1. Introduction

As the global aging process accelerates, aging has become one of the major social and economic challenges faced by countries worldwide. According to United Nations data, the proportion of the global population aged 60 and above is rapidly increasing, projected to rise from 12% in 2019 to 22% by 2050. This phenomenon is especially pronounced in developed countries and some developing countries. Population aging not only signifies an increase in the absolute and relative numbers of the elderly but also an increase in their proportion within the overall population structure. The underlying causes include declining birth rates and increased life expectancy, leading to a gradual decrease in the proportion of the working-age population, thereby profoundly impacting various aspects of society.

In the context of population aging, the reduced supply and changing demand for labor have become critical factors affecting economic growth. A decline in the working-age population directly leads to a tightening labor market, which increases labor costs for enterprises and slows potential economic growth. Concurrently, as the proportion of the elderly population rises, the pressure on the social security system gradually increases, especially in pension and healthcare expenditures. Social Security originated from the United States Social Security Act of 1935 [1]. Each country that has established social security systems has done so through legislation, meaning that social security systems are a governmental responsibility [2], Furthermore, social security expenditure is a significant component of fiscal expenditure and is critical in government constraints and social development guidance [3]. The state of government finances is deeply influenced by economic growth. Therefore, population aging significantly impacts the interplay between economic growth and social security expenditure.

Existing literature has extensively studied the bilateral relationships between population aging, social security expenditure, and economic growth, such as the impact of population aging on economic growth [4], the role of economic growth in determining social security expenditure [5], and the feedback effect of social security expenditure on economic growth [6]. However, less focus has been placed on the dynamic mechanism through which population aging indirectly affects social security expenditure via economic growth. Hence, this study not only explores the bilateral relationships between population aging, social security expenditure, and economic growth but also delves into their intrinsic connections and comprehensive impact on the socio-economic system. By means of comparative analysis and overall analysis, this paper reveals how to achieve long-term stability and sustainable development of society through the coordination of economic growth and social security expenditure under the background of aging.

2. The Relationship Between Social Security Expenditure and Population Aging

2.1. The Composition and Changes of Social Security Expenditure

The main contents of China’s social security expenditure include social insurance, social welfare, social assistance and special care and resettlement, and it is rigid and will not decrease with the decline of the economic level. The main body of the burden of social security expenditure includes the government, enterprises and individuals. Part of the burden borne by the government as the main body is the financial social security expenditure. Therefore, financial social security expenditure can reflect a country 's support and attention to social security to a certain extent.

The structure of China's fiscal social security expenditure has mainly gone through three stages. The first stage is from the reform and opening up to 1997.This stage is in the early stage of social security development, and there are few financial social security expenditure items. The second stage is from 1998 to 2006, China's social security system has been continuously improved, and the financial social security expenditure project has increased the retirement fees and subsidy expenditures of administrative institutions. The third stage is from 2007 to the present. In 2007, the government 's income and expenditure classification project was adjusted and reformed, and the part of fiscal expenditure for social security was concentrated on ' social security and employment '. The core components mainly include social insurance, social welfare, social relief and special care and resettlement expenditure [7].

2.2. The Relationship Between Social Security Expenditure and Population Aging

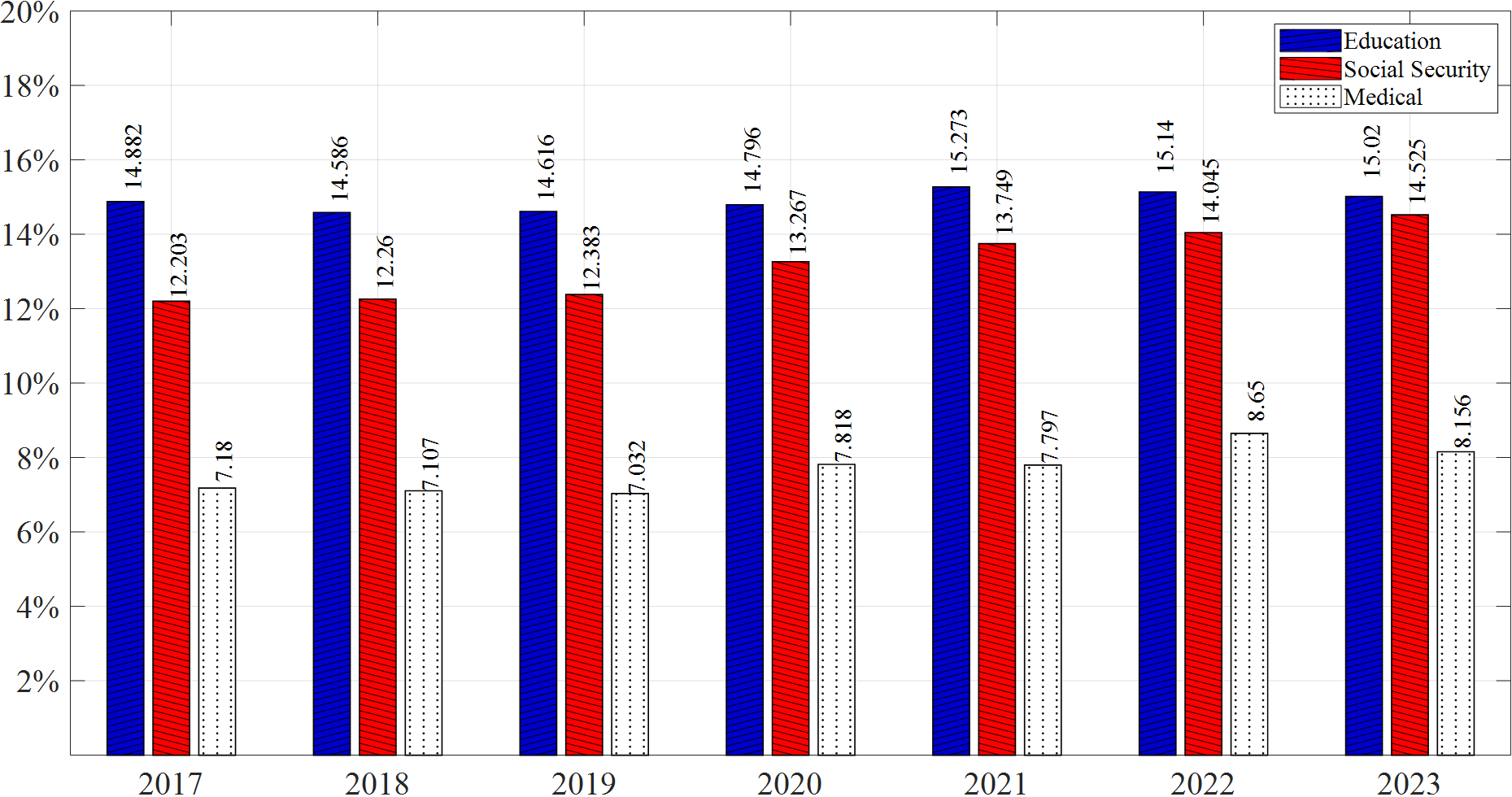

The intensification of population aging has led to a host of social and economic challenges, including the aging of the population structure, the mismatch between labor supply and demand, and the growing imbalance between pension income and expenditure. These issues are most directly manifested in the sharp increase in actual demand for social security services. Notably, the excessive growth in social security expenditures poses a significant threat to national finances [8]. Figure 1 illustrates the trend chart derived from the fiscal expenditure data in the 'China Statistical Yearbook' from 2017 to 2023. During this period, China's social security and healthcare expenditures grew by an average of about 10% annually, with their share of total fiscal expenditure steadily rising to 22.70%, surpassing other expenditure items. Meanwhile, education spending has remained relatively stagnant over the past decade, consistently hovering around 14% of the national budget, and the proportion of social security and healthcare expenditures has significantly exceeded that of education expenditures from 2017 to 2023. This trend underscores the crowding-out effect of rising social security and healthcare costs on other critical fiscal areas, particularly education, as the aging population drives up these costs. Moreover, since China entered an aging society in 2001, the growth rate of fiscal expenditure has significantly outpaced that of fiscal revenue, leading to a gradual expansion of the national fiscal deficit. The deficit rate has remained persistently high since reaching 3.37% in 2015, exceeding the internationally accepted 'Maastricht' Treaty standard, which recommends a maximum deficit rate of 3%. This persistent fiscal imbalance is largely attributable to the surge in social security and healthcare expenditures, highlighting the strain that an aging population places on national finances and the resulting challenges in maintaining a balanced and sustainable fiscal policy.

Figure 1: The change chart of China’s fiscal expenditure structure from 2017 to 2023

3. The Relationship Between Economic Growth and Population Aging

Most studies have shown that population aging will lead to a decline in potential economic growth, but at the same time, the impact of aging on potential economic growth can be alleviated of utilizing technological upgrading and human capital investment.

Population aging will affect economic growth through four channels. Firstly, population aging will affect the supply of labor. Hu and Liu et al. used the provincial panel data of China from 1990 to 2008 to establish an extended Solow model for research [9]. The results show that the decline in the population dependency ratio and the increase in the share of the working-age population are conducive to economic growth. This has also been an important source of demographic dividends since China's reform and opening. However, the current aging population is changing this favorable demographic structure. The study of Sun Aijun and Liu Shenglong also supports this conclusion [10]. The study found that the economic growth caused by the decline in the population dependency ratio between 1990 and 2010 was about 1.44 percentage points, and the contribution rate was about 15 %. The current aging of the population will hurt the economy.

Secondly, as population aging becomes more pronounced, it has a significant impact on labor productivity. With age, individuals experience a natural decline in physical function, leading to an aging workforce characterized by diminished physical strength, intelligence, and cognitive abilities. This aging trend within the labor force presents challenges in adapting to the demands of industrial structural upgrading, as older workers are generally slower in adjusting and updating their knowledge base. Zhang Zheng for instance, conducted a study on migrant workers in Dongguan and found that in labor-intensive industries, worker productivity declines sharply after the age of 35 [11]. Lehman posited that there is an inverted "U" relationship between individual age and labor productivity, with the productivity peak varying depending on the industry [12]. For example, in sectors such as artistic creation and theoretical physics, the productivity peak tends to occur around age 30, followed by a rapid decline. Conversely, in fields like medical research and historical studies, the productivity peak is observed between the ages of 40 and 50, with a more gradual decline thereafter. Maestas et al. in their analysis of U.S. population and economic data from 1980 to 2010, found that for every 10% increase in the population aged 60 and above, the growth rate of U.S. per capita GDP declines by 5.5 percentage points [13]. This decline is primarily attributed to reduced labor productivity due to aging workers, which accounts for two-thirds of the decrease, while the remaining one-third is due to the slower growth rate of the working-age population. Looking ahead, they predict that the annual growth rate of U.S. GDP will decrease by 1.2 percentage points over the next decade and by 0.6 percentage points over the next twenty years, underscoring the long-term economic effects of an aging workforce.

Thirdly, population aging might also affect industrial upgrading. Zhi-guo Lu argues that adjusting the industrial structure requires a highly mobile labor force capable of moving between different regions and sectors [14]. However, older workers often have fixed living habits and professional skills, making it difficult for them to adapt to new industries and locations, thereby hindering industrial upgrading. Ren Dong and Li Xinyun presented similar views, arguing that as workers age, the cost of changing jobs increases while the probability and mobility of job changes decrease [15]. Hence, older workers find it challenging to quickly adapt to the needs of industrial upgrading. An increase in the proportion of young workers can significantly promote industrial upgrading, whereas an aging labor force structure will inhibit it.

Lastly, increased pension burdens may crowd out investment. Wang Wei et al. argue that the increased burden of pensions due to population aging will crowd out household investment in human capital, corporate R&D investment, and national science and education expenditure, thereby negatively affecting the quality of the labor supply and hindering industrial upgrading [16].

4. The Relationship Between Social Security and Economic Growth

The purpose of economic development is to promote economic growth, while the aim of social security is to mitigate various risks through redistributive means; the two are interrelated. Franco Modigliani posits that when people have social security, especially pension insurance, their expectations of future income substantially increase, leading to higher current consumption [6].When people have stable or continuously improving institutional guarantees, their positive expectations for the future stabilize, significantly boosting consumption. First, consumption directly drives economic growth by increasing gross domestic product (GDP). Second, consumption can indirectly stimulate the economy by increasing demand, leading to a rise in total demand and a relative decrease in total supply, which causes product prices to rise. Consequently, investment demand increases, influencing the growth rate of output and ultimately impacting GDP, thereby stimulating economic growth.

A reasonable and effective social security system can significantly promote economic development. However, the current social security system in China is not fully aligned with economic development. In recent years, many enterprises have reported that the burden of social insurance contributions is too heavy. The main cause of this issue is the irrational growth of social insurance benefits, particularly the rapid increase in basic pension benefits for employees in earlier years. This has made it difficult to balance the fund’s revenues and expenditures and has created irrational expectations among some segments of society. If this continues, when economic growth slows and businesses struggle to bear high social insurance costs, it could indirectly reduce the government's social security fund pool, exacerbating the debt burden on some local governments.

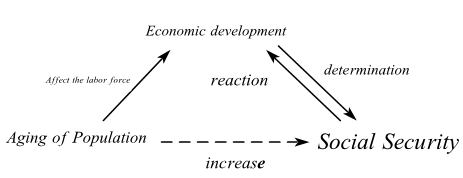

Population aging impacts economic development by affecting the labor supply-demand relationship, and economic development, in turn, determines social security. Moreover, social security can react to its expenditure. Population aging mainly influences social security expenditure by impacting economic development. The process of this dynamic adjustment is illustrated in Figure 2.

Figure 2: The dynamic relationship between economic development, population aging and social security.

5. Conclusion

The issue of social security has consistently been a major focus for government departments, experts, scholars, and the public, given its essential role in driving socio-economic development. This paper conducts a thorough analysis of the intricate relationship between population aging, social security expenditure, and economic growth, leading to several key conclusions:

Firstly, the phenomenon of population aging predominantly affects economic growth by altering the dynamics of labor supply and demand. As the aging trend intensifies, the labor force becomes increasingly older, resulting in a gradual decline in workers' physical strength, intellectual capacity, and cognitive abilities. Moreover, the elderly population tends to be slower in adjusting and updating their knowledge structures, which makes it challenging for them to quickly adapt to the demands of industrial upgrading. Secondly, the intensification of population aging has led to a host of social and economic challenges, most notably reflected in the rising demand for social security. For example, since China entered an aging society in 2001, the growth of fiscal expenditure has significantly outpaced that of fiscal revenue, causing the national fiscal deficit rate to gradually expand, peaking at 3.37% in 2015 and remaining persistently high thereafter. Finally, there exists a reciprocal relationship between the levels of social security and economic growth.

On the one hand, economic growth provides the material foundation and prerequisites for societal development. On the other hand, social security, as an integral socio-economic system, also exerts a considerable influence on economic growth.

To effectively address the challenges posed by an increasingly aging population, solutions should be pursued from the perspective of economic development. By sustaining economic growth through industrial upgrading and aligning the growth rate of social security expenditure with that of economic growth, these challenges can be better managed. Additionally, the internal structure of social security expenditure should be adjusted to harmonize the growth proportions of various social insurance components, thereby optimizing the overall expenditure structure.

References

[1]. Fox, C. (2021) Save Our Senior Noncitizens: Extending Old Age Assistance to Immigrants in the United States, Social Science History. 45(1), 55-81.

[2]. Tomita, Y., Kimura, A. (2021) Financial Resource of Public Social Security Expenditure, the Rule of Law, and Economic Inequality: International Comparison of Legal Origins. Economic Research. 2021;34(1):2997-3014.

[3]. Hu, Y., Wu, Y., Zhou, W., Li, T., Li, L. (2020) A Three-stage Dea-based Efficiency Evaluation of Social Security Expenditure in China. PLOS one, 15(2): e0226046.

[4]. Xu, S. (2011) A Study on the Effect of Population Aging on Economic Growth in China. Nanjing University.

[5]. Li, Q. (2021) Economic Development and Social Security. Social Sciences in Chinese Higher Education Institutions. (002), 59-67.

[6]. Qi, G. (2019) A Study on the Impact of Social Security on Economic Growth in China2019. Atlantis Press.

[7]. Wei, G. (2020) Age Structure of Population,Social Security Level and the Income Gap Between Urban and Rural Areas:Based on GMMEstimation Method and Panel Threshold Regression. Northwest population. 41(5), 195.

[8]. Zhu, M. (2019) Population Aging and Government Expenditure Structure: Evidence from China Based on SD Analysis Statistics&Information Forum, 34(11).

[9]. Angang, H., Shenglong, L. (2012) Population Aging,Population Growth and Economic Growth: Evidence from China’s Provincial Panel Data. Population Research. 36(3), 13.

[10]. AIjun, S. (2014) The Effects of Demographic Changes on Economic Growth. Population Economics. (1), 10.

[11]. Zhang, Z. (2011) Age differences in labor productivity and the Lewis turning point. Chinese Rural Economy, (8), 11.

[12]. Lehman, H.C. (2019) Age and Achievement 1987.

[13]. Maestas, N., Mullen, K.J., Powell, D. (2016) The Effect of Population Aging on Economic Growth, the Labor Force and Productivity. Ewing Marion Kauffman Foundation Research Paper Series.

[14]. Zhi, L. (2015) Influences of China's Aging Population on the Adjustment of its Industrial Structure. Journal of Shenzhen University(Humanities & Social Sciences). (2), 5-51.

[15]. Ren, D., Li, X. (2014) The Relationship between Labor Age Structure and Industrial Structure Change:Based on Provincial Panel Data. Population Economics. (005), 95-103.

[16]. Wang, W. (2015) Research on Effects of Population Aging on Industrial Upgrading. China Industrial Economics. (11), 15.

Cite this article

Zhao,P. (2024). Study on the Dynamic Relationship Between Social Security Expenditure, Population Aging and Economic Growth. Advances in Economics, Management and Political Sciences,142,66-71.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fox, C. (2021) Save Our Senior Noncitizens: Extending Old Age Assistance to Immigrants in the United States, Social Science History. 45(1), 55-81.

[2]. Tomita, Y., Kimura, A. (2021) Financial Resource of Public Social Security Expenditure, the Rule of Law, and Economic Inequality: International Comparison of Legal Origins. Economic Research. 2021;34(1):2997-3014.

[3]. Hu, Y., Wu, Y., Zhou, W., Li, T., Li, L. (2020) A Three-stage Dea-based Efficiency Evaluation of Social Security Expenditure in China. PLOS one, 15(2): e0226046.

[4]. Xu, S. (2011) A Study on the Effect of Population Aging on Economic Growth in China. Nanjing University.

[5]. Li, Q. (2021) Economic Development and Social Security. Social Sciences in Chinese Higher Education Institutions. (002), 59-67.

[6]. Qi, G. (2019) A Study on the Impact of Social Security on Economic Growth in China2019. Atlantis Press.

[7]. Wei, G. (2020) Age Structure of Population,Social Security Level and the Income Gap Between Urban and Rural Areas:Based on GMMEstimation Method and Panel Threshold Regression. Northwest population. 41(5), 195.

[8]. Zhu, M. (2019) Population Aging and Government Expenditure Structure: Evidence from China Based on SD Analysis Statistics&Information Forum, 34(11).

[9]. Angang, H., Shenglong, L. (2012) Population Aging,Population Growth and Economic Growth: Evidence from China’s Provincial Panel Data. Population Research. 36(3), 13.

[10]. AIjun, S. (2014) The Effects of Demographic Changes on Economic Growth. Population Economics. (1), 10.

[11]. Zhang, Z. (2011) Age differences in labor productivity and the Lewis turning point. Chinese Rural Economy, (8), 11.

[12]. Lehman, H.C. (2019) Age and Achievement 1987.

[13]. Maestas, N., Mullen, K.J., Powell, D. (2016) The Effect of Population Aging on Economic Growth, the Labor Force and Productivity. Ewing Marion Kauffman Foundation Research Paper Series.

[14]. Zhi, L. (2015) Influences of China's Aging Population on the Adjustment of its Industrial Structure. Journal of Shenzhen University(Humanities & Social Sciences). (2), 5-51.

[15]. Ren, D., Li, X. (2014) The Relationship between Labor Age Structure and Industrial Structure Change:Based on Provincial Panel Data. Population Economics. (005), 95-103.

[16]. Wang, W. (2015) Research on Effects of Population Aging on Industrial Upgrading. China Industrial Economics. (11), 15.