1. Introduction

Japan's economic landscape is defined by its unique position within the global financial system, particularly through its monetary policies and the role of the yen in international markets. A central concept in understanding Japan's economic strategy is the 'Impossible Trinity,' also known as the 'Mundellian Trilemma.' This economic theory asserts that a country cannot simultaneously achieve the goals of maintaining a fixed foreign exchange rate, allowing free capital movement, and conducting an independent monetary policy. According to this theory, Japan has chosen to prioritize free capital movement and an independent monetary policy, which results in a flexible exchange rate for the yen, similar to other major economies like Canada [1].

In recent years, the yen has experienced notable depreciation, which has far-reaching implications for Japan’s economy [2]. This report aims to analyze the effects of the yen’s recent depreciation on various aspects of the country’s economy, including Japan’s trade balance, its dynamics within the domestic financial markets, and the broader economic outlook. By examining these factors, this report seeks to examine the key factors driving the depreciation of the yen, as well as provide a comprehensive understanding of how such depreciation impacts Japan’s economic activities.

2. Key Drivers of Yen Depreciation

2.1. Interest Rate Differential

The Bank of Japan (BoJ) has maintained ultra-low interest rates for an extended period, often near zero or even negative, as part of its efforts to stimulate economic growth and combat deflation. This is evident from its 10-year government bond yields, which have hovered around 0% since 2015, occasionally dipping into negative territory [3]. In contrast, the United States has experienced a significant rise in interest rates, particularly after 2021, when the Federal Reserve began increasing rates to control inflation. Data sources from FRED have shown that U.S. 10-year government bond yields have risen sharply, reaching around 5% in recent years [4].

This widening interest rate differential between Japan and the U.S. has made USD-denominated assets far more attractive to investors compared to yen-denominated assets. As a result, there has been a significant outflow of capital from Japan, with investors selling yen to purchase dollars, thereby contributing to the weakening of the yen. The persistence of this interest rate gap is a key driver of the yen’s depreciation, as the search for higher yields continues to draw capital away from Japan.

2.2. Carry Trade Dynamics

The carry trade is a financial strategy based on another economic theory, Uncovered Interest Rate Prity (UIP). UIP suggests that the difference in interest rates between two countries is equal to the expected change in exchange rates between their currencies. In other words, if one currency offers a higher interest rate, it is expected to depreciate relative to a currency with a lower interest rate to offset the potential gains from the interest rate differential.

Yen carries trade resembles UIP because the investor is betting that the currency with the lower interest rate (the yen) will not appreciate significantly against the currency with the higher interest rate (the dollar). The trade profits if the exchange rate remains stable or if the yen depreciates, which is consistent with the UIP theory.

The carry trade is a financial strategy that allows investors to capitalize on the interest rate differential between two countries by mainly borrowing in a currency with low interest rates, such as the yen, and investing in currencies with higher yields, like the USD.

For instance, let's assume in this context that a trader starts by taking a loan of ¥10,000,000 at a comparatively modest yearly interest rate of 0.40% from the Japanese Yen financial market. The borrowed amount is then exchanged for U.S. dollars at a rate of ¥120 per dollar, resulting in $83,333.33. This converted sum is then placed in the U.S. dollar financial market, where it gains a 5.00% return over 360 days. At the conclusion of the investment term, the $83,333.33 increases to $87,500 due to the 5.00% interest.

The investor then converts the $87,500 back into yen, using the same exchange rate of ¥120 per dollar, yielding ¥10,500,000. To close the carry trade, the investor repays the original loan of ¥10,000,000 plus 0.40% interest, totaling ¥10,040,000. After settling the loan, the investor is left with a profit of ¥460,000.

This strategy is lucrative in the sense that the returns from the higher-yield investments generally surpass the cost of borrowing in yen, even after accounting for the most significant risk, like exchange rate fluctuations, which is in the case if the yen appreciates against the dollar during the investment period, potentially erasing any gains that the investor makes from the interest rate differentials.

The widespread execution of this strategy in international markets has exerted significant downward pressure on the yen. As large volumes of yen are exchanged for other currencies, the yen depreciates, leading to substantial capital outflows from Japan. This continuous selling of yen not only weakens the currency but also amplifies the outflow of capital, further exacerbating the yen’s depreciation [5].

2.3. Japan’s Monetary Policy

In addition, the BoJ has implemented several expansionary measures to combat deflation and stimulate economic growth, including quantitative easing (QE) and negative interest rates. QE involves large-scale purchases of government bonds and other financial assets, increasing the money supply and exerting inflationary pressure on the yen. Negative interest rates, introduced to encourage lending and investment, further reduce the attractiveness of yen-denominated investments and contribute to the currency's depreciation. Overall, the combined effects of QE and negative interest rates are designed to increase inflationary pressures in Japan, which has struggled with deflation for years.

While these expansionary monetary policies, such as quantitative easing and negative interest rates, have certainly contributed to inflationary pressures on the yen, they do not fully explain the recent and pronounced depreciation [6]. These policies have been in place for several years, meaning their effects on the yen have already been largely priced into the market. The recent depreciation is more directly attributable to other factors, such as the widening interest rate differential between Japan and other major economies, particularly the United States. As global investors seek higher returns in U.S. markets, the yen is increasingly sold off, leading to substantial capital outflows from Japan and exacerbating the yen’s decline. Therefore, while Japan’s monetary policies set the stage, the current downward trend of the yen is driven more by external forces and market dynamics that have intensified in recent years.

3. Exiting Deflation: Increased Import Costs and Inflation

3.1. Impact on Prices

A key merit of yen depreciation is that it aids Japan’s escape from its prolonged period of deflation. For years, deflation has plagued the Japanese economy, leading to a cycle of falling prices, reduced consumer spending, and lowered levels of investment. The depreciation of the yen plays a crucial role in reversing this trend by making imports more expensive. As the value of the yen declines, more yen is required to purchase the same amount of goods from abroad, thereby increasing the overall cost of imports.

Rising import costs are particularly significant in a country like Japan, which relies heavily on imported raw materials, energy, and food. For example, the price of imported oil and natural gas surges with a weaker yen, leading to higher energy costs. This, in turn, raises the cost of production for various industries that depend on energy, and these increased costs are often passed on to consumers in the form of higher prices for goods and services.

This relationship is evident in the correlation between Japan’s import prices and CPI, as the online database Trading Economics depicts. Following its economic data, as the yen began to depreciate more significantly beginning in 2021, import prices started to climb sharply. The increase in import prices is a key driver of the broader rise in Japan’s CPI, reflecting how these higher costs are being passed through to consumers. The economic data shows a clear upward trend in import prices from 86.3 points in January 2021 to 189 points by October 2022, the highest level in a decade. Correspondingly, the CPI also began to rise in early 2021, underscoring the tight correlation between the two indicators [7, 8].

This correlation highlights how sensitive Japan's CPI is to changes in import prices, given the country's dependency on imported raw materials and goods. The rise in the CPI directly mirrors these increases in import prices, illustrating the pass-through effect where higher costs for imported goods lead to higher consumer prices.

3.2. Consumer Behavior

As prices rise, consumer behavior typically shifts in response to the anticipated increase in costs. When consumers expect prices to continue climbing, they are more likely to accelerate their purchases to avoid paying higher prices in the future. This urgency to spend can fuel consumer demand in the short term. Moreover, as prices increase, consumers inevitably spend more on the same goods and services, which can significantly impact their cost of living. For instance, when the price of essential items like food rises, households must allocate a larger portion of their income to cover these basic needs. This reallocation often leaves less money available for discretionary spending or savings, potentially leading to a reduced savings rate.

The World Bank Group reported that Japan’s gross domestic savings rate fell from 25.2% in 2021 to 22.8% in 2022. This decline reflects how inflation and low interest rates can prompt consumers to prioritize immediate spending and investment over saving, further influencing economic dynamics [9].

4. Enhancing International Competitiveness: Boosting Exports

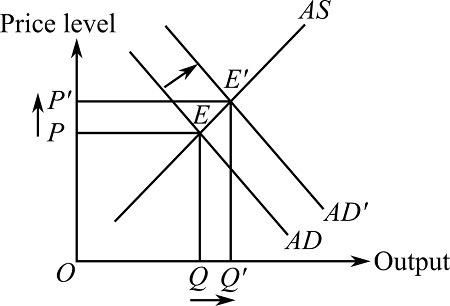

Yen depreciation plays a critical role in stimulating Japan's economy, particularly through its impact on exports. According to the Aggregate Demand-Aggregate Supply (AD-AS) model, a weaker yen can boost aggregate demand (AD) by increasing net exports (NX), which, in turn, influences both the overall output and the price level in the economy.

When the yen depreciates, Japanese goods and services become cheaper for foreign buyers, leading to an increase in exports. Simultaneously, imports become more expensive for domestic consumers, prompting a decrease in import volumes. As shown in Figure 1, the net effect is an increase in net exports (NX), which directly contributes to higher aggregate demand (AD).

Figure 1: Impact of Shifts in Aggregate Demand and Supply on Price Level and Output

This increase in aggregate demand has several significant effects:

Increase in Total Output: As demand for Japanese goods and services increases, both domestically and internationally, firms respond by boosting production, which leads to a rise in total output. This expansion shifts the economy to a new equilibrium with a higher output level, as illustrated by a rightward shift of the Aggregate Demand (AD) curve in the AD-AS model.

Increase in Price Level: Concurrently, the heightened demand exerts upward pressure on prices. As firms compete for resources and expand operations, the increased demand for inputs drives up costs, which are passed on to consumers in the form of higher prices. Consequently, this results in an overall increase in the price level within the economy.

In the short term, the combination of increased output and higher prices reflects a temporary boost in economic activity. The rightward shift in the AD curve signifies that aggregate demand has risen across all price levels, leading to both higher production and inflation.

However, in the long term, the economy is likely to return to its potential output, which is determined by factors such as labor force size, capital stock, and technology. While output returns to its natural rate, the higher price level persists, reflecting the inflationary impact of increased demand. Thus, yen depreciation serves as a powerful tool for stimulating short-term aggregate demand, raising output and prices in the near term while also leading to a higher price level in the long run.

As indicated by the export data from the Ministry of Finance, Japanese exports reached a record high in 2022, driven by a weaker yen, which made Japanese products more attractive, and strong overseas demand post-COVID-19 recovery. The consistent upward trend in export values aligns with periods of yen depreciation, where Japanese goods became more competitively priced in global markets, thereby boosting demand. The data highlights the significant impact of yen depreciation on increasing Japan’s export volumes [10].

5. Attracting Foreign Investment: Cheaper Yen-Denominated Assets

When the value of the Japanese yen decreases relative to other currencies, yen-denominated assets—such as stocks, bonds, and real estate—become more affordable for investors using stronger foreign currencies. This devaluation allows investors from countries with stronger currencies to acquire more Japanese assets for the same amount of money, making Japan an attractive destination for foreign investment.

To illustrate the impact of yen depreciation using real data, consider the exchange rate changes over recent years. For example, in 2022, the Japanese Yen significantly weakened against the U.S. Dollar, moving from approximately 115 JPY per USD in early 2022 to around 150 JPY per USD by October 2022. Consequently, a Japanese stock priced at 15,000 JPY would decrease in cost for a foreign investor from about 130.43 USD to 100 USD. This reduction in asset prices due to yen depreciation can attract more foreign investors to Japan [11].

The World Bank data on Foreign Direct Investment (FDI) in Japan supports this relationship. In 2022, FDI inflows into Japan reached approximately $32.53 billion USD, marking a significant increase compared to previous years. This represents a 68.6% year-on-year increase, which aligns with the yen depreciation during that period. The significant rise in FDI underscores how a weaker yen made Japanese assets more attractive to foreign investors, resulting in a substantial influx of capital into the country [12].

The increase in FDI brings multiple benefits to Japan’s economy. It boosts competition in the domestic market, spurs economic growth by injecting capital, creates jobs, and enhances productivity. Furthermore, foreign investment can drive technological advancements by boosting innovation and efficiency, ultimately contributing to long-term financial market stability and economic sustainability.

Additionally, a weaker yen often positively impacts the stock prices of Japanese companies, especially those that are export oriented. As Japanese products become more competitive internationally, profits from overseas operations, when converted back to yen, increase. This dynamic is further reflected in the rising stock market capitalization relative to GDP, suggesting that the Japanese stock market is gaining strength and playing an increasingly significant role in the economy.

6. Conclusion

The depreciation of the yen has had multifaceted effects on Japan's economy, creating both opportunities and challenges. While the weaker yen has provided a significant boost to Japan's export sector and made Japanese assets more attractive to foreign investors, it has also led to higher import costs and inflationary pressures that directly impact consumers. The interplay between these factors highlights the complex nature of yen depreciation, where benefits in terms of enhanced international competitiveness and increased foreign investment are counterbalanced by the risks of rising consumer prices and altered savings behavior.

Moving forward, Japan's policymakers must carefully navigate these dynamics to maintain economic stability. Strategic measures may include continuing to stimulate exports while implementing targeted interventions to mitigate the inflationary impact on consumers. By striking a balance between these forces, Japan can leverage the benefits of yen depreciation while safeguarding against its potential downsides, thereby ensuring sustained economic growth and financial stability in the long term.

References

[1]. Aizenman, J., & Ito, H. (2013). Trilemma policy convergence patterns and output volatility. Journal of International Money and Finance, 35, 31-54. https://doi.org/10.1016/j.jimonfin.2013.01.006

[2]. Shioji, E. (2015). Time varying pass-through: Will the yen depreciation help Japan hit the inflation target? Journal of the Japanese and International Economies, 37, 43-58. https://doi.org/10.1016/j.jjie.2015.06.001

[3]. McKinnon, R., & Schnabl, G. (2003). Synchronised business cycles in East Asia and fluctuations in the yen/dollar exchange rate. World Economy, 26(8), 1067-1088.

[4]. Yokokawa, N. (2023). Re-emergence of Asia and the rise and fall of the Japanese economy in super long waves of capitalist world systems. In Japan’s Secular Stagnation and Beyond (pp. 125-158). Routledge.

[5]. Ito, T., & Mishkin, F. S. (2021). Unwinding the Japanese Yen Carry Trade: Domestic and International Consequences. Journal of International Money and Finance, 110, 102292. https://doi.org/10.1016/j.jimf.2020.102292

[6]. The effectiveness of the negative interest rate policy in Japan: An early assessment. Journal of the Japanese and International Economies, 52, 142-153. https://doi.org/10.1016/j.jjie.2019.01.001

[7]. Trading Economics. (2023). Japan import prices. Retrieved August 19, 2024, from https://tradingeconomics.com/japan/import-prices

[8]. Trading Economics. (2022). Japan consumer price index (CPI). Retrieved August 19, 2024, from https://tradingeconomics.com/japan/consumer-price-index-cpi

[9]. Yoshikawa, H. (1990). On the equilibrium yen-dollar rate. The American Economic Review, 80(3), 576-583.

[10]. Ibrahim, M. H. (2007). The Yen‐Dollar Exchange Rate And Malaysian Macroeconomic Dynamics. The developing economies, 45(3), 315-338.

[11]. Frankel, J. A., & Froot, K. A. (1987). Short-term and long-term expectations of the yen/dollar exchange rate: evidence from survey data. Journal of the Japanese and International Economies, 1(3), 249-274.

[12]. World Bank. (2024). Foreign direct investment, net inflows (BoP, current US$) - Japan. Retrieved August 19, 2024, from https://data.worldbank.org/indicator/BN.KLT.DINV.CD?locations=JP

Cite this article

Tang,J. (2024). An Analysis of Yen Depreciation on Japan’s Economy. Advances in Economics, Management and Political Sciences,137,39-44.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Aizenman, J., & Ito, H. (2013). Trilemma policy convergence patterns and output volatility. Journal of International Money and Finance, 35, 31-54. https://doi.org/10.1016/j.jimonfin.2013.01.006

[2]. Shioji, E. (2015). Time varying pass-through: Will the yen depreciation help Japan hit the inflation target? Journal of the Japanese and International Economies, 37, 43-58. https://doi.org/10.1016/j.jjie.2015.06.001

[3]. McKinnon, R., & Schnabl, G. (2003). Synchronised business cycles in East Asia and fluctuations in the yen/dollar exchange rate. World Economy, 26(8), 1067-1088.

[4]. Yokokawa, N. (2023). Re-emergence of Asia and the rise and fall of the Japanese economy in super long waves of capitalist world systems. In Japan’s Secular Stagnation and Beyond (pp. 125-158). Routledge.

[5]. Ito, T., & Mishkin, F. S. (2021). Unwinding the Japanese Yen Carry Trade: Domestic and International Consequences. Journal of International Money and Finance, 110, 102292. https://doi.org/10.1016/j.jimf.2020.102292

[6]. The effectiveness of the negative interest rate policy in Japan: An early assessment. Journal of the Japanese and International Economies, 52, 142-153. https://doi.org/10.1016/j.jjie.2019.01.001

[7]. Trading Economics. (2023). Japan import prices. Retrieved August 19, 2024, from https://tradingeconomics.com/japan/import-prices

[8]. Trading Economics. (2022). Japan consumer price index (CPI). Retrieved August 19, 2024, from https://tradingeconomics.com/japan/consumer-price-index-cpi

[9]. Yoshikawa, H. (1990). On the equilibrium yen-dollar rate. The American Economic Review, 80(3), 576-583.

[10]. Ibrahim, M. H. (2007). The Yen‐Dollar Exchange Rate And Malaysian Macroeconomic Dynamics. The developing economies, 45(3), 315-338.

[11]. Frankel, J. A., & Froot, K. A. (1987). Short-term and long-term expectations of the yen/dollar exchange rate: evidence from survey data. Journal of the Japanese and International Economies, 1(3), 249-274.

[12]. World Bank. (2024). Foreign direct investment, net inflows (BoP, current US$) - Japan. Retrieved August 19, 2024, from https://data.worldbank.org/indicator/BN.KLT.DINV.CD?locations=JP