1. Introduction

Tesla, has established itself as a global leader in the electric vehicle industry, renowned for its groundbreaking technologies and ambitious mission to accelerate the world’s transition to sustainable energy. Since its founding in 2003, Tesla has expanded its product lineup to include not only electric vehicles but also energy storage solutions and solar energy products. This innovative approach, coupled with a vertically integrated business model, has allowed Tesla to dominate the EV market while maintaining a strong commitment to research and development.

Tesla’s cost structure makes it a compelling subject for analysis. Unlike traditional automakers, Tesla combines high R&D investment in areas such as battery technology and autonomous driving with substantial capital expenditures in production facilities like its Gigafactories. Battery technology plays a central role in Tesla's ability to drive down costs and enhance vehicle performance, which has been a key factor in its market leadership [1]. These Gigafactories aim to reduce per-unit costs through economies of scale, further distinguishing Tesla’s approach from its competitors. As Tesla scales globally, understanding the composition and drivers of its cost structure is essential to assessing its long-term viability and competitive positioning.

Cost analysis plays a vital role in assessing business performance, helping firms optimize resource allocation, reduce waste, and enhance profitability. In Tesla's case, its ability to balance high production and innovation costs while maintaining healthy profit margins is of particular interest. By analyzing Tesla’s cost structure, this paper seeks to offer insights into how the company manages its manufacturing processes, R&D investments, and supply chain expenses, and how these factors contribute to its overall financial performance.

This essay is significant not only for understanding Tesla’s operations but also for providing broader implications for the EV industry. As the global transition to electric vehicles accelerates, industry stakeholders, policymakers, and competitors will benefit from understanding how a leading company like Tesla manages its costs while driving innovation. Moreover, cost management will become increasingly critical as Tesla faces growing competition from both traditional automakers entering the EV market and new startups.

2. Cost Analysis Based on Linear Regression

2.1. Research Intent and Reasons for Using Linear Regression

Exploring Tesla's cost analysis serves multiple purposes, such as identifying cost-saving opportunities, improving efficiency, and maximizing profit margins in an industry that is highly competitive and capital-intensive. By conducting cost analysis, Tesla can evaluate the financial impact of its decisions, like investments in Gigafactories, supply chain optimization, and sustainability initiatives. This analysis helps them stay agile in response to market fluctuations, especially when dealing with expensive components like batteries and advanced technology.

Using linear regression as a method to analyze Tesla’s costs provides several benefits. Linear regression helps to model the relationship between dependent variables and independent variables. The method is simple yet powerful in estimating cost behaviors and predicting future trends. Additionally, linear regression allows for analyzing trends over time and isolating the effects of specific factors, such as the impact of automation on reducing labor costs or the role of Gigafactories in lowering transportation expenses. By identifying these patterns, Tesla can make informed decisions to optimize costs and maintain its competitive edge in the EV industry. This approach provides actionable insights for forecasting future financial performance and improving operational efficiency.

2.2. Linear Regression

The data used for this analysis was extracted from Tesla’s financial statements from 2022 to 2023. Key cost components were selected as independent variables based on their relevance to Tesla's overall cost structure. The dependent variable in this analysis is the "Total Cost of Revenues" (Y), which includes direct production costs, labor, and materials. The following variables in Table 1were selected as independent variables (X1, X2, … X10):

Table1: Independent variable definition.

X1 | Total Assets |

X2 | Total Liabilities |

X3 | Inventory |

X4 | Accounts Receivable |

X5 | Long-term Liabilities |

X6 | Total Revenues |

X7 | Selling and Administrative Expenses |

X8 | Research & Development Expenses |

X9 | Interest Expenses |

X10 | Services & Other Revenues |

Each of these variables was selected due to their direct or indirect impact on Tesla’s cost structure, either through production efficiency, financial obligations, or operational scaling.

Financial reports for each quarter from 2022 to 2023 were sourced from Tesla's official website. Ten key variables were selected from these reports to serve as the independent variables for the linear regression analysis. Quarterly data were chosen because they provide a detailed and time-sensitive perspective on Tesla's financial performance, capturing short-term fluctuations that may not be observable in annual or biannual reports. This approach enhances the precision of the regression model by reflecting more granular trends and patterns."

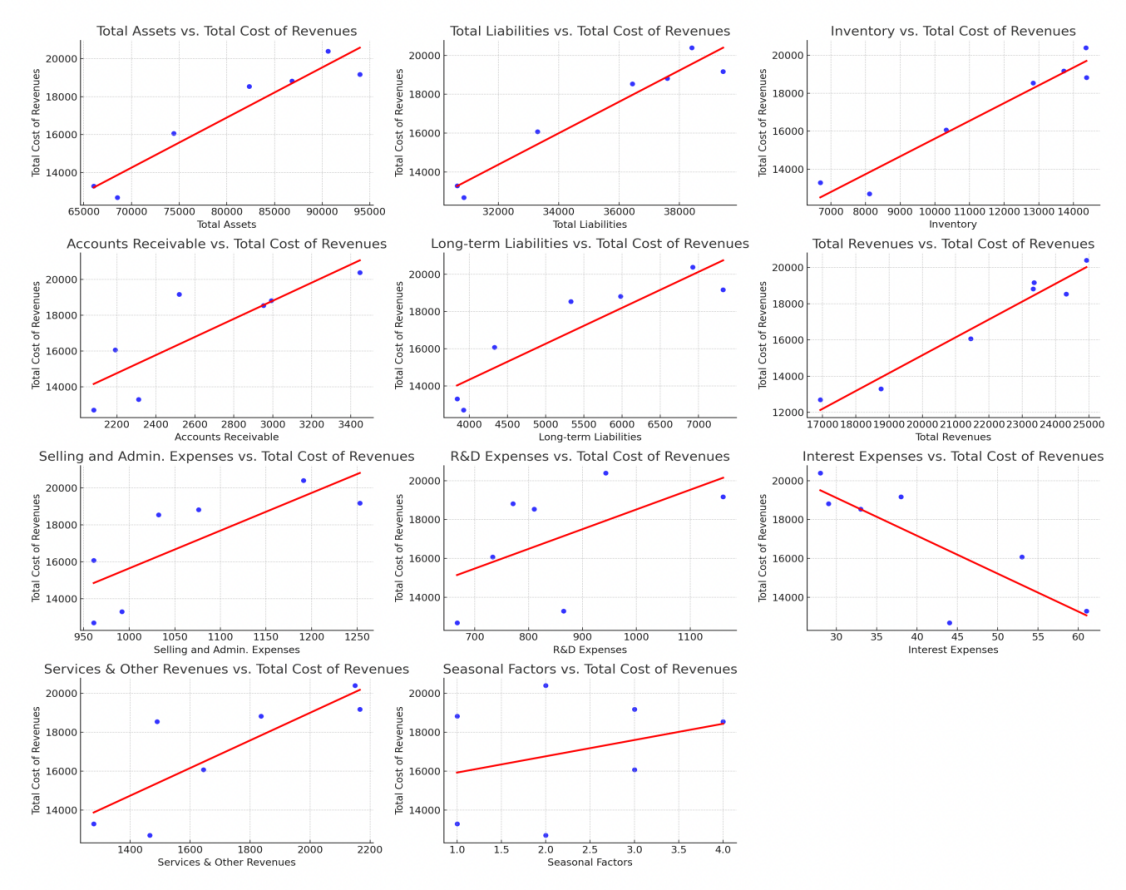

A multivariate linear regression model was applied to the dataset, using Tesla's Total Cost of Revenues as the dependent variable and the ten aforementioned independent variables as predictors. The corresponding results are shown in Figure 1.

The general form of the linear regression equation used is:

\( Y={β_{0}}+{β_{1}}{X_{1}}+{β_{2}}{X_{2}}+⋯+{β_{10}}{X_{10}}+ϵ \) (1)

The regression model was first tested for multicollinearity using the Variance Inflation Factor. Variables with a VIF greater than 5 indicate potential multicollinearity, suggesting that these variables are highly correlated with each other. Multicollinearity can distort the regression results by inflating the variance of the coefficient estimates, making it difficult to assess the individual effect of each variable.

Table2: Verify the VIF of R value.

Independent Variable (X) | R-value | VIF(1/1-R2) | Notes |

Total Assets | 0.950438374 | 10.34480287 | If the VIF value is less than 5, there is no multicollinearity in the independent variable. |

Total Liabilities | 0.967528122 | 15.65206528 | |

Inventory | 0.969504896 | 16.6499455 | |

Accounts Receivable | 0.838606161 | 3.369956827 | |

Long-term Liabilities | 0.90712582 | 5.645802212 | |

Total Income | 0.976549272 | 21.57426618 | |

Sales/Management Expenses | 0.775070501 | 2.504597702 | |

R&D Expenditure | 0.547067041 | 1.427108332 | |

Interest Expense | -0.804970398 | 2.840726233 | |

Service and Other Income | 0.810429559 | 2.913719555 |

By calculating this, it can tell that Total Assets, Total Liabilities, Inventory, and Total Revenues exhibited VIF values higher than 10, indicating substantial multicollinearity. This suggests that these variables are strongly correlated with each other, as is expected in a company like Tesla, where assets, liabilities, and revenues grow in tandem with production scale and market reach.

Consequently, only the variables with a Variance Inflation Factor greater than 5 were selected for inclusion in the final analysis, as these variables demonstrated a higher degree of multicollinearity. By focusing on these variables, the analysis aimed to account for potential multicollinearity while ensuring that only the most impactful predictors were used. After selecting the appropriate variables, the linear regression model was constructed, and the resulting plot was generated based on both the R-squared value and the VIF values. This approach allowed for a more robust analysis of the relationships between the independent and dependent variables, ultimately improving the model’s accuracy and interpretability.

Figure 1: Regression results.

2.3. Discussion and Implications

Tesla's linear regression analysis for 2022 to 2023 reveals not only critical financial interdependencies but also highlights the importance of effective cost control measures. With a significant portion of the company's expenses tied to total revenues, understanding and managing these costs is essential for sustaining profitability and ensuring long-term growth.

2.3.1. Understanding Cost Structure

Tesla's cost structure is influenced by various factors, including total assets, inventory levels, and operational expenditures. The analysis shows a strong correlation between total revenues and the total cost of revenues, indicating that as revenues increase, costs also rise. A comprehensive life cycle cost assessment is vital to understanding Tesla’s ability to balance production costs while innovating in battery technology and electric vehicle efficiency [2]. This necessitates a comprehensive approach to cost management that aligns with Tesla's growth objectives.

Optimization of Fixed and Variable Costs: Tesla should strive to maintain an optimal balance between fixed and variable costs. Fixed costs, such as manufacturing facilities and equipment, can become burdensome if production does not meet projected levels. By optimizing factory utilization and scheduling production runs efficiently, Tesla can spread fixed costs over a larger number of vehicles. Conversely, variable costs, such as labor and materials, should be continually assessed and negotiated to ensure competitive pricing.

Standardization and Modularization: Implementing standardization and modularization in manufacturing can significantly reduce costs. By creating a modular design for its vehicles, Tesla can streamline assembly processes and reduce the complexity involved in manufacturing different models. Standardized components can also facilitate bulk purchasing, thereby decreasing per-unit costs.

Strategic Sourcing: Tesla should enhance its sourcing strategies by establishing long-term contracts with suppliers to lock in prices for key components. This can mitigate the impact of price fluctuations in raw materials and ensure a more predictable cost structure. Furthermore, identifying alternative suppliers can enhance competition and drive down costs, ensuring that Tesla maintains leverage in negotiations.

2.3.2. Streamlining Production Processes

One of the primary areas for cost control lies in optimizing production processes. By leveraging advanced manufacturing technologies, such as automation and robotics, Tesla can enhance production efficiency, reduce labor costs, and minimize material waste.

Adoption of Advanced Manufacturing Technologies: Tesla has already made significant strides in automation at its Gigafactories, but further investments in advanced robotics and AI-driven production lines can enhance output quality and consistency. Automated systems can significantly reduce labor costs and human error, leading to more reliable production schedules.

Lean Manufacturing Practices: Implementing Lean manufacturing principles can help Tesla identify and eliminate waste in the production process. By focusing on continuous improvement and employee engagement, Tesla can create a culture of efficiency that reduces unnecessary costs while maintaining high-quality output. Regular training sessions on Lean principles can empower employees to spot inefficiencies and suggest improvements.

Process Reengineering: Tesla can periodically reassess its production workflows to identify bottlenecks and inefficiencies. Process reengineering involves rethinking how work is done to improve efficiency, reduce cycle times, and enhance product quality. By analyzing production data, Tesla can identify areas where improvements can be made and implement targeted changes.

2.3.3. Supply Chain Optimization

Supply chain efficiency and total cost of ownership remain critical factors as Tesla scales production [3]. Given the recent disruptions caused by global supply chain issues, Tesla should consider diversifying its supplier base to mitigate risks associated with single-source dependency.

Diversification of Supplier Base: By identifying multiple suppliers for critical components, Tesla can reduce the risk of production delays caused by shortages or price hikes. This diversification allows Tesla to maintain flexibility in sourcing and can lead to more competitive pricing as suppliers vie for contracts.

Just-in-Time (JIT) Inventory Management: Implementing JIT inventory practices can minimize holding costs and enhance cash flow. By receiving goods only as they are needed in the production process, Tesla can reduce storage costs and the risk of inventory obsolescence. This approach requires strong relationships with suppliers to ensure timely deliveries.

Supplier Relationship Management: Building strong relationships with suppliers can lead to better pricing and service levels. Tesla should invest in supplier relationship management strategies, including regular communication, joint planning, and collaborative problem-solving. This can enhance trust and responsiveness, further driving down costs.

2.3.4. R&D Investment for Cost Efficiency

Investments in research and development have proven to be essential for Tesla to maintain its edge, especially in areas like rechargeable battery technology, which is critical for cost control and sustainability [4]. By developing new technologies that improve battery efficiency or reduce production costs, Tesla can enhance its product offerings while simultaneously lowering operational expenses. Tesla’s electric powertrains continue to evolve, showcasing the company’s commitment to lowering production costs while enhancing the efficiency of its vehicles [5].

Focus on Battery Technology: Tesla’s commitment to R&D in battery technology is essential for reducing production costs. Advances in battery efficiency can lead to lower costs per kilowatt-hour, directly impacting the overall cost of electric vehicles. Developing proprietary battery technology can also create a competitive advantage in the market.

Innovative Manufacturing Techniques: Investing in new manufacturing processes, such as 3D printing for certain components, can significantly reduce material waste and lower production costs. These technologies can also enhance design flexibility, allowing for rapid prototyping and adjustments without extensive retooling.

Sustainability in R&D: Tesla's commitment to sustainability can drive cost efficiencies. By developing environmentally friendly production methods and materials, the company can not only reduce costs but also enhance its brand image. Sustainable practices can often lead to long-term savings by minimizing resource consumption and waste.

2.3.5. Energy Efficiency Initiatives

Given Tesla's focus on sustainability, implementing energy efficiency initiatives within manufacturing facilities can also play a significant role in cost control. By investing in renewable energy sources, such as solar panels and energy storage systems, Tesla can reduce its dependence on traditional energy sources, leading to lower utility costs.

Renewable Energy Adoption: Installing solar panels at manufacturing sites can significantly reduce electricity costs. Tesla's solar products can provide not only energy for production facilities but also serve as a demonstration of its commitment to sustainable practices.

Energy Storage Solutions: Utilizing Tesla's own battery technology for energy storage can provide a buffer against fluctuations in energy prices and enhance energy efficiency. This allows the company to store excess energy generated during peak production times and utilize it during high-demand periods.

Energy Audits and Optimization: Regular energy audits can help identify areas where energy consumption can be reduced. By implementing energy-efficient technologies, such as LED lighting and energy management systems, Tesla can lower operational costs while also minimizing its environmental footprint.

2.3.6. Monitoring and Analytics

To effectively manage costs, Tesla should leverage data analytics to monitor and analyze spending across various departments:

Real-Time Financial Dashboards: Implementing real-time financial dashboards can provide Tesla’s management with immediate insights into spending patterns and budget adherence. By visualizing financial data, the company can quickly identify areas of overspending and take corrective actions. These dashboards can also facilitate communication across departments, ensuring that everyone is aligned with cost management objectives.

Predictive Analytics: Utilizing predictive analytics can help Tesla forecast future expenses based on historical data and market trends. By anticipating potential cost increases, Tesla can implement proactive measures to mitigate financial risks. This forward-looking approach will enable the company to remain agile and responsive to changing market conditions.

Benchmarking and Key Performance Indicators (KPIs): Establishing KPIs for cost management allows Tesla to measure performance against industry standards. By benchmarking its cost structure against competitors, the company can identify best practices and areas for improvement. Regularly reviewing KPIs can help Tesla stay focused on its cost control objectives and drive continuous improvement.

2.3.7. Employee Training and Engagement

Investing in employee training and engagement is crucial for fostering a culture of cost consciousness:

Cost Awareness Programs: Tesla should implement cost awareness programs that educate employees about the importance of cost control. By raising awareness of how individual actions impact overall costs, employees will be more likely to engage in cost-saving behaviors. These programs can include workshops, seminars, and regular communications about financial performance.

Incentive Programs: Introducing incentive programs tied to cost-saving initiatives can motivate employees to actively participate in cost management efforts. Recognizing and rewarding individuals or teams that identify and implement cost-saving measures can foster a culture of innovation and accountability.

Cross-Functional Collaboration: Encouraging cross-functional collaboration among departments can lead to innovative solutions for cost control. By bringing together employees from different areas of the organization, Tesla can harness diverse perspectives and expertise to identify cost-saving opportunities.

2.3.8. Strategic Decision-Making

Panel data analysis suggests that Tesla’s decision-making processes regarding cost control and investment in technology have a significant impact on its operational efficiency [6]. In light of the multicollinearity observed in the regression analysis, it is essential for Tesla to incorporate cost considerations into its strategic decision-making process:

Cost-Impact Assessments: Before launching new products or initiatives, Tesla should conduct cost-impact assessments to evaluate the financial implications of decisions. By understanding the potential costs associated with new ventures, the company can make informed choices that align with its overall financial strategy.

Scenario Planning: Engaging in scenario planning allows Tesla to prepare for potential financial challenges and opportunities. By modeling different scenarios based on varying market conditions, the company can develop contingency plans that support cost control objectives.

Stakeholder Engagement: Involving key stakeholders in the decision-making process ensures that cost control considerations are integrated into broader business strategies. By fostering open communication and collaboration, Tesla can align its cost management efforts with its growth objectives.

2.3.9. Future Considerations

As Tesla navigates a rapidly evolving automotive landscape characterized by increasing competition and technological advancements. The company should prioritize investments in areas that enhance operational efficiency and revenue generation. Additionally, continuous monitoring of these financial relationships through periodic regression analyses will allow Tesla to adjust its strategies responsively. The conclusions are as follow:

(1) Business expansion is synchronized with cost growth: Tesla's expansion strategy is driving up total costs, but these cost increases are an inevitable part of business expansion.

(2) R&D and production efficiency are key to cost control: despite high R&D expenditures, Tesla's innovations in batteries and Autopilot will help it maintain a competitive advantage over the long term and gradually reduce unit production costs.

(3) Optimizing operations and supply chain management is a key focus for the future: by managing the supply chain in a refined manner, reducing reliance on external suppliers, and optimizing production lines, Tesla has the opportunity to continue to reduce production costs in the future.

3. Revenue Costs and Suggestions on Cost Controlling

3.1. Revenue and Cost

Over the past two years, Tesla has experienced remarkable revenue growth, driven by strong demand for its electric vehicles, particularly the Model 3 and Model Y. Tesla’s affordability in vehicles like the Model Y can be attributed to strategic decisions in production and material sourcing, ensuring competitive pricing despite rising material costs [7]. Global expansion, especially in markets like China and Europe, has been a key contributor to this revenue increase. Tesla's ability to scale its production rapidly has allowed it to capitalize on the growing interest in electric vehicles, solidifying its position as a market leader. In addition to vehicle sales, Tesla’s energy division, including solar panels and energy storage solutions, has also shown steady progress, though it still represents a smaller portion of the company’s overall revenue.

On the cost side, Tesla has faced challenges from rising raw material costs, especially for batteries, and disruptions in the global supply chain. Tesla’s cost structure is further pressured by the broader challenges electric vehicles face, such as scaling production and securing critical materials [8]. However, the company has managed to balance these pressures through production efficiency and economies of scale. By optimizing operations in its Gigafactories and vertically integrating key components, Tesla has been able to maintain relatively stable costs despite external economic pressures. Additionally, Tesla’s substantial investments in research and development, particularly in autonomous driving technology and new vehicle models, have contributed to its overall cost structure, but are essential for sustaining long-term growth and innovation.

3.2. Suggestions on Cost Controlling

3.2.1. Enhancing Production Efficiency through Automation

Improving production efficiency through automation is a key strategy for Tesla to manage its operational costs more effectively. Tesla’s Gigafactories, which produce electric vehicles and batteries, represent a significant portion of the company’s capital expenditures and ongoing costs. Automation in Tesla’s Gigafactories has the potential to drive down production costs, similar to the impact of automation on hybrid vehicles [9]. By further advancing automation technologies within these factories, Tesla can reduce its reliance on labor, streamline its manufacturing processes, and increase its output relative to input.

To achieve this, Tesla should invest in expanding its automation capabilities, particularly in vehicle assembly and battery production. The integration of more advanced robotics and artificial intelligence systems would allow the company to reduce labor costs, minimize errors, and shorten production times. Additionally, Tesla should continuously optimize its Gigafactory layouts to minimize material handling times and reduce energy consumption, while also eliminating operational inefficiencies. The application of lean manufacturing principles would further enhance production flows and eliminate waste.

These improvements are expected to deliver several key benefits, including reduced labor and operational costs, increased production capacity without a proportional rise in expenses, and greater consistency and quality in manufacturing processes, which would result in fewer defects and rework.

3.2.2. Strengthening Supply Chain Resilience and Cost Efficiency

Effective supply chain management is critical to controlling costs, especially in the automotive industry, where the sourcing of raw materials and components is often subject to volatility. Tesla's global operations, coupled with its reliance on essential materials such as lithium, cobalt, and nickel for battery production, make the company vulnerable to supply chain disruptions and price fluctuations. To mitigate these risks and enhance cost efficiency, Tesla should adopt a more proactive and integrated supply chain strategy.

Tesla has already taken steps toward vertical integration by producing its own batteries. Expanding this vertical integration to include more upstream activities, such as securing long-term procurement contracts for key raw materials or even participating in raw material mining, could help stabilize input costs and reduce exposure to market volatility. Furthermore, Tesla should focus on diversifying its supplier base to avoid dependence on specific regions or single suppliers. By establishing relationships with multiple suppliers for critical components and raw materials across different geographic locations, Tesla can build a more resilient supply chain.

In addition, leveraging predictive analytics and AI-driven supply chain tools could allow Tesla to anticipate market fluctuations, optimize inventory levels, and reduce excess stock. This proactive approach would help the company avoid the high costs associated with last-minute sourcing or shipping in times of supply chain disruptions.

The expected benefits of these strategies include greater cost stability through long-term supply agreements and vertical integration, enhanced supply chain resilience against geopolitical and economic uncertainties, and reduced costs linked to raw material price volatility.

3.2.3. Optimizing Research and Development Spending

Tesla’s substantial investment in research and development has been a crucial factor in securing its leadership in the electric vehicle market, particularly through advancements in battery technology and autonomous driving. However, with the increasing competition and the entry of new players in the EV industry, it is essential for Tesla to ensure that its R&D expenditures remain efficient and are strategically directed toward projects that offer the highest return on investment.

To achieve this, Tesla should focus its R&D efforts on high-impact projects that demonstrate clear commercial potential and significant cost-saving opportunities. For example, the development of next-generation battery technologies, such as the 4680 cell, and further refinement of its Full Self-Driving (FSD) software should be prioritized. By concentrating resources on these transformative innovations, Tesla can continue to enhance its competitive edge while optimizing the value of its R&D investments.

Moreover, enhancing collaboration with external partners, such as universities, research institutions, and technology firms, would enable Tesla to share both the costs and risks associated with cutting-edge research. These collaborations not only introduce fresh insights but also shorten the time required to bring new technologies to market. Leveraging external expertise can accelerate the pace of innovation while easing the financial burden on the company.

In addition, Tesla should adopt a modular innovation approach, integrating new technologies incrementally into existing platforms rather than through large-scale overhauls. This strategy allows for continuous technological advancement without requiring substantial upfront capital investment. Incremental integration of new technologies ensures that Tesla remains agile and can adapt to market demands while maintaining cost efficiency.

The expected benefits of these strategies include a more focused allocation of R&D resources, which will lead to quicker commercialization of high-impact technologies, reduced costs through partnerships and collaborative efforts, and gradual improvements in product design and manufacturing processes that will generate long-term cost savings.

3.2.4. Managing Long-Term Financial Sustainability

Tesla’s rapid expansion has been fueled by significant capital investments in new factories, product lines, and technology development. However, this growth has also increased the company’s long-term liabilities and financial obligations. To maintain its financial health, Tesla must carefully manage its capital expenditures and debt while exploring alternative financing options that support growth without overburdening the balance sheet.

Tesla should focus on aligning its capital expenditures with cash flow generation to prevent excessive debt accumulation. By pacing investments in new facilities or production lines based on demand forecasts, the company can reduce the financial risks associated with overcapacity. Additionally, Tesla can leverage green financing options, such as green bonds or sustainability-linked loans, to lower financing costs. These options often provide favorable terms and align with Tesla’s environmental goals. Maintaining a balanced approach to financing is also crucial. Monitoring key financial ratios, such as the debt-to-equity ratio, will enable Tesla to optimize its capital structure and minimize interest expenses over time [10].

By implementing these strategies, Tesla will enhance its financial flexibility, reduce financing costs, and better align its capital investments with market demand, minimizing the risk of overcapacity.

4. Conclusion

Tesla’s cost structure, driven by its substantial investments in R&D, production facilities, and global expansion, underscores the company’s commitment to maintaining its competitive edge in the rapidly growing EV market. This analysis reveals that Tesla’s ability to balance high costs associated with innovation and scaling, while optimizing production efficiency, has enabled the company to sustain strong revenue growth. Tesla’s strategic financial planning, as outlined in industry forecasts, indicates that continued innovation will be key to maintaining its competitive edge while controlling costs. Key factors such as automation in its Gigafactories, supply chain resilience, and strategic R&D spending are central to Tesla’s cost management strategy, allowing it to adapt to market demand and external economic pressures.

However, there are limitations to the current analysis. The linear regression model is based on historical data from Tesla’s financial statements, which may not fully account for future market disruptions or unpredictable external factors such as raw material shortages or changes in regulatory policies. Additionally, some assumptions in the model, such as linearity between variables, may oversimplify the complex relationships in Tesla’s cost structure, potentially affecting the accuracy of projections.

Looking ahead, Tesla’s financial health will depend on its ability to continue innovating while managing costs effectively. The company must remain vigilant in its approach to sustainability and operational efficiency as competition intensifies. Future advancements in battery technology, supply chain diversification, and green financing options will play critical roles in reducing costs and securing Tesla’s leadership in the EV market. By continuously refining its cost management strategies, Tesla is well-positioned to navigate future challenges and capitalize on new opportunities in the electric mobility and renewable energy sectors.

References

[1]. Wolff, S., Waclaw, A., & Lienkamp, M. (2021). An overview of parameter and cost for battery electric vehicles. World Electric Vehicle Journal, 12(1), 21-35.

[2]. Ayodele, B. V., & Mustapa, S. I. (2020). Life cycle cost assessment of electric vehicles: A review and bibliometric analysis. Sustainability, 12(6), 2387.

[3]. Lebeau, K., Lebeau, P., Macharis, C., & Van Mierlo, J. (2013). How expensive are electric vehicles? A total cost of ownership analysis. World Electric Vehicle Journal, 6(4), 996-1007.

[4]. Meegoda, J., Charbel, G., & Watts, D. (2024). Sustainable management of rechargeable batteries used in electric vehicles. Batteries, 10(5), 167-181.

[5]. Lienkamp, M. (2024). Quantifying the state of the art of electric powertrains in battery electric vehicles: Comprehensive analysis of the Tesla Model 3. World Electric Vehicle Journal.

[6]. Wang, Q. (2023). Analysis of Tesla company’s operations based on panel data. Academic Journal of Humanities & Social Sciences, 6(18), 50-58.

[7]. Hareyan, A. (2023). Cost analysis of Tesla Model Y: What makes it affordable. Torque News.

[8]. Alanazi, F. (2023). Electric vehicles: Benefits, challenges, and potential solutions for widespread adaptation. Applied Sciences, 13(10), 6016-6032.

[9]. Markel, T., & Simpson, A. (2007). Cost-benefit analysis of plug-in hybrid electric vehicle technology. World Electric Vehicle Journal.

[10]. Wang, X. (2024). Financial analysis and strategic forecast of Tesla, Inc. In X. Li, C. Yuan, & J. Kent (Eds.), Proceedings of the 7th International Conference on Economic Management and Green Development (pp. 163-172). Springer, Singapore.

Cite this article

Wang,Z. (2025). A Multivariate Linear Regression on Cost Analysis of Tesla. Advances in Economics, Management and Political Sciences,146,107-117.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wolff, S., Waclaw, A., & Lienkamp, M. (2021). An overview of parameter and cost for battery electric vehicles. World Electric Vehicle Journal, 12(1), 21-35.

[2]. Ayodele, B. V., & Mustapa, S. I. (2020). Life cycle cost assessment of electric vehicles: A review and bibliometric analysis. Sustainability, 12(6), 2387.

[3]. Lebeau, K., Lebeau, P., Macharis, C., & Van Mierlo, J. (2013). How expensive are electric vehicles? A total cost of ownership analysis. World Electric Vehicle Journal, 6(4), 996-1007.

[4]. Meegoda, J., Charbel, G., & Watts, D. (2024). Sustainable management of rechargeable batteries used in electric vehicles. Batteries, 10(5), 167-181.

[5]. Lienkamp, M. (2024). Quantifying the state of the art of electric powertrains in battery electric vehicles: Comprehensive analysis of the Tesla Model 3. World Electric Vehicle Journal.

[6]. Wang, Q. (2023). Analysis of Tesla company’s operations based on panel data. Academic Journal of Humanities & Social Sciences, 6(18), 50-58.

[7]. Hareyan, A. (2023). Cost analysis of Tesla Model Y: What makes it affordable. Torque News.

[8]. Alanazi, F. (2023). Electric vehicles: Benefits, challenges, and potential solutions for widespread adaptation. Applied Sciences, 13(10), 6016-6032.

[9]. Markel, T., & Simpson, A. (2007). Cost-benefit analysis of plug-in hybrid electric vehicle technology. World Electric Vehicle Journal.

[10]. Wang, X. (2024). Financial analysis and strategic forecast of Tesla, Inc. In X. Li, C. Yuan, & J. Kent (Eds.), Proceedings of the 7th International Conference on Economic Management and Green Development (pp. 163-172). Springer, Singapore.