1. Introduction

Financial crisis has the characteristics of concealment, universality, contagiousness, and explosiveness [1]. The outbreak of the financial crisis represents the multiple shortcomings of the current economic, political, and social systems. Observing the causes, courses, and solutions to the financial crisis from an observer's perspective will be more comprehensive, thereby help with summarizing experience and drawing lessons. This holds considerable importance for the future development of the global economy. The world has already experienced numerous financial crises. Each event had different scope, and had varying degrees of impact. Identifying the aspects that scholars have focused on during these crises can provide valuable reference points for analyzing the Asian financial crisis.

In 20th century, capitalist world faced the most serious crisis – The Great Depression of 1929 to 1933. Academics have focused on the huge impact of the crisis. Stock prices fell; the economic system collapsed; international trade dropped to 60%; and more than 30 million people were unemployed worldwide. Out of this crisis was born Keynesianism. In the 1970s, there were two serious oil shocks. In response to these two events, scholars analyzed the impact of these two oil crises on other industries. The oil crisis caused the stock index of various industries to drop sharply across the country. Unemployment and inflation were also stubbornly high. In addition, scholars also discuss the emergence of neoliberalism [2]. In 1987, the world experienced an across-the-board fall in stock prices. Scholars called this event as The Black Monday. The event first happened in Asia Pacific, then in Europe and the US. Scholars have analyzed the causes of this incident. Some people believe that The Black Monday in 1987 was caused by Program Trading. Others say it was caused by Portfolio Insurance. They also discussed how regulators and governments should respond when similar stock market crashes occur [3].

In 2007, the United States experienced a subprime mortgage crisis, which subsequently triggered the Global Financial Crisis of 2008. During this event, scholars focus on analyzing the economic conditions in the United States prior to the subprime crisis. They examine the causes of the global economic downturn and develop strategies to address such crises. Countries also formulated different policies and measures in the financial industry and the real economy [1]. Among the many economic crises, the Asian financial crisis that occurred in 1997 was particularly striking. This event had a huge impact and reflected the inherent systemic of Asian countries. Therefore, understanding this financial crisis and draw lessons from the event can prevent similar events from happening in the future.

This article offers a general retrospection and introspection of Thailand’s circumstances during the 1997 Asian financial crisis. First, the article analyses the economic impact on Thailand. Then, the article introduces the measures that Thailand used in this event. In order to prevent such event from happening again, governments should strengthen the financial regulatory systems and plan ahead for possible future situations.

2. Overview of 1997 Asian Financial Crisis

Thailand was the first country to suffer from the crisis. On July 2, 1997, the Thai government announced the adoption of a floating exchange rate system for the Thai baht. Subsequently, the baht depreciated by 15% to 20% in the Bangkok foreign exchange market. Then the currencies of other countries began to fall sharply. Between July 1, 1997 and February 18, 1998, there was a depreciation of 74% for the Indonesian rupiah, 43% for the Thai baht, 33% for the Malaysian ringgit, and 13% for the Philippine peso. In addition, both Korean won and Japanese yen experienced depreciation as well [4]. The depreciation of currencies, combined with the collapse of stock markets, severely impacted people's livelihoods. According to estimates from the World Bank, these events ultimately led to social unrest and political crises, pushing over 100 million middle-class individuals in Asia below the poverty line. The Asian financial markets were in a precarious state during July and August. By September, the markets appeared to be gradually stabilizing. Unfortunately, this nascent recovery was disrupted by a speculative sell-off on September 17. This event directly led to the devaluation of currencies across Southeast Asia. Subsequently, significant currency depreciations were observed in other areas in the Southeastern Asia, with stock markets suffering substantial damages [5].

The 1997 financial crisis caused significant damage to the Asian region. In the aftermath of this crisis, these regions devoted considerable effort to recover. Learning from this severe lesson, emerging Asian countries implemented a series of reforms. These reforms included substantially increasing foreign exchange reserves, strengthening financial management systems and banking systems, and enhancing self-insurance capabilities [6]. Additionally, regional cooperation was bolstered, including the establishment of an East Asian foreign exchange reserve pool.

3. Impact of 1997 Financial Crisis on the Thai Economy

3.1. Thai Economy before 1997

As the first country being affected, analyzing Thailand's situation greatly aids with understanding the formation of the 1997 Asian financial crisis. Before the 1997 financial crisis, Thailand spent considerable time developing its globalized economy. To align its foreign exchange system with the globalization of its economic and financial systems and the increasing international mobility of capital, Thailand implemented three rounds of foreign exchange liberalization.

In May 1990, the Thai government decided that commercial banks could approve foreign exchange transactions related to trade activities without the approval of the Bank of Thailand. Additionally, the Thai government expanded the limits for purchasing foreign currency, making transfers and currency exchanges for tourism more convenient. At the same time, the government allowed commercial banks to remit funds for debt repayment, stock sales, or liquidation within certain limits. In April 1991, Thailand no longer restricted capital transactions. Non-Thai residents could open and hold foreign exchange accounts at authorized banks in Thailand for funds originated from abroad. Exporters could accept payments in Thai baht from non-resident baht accounts without requiring approval from the central bank and could use their export earnings to repay foreign debts. In February 1994, the restrictions on residents transferring direct investments abroad were relaxed, and limits on carrying cash to Thailand's neighboring countries, including Vietnam, were raised. The government removed restrictions on travel expenses and allowed residents to use foreign exchange earnings from abroad to make their payments.

The relaxation of foreign exchange controls aimed to achieve two main objectives. First, it sought to allow market forces to play a more active role. Second, it encouraged greater use of the Thai baht in regional trade. Foreigners were permitted to hold and operate non-resident baht accounts to facilitate international trade and investment. Thailand was among the earlier countries to ease regulations on capital financial accounts. The inflow of foreign debt fueled the expansion of domestic credit in Thailand, which, in turn, spurred an investment boom. Between 1994 and 1996, Thailand's already high investment rate exceeded 40%. Like most countries in the world, Thailand borrowed foreign currencies. Therefore, debt repayment ultimately had to come from current account surpluses [7].

3.2. Economic Impact

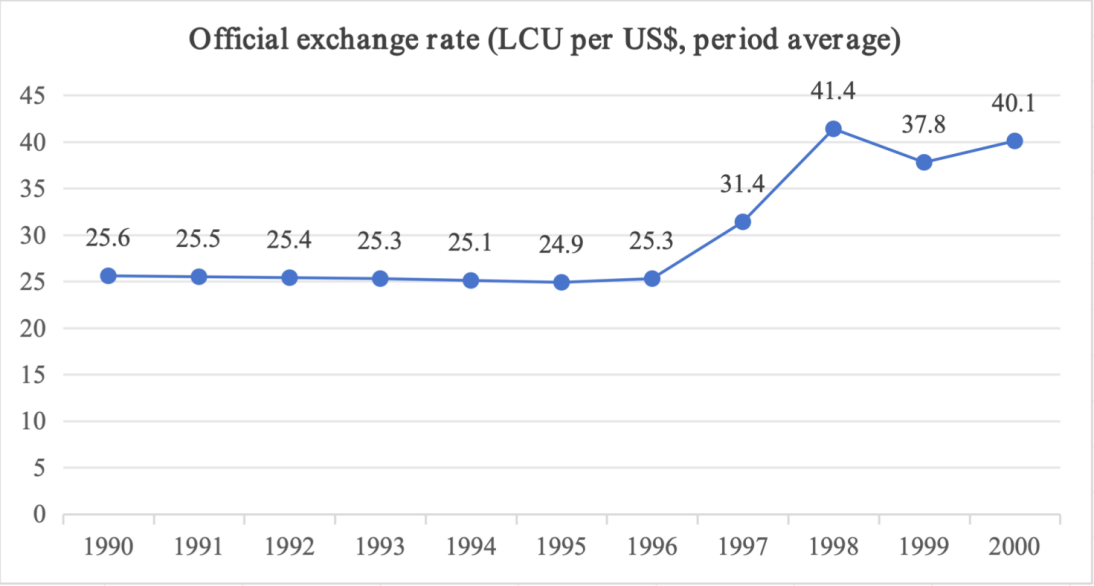

However, Thailand ran current account deficits in 19 out of the 20 years before the crisis. Thailand's exchange rate system made almost no adjustments and had many flaws, making it a particularly vulnerable target for international speculative capital. In July 1997, under the attack of hot money, the Thai baht plunged [8].

Figure 1: Exchange rate from 1990 to 2000 (Data Source: World Bank).

As can be seen from Figure 1, Thailand maintained a relatively stable exchange rate between its currency and the US dollar before 1996. However, after 1996, the Thai baht depreciated significantly. The direct effect of currency depreciation was the economic recession. First of all, since 1996, Thailand's Gross Domestic Product (GDP) had dropped rapidly, from 183 billion in 1996 to 114 billion in 1998. According to data from the World Bank, Thailand's GDP grew at an annual rate of 5.65% in 1996. However, by 1997, GDP growth had turned negative, and the annual GDP growth rate fell sharply to -2.8%, and reached a low of -7.6% in 1998.

Before the crisis, with the steady growth in Thailand's GDP until 1996, many people were lifted out of poverty every year. However, in the two years after 1996, the absolute number of people living in extreme poverty increased from 6.8 million to 7.9 million. Obviously, the economic contraction brought on by the 1997 Asian financial crisis had undone Thailand's efforts to reduce poverty in previous years, leading to an increased poverty incidence [9].

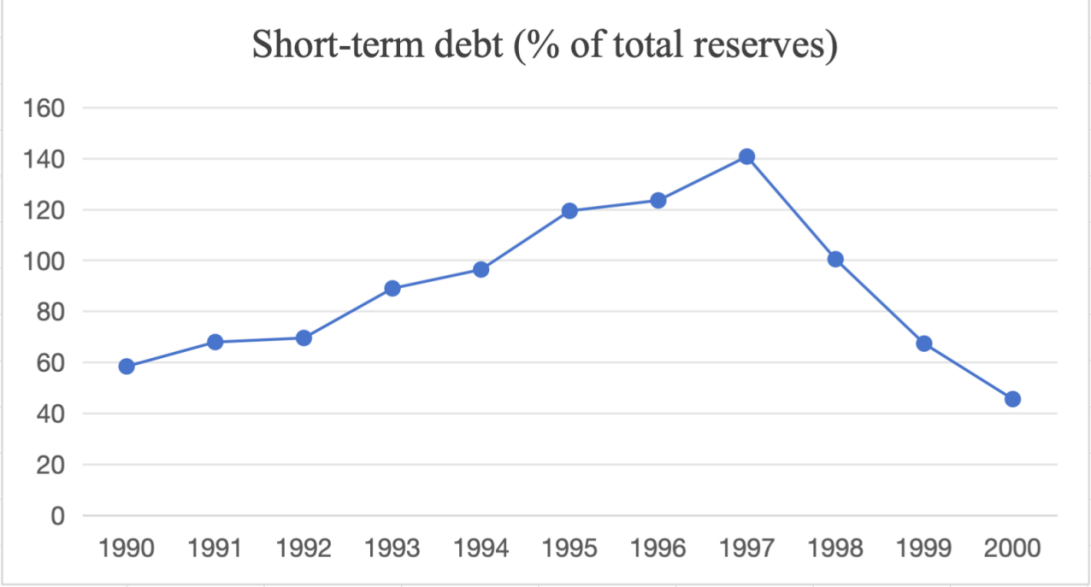

Figure 2: Short-term debt from 1990 to 2000 (Data Source: World Bank).

In order to compensate for the impact of the financial crisis, Thailand opened its capital account and made heavy use of short-term capital financing to fill the foreign trade deficit and funding gap. From Figure 2, by 1997, Thailand's short-term external debt had reached 140.67% of its total foreign exchange reserves. Nevertheless, such a strategy obviously had big flaws. The International Monetary Fund (IMF) raised questions, noting that the crisis showed the risks of opening the capital account before ensuring the soundness of the domestic financial system, and that opening short-term capital flows before opening long-term capital flows would increase vulnerability [4]. With the devaluation of the currency, the economy collapsed, capital outflew on a large scale, and a large number of enterprises went bankrupt.

From 1997 to 1998, Thailand experienced rapid growth in inflation, soaring from 5.63% to 7.99%. However, by 1999, the inflation rate had fallen rapidly to 0.28%, and there was deflation. By this time, Thailand was already experiencing hyperinflation. At this time, the growth of the inflation rate would be accompanied by the rapid growth of the unemployment rate. Between 1997 and 1998, Thailand's unemployment rate increased from 0.87% to 3.4%. Thailand's agriculture was highly developed and was an important source of income for the country. As a result, employment in rural areas had received a greater impact than in cities, with employment levels dropped by 3.2% by August 1998 compared to a decrease of 2.6% in urban areas. It was not just Thailand, but also other parts of the Southeastern Asia that have experienced severe and widespread unemployment. The World Bank estimates that more than 100 million people in Asia's middle class had fallen back into poverty [10].

3.3. Countermeasures

To address the difficulties faced by Thailand, the IMF required Thailand to implement an austerity plan. According to this plan, Thailand needed to cut part of its budget and halt subsidies to state-owned enterprises. Additionally, Thailand began to implement a tight monetary policy and continued to follow a "managed floating" exchange rate system. Thailand also ceased printing money to resolve funding problems for local companies. Subsequently, Thailand further reformed its economic structure. On December 8, 1997, among the 58 financial companies that had declared closure, 56 were required to shut down permanently. In 1998, Thailand amended its banking laws. With the assistance of the IMF, Thailand raised $17.2 billion in standby credit. This money could be used to address a series of social issues arising from the austerity plan [11].

4. Lessons Learned and Suggestions

The root cause of the Asian financial crisis in 1997 was the mistake in monetary policy. The foreign exchange policy adopted by the Southeast Asian countries was the free foreign exchange speculation under the fixed exchange rate. Under the deliberate attack of the external speculative capital, the countries would fall into the economic crisis. The Global Financial Crisis in 2008 occurred because of the cross-risk transmission caused by credit policies. However, both financial crises showed that mistakes in macroeconomic policy and flaws in the economic development model can lead to serious results [1, 12].

The description above shows how a massive financial crisis has had a profound impact on the society. Valuable lessons learned from the 1997 Asian financial crisis can effectively help prevent such an event from happening again. Since the 1980s, Thailand's economy entered an era of rapid development. However, due to Thailand's unhealthy economic development model, once the economy was contracted, corporate profits would be significantly reduced, the external debt repayment ability would inevitably decline, and the problems would become more severe. As a result, when faced with a financial crisis, its economy would collapse immediately. In addition, inadequate regulation of the financial sector was another important factor in this situation. Both banks and financial institutions lacked strong regulatory systems. Many entities borrowed large amounts of foreign debt that the company could not repay, which was a problem that perpetuated a never-ending cycle [12].

Moreover, it is necessary to understand ways to prevent future crises. Planning ahead for possible future situations is the key. It is crucial to accurately assess the current economic situation beyond just looking at how well things are going right now and predict what might happen in the future economically. During the economic boom in the late 20th century, many Asian countries depended heavily on opening up their economies and getting investments from other countries for growth support. Nevertheless, this approach made their financial systems very weak when there was a crisis. Therefore, keeping an eye on economic conditions before any crisis might happen is essential along with making timely changes aimed at strengthening the economy.

5. Conclusion

In the 1980s, Asian countries experienced rapid economic growth and prosperity. During this period, economic globalization advanced swiftly, with many Asian nations embarking on financial liberalization reforms. However, the Asian financial crisis of 1997 exposed significant flaws in both the economic and political structures of these countries. This article first reviews the course of the Asian financial crisis and then analyzes the measures Thailand implemented to develop its economy prior to the crisis. Before 1997, Thailand undertook three rounds of currency liberalization. However, Thailand's flawed exchange rate system became the best target for international hot money attacks. The 1997 crisis severely impacted Thailand, causing a dramatic fall in the value of the baht and GDP, alongside a substantial rise in domestic unemployment. In fact, the crisis extended beyond Thailand, plunging a large number of middle-class families throughout East Asia into poverty. To address the crisis, the IMF required Thailand to implement austerity measures. Ultimately, the financial crisis was resolved by 1999. This event underscores the importance of devising suitable economic development models and establishing effective financial system regulation for a nation's development. Furthermore, it is crucial for governments to conduct timely assessments of their economic conditions and take preventive measures against potential future crises. Analyzing the 1997 Asian financial crisis can provide valuable insights for financial system reforms and policy formulation. It also offers guidance for implementing timely responses and appropriate policies in the event of similar occurrences in the future, thereby minimizing losses.

This article offers a general summary and reflection on Thailand's performance during the 1997 Asian financial crisis, but it has certain shortcomings that need to be addressed. Firstly, since the 20th century, there have been numerous financial crises worldwide. To conduct a thorough analysis of the 1997 Asian financial crisis, it is essential to compare it with other financial crises. Although the article mentions other financial crises at the beginning, it does not provide a detailed comparison. Secondly, while the article uses various economic indicators to describe the impact on Thailand's economy during the crisis, the analysis is not comprehensive. As an agricultural export country, Thailand's trade activities have not been adequately examined. Recognizing these deficiencies, future research on the Asian financial crisis should aim for a more holistic analysis of the impact on each affected country. Future analysis should encompass not only economic indicators but also aspects such as livelihoods and cultural effects.

References

[1]. Shen, H. (2024) A comparative analysis of Asian financial crisis and American subprime crisis. Economics (07), 90-93.

[2]. Wang, M. (2023) Research on the Three Great Crises of Capitalism and the Three Evolution of Liberalism since the 20th Century. Inner Mongolia Normal University, Master's thesis.

[3]. Chen, S. (2015) How Black Monday was Saved in 1987. Wen Wei Po, T02, 1-3.

[4]. Zhang, L. and Zhang, J. (2022). Review and Reflection on Asian Financial Crisis. China Economic Times, 001, 1-4.

[5]. Deng, W. (2021) A Bird 's-eye View of the Asian Financial Crisis. China Economic Review, (08), 72-77.

[6]. Chen, J. (2019) Implications of Asian Financial Crisis on capital account convertibility in China. Regional Finance Research (10), 55-61.

[7]. Vajragupta, Y. and Vichyanond, P. (2001) Thailand’s financial evolution and the 1997 crisis. In Finance, Governance and Economic Performance in Pacific and South East Asia. Edward Elgar Publishing Limited, 155-193.

[8]. Yin, J. (2022) The 25th anniversary of the Asian Financial Crisis: Retrospect and Reflection. China Foreign Exchange (18), 8-13.

[9]. Warr, P. (2009) Thailand’s Crisis Overload. Southeast Asian Affairs, 2009(1), 334–354.

[10]. Knowles, J. C., Pernia, E. M. and Racelis, M. (1999) Social consequences of the financial crisis in Asia. Asian Development Bank, Economic Staff Paper Series, No. 60.

[11]. Lauridsen, L. S. (1998) The financial crisis in Thailand: causes, conduct and consequences?. World development, 26(8), 1575-1591.

[12]. Guan, T., Lian, P., Pan, H., Zhao, Q. and Tu, Y. (2022) Asian financial crisis of "danger" and "machine". China's foreign exchange (18), 14 to 25.

Cite this article

Wang,H. (2024). Thailand During the Asian Financial Crisis: Retrospection and Introspection. Advances in Economics, Management and Political Sciences,141,123-129.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance's Role in the Just Transition

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shen, H. (2024) A comparative analysis of Asian financial crisis and American subprime crisis. Economics (07), 90-93.

[2]. Wang, M. (2023) Research on the Three Great Crises of Capitalism and the Three Evolution of Liberalism since the 20th Century. Inner Mongolia Normal University, Master's thesis.

[3]. Chen, S. (2015) How Black Monday was Saved in 1987. Wen Wei Po, T02, 1-3.

[4]. Zhang, L. and Zhang, J. (2022). Review and Reflection on Asian Financial Crisis. China Economic Times, 001, 1-4.

[5]. Deng, W. (2021) A Bird 's-eye View of the Asian Financial Crisis. China Economic Review, (08), 72-77.

[6]. Chen, J. (2019) Implications of Asian Financial Crisis on capital account convertibility in China. Regional Finance Research (10), 55-61.

[7]. Vajragupta, Y. and Vichyanond, P. (2001) Thailand’s financial evolution and the 1997 crisis. In Finance, Governance and Economic Performance in Pacific and South East Asia. Edward Elgar Publishing Limited, 155-193.

[8]. Yin, J. (2022) The 25th anniversary of the Asian Financial Crisis: Retrospect and Reflection. China Foreign Exchange (18), 8-13.

[9]. Warr, P. (2009) Thailand’s Crisis Overload. Southeast Asian Affairs, 2009(1), 334–354.

[10]. Knowles, J. C., Pernia, E. M. and Racelis, M. (1999) Social consequences of the financial crisis in Asia. Asian Development Bank, Economic Staff Paper Series, No. 60.

[11]. Lauridsen, L. S. (1998) The financial crisis in Thailand: causes, conduct and consequences?. World development, 26(8), 1575-1591.

[12]. Guan, T., Lian, P., Pan, H., Zhao, Q. and Tu, Y. (2022) Asian financial crisis of "danger" and "machine". China's foreign exchange (18), 14 to 25.