1.Introduction

In 1978, the Chinese reform and openness had pushed the domestic economy into a prosperous stage and brought the global economy into another dimension. The Better-off policy attracted massive FDI (Foreign Direct Investment) and its profit peaked in 2013 with about $105.24 billion inflowed to China [1]. Additionally, cost-efficient labor and landing had increased the Chinese global competitiveness of OEM (Original Equipment Manufacturers) which performed as a global factory by exporting goods and blew the domestic economic growth. The rebounded diplomacy with United States in 1979 accelerated the domestic economy further. The USA-China Trade Agreement Article I states - the Contracting Parties undertake all measures to create the most favorable conditions at the long-term development [2]. The agreement was set up to benefit the development of international trade in all aspects for both countries so that thier cooperation was leading them to an excellent pathway. However, the current intensive trade relation between these two countries illustrates the opposite way. This essay will investigate the reason for the changing attitude. Additionally, the product of the trade war - Phase One has turned the discussion on the tele-communication which created more conflicts. This essay will explore the development of bilateral trading-relation of US and China and their economic contexts from 1979 to 2020. On the other hand, according to the China Briefing report, the bystander countries were cautious with both sides, to avoid unnecessary misery [3]. This report reckons the trade war has created more trading opportunities for other nations' economic growth for an overall 3% [4]. As the world’s biggest two economic bodies, the competition between them certainly would have created some impact. This essay will analyse the impact of the US-China Trade War in a domestic and also a global context.

2.The Domestic Effect of the USA-China Trade War7

2.1.The Economy of USA-China Under the Trade Agreement 1979

In 1979, China was still in the early stage of the re-openness led by Deng Xiaoping. The economy was mainly depended on agriculture with a low GDP per capita. At the same time, the United States was experiencing the aftermath of the 1970s economic challenge - stagflation and the beginning of de-industrialization. China has an advantage on cheap labor costs, however, it desperately required the recognitiuon from the west so that they could create a bilateral trade relation. Therefore, the 1979 US-China Trade agreement was created and has contributed to the cooperation of the West and Eas. China was listed as a member of MFN (Most Favored Nation) by this aggreement so that it could enjoy the same low tariff as other trade partners. According to the US-China Trade Agreement article III [2], by encouraging commercial exchange, contacts and supporting technical seminars in each other’s country. Because of the leading technology and economy United States controled, Chinese economy was in a subordinate position. Therefore the American investment injected into China was highly supportive. To enact foreign investment, China has set up special economic zones like ShenZheng and opened coastal cities to embrace more technology and commerce into the domestic economy. As a result, the foreign investment given by the USA to China peaked at 2002 at $542,392 billion [5].

Table 1 has shown that since the introduction of the USA-China Trade agreement, the amount of the US dollar has been injected into the Chinese market. Significantly, the year of 2000 held with $438,389 Billion stands as the highest investment from 1997 to 2014. The trend rate has declined to below $300,000 since 2006 and remained this figure ever since. Moreover, the American investment outflew to China was mainly focusing on manufacturing and high-technology industries. Meanwhile, in 2004, the Chinese manufacturing output reached $625.22 billion and it overtook 31.98% of the GDP[5] with a $196.68 billion worth of exports departed to United States [5]. This means that one-third of the Chinese manufacturing output was trading with American companies. By 2017 the worth of USA imported goods from China reached $505,165.1 million [2] which was the highest figure since the 1979 USA-China trade agreement and the figure was climbing constantly. However, the trade balance of the USA was $-634,141 million. Furthermore, during 2004 the worth of USA exporting capital goods was $343,064 billion with the product share of 42.10% and China imported $276,028 million [6].

Therefore, since the 1979 agreement, China has built an unbreakable bilateral trade relation with the Unites States and both countries enjoyed the benefits. More specifically, China has ended the three-world approach in response to the international trade market [7], which won an enormous economic growth, and embedded its global supplier character. Whereas the USA has opened the Chinese market and released domestic de-industralistion and enjoyed the low-cost manufacturing in China. However, as Kissinger [7] argues in On China, the Cold War background has promoted the trading relation of China and the United States, but the lack of shared strategic technology and economic competition would have eroded their mutual beneficial relation.

Table 1: China received FDI by USA 1997-2014 [5]

|

1997 |

2000 |

2003 |

2006 |

2009 |

2012 |

2014 |

|

|

Billions |

$323,915 |

$438,389 |

$419,851 |

$286,509 |

$255,499 |

$259,809 |

$237,074 |

Source : National Bureau of Statistic of China

2.2.The Turning Point of the Bilateral Trade Relations

The first tariff that came into force was imposed by the Trump government in 2018 with $34 billion worth of Chinese commodities. The Chinese government reacted the same amount of tariff on American products immediately. This meant the MFN and the 2001 WTO has came to an end. The American government claimed the Chinese VIE ( Variable interest entity ) has raised the concern of American investors regarding the transparency of the Chinese financial market. They also accused China’s prohibition on forces technology transfer has breached the agreement created by WTO. On the other hand, the Chinese protectionist strategy has ensured the domestic company shares would not be taken over by foreign investors. For example, Alibaba has undertaken VIE structure effectively which allowed foreign investors to gain exposure but without owning equity.

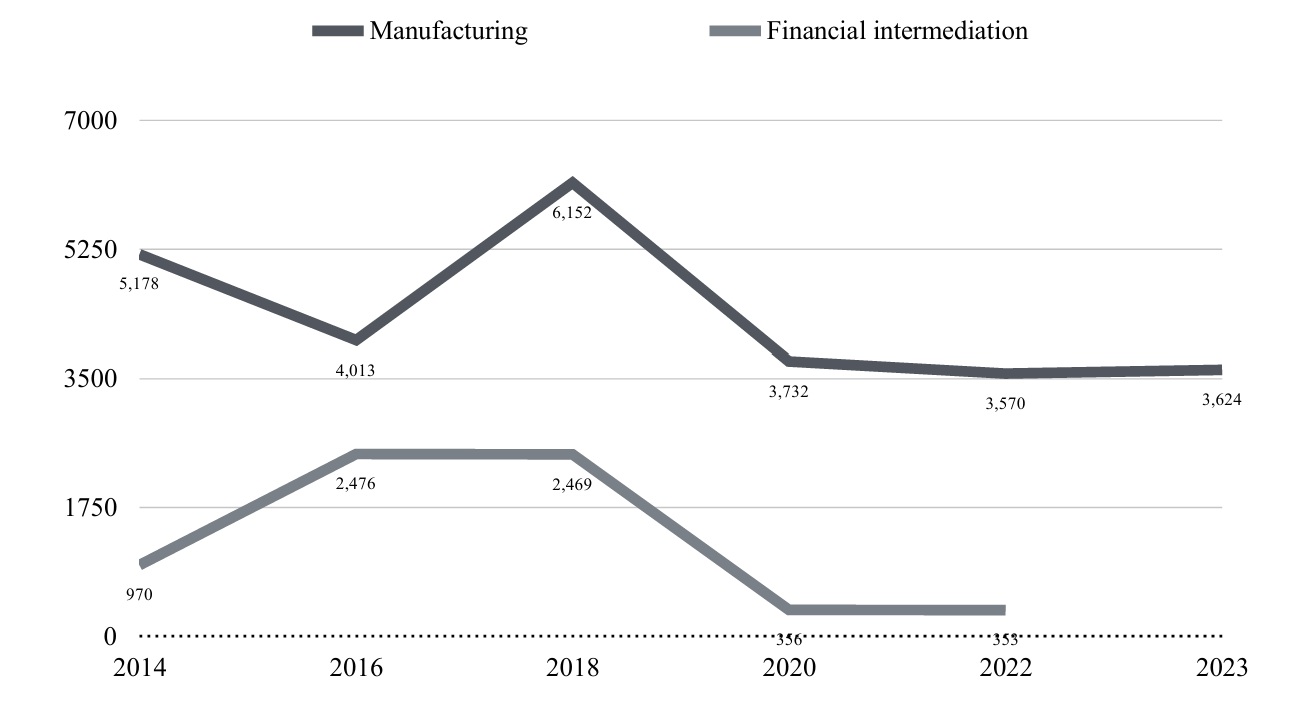

Figure 1: The Number of projects constructed by FDI

Source: National Bureau of Statistic of China

Since the American accusation, Chinese foreign investment in manufacturing and financial intermediation has reduced in 2018 sharply. Figure 1 illustrated the decrease in the number of the FDI constructed within China at manufacturing and financial intermediate. Significantly, in 2008, the number of cases in manufacturing (6152) and financial (2469) was the highest outcome from 2014 to 2023 [8]. This was a turning point for both industries. Meanwhile, the trend rate was constantly declining until 2020. Therefore, the suspension of the sudden introduction of USA protectionism and accusation could be the reason that led to this phenomenon. Furthermore, the protectionist strategy on both countries has caused the US exports of trade goods to China constrained by $13.8 billion and Chinese exports to the USA constrained by $70 billion. Hence the increase of the tariff has not only solely influenced China but also the US, plus, the great amount of the reduction of export from China - USA has alluded that China was playing a critical role in the America supply chain.

The rise of the Chinese telecommunication sector - innovation of Huawei’s 5G, has further verified Kissinger’s argument and catalyzed the US-China technological rivalry [7]. The USA sanctioned Chinese technology companies like Huawei, Xiaomi, etc. This sanction accused the potential cyber-attack and also aimed to persuade the US’s allies to ban these companies. However, the creation of BRI ( Belt and Road Initiative ) introduced by China has given these sanctioned companies another choice to invest telecommunication infrastructure to developing countries, like Pakistan. This method can also help China to expand its international influence. Although the American sanction has limited Chinese top-tech companies from entering the European and American financial markets, the market for developing countries was opened. Moreover, the competition between the 6G and the AI ( Alliance Intellectual ) is still ongoing intensively. Overall, the sanction is controversial, the United States chose to create an competitive relation instead of a cooperative ally.

2.3.The Phase One Deal

The 1979 agreement was focusing on lowering barriers, tariff reduction, and the framework of the US-China trade relation. However, with the world-spreading pandemic, COVID-19 that started in 2019, the balance between these two countries has changed. The effect of US-China trade war and the 2019 COVID-19 together has not only exacerbated the existing problems and also built new challenges to global trade. The global lockdown and closing of China’s customs office has further shifted the global supply chain. This forced some countries like the US to bring their manufacturing industry closer to their country or nearby regions in order to mitigate the potential disruptions. Most importantly, COVID-19 has accelerated the negotiation of the China-US with the creation of Phase One deal. Despite the high tariff on Chinese commodities exported to the US, China still be the TOP five trading partners with the USA and the data were in a climbing trend rate. Since the introduction of the Phase One deal the volume of the US imports of goods from China has climbed to $504.29 Billion at 2021 which was a $71.74 billion increase, and in 2020 reached $536.31 Billion, which was the second highest from 1985 to 2021 [8]. Therefore, the Phase One deal is a compromise regarding to the new challenges brought by COVID-19.

The 2020 Phase One deal is on the other hand, concentrating on the US’s concern on Intellectual Property, technology transfer, and agricultural and financial services. According to the fact sheet published by the US government [9], China has canceled the long-standing practice of technology transfer which worked as a condition of entering the Chinese market and building a transparent and fair market for foreign investors. Agriculturally, China must import over $400 billion of US-made farm products. The deal has temporarily eased the trade tension in China, but many underlying issues remained still unsolved.

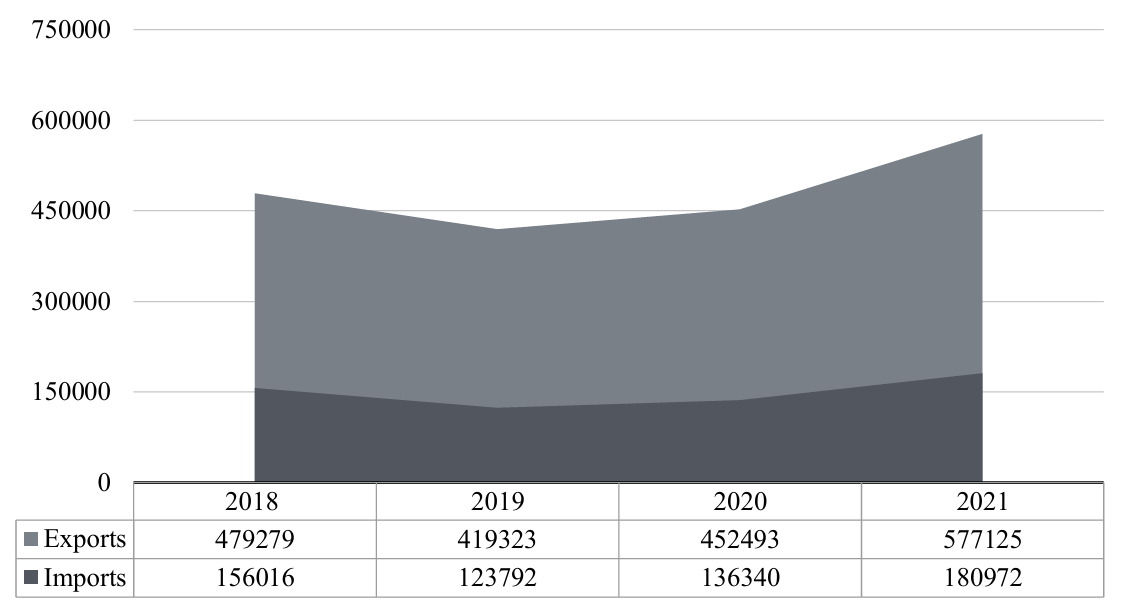

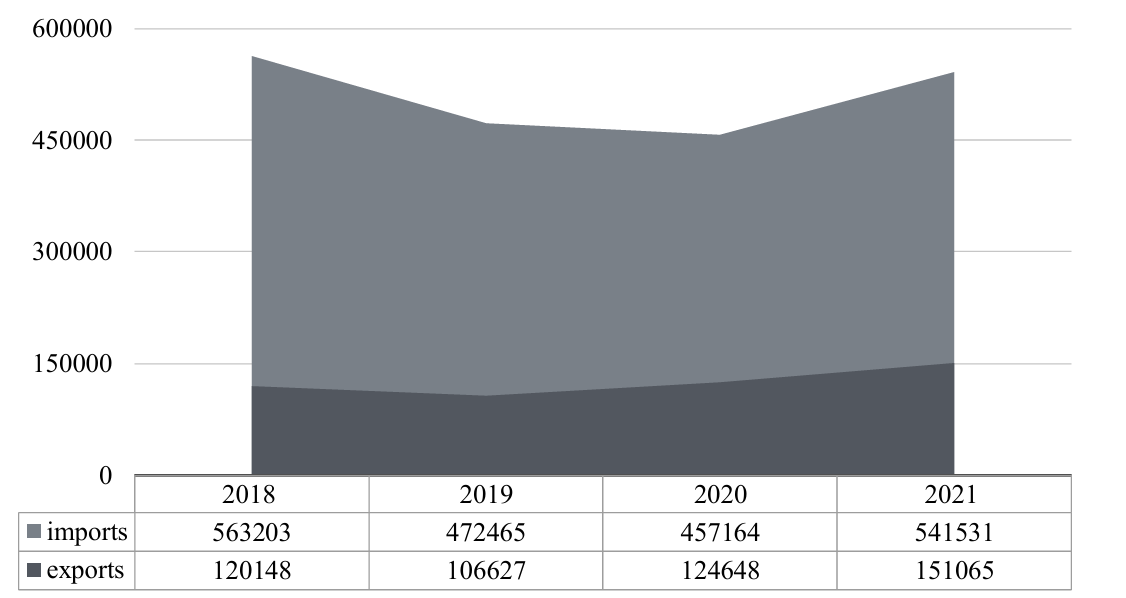

By 2020, China had become the second largest economy body and global manufacturing supplier, the US would still depend on China in lots of areas, for example, raw materials, labour service, etc, so that the US’s trade deficit would not be relieved easily. Figure 2 and figure 3 show the imports and exports of the US and China from 2018 to 2021. Significantly, Figure 2 demonstrates the imports from China to the US have exceeded the exports to China, therefore, the balance of trade was in extreme deficit. Whereas from Figure 3, Chinese exports to the US were in an extreme low trend rate with a high export to the US, and the light-shaded region is the surplus of the Chinese balance of trade. The Phase One deal was designed to correct the imbalance trade rate of the US to China, but it has failed to perform. Moreover, Phase One has included provisions for consultations and the right of the imposed tariff if either country has failed to meet commitments. According to Figure 2 and Figure 3, the US shows a high reliance on the Chinese commodity, so it is hard to evaluate which country would impact the most.

Figure 2: The Trade of China with US [10]

Source: World Integrated Trade Solution

Figure 3: The Trade of USA with China [11]

Source: World Integrated Trade Solution

The Phase One deal highlighted the competition role, instead of a stabilized relationship, the increasing rivalry and distrust between the two bodies created a clear distinction with the 1979 agreement which was a fundamental movement for US-China relations. The deal addressed intellectual property has redefined the trade relationship by securing a commitment from China to purchase US goods. Additionally, the deal listed the compromise of the Chinese VIE policy and ensured a transparent, just and non-discriminated market for foreign investors. Shenzhen Mindray was directly shared by NYSE through a traditional structure where foreign investors owned and did not rely on the VIE structure, therefore, Mindray could avoid the complexity and regulatory risks of VIE, offering a secure investment for international investors. Therefore, a Phase One deal emphasized the transparency of Chinese regulation would encourage more direct foreign investment into the Chinese market. However, this could depend on how successfully the deal is enacted with Chinese regulations.

3.The Global Effect of the USA-China Trade War

The unpredictable US-China trade competition has further influenced the global economic market and reshaped the global supply chain with a greater support on risk management and regionalization. According to the report from the ‘bystander effect’ of the US-China trade war [12], subset countries had exports grew faster than untaxed products. For instance, the manufacturing and technology sectors have begun diversifying their supply chains to other regions - Vietnam, etc, rather than relying on China mainly. Additionally, high tariffs on Chinese products have further accelerated this phenomenon. Therefore, subset countries, like the 20th century China, would be the main beneficial nations through the trade war. On the other hand, some companies chose to move back to their home country, as a less costly and stable method. Additionally, the complexity of the re-shaping supply chain has increased the cost of the manufacturing sectors and the risk of sectors to find safe and stable nations. Furthermore, the imposed tariff by the US and China on both sides of the product would pass on the cost to the customer. As companies would have raise the price of products to release the tariff on their product, customers would be the one to undertake the pressure. On the other hand, the imposed tariff would encourage companies at R&D to reduce the reliance of labor and reduce the average cost of production.

4.Conclusion

To conclude, this essay has explored the multifaceted impact according to three main periods and two agreements of the specific circumstances. The 1979 trade agreement was the root of the bilateral trade relations of China and the US guarded the competitive relationship and the trigger point for China to step into the global market. In contrast, the tariffs imposed by both countries made their relationship dropped to an ice point which forced each country to find an alternative. The 2020 Phase One deal has decoupled the relationship, illustrated a compromise made by both countries wen facing common unpredictable issue. Together, these arguments have illustrated the complexities of managing dynamic and stable relations for the two biggest economic bodies. To suggest, both countries should develop a more open and inclusive multiple-trading system which is based on an agreed treaty. This can protect the intensity of the global supply chain and promote a healthier international trading development. Secondly, both contries should strengthen their communiation and corporation. They should solve challenges like, protectionism together in order to promote the recovery of global economy.

References

[1]. Baláž, P., Zábojník, S., Harvánek, L., Baláž, P., Zábojník, S., Harvánek, L. (2020) FDI as a Driving Force of China’s Expansion. China's Expansion in International Business: The Geopolitical Impact on the World Economy, 161-235.

[2]. Rhodes, S. A., Jackson, J. H. (1999) United States Law and China's WTO Accession Process. Journal of International Economic Law, 2(3), 497-510.

[3]. Broadman, H. G., Sun, X. (1997) The distribution of foreign direct investment in China. World Bank Publications.

[4]. Zhang, J. (2024) China’s Perspective. Further ASEAN–China Cooperation for Joint Prosperity: Envisioning ACFTA 3.0 in the Digital Era, 225.

[5]. National Bureau of statistics of China. (2024) The statics of USA FDI.

[6]. World Bank. (2024) World Integrated Trade Solution.

[7]. Matthews, R., Anicetti, J. (2024) The Role of Defence Countertrade in Chinese Geoeconomic Diplomacy. Journal of Strategic Studies, 1-31.

[8]. Statists of China. (2024) FDI construction. Retrieved from https://data.stats.gov.cn/english/easyquery.htm?cn=C01

[9]. Chow, D. C. (2020) A New Controversial Approach to Dispute Resolution under the US-China Trade Agreement of 2020. Harv. Negot. L. Rev., 26, 31.

[10]. Starzyk, K. (2022) China-united States Trade in the Long Term. Implications for the World Economy.

[11]. WITS, W. (2018) World integrated trade solution.

[12]. World Integrated Trade Solutions by World Bank. (2022) The USA and China Imports and outports from 2018 - 2021. Retrieved from https://wits.worldbank.org/CountryProfile/en/Country/USA/Year/2019/SummaryText

Cite this article

Wang,Y. (2024). The Impact of Bilateral Trade Relation of USA-China From 1979 to 2020. Advances in Economics, Management and Political Sciences,140,211-217.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance's Role in the Just Transition

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Baláž, P., Zábojník, S., Harvánek, L., Baláž, P., Zábojník, S., Harvánek, L. (2020) FDI as a Driving Force of China’s Expansion. China's Expansion in International Business: The Geopolitical Impact on the World Economy, 161-235.

[2]. Rhodes, S. A., Jackson, J. H. (1999) United States Law and China's WTO Accession Process. Journal of International Economic Law, 2(3), 497-510.

[3]. Broadman, H. G., Sun, X. (1997) The distribution of foreign direct investment in China. World Bank Publications.

[4]. Zhang, J. (2024) China’s Perspective. Further ASEAN–China Cooperation for Joint Prosperity: Envisioning ACFTA 3.0 in the Digital Era, 225.

[5]. National Bureau of statistics of China. (2024) The statics of USA FDI.

[6]. World Bank. (2024) World Integrated Trade Solution.

[7]. Matthews, R., Anicetti, J. (2024) The Role of Defence Countertrade in Chinese Geoeconomic Diplomacy. Journal of Strategic Studies, 1-31.

[8]. Statists of China. (2024) FDI construction. Retrieved from https://data.stats.gov.cn/english/easyquery.htm?cn=C01

[9]. Chow, D. C. (2020) A New Controversial Approach to Dispute Resolution under the US-China Trade Agreement of 2020. Harv. Negot. L. Rev., 26, 31.

[10]. Starzyk, K. (2022) China-united States Trade in the Long Term. Implications for the World Economy.

[11]. WITS, W. (2018) World integrated trade solution.

[12]. World Integrated Trade Solutions by World Bank. (2022) The USA and China Imports and outports from 2018 - 2021. Retrieved from https://wits.worldbank.org/CountryProfile/en/Country/USA/Year/2019/SummaryText