1. Introduction

With the rapid advancement of technology, AI's role and influence in society have become increasingly prominent in recent years. From industrial applications to everyday life, AI has made a profound impact across various sectors, often disrupting traditional industry ecosystems. Notable examples include self-driving vehicles, visual rendering in the film and gaming industries, natural language processing in question-and-answer search engines, and innovative healthcare solutions..

Engineers can use big data, cloud computing, and artificial neural networks to develop computers capable of emulating human intellect through deep learning to achieve such results. These are all strongly tied to data centres and GPUs. Thus, this article will examine the semiconductor industry’s leaders, AMD and NVIDIA, as research subjects, examining their respective tactics in the CPU and GPU industries. The emphasis is on their decision-making in the 1990s, 2000s, and 2010, specifically how management addressed market difficulties and opportunities. At the same time, this study uses the SWOT analysis method to evaluate AMD and NVIDIA’s internal and external environments, focusing on their respective strengths, weaknesses, opportunities, and threats. It also uses event analysis to provide insights into key management decisions over the years, focusing on product architecture, market positioning, and strategic investments.

2. Company Introduction

2.1. AMD

Advanced Micro Devices (AMD), established in 1969 and headquartered in Santa Clara, California, is a prominent entity in the semiconductor industry, specialising in developing high-performance computing and graphics technologies. The company’s diverse product portfolio includes central processing units (CPUs), graphics processing units (GPUs), chipsets, microprocessors, system-on-a-chips (SoCs), motherboard chipsets, field programmable gate arrays (FPGAs), network interface controllers, embedded processors, solid-state drives, drivers, and TV accessories. In 2023, AMD reported a revenue of $22.68 billion and a market capitalisation of $250.81 billion. The company has established itself as a formidable competitor to Intel in the CPU sector and NVIDIA in the GPU market, driven by its innovative architectures, such as Zen for CPUs and RDNA for GPUs, serving a broad range of markets, including personal computing, gaming consoles, and data centres.

2.2. NVIDIA

NVIDIA, founded in 1993 and headquartered in Santa Clara, California, is a global leader in GPU technology and a key player in AI-driven industries. The company is renowned for its GeForce GPUs and has expanded its expertise into artificial intelligence, deep learning, and autonomous vehicles. NVIDIA’s diverse product portfolio includes graphics processing units (GPUs), central processing units (CPUs), chipsets, drivers, collaborative software, tablet computers, TV accessories, laptop GPU chips, and data processing units. In FY 2024, NVIDIA reported a revenue of $31.82 billion and a market capitalisation of $60.92 billion. NVIDIA holds a dominant position in the GPU market, consistently outperforming competitors through technological innovations and superior performance. The company has expanded its portfolio beyond gaming, becoming a leader in AI, data centers, and autonomous vehicle technologies. This diversification has further reinforced its standing as a key player in the semiconductor industry.

3. Analyse Method

3.1. SWOT Analysis

SWOT analysis is a strategic tool used to evaluate a company's internal and external environment. By identifying internal factors such as Strengths (S) and Weaknesses (W), alongside external factors like Opportunities (O) and Threats (T), the analysis helps businesses develop strategies that capitalize on their strengths, mitigate weaknesses, seize opportunities, and navigate potential challenges [1].

3.1.1. Strengths

Strengths refer to internal factors that provide an organization with a competitive edge. These can include core capabilities, valuable resources, strong market positioning, and a well-established brand reputation. Identifying and leveraging these strengths enables a company to address areas that need improvement and maximize its potential. Key questions to consider include: What are our strongest assets? What makes us stand out from competitors? What are our unique selling points? Example: A company’s exceptional customer service with a high Net Promoter Score (NPS) provides a distinct competitive edge [1].

3.1.2. Weaknesses

Weaknesses are internal elements that hinder an organization’s success. These may involve inefficient processes, outdated technology, limited resources, or low employee morale. By identifying these weaknesses, companies can pinpoint areas for improvement and reduce risks. Key questions to consider include: Where do we fall short compared to competitors? What factors contribute to customer dissatisfaction? An example of a weakness might be limited e-commerce presence due to a low marketing budget [1].

3.1.3. Opportunities

Opportunities are external variables that can assist a company flourish. These could result from market trends, new technologies, or increasing client needs. Businesses might benefit from identifying prospects for future growth. Example questions: How are customers’ needs changing? Are there new markets to explore? Example: Running digital marketing campaigns on platforms like YouTube and Instagram to boost brand visibility [1]

3.1.4. Threats

Threats are external issues that could harm the business. These could include new competitors, legislative changes, or fluctuations in market demand. Identifying hazards enables firms to develop proactive solutions to mitigate their impact. Example questions: What external variables could jeopardise our business? Are competitors launching disruptive products? For example, a new competitor entering the e-commerce industry may result in consumer loss [1].

3.2. Event Analysis

Event analysis involves evaluating and interpreting specific occurrences to understand their causes, effects, and significance. This approach is commonly used in sectors like business, economics, security, and engineering, where comprehending the details and patterns of events is essential for decision-making, risk assessment, and drawing lessons from past experiences. A key tool within event analysis is Root Cause Analysis (RCA), which focuses on identifying the underlying causes of issues rather than addressing surface-level symptoms. RCA typically includes steps such as defining the problem, gathering and analyzing relevant data, assessing preventive measures, and formulating targeted questions to conduct a thorough cause-and-effect analysis [2].

4. Analysis

4.1. SWOT Analysis of NVIDIA

4.1.1. Strengths

Technological Leadership: NVIDIA is a leader in GPU and AI technology, especially in dedicated graphics cards. It holds 88% shares in the market [3], which is used for high-performance computing. At the same time, Nvidia controls 70% to 95% of the AI chip market, which is used for training and deploying models like OpenAI’s GPT.

Diversified Revenue Streams: NVIDIA’s revenue comes from various sectors, including gaming, data centres, professional visualisation, and automotive. The multiple fields have brought it quite considerable income. The quarterly Data Center revenue of $26.3 billion accounted for 87.5% [4].

Strong Brand Reputation: NVIDIA enjoys high brand recognition and a global reputation. For example, data centres are used for analysing and training AI, and GPUs are widely used in personal computers, game development, and professional visualisation fields [3].

Robust financial position: Strong revenue growth and profitability give the company the financial strength to invest in research, development, and acquisitions. On June 19, 2024, Nvidia surpassed Microsoft and Apple to become the world’s most valuable company with a valuation of $3 trillion.

Powerful ecosystem: NVIDIA has built a robust ecosystem around its products, including software development kits, APIs, and a large developer community. This ecosystem enhances NVIDIA products’ appeal and helps lock in users while these users unknowingly reinforce NVIDIA’s technological barriers.

4.1.2. Weaknesses

Dependence on Specific Markets: Although NVIDIA operates in multiple sectors, a significant portion of its revenue relies on the data centre.

High R&D Costs: Continuous technological innovation requires substantial R&D investment, which may impact the company’s profit margins.

4.1.3. Opportunities

Artificial Intelligence and Machine Learning: With the rapid development of AI and machine learning technologies, it is estimated that the global artificial intelligence market size will reach 196.63 billion dollars in 2023 [5]. NVIDIA has the opportunity to expand its market share in these areas further.

Autonomous Vehicles: NVIDIA’s investments and partnerships in autonomous driving technology provide significant market opportunities. In 2022, the scale of China’s autonomous driving market was 289.4 billion yuan. With the continuous advancement of technology and the expanding application scenarios, the autonomous driving industry will welcome more business opportunities and market share [6].

Cloud Computing/ Data Center: Due to the rapid development of AI, the demand for data centres, which are the main sites for training AI, has also surged rapidly [5]. The growth of the cloud computing market offers new opportunities for NVIDIA’s high-performance computing solutions.

4.1.4. Threats

Intense Market Competition: NVIDIA faces fierce competition from AMD and Intel. Among them, Intel mainly focuses on integrated graphics, while AMD directly competes in the discrete graphics market.

Technological Changes: Rapid technological changes may render existing products obsolete, requiring NVIDIA to innovate to stay competitive continuously.

Regulations and Trade Policies: Changes in international trade policies and regulations may affect NVIDIA’s global operations. For example, in 2021, the US Federal Trade Commission (FTC) filed a lawsuit to block American chip supplier Nvidia Corp. from acquiring British chip design provider Arm Ltd. for $40 billion [7].

4.2. SWOT Analysis of AMD

4.2.1. Strengths

Technological Leadership: AMD is known for its technological advancements, including the first 64-bit and dual-core processors. Recently, it developed the first 7nm x86 processor [8].

Competitive pricing: AMD’s GPU strategy is to achieve relatively high performance at a relatively low price, which is why it can establish a foothold in the market.

Strategic partnerships: AMD strongly collaborates with game console manufacturers like Microsoft and Sony, providing semi-custom chips for their gaming consoles.

Strong product portfolio: AMD’s diverse product lineup is a significant advantage, including desktop processors, mobile processors, and data centre processors. The market share of x86 computer processors is approximately 33% [9]. The benefit of this is that it avoids direct competition with leading companies on a single track.

Increase market share: The AMD EPYC server-grade processor series has made significant progress in data centres traditionally dominated by Intel, capturing a considerable market share [10].

4.2.2. Weaknesses

Dependence on outsourced manufacturing: AMD has no manufacturing plants and heavily relies on third-party manufacturers (primarily TSMC) to produce its chips. This dependence will make the company uncertain, such as capacity issues and delivery delays.

Competitive pressure: the semiconductor industry is highly competitive and faces fierce competition from major companies like Intel and NVIDIA. These competitors occupy a broader market, have higher technological barriers, and possess more financial resources and distribution channels.

Dependence on key customers: A portion of AMD’s revenue comes from a few major clients, such as Sony and Microsoft, in the gaming console market. If these customers switch suppliers or reduce their demand, it will pose a significant risk to AMD [11].

4.2.3. Opportunities

Data Centers and Cloud Computing: With the increase in data consumption and the demand for cloud services, AMD’s EPYC server processors have significant opportunities in the data centre sector. With their high performance and competitive pricing, they can gain more market share in this field [10].

Artificial Intelligence and Machine Learning: AI and ML are rapidly growing fields that require powerful processing capabilities, and most companies need to control costs, which presents an opportunity for AMD’s low-cost, high-performance CPUs and GPUs.

4.2.4. Threats

Intense Market Competition: The competition in the semiconductor industry is exceptionally fierce. AMD’s main competitors are the established company Intel and the emerging company Nvidia, both of which possess substantial economic resources and accumulated technology, continuously innovating in their products.

Supply chain disruption: AMD’s chip production heavily relies on external manufacturers, primarily Taiwan Semiconductor Manufacturing Company (TSMC). Suppose there are internal decision-making conflicts or external political factors, such as the deterioration of China-U.S. relations, in these relationships. It will cause unpredictable losses for AMD.

4.3. Business Decision Analysis

Based on the collected data, this report reveals that AMD was established as early as 1969 and entered the semiconductor industry, while NVIDIA was founded in 1993. Both companies experienced a downturn in the 1990s. So why did the earlier-starting AMD get surpassed by NVIDIA? After gathering information, this report has identified the following key points, all of which are closely related to the decisions made by the company’s management. This article will be analysed based on a timeline.

Before this, this report will briefly introduce the two main brains of modern computers—CPU and GPU. The CPU (Central Processing Unit) is the core processing unit of a computer, responsible for executing instructions in computer programs. It handles various computational tasks, including logical operations, arithmetic operations, and data transfer. The GPU (Graphics Processing Unit) is specifically designed to handle computing tasks related to graphics and images. They were created to accelerate graphic rendering but are now widely used for parallel computing tasks, such as artificial intelligence and machine learning. In short, the CPU excels at handling complex, sequential computing tasks, while the GPU is adept at managing large-scale, parallel computing tasks. The two complement each other, enhancing the overall performance of the computer.

4.3.1. 1990-2000s

The first point is the company’s product architecture. The primary distinction between AMD and NVIDIA is that NVIDIA solely develops and manufactures GPUs, whereas AMD is responsible for designing both CPUs and GPUs but does not manufacture either [12] [13]. In the long run, AMD has a greater market share and more customers. However, AMD will face new competition in the CPU market behemoth Intel. In its early days, AMD did not build its unique CPU architecture; instead, it functioned more like a foundry, creating Intel x86 strategy chips. In this setting, AMD swiftly amassed significant financial wealth by producing chips for Intel while gaining relevant technical skills in chip production and design. However, this constituted a significant problem: AMD did not follow an independent research and development innovation route but engaged in reverse engineering of Intel’s CPUs. So, it can be described as a counterfeit of Intel chips. This also means Intel can sue AMD anytime, as it did in the 1990s. The legal war between AMD and Intel has raged for many years, primarily over the licensing of the x86 architecture. The two firms achieved a deal in 1995 that allowed AMD to continue making x86-compatible processors, but the battle has hampered AMD’s technological advancement and market expansion. AMD has obtained some technical rights but failed to compete directly with Intel in the leading high-performance market. This has caused AMD to change its product positioning and strategy, with a focus on the mid-range and low-end markets [14].

At the same time, Intel has a dominant position in the graphics card industry, but there are no actual GPUs; instead, there are integrated graphics. As a result, its founder and CEO, Jensen Huang, decided to take a different approach and begin developing standalone graphics cards. Several products failed early on, most notably the NV1 graphics card. The NV1 failed to acquire market share due to its weak DirectX compatibility. Finally, in 1999, NVIDIA introduced the GeForce 256, the first genuine GPU with hardware-accelerated transformation and lighting (T&L) capabilities. The advent of the GeForce 256 moved NVIDIA to the top of the graphics processing unit market, where it competed fiercely with 3dfx and ATI [12].

4.3.2. 2000-2010s

Faced with strong competition in Europe and America’s traditional markets, AMD began expanding into China and other emerging markets, such as Latin America, in the early 2000s. They drew many small and medium-sized PC manufacturers by providing CPUs with a better price-performance ratio at lower prices. For example, due to their greater cost-performance ratios, AMD’s Athlon XP and Turion processor series were successful in the mid-range and low-end PC markets. Later, in 2003, they introduced the first 64-bit processor to the market. Defeat Intel and rapidly take the crown of innovation [14].

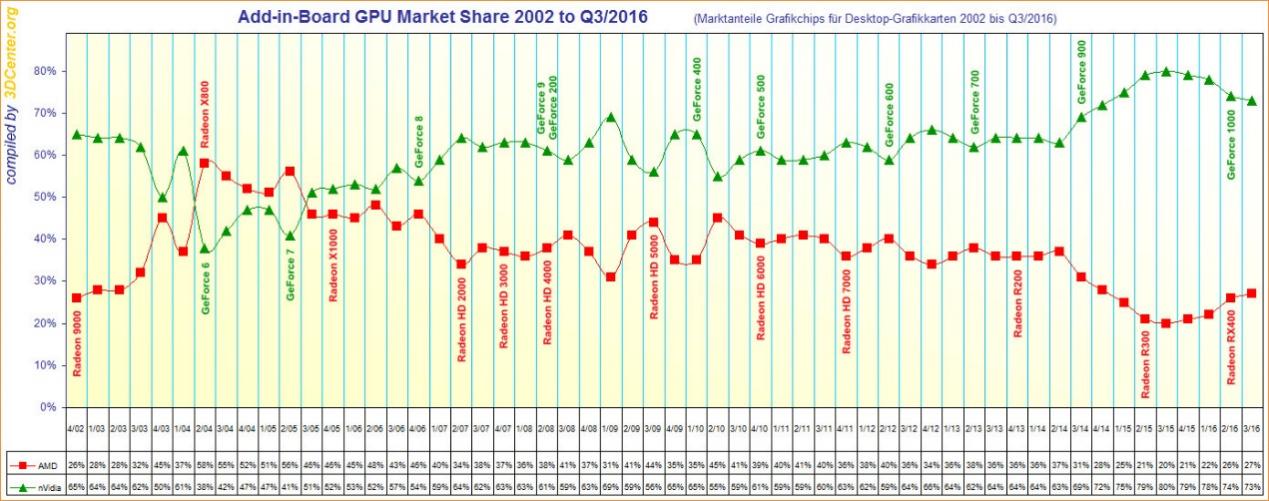

Unlike AMD, NVIDIA did not face widespread lawsuits or market fragmentation in its early days. Instead, it decided to concentrate on technology leadership and purchasing innovative businesses. In 2000, it purchased SGS-Thomson’s graphics division, enhancing its technological capabilities. From Figure 1 2002, NVIDIA’s discrete graphics card market share surpassed 60% [13], extending the gap with ATI (its primary competitor).

Figure 1: GPU market share (Picture credit: TechPowerup)

In 2006, Jensen Huang’s decisions led NVIDIA to broader application fields. NVIDIA introduced the CUDA platform (Compute Unified Device Architecture), which enables GPUs to be utilised for general computing. This broadens its product ecosystem, improves downstream customers’ reliance on its products, and decreases the risk of losing consumers owing to minor advantages in competitor products. This strategic move has enabled NVIDIA to build a strong foundation in high-performance computing (HPC), artificial intelligence (AI), and data centre industries. The results are clear: NVIDIA’s investment in artificial intelligence has been extremely fruitful. By 2024, NVIDIA’s market share in the AI chip sector will surpass 90%, with Tensor Cores forming the foundation of deep learning frameworks [15].

In 2006, CEO Héctor Ruiz decided to spend $5.4 billion to acquire ATI Technologies, just as it entered the graphics processing unit (GPU) industry, seven years after NVIDIA had previously done so. After acquiring ATI, AMD had substantial hurdles due to the two firms’ opposing mindsets, resulting in integration issues and financial losses from decreased cash flow. Due to a lack of resources and difficulty in allocation, AMD was compelled to sell off corporate assets. However, in the long run, AMD has expanded its product ecosystem by merging CPU and GPU technology, eventually leading to achievements in the APU (Accelerated Processing Unit) industry and laying the way for the later Ryzen series. Before 2010, AMD suffered continuous defeats, particularly when competing with Intel in the high-end market. To address these issues, AMD focused on building a new generation of microprocessor design, introducing the Ryzen series, which eventually began to turn the tide in 2017, allowing the company to regain market dominance.

4.3.3. 2010-Now

Around 2010, AMD experienced severe financial difficulties. In the CPU area, AMD’s Bulldozer architecture failed to compete successfully with Intel’s Sandy Bridge design, resulting in a sustained fall in its high-end market share. Despite its struggles with high-end CPUs, AMD continues to gain market share thanks to its low-end and mid-range processors. In 2012, AMD’s market share dipped below 20%, a low milestone in the company’s history [16].

AMD introduced its first-generation APU (Accelerated Processing Unit) in 2011, a technology that combines the CPU and GPU into a single chip. The introduction of the APU brought benefits to budget-conscious markets and specific multimedia applications, particularly in China and emerging economies. Although the APU has not fully altered the industry, it does represent AMD’s investigation of the balance between power consumption and performance. Lisa Su became CEO in 2014, emphasising technology innovation and market repositioning, which fueled the creation of the Zen architecture. AMD announced the Ryzen CPUs in 2017 based on the brand-new Zen architecture. The Zen architecture enhanced instructions per clock (IPC) while dramatically lowering power consumption. After the release of Ryzen, AMD’s CPU market share continued to climb progressively, enabling the company to make a comeback in the high-end CPU market. At the same time, EPYC processors based on the Zen architecture for the server market have been introduced. AMD has effectively fought with Intel in the data centre business, particularly in cloud computing and hyperscale data centres, laying the groundwork for AMD’s success in artificial intelligence [14].

Following 2010, NVIDIA continued to dominate the consumer graphics processor unit market. The GeForce GTX and RTX series graphics cards, with their exceptional performance and unique capabilities (such as real-time ray tracing RT Cores and DLSS), have dominated the high-end gaming market, accounting for 88% of the discrete graphics card market share [3]. NVIDIA’s early adoption of its CUDA architecture in 2006, which resulted in the emergence of a product ecosystem, has aided NVIDIA’s graphics processors in gradually evolving into essential hardware for deep learning, AI, and scientific computing. In 2016, NVIDIA’s Pascal architecture and Tesla V100 graphics processor were widely deployed in AI research labs and data centres. NVIDIA’s Tensor Cores technology dramatically improves the efficiency of deep learning computations.

Furthermore, NVIDIA is steadily pushing into the data centre industry with its Tesla and Ampere designs. The Ampere architecture improves AI inference performance while attracting more scientific and high-performance computing (HPC) clients due to its efficient FP64 floating-point operations. At the same time, NVIDIA is expanding into the field of autonomous vehicles with its Drive platform, which is creating AI processors for self-driving. Several automakers have used its Drive PX platform to create self-driving systems.

4.4. Discussion

In its early days, AMD battled with Intel using reverse engineering. Despite obtaining legal authority, AMD could not challenge Intel’s supremacy in the high-end market, confining itself to a commercial struggle with Intel in the CPU industry, which delayed the opportunity to establish an alternate path. Until 2006, then-CEO Héctor Ruiz had agreed to invest $5.4 billion to buy ATI. This strategic decision broadened AMD’s product portfolio and enabled them to enter the GPU market. In the short term, this merger put a financial strain on the company, and combined with the failure of the Bulldozer design, AMD found itself in a slump for a while. However, AMD is establishing the groundwork for its long-term success in the GPU market.

Lisa Su assumed the role of CEO at AMD in 2014, and her leadership significantly transformed the company’s trajectory. She focused on technological innovation and strategic market repositioning, which led to the development and success of the Zen architecture. The launch of the Zen architecture in 2017 marked AMD's resurgence in the CPU market, with the Ryzen processor series enabling the company to compete across both high-performance and budget segments. Under Lisa Su's guidance, AMD regained market dominance and returned to profitability. Additionally, her promotion of EPYC chips positioned AMD as a formidable competitor to Intel in the data center sector, highlighting the company's ability to swiftly adapt to market shifts under her leadership.

Jensen Huang, the founder and CEO of NVIDIA, is deeply intertwined with the company’s success. Since its inception in 1993, Huang has prioritized technological innovation as the foundation for NVIDIA's growth, with a focus on independent graphics cards. In 1999, he led the launch of the GeForce 256 GPU, a groundbreaking development that revolutionized the graphics processing industry and solidified NVIDIA’s leadership in the high-performance graphics card market. Huang’s strategic decisions also expanded NVIDIA’s reach into broader applications, most notably with the introduction of the CUDA platform in 2006. This move not only strengthened NVIDIA’s product ecosystem but also enabled its GPU technology to become integral to the AI and high-performance computing sectors.

Jensen Huang’s vision extends to data centres, self-driving cars, and artificial intelligence. Through acquisitions and strategic collaborations, NVIDIA has developed a strong leadership position in these expanding areas. The decision to purchase Arm in 2020 (despite regulatory challenges) exemplifies Jensen Huang’s long-term vision for the company’s future strategy. These strategic decisions by management have enabled NVIDIA to preserve its dominance in the graphics processing business and emerge as a prominent player in AI and deep learning hardware.

5. Conclusion

Since its inception, it has been difficult to determine whether AMD or NVIDIA is wiser or stronger regarding technology. However, the substantial gap in market share today is due not just to technological progress but also to major decisions that formed their various market positions, emphasising the importance of corporate decision-making in growth and transformation. Thus, this research used the SWOT and event analysis methods to discover the difference between AMD and NVIDIA in the last several decades. The SWOT analysis pointed out that AMD’s advantage stems from its technological innovation and cost-performance strategy, which allows it to compete with Intel and NVIDIA in the mid-to low-end market. However, its reliance on outsourced manufacturing and a few key clients raises concerns.

Meanwhile, NVIDIA has strengthened its market position through technological leadership and diverse revenue streams, with a notably strong performance in AI and data centres. The event analysis found that since the 1990s, AMD has fought with Intel through reverse engineering, but the lack of independently created architectures has put it at a competitive disadvantage in the high-end segment. The acquisition of ATI in 2006 aided AMD’s entry into the GPU industry. Although it caused financial strain in the short term, it eventually drove the successful rebirth of the APU and Ryzen series in the long run. With the release of the GeForce 256 in 1999, NVIDIA secured its position as a market leader in GPUs.The introduction of the CUDA platform in 2006 accelerated its progress into AI and high-performance computing, bolstering its technological advantages and market ecology.

Overall, AMD and NVIDIA’s growth trajectories demonstrate that, while technology resources are crucial, the decisions about how to use these resources determine a company’s fate. Lisa Su’s strategy overhaul has rejuvenated AMD, while Jensen Huang’s technology-driven approach and diverse layout have continually enabled NVIDIA to expand into new areas. The management’s vision and execution were the primary factors that helped the two organisations recover from their lows and make market breakthroughs, highlighting the importance of leadership decisions on a company’s success or failure.

References

[1]. Helms, M. M. and Nixon, J. (2010). Exploring SWOT analysis - where are we now? A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215-251.

[2]. Han, E. (2023). Root Cause Analysis: What It Is & How to Perform One | HBS Online. [Online] Harvard Business School Online.

[3]. Peng, C.: Nvidia Corporation: PC Gaming Industry Strategic Audit..(2023). Honors Theses, University of Nebraska-Lincoln.

[4]. NVIDIA Newsroom (2024). NVIDIA Announces Financial Results for Second Quarter Fiscal 2025. [Online] Available at: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2025.

[5]. Cazzaniga, M., Jaumotte, M.F., Li, L., Melina, M.G., Panton, A.J., Pizzinelli, C., ... Tavares, (2024). M.M.M.: Gen-AI: Artificial intelligence and the future of work. International Monetary Fund.

[6]. Zhao, H., Meng, M., Li, X., Yu, Q., Li, L., Galland, S. (2024). The development of automated driving in China: a comparison to Germany regarding the government policies, laws and regulations, and industries. Transportation Letters 16(8), 933–941.

[7]. Abbott, A.F., Spulber, D.F.: Antitrust Merger Policy and Innovation Competition. (2024). Journal of Business & Technology Law 19(2), 2.

[8]. Hoey, J.V. (2019). Beginning x64 Assembly Programming. Apress eBooks. doi:https://doi.org/10.1007/978-1-4842-5076-1.

[9]. Farhan, A.H. (2024). Are Nvidia’s Shares Overvalued Following the Surge of Artificial Intelligence? International Journal of Business and Technology Management 6(3), 262–275.

[10]. Velten, M., Schöne, R., Ilsche, T. and Hackenberg, D. (2022). Memory Performance of AMD EPYC Rome and Intel Cascade Lake SP Server Processors. Proceedings of the 2022 ACM/SPEC on International Conference on Performance Engineering. doi: https://doi.org/10.1145/3489525.3511689.

[11]. Advanced Micro Devices, Inc. (2024). AMD Reports Fourth Quarter and Full Year 2023 Financial Results. [Online] Available at: https://ir.amd.com/news-events/press-releases/detail/1180/amd-reports-fourth-quarter-and-full-year-2023-financial.

[12]. MarketLine Company Profile: NVIDIA Corporation (2024). pp. 1–68. Available at: https://research-ebsco-com.sussex.idm.oclc.org/linkprocessor/plink?id=dd8d7e7e-12e9-31e4-8285-71e197cd02e9.

[13]. Chen, S. (2024). Research on Nvidia Investment Strategies and Analysis. Highlights in Business, Economics and Management, 24, 2234-2240.

[14]. MarketLine Company Profile: Advanced Micro Devices, Inc (2024), pp. 1–51. Available at: https://research-ebsco-com.sussex.idm.oclc.org/linkprocessor/plink?id=d5ba355e-4e66-3efc-828d-3355c1aee5b1.

[15]. Sun, H., Baek, J., Baddela, A., Mendonca, G.: A Review of America's Semiconductor Export Controls. SSRN(2024)

[16]. Advanced Micro Devices, Inc. (2024). Annual Filings. [Online] Available at: https://ir.amd.com/sec-filings/filter/annual-filings?page=2#gallery-0000002488-3274-1.

Cite this article

Tan,T. (2025). Business Analysis: A Comparative Analysis of AMD and NVIDIA. Advances in Economics, Management and Political Sciences,146,51-60.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Helms, M. M. and Nixon, J. (2010). Exploring SWOT analysis - where are we now? A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215-251.

[2]. Han, E. (2023). Root Cause Analysis: What It Is & How to Perform One | HBS Online. [Online] Harvard Business School Online.

[3]. Peng, C.: Nvidia Corporation: PC Gaming Industry Strategic Audit..(2023). Honors Theses, University of Nebraska-Lincoln.

[4]. NVIDIA Newsroom (2024). NVIDIA Announces Financial Results for Second Quarter Fiscal 2025. [Online] Available at: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2025.

[5]. Cazzaniga, M., Jaumotte, M.F., Li, L., Melina, M.G., Panton, A.J., Pizzinelli, C., ... Tavares, (2024). M.M.M.: Gen-AI: Artificial intelligence and the future of work. International Monetary Fund.

[6]. Zhao, H., Meng, M., Li, X., Yu, Q., Li, L., Galland, S. (2024). The development of automated driving in China: a comparison to Germany regarding the government policies, laws and regulations, and industries. Transportation Letters 16(8), 933–941.

[7]. Abbott, A.F., Spulber, D.F.: Antitrust Merger Policy and Innovation Competition. (2024). Journal of Business & Technology Law 19(2), 2.

[8]. Hoey, J.V. (2019). Beginning x64 Assembly Programming. Apress eBooks. doi:https://doi.org/10.1007/978-1-4842-5076-1.

[9]. Farhan, A.H. (2024). Are Nvidia’s Shares Overvalued Following the Surge of Artificial Intelligence? International Journal of Business and Technology Management 6(3), 262–275.

[10]. Velten, M., Schöne, R., Ilsche, T. and Hackenberg, D. (2022). Memory Performance of AMD EPYC Rome and Intel Cascade Lake SP Server Processors. Proceedings of the 2022 ACM/SPEC on International Conference on Performance Engineering. doi: https://doi.org/10.1145/3489525.3511689.

[11]. Advanced Micro Devices, Inc. (2024). AMD Reports Fourth Quarter and Full Year 2023 Financial Results. [Online] Available at: https://ir.amd.com/news-events/press-releases/detail/1180/amd-reports-fourth-quarter-and-full-year-2023-financial.

[12]. MarketLine Company Profile: NVIDIA Corporation (2024). pp. 1–68. Available at: https://research-ebsco-com.sussex.idm.oclc.org/linkprocessor/plink?id=dd8d7e7e-12e9-31e4-8285-71e197cd02e9.

[13]. Chen, S. (2024). Research on Nvidia Investment Strategies and Analysis. Highlights in Business, Economics and Management, 24, 2234-2240.

[14]. MarketLine Company Profile: Advanced Micro Devices, Inc (2024), pp. 1–51. Available at: https://research-ebsco-com.sussex.idm.oclc.org/linkprocessor/plink?id=d5ba355e-4e66-3efc-828d-3355c1aee5b1.

[15]. Sun, H., Baek, J., Baddela, A., Mendonca, G.: A Review of America's Semiconductor Export Controls. SSRN(2024)

[16]. Advanced Micro Devices, Inc. (2024). Annual Filings. [Online] Available at: https://ir.amd.com/sec-filings/filter/annual-filings?page=2#gallery-0000002488-3274-1.