1.Introduction

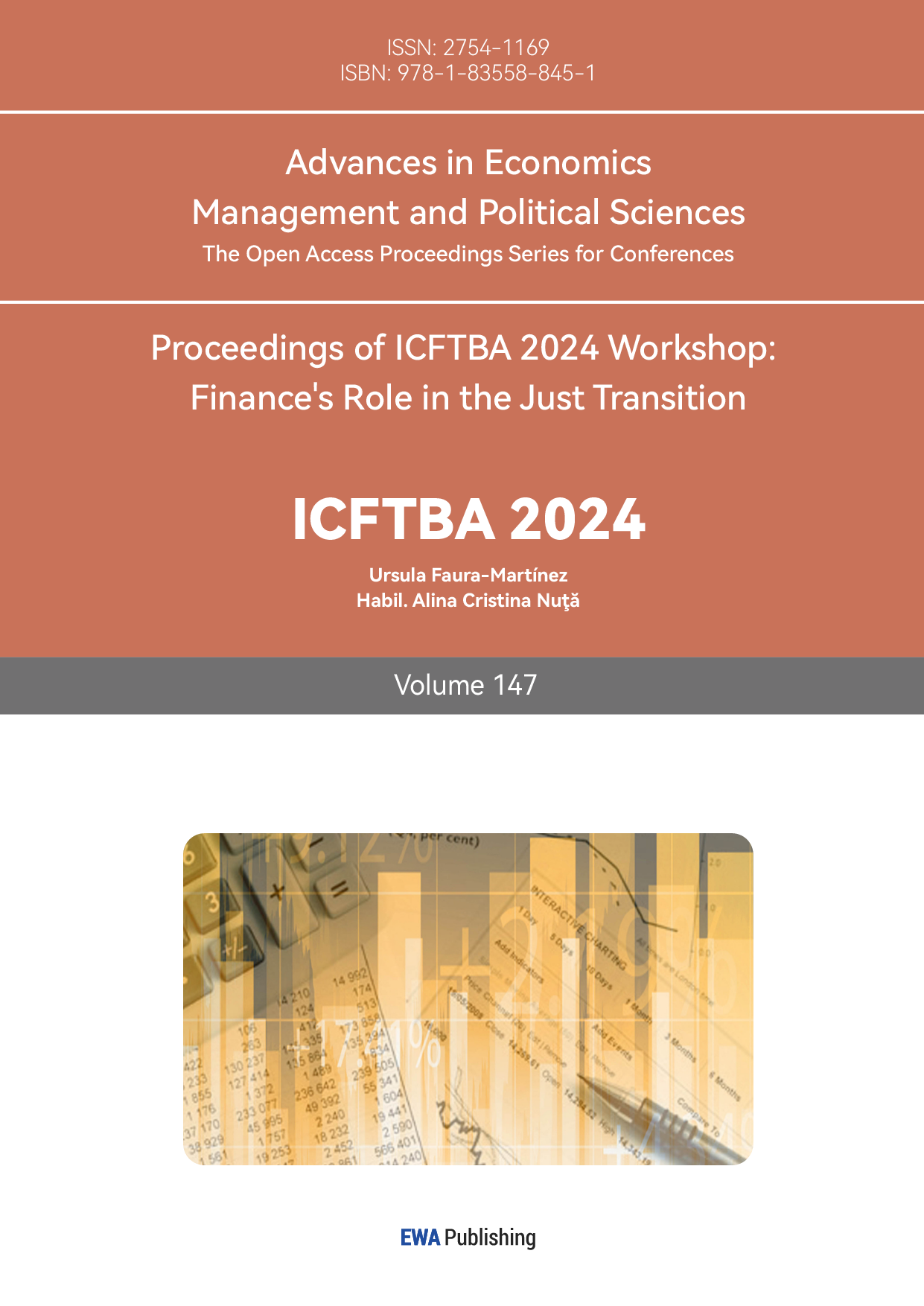

The outbreak of the Russia-Ukraine war has exacerbated the tension in international relations, resulting in rising energy and food prices. Russia's commodities exports have decreased as a result of the trade restrictions and economic dictatorship that the US, the EU, and other Western nations imposed on the country. Furthermore, the economic difficulties resulting from the trade tensions between the US and China have a direct bearing on the imports and exports of emerging market nations, delaying their economic growth. Developing nations with a comparatively full market economy, a comparatively quick rate of economic growth, and significant development potential are referred to as emerging market nations. Frequently mentioned by scholars and media include China, Brazil, India, Malaysia, Thailand, the Philippines, Mexico, South Africa, Thailand, Turkey, etc [1]. The trade economy has steadily grown in importance as global economic integration has progressed, contributing to the economic growth of developing market nations. Because they have less developed financial markets and are more exposed to US risk than developed countries, emerging market nations are more susceptible to shifts in central banks' monetary policies [2]. The US dollar's hegemony in the global monetary system has a significant impact on the economic development of emerging market nations, meaning that fluctuations in the Federal Reserve's exchange rate have an impact on these nations' import and export trade balances. Over the last two years, the Federal Reserve has raised interest rates in order to reduce inflationary pressures; since the start of 2022, the Fed has raised rates by 475 basis points in a single year, from March 2022 to March 2023 [3]. The effective federal funds rate in the US stays at 5.33 from August 2023 to July 2024, based on statistics from the Federal Reserve Fund (FRED). The increase in interest rates by the Fed may cause multinational corporations operating in emerging market nations to spend less in manufacturing and incur higher production costs, which will lower exports and result in a trade deficit.

Figure 1: Changes in the Fed's effective federal funds rate over the past five years [1]

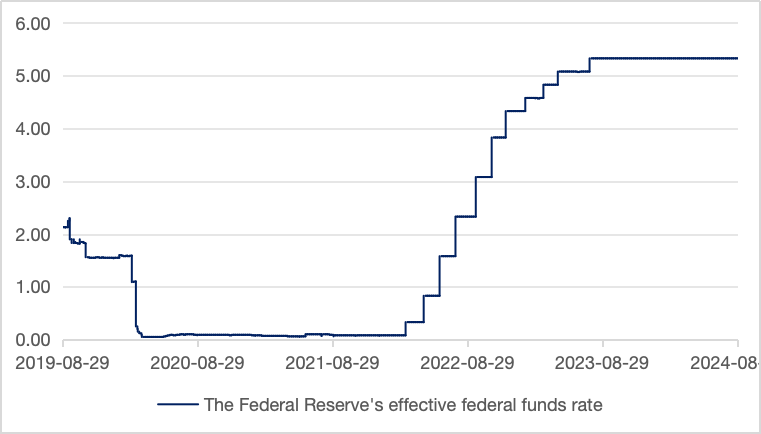

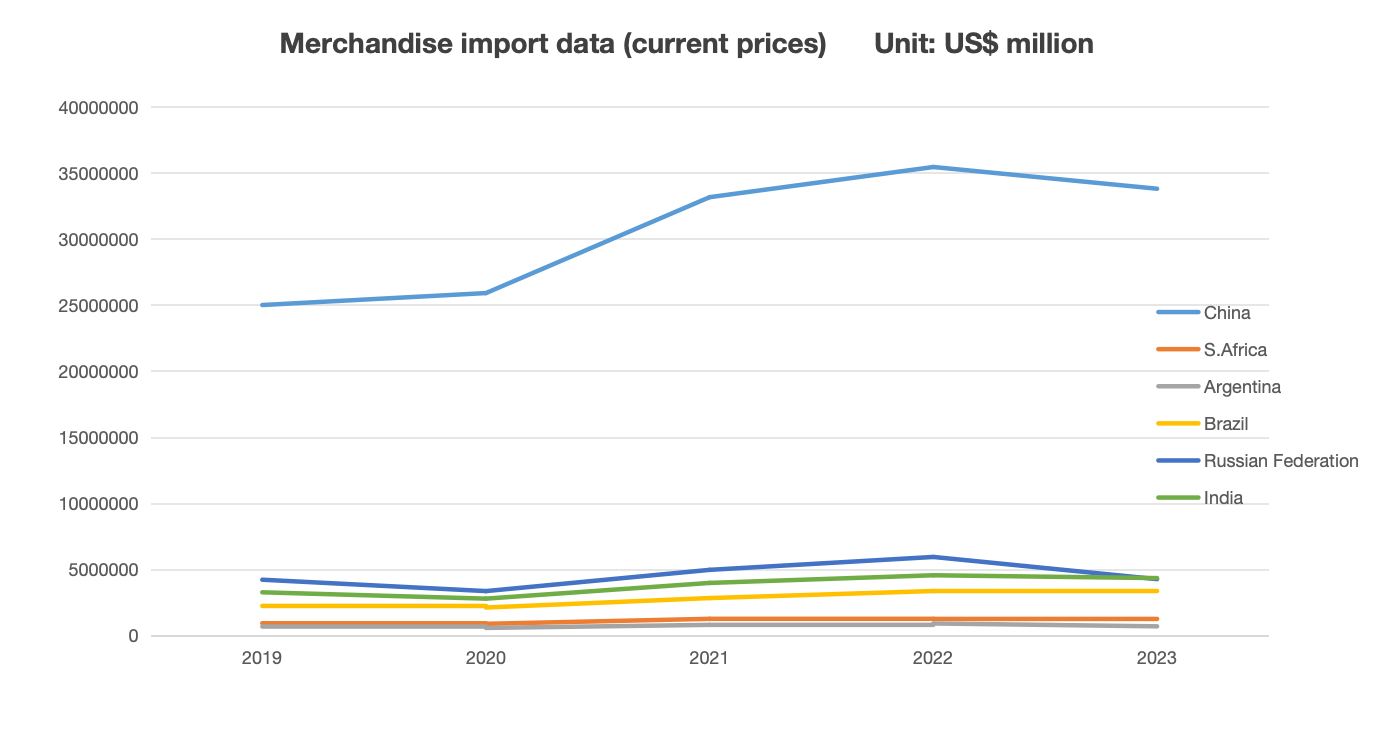

The data presented in Figures 1, 2, and 3 illustrates that, despite annual variations in the aggregate import and export figures of emerging market nations, the general pattern of development remains consistent, and the Fed's monetary policy changes coincide with one another. This paper examines the existing literature based on the Federal Reserve's policy changes over the last five years. It unifies the various effects of US monetary policy on the import and export of different countries and addresses the effects of the Fed's interest rate hike and reduction policy on the import and export of emerging market countries from three perspectives: spillover effect on capital flow, FDI of multinational enterprises, and macroeconomy. On this basis, we should think about how China should respond to a series of changes in the global trade economy and what measures to take to reduce related losses. Macroeconomically speaking, it offers China a theoretical framework for responding to shifts in foreign exchange policy and modifying trade and economic policies. This is extremely important for the growth of trade economies in emerging markets and the stability of the world trading system.

Figure 2: Merchandise import data of selected emerging market countries in the past five years (current price) in millions of US dollars [2]

Figure 3: Merchandise export data (current prices) of selected emerging market countries in the past five years, unit: million US dollars [3]

2.Literature review

As one of the largest economies in the world, the United States has a large impact on the global economy through a variety of channels in the current global economic integration. The Federal Reserve has frequently modified its monetary policy in response to shifts in the global trade economy and to enhance the domestic economic climate in the United States since the trade spat between China and the United States. The two distinct economies that are the focus of current study on the effects of changes in the Fed's monetary policy are developed countries and emerging market nations.

In recent years, the literature on the influence of Fed monetary policy changes on developed countries can be summarized as follows: Through three channels—exchange rates, trade, and capital flows—US monetary policy influences the developed nations' financial market volatility, price stability, and economic growth. Ma Li and Yu Huijuan investigated how the Fed's base money supply and bond purchase program affected the macroeconomic indicators of other industrialized nations using the panel vector autoregressive analytic method [2]. Research has indicated that the monetary policy of the United States, which is loose, has had a notable impact on other industrialized nations. leading to a widening of trade deficits, rising price levels, and increased output, as well as a ripple effect of multiple economic variables such as capital markets, exchange rates, and money supply. Li Zihao systematically investigated the effects of the Fed's interest rate hike policy on the interest rate dynamics of advanced economies using the time-varying impulse response analysis framework, and it was discovered that there was a significant synchronization between the US and Chinese monetary policies [4]. According to the data, the Fed's interest rate increases have greatly accelerated the growth of advanced economies while slowing down growth in other regions, such as Italy and Australia. This phenomenon suggests that monetary policy can have a differentiated impact across economies. Wei Nianchun carried out a thorough quantitative study of the ripple effects of the Fed's monetary policy or economic shocks between various economies using the vector autoregressive model [5]. The results of the study clearly show that such spillovers show significant differences between economies such as the eurozone and Japan. Among them, the eurozone economy has been particularly affected, and the impact on the Japan economy has shown a gradual weakening trend. This result illustrates how closely related and well synchronized the sources of movement in US monetary policy are to the eurozone. By examining the spillover effects of changes in US monetary policy, Tang Lingxiao and Xu Tao discovered that nations with various economic bases respond differently to the uncertainty of US monetary policy [6]. Since this study, the sample countries are divided into emerging market countries and developed countries, and the differential impact of United States monetary policy changes on them is further analyzed. The findings indicate that the capital anomalies of developed economies are more significantly impacted by changes in US monetary policy.

Furthermore, emerging market nations are impacted by the recent monetary policy adjustments made by the Fed primarily in three ways: capital flows, the overall macroeconomy, and import and export trade. Tan et al. reviewed the literature on the impact of monetary policy changes on the spillover effects of United States emerging market countries and concluded that monetary policy changes in these countries would lead to issues like capital flight, higher interest rates, and weakened monetary policy independence [3]. He Yi used vector autoregressive models, time-varying vector autoregressive models, and mediating effect models to examine how the Fed's monetary policy affected interest rate transmission efficacy in emerging market nations at various times in time. The findings indicate that the monetary policy of the Federal Reserve has a variable and time-varying effect on the efficiency of interest rate transmission in emerging market nations. This effect is primarily caused by changes in the financial openness of these nations, which in turn impacts the effectiveness of interest rate transmission [7]. The enterprise investment rate was used as the dependent variable in Gou Qin et al.'s analysis. The core explanatory variable was the change in US monetary policy in the twelfth year (USMPt), and the product of whether there is an ownership linkage between US and emerging market enterprises (USLinkagei). The role and specific transmission mechanism of ownership linkages between US and emerging market enterprises in the cross-border transmission of US monetary policy were thoroughly examined, confirming the role of multinational corporations in the spillover effect of US monetary policy [8]. The impact of conventional and unconventional monetary policies in the United States on China's economy were compared by Liu Weiping and Ma Yongjian using the vector autoregressive model. They selected policy variables, macroeconomic indicators, financial, and asset price indicators, and discovered that the United States' loose monetary policy had a significant negative spillover effect on China's macroeconomy as a whole [9]. By examining the hike and decrease in the Fed's policy rate, Wang et al. investigated the impact of the Fed's interest rate adjustments on the macroeconomy of emerging market nations. They came to the conclusion that these actions have a broad range of macroeconomic repercussions on these nations [10]. The impact of the United States' loose monetary policy on China's export trade of various industries was examined by Nie Jing and Jin Hongfei using the structural vector autoregressive model of "block exogeneity" constraints. They also performed variance decomposition and cumulative impulse response analysis on the model results and came to the conclusion that the loose monetary policy of the United States has a negative spillover effect on the exports of most industries and only a weak positive spillover effect on a few industries [11]. The flexible monetary policy of the United States significantly hinders the growth of medium- and high-tech businesses while having no effect on the export of low-tech companies. Based on Yu Le's qualitative analysis, a structural vector autoregressive model is established to examine the impacts of the Fed's four rounds of quantitative easing monetary policy on China's foreign trade through four different channels from 2008 to 2013, namely the Sino-US exchange rate, international commodity prices, foreign investment, and the US domestic economy. The model aims to determine the significance and differences in these impacts [12]. The conclusion is that by bolstering the US economy, the Fed's loose monetary policy has temporarily enhanced China's trading position. Under the long-term impact, rising commodity prices and foreign direct investment have respectively inhibited exports and promoted imports, which has worsened China's trade balance. Ma Li and Yu Huijuan studied the spillover effect of the Fed's quantitative easing monetary policy on the BRICS using the panel vector autoregressive method, with the Fed's base money and asset size as independent variables and the economic output, price level, import and export trade, exchange rate, capital market fluctuations, and money supply of the BRICS countries as dependent variables [13]. The findings indicate that the United States' quantitative easing monetary policy has a stable long-term effect on the BRICS nations. In the short term, this will result in real economic growth and currency appreciation for the BRICS nations, as well as the development of their virtual economies. Among them, he stated that the Fed's quantitative easing monetary policy expanded the demand for BRICS products in the early stages of implementation, which somewhat stimulated domestic consumption in the United States, in the research section on the impact of the Fed's loose monetary policy on import and export trade. Over time, as the US dollar depreciates and the value of the BRICS currencies increases, BRICS goods become less competitive outside, resulting in a progressive drop in the BRICS trade surplus. Xu Jiayun used micro enterprise data to explore the effects of the Fed's monetary policy adjustments on Chinese manufacturing companies through empirical analysis, taking the import trade volume of enterprises as the dependent variable, and the federal funds interest rate, year, and control variables as the dependent variables, among which the control variables include the real effective exchange rate, enterprise productivity, enterprise size, average wage, enterprise profit margin, financing constraints, government subsidies, dummy variables of enterprise type (foreign-funded enterprises are assigned 1, otherwise they are domestic-funded enterprises), and dummy variables of processing trade enterprises (Processing trade enterprises are assigned a value of 1, otherwise other enterprises), and a regression equation model is constructed. The findings demonstrate that by making financing easier, the Fed's expansionary monetary policy has increased imports [14]. Through the analysis of the differences in the model, he believes that the differences in enterprise productivity, profit margin, ownership, whether to export, the type of imported products, and the influence of changes in US monetary policy on the import behavior of Chinese firms is highly heterogeneous, depending on the import source country or region. According to Peng Yifeng, who examines the effects of the Fed's loose monetary policy on China's imports and exports through the lens of commodity trading, the Fed's quantitative easing monetary policy will impede the growth of China's foreign trade industry and have a significant negative impact on China's trade income [15]. The effect of the Fed's tightening monetary policy on the import and export trade of emerging market nations is examined by Kim Young-hee [16]. Studies indicate that the demand for goods and services from emerging market nations has decreased as a result of the Fed's tightening stance. By lowering the volume of products imported from emerging market nations, the Fed's balance sheet reduction program has raised interest rates in those nations.

The literature mentioned above offers a solid theoretical foundation for the investigation in this work, but there are still shortcomings. While the implications of the Fed's monetary policy through spillover effects on other economies have been extensively researched, it does not combine theory with reality, and lacks the connection and expansion with practical related fields. Studying the effects of the Federal Reserve's monetary policy on the imports and exports of emerging market countries is extremely practical because a nation's imports and exports can accurately reflect its trade and economic circumstances, and because emerging market economies hold a unique position in the global economy. To make the research process easier to understand and more in line with reality, we will focus on the two most common and typical monetary policies of the Federal Reserve—raising interest rates and cutting interest rates—in this paper. This will allow us to take timely action in response to changes in the Fed's monetary policy.

3.Research Methods

The literature research method is a research method based on the systematic analysis of existing literature through the collection, identification, and sorting of literature in related fields, from which the development of the research topic, the status of research, the existing problems, and the future trend are extracted. Using the two main economies of developed and emerging market nations as its focus, this paper will employ this methodology to identify research directions, identify breakthroughs in the field, and create a title. It will also gather and organize research findings regarding the effects of the Fed's monetary policy changes on international trade and the economy, offering a strong theoretical foundation and point of reference for further study.

4.Technical roadmap and feasibility analysis

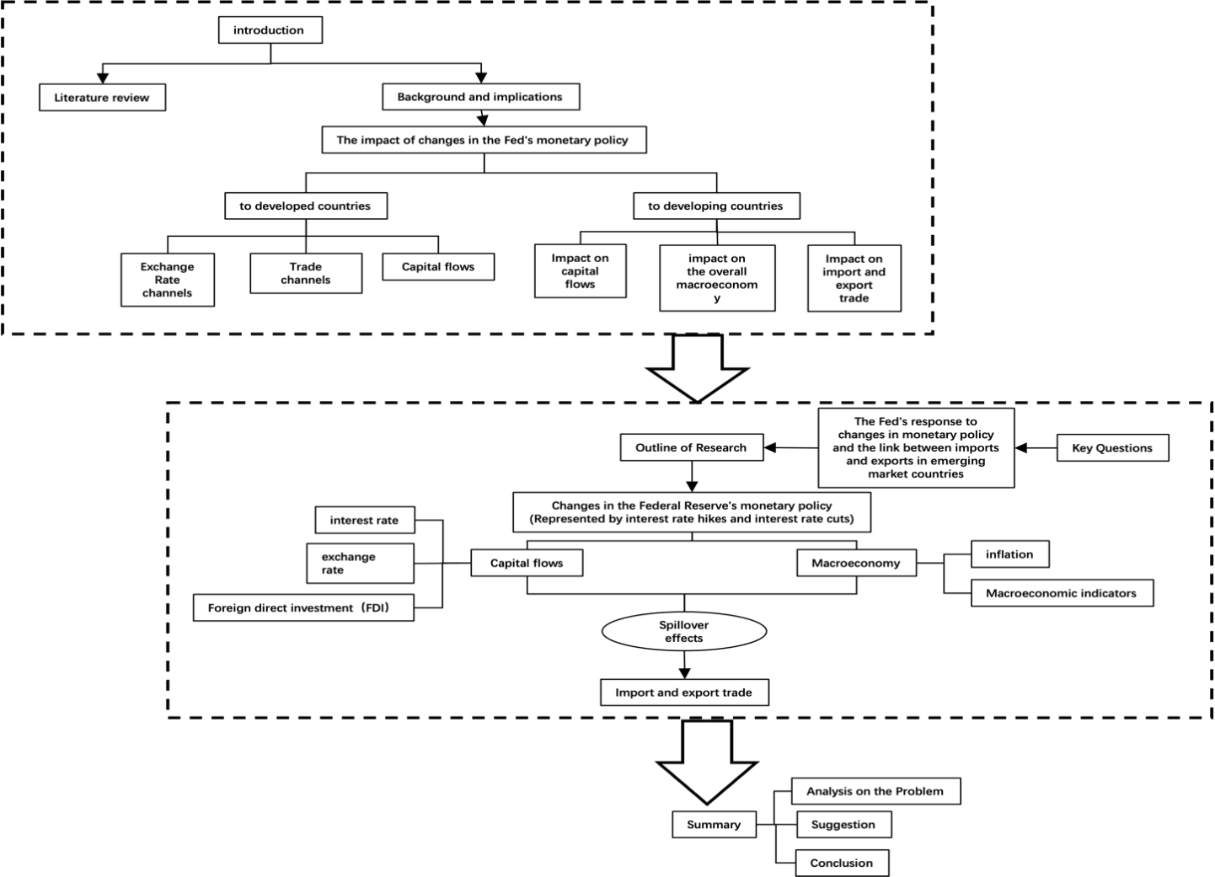

Figure 4: Technology roadmap of the study [16]

Figure 4 shows the technical roadmap of this document. By summarizing the literature, this study is feasible from a theoretical perspective. First of all, this study is theoretically based on the capital flow and macro aspects of the Fed's changes, and this theoretical framework has been widely applied and verified. Second, the research group has accumulated sufficient theoretical knowledge in the early stages of international trade and international finance courses, such as the monetarist inflation theory proposed by Milton Friedman, that is, the purchasing power of money will decline, and the level of prices will rise when the money supply surpasses the amount needed for economic expansion. According to Irving Fisher's theory, the Fisher Effect, nominal interest rates increase in tandem with anticipated increases in inflation to maintain real interest rates at their current levels. as well as the interest rate parity hypothesis, which postulates that, in the absence of obstacles to capital flows, capital will move from lower-interest countries to higher-interest countries based on differences in interest rates, causing exchange rate fluctuations until the returns on financial investments in both countries are equal. In addition, the research group is guided by experienced mentors, who are constantly revised and improved during the research process to make the final research results more professional.

5.The innovation point of the project

This document first identifies the two Federal Reserve monetary policies that are most common, increasing and decreasing interest rates, and it then lists the different monetary policy modifications. The Fed's monetary policy in recent years has mostly focused on raising interest rates due to the global environment. It is evident from looking at the data in Figures 1, 2, and 3 that the Fed's interest rate hike policy has an effect on the import and export of goods in emerging market nations. Research subjects used to favor the Fed's quantitative easing (tightening) monetary policy, but the Fed's monetary policy adjustments are varied and complex. This article summarizes the two most common types of monetary policy, making it more useful.

Second, this article uses capital flows and macroeconomic spillover effects to relate the Fed's changes in monetary policy to import and export commerce. Previous research has examined the effects of the Fed's monetary policy changes on import and export commerce of different nations, as well as the economic spillover effects (this study solely addresses the economic spillover effects). However, the three have not been connected.

Third, the focus of this paper's research is emerging market nations. Emerging market countries are a very important economy in the current world situation, including many developing countries with great development potential. In recent years, the study on the economic activities of emerging market countries has gradually increased, but the research on the import and export trade of these countries is rather limited. This work closes a gap in the field.

6.Influence mechanism

Using the Fed's primary goals and instruments, this article examines the mechanisms by which changes in monetary policy affect the world economy. This paper examines the effects of the Fed's interest rate hike and cut monetary policy on capital flows and the macroeconomies of developed and emerging market nations, with reference to the evolution and current trend of the Fed's monetary policy following the Sino-US trade conflict. It also examines the relationship between the Fed's monetary policy changes and the import and export of emerging market nations.

The monetary policy decisions made by the Fed have a broad effect on capital flows. Regarding capital flows, we will discuss interest rates, exchange rates, and FDI. First, because emerging market economies are now strongly dependent on the dollar due to global economic integration, increases in interest rates by the Fed have a knock-on effect on money and financial markets. Following the Fed's rate hike, the US capital market saw a rise in interest rates, and the gap between US interest rates and those of other nations grew considerably. Interest rate increases have caused capital outflows from other nations by luring a wave of international investors looking for greater payouts into the US. Over time, as the flow of funds has slowed down, the level of interest rates in other countries has gradually decreased, which has caused a spillover effect on international finance. In the short term, the conductivity of the interest rate hike policy implementation has prompted a slight increase in interest rates in emerging market countries. Second, the relative attractiveness of US dollar assets rises when the US adopts interest rate hike policies. This encourages capital flows from across the world to the US, which in turn helps the US dollar exchange rate appreciate, resulting in significant cross-border spillover effects. Under the effect of this effect, the currencies of other countries often face depreciation, investment and consumption demand are suppressed, import costs are rising, and their export competitiveness is weakened, which exacerbates the risk of imported inflation and poses a challenge to domestic economic stability. Furthermore, spillover effects have been felt in the bond, stock, and commodities markets; as a result, investors may choose to adopt more cautious investing strategies in response to uncertainty, leading to further tightening of market liquidity, increasing asset price volatility, and posing a potential threat to the stability of the global economic and financial system. In parallel, foreign direct investment (FDI) in emerging market nations has decreased as a result of the Fed's interest rate hikes. As a result, investors may decide to sell their holdings and bring their money back to the US, which will enhance FDI into the US, which in turn leads to much lower investment by local enterprises in emerging market countries than in United States-related multinational industries. For emerging countries, this means higher investment costs and lower profitability, which in turn leads to a continued contraction in FDI inflows. Emerging market countries will face a financial shortfall and a reduced willingness of TNCs to sustain and expand their investments, creating spillover effects.

The macroeconomy of emerging market nations is greatly impacted by changes in the Fed's monetary policy; the most common effect is shown in changes to macroeconomic indicators. Under the effect of rate of interest effectiveness, the Federal Reserve's interest rate hike leads to the depreciating currencies of emerging market countries through the financial market and money market, and the national investment and consumption desire continues to decrease due to the rise in inflation, and the gap between the relative income of the people and other developed countries is further widened, resulting in a spillover effect on the per capita gross domestic product (GDP) of emerging market countries. Besides, the price level (CPI) in emerging market nations has been impacted by changes in the Federal Reserve. In emerging market nations, inflation will increase when the Fed modifies its monetary policy. Due to the Fed's interest rate hike, the value of the dollar will rise, which will discourage capital from investing in the actual economies of emerging market nations. Additionally, the depreciation of these nations' currencies will result in issues like decreased purchasing power, increased unemployment, and higher prices and costs. Interest rate reduction by the Fed will shift capital further into emerging market countries' markets, resulting in an increase in the value of those countries' currencies and an inflationary cascade.

Trade between emerging market nations has been impacted by shifts in the Fed's monetary policies. In terms of capital flows, the United States and emerging market countries have different interest rates, which draws more foreign capital into the United States after the Fed raises rates. This capital spillover effect lowers the level of investment and consumption throughout the entire nation, and economic activities contract, which is likely to further expand the trade deficit. Additionally, the US dollar has appreciated due to the negative spillover effect of the Fed's interest rate hike through exchange rate changes, and emerging market countries' money supply has been declining. As a result, these countries' demand for imported goods from other countries has declined, export volume has sharply decreased, and the import and export trade has been impacted. Meanwhile, the scale of FDI flowing into emerging market countries has been declining, resulting in the transmission of spillover effects from multinational corporations to United States affiliates in emerging market countries through their internal capital markets and internal supply chains, and the cross-border trade costs of trading companies have risen, which has indirectly worsened the import and export trade situation. As the US dollar declined in value in the near term, the Fed started to implement its interest rate decrease monetary strategy, United States domestic consumption was stimulated to a certain extent, and the demand for goods in emerging market countries increased. However, as the dollar continues to depreciate and emerging market currencies appreciate, the export competitiveness of emerging market countries' goods has been weakened, eventually leading to a smaller trade surplus. From a macroeconomic perspective, the consumer price index (CPI), the GDP growth rate year over year, the stock index (INDEX), and the money supply (M2) are among the macroeconomic variables that are significantly impacted by the Fed's tightening monetary policy in emerging market nations. Macroeconomic indicators show that the Fed's tightening monetary policy has a long-lasting effect on emerging market nations, with a particularly strong long-term impact on the countries' price index. Moreover, rising inflation rates have disrupted these nations' market economies and decreased domestic demand for imports, which is detrimental to their import trade.

However, due to various company trade patterns, the ripple effects of the Fed's monetary policy adjustments are clearly diverse: The financial constraints faced by US affiliates in emerging markets are more severe due to higher interest rates in the US than by local businesses in these nations. The import of two-way trading enterprises is more impacted by changes in US monetary policy than pure import enterprises because they are subject to the financial strain of information costs, sunk costs, and transaction costs associated with import and export trade. Compared with enterprises whose main business is the sale of capital imports, the scale and quality of intermediate goods imports in emerging market countries have been significantly improved in recent years, and the profit level of pure intermediate goods importers has continued to increase, and the financing situation has been continuously improved. At the same time, the capital threshold for intermediate imports is lower than that for capital imports, so the spillover effect of higher federal funds rates through tighter domestic financing has a more significant negative impact on capital goods importers.

7.Analysis on the Problem

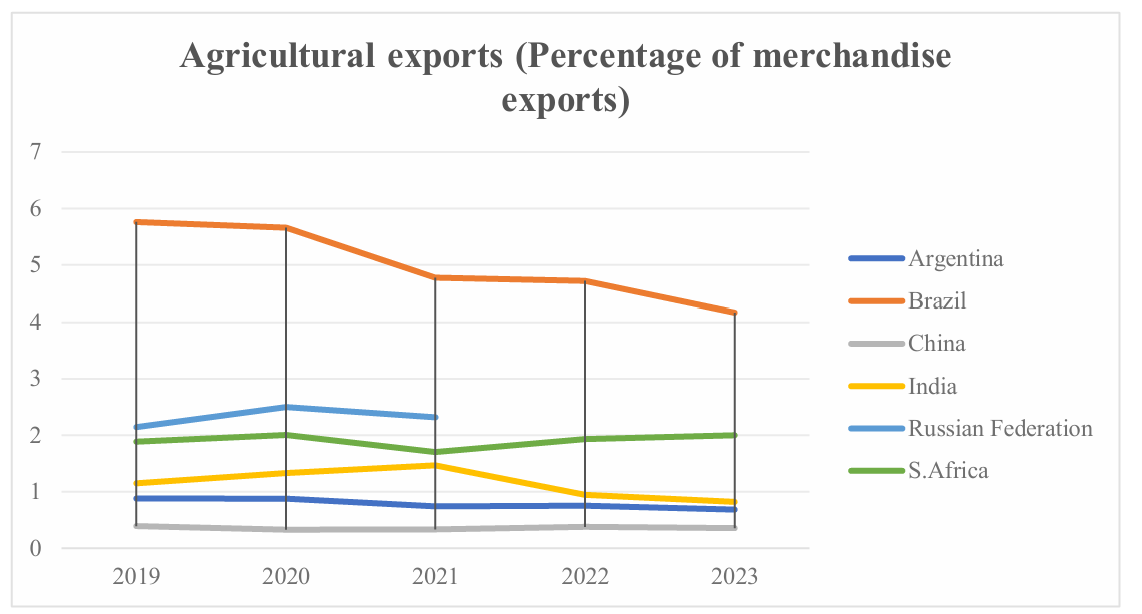

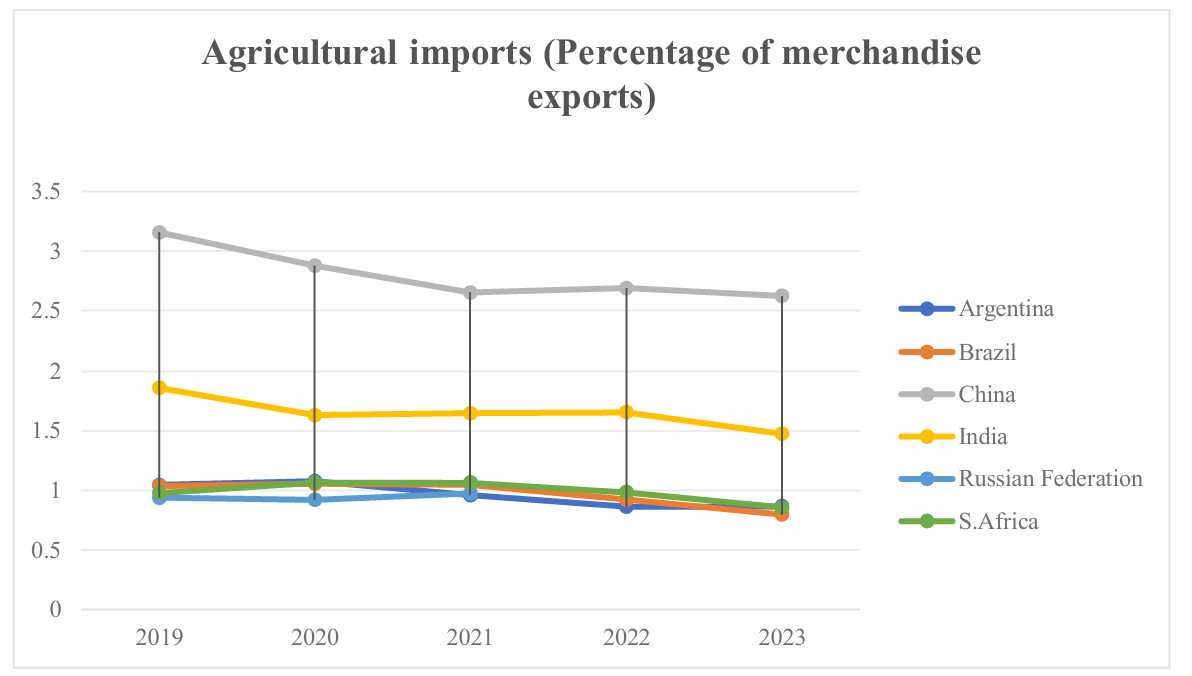

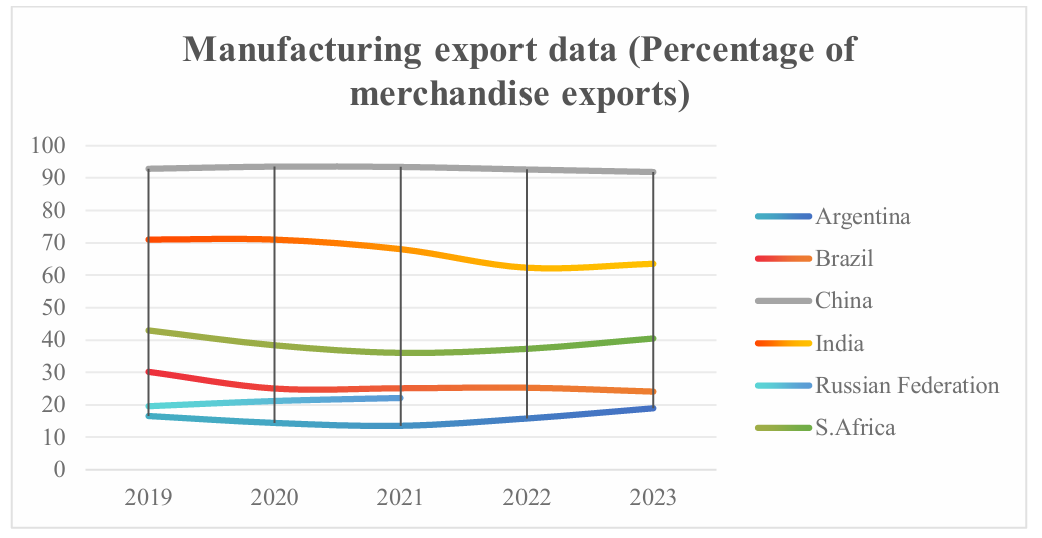

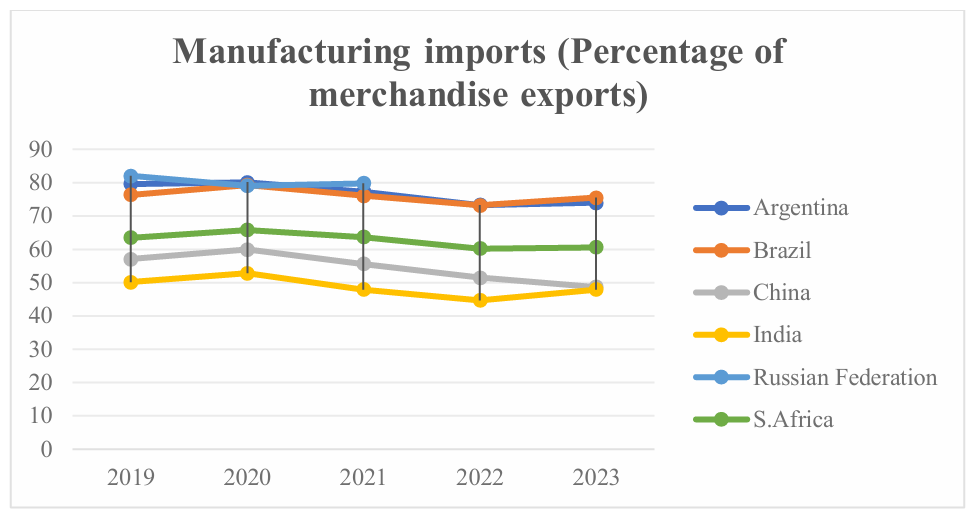

Exchange rates are one way that the United States and other nations are connected. Because to the Federal Reserve's loose monetary policy, there has been a decline in the demand for the products of emerging market nations on the global market, which has led to a sharp decline in exports from these nations and a rise in the demand for imports [17]. The strengthening of the dollar results in increased prices for American goods abroad when the Federal Reserve hikes interest rates, boosting demand for American products. This shift causes global capital to flow into the U.S., triggering cross-border spillover effects. As a result, other countries experience currency depreciation, increased import costs, and weakened export competitiveness. Manufacturing and agriculture are two specific industries that are negatively impacted by U.S. monetary policy. As shown in Figures 1, 4, and 5, it can be seen that although there are variations in the percentage of agricultural and manufacturing exports among emerging market countries over the past five years, The trend indicates a fall in accordance with adjustments to the monetary policy of the Federal Reserve. The percentage of imported products has also declined more significantly than the percentage of exports in the same year. This indicates that emerging market countries are affected by changes in Federal Reserve policies, resulting in decreased international demand for their export products and a decline in demand for imported goods.

Figure 5: Agricultural exports (percentage of merchandise exports) of some emerging market countries over the past five years [17]

Figure 6: Agricultural imports (percentage of merchandise exports) of some emerging market countries over the past five years [17]

Figure 7: Export data of manufactured products of some emerging market countries in recent 5 years (as a percentage of merchandise exports) [17]

Figure 8: Imports of manufactured goods (% of merchandise exports) for selected emerging market countries in recent 5 years [17]

The Federal Reserve's monetary policy not only affects trade in goods but also has a profound impact on trade financing in emerging market countries due to capital flows triggered by policy changes [18]. When the Federal Reserve increases mortgage rates, it leads to currency depreciation in nations with emerging economies through the impact of interest rates in both financial and monetary markets, generating spillover effects in trade financing in the Figure 5, Figure 6 and Figure 7.

Moreover, the Federal Reserve's policy changes also impact the price levels in emerging market countries [18]. An increase in interest rates leads to dollar appreciation, which reduces capital investment in the real economies of emerging market countries. The depreciation of their currencies causes a decline in purchasing power, rising unemployment rates, and increases in prices and costs. When the Federal Reserve implements a rate cut, the depreciation of the dollar stimulates domestic consumption to some extent, resulting in increased demand for products from countries with emerging economies. Furthermore, the monetary policies of the central banks of other industrialized nations, such Japan and Europe, are quite similar to those of the Federal Reserve System. The primary high-interest rate policies of the European Central Bank and the Bank of Japan have the potential to worsen the debt issues in emerging market nations. When U.S. interest rates are high, funds flow back from emerging markets to the dollar area, increasing the dollar exchange rate and attracting more capital out of emerging markets. Major European and American central banks modify their monetary policies and interest rates, enacting boosts or decreases in rates that have an indirect impact on newly developed countries' export trade, rates of exchange, and monetary policy space.

The U.S. economy is connected to the rest of the world through goods, factors, and asset markets [19,20]. Due to the effects of the Federal Reserve's tighter monetary policy, developing market nations' products are less in demand on the global market, which forces them to enact trade protection laws and raise trade barriers, resulting in a decline in import and export volumes. The strengthening of the dollar results in a relative increase in the price of American goods on the foreign market when the US central bank hikes interest rates, increasing demand for U.S. products. Meanwhile, while suppressing domestic product exports, the U.S. lowers the prices of imported goods from other countries, leading to an expansion of global trade deficits. When the U.S. economy slows due to rate hikes, it exerts economic pressure on other countries through spillover effects, prompting them to adopt trade protection measures to safeguard their domestic industries. Consequently, the impact of the Federal Reserve's financial policy volatility on the monetary policies of other nations makes enterprises inclined to produce domestically, reducing trade exchanges, leading governments to increase import tariffs, and limiting import quotas, thus raising international trade barriers.

8.Suggestion

Based on the above research and in light of actual conditions, the following suggestions are made for emerging market countries to hedge against exchange rate risks: Through technological advancements and innovation, emerging market countries can significantly lower production costs and effectively break the long-standing monopolies in various industries. This not only promotes a more competitive business environment but also enables them to gradually reduce their over-reliance on imported technology from developed countries. Consequently, these countries can enhance the global competitiveness of their export products, making them more attractive in international markets. Furthermore, developing nations might give priority to the advancement of high-tech sectors like computer science, biotechnology, and renewable energy to diversify their economic base and reduce dependence on traditional product imports and exports. The shift toward high-tech industries not only strengthens economic resilience but also fosters innovation and creates job opportunities, strengthening the domestic economy even more and reducing the negative consequences of economic uncertainty brought on by adjustments to U.S. central bank monetary policy.

Emerging market nations can use sophisticated financial tools like forward contracts and foreign currency options to mitigate the possible detrimental effects of exchange rate volatility on global commerce. These tools can hedge currency risks, allowing businesses to better manage exchange rate volatility and ensure the stability of financial transactions. Finally, emerging market countries can leverage relevant trade policies or agreements as a shield against the negative economic impacts that may arise from modifications to the American Central Reserve's monetary policy. By establishing mutually beneficial trade agreements and promoting cooperation with other economies, they can alleviate risks from external economic shocks and ensure the stability and resilience of trade relations. For emerging market countries with generally large populations, the dynamics of the population constitute a significant factor. These nations might see a demographic dividend, but whether they can capitalize on this depends on educational policies and the degree of women's integration into the labor market. Therefore, emerging market countries should expand educational access, enrich educational resources, and improve educational levels as appropriate. When selecting labor, emphasis should be placed on gender equality, actively encouraging women's employment and increasing their participation in the workforce. Conversely, population decline and aging will pose challenges for emerging market countries. For these countries, these consequences can be substantially mitigated by continuing to accumulate capital at a quick pace and by making technological and skill advancements.

With the aim to boost the emerging market economies' position in the global trade marketplace, their governments need to increase the competitiveness of domestic products overseas. This can be achieved through two main approaches: First, enhancing domestic industry competitiveness. Emerging market countries can improve their industrial competitiveness through technological innovation, industrial upgrading, and talent cultivation, thereby strengthening their ability to respond to risks in the global market. Increased government investment in production technology research and development not only helps improve production efficiency and reduce production costs but also enhances the international competitiveness of their export products, alleviating the spillover effects of dollar appreciation. Emerging market countries can also promote industrial upgrading by adjusting their industrial structure, increasing the share of the tertiary sector, and developing high-value-added industries such as renewable energy and high-tech sectors, thus reducing reliance on traditional industries. Furthermore, talent cultivation is a crucial pathway to increasing the competitiveness of domestic products. Emerging market countries should strengthen education and training for personnel in relevant industries and attract talent to improve the professional knowledge level of producers, thereby attracting foreign investment and increasing FDI inflows. Secondly, strengthening regional cooperation and trade agreements. Emerging market countries can enhance regional cooperation by signing free trade agreements to address the uncertainties in international trade posed by U.S. Federal Reserve policies. Regional cooperation can increase the interdependence among emerging market countries, buffering the adverse effects of global economic uncertainties stemming from alterations to US financial regulations and ensuring the stability of global trade. Signing free trade agreements also facilitates the flow of investments among emerging market countries, reduces trade barriers, and makes their export products more competitive in other developing countries, thereby expanding trade volumes and enhancing the complementarity of industrial chains to achieve optimal resource allocation. Additionally, regional cooperation can promote technological exchange and innovation among countries. As emerging market countries strengthen cooperation, they can share technology and experience, driving industrial upgrades. Countries can improve their GDP and product competitiveness through joint research and technological collaboration, thereby reducing dependence on technologies from developed countries.

9.Conclusion

The Federal Reserve's monetary policy adjustment has strengthened the dollar, which has caused the currencies of emerging market nations to depreciate relative to one another. As the Fed raises interest rates, global investors turn their attention back to the U.S., causing capital to flow out of emerging markets, which may destabilize their financial markets and overall economic stability. For emerging market countries with significant dollar debt, a stronger dollar increases repayment costs, adding to fiscal burdens and default risks. In response, these countries need to adopt various measures, such as adjusting monetary policies through financial instruments like forex options and forward contracts to hedge currency risks, enhancing financial regulation to improve risk prevention, and adjusting trade and economic structures to bolster economic autonomy and resilience. These strategies not only help mitigate the negative impacts of Fed rate hikes on trade but also promote sustainable economic development in emerging markets.

This analysis suggests several avenues for further research expansion. An analysis of the synergistic effects of different countries' monetary policies and their influence on trade could involve comparing the monetary policies of major economies (e.g. the EU, UK, and Japan) to explore their combined effects on trade in emerging markets; studying particular regions (e.g. Southeast Asia, Latin America, and Africa); and investigating how mechanisms for regional trade cooperation can improve internal economic stability in the face of external monetary policy shifts. Additionally, from a sustainable development viewpoint, studying the monetary policy of the Fed impact on global green trade and its implications for emerging market countries could provide significant insights.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Zhou Xinyu. International Forum, 2013, 15(02):67-72+81.Bootorabi, F., Haapasalo, J., Smith, E., Haapasalo, H. and Parkkila, S. (2011) Carbonic Anhydrase VII—A Potential Prognostic Marker in Gliomas. Health, 3, 6-12.

[2]. Ma Li, Yu Huijuan. Research on the spillover effect of loose monetary policy in the United States based on the PVAR model: A case study of data from 10 economically developed countries [J]. Finance and Trade Research, 2016, 27(01):80-88+114

[3]. Tan Xiaofen, Shao Han. The spillover effect of United States monetary policy on emerging market countries: a perspective of capital flow[J]. Comparison of Economic and Social Systems, 2020, (06):26-37.

[4]. Li Zihao. Research on the macroeconomic effect of the Fed's interest rate hike on G20 countries [D]. Jinan University,2020

[5]. Wei Nianchun. Research on the spillover effect of the Fed's monetary policy [D]. Lanzhou University of Finance and Economics, 2021.

[6]. Tang Lingxiao, Xu Tao. The spillover effect of monetary policy uncertainty of financial powers on abnormal capital fluctuations: A case study of the United States [J/OL]. Journal of Social Sciences of Hunan Normal University, 2024,(04):26-38.

[7]. Gou Qin, Su Xiaomei, Tan Xiaofen. The spillover effect of United States monetary policy on emerging markets: the channel of multinational enterprises[J].World Economy,2023,46(07):27-55.)

[8]. Liu Weiping, Ma Yongjian. The impact of United States monetary policy adjustment on China's economy in the post-financial crisis era [J]. Journal of Wuhan University (Philosophy and Social Science),2020,73(05):123-136.

[9]. Wang Zhengguo, Li Xiang, Xu Shuzheng. Spillover effect and countermeasures of cyclical adjustment of interest rates in the United States [J]. Financial Market Research,2023,(04):19-32.

[10]. Nie Jing, Jin Hongfei. Research on the spillover effect of United States quantitative easing monetary policy on China's industrial exports [J]. Journal of International Finance, 2015,(03):3-12.)

[11]. Yu Le. An empirical analysis of the impact of the Fed's quantitative easing monetary policy on China's foreign trade [D]. Beijing University of Posts and Telecommunications, 2014.

[12]. Ma Li, Yu Huijuan. Research on the spillover effect of quantitative easing monetary policy of the United States on BRICS countries [J]. Journal of International Finance,2015,(03):13-22.)

[13]. Xu Jiayun. United States Monetary Policy Changes and Imports of Chinese Manufacturing Enterprises: An Empirical Analysis Based on Micro Enterprise Data [J]. Journal of International Trade, 2020,(02):142-156.)

[14]. Peng Yifeng. An empirical study on the impact of the Fed's quantitative easing monetary policy on China's foreign trade [J]. Science and Technology Economic Market, 2020,(08):45-46.)

[15]. Kim Young-hee. The impact of the Fed's double-tightening policy on China's import and export trade [J]. China Ocean Shipping,2022,(03):28-32+8.)

[16]. Ca’ Zorzi, Michele and Dedola, Luca and Georgiadis, Georgios and Jarocinski, Marek and Stracca, Livio, and Strasser, Georg H., Monetary Policy and its Transmission in a Globalized World (May, 2020). ECB Working Paper No. 20202407

[17]. Lionel Fontagné, Jean Fouré, and Alexander Kecka, Simulating World Trade in the Decades Ahead: Driving Forces and Policy Implications (April, 2014).. WTO Working Paper ERSD-2014-05

[18]. Dornbusch R, Fischer S. The open economy: implications for monetary and fiscal policy [M] The American business cycle: continuity and change. University of Chicago Press, 1986: 459-516.

[19]. Tan Xiaofen. The withdrawal of the Fed's quantitative easing monetary policy and its impact on China [J]. Journal of International Finance,2010,(02):26-37.)

[20]. Chen Chao. Import trade, FDI, and international intellectual capital spillover: An empirical analysis from cross-border panel data [J]. Journal of World Economy, 2016,(02):90-100+137.)

Cite this article

Feng,Y.;Jiang,Z.;Wang,Y. (2025). An Examination of How the Monetary Policies of the United States Federal Reserve Affect Both the Imports and Exports of Emerging Market Economies. Advances in Economics, Management and Political Sciences,147,87-100.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance's Role in the Just Transition

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhou Xinyu. International Forum, 2013, 15(02):67-72+81.Bootorabi, F., Haapasalo, J., Smith, E., Haapasalo, H. and Parkkila, S. (2011) Carbonic Anhydrase VII—A Potential Prognostic Marker in Gliomas. Health, 3, 6-12.

[2]. Ma Li, Yu Huijuan. Research on the spillover effect of loose monetary policy in the United States based on the PVAR model: A case study of data from 10 economically developed countries [J]. Finance and Trade Research, 2016, 27(01):80-88+114

[3]. Tan Xiaofen, Shao Han. The spillover effect of United States monetary policy on emerging market countries: a perspective of capital flow[J]. Comparison of Economic and Social Systems, 2020, (06):26-37.

[4]. Li Zihao. Research on the macroeconomic effect of the Fed's interest rate hike on G20 countries [D]. Jinan University,2020

[5]. Wei Nianchun. Research on the spillover effect of the Fed's monetary policy [D]. Lanzhou University of Finance and Economics, 2021.

[6]. Tang Lingxiao, Xu Tao. The spillover effect of monetary policy uncertainty of financial powers on abnormal capital fluctuations: A case study of the United States [J/OL]. Journal of Social Sciences of Hunan Normal University, 2024,(04):26-38.

[7]. Gou Qin, Su Xiaomei, Tan Xiaofen. The spillover effect of United States monetary policy on emerging markets: the channel of multinational enterprises[J].World Economy,2023,46(07):27-55.)

[8]. Liu Weiping, Ma Yongjian. The impact of United States monetary policy adjustment on China's economy in the post-financial crisis era [J]. Journal of Wuhan University (Philosophy and Social Science),2020,73(05):123-136.

[9]. Wang Zhengguo, Li Xiang, Xu Shuzheng. Spillover effect and countermeasures of cyclical adjustment of interest rates in the United States [J]. Financial Market Research,2023,(04):19-32.

[10]. Nie Jing, Jin Hongfei. Research on the spillover effect of United States quantitative easing monetary policy on China's industrial exports [J]. Journal of International Finance, 2015,(03):3-12.)

[11]. Yu Le. An empirical analysis of the impact of the Fed's quantitative easing monetary policy on China's foreign trade [D]. Beijing University of Posts and Telecommunications, 2014.

[12]. Ma Li, Yu Huijuan. Research on the spillover effect of quantitative easing monetary policy of the United States on BRICS countries [J]. Journal of International Finance,2015,(03):13-22.)

[13]. Xu Jiayun. United States Monetary Policy Changes and Imports of Chinese Manufacturing Enterprises: An Empirical Analysis Based on Micro Enterprise Data [J]. Journal of International Trade, 2020,(02):142-156.)

[14]. Peng Yifeng. An empirical study on the impact of the Fed's quantitative easing monetary policy on China's foreign trade [J]. Science and Technology Economic Market, 2020,(08):45-46.)

[15]. Kim Young-hee. The impact of the Fed's double-tightening policy on China's import and export trade [J]. China Ocean Shipping,2022,(03):28-32+8.)

[16]. Ca’ Zorzi, Michele and Dedola, Luca and Georgiadis, Georgios and Jarocinski, Marek and Stracca, Livio, and Strasser, Georg H., Monetary Policy and its Transmission in a Globalized World (May, 2020). ECB Working Paper No. 20202407

[17]. Lionel Fontagné, Jean Fouré, and Alexander Kecka, Simulating World Trade in the Decades Ahead: Driving Forces and Policy Implications (April, 2014).. WTO Working Paper ERSD-2014-05

[18]. Dornbusch R, Fischer S. The open economy: implications for monetary and fiscal policy [M] The American business cycle: continuity and change. University of Chicago Press, 1986: 459-516.

[19]. Tan Xiaofen. The withdrawal of the Fed's quantitative easing monetary policy and its impact on China [J]. Journal of International Finance,2010,(02):26-37.)

[20]. Chen Chao. Import trade, FDI, and international intellectual capital spillover: An empirical analysis from cross-border panel data [J]. Journal of World Economy, 2016,(02):90-100+137.)