1. Introduction

With the acceleration of global economic integration, the competition within the industry is growing more and more intense. Enterprises generally take the pursuit of cost efficiency and the realization of product characteristics as the core strategy, this consensus has been generally established in the industry. Supply chain finance is crucial in linking the capital flows of the upstream and downstream in the industrial chain. It has demonstrated incalculable value in easing the financing hardships of small and medium-sized enterprises and facilitating the overall optimization and upgrading of the supply chain to a higher level. However, problems such as information asymmetry, low transaction transparency, high trust cost, and complicated processes under the traditional mode seriously restrict the further release of its efficiency.

In this scenario, the emergence of blockchain technology has presented unparalleled prospects for revolutionizing supply chain finance innovations. By leveraging its decentralized nature, immutability, enhanced transparency, and smart contract capabilities, blockchain offers crucial technical backing for establishing a more secure, streamlined, and trustworthy ecosystem within supply chain finance. Blockchain makes it possible to achieve real-time data sharing and verification at all stages of the supply chain, thus enhancing information clarity and greatly reducing information asymmetries. Meanwhile, the automatic execution of smart contracts reduces the hazards associated with human intervention, simplifies the operation process, and improves financing efficiency and capital flow speed.

This research conducts an in-depth exploration of the pioneering application models of blockchain technology in supply chain finance, including but not limited to accounts receivable financing, inventory financing, and order financing based on blockchain. Firstly, it examines the application of blockchain in accounts receivable financing, analyzing how it enhances the efficiency and security of the process. Secondly, it delves into inventory financing with the assistance of blockchain technology, exploring the potential for improving inventory management and financing options. Finally, it investigates the role of blockchain in order financing, discussing its impact on supply chain operations and financial services. The objective of this paper is to dissect how these innovative applications transform the operational framework of supply chain finance and augment its capacity to support the real economy. The integration of blockchain technology with supply chain finance has had a deep influence on various facets, including enterprise financing costs, operational effectiveness, and risk mitigation strategies, offering both theoretical underpinning and practical directives for the future trajectory of supply chain finance development.

2. The Development and Current Situation of Supply Chain Finance

2.1. Development of Supply Chain Finance

The emergence of supply chain finance is because in the development and expansion of the supply chain, people no longer only focus on raw materials and final products, and production processes such as deep processing of semi-finished products are valued. The proportion of intermediate products is increasing, and credit trade is frequently adopted. The two sides of a trade settle multiple products centrally for some time after the transaction is completed. This greatly reduces the operational expenses incurred by the purchasing entity for the purchaser. For the small and medium-sized enterprises in the upstream of the supply chain, their ability to bear risks is low, and the downstream delays in the delivery of goods. The pressure of capital demand and high-risk loans is greatly increased [1]. This undoubtedly puts upstream and downstream enterprises on opposite sides, which goes against the principle of community of interests in the supply chain [2].

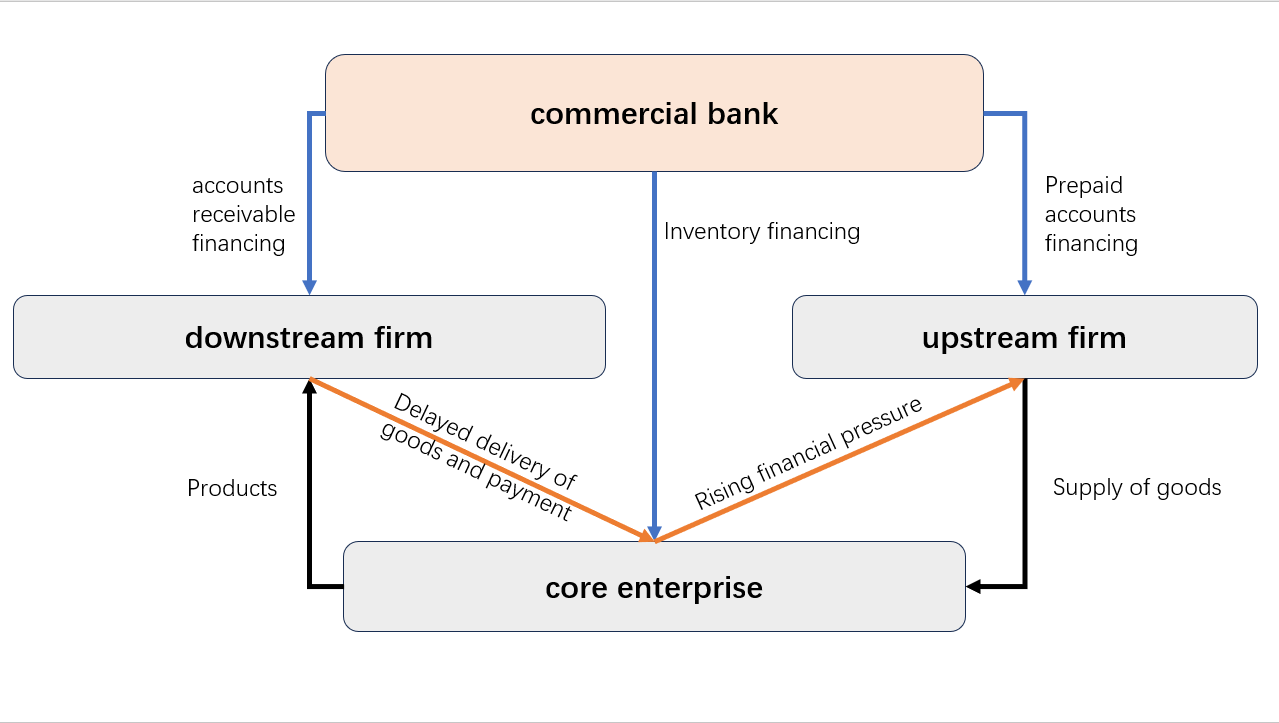

Therefore, to provide financing activities such as loans to upstream enterprises and form supply chain financing, supply chain management introduces third-party financial institutions into the supply chain. The cost of capital in the supply chain should be reasonably dispersed, and on the premise of realizing delayed payment, a large number of loans should be provided to suppliers quickly, which solves the problem of confrontation between the two sides, as shown in Figure 1. On this basis, financial institutions have developed other auxiliary business products in the supply chain, including resource integration of information, capital and logistics, credit products provided to buyers, consulting services, survey services, and other intermediate business products. With the introduction of relevant laws and regulatory measures, the system of supply chain finance is gradually complete.

Figure 1: Operation of commercial banks in the supply chain (Photo credit: Original).

2.2. Current Situation of Supply Chain Finance

Supply chain finance has shown a trend of swift expansion and digital transformation in recent years. Combined with big data, artificial intelligence, blockchain and other technologies, it can deal with the risks of false transactions, self-financing and self-insurance existing in traditional supply chain finance. Simultaneously, it also establishes online automated services to improve service efficiency and customer experience. However, numerous risk issues persist in supply chain finance, such as information asymmetry among core enterprises, financial institutions and financing subjects, challenges brought by technical security and data security, and a series of risks and hidden dangers such as imperfect laws and regulations [3].

3. Matching Analysis and Application of Blockchain Technology and Supply Chain Finance

To a certain degree, issues like information asymmetry and moral hazard impede the progress of the supply chain. To tackle these common problems, integrating blockchain technology into supply chain finance can help lower the costs associated with supply chain financing and enhance financing efficiency.

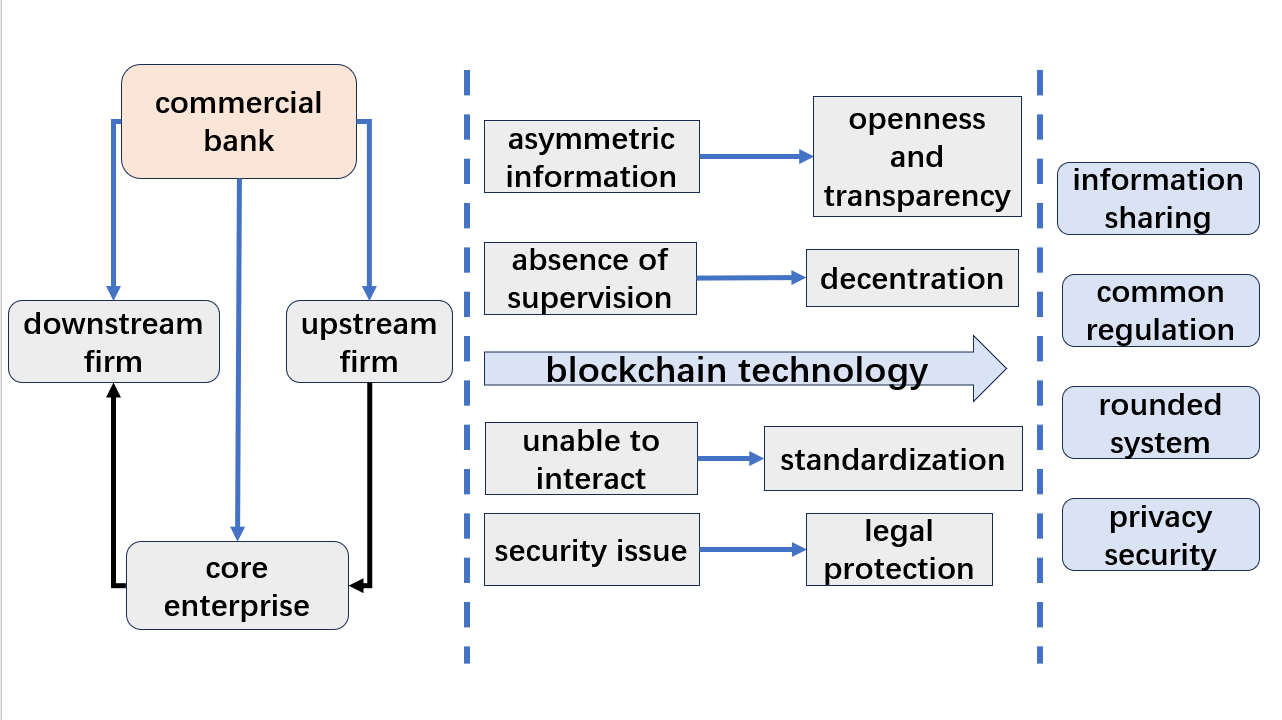

3.1. Blockchain Technology enables Transparent Transactions and Information Transmission

Traditional supply chain finance encounters challenges such as information segmentation without sharing and "information island" [4]. Financial institutions, including commercial banks, cater to enterprises throughout the entire supply chain. However, the creditworthiness of customers at each stage, along with the information they provide, remains undisclosed and unshared among these entities. Consequently, commercial banks find it challenging to ascertain the authenticity and reliability of information, and they can only make judgments from the information provided by customers, which exacerbates the issue of information asymmetry. The introduction of blockchain technology can solve this problem, as shown in Figure 2. Blockchain technology represents a distributed ledger system with blockchain storage and cryptographic guarantee of immutable and unforgeable. With blockchain technology in place, all information of all enterprises in the supply chain will be open and transparent within the supply chain and cannot be tampered with [5]. This reduces the cost of information exchange, promotes the efficiency of information exchange along the supply chain, further achieves rapid financing, and greatly reduces transaction fraud, false transactions and other risk problems. There will be a fairer and faster channel for communication and judgment on disputes such as information proof and accountability. Blockchain technology supports the free exchange of information, making the flow of funds transparent and reducing risks.

Figure 2: Blockchain technology is targeted to solve the problems and impacts of supply chain finance (Photo credit: Original).

In 2015, a number of state-owned enterprises established a supply chain financial service platform, China Enterprise Cloud Chain, based on the Internet. Relying on blockchain technology, the cloud chain of Chinese enterprises has achieved extensive credit penetration in the supply chain finance system. This technology enables the efficient transfer of information on the blockchain platform to enterprises in all links of the supply chain. In this way, a more robust credit structure can be constructed.

3.2. Blockchain Technology Realize Unmediated Transactions and Reduce Interference Items

According to the needs of each node in the supply chain, commercial banks provide enterprises with different products and services, which are customized according to the risk tolerance and credit status of each enterprise. Financing activities are highly dependent on manpower, with a large number of uncertain risks, high labor costs, and large security risks. The above forms a moral hazard problem. The decentralized characteristics of blockchain technology can form contracts with their trust, Reduce the human cost of the activity, and weaken the negative impact of human factors [6]. As the number of enterprises involved in the transaction increases in the supply chain, all enterprises jointly supervise the execution of the transaction, the more "regulators" there are, and the lower the cost of determining whether the other party is credible [7].

Yixin Finance, a professional auto finance trading platform in China, is a company mainly engaged in auto finance trading. But its performance has been poor in recent years and it has shifted to the loan facilitation business. Through blockchain technology, Yixin Finance has realized digital certificates and smart contracts, which can carry out digital identity authentication and ensure the security of transactions. This reduces the labor cost of transaction review and settlement, shortens the time needed for confirmation, and improves the security and credibility of supply chain finance.

4. Conditions and Guarantees for the Combination of Blockchain Technology and Supply Chain Finance

To realize the integration of blockchain technology and supply chain finance, certain preconditions and follow-up safeguard measures are needed. Including the basis of user cognitive will, the establishment and strengthening of security and privacy mechanisms, as well as the corresponding legal system as a guarantee for the smooth improvement of the ecological system.

4.1. Conditions for the Introduction of Blockchain Technology into Supply Chain Finance

4.1.1. Promote User Awareness and Obtain User Support

Blockchain technology connects every enterprise in the supply chain, forming an information-sharing, open, and transparent mechanism. However, the source of the information requires companies to actively join the blockchain and be willing to share it publicly. Only when users are willing to join and share their information, information sharing can be realized and the mechanism can be perfected [4]. Therefore, the willingness of users to use blockchain technology has become a prerequisite. At the same time, blockchain also has the characteristics of unlimited expansion. As the user base expands, information sources become more abundant, and the information shared becomes more valuable for reference. Meanwhile, the number of regulatory entities in the supply chain also increases, which further enhances the reliability of joint supervision among enterprises at all levels of the supply chain.

4.1.2. Establish a standardization Mechanism to Improve Safety Performance

Although blockchain technology has been proposed for many years, it has not been able to achieve widespread application due to the lack of a unified and effective standardization mechanism. Different blockchains may have different programming languages and privacy protocols, making it difficult for chains to interact with each other. The establishment of a standardized blockchain foundation will realize the interactive and cross-operation of multiple chains and break the closed single-chain environment to achieve scale. With the formation of multi-chain interaction, more attention should be paid to data privacy security. Privacy protection should be considered in the construction of blockchain, and the exclusive customization of asymmetric encryption technology should be promoted [8]. The information security of users should be put in the first place, and the parallel-serial capability of blockchain should be improved on this basis.

4.2. Guarantee to Realize the Combination of Blockchain Technology and Supply Chain Finance

4.2.1. Improve the Ecosystem of Blockchain and Supply Chain Finance

The application of blockchain technology to supply chain finance accurately solves the problems of information asymmetry and no supervision in the supply chain. Through innovative means such as smart contracts embedded in blockchain technology and advanced encryption algorithms, the security and credibility of supply chain finance are notably enhanced. Simultaneously, it integrates big data and Internet of Things technology to build a shared data platform to optimize the financing process and efficiency. Leveraging core enterprises within the supply chain as pivotal drivers, it is imperative to encourage upstream and downstream enterprises, alongside financial institutions, to collaboratively enhance the blockchain-based supply chain finance ecosystem.

4.2.2. Establish a Complete Legal Protection System

Although blockchain has exerted a great function in lowering the operating costs and risks of supply chain finance, there are numerous imperfect aspects of blockchain technology itself. Moreover, it lacks legal supervision. For example, blockchain is immutable, once the released code has vulnerabilities, it cannot be changed in time, and rights and obligations in smart contracts cannot be assigned to the code. Anonymity and decentralization in the blockchain make it difficult to identify those responsible [9]. If these defects are not subject to legal supervision, it is easy to breed money laundering, illegal transactions, and other criminal behaviors. The establishment of a comprehensive legal protection system is an essential prerequisite for the long-term operation of blockchain combined with supply chain finance.

5. Development Limitations and Future Prospects of Supply Chain Finance

5.1. Development Limitations of Supply Chain Finance

Once combined with blockchain, supply chain finance still encounters practical application issues.

First, although blockchain technology addresses the issue of asymmetric information within supply chain finance, it cannot guarantee the authenticity of information. If a company provides false information, blockchain technology cannot identify it. Due to the unalterable characteristic of blockchain, once information is recorded in the blockchain, false information cannot be changed in time. The level of trust within supply chain finance still has significant room for improvement [10]. Secondly, when blockchain technology is utilized in supply chain finance, there are compatibility problems between them. Blockchain technology is constrained by the legal system, human cognition, and other parties, and it is difficult to play an ideal role mechanism. If not constrained, blockchain will be used by willing people, resulting in information leakage and other problems. In addition, the trust obtained under the anonymity mechanism will be greatly reduced, and blockchain technology cannot achieve the ideal effect in practical application.

5.2. Future Prospects of Supply Chain Finance

In line with the global trend of intelligence, the combined utilization of technologies such as artificial intelligence and blockchain can conduct real-time and predictive analysis of corporate credit and massive transaction data, and promote the diversification and customization of financing products. By mastering customer preferences to customize services, the professionalism of supply chain finance can be improved. In recent years, the emergence of green supply chain finance, fueled by the drive to achieve carbon peaking and neutrality goals, has emerged as a significant direction for promoting enterprises' green transformation.

6. Conclusion

Objectively, blockchain technology will address issues like information asymmetry and moral hazard, which are common shortcomings in traditional supply chains. Blockchain technology has formed a series of solutions, including information transparency and full supervision. Under the condition of legal supervision in place and people's cognitive acceptance improving, the ecosystem formed by blockchain technology in supply chain finance will play a huge role. However, there are still problems such as false information in the supply chain waiting to be solved. In the future, people can achieve breakthroughs in the above limitations by introducing more advanced technologies. For instance, applying big data and artificial intelligence to supply chain finance.

References

[1]. Marjaneh Jahangiri Lahkani. et al. (2020). Sustainable B2B E-Commerce and Blockchain-based Supply Chain Finance. Sustainability, 12(10), 3968.

[2]. Hu, Y, F., Huang, S, Q. (2009). Supply Chain Finance: Background, Innovation and Concept Definition. Journal of Financial Research, (350):194-206.

[3]. Arief Rijanto. (2021). Blockchain Technology Adoption in Supply Chain Finance. J. Theor. Appl. Electron. Commer. Res. 16(7), 3078-3098.

[4]. Guo, J, E., Chen, C. (2020). Research on the Development and Innovation of Supply Chain Finance Driven by Blockchain Technology. Journal of Xi'an Jiaotong University (Social Sciences). (161): 46-54.

[5]. Wang, H. Y. (2024). Research on the Development of Agricultural Supply Chain Finance Based on Blockchain Technology. Heilongjiang Finance, (08): 48-52.

[6]. Lin, N. (2019). Research on Innovation of Supply Chain Finance Model Based on Blockchain Technology. New Finance, (04): 51-55.

[7]. Du, M. X., Chen, Q. J., Xiao, J., Yang, H. H., Ma, X. F. (2020). Supply Chain Finance Innovation Using Blockchain. IEEE Transactions on Engineering Management, 67, 1045-1058.

[8]. Deng, J, P. (2019). Blockchain Regulatory Mechanism and Enlightenment in the United States. China Policy Review, (01): 125-130.

[9]. Zhao, L., Shi, J. (2020). Governing Chain by Law: Technology Application and Legal Supervision of Blockchain. Journal of Law Application, (3): 33-49.

[10]. Gong, Q., Ban, M, Y., Zhang, Y, L. (2021). Blockchain, Enterprise Digitalization and Supply Chain Finance Innovation. Journal of Management World, (2): 22-34.

Cite this article

Liu,S. (2025). Research on the Development and Application of Supply Chain Finance Based on Blockchain Technology. Advances in Economics, Management and Political Sciences,144,134-139.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance's Role in the Just Transition

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Marjaneh Jahangiri Lahkani. et al. (2020). Sustainable B2B E-Commerce and Blockchain-based Supply Chain Finance. Sustainability, 12(10), 3968.

[2]. Hu, Y, F., Huang, S, Q. (2009). Supply Chain Finance: Background, Innovation and Concept Definition. Journal of Financial Research, (350):194-206.

[3]. Arief Rijanto. (2021). Blockchain Technology Adoption in Supply Chain Finance. J. Theor. Appl. Electron. Commer. Res. 16(7), 3078-3098.

[4]. Guo, J, E., Chen, C. (2020). Research on the Development and Innovation of Supply Chain Finance Driven by Blockchain Technology. Journal of Xi'an Jiaotong University (Social Sciences). (161): 46-54.

[5]. Wang, H. Y. (2024). Research on the Development of Agricultural Supply Chain Finance Based on Blockchain Technology. Heilongjiang Finance, (08): 48-52.

[6]. Lin, N. (2019). Research on Innovation of Supply Chain Finance Model Based on Blockchain Technology. New Finance, (04): 51-55.

[7]. Du, M. X., Chen, Q. J., Xiao, J., Yang, H. H., Ma, X. F. (2020). Supply Chain Finance Innovation Using Blockchain. IEEE Transactions on Engineering Management, 67, 1045-1058.

[8]. Deng, J, P. (2019). Blockchain Regulatory Mechanism and Enlightenment in the United States. China Policy Review, (01): 125-130.

[9]. Zhao, L., Shi, J. (2020). Governing Chain by Law: Technology Application and Legal Supervision of Blockchain. Journal of Law Application, (3): 33-49.

[10]. Gong, Q., Ban, M, Y., Zhang, Y, L. (2021). Blockchain, Enterprise Digitalization and Supply Chain Finance Innovation. Journal of Management World, (2): 22-34.