1. Introduction

1.1. Background

The wave of the digital economy has swept across the globe, profoundly transforming lifestyles and reshaping consumer behavior. With the ongoing evolution of digital technology, digital economy theories and products are developing rapidly, becoming a new engine for economic growth. In the financial sector, financial technology (FinTech) has risen swiftly, introducing a variety of convenient digital financial products that have significantly altered the traditional financial landscape. However, the emergence of these digital financial products also poses challenges to traditional financial theories, prompting in-depth reflections on the new changes within the financial market. In this context, exploring the impact of digital financial products on household finance, financial systems, consumer behavior, corporate marketing strategies, and government policies holds considerable practical significance. Such an exploration will enhance our understanding of development trends in the digital economy era, providing valuable insights for future economic progress.

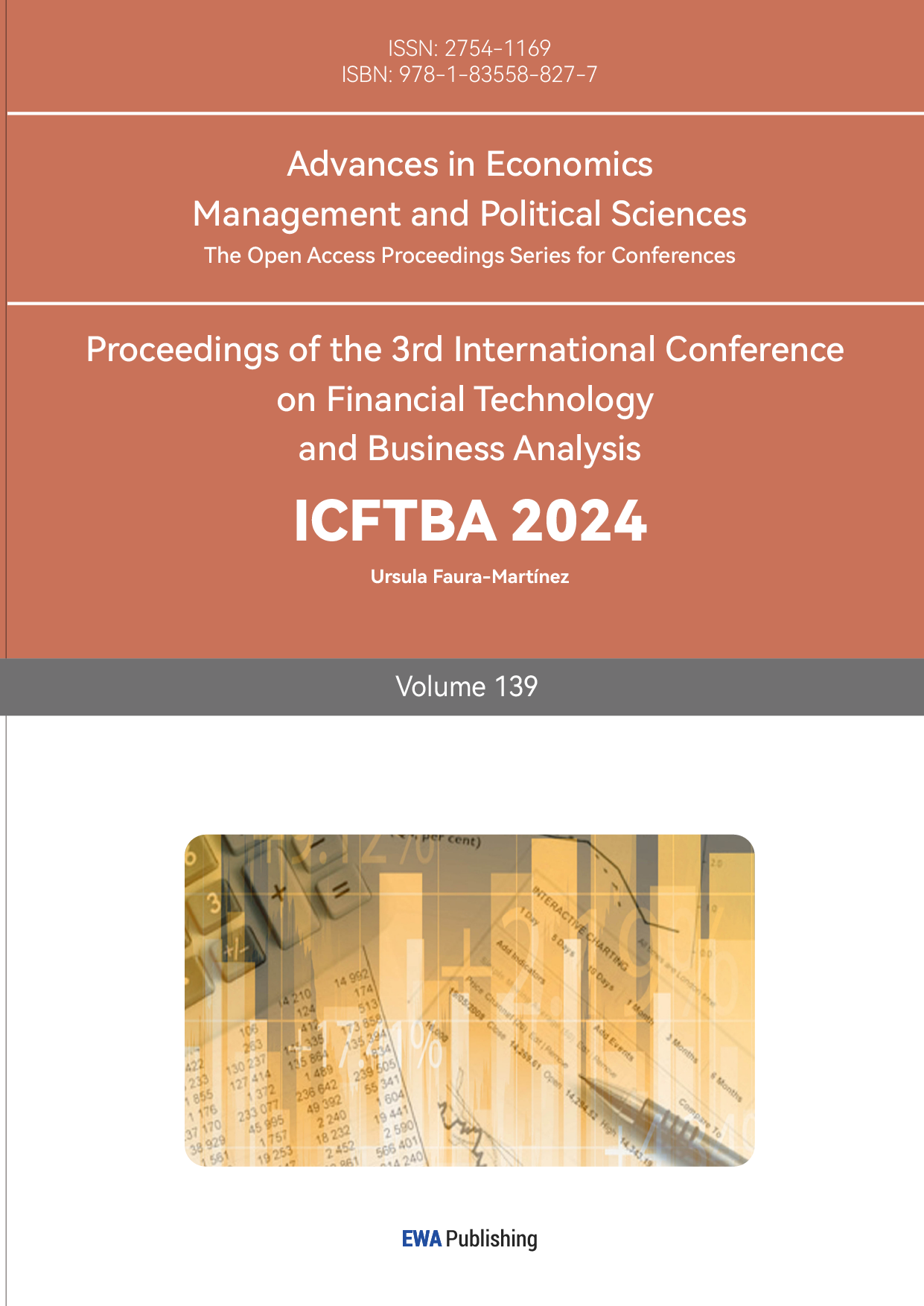

Figure 1: Changes in the Number of Yu’e Bao Account Holders.

1.2. The Baumol-Tobin Model

The Baumol-Tobin Model is a theoretical model of money demand in economics. Proposed by economists William Baumol and James Tobin in the 1950s, it aims to explain the relationship between individuals’ motives for holding cash and the transaction costs associated with cash usage. According to this model, consumers face a trade-off between holding cash and using cash for transactions. Holding cash incurs an opportunity cost since these funds do not generate interest income, whereas frequent transactions lead to increased transaction costs. Therefore, consumers choose an optimal cash-holding amount to balance the costs of holding money and the costs of transactions. In summary, the core of the Baumol-Tobin Model is to determine the demand for money by analyzing the trade-off between transaction costs and cash-holding costs.

2. Literature Review

The advent of the digital economy has fundamentally transformed the operations of financial markets. Innovations in digital financial products not only provide consumers with a wider range of options but also present new challenges to traditional financial theories. Traditional theories of money demand, such as the Baumol-Tobin model, have proven inadequate in explaining phenomena within the modern financial environment. Therefore, exploring the impact of the digital economy on financial products and related fields is of significant theoretical and practical importance.

Firstly, the development of digital finance has altered the operational models of traditional financial institutions. Emerging digital financial products, such as mobile payments, blockchain technology, and digital currencies, are redefining the boundaries of financial products [1]. Compared to traditional financial products, digital financial products offer greater convenience and lower transaction costs, while also creating new market opportunities. For instance, blockchain technology not only enhances transparency and security in transactions but also fosters the growth of decentralized finance (DeFi) [2]. Fintech companies, through innovative business models such as peer-to-peer (P2P) lending and crowdfunding, have disrupted the monopolistic position of traditional financial institutions, increasing competition within the financial market. Moreover, digital finance enhances the efficiency of financial institutions and reduces operational costs. Technologies such as big data analytics and artificial intelligence can optimize processes like risk management and customer service [3]. However, digital financial products also introduce regulatory challenges, such as regulatory arbitrage and increased financial risks [4].

Secondly, corporate marketing strategies have evolved significantly in the context of the digital economy. Big data analytics and precision marketing have become crucial tools for companies to enhance profitability [5]. The influence of online live-stream shopping on consumer emotions and behaviors significantly stimulates consumer emotional responses, enhances consumer trust, and plays a vital role in increasing product sales and follower counts for businesses [6]. By deeply analyzing consumer data, companies can more effectively target their markets, optimize product design, and refine promotional strategies [7]. Furthermore, emerging digital financial products offer companies more diverse financing options, such as crowdfunding and online lending platforms, providing better investment opportunities and improved profitability [8]. Digital finance effectively mitigates inefficient investments, especially in non-state-owned enterprises and regions with a higher level of institutional development, by alleviating inefficiencies through resource and governance effects, which contributes to reducing inefficient investments, enhancing corporate investment willingness and capacity, and boosting overall investment levels [9]. The development of the digital economy has led to new consumption models such as e-commerce, social commerce, and mobile payments, influencing corporate marketing strategies.

Additionally, the digital economy has promoted the development of personalized and customized services, advancing consumer behavior theory. The growth of the digital economy has transformed consumer financial behavior. Studies show that the widespread adoption of digital financial tools lowers psychological barriers in financial decision-making, leading to increased impulsive consumption and a decline in savings rates [10]. Furthermore, the application of big data and artificial intelligence enables financial institutions to analyze consumer behavior more accurately, thereby offering personalized financial services [11]. These changes challenge traditional money demand theories, necessitating a reevaluation of consumers’ motives for money demand in this new environment.

However, the digital economy also brings challenges and issues. Privacy protection and data security have become focal points of consumer concern. With the massive collection and use of personal data, consumers are increasingly worried about privacy breaches and data misuse [12]. Algorithmic discrimination violates consumers’ rights to identity equality at the information collection stage, their rights to informed choice during targeted advertising, and their rights to fair trade and pricing benefits during personalized pricing, exacerbating the technological gap between businesses and consumers and further reinforcing consumers’ disadvantaged position in information access [13]. Additionally, issues such as discriminatory pricing practices (“big data killing familiarity”), inadequate regulation of emerging financial products, and the resulting financial risks have arisen [14]. To address these issues, governments need to improve data protection legislation, draw from international financial regulatory frameworks, and establish robust credit systems [15]. By strengthening regulation, governments can not only effectively mitigate financial risks but also promote the healthy development of the digital economy, achieving a win-win outcome for economic and social benefits.

In summary, the digital economy has brought multifaceted impacts, including changes in the operations of financial institutions, the promotion of corporate and regional development, the emergence of new consumption models, and the advancement of personalized services. However, it also faces challenges such as privacy protection and algorithmic discrimination, which require collaborative efforts from businesses and regulatory agencies to address.

3. Analysis of the Impact of the Digital Economy on Household Finance

3.1. Analysis of the Impact of the Digital Economy on Consumer Behavior

3.1.1. Impact on Cash Holding Costs

Digital financial products significantly reduce the costs associated with financial transactions. For example, when using platforms like Lingqian Tong for small-scale investments, users do not need to frequently visit banks or make withdrawals; instead, they can manage spare funds automatically. This implies that per-transaction costs are lowered, and more convenient transaction methods reduce the consumption of time and effort. Furthermore, consumers can increase transaction frequency at virtually no cost: low transaction costs make users more inclined to conduct frequent small transactions rather than consolidating large withdrawals.

According to the Baumol-Tobin model, a decrease in transaction costs leads users to increase their cash holdings to reduce transaction frequency. However, digital financial products, through features like automated wealth management and high liquidity, allow users to flexibly switch between holding highly liquid assets (like Lingqian Tong) and high-return investments, which somewhat diminishes the model’s binary choice between holding and not holding cash.

Digital financial products like Lingqian Tong offer relatively high-interest returns, thus reducing the opportunity cost of holding cash. Even if users hold a larger amount of liquid assets, they can still earn returns, thereby mitigating the loss of investment opportunities from holding cash. Additionally, consumers can better diversify their assets: digital financial products facilitate efficient capital allocation across various assets, enabling users to easily invest idle funds in higher-yield financial products instead of simply holding cash. This makes the opportunity cost of holding cash more tangible and manageable.

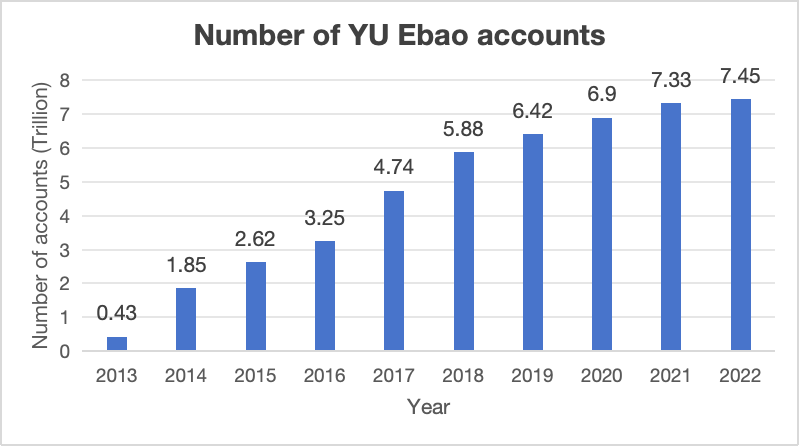

Figure 2: Transaction Volume of Third-Party Comprehensive Payments from 2016 to 2022.

3.1.2. Shift in Consumer Behavior

As digital financial products have become widespread, consumers’ behaviors regarding monetary savings and investments have undergone significant changes. First, with the improvement in fund liquidity, digital products like Lingqian Tong offer high liquidity, allowing users to invest and redeem funds at any time, bridging the liquidity gap between traditional cash holdings and investments. Additionally, consumers can better balance cash holdings and investments; users no longer need to make a strict binary choice between holding cash and investing, as digital platforms allow for both. For example, Lingqian Tong automatically allocates idle funds into investment products, maintaining liquidity while enhancing the efficient use of funds. Finally, consumer financial participation has increased: digital financial products lower the investment threshold, enabling more consumers to engage in small-scale, frequent investments, thereby transforming the structure of money demand under the traditional model.

3.2. Analysis of the Impact of the Digital Economy on Corporate Marketing Strategies

3.2.1. The Impact of Digital Financial Products on Corporate Financing

With the advancement of the digital economy, various innovative digital financial products have emerged, greatly expanding corporate financing channels. For example, P2P lending platforms offer companies a novel financing avenue beyond the constraints of traditional bank loans. These platforms generally have simplified approval processes and faster loan disbursements, effectively meeting the urgent funding needs of businesses, particularly small and medium-sized enterprises (SMEs). Additionally, the rise of equity crowdfunding platforms has provided companies with new ways to raise capital. By designing appropriate equity transfer schemes, companies can attract various types of investors, thereby securing essential funding support. This not only broadens corporate financing options but also enhances interaction between companies and investors.

Digital financial products typically offer high liquidity and low entry barriers, allowing companies to reduce their overall capital costs. For instance, supply chain finance uses the credit support of core enterprises to benefit upstream and downstream companies, helping SMEs access financing services at lower costs. Furthermore, digital financial platforms utilize big data analytics and other technologies to more accurately assess corporate credit risk. With precise insights into company conditions, financial institutions can offer more favorable financing rates to creditworthy companies, further reducing their financial burdens.

The development of the digital economy encourages financial institutions to strengthen credit assessment and risk management for companies. Not only do fintech companies use big data and artificial intelligence to provide precise credit evaluations for financial institutions, assisting them in fully understanding corporate operations and credit levels, but other components within the financial ecosystem are also interacting and optimizing together. Through multi-dimensional data analysis, companies can receive personalized financing solutions tailored to their actual needs and capabilities. For example, by analyzing financial, operational, and tax data, fintech services can generate comprehensive credit reports, helping financial institutions customize financing solutions for companies more effectively.

3.2.2. How Companies Can Seize Opportunities Presented by the Digital Economy

Companies leverage big data analytics and artificial intelligence to conduct in-depth customer data mining and achieve targeted marketing. By building customer profiles, companies can understand customer needs, preferences, and behavioral patterns, enabling them to offer personalized products and services. For instance, by applying machine learning algorithms to analyze customer purchase history and browsing records, companies can predict future buying behavior and carry out targeted marketing campaigns.

With technologies like the Internet of Things (IoT) and blockchain, companies can achieve visualized and intelligent supply chain management. Blockchain technology ensures the authenticity and immutability of supply chain data, enhancing trust across the supply chain. Meanwhile, IoT technology enables real-time monitoring of the logistics process, reducing both inventory and logistics costs.

3.2.3. Case Study

On November 1, 2019, Hello TransTech (Hello Chuxing) announced its integration with “Double Chain Connect,” a supply chain collaboration network based on blockchain technology, developed by Ant Financial and MYbank. Launched on January 4, 2019, Double Chain Connect enables Hello TransTech, as a core enterprise, to digitally confirm and record its payable accounts to upstream suppliers on the blockchain. This action transforms accounts payable into digital receivables certificates, which primary suppliers can then transfer to secondary or tertiary suppliers. Suppliers can use these certificates to obtain loans from banks, thus solving their financing challenges. Based on the real transaction data on the blockchain and Hello TransTech’s credit endorsement, banks provide financing services, lowering the threshold and cost of financing for suppliers. This also optimizes Hello TransTech’s supply chain management, strengthens cooperation with suppliers, and enhances the stability and competitiveness of its supply chain.

For Hello TransTech’s upstream suppliers, particularly small and micro-enterprises, Double Chain Connect addresses the issues of financing difficulty and high financing costs, reducing the time needed for financing from potentially three months or longer to nearly instantaneous—about one second. This allows suppliers to promptly access funds for production, business expansion, and more, thereby strengthening their survival and growth capabilities.

3.3. Analysis of the Impact of the Digital Economy on Financial Innovation

3.3.1. Service Model Innovation

The digital economy provides robust data support for financial institutions, enabling them to use big data and artificial intelligence to analyze critical information such as clients’ financial status, spending habits, and risk preferences. By creating detailed customer profiles, financial institutions can break away from traditional standardized service models to offer personalized financial products and services tailored to individual needs. This personalized service model precisely meets the unique requirements of different customer groups. For example, financial products integrating innovative investment strategies can be tailored for young technology enthusiasts, while simplified, lower-risk savings and investment options can be designed for older clients, significantly enhancing customer satisfaction and loyalty.

Under the influence of the digital economy, financial service channels are diversifying and innovating rapidly. In addition to traditional offline branches and online websites, financial institutions are actively exploring new channels such as mobile applications, social media platforms, and wearable devices to expand their service reach. The widespread use of mobile banking apps allows clients to perform financial operations—like transfers, payments, and investments—anytime, anywhere. Social media platforms have become new fronts for promoting financial products and also offer efficient channels for collecting customer feedback. Additionally, wearable devices, such as smartwatches with payment functions, enrich the accessibility of financial services, significantly enhancing convenience and availability.

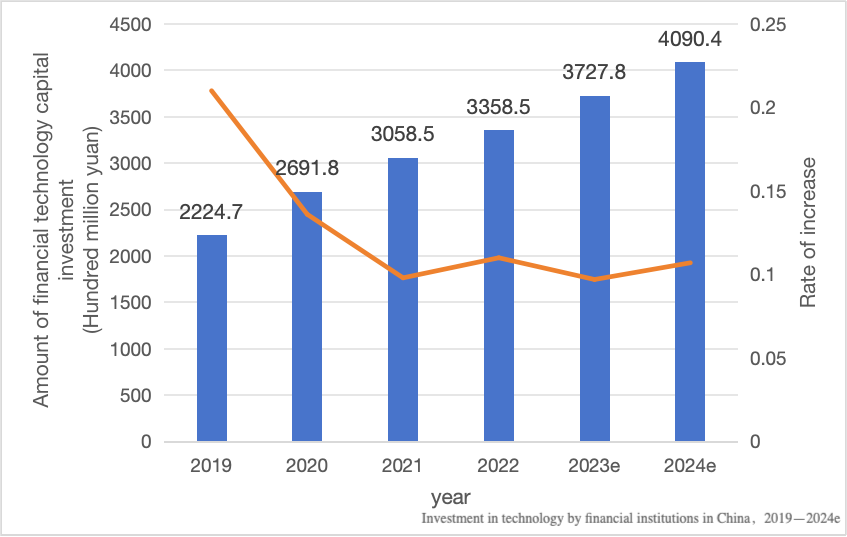

Figure 3: Investment in Financial Technology by Chinese Financial Institutions, 2019–2024 (Projected).

3.3.2. Innovation in Financial Market Structure

The digital economy, through advanced technologies like blockchain and smart contracts, has significantly advanced the disintermediation process in financial markets. Some emerging fintech companies are leveraging these technological advantages to directly connect fund providers with those in need of capital, greatly reducing the traditional financial intermediaries’ role in transactions. For instance, the rise of P2P lending platforms bypasses traditional intermediaries like banks, enabling direct connections between borrowers and investors, which lowers lending costs and increases capital allocation efficiency.

At the same time, financial markets are also witnessing a trend toward reintermediation. Some large fintech platforms, with their strong technical capabilities and vast user data resources, are gradually emerging as new financial intermediaries. These platforms integrate various financial resources, providing comprehensive services across payment, wealth management, and credit sectors. Ant Financial, for example, plays a significant role in the financial market by offering users a convenient and efficient one-stop financial service solution through its powerful platform.

The development of the digital economy has significantly lowered the entry barriers in the financial sector, attracting numerous non-traditional financial players into the market. Technology companies, e-commerce enterprises, and telecom operators are leveraging their technical expertise and business resources to enter the financial field, introducing diverse business models and innovative thinking into the financial market. For example, Amazon, a leading e-commerce company, has utilized its massive user and transaction data accumulated on its platform to launch a range of financial services, including payment and lending solutions. Through unique risk assessment and product design methods, Amazon has carved out a niche for itself within the financial market.

4. Conclusions

4.1. Data Protection and Privacy Security

At the regulatory level, the government should expedite the establishment of a legal framework for data protection and privacy security to ensure the legality and transparency of data collection, storage, and usage. It is recommended to draw on international best practices, such as the EU’s General Data Protection Regulation (GDPR), to set stringent data protection standards.

4.2. Financial Risk Monitoring and Assessment

To effectively manage financial risks, the government should implement comprehensive financial risk monitoring and assessment mechanisms in line with the Basel Accords and other international financial regulatory frameworks. Financial regulatory authorities must significantly enhance supervision over the credit market, establishing a complete regulatory system covering pre-loan, in-loan, and post-loan stages. Specifically, prior to lending, there should be rigorous risk assessments and approvals, including thorough evaluations of borrowers’ credit, repayment capabilities, and collateral measures, along with an efficient approval process and authority management. Clear upper limits and ranges for loan amounts and terms should be set to restrict personal housing loans and fixed asset loans, thus preventing excessive borrowing. Additionally, loan fund flow control must be enforced to prevent funds from entering speculative areas by specifying the use of funds and implementing a trusted payment mechanism. Regulatory agencies should also require lending institutions to meet capital adequacy standards and improve their internal risk management systems to enhance sustainable development capabilities. Finally, by establishing post-loan monitoring mechanisms, implementing follow-up tracking, and issuing risk warnings, regulatory bodies can ensure the compliant use of loan funds and promptly identify and address potential risk signals. These measures collectively form a systematic financial risk management framework to enhance the resilience and stability of the overall financial system.

4.3. Credit Reporting Mechanism and Consumer Credit Education

In a complex and dynamic financial environment, the government must improve the credit reporting system and strengthen consumer financial literacy education. A well-developed credit reporting system is crucial for the stable functioning of financial markets, as it enables accurate assessments of consumer creditworthiness. By enhancing consumer financial literacy, the public can gain a deeper understanding of financial product characteristics, risks, and service rules. Only when individuals possess adequate knowledge and judgment regarding financial products and services can they effectively protect their rights, make informed financial decisions, and significantly reduce financial risks, thereby promoting the healthy development of financial markets.

References

[1]. Zheng, Z., Xie, S., Dai, H. N., Chen, X., & Wang, H. (2018). An overview of blockchain technology: Architecture, consensus, and future trends. Proceedings of the IEEE, 106(5), 986–1012.

[2]. Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.

[3]. Nicoletti, B. (2017). The future of fintech: Integrating finance and technology in financial services (1st ed.).

[4]. Arner, D. W., Barberis, J., & Buckley, R. P. (2020). The evolution of fintech: A new post-crisis paradigm? Georgetown Journal of International Law, 47, 1271–1319.

[5]. McAfee, A., & Brynjolfsson, E. (2012). Big data: The management revolution. Harvard Business Review, 90(10), 60–68.

[6]. Liu, Y., Li, Q., & Yin, M. (2020). Research on the impact of live streaming shopping characteristics on consumer purchasing behavior. Soft Science, 34(6), 7.

[7]. Wedel, M., & Kannan, P. K. (2016). Marketing analytics for data-rich environments. Journal of Marketing, 80(6), 97–121.

[8]. Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

[9]. Xue, L., Li, Y., Chen, Z., & Chen, J. (2024). Digital financial development and inefficient investment: A study based on the dual perspectives of resource and governance effects. Humanities and Social Sciences Communications, 11, 1–10.

[10]. Chen, Y., & Huang, Y. (2021). Digital finance and consumer behavior: Evidence from China. Journal of Financial Economics, 142(2), 345–362.

[11]. Davenport, T. H., & Ronanki, R. (2018). Artificial intelligence for the real world. Harvard Business Review, 96(1), 108–116.

[12]. Acquisti, A., Taylor, C., & Wagman, L. (2016). The economics of privacy. Journal of Economic Literature, 54(2), 442–492.

[13]. Li, D. (2021). Algorithmic discrimination against consumers: Behavioral mechanisms, profit and loss definition, and collaborative regulation. Journal of Shanghai University of Finance and Economics, 23(2), 17–33. https://doi.org/10.16538/j.cnki.jsufe.2021.02.002.

[14]. Li, X., & Wang, Y. (2020). Regulatory challenges of digital financial services in China. China Economic Review, 61, 101457.

[15]. Zhang, T., Gao, Z., & Liu, Y. (2019). Data protection and privacy in the age of big data: A regulatory approach. Journal of Law and Economics, 62(3), 675–700.

Cite this article

Wei,Y. (2024). The Impact of the Digital Economy on Household Finance: A Mechanism Analysis Based on the Baumol-Tobin Model. Advances in Economics, Management and Political Sciences,139,60-68.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zheng, Z., Xie, S., Dai, H. N., Chen, X., & Wang, H. (2018). An overview of blockchain technology: Architecture, consensus, and future trends. Proceedings of the IEEE, 106(5), 986–1012.

[2]. Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.

[3]. Nicoletti, B. (2017). The future of fintech: Integrating finance and technology in financial services (1st ed.).

[4]. Arner, D. W., Barberis, J., & Buckley, R. P. (2020). The evolution of fintech: A new post-crisis paradigm? Georgetown Journal of International Law, 47, 1271–1319.

[5]. McAfee, A., & Brynjolfsson, E. (2012). Big data: The management revolution. Harvard Business Review, 90(10), 60–68.

[6]. Liu, Y., Li, Q., & Yin, M. (2020). Research on the impact of live streaming shopping characteristics on consumer purchasing behavior. Soft Science, 34(6), 7.

[7]. Wedel, M., & Kannan, P. K. (2016). Marketing analytics for data-rich environments. Journal of Marketing, 80(6), 97–121.

[8]. Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

[9]. Xue, L., Li, Y., Chen, Z., & Chen, J. (2024). Digital financial development and inefficient investment: A study based on the dual perspectives of resource and governance effects. Humanities and Social Sciences Communications, 11, 1–10.

[10]. Chen, Y., & Huang, Y. (2021). Digital finance and consumer behavior: Evidence from China. Journal of Financial Economics, 142(2), 345–362.

[11]. Davenport, T. H., & Ronanki, R. (2018). Artificial intelligence for the real world. Harvard Business Review, 96(1), 108–116.

[12]. Acquisti, A., Taylor, C., & Wagman, L. (2016). The economics of privacy. Journal of Economic Literature, 54(2), 442–492.

[13]. Li, D. (2021). Algorithmic discrimination against consumers: Behavioral mechanisms, profit and loss definition, and collaborative regulation. Journal of Shanghai University of Finance and Economics, 23(2), 17–33. https://doi.org/10.16538/j.cnki.jsufe.2021.02.002.

[14]. Li, X., & Wang, Y. (2020). Regulatory challenges of digital financial services in China. China Economic Review, 61, 101457.

[15]. Zhang, T., Gao, Z., & Liu, Y. (2019). Data protection and privacy in the age of big data: A regulatory approach. Journal of Law and Economics, 62(3), 675–700.