1. Introduction

Game Theory is an advanced mathematical model that intends to study strategic behavior among reasonable decision-makers known as players. These players take decisions, which impact their outcomes as well as the outcomes of the other participants. The precise idea was defined by John von Neumann in the early twentieth century, even though it would take some time to turn out to be an acknowledged guideline of present-day choice hypothesis. Von Neumann’s works delivered the framework necessary for the investigation of competitive events in which the outcome of any subject depends on other subjects’ actions [1]. John Nash, the other key contributor to the concept of Game Theory, continued with these concepts and postulated the Nash Equilibrium. This notion refers to a position in which no participant can gain better results by adjusting his/her approach while other participants maintain their chosen strategies. This equilibrium point has thus transformed into an important factor in contemporary strategic management [2].

Game Theory was initially used in economics but recently has been widely used in finance. It helps to formulate and estimate behaviours in financial markets and to comprehend competitive or cooperative strategies. Its ability to anticipate and even manipulate market trends makes Game Theory one of the essential instruments to use during financial planning of such business processes as pricing or auctioning and the management of risks. Its application remains valid as more and more financial markets are freely opening and integrating.

Game Theory is built upon three fundamental components: players, strategies, and the pay off matrix. In any game-theoretic model, the players are the agents who have to make decision out of the set of choices open to them which are strategies or actions. These then are the approaches, this is the various roads through which the planned chain of the overall actions a player can choose; the consequences of these choices result in payoffs. Payoffs on the other hand refer to the gains or losses that accrue to the players as a consequence of the employed strategies [3]. Nash Equilibrium is one of the major concepts discussed in the field of Game Theory. It happens when making strategies, none of the players can increase his or her payoff while the others have not changed theirs. This equilibrium is important because it shows that players get the best response of other players in the game; thus, it is a steady solution to strategic games [4]. Game Theory also divides games into classes, for instance cooperative and non-cooperative games, and zero-sum and non zero-sum games. These distinctions are particularly important in finance, where understanding the nature of the game can significantly influence strategic decision-making and outcomes [3].

Game theory is critical in understanding market behavior especially in modelling how investors, firms, and regulators engage in different scenes within the financial markets. These interactions can be modeled as strategic games, wherein situating of the market trends and responses from the various market players is well comprehended, offering the analysts good insights into the contexts of the financial markets [5]. This predictive capability is useful for strategic planning since financial professionals operate in competitive and uncertain settings. It is used in setting optimality of prices, in streamlining competitive bids on auctions, and in crucial decisions to mergers and acquisitions [6]. For instance, in auctions, players employ game theory in an attempt to manipulate competitors and achieve the greatest amount of payoff given the rival’s actions [7]. Further, this paper will focus on the real-life application of Game Theory in financial contexts and how it impacts the assessment of markets and decision-making portfolios and end results through case studies and illustration. Key research questions include: How effective is Game Theory in real-world financial situations? What are the limitations of these models?

2. Theoretical Foundations

2.1. Overview of Existing Research

Game Theory has remained an important tool in economics and finance and has offered a model where rational players in strategic interaction are placed. The work that was set by John von Neumann and John Nash is the main groundwork for what has now formed the focus of contemporary decision-making. Formerly known as Rational Choice Theory, Game Theory has been more developed after its economic background and is widely used in the financial field. Recent studies proved that the knowledge of Game Theory is crucial when it comes to the analysis of the markets: one player’s actions can impact the decisions of others [8].

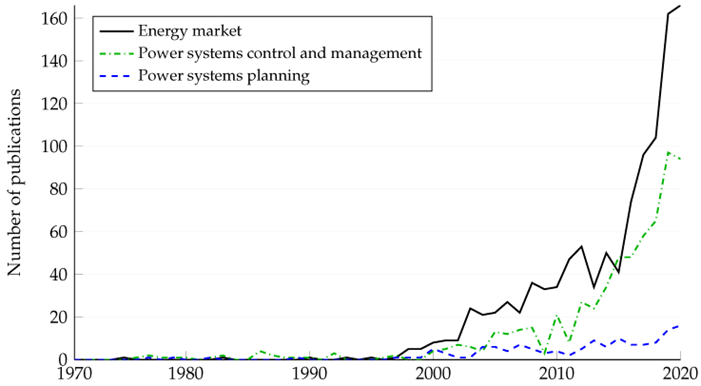

Allen and Morris have made a good attempt in presenting the literature on how Game Theory has been used in financial models with emphasis on the field of asset pricing, corporate finance and market microstructure (Figure 1). Their research also makes them show how this field has advanced from perfect models to complex structures such as using asymmetric information and strategic behaviours of the game theory. These have placed Game Theory as a key resource for both the financial analysts and the economists in the modern world. However, as can be seen from the above literature review, there is still some research weaknesses that have been highlighted. Additional studies have shown that the application of combining Game Theory with the latest innovations in the financial industry, including blockchain and artificial intelligence, remains underexplored [9]. These technologies offer fresh possibilities for modeling and elevating fresh difficulties and their adoption in game-theoretic contexts could significantly improve the field [8, 9].

Figure 1: Growth of publications on game theory in energy markets and power systems (1970–2020) [9]

Game Theory has found its full-blown applicability in commerce and economics in general and finance in particular. Pricing strategies and auctions have been modeled using it, risk management and market behavior have also been modeled using it. As described by Navon et al., Game Theory is a core element in the architecture and functioning of today’s complex power systems, which are inherently coupled with financial markets [5]. Their work is suggestive of understanding the strategic behavior between the market players since such behavior affects the reliability and efficiency of the system substantially. Likewise, Allen and Morris discussed how Game Theory is useful in describing economic phenomena and can be used to explain the behavior of financial decisions under risk [8]. These applications make Game Theory to be a powerful instrument in theoretical and practical financial analysis.

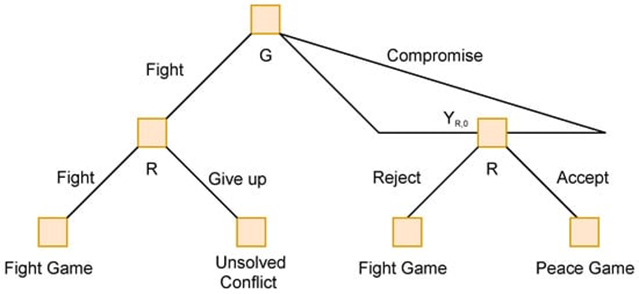

Figure 2: Decision tree illustrating strategic choices and outcomes in a game-theoretic scenario [1].

This paper seeks to establish the foundation of Game Theory, focusing on the principles necessary to use in finance (Figure 2). Nash Equilibrium which was discovered by John gives a scenario where no individual can benefit more from the other party without changing his/her strategy. This is particularly important in financial situations as the investors or firms anticipate other players actions in order to maximize their returns [7]. Another typical category is the cooperative/non-cooperative one. In cooperative games, compensation is reciprocal, familiar in partnerships, finance for example while in non-cooperative games, emphasis is on rivalry [7]. Additionally, evolutionary game theory considers the dynamics of strategy evolution over time, offering insights into how financial markets adapt to changing conditions and predicting responses to new regulations or shifts in behavior [2].

2.2. Summary of Literature

Literature review on Game Theory in finance shows that there is a rich theory structure to explain strategic behaviors during financial operations. That being said, the current studies and the current review revealed some gaps that one cannot help but consider. New research revealed that, although Game Theory is commonly used in constructing financial models, the development of new technologies such as blockchain and AI is not properly incorporated into these models. These technologies are quickly revolutionizing the financial markets. Thus, the integration of these technologies into game-theoretic models could greatly improve the performance and relevance of these models in today’s dynamic financial environment [2].

Further, the literature does not provide detailed works that consider the weaknesses of Game Theory in handling with real-life challenges. Therefore, while applying the Game Theory in financial markets, it is pertinent to note that these markets are also characterized by some key imperfection like information asymmetry, and behavioral bias among others. More research is required to understand how such numbers of complexities can be incorporated into different game-theoretic models to enhance their richness and realism. This research seeks to address these gaps by seeking a more effective method of solving modern financial issues using Game Theory tools in order to arrive at more accurate results and finer strategies for financial managers in table 1 [2, 7].

Table 1: Payoff matrix illustrating the outcomes of strategic decisions between two players in a game-theoretic scenario [3].

Player 1 Action | Player 2 Action | Player 1 Payoff | Player 2 Payoff |

Collaborate | Collaborate | -1 | -1 |

Collaborate | Defect | -3 | 0 |

Defect | Collaborate | 0 | -3 |

Defect | Defect | -2 | -2 |

3. Case Applications

3.1. Research Design

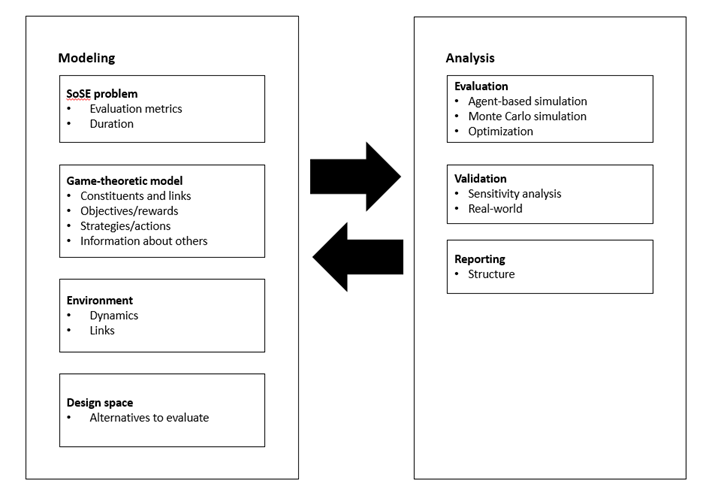

The present study is a qualitative one, with a keen focus on theoretical considerations based on the principles of game theory. The study is organized based on game theoretic pillars that include, the Nash Equilibrium, cooperative and non-cooperative games, and the evolutionary games. These frameworks are crucial because they enable the analysis of strategic engagements of financial investors, firms and regulators in different contexts. The research design also involves the comparison of various game-theoretic models that were used in solving real-life problems in the financial market. Thus, through a comparison of such models, the study in question intends to reveal the best management practices for various financial situations. This method is combined with case studies enabling a better understanding of how these strategies work in practice. This applies to the use of the theoretical analysis in conjunction with the description of strategic actions in financial markets to guarantee a rich understanding of the strategic processes (Figure 3).

Figure 3: Framework for modeling and analyzing game-theoretic problems in strategic decision-making [3].

3.2. Data Collection

Data collection for this research is very extensive, both from theories and from existing literature. Primary data involves an empirical survey of academic publications with emphasis on scholarly and peer reviewed journals, books and conference papers which highlight uses of Game Theory in finance. In this literature, the theoretical framework is set and there is an understanding of the main issues and trends. Moreover, real-life examples derived from the selected financial cases increase practical significance as the subjects addressed cover different areas from the analysis of market behavior to corporate strategies. In addition, historical financial data on markets, prices, and auctions are critically examined as reference material for the theoretical models and findings of this research.

3.3. Data Analysis

As for the methods of data analysis used in this research, they combine both qualitative and quantitative approaches. The qualitative analysis focuses on thematic analysis of existing literature and case studies, identifying key sources of information and extracting meaning from relevant topics that reflect the strategic use of Game Theory in the financial domain. For the quantitative part, basic descriptive statistics are applied to financial data, including market trends, pricing strategies, and auction outcomes, to support the theoretical models presented in this study. This approach allows for a more comprehensive understanding of patterns in strategic decision-making and market behavior. Additionally, case studies and examples of mergers, acquisitions, and auctions are used to demonstrate practical applications of game-theoretic models in real-world financial scenarios. Graphs and data tables are utilized to illustrate how Game Theory can predict financial results, providing a visual representation of key trends and outcomes. The combined use of both qualitative and quantitative methods ensures that the analysis is well-rounded and captures the practical implications of game-theoretic strategies in financial contexts, enhancing the overall validity and depth of the findings.

3.4. Applications in Finance

One of the key concepts for analyzing market processes is Game Theory, and its methodology is aimed at describing relations between the financial market participants. Availing information about the strategic behaviors of investors, firms, and regulators, Game Theory enables one to make forecasts of market shifts and their reaction to different stimuli. For instance, Nash Equilibrium permits the assessment of competitive settings, in which performance depends on players’ actions. It has been applied in forecasting market trends, assessing the impact of changes in regulations, and the best strategies for investment. The accuracy of using Game Theory to describe a market’s actions and decisions makes it a powerful tool for a financial analyst to use when attempting to penetrate the mysteries of financial theaters [10].

3.5. Strategic Decision Making

Another area where Game Theory plays an important part is the decisions that are made in the sphere of finance. One of the fields which widely apply game-theoretic models is pricing strategies where firms select the best pricing policy adapted to a competitive environment. In auctions, Game Theory offers the results for bidding strategy and participants’ payoffs and risks’ levels. Moreover, mergers and acquisition are usually accompanied by bargaining scenario where game theory can be employed in assessing the probable impacts of decision-making choices. The above applications illustrate how Game Theory can be applied in variety of contexts within the financial industry including determining price levels to handling of corporate transactions [11].

3.6. Risk Management

Game Theory is a helpful tool in building financial risk evaluation and decisions since it provides an account of the behavior of different agents under conditions of risk. Banks and other financial organizations apply Game Theory as a tool for forecasting possible loses and creating efficient strategies that would help avoid the negative scenario. For instance, Game Theory can be used to analyse the actions of rivals to identify and avoid potential adverse consequences that may arise, for instance, from price competition or shifting market environments. Seeing certain potential situations through the lens of multiple self-serving agents, those financial managers gain an understanding of the nature of risks to apply appropriate measures to safeguard asset ownership and gain the maximum possible returns. This use of the game theory underlines the need for risk management applications that are competitive pressure resistant [11].

3.7. Case Studies

One place, where business finance would find the use of Game Theory very handy, is where there are real and live examples of the application of the method. Such interactive choices include the application of Game Theory in auction design where bidding behaviour can be anticipated and revenue maximised [12]. An example mostly common with Game Theory could be mergers and acquisitions where the best strategic choices of such firms are harmonized. From the following case studies of firms’ real experiences, one can see how the Game Theory has been used to help companies avoid unfavorable financial realities. The above examples demonstrate the application of Game Theory as a tool in identifying strategies and its application in managing competition to optimize financial gains [6, 7].

4. Results and Discussion

The findings from using game theory in the selected case studies were useful in establishing the game theory’s relevance in the financial decision-making process. Thus, the main conclusions show that theoretic models of Game Theory helped to organize expectations of competitors’ actions, to choose the most effective actions in the game, and to avoid many risks regarding competitors. In the case studies that were based on auctions, the Game Theory was particularly used in the determination of bidding strategies that tend to provide better results. In the same manner, in a mergers and acquisitions environment, the application of Game Theory enabled the companies to have a better ability to predict the response of other players in the game to avoid making uninformed decisions. The outcome also demonstrated that Game Theory helped financial institutions to manage risk by predicting probable market disturbances and avoiding them.

4.1. Analysis

Analyzing each case in detail it is possible to recognize that Game Theory played a crucial role in defining the strategic actions by providing a strong theoretical framework. That is why in the framework of auctions with many participants the strategic interaction described by Game Theory helped to expect the actions of competitors, and, therefore, increase the value of the participants’ earnings and decrease risks. For instance, the Nash Equilibrium concept assisted bidders in comprehending the most appropriate bidding approaches that would guarantee them that none of the involved parties would be benefited by unilaterally modifying their procedures. Wherever there were M&As, Game Theory facilitated calculation of pros and cons of various strategic steps that were beneficial and suitable for companies to select that would allow value addition with less collateral damage to company’s reputation on the market. Game Theory was also helpful in risk management since it was useful in predicting market patterns by the financial institutions hence enhanced portfolio management and reduced risk.

4.2. Interpretation

The outcome of the study points to the fact that Game Theory is not only useful in identifying the behavioral pattern of the market, but it also plays a significant role in bringing about the best strategies in decision making in rather dynamical financial market. Through application of Game Theory institutions and firms can enjoy competitive advantage given the ability to uncover and understand more on the strategic moves afoot. The results also demonstrate how the integration of the Game Theory into the financial models will allow for the enhancement of results, while avoiding unnecessary risks. In summary, this kind of study proves that Game Theory is an important tool in the arsenal of contemporary financial specialists, as well as somebody who works in conditions of rivalry and weak certainty.

4.3. Implications for Financial Decision Making

Therefore, the findings from this study supports the applicability of the Game Theory in monetary decision management. Using the knowledge gained from the theory of Games, financial professionals are well suited to forecast the strategies of rivals, the regulators and other players in the financial market, as the theory helps them come up with better staccato moves. Due to its effectiveness in modeling and forecasting the market behavior, it is more effective under high risky situations like mergers, acquisitions and pricing strategies etc. It is clear from the above argue that the use of Game Theory in developing models for the financial markets provides better solutions in assisting decision making processes hence improving the overall performances and stability of the financial markets [4].

4.4. Comparison with Existing Literature

The findings of this study support the prior studies in the finance literature that incorporate Game Theory as a valid tool in the strategic planning process. As in the case of Axelsson, this study proves that Game Theory offers insights into the cooperation of independent participants of the market, thus contributing to more efficient and stable functioning of the financial market [4]. Further, this study corroborates the findings of Staňková et al. who noted the relevance of Game Theory in crafting decision making under conditions of risk [13]. However this informs extends the literature by offering more unique case studies that explain how Game Theory can be used in other real life situations in the corporate financial domain.

4.5. Limitations of the Study

Nevertheless, it should be pointed out that there are several limitations that relate to this research. First, the choice of the objects of analysis may not be randomly and adequately chosen due to the large variety of financial markets in the world. Further, it employs theoretical models as a backbone of its analysis, while although being rather consistent, they do not always reflect the intricacies of reality in financial transactions. One more limitation is that data selection might be rather subjective and the paper concentrates mainly on positive examples of Game Theory application, which might lead to missing such instances when this theory was not very efficient. These drawbacks indicate that future studies should attempt to apply Game Theory in other markets and evaluate the effectiveness of the tool in more various conditions.

4.6. Future Research Directions

Future research should consider investigating the usefulness of Game Theory in covering even more financial markets and environments, in order to increase the external validity of the results. As such, it would be useful to undertake empirical research that seeks to apply the theoretical models in the real world especially in emerging markets at a time of financial crisis. Also, the possibility of integrating Game theory with other analytical frameworks like machine learning and behavioral economics could help to unpack more subtle mechanisms of market dynamics. Furthermore, future studies should also examine the implication of strategic moves based on the concept of Game Theory on market stability and firms’ financial sustainability as indicated in this research work’s limitations.

5. Conclusion

This research underlined that Game Theory is highly applicable to finance, namely for the evaluation of markets, for decision-making, and for calculating risks. By looking at the case studies then it was clear how Game Theory works to determine the resultant consequences given a particular set of financial relations and gives a framework for analyzing competion. Therefore Growth of financial markets is expected to enhance the use of Game Theory and link it to technology and behavioral changes. The growth can potentially bring improved accuracy of the utilization of Game Theory as a predictive tool in the sphere of finance. Game Theory however still has its significance among the finance community as a model for providing insight into the strategic plans of various agents. To remain relevant in the future, it is necessary to apply new challenges in the global financial market to the seven principles to guarantee its importance to subsequent finance strategies.

References

[1]. Ho, E., Rajagopalan, A., Skvortsov, A., Arulampalam, S. and Piraveenan, M. (2021) Game Theory in Defence Applications: A Review. Sensors, 22(3), 1032.

[2]. Liu, Z., Luong, N.C., Wang, W., Niyato, D., Wang, P., Liang, Y. and Kim, D.I. (2019) A Survey on Applications of Game Theory in Blockchain. Procedia Computer Science.

[3]. Fan, K. and Hui, E.C. (2020) Evolutionary game theory analysis for understanding the decision-making mechanisms of governments and developers on green building incentives. Building and Environment, 179, 106972.

[4]. Axelsson, J. (2018). Game theory applications in systems-of-systems engineering: A literature review and synthesis. Procedia Computer Science, 153, 154-165. https://doi.org/10.1016/j.procs.2019.05.066

[5]. Navon, A., et al. (2019) Applications of Game Theory to Design and Operation of Modern Power Systems: A Comprehensive Review. Energies, 13(15), 3982.

[6]. AlOmari, A.M.H. (2024) Game theory in entrepreneurship: a review of the literature. Journal of Business and Socio-economic Development, 81-94.

[7]. Piraveenan M. (2019) Applications of Game Theory in Project Management: A Structured Review and Analysis. Mathematics, 7(9), 858.

[8]. Allen, F. and Morris, S. (2014) Game Theory Models in Finance. In K. Chatterjee & W. Samuelson (Eds.), Game Theory and Business Applications. Springer, Boston, MA, 194.

[9]. Navon, A., et al. (2019) Applications of Game Theory to Design and Operation of Modern Power Systems: A Comprehensive Review. Energies, 13(15), 3982.

[10]. Camerer, C.F. and Ho, T. (2014) Behavioral Game Theory Experiments and Modeling. Handbook of Game Theory With Economic Applications, 517-573.

[11]. Adler, N., Brudner, A. and Proost, S. (2021) A Review of Transport Market Modeling Using Game-Theoretic Principles. European Journal of Operational Research, 291, 808-829.

[12]. Uka, A. and Krasniqi, V. (2021) “Game Theory” Case study: “Viva Fresh Store and ETC market”. UBT International Conference.

[13]. Staňková, K., Brown, J.S., Dalton, W.S. and Gatenby, R.A. (2019) Optimizing Cancer Treatment Using Game Theory: A Review. JAMA Oncology, 5(1), 96-103.

Cite this article

Huang,K. (2025). The Strategic Influence of Game Theory on Financial Decision-Making. Advances in Economics, Management and Political Sciences,148,94-102.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ho, E., Rajagopalan, A., Skvortsov, A., Arulampalam, S. and Piraveenan, M. (2021) Game Theory in Defence Applications: A Review. Sensors, 22(3), 1032.

[2]. Liu, Z., Luong, N.C., Wang, W., Niyato, D., Wang, P., Liang, Y. and Kim, D.I. (2019) A Survey on Applications of Game Theory in Blockchain. Procedia Computer Science.

[3]. Fan, K. and Hui, E.C. (2020) Evolutionary game theory analysis for understanding the decision-making mechanisms of governments and developers on green building incentives. Building and Environment, 179, 106972.

[4]. Axelsson, J. (2018). Game theory applications in systems-of-systems engineering: A literature review and synthesis. Procedia Computer Science, 153, 154-165. https://doi.org/10.1016/j.procs.2019.05.066

[5]. Navon, A., et al. (2019) Applications of Game Theory to Design and Operation of Modern Power Systems: A Comprehensive Review. Energies, 13(15), 3982.

[6]. AlOmari, A.M.H. (2024) Game theory in entrepreneurship: a review of the literature. Journal of Business and Socio-economic Development, 81-94.

[7]. Piraveenan M. (2019) Applications of Game Theory in Project Management: A Structured Review and Analysis. Mathematics, 7(9), 858.

[8]. Allen, F. and Morris, S. (2014) Game Theory Models in Finance. In K. Chatterjee & W. Samuelson (Eds.), Game Theory and Business Applications. Springer, Boston, MA, 194.

[9]. Navon, A., et al. (2019) Applications of Game Theory to Design and Operation of Modern Power Systems: A Comprehensive Review. Energies, 13(15), 3982.

[10]. Camerer, C.F. and Ho, T. (2014) Behavioral Game Theory Experiments and Modeling. Handbook of Game Theory With Economic Applications, 517-573.

[11]. Adler, N., Brudner, A. and Proost, S. (2021) A Review of Transport Market Modeling Using Game-Theoretic Principles. European Journal of Operational Research, 291, 808-829.

[12]. Uka, A. and Krasniqi, V. (2021) “Game Theory” Case study: “Viva Fresh Store and ETC market”. UBT International Conference.

[13]. Staňková, K., Brown, J.S., Dalton, W.S. and Gatenby, R.A. (2019) Optimizing Cancer Treatment Using Game Theory: A Review. JAMA Oncology, 5(1), 96-103.