1. Introduction

With the implementation of China's economic reform and opening up policy, foreign direct investment has grown rapidly. However, rising labor costs, supply chain restructuring and global economic uncertainty have slowed the growth of FDI in recent years. As a critical transport infrastructure, the development of China's high-speed rail network has significantly improved regional connectivity, boosted economic growth, and it has the potential to increase foreign direct investment inflows. Between 2009 and 2022, The number of passengers using China's high-speed train has increased significantly, becoming people's preferred mode of travel. High-speed rail has played an important role in such areas as industrial agglomeration and population mobility. On the basis of previous studies, further examines the impact of high-speed rail on FDI and its economic effect. Provide valuable insights to other countries seeking to attract foreign investment.

2. Literature Review

Wang Y. believes high-speed rail’s opening can improve inter-regional accessibility, shorten the space and time distance, eliminate inter-regional communication, and promote economic growth. [1] However, Fageda, X. believes that overall high-speed rail’s opening impact is little, mainly affected by the network layout, construction costs or environmental costs. In addition, the opening of the high-speed rail may enhance the siphon effect, which will hurt the economic growth of the surrounding areas. [2] Moreover, most literature studies mainly focus on analyzing the relationship between economic development or transportation infrastructure and FDI. Infrastructure is attractive to FDI, especially in the field of transportation. Koyuncu, C. finds countries with higher transportation infrastructure tend to have higher FDI levels. [3] Hong, J. states infrastructure related to land transportation has the most influence on economic development in China, followed by water transportation, whilst air transportation has a lesser influence. [4] There is still a gap in the literature on the relationship between the opening of high-speed rail and FDI inflow.

3. Mechanism Analysis of the Effects of High-Speed Rail on FDI Inflow

3.1. The theoretical mechanism of the opening of high-speed railway affecting FDI inflow

The quality of urban infrastructure for transportation has a direct impact on FDI, because FDI is more sensitive to talent, market and other factors. The opening of high-speed rail mainly affects FDI inflow from three aspects: talent flow, market size and industrial agglomeration. Zhang, Dong and Yao found that high-speed rail can improve transport connectivity, reduce travel time and costs, and facilitate cross-regional mobility and concentration of businesses and people. [5] Li et al. discovered high-speed opening Railway shortens the reachable time between cities, weakens the spatial barriers between cities, makes the circulation of elements and commodities more freely, and expands the market of radiation scope, which makes the potential market scale expand. [6] Eckert et al. finds the expansion of scale effect can reduce the cost of products, and the increase in sales quantity and the decrease in product cost enable enterprises to obtain higher profits and attract enterprises to enter, thus forming enterprise agglomeration. [7]

H1: High-speed rail’s opening will attract FDI inflows in Chinese cities.

3.2. The impact of high-speed rail openings on FDI inflow from the center to the periphery

The network of high-speed rail in China, provincial cities, sub-provincial cities and municipalities usually serve as central cities, which are able to more effectively radiate peripheral cities due to their concentrated resources and convenient transportation. [8] According to Friedman’s center-periphery theory, the rapid development of central cities will drive the development of peripheral cities and eventually form economic integration. [9] However, this "driving" effect is not absolute, and may present a positive or negative effect. As the center of a region, the central city has highly developed transportation network and economic resources. The high-speed rail's opening breaks the space-time barrier, making talent, capital and other factors converge to the central city, forming the "siphon effect" of the central city on the resources of the peripheral cities, which will enhance the location advantage of the central city and enhance its attraction to FDI.

For peripheral cities, whether the FDI level can benefit depends on the "polarization effect" and "diffusion effect" of the urban circle connected by high-speed rail. On the one hand, Li finds affected by the "siphon effect", the opening of high-speed rail accelerates the accumulation of resource elements to the central city, it also quickens the movement of talent and resources from outlying cities to the city center.[10] On the other hand, Lu finds the rail will reduce the distance between center cities and their periphery, thus the center cities' resources will spread more quickly to the neighboring cities, making it easier for the periphery cities to access their industrial and commercial resources. [11]

H2: High-speed railway’s opening has different impact on FDI inflow in central cities and peripheral cities.

3.3. Marginal effect of the opening of high-speed rail

The law of diminishing marginal effect is proposed in the Principles of Economics, that is, with the continuous increase of production factors, the increment of output brought by each additional unit of production factors will gradually decrease. [12] Combined with the marginal effect theory, the impact of the opening of high-speed rail on FDI inflow can be explained from the following three perspectives. First, infrastructure is subject to marginal effects. When studying the impact of high-speed rail on China's urban economy, which is discovered that high-speed rail has a greater impact on economic growth in smaller cities. Second, the marginal effect of economic benefits. For already highly developed central cities, economic growth from additional transportation improvements may face diminishing returns. For peripheral cities, the economic opportunities brought about by high-speed rail connections may yield greater marginal benefits. Research by Lin shows that high-speed rail promotes urban specialization by reducing the cost of intercity transportation. [13] Finally, the marginal effect of FDI attraction: the central city may already be the hot spot of FDI, and it is difficult to further improve the marginal effect of FDI. The FDI attractiveness of peripheral cities with high-speed rail connections is likely to rise rapidly from a low level.

H3: The impact of the opening of high-speed rail on FDI inflow is significantly heterogeneous among cities with different administrative levels, high-speed rail lines and types.

4. Methodology

This paper selects high-speed rail data from 300 prefecture-level cities in China from 2008 to 2021, and uses a multi-time point difference model to test 3 hypotheses.

4.1. Model setting

The difference model is an econometric method widely used in policy evaluation and causal reasoning. The multi-time-point differential model is more powerful and flexible in studying policy effects than the standard DID model, and can provide a deeper and more comprehensive analysis. This paper constructs multi-time DID model. The multi-time points in the multi-time DID model used in this paper are mainly reflected in the setting of the processing variable HSR. This variable allows different cities to open high-speed trains at different points in time. It can comprehensively consider the effect of high-speed rail openings on foreign direct investment inflow at various time points. The benchmark model refers to Li. F’ model [14] settings follow:

\( {FDI_{it}}= {β_{0}}+{{β_{1}}HSR_{it}}+{{β_{2}}GDP_{it}}+{{β_{3}}FIN_{it}}+{β_{4}}{HC_{it}}+{β_{5}}{INNO_{it}}+{β_{6}}{IS_{it}}+{β_{7}}{WAGE_{it}}+{μ_{i}}+{θ_{t}}+{ε_{it}}\ \ \ (1) \)

where the city and year are denoted by the subscripts i and t, respectively; FDI is the actual amount of foreign capital utilized by prefecture-level cities to measure the level of FDI inflow; HSR is dummy variable, if high-speed rail has been installed in a city and the year of installation is time for the first high-speed rail, and each year after that is equal to 1, otherwise equal to 0; Control variables include: GDP (gross domestic product), Chakrabarti finds that market size (usually measured by GDP) is one of the most robust determinants of FDI; [15] FIN (balance of deposits and loans of financial institutions as a proportion of GDP), Alfaro shows that developed financial markets can significantly enhance the promoting effect of FDI on economic growth; [16] HC (amount of university attendees per 10,000 individuals), Noorbakhsh finds that human capital is an important determinant of FDI attraction in developing countries; [17] INNO (quantity of applications for patents), Cheng finds that regional innovation capability has a significant impact on research and development investment of multinational corporations.;[18] IS (GDP percentage of secondary industry production value), Wheeler shows that good infrastructure had a significant positive impact on FDI in the manufacturing industry in the United States. [19] And Coughlin studies the factors that attract foreign direct investment in American states and The secondary industry to GDP ratio serves as a gauge for the industrial structure.[20] WAGE (Average wages of city workers); \( {β_{0}} \) is the constant term; \( {μ_{i}} \) is the urban fixed effect; \( {θ_{t}} \) is the year fixed effect; and \( {ε_{it}} \) is the random error term.

4.2. Sample and Data Selection

The sample data in this paper are the relevant data of 300 prefecture-level cities in China from 2008 to 2021. In addition to the open data of high-speed rail, the FDI data and macroeconomic data used in this paper are all from CNRDS and EPS data platforms.

5. Empirical Results and Analyses

Before using the multi-time point difference model, the feasibility of the model is tested by parallel trend, and the results show that the model is feasible. Then the step-up regression method is used for regression.

5.1. Test of Parallel Trend

Parallel trend hypothesis is a key premise of DID model analysis. This hypothesis requires that the trends of the treatment group and the control group should be parallel before treatment, that is, in the absence of treatment, the two groups' dependent variables exhibit the same temporal trend. If the parallel trend hypothesis is true, then we can assume that control group and the treatment group continue to maintain this parallel trend in the absence of treatment, and therefore the difference after treatment can be attributed to the treatment itself. The following model is introduced:

\( {FDI_{it}}={α_{0}}+\sum _{i=1}^{5}HSR_{it}^{-i}+\sum _{i=1}^{7}HSR_{it}^{i}+{α_{1}}×{X_{it}}+{μ_{i}}+{θ_{t}}+{ε_{it}} \) (2)

Where \( HSR_{it}^{-i} \) and \( HSR_{it}^{i} \) are the variable of high-speed rail, and the superscript represents its advance term and lag term. \( {X_{it}} \) are all control variables; \( {μ_{i}} \) is the urban fixed effect; \( {θ_{t}} \) stands for time fixed effect; \( {ε_{it}} \) is the random error term.

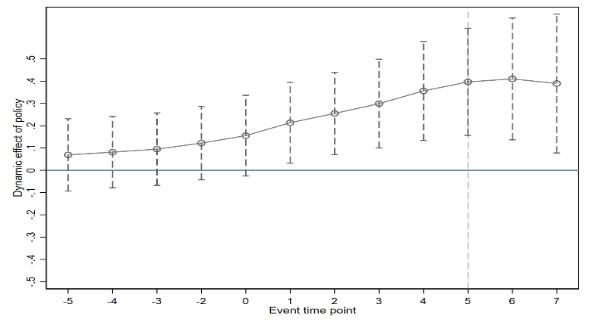

Figure 1: Parallel trend hypothesis test.

The vertical axis represents the dynamic effect of the policy, and the horizontal axis represents the time point of the event, where the year 0 denotes the high-speed rail's opening, the year prior to its opening is represented by a negative number, and the year following its opening is represented by a positive number. Each point in the graph represents an estimate of the policy effect at that point in time. It is evident that the mean value of the opening advance terms of high-speed rail is not significantly different from 0, demonstrating that there was no discernible change in the time trend between the control group and the control group prior to the opening of the high-speed rail, which means that the parallel trend hypothesis is satisfied between the cities opened by high-speed rail and the cities not opened by high-speed rail, and the multi-time-point differential model is effective.

5.2. Benchmark Model

The step-by-step regression method is adopted in this paper to avoid multi-collinearity caused by introducing multiple control variables to the maximum extent. Table 1 shows the results of differential regression of the impact of high-speed rail on regional FDI inflow effect. Column (1) shows the regression results without adding control variables. It is evident that the estimated coefficient describing impact of high-speed rail opening on FDI is notably favorable, which indicates high-speed rail’s opening can significantly promote the station cities to attract FDI flows. After control variables are progressively introduced to columns (2) - (5), the coefficient value of HSR tends to decrease with the increase of the number of explanatory variables, but the coefficient value is always significantly positive.

Table 1: Benchmark Model Regression Result.

(1) | (2) | (3) | (4) | (5) | |

VARIABLES | FDI | FDI | FDI | FDI | FDI |

HSR | 0.976*** | 0.229*** | 0.188*** | 0.189*** | 0.182*** |

(17.82) | (5.00) | (4.17) | (4.17) | (4.01) | |

GDP | 1.368*** | 1.191*** | 1.158*** | 1.108*** | |

(48.98) | (37.31) | (34.61) | (27.46) | ||

FIN | 0.050*** | -0.041* | -0.044** | -0.053** | |

(2.73) | (-1.88) | (-1.99) | (-2.37) | ||

HC | 0.001*** | 0.001*** | 0.001*** | ||

(10.72) | (9.45) | (9.21) | |||

IS | 0.007*** | 0.005** | 0.005** | ||

(3.10) | (2.26) | (2.19) | |||

WAGE | 1.065*** | 1.071*** | |||

(3.28) | (3.30) | ||||

INNO | 0.108** | ||||

(2.24) | |||||

Constant | 13.431*** | -11.957*** | -8.886*** | -13.172*** | -12.727*** |

(35.55) | (-20.78) | (-14.04) | (-9.08) | (-8.70) | |

Urban FE Year FE | YES YES | YES YES | YES YES | YES YES | YES YES |

Observations | 3,742 | 3,742 | 3,742 | 3,742 | 3,742 |

R-squared | 0.527 | 0.720 | 0.728 | 0.729 | 0.729 |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

5.3. Robustness Test

5.3.1. Placebo Test

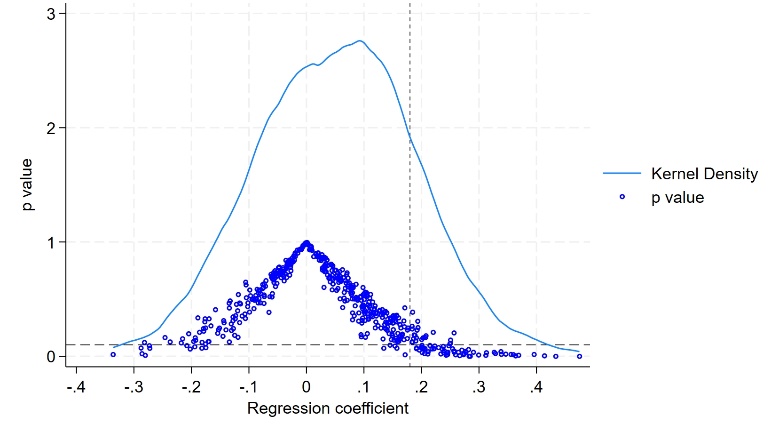

Placebo test is a method used to verify the robustness of study results and to rule out confounding factors. In this paper, 500 randomized replacement placebo tests were conducted, and the results are shown in the figure. The regression coefficient of high-speed railway is close to the normal distribution with 0 as the center, and the highest point of P-value is close to 0 rather than the coefficient of benchmark regression, which indicates the regression result of this paper is robust.

Figure 2: Parallel trend hypothesis test.

5.3.2. Lag one-phase Regression

In order to further verify the robustness of the results of this study and solve the potential endogeneity problem, this paper adopts a delayed one-stage regression analysis. The principle of this method is to use the lag value of the explanatory variable to predict the dependent variable, helping to alleviate the problem of simultaneous correlation and reverse causation. From the regression results, the lag one phase regression results are highly consistent with our benchmark model, which not only enhances the credibility of our results, but also indicates that the impact of key variables such as high-speed rail on FDI is sustained and stable.

6. Heterogeneity Analysis

This study groups Chinese cities based on city type, route type, and center periphery in order to investigate the diverse effects of high-speed rail on FDI attraction of cities.

6.1. Center-peripheral city heterogeneity

In order to test hypothesis 2, the sample cities in this paper are separated into central and periphery cities. The central city refers to the provincial capital city, the deputy provincial capital city and the municipality. Other than that, it's a peripheral city. High-speed rail’s opening has no discernible effect on FDI inflow into core cities. For peripheral cities, high-speed rail’s opening brings more FDI inflows, which is consistent with the hypothesis 2. It shows that although the central cities, as the economic and political centers of a region, have more re-sources and policy support than the peripheral cities, under the effect of diffusion and marginal effect, the high-speed rail in the central cities has no obvious influence on the attraction of FDI. Central cities already have relatively perfect transportation network and infrastructure, and have become hot cities of FDI inflow, they may face marginal diminishing effect. While the peripheral cities are relatively poor in transportation infrastructure and resources, high-speed rail's opening can help them increase availability of resources, promote agglomeration of industries also, thus enhance the appeal of FDI from a very low level.

Table 2: Central-peripheral City and Not Main line-main line City Regression Result.

(1) | (2) | (3) | (4) | |

VARIABLES | Central city FDI | Peripheral city FDI | Not main line HSR city FDI | Main line HSR city FDI |

HSR | -0.119 | 0.188*** | 0.313*** | 0.081 |

(-1.08) | (3.98) | (4.34) | (1.33) | |

GDP | 1.281*** | 1.061*** | 1.025*** | 1.049*** |

(5.23) | (23.23) | (16.47) | (20.72) | |

FIN | 0.042 | -0.056* | -0.132*** | 0.001 |

(0.87) | (-1.87) | (-3.87) | (0.02) | |

HC | -0.000* | 0.002*** | 0.001*** | 0.001*** |

(-1.70) | (8.92) | (5.70) | (5.88) | |

IS | -0.009 | 0.006*** | -0.001 | 0.023*** |

(-0.85) | (2.71) | (-0.35) | (7.23) | |

WAGE | 9.513*** | 0.320 | 0.721 | 2.184*** |

(7.33) | (0.92) | (1.37) | (5.77) | |

INNO | 0.172 | 0.013 | -0.125* | 0.343*** |

(0.93) | (0.25) | (-1.87) | (5.04) | |

Constant | -55.364*** | -10.956*** | -11.268*** | -18.847*** |

(-8.37) | (-7.26) | (-5.15) | (-11.20) | |

Urban FE Year FE | YES YES | YES YES | YES YES | YES YES |

Observations | 490 | 3546 | 2244 | 1192 |

R-squared | 0.884 | 0.693 | 0.630 | 0.792 |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

6.2. City of high-speed line heterogeneity

China's high-speed rail "four horizontal and four vertical" is the core layout of China's medium and long-term railway network planning, and is the pillar of China's high-speed rail. Four "vertical" trunk lines form a north-south high-speed transport corridor; Four "horizontal" trunk lines connect important cities and regions in the east, central and west to promote regional economic integration. This paper divides Chinese cities into "four horizontal and four vertical" transport network cities and non-" four horizontal and four vertical "transport network cities, and carries out grouping regression. The regression findings demonstrate that the opening of HSR significantly increases the FDI influx into non-HSR mainline cities, as indicated in Table 2, and the FDI influx into non-HSR mainline cities is significantly boosted by the advent of HSR, because these cities were originally in a relatively marginal traffic position and relatively weak infrastructure. The opening of high-speed rail has greatly improved transport connectivity in these cities, making it easier for foreign companies to enter and operate, so FDI inflows have increased significantly. However, in the mainline high-speed rail cities, the opening of high-speed rail has no significant impact on FDI inflow.

6.3. City type heterogeneity

In order to explore the heterogeneity of FDI attraction of different city types, this paper divides 300 prefecture-level cities in China into agricultural cities, industrial cities and service cities. The classification criteria refer to the city classification management document issued by the Chinese government, which classifies cities with primary industry accounting for more than 30% of GDP as agricultural cities, classifies cities with secondary industry accounting for more than 50% of GDP as industrial cities, and classifies cities with tertiary industry accounting for more than 60% of GDP as service cities. It can be seen from the regression results in table 3 that in agricultural cities, the opening of high-speed rail can significantly promote the FDI inflow of agricultural cities, which may be due to the relatively backward infrastructure of agricultural cities, and the opening of high-speed rail has improved the transport accessibility of these cities and attracted more foreign investment. In industrial cities, the opening of high-speed rail has a significant but relatively small impact on FDI, indicating that the opening of high-speed rail has a certain promoting effect on FDI in industrial cities, but the impact is relatively limited. Among service cities, the opening of high-speed rail has a significant negative correlation with the impact of FDI, indicating that the opening of high-speed rail may inhibit the FDI inflow of service cities, the reason is that high-speed rail enhances the connectivity of service cities with nearby low-cost cities, so investors may prefer to choose cities with convenient transportation but lower costs. In addition, the high value-added service industry is more sensitive to costs, and investors may choose cities with lower costs to diversify their business, further reducing the FDI inflow of service cities.

Table 3: Regression Results of City Type.

(1) | (2) | (3) | |

VARIABLES | Agricultural city FDI | Industrial city FDI | Service city FDI |

HSR | 0.144** | 0.168* | -0.324** |

(2.43) | (1.91) | (-2.10) | |

GDP | 1.011*** | 1.155*** | 1.051*** |

(16.93) | (13.58) | (7.94) | |

FIN | -0.048 | -0.016 | -0.121*** |

(-1.41) | (-0.23) | (-2.93) | |

HC | 0.002*** | 0.000 | 0.000** |

(6.87) | (0.90) | (2.19) | |

IS | 0.010*** | -0.017** | 0.033*** |

(3.18) | (-2.35) | (3.30) | |

WAGE | 0.411 | 0.260 | 5.434*** |

(0.89) | (0.35) | (5.85) | |

INNO | -0.064 | 0.201* | 0.272 |

(-1.03) | (1.85) | (1.35) | |

Constant | -10.594*** | -10.682*** | -33.551*** |

(-5.20) | (-3.59) | (-8.38) | |

Urban FE Year FE | YES YES | YES YES | YES YES |

Observations | 2,313 | 893 | 446 |

R-squared | 0.671 | 0.730 | 0.865 |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

7. Conclusions and Policy Implications

In this paper, the multi-time point difference model is used to study the impact of high-speed rail on FDI attraction. The results show that FDI inflow increases significantly after the opening of HSR, and the impact of HSR opening on the development of different cities is heterogeneous. In peripheral cities, non-mainline high-speed rail cities and agricultural cities, the opening of high-speed rail has a significant positive impact on FDI inflow, while under the influence of diffusion effect and marginal effect, there is no significant impact on FDI inflow in central cities and mainline high-speed rail cities. The conclusions of this study can provide some recommendations for the Chinese government and other developing countries. First, priority should be given to the layout of high-speed rail in relatively underdeveloped surrounding cities and agricultural cities to improve regional transportation convenience and reduce logistics costs. Second, government should promote the construction of non-trunk high-speed railways and realize convenient high-speed rail connections between cities at different levels. Third, adapt to local conditions and promote high-speed rail to drive industrial development. At the same time, with the help of high-speed rail channel effect to attract more talent inflow, in order to promote the transformation of surrounding cities and industrial upgrading.

References

[1]. Li, F., Su, Y., Xie, J., Zhu, W., & Wang, Y. (2020). The impact of High-Speed Rail opening on city economics along the Silk Road Economic Belt. Sustainability, 12(8), 3176.

[2]. Albalate, D., & Fageda, X. (2016). High speed rail and tourism: Empirical evidence from Spain. Transportation Research Part A: Policy and Practice, 85, 174-185.

[3]. Unver, M., & Koyuncu, C. (2016, October). The impact of infrastructure on FDI inflows: a panel data analysis. In 2nd International Osmaneli Social Sciences Congress (pp. 12-14).

[4]. Hong, J., Chu, Z., & Wang, Q. (2011). Transport infrastructure and regional economic growth: evidence from China. Transportation, 38, 737-752.

[5]. Zhang, B., Dong, W., & Yao, J. (2023). The Opening of High-Speed Railways, the Improvement of Factor Allocation Efficiency between Regions, and the City’s Environmental Quality Improvement. International Journal of Environmental Research and Public Health, 20(5), 4648.

[6]. Li, X., Huang, B., Li, R., & Zhang, Y. (2016). Exploring the impact of high-speed railways on the spatial redistribution of economic activities-Yangtze River Delta urban agglomeration as a case study. Journal of Transport Geography, 57, 194-206.

[7]. Eckert, S., Koppe, M., Burkatzki, E., Eichentopf, S., & Scharf, C. (2022). Economies of scale: The rationale behind the multinationality-performance enigma. Management International Review, 62(5), 681-710.

[8]. Zheng, K., Li, Y., & Xin, X. (2022). The Influencing Mechanism of High-Speed Rail on Innovation: Firm-Level Evidence from China. Sustainability, 14(24), 16592.

[9]. Friedman, J. (1995). Global system, globalization and the parameters of modernity. Global modernities, 69-90.

[10]. Li, J., Elahi, E., Cheng, P., Wu, A., Cao, F., Jian, W., ... & Khalid, Z. (2023). The Opening of High-Speed Railway and Coordinated Development of the Core–Periphery Urban Economy in China. Sustainability, 15(5), 4677.

[11]. Lu, Y., & Zeng, L. (2022). How do high-speed railways facilitate high-quality urban development: evidence from China. Land, 11(9), 1596.

[12]. Marshall, A. (2013). Principles of economics. Springer.

[13]. Lin, Y. (2017). Travel costs and urban specialization patterns: Evidence from China’s high speed railway system. Journal of Urban Economics, 98, 98-123

[14]. Li, F., Su, Y., Xie, J., Zhu, W., & Wang, Y. (2020). The impact of High-Speed Rail opening on city economics along the Silk Road Economic Belt. Sustainability, 12(8), 3176.

[15]. Chakrabarti, A. (2001). The determinants of foreign direct investments: Sensitivity analyses of cross‐country regressions. kyklos, 54(1), 89-114.

[16]. Alfaro, L., Chanda, A., Kalemli-Ozcan, S., & Sayek, S. (2004). FDI and economic growth: the role of local financial markets. Journal of international economics, 64(1), 89-112.

[17]. Noorbakhsh, F., Paloni, A., & Youssef, A. (2001). Human capital and FDI inflows to developing countries: New empirical evidence. World development, 29(9), 1593-1610.

[18]. Cheng, L. K., Qiu, L. D., & Tan, G. (2005). Foreign direct investment and international trade in a continuum Ricardian trade model. Journal of Development Economics, 77(2), 477-501.

[19]. Wheeler, D., & Mody, A. (1992). International investment location decisions: The case of US firms. Journal of international economics, 33(1-2), 57-76.

[20]. Coughlin, C. C., & Segev, E. (2000). Foreign direct investment in China: a spatial econometric study. World economy, 23(1).

Cite this article

Wang,X.;Charoenseang,J. (2024). The Impact of High-speed Rail on FDI Attraction in Chinese Cities. Advances in Economics, Management and Political Sciences,139,77-86.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, F., Su, Y., Xie, J., Zhu, W., & Wang, Y. (2020). The impact of High-Speed Rail opening on city economics along the Silk Road Economic Belt. Sustainability, 12(8), 3176.

[2]. Albalate, D., & Fageda, X. (2016). High speed rail and tourism: Empirical evidence from Spain. Transportation Research Part A: Policy and Practice, 85, 174-185.

[3]. Unver, M., & Koyuncu, C. (2016, October). The impact of infrastructure on FDI inflows: a panel data analysis. In 2nd International Osmaneli Social Sciences Congress (pp. 12-14).

[4]. Hong, J., Chu, Z., & Wang, Q. (2011). Transport infrastructure and regional economic growth: evidence from China. Transportation, 38, 737-752.

[5]. Zhang, B., Dong, W., & Yao, J. (2023). The Opening of High-Speed Railways, the Improvement of Factor Allocation Efficiency between Regions, and the City’s Environmental Quality Improvement. International Journal of Environmental Research and Public Health, 20(5), 4648.

[6]. Li, X., Huang, B., Li, R., & Zhang, Y. (2016). Exploring the impact of high-speed railways on the spatial redistribution of economic activities-Yangtze River Delta urban agglomeration as a case study. Journal of Transport Geography, 57, 194-206.

[7]. Eckert, S., Koppe, M., Burkatzki, E., Eichentopf, S., & Scharf, C. (2022). Economies of scale: The rationale behind the multinationality-performance enigma. Management International Review, 62(5), 681-710.

[8]. Zheng, K., Li, Y., & Xin, X. (2022). The Influencing Mechanism of High-Speed Rail on Innovation: Firm-Level Evidence from China. Sustainability, 14(24), 16592.

[9]. Friedman, J. (1995). Global system, globalization and the parameters of modernity. Global modernities, 69-90.

[10]. Li, J., Elahi, E., Cheng, P., Wu, A., Cao, F., Jian, W., ... & Khalid, Z. (2023). The Opening of High-Speed Railway and Coordinated Development of the Core–Periphery Urban Economy in China. Sustainability, 15(5), 4677.

[11]. Lu, Y., & Zeng, L. (2022). How do high-speed railways facilitate high-quality urban development: evidence from China. Land, 11(9), 1596.

[12]. Marshall, A. (2013). Principles of economics. Springer.

[13]. Lin, Y. (2017). Travel costs and urban specialization patterns: Evidence from China’s high speed railway system. Journal of Urban Economics, 98, 98-123

[14]. Li, F., Su, Y., Xie, J., Zhu, W., & Wang, Y. (2020). The impact of High-Speed Rail opening on city economics along the Silk Road Economic Belt. Sustainability, 12(8), 3176.

[15]. Chakrabarti, A. (2001). The determinants of foreign direct investments: Sensitivity analyses of cross‐country regressions. kyklos, 54(1), 89-114.

[16]. Alfaro, L., Chanda, A., Kalemli-Ozcan, S., & Sayek, S. (2004). FDI and economic growth: the role of local financial markets. Journal of international economics, 64(1), 89-112.

[17]. Noorbakhsh, F., Paloni, A., & Youssef, A. (2001). Human capital and FDI inflows to developing countries: New empirical evidence. World development, 29(9), 1593-1610.

[18]. Cheng, L. K., Qiu, L. D., & Tan, G. (2005). Foreign direct investment and international trade in a continuum Ricardian trade model. Journal of Development Economics, 77(2), 477-501.

[19]. Wheeler, D., & Mody, A. (1992). International investment location decisions: The case of US firms. Journal of international economics, 33(1-2), 57-76.

[20]. Coughlin, C. C., & Segev, E. (2000). Foreign direct investment in China: a spatial econometric study. World economy, 23(1).