1. Introduction

Artificial Intelligence (AI) and Machine Learning (ML) have become the major powers of the future in the fields of quantitative finance, financial technology (Fintech) and stock market forecasting. These technologies have revolutionized the way data is analyzed in the financial industry. There have been dramatic changes in risk assessment, management practices and trading strategies. Artificial Intelligence and ML have become an essential tool as the financial industry moves towards data analytics as its primary mode of operation. With these technologies, firms can respond faster to market dynamics, anticipate market trends, and make more informed decisions, ultimately reshaping the financial and investment landscape [1,2].

AI and ML have been widely used in finance, especially quantitative finance and financial can. Researchers have focused on several aspects of risk management, asset pricing, and investment portfolios. Traditional financial models such as econometric models have been the basis of quantitative finance. However, they have limitations in handling large and complex data sets and adapting to rapidly changing markets [3]. To address these challenges, some firms have introduced new models. For example, artificial intelligence algorithms have shown significant results in forecasting and decision making, especially when some uncertainties are present. Studies have shown that ML significantly improves the accuracy and efficiency of financial services, such as credit risk modeling and customer analytics [4,5]. In addition, some techniques of novel AI such as Natural Language Processing (NLP) have been used for stock market forecasting, which offer superior performance compared to traditional analytical models, especially in capturing nonlinear relationships and temporal patterns [6,7].

This study aims to investigate the role of AI and machine learning in quantitative finance, financial technology, and stock market forecasting, with a focus on their practical applications, advantages, and challenges. It provides a comprehensive overview of AI and machine learning applications in these areas, covering key concepts, background, and core principles. The analysis delves into the strengths and limitations of these technologies, examining current approaches and highlighting the potential for future advancements and innovations in the financial sector.

2. Methodology

2.1. Dataset Description and Preprocessing

A substantial amount of data is utilized in the application of AI and ML. This data offers valuable insights, such as customer preferences, transaction records, and market quotes. Some platforms also provide additional information, including stock prices and trading volumes [7]. Analyzing this data enables effective market forecasting and helps mitigate financial risks. This study examines the integration of AI and ML into quantitative finance and fintech, aligned with the research objectives. A financial dataset from Kaggle, which includes historical stock prices, trading volumes, and financial statements from various companies, serves as a foundation for analysis. Sourced from stock exchanges and public trading records, this dataset presents features such as opening and closing prices, highs and lows, and volume, all of which are critical for building predictive models and conducting financial analysis.

2.2. Proposed Approach

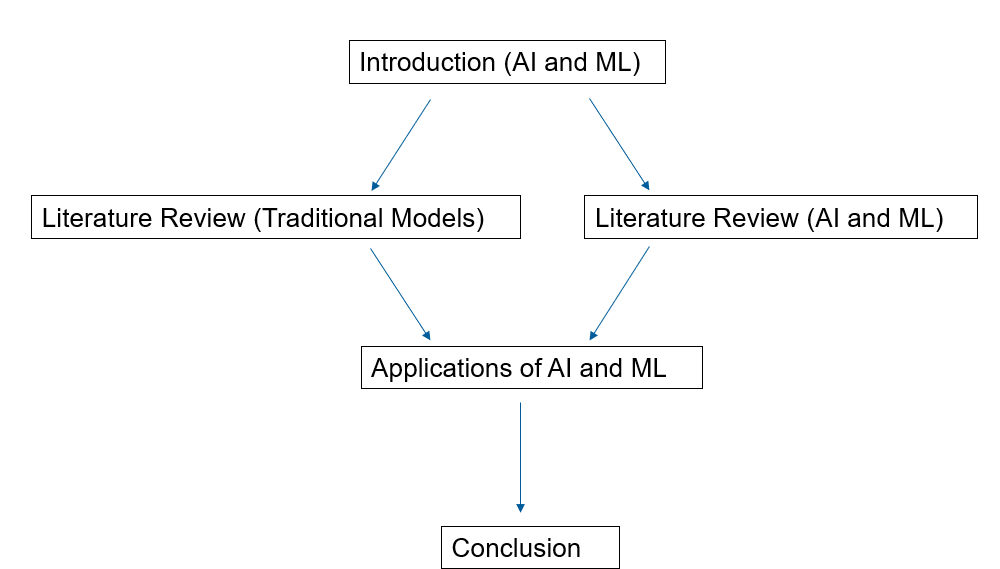

This method was selected for its ability to manage large datasets and effectively capture financial data. The procedure encompasses data collection, preprocessing, model selection, and simulation, followed by outcome analysis and model refinement. Specifically, the linear regression model is employed for predicting continuous values, making it particularly suited for stock price forecasting based on historical data. This model fits a line to the data, capturing the relationship between dependent and independent variables. In this research, models are trained and evaluated using Python libraries such as Scikit-learn and TensorFlow, enabling efficient large-scale implementation. The pipeline is illustrated in Figure 1.

Figure 1: The structure of the study.

2.2.1. Mainstream models and techniques

AI and ML have become integral to modern finance, particularly in areas such as stock market forecasting, risk management, and portfolio optimization. Among the most widely used models in financial applications are Artificial Neural Networks (ANNs), Support Vector Machines (SVMs), and Decision Trees. Each of these models is selected based on its unique ability to process and interpret financial data effectively. For instance, ANNs are highly effective for tasks that involve complex, non-linear relationships between variables, making them particularly suitable for stock price prediction. Their capacity to learn from vast amounts of historical data and uncover intricate patterns makes them invaluable in forecasting future market movements, which are often influenced by numerous interdependent factors. In contrast, Support Vector Machines (SVMs) excel in classification tasks, such as credit risk analysis. By creating clear boundaries between classes, SVMs help financial institutions assess whether a borrower falls into a high- or low-risk category, thereby aiding in risk management decisions.

Decision Trees, on the other hand, are favored for their interpretability and ability to handle both regression and classification tasks. In finance, Decision Trees are commonly employed to build robust trading models. These models help identify key decision points based on market conditions, enabling traders to make informed decisions on buying or selling assets. Additionally, Decision Trees provide clear insights into the reasoning behind each prediction or decision, which is crucial for regulatory compliance and risk assessment in financial settings. In summary, AI and ML models such as ANNs, SVMs, and Decision Trees play a vital role in the financial industry by providing sophisticated tools for predicting stock prices, managing credit risk, and developing trading strategies, each tailored to specific financial tasks and challenges.

2.2.2. Introduction to AI technology

AI is a subfield of computer science focused on creating intelligent systems that exhibit characteristics associated with human intelligence, such as learning, reasoning, and decision-making. At its core, AI refers to systems that can perceive their environment, gather experience, and improve their performance by learning from that experience to achieve specific goals. This involves the development of algorithms and models capable of analyzing data, identifying patterns, and making decisions or predictions based on that data. In the financial industry, AI technologies play a transformative role by applying market data, indicators, and past experience to assess financial conditions, predict market trends, and manage investments. AI systems can analyze vast quantities of data in real-time—data sets far too large for humans to process efficiently—enabling quicker and more informed decision-making. This ability to work with big data allows AI to provide insights into market fluctuations, anticipate future trends, and optimize investment strategies.

Moreover, AI models, such as machine learning algorithms, continuously improve over time by learning from new data, enhancing their predictive accuracy. This is particularly important in finance, where market dynamics change rapidly, and success often hinges on the ability to adapt to evolving conditions. AI's capacity to process diverse data sources, including market sentiment, news reports, and historical price patterns, gives it an edge in predicting stock prices, managing risk, and making trading decisions. In essence, AI is reshaping the financial industry by offering tools that enhance efficiency, reduce human error, and provide predictive insights that would otherwise be unattainable. Whether through algorithmic trading, portfolio management, or risk assessment, AI systems are revolutionizing the way financial institutions operate, making them more adaptive, responsive, and capable of navigating the complexities of global markets.

2.2.3. Introduction to ML technology

ML, a crucial subfield of AI, focuses on creating algorithms that allow computers to learn from experience and improve their performance in dynamic environments. In finance, where vast amounts of data and constantly fluctuating market conditions are the norm, ML methods have become indispensable. These methods enable systems to adapt to changing conditions, enhance predictive accuracy, and make better decisions over time.

ML can be categorized into three primary types: supervised learning, unsupervised learning, and reinforcement learning. Supervised learning involves training models on labeled data, enabling them to make predictions based on known inputs and outputs. In contrast, unsupervised learning is applied to unlabeled data, where the goal is to uncover hidden patterns or structures. Reinforcement learning, another powerful approach, enables systems to make optimal decisions through trial and error, learning from the outcomes of previous actions to improve future performance. Several ML models are widely employed in the financial sector, with SVMs and ANNs being prominent examples. SVMs are commonly used in credit scoring, where they help classify potential borrowers into risk categories. ANNs, on the other hand, are highly effective in stock price prediction and risk analysis, leveraging their ability to process non-linear relationships within large datasets. Decision Trees and Random Forests also play an essential role, providing transparent and interpretable models for tasks such as portfolio management, trading strategies, and risk assessment.

These ML models form the foundation of many AI-driven financial applications that enhance the accuracy of financial forecasts, improve risk management strategies, and support more informed decision-making. By leveraging the power of machine learning, financial institutions can better navigate the complexities of the modern market and respond swiftly to emerging challenges and opportunities.

3. Discussion

3.1. Introduction to The Application of AI technology in Quantitative Finance

AI improves quantitative finance's accuracy, speed, and scope [8]. AI analyses enormous amounts of organized and unstructured data like market prices, economic indicators, news stories, and social media sentiments. Advanced machine learning algorithms anticipate stock prices, assess and manage financial market risks, and choose the best investing methods. HFTs exploit market inefficiencies with millisecond trading using AI. Text mining is applied to analyze financial data and news to determine the mood of the market and possible events in the market. These AI applications in quantitative finance enhance financial processes and reveal patterns and relations that are not easily identifiable by human analysts, leading to more precise and impartial financial decisions.

3.2. Discussion on Current Methods, Future Prospects, and Challenges

The current use of AI and machine learning in quantitative finance has shown the following benefits. These technologies have significantly improved the precision of financial predictions, risk evaluation, and portfolio management. AI systems can analyze and interpret large volumes of data within a short time, which is much faster than human beings, hence real-time market analysis and quick decision-making [9]. This has resulted in better market conditions, enhanced risk control, and recognition of investment prospects that may be challenging to see. In addition, the use of AI in automating many financial processes has made it possible to cut operational costs and eliminate human errors in many repetitive tasks.

As for the future, the combination of AI with other advanced technologies is expected to bring even more benefits to quantitative finance. Integrating AI with blockchain technology could improve the security and efficiency of financial transactions, while quantum computing could significantly boost the computational capacity for financial analysis. There is also increasing concern with using XAI techniques that seek to provide an understanding of how AI makes its decisions. This could solve the problems of regulation and increase the level of trust in the financial systems based on artificial intelligence. Furthermore, advancing reinforcement learning algorithms may result in better and more flexible trading strategies capable of handling more complicated and volatile markets [10].

However, some issues still have to be solved: Data privacy and security are always an issue, and this is even more so when AI systems need to process large amounts of potentially sensitive financial data. Another issue is the problem of non-bias in AI systems, which can only deepen the existing inequalities in the financial sector. The fast rate of technology development also presents some risks for the regulators in that they have to ensure that they allow innovation while at the same time maintaining the integrity of the markets and the consumers. Solving these problems will involve continuous engagement of technologists, financial specialists, and policymakers to guarantee that the application of AI in the financial industry is appropriate and moral. As AI advances, managing the risks that may arise while at the same time leveraging on the benefits that AI has to offer will be vital in the future of quantitative finance and the financial sector in general.

4. Conclusion

This study explores the role of AI and ML in quantitative finance, fintech, and stock market forecasting, emphasizing their applications, strengths, and limitations. The methodology incorporates widely used AI and ML models, such as ANN, SVMs, and Decision Trees, which are particularly effective for tasks like analyzing historical stock price data, predicting stock prices, and classifying credit risk. Datasets from platforms like Kaggle were employed, and the models were debugged and refined using tools such as Scikit-learn and TensorFlow. The findings demonstrate that AI and ML significantly enhance the accuracy of financial forecasting and improve portfolio management strategies. Looking ahead, future research will investigate the integration of AI with emerging technologies such as blockchain and quantum computing, with the aim of further advancing efficiency and innovation within the financial sector.

References

[1]. Joshi, P., & Visvanathan, C. (2019). Sustainable management practices of food waste in Asia: Technological and policy drivers. Journal of Environmental Management, 247, 538–550.

[2]. Herrell, K. (2024). Understanding AI and ML in the real-time economy. Forbes. Retrieved on 2024, Retrieved from: https://www.forbes.com/councils/forbestechcouncil/2024/02/09/understanding-ai-and-ml-in-the-real-time-economy/

[3]. Shiyyab, F. S., Alzoubi, A. B., Obidat, Q. M., & Alshurafat, H. (2023). The impact of artificial intelligence disclosure on financial performance. International Journal of Financial Studies, 11(3), 115.

[4]. Soori, M., Arezoo, B., & Dastres, R. (2023). Artificial intelligence, machine learning, and deep learning in advanced robotics: A review. Cognitive Robotics, 3(1), 54–70.

[5]. Javaid, H. A. (2024). AI-driven predictive analytics in finance: Transforming risk assessment and decision-making. Advances in Computer Sciences, 7(1).

[6]. Heilig, T., & Scheer, I. (2023). Decision intelligence: Transform your team and organization with AI-driven decision-making. John Wiley & Sons.

[7]. Semeraro, F., Griffiths, A., & Cangelosi, A. (2023). Human–robot collaboration and machine learning: A systematic review of recent research. Robotics and Computer-Integrated Manufacturing, 79, 102432.

[8]. Kumar, N., Agarwal, P., Gupta, G., Tiwari, S., & Tripathi, P. (2024). AI-driven financial forecasting: The power of soft computing. In Intelligent optimization techniques for business analytics, 146–170.

[9]. Javaid, H. A. (2024). The future of financial services: Integrating AI for smarter, more efficient operations. MZ Journal of Artificial Intelligence, 1(2).

[10]. Bahoo, S., Cucculelli, M., Goga, X. et al. (2024). Artificial intelligence in Finance: a comprehensive review through bibliometric and content analysis. SN Bus Econ 4, 23.

Cite this article

Zheng,T. (2024). The Role of Artificial Intelligence and Machine Learning in Quantitative Finance and Stock Market Forecasting. Advances in Economics, Management and Political Sciences,135,98-102.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Joshi, P., & Visvanathan, C. (2019). Sustainable management practices of food waste in Asia: Technological and policy drivers. Journal of Environmental Management, 247, 538–550.

[2]. Herrell, K. (2024). Understanding AI and ML in the real-time economy. Forbes. Retrieved on 2024, Retrieved from: https://www.forbes.com/councils/forbestechcouncil/2024/02/09/understanding-ai-and-ml-in-the-real-time-economy/

[3]. Shiyyab, F. S., Alzoubi, A. B., Obidat, Q. M., & Alshurafat, H. (2023). The impact of artificial intelligence disclosure on financial performance. International Journal of Financial Studies, 11(3), 115.

[4]. Soori, M., Arezoo, B., & Dastres, R. (2023). Artificial intelligence, machine learning, and deep learning in advanced robotics: A review. Cognitive Robotics, 3(1), 54–70.

[5]. Javaid, H. A. (2024). AI-driven predictive analytics in finance: Transforming risk assessment and decision-making. Advances in Computer Sciences, 7(1).

[6]. Heilig, T., & Scheer, I. (2023). Decision intelligence: Transform your team and organization with AI-driven decision-making. John Wiley & Sons.

[7]. Semeraro, F., Griffiths, A., & Cangelosi, A. (2023). Human–robot collaboration and machine learning: A systematic review of recent research. Robotics and Computer-Integrated Manufacturing, 79, 102432.

[8]. Kumar, N., Agarwal, P., Gupta, G., Tiwari, S., & Tripathi, P. (2024). AI-driven financial forecasting: The power of soft computing. In Intelligent optimization techniques for business analytics, 146–170.

[9]. Javaid, H. A. (2024). The future of financial services: Integrating AI for smarter, more efficient operations. MZ Journal of Artificial Intelligence, 1(2).

[10]. Bahoo, S., Cucculelli, M., Goga, X. et al. (2024). Artificial intelligence in Finance: a comprehensive review through bibliometric and content analysis. SN Bus Econ 4, 23.