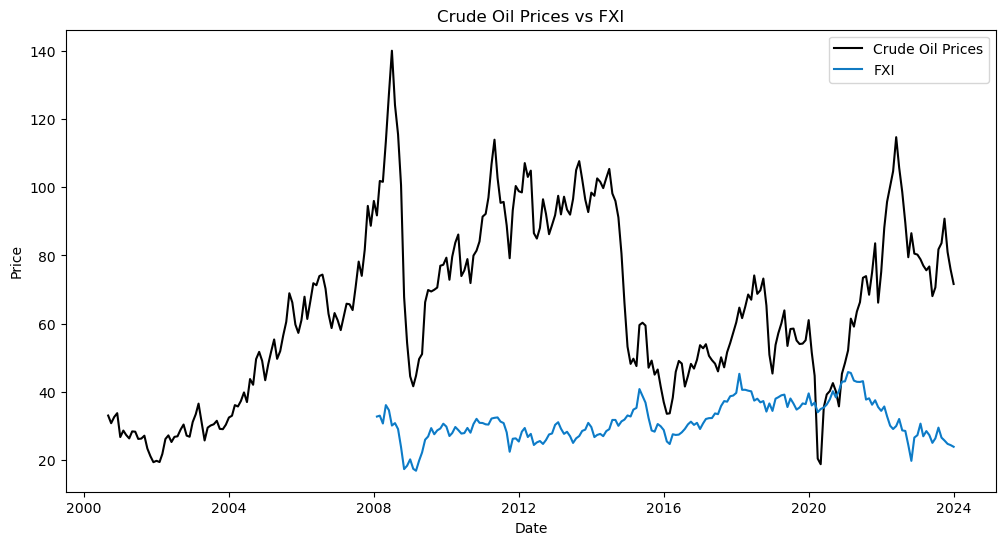

Comprehensive visual illustrations were presented to showcase the correlation between crude oil prices and the performance of various Exchange-Traded Funds (ETFs) from 2000 to 2024. Each figure compares the movements of crude oil prices with a specific ETF, providing valuable insights into the relationship between these variables.

In Figure 1, the correlation between crude oil prices and the SPY ETF, which mirrors the S&P 500, is depicted. Despite the fluctuating nature of crude oil prices, the SPY ETF demonstrates an overall upward trajectory, with a tenuous positive correlation observed between the two. This suggests that alterations in oil prices might have a limited impact on the performance of the SPY ETF.

Moving to Figure 2, the focus shifts to the EEM ETF, monitoring emerging markets. Both crude oil prices and the EEM ETF exhibit considerable volatility. The displayed correlation hints at a certain level of connection between crude oil prices and the performance of emerging markets, although it does not imply a causal relationship.

Figure 3 delves into the correlation between crude oil prices and the EWC ETF, which represents the Canadian market. The data showcases parallel trends between crude oil prices and this ETF, indicating that fluctuations in crude oil prices could potentially influence the Canadian market, possibly due to Canada's significant involvement in global energy production.

Shifting attention to Figure 4, the spotlight is on the FXI ETF, tracking China's large-cap stocks. The FXI ETF displays an upward trend, potentially linked to crude oil prices. Given China's substantial consumption of crude oil, these correlations may reflect broader economic dynamics at play.

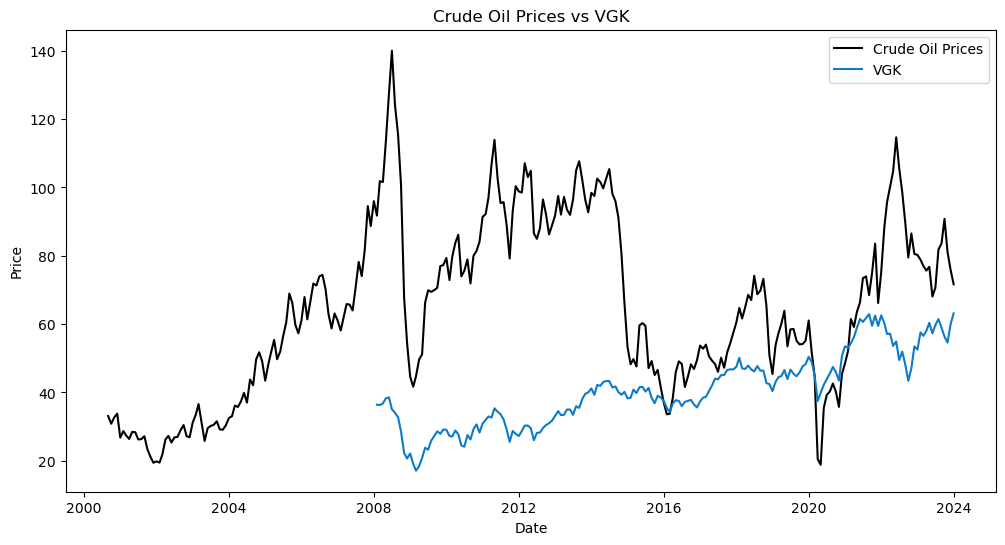

Lastly, Figure 5 presents the VGK ETF, symbolizing European stocks. The VGK ETF also demonstrates a correlation with crude oil prices, although it is essential to acknowledge that additional factors could impact this relationship.

It is crucial to acknowledge that the correlation observed between crude oil prices and ETF performance in each figure is indicative and does not inherently infer causation. Additional analysis is imperative to unveil the underlying mechanisms that influence these relationships.

Figure 1: Crude Oil vs SPY

(Picture Credit: Original)

Figure 2: Crude Oil Prices vs EEM

(Picture Credit: Original)

Figure 3: Crude Oil Prices vs EWC

(Picture Credit: Original)

Figure 4: Crude Oil Prices vs FXI

(Picture Credit: Original)

Figure 5: Crude Oil Prices vs VGK

(Picture Credit: Original)

4.2. Predictive Strategy Using Crude Oil Futures and S&P 500 ETF

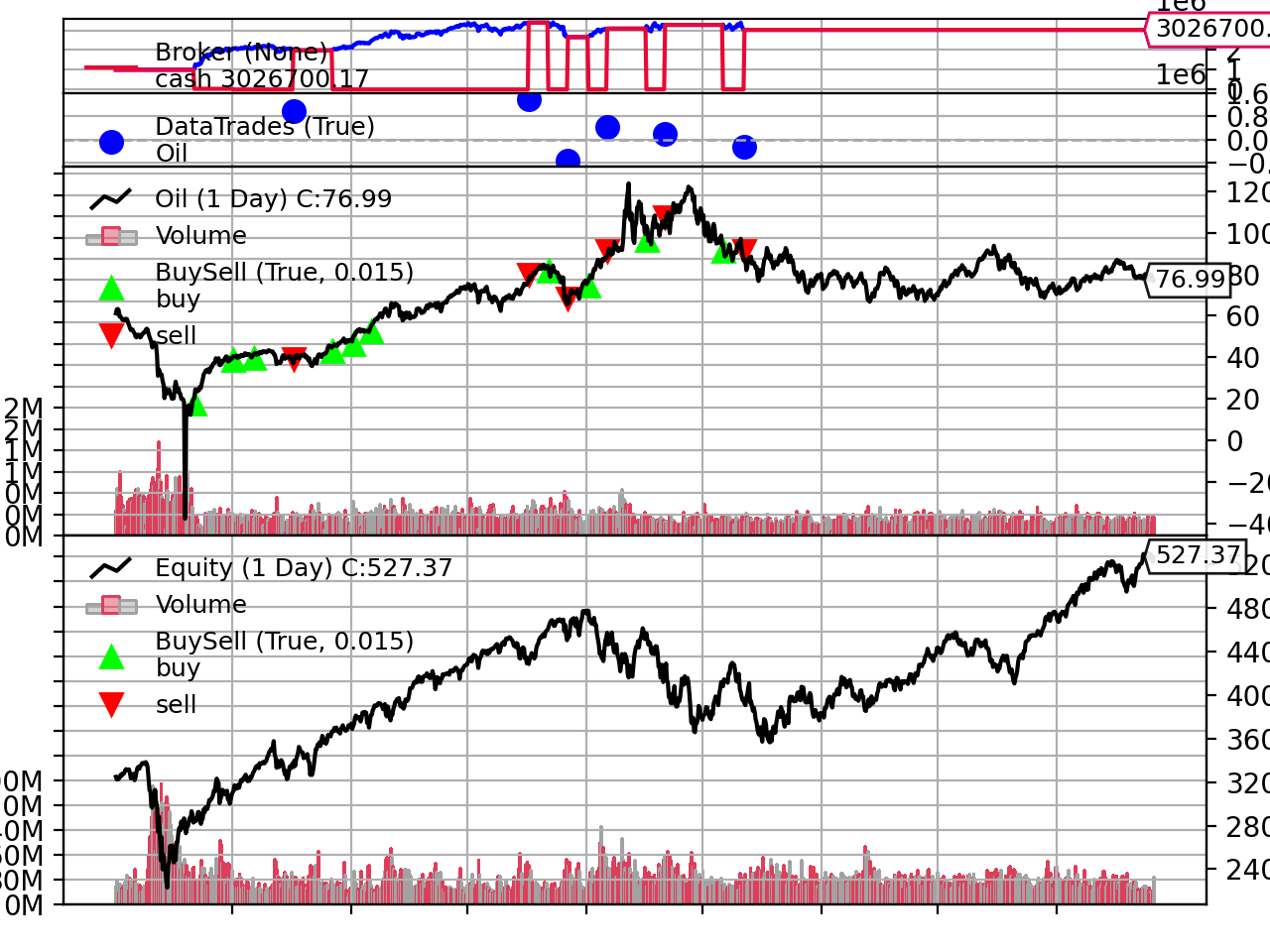

In the second segment of our study, we concentrated on implementing a forecasting trading strategy utilizing crude oil futures prices (CL=F) to predict the returns of the SPDR S&P 500 ETF (SPY). The strategy underwent backtesting from January 1, 2020, to June 1, 2024, commencing with an initial investment of $1,000,000.

By employing a linear regression model, we established a statistically significant correlation between crude oil futures returns and SPY returns. This model illustrated that crude oil futures returns could effectively anticipate SPY returns [10]. The trading strategy involved taking a long position in SPY when the projected return surpassed the risk-free rate of 0.03% per month and liquidating the position otherwise.

4.3. Backtesting Results

The results of the backtesting exercise were striking, with the initial $1,000,000 investment growing to a staggering $3,026,700.17. This substantial growth is a testament to the model's robust predictive capabilities, which were able to generate a strong annualized return of 28.29%. Notably, the strategy's risk profile was well-managed, with an annualized volatility of 25.26% and a Sharpe ratio of 1.12, indicating a positive risk-adjusted return. Furthermore, the maximum drawdown of 22.03% demonstrates the strategy's ability to mitigate potential losses and maintain its overall value. Overall, the key performance metrics highlight the strategy's impressive returns, risk management, and ability to generate value in excess of its risk.

These results underscore the strength of the predictive strategy, showcasing notable portfolio growth and proficient risk management.

Figure 6: Predictive Strategy Outstanding Results.

(Picture Credit: Original)

5. Conclusion

This study has demonstrated the significant predictive power of crude oil prices in anticipating the returns of ETFs, particularly the SPDR S&P 500 ETF (SPY). The analysis revealed a uniform inverse correlation between crude oil prices and ETF returns, suggesting that movements in crude oil prices can serve as a valuable predictive signal for ETF performance. Moreover, the implementation of a trading strategy utilizing crude oil futures prices to predict SPY returns yielded impressive results, with an annualized return of 28.29% and a Sharpe ratio of 1.12, indicating a strong and sustainable investment opportunity.

The strategy's robust performance was accompanied by effective risk management, as demonstrated by an annualized volatility of 25.26% and a maximum drawdown of 22.03%. These findings have significant implications for investors and policymakers, highlighting the importance of considering commodity price dynamics in investment decisions and economic policymaking.

By incorporating crude oil prices into their decision-making frameworks, investors can enhance their return predictions and optimize their portfolios, while policymakers can promote economic resilience and stability by accounting for the broader economic consequences of crude oil price fluctuations. Ultimately, this study underscores the potential benefits of integrating commodity price analysis into investment strategies and economic policy, offering a valuable tool for navigating the complexities of global markets and promoting economic prosperity.

References

[1]. Ratti, R. A., & Vespignani, J. L. (2016). Oil prices and global factor macroeconomic variables. Energy Economics, 59, 198-212. https://doi.org/10.1016/j.eneco.2016.06.002

[2]. Basher, S. A., Haug, A. A., & Sadorsky, P. (2012). Oil prices, exchange rates and emerging stock markets. Energy Economics, 34(1), 227-240. https://doi.org/10.1016/j.eneco.2011.10.005

[3]. Pitta de Jesus, D., Bezerra, B. F. L. S., & Besarria, C. N. (2020). The non-linear relationship between oil prices and stock prices: Evidence from oil-importing and oil-exporting countries. Research in International Business and Finance, 54, 101229. https://doi.org/10.1016/j.ribaf.2020.101229

[4]. Naifar, N., & Al Dohaiman, M. S. (2013). Nonlinear analysis among crude oil prices, stock markets' return, and macroeconomic variables. International Review of Economics & Finance, 27, 416-431. https://doi.org/10.1016/j.iref.2013.01.001

[5]. Ji, Q. (2012). System analysis approach for the identification of factors driving crude oil prices. Computers & Industrial Engineering, 63(3), 615-625. https://doi.org/10.1016/j.cie.2011.07.021

[6]. Sharma, S., Aggarwal, V., & Yadav, M. P. (2021). Comparison of linear and non-linear GARCH models for forecasting volatility of select emerging countries. Journal of Advances in Management Research, 18(4), 526-547. https://doi.org/10.1108/JAMR-07-2020-0152

[7]. Liu, G., & Guo, X. (2022). Forecasting stock market volatility using commodity futures volatility information. Resources Policy, 75, 102481. https://doi.org/10.1016/j.resourpol.2021.102481

[8]. Jin, J., Han, L., Wu, L., & Zeng, H. (2020). The hedging effectiveness of global sectors in emerging and developed stock markets. International Review of Economics & Finance, 66, 92-117. https://doi.org/10.1016/j.iref.2019.11.001

[9]. Lee, C.-C., & Chen, M.-P. (2021). The effects of investor attention and policy uncertainties on cross-border country exchange-traded fund returns. International Review of Economics & Finance, 71, 830-852. https://doi.org/10.1016/j.iref.2020.10.015

[10]. Nonejad, N. (2022). Equity premium prediction using the price of crude oil: Uncovering the nonlinear predictive impact. Energy Economics, 115, 106395. https://doi.org/10.1016/j.eneco.2022.106395

Cite this article

Lin,Y. (2024). Exploring the Correlation Between Crude Oil Prices and ETF Performance: A Predictive Analysis Using Crude Oil Index. Advances in Economics, Management and Political Sciences,140,14-22.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance's Role in the Just Transition

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ratti, R. A., & Vespignani, J. L. (2016). Oil prices and global factor macroeconomic variables. Energy Economics, 59, 198-212. https://doi.org/10.1016/j.eneco.2016.06.002

[2]. Basher, S. A., Haug, A. A., & Sadorsky, P. (2012). Oil prices, exchange rates and emerging stock markets. Energy Economics, 34(1), 227-240. https://doi.org/10.1016/j.eneco.2011.10.005

[3]. Pitta de Jesus, D., Bezerra, B. F. L. S., & Besarria, C. N. (2020). The non-linear relationship between oil prices and stock prices: Evidence from oil-importing and oil-exporting countries. Research in International Business and Finance, 54, 101229. https://doi.org/10.1016/j.ribaf.2020.101229

[4]. Naifar, N., & Al Dohaiman, M. S. (2013). Nonlinear analysis among crude oil prices, stock markets' return, and macroeconomic variables. International Review of Economics & Finance, 27, 416-431. https://doi.org/10.1016/j.iref.2013.01.001

[5]. Ji, Q. (2012). System analysis approach for the identification of factors driving crude oil prices. Computers & Industrial Engineering, 63(3), 615-625. https://doi.org/10.1016/j.cie.2011.07.021

[6]. Sharma, S., Aggarwal, V., & Yadav, M. P. (2021). Comparison of linear and non-linear GARCH models for forecasting volatility of select emerging countries. Journal of Advances in Management Research, 18(4), 526-547. https://doi.org/10.1108/JAMR-07-2020-0152

[7]. Liu, G., & Guo, X. (2022). Forecasting stock market volatility using commodity futures volatility information. Resources Policy, 75, 102481. https://doi.org/10.1016/j.resourpol.2021.102481

[8]. Jin, J., Han, L., Wu, L., & Zeng, H. (2020). The hedging effectiveness of global sectors in emerging and developed stock markets. International Review of Economics & Finance, 66, 92-117. https://doi.org/10.1016/j.iref.2019.11.001

[9]. Lee, C.-C., & Chen, M.-P. (2021). The effects of investor attention and policy uncertainties on cross-border country exchange-traded fund returns. International Review of Economics & Finance, 71, 830-852. https://doi.org/10.1016/j.iref.2020.10.015

[10]. Nonejad, N. (2022). Equity premium prediction using the price of crude oil: Uncovering the nonlinear predictive impact. Energy Economics, 115, 106395. https://doi.org/10.1016/j.eneco.2022.106395