1. Introduction

Mining banking is a typical example of obtaining valuable financial information through big data analysis. Historically, banking activities were manual and data intensive [1]. With technical improvements, notably the creation of computerized systems in the twentieth century, data began to be used more efficiently. The introduction of big data technology in the twenty-first century has transformed banking operations by allowing more precise processes [2]. In the early years, data mining in banking was primarily used for basic customer segmentation and credit scoring. However, with the growth of data and upgrading in machine learning and artificial intelligence, mining banking has evolved into a sophisticated domain [3]. Banks now leverage big data to optimize risk management, personalize customer experiences, detect fraudulent activities, and improve regulatory compliance.

Recent breakthroughs in mining finance have emerged in the usage of the techniques in more complicated and advanced applications [4] These involve real-time fraud detection, predictive loan approval analytics, and consumer sentiment analysis. Big data technologies and approaches are also used to track market movements, improve investment portfolios, and assure regulatory compliance [5]. Several studies have found that banks with implementation of big data estimation enhance their decision-making processes and operational efficiency significantly [6].

For the sake of analyzing of Big Data technologies in the mining banking industry. Here has a growing need for the intervention of Big Data technologies as banks require faster, accurate and low-cost techniques for managing large amounts of data. This study will look at how big data approaches have been used in two specific examples and assess their impact, limitations and potential future developments. Following of the research will be evaluated. Section 2 provides an overview of big data technologies and their applications in mining banking. Sections 3 and 4 give two case studies through which the important role of big data in mining banking is demonstrated. Section 5 explores the limitations and potential applications of big data in this regard. Finally, Section 6 concludes by summarizing the findings and their implications.

2. Descriptions of Big Data

Big data refers to the huge amount of information, numbers and other data that organizations need to deal with and process on a daily basis. Big data technology is the technical means to process this information digital data. Big data analysis can reveal insights that lead to improved judgments and smart business movements [7]. Big data technologies are used to evaluate huge volumes data generated by banking activity. These technologies include machine learning algorithms, data mining methods, and AI [8]. The use of big data in mining banking includes fraud detection, risk management, consumer analytics, and regulatory compliance.

For example, in fraud detection, big data enables banks to monitor transaction patterns in real time, detecting abnormalities that may suggest fraudulent behavior. Predictive analytics improves risk management by using previous data to foresee prospective dangers, allowing institutions to take preventive steps [9]. Client analytics employs large data to obtain insights into client behavior, allowing banks to tailor services and increase customer satisfaction.

3. Real-time Fraud Detection Using Big Data in Banking

In recent years, the application of big data analytics in real-time fraud detection becoming a cornerstone of modern banking security [10]. As financial transactions have increasingly shifted to digital platforms, the volume has boosting exponentially. This surge in data has created both challenges and opportunities for banks, particularly in the area of fraud detection.

JPMorgan Chase, a leading global financial institution, has implemented a big data-driven approach to fraud detection. The bank's system continuously monitors transactions, flagging those that deviate from established patterns of behavior [11]. This is accomplished by putting past transaction data into machine learning algorithms, which detect abnormalities that may suggest fraudulent behavior. JPMorgan Chase's technology is built on a mix of supervised and unsupervised machine learning methods. Supervised learning models, trained on labeled datasets including instances of both legal and fraudulent transactions, are used to forecast the likelihood of a new transaction being fraudulent. While unsupervised learning models find anomalies in the data without prior classification, allowing them to detect previously unknown types of fraud.

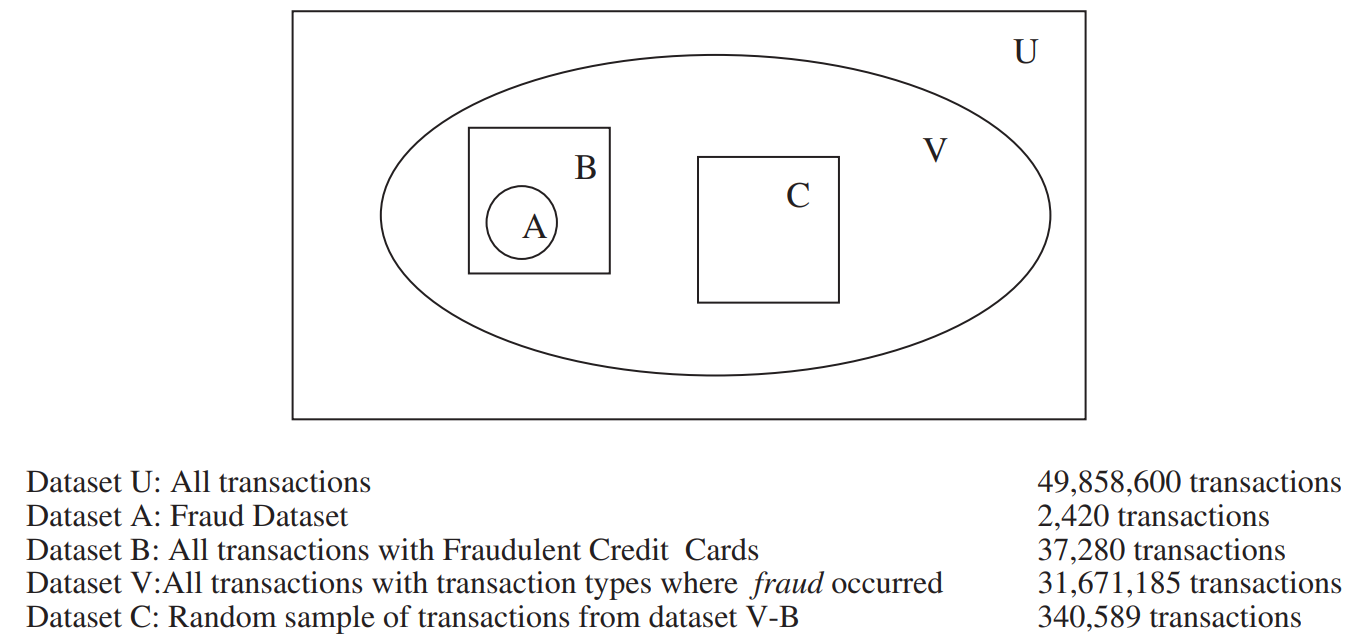

Figure 1: A sketch of model construction [12].

One of the core models used by JPMorgan Chase to respond to fraudulent tactics is the Random Forest approach, which are suitable to deals large data sets and describe complex relationships between variables. The model is continually updated as new data becomes available, allowing it to constantly detect developing fraudulent methods (seen from Fig. 1) [12]. The system also includes a deep learning model, namely a neural network, which excels in detecting detailed patterns in the data. The installation of this big data technology has greatly decreased the bank's vulnerability to fraudulent activity. According to internal reports, the technology reduced fraud-related costs by 40% in the first year of deployment. Furthermore, the system's real-time capabilities allow potentially fraudulent transactions to be recognized and terminated nearly instantly, reducing financial loss.

4. Customer Segmentation and Personalization in Banking Using Big Data

Customer segmentation and customization are another important use cases for big data in banking. As competition in the banking industry heats up, financial institutions are increasingly turning to big data analytics to better understand the clients and provide tailored services [13]. Wells Fargo, one of the major banks in the U.S., has adopted a big data-driven strategy to client segmentation. To build a comprehensive customer profile, banks collect data from multiple originations, e.g., transaction history, social media activity and customer interactions. This information is then used to classify customers into different categories based on their behavior, tastes and financial status. Wells Fargo therefore uses powerful machine learning algorithms and data analytics systems to process and analyze large amounts of structured and unstructured data. For example, the bank uses clustering techniques, such as K-means clustering, to group customers with similar transaction patterns, spending habits, and product usage. Additionally, natural language processing is used to evaluate customer reviews and social media mentions, allowing the bank to gauge sentiment and spot emerging trends. Wells Fargo can use this information to customize marketing efforts, come up with tailored financial products, and improve customer support services to maximize benefits [14]. Customers categorized as high-value segments may receive personalized investment advice and unique incentives, while those whose value is assessed as lower value may be targeted for retention by Wells Fargo. This deep segmentation not only increases customer satisfaction, but also improves profitability by better matching products and services to specific consumer needs.

Figure 2: A sketch of analysis models [15].

It is through the use of big data algorithms and predictive analytics such as, for example, K-means clustering techniques that Wells Fargo achieves this segmentation by grouping clients with similar characteristics. Predictive models are then used to estimate future behavior and find areas for targeted marketing [15]. A overall presentation of the methods are illustrated in Fig. 2. By embracing big data, Wells Fargo has greatly increased client engagement. Personalized marketing efforts targeted to the unique demands of each consumer category have resulted in a 30% increase in customer retention and a 25% increase in cross-selling opportunities. Furthermore, the bank's capacity to anticipate consumer demands has resulted in improved satisfaction ratings and a more competitive market position.

5. Limitations and Prospects

While the using of big data in mining banking has yielded promising outcomes, certain limits and hurdles must be overcome. Inaccurate, incomplete, or inconsistent data might result in incorrect insights and conclusions. Furthermore, integrating data can be difficult and time-consuming, necessitating large investments in technology and personnel. Another significant constraint is the question of data privacy. With a rising volume of personal data being gathered and processed, banks must negotiate complicated regulatory settings to maintain compliance with data protection rules. This involves complying with requirements, which could failure to comply with these requirements can result in significant fines and reputational harm to a bank. Furthermore, the utilization of big data analytics necessitates a professional workforce capable of handling and understanding large datasets. As a result, the demand for professional data scientists and analysts has increased dramatically in a large number of organizations. However, again, the number of data scientists is again limited, leading to an oversupply in the market. This lack of talent may hinder the application and development of big data technologies in the banking industry.

Looking ahead, the new technologies are likely to dramatically improve the state of the art as well as the theoretical knowledge of big data science. This will not only improve the predictive power of big data models, but also allow for more accurate risk assessments and tailored consumer experiences. Combining these again with the banking industry, the implantation of such technologies will hold great promise for the banking industry [16]. However, there is one issue that cannot be ignored; as the volume of data increases, data governance and ethics issues will become more important [16]. Therefore, banks will need to build strong data management frameworks to guarantee that big data is utilized responsibly and openly, weighing the advantages of innovation against the requirement for privacy and security.

6. Conclusion

To sum up, this study investigated the use of big data approaches in mining banking, with an emphasis on two main applications: real-time fraud detection and customer segmentation. The case studies of JPMorgan Chase and Wells Fargo show how it may greatly improve the efficiency and efficacy of banking operations, resulting in increased security, customer happiness, and profitability. Despite the positive outcomes, issues such as data quality, privacy concerns, and a skill deficit must be solved before big data can completely fulfill its promise in banking. With the upgrading of techniques, the integration of AI and quantum computing with big data analytics will likely open new avenues for innovation, transforming the banking industry even further. In conclusion, the successful implementation of it in mining banking not only enhances operational capabilities but also provides a competitive edge in data-driven world. Future study ought to focus on overcoming the existing limitations and exploring new frontiers in big data analytics to ensure that banks can continue to thrive in the digital age.

References

[1]. Fayyad, U., Piatetsky-Shapiro, G. and Smyth, P. (1996) From data mining to knowledge discovery in databases. AI magazine, 17(3), 37-54.

[2]. Provost, F. and Fawcett, T. (2013) Data science for business: What you need to know about data mining and data-analytic thinking. O'Reilly Media, Inc.

[3]. Ghosh, S. and Reilly, D.L. (1994) Credit card fraud detection with a neural-network. System Sciences, 1994. Proceedings of the Twenty-Seventh Hawaii International Conference on, 3, 621-630.

[4]. Manyika, J., Chui, M., Brown, B., Bughin, J., Dobbs, R., Roxburgh, C. and Byers, A.H. (2011) Big data: The next frontier for innovation, competition, and productivity. McKinsey Global Institute.

[5]. Chen, H., Chiang, R.H.L. and Storey, V.C. (2012) Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165-1188.

[6]. Gomber, P., Koch, J.A. and Siering, M. (2017) Digital Finance and FinTech: Current Research and Future Research Directions. Journal of Business Economics, 87(5), 537-580.

[7]. Chen, M., Mao, S. and Liu, Y. (2014) Big data: A survey. Mobile Networks and Applications, 19(2), 171-209.

[8]. Kaisler, S., Armour, F., Espinosa, J.A. and Money, W. (2013) Big data: Issues and challenges moving forward. In System sciences (HICSS), 2013 46th Hawaii international conference 995-1004.

[9]. Gandomi, A. and Haider, M. (2015) Beyond the hype: Big data concepts, methods, and analytics. International Journal of Information Management, 35(2), 137-144.

[10]. Chen, H., Chiang, R. H. and Storey, V.C. (2012) Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165-1188.

[11]. Ellahi, E., Talha, M., Vidhate, D.A., Mann, G., Chauhan, S. and Singh, V. (2024) Fraud Detection and Prevention in Finance: Leveraging Artificial Intelligence and Big Data. Dandao Xuebao Journal of Ballistics, 36(1), 54-62.

[12]. Bhattacharyya, S., Jha, S., Tharakunnel, K. and Westland, J.C. (2011) Data mining for credit card fraud: A comparative study. Decision Support Systems, 50(3), 602-613.

[13]. Kumar, V. and Reinartz, W. (2018) Customer Relationship Management: Concept, Strategy, and Tools. Springer.

[14]. Munot, D., Wakharde, D., Vispute, S., Kamble, V., Potdar, C. and Rajeswari, K. (2022) An automated system for rural people complaint handling, monitoring, and analysis using data analytics. 2022 6th International Conference On Computing, Communication, Control And Automation (ICCUBEA), 1-7.

[15]. Kaisler, S., Armour, F., Espinosa, J. A. and Money, W. (2013) Big data: Issues and challenges moving forward. System sciences (HICSS), 2013 46th Hawaii international conference, 995-1004.

[16]. Mayer-Schönberger, V. and Cukier, K. (2013) Big Data: A Revolution That Will Transform How We Live, Work, and Think. Houghton Mifflin Harcourt.

Cite this article

Gong,S. (2024). Implementation of Big Data Techniques in Banking: Evidence from Real-time Fraud Detection and Customer Segmentation. Advances in Economics, Management and Political Sciences,134,161-166.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fayyad, U., Piatetsky-Shapiro, G. and Smyth, P. (1996) From data mining to knowledge discovery in databases. AI magazine, 17(3), 37-54.

[2]. Provost, F. and Fawcett, T. (2013) Data science for business: What you need to know about data mining and data-analytic thinking. O'Reilly Media, Inc.

[3]. Ghosh, S. and Reilly, D.L. (1994) Credit card fraud detection with a neural-network. System Sciences, 1994. Proceedings of the Twenty-Seventh Hawaii International Conference on, 3, 621-630.

[4]. Manyika, J., Chui, M., Brown, B., Bughin, J., Dobbs, R., Roxburgh, C. and Byers, A.H. (2011) Big data: The next frontier for innovation, competition, and productivity. McKinsey Global Institute.

[5]. Chen, H., Chiang, R.H.L. and Storey, V.C. (2012) Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165-1188.

[6]. Gomber, P., Koch, J.A. and Siering, M. (2017) Digital Finance and FinTech: Current Research and Future Research Directions. Journal of Business Economics, 87(5), 537-580.

[7]. Chen, M., Mao, S. and Liu, Y. (2014) Big data: A survey. Mobile Networks and Applications, 19(2), 171-209.

[8]. Kaisler, S., Armour, F., Espinosa, J.A. and Money, W. (2013) Big data: Issues and challenges moving forward. In System sciences (HICSS), 2013 46th Hawaii international conference 995-1004.

[9]. Gandomi, A. and Haider, M. (2015) Beyond the hype: Big data concepts, methods, and analytics. International Journal of Information Management, 35(2), 137-144.

[10]. Chen, H., Chiang, R. H. and Storey, V.C. (2012) Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165-1188.

[11]. Ellahi, E., Talha, M., Vidhate, D.A., Mann, G., Chauhan, S. and Singh, V. (2024) Fraud Detection and Prevention in Finance: Leveraging Artificial Intelligence and Big Data. Dandao Xuebao Journal of Ballistics, 36(1), 54-62.

[12]. Bhattacharyya, S., Jha, S., Tharakunnel, K. and Westland, J.C. (2011) Data mining for credit card fraud: A comparative study. Decision Support Systems, 50(3), 602-613.

[13]. Kumar, V. and Reinartz, W. (2018) Customer Relationship Management: Concept, Strategy, and Tools. Springer.

[14]. Munot, D., Wakharde, D., Vispute, S., Kamble, V., Potdar, C. and Rajeswari, K. (2022) An automated system for rural people complaint handling, monitoring, and analysis using data analytics. 2022 6th International Conference On Computing, Communication, Control And Automation (ICCUBEA), 1-7.

[15]. Kaisler, S., Armour, F., Espinosa, J. A. and Money, W. (2013) Big data: Issues and challenges moving forward. System sciences (HICSS), 2013 46th Hawaii international conference, 995-1004.

[16]. Mayer-Schönberger, V. and Cukier, K. (2013) Big Data: A Revolution That Will Transform How We Live, Work, and Think. Houghton Mifflin Harcourt.