1. Introduction

Financial anomaly refers to a phenomenon in the financial market that deviates from the traditional financial theory. The existence of financial anomalies violates the basic assumption of the efficient market hypothesis that market prices adequately reflect all available information. These phenomena reveal the irrational behavior in the market mechanism, information asymmetry and the complexity of investor psychology.

As financial theory has evolved, and with the wealth and variety of market data, the research on the interpretation and impact of financial anomalies has made remarkable progress. Many scholars have explored traditional asset pricing theories, yet their findings often fall short. Consequently, researchers continue to look for new laws from the perspective of the transformation of homogeneous beliefs into heterogeneous beliefs [1]. Financial anomalies include abnormal price movements in the stock market, momentum effects and abnormal returns in the fixed income market. However, the manifestations and causes of anomalies between different financial markets remain underexplored.

This paper employs comparative analysis to examine three representative financial markets in China, the United States and Europe, It explores the manifestations of financial anomalies in each market, the reasons for this phenomenon and the cultural and institutional influences at play. and finds the commonalities and differences among these markets. This research paper adopts various methods such as historical data analysis, case study and literature review, hoping to comprehensively observe and explain the complexity and diversity of financial anomalies in different markets. The study of financial anomalies has important practical significance and theoretical value. As a reference for the improvement of investors' investment strategies and the identification of non-efficiency phenomena in the market, this study will contribute to the development of a more nuanced global financial market model and deepen the understanding of the global financial market, and support efforts to foster international financial cooperation while improving the stability and efficiency of the financial market.

2. Literature Review

2.1. Types of Financial Market Anomalies

Financial visions may take many different forms and are not limited to just one category. The stock market anomaly, which includes the momentum, reversal, and calendar effects, is the most notable of them. Furthermore, there exist distinct irregularities in the currency and fixed income markets. One of the stock market oddities that has been examined the most is the momentum effect. It alludes to the propensity of stock prices to rise over a certain length of time; that is, equities that have historically performed well will often continue to rise, whereas those that have historically performed poorly would likely continue to fall. But when Jegadeesh and Titman contended that there is proof that momentum investing methods provide anomalous returns in several stock markets, the theory took a serious hit. Since then, it has evolved into one of the murky corners of finance, giving rise to a continuous discussion about its very existence [2]. For example, overconfidence and a herd mentality can cause the market to stall its response to information, thus perpetuating price trends. Investors tend to have higher expectations for stocks that have performed well recently and ignore short-term price fluctuations, thus driving the continued rise in the prices of these stocks. The momentum effect manifests itself across multiple markets and time periods, and its persistence and intensity may vary due to changes in market conditions, economic cycles and investor behavior. The reversal effect refers to the reversal phenomenon of stock prices over a long period of time, which means that a stock that performs well may perform poorly in the future, and a stock that performs poorly may rebound. Condition. This phenomenon challenges the momentum effect and reflects the market's potentially irrational behavior in how it handles stock performance. First, an overreaction in the market can cause stock prices to deviate from their intrinsic value in the short term. Undervalued stocks experience excess returns over time, while overvalued stocks underperform. Secondly, investors may be affected by market sentiment and noise in the short term and ignore fundamental factors. Jegadeesh and Titman studied the U.S. stock market over the past 50 years and believed that in the next year, if investors buy stocks that have performed well in the past and sell stocks that have performed averagely in the past, they will receive a huge rate of return no matter how the external environment changes. It shows that there is indeed a stock market anomaly such as the "reversal effect" in the stock market [3]. The calendar effect refers to a cyclical phenomenon that exists in financial markets, which means that during certain specific periods of time, the market exhibits systematic abnormal returns or fluctuations. These anomalies are usually related to specific dates or time periods. Common calendar effects include January effect, weekend effect, and month effect. The January effect, the best-known of the calendar effects, refers to the tendency for stock markets to exhibit abnormal returns in January of each year, especially for small-cap stocks. The existence of calendar anomalies provides important information for investors to obtain abnormal returns by knowing the past behavior of stock prices. On the other hand, scholars can question the validity of the weak-form efficient market hypothesis [4]. The premium puzzle in market anomalies mainly describes the long-term inconsistency between the expected returns of certain assets and their actual returns. Specifically, high-risk assets, in particular, generate significantly higher returns in long-term observations than the theoretically predicted risk premiums. This phenomenon confuses investors, academics, and market analysts because it goes against the expectations of traditional financial theory. If a security's return is highly correlated with the consumption of the average investor, selling the security would significantly lower the variance of the investor's consumption stream. This is how financial economists usually explain these variations in average returns [5].

2.2. Theoretical Basis of Anomalies in Financial Markets

Behavioural finance is a field that examines the influence of investor psychology and behaviour on financial markets, seeking to elucidate market oddities that conventional financial theories fail to address comprehensively. Behavioural finance questions conventional financial theory, especially the presumption that market participants consistently act rationally. Behavioural finance encompasses several disciplines, including psychology, economics, and sociology. Behavioural finance highlights that individuals are frequently swayed by cognitive biases and emotional influences during decision-making. Investors frequently exhibit overconfidence, loss aversion, and confirmation bias when confronted with risks. Loss aversion indicates that investors exhibit more sensitivity to losses than to equal profits, leading to reluctance in selling assets at a loss and resulting in a "sunk cost" impact. Behavioural finance highlights the significance of social influences, a phenomenon notably observable in market booms and collapses. Behavioural finance seeks to comprehend investors and the manifestation of their interactions inside financial markets. This insight can assist investing professionals in mitigating investors' overconfidence in their capacity to outperform the market. It can assist investing experts in addressing this overconfidence [6]. The market efficiency hypothesis is another fundamental concept within the realm of financial market analysis. This theory posits that in financial markets, asset prices completely incorporate all accessible information, rendering it impossible for investors to consistently surpass market performance through the acquisition or analysis of information in an efficient market. The efficient market hypothesis (EMH) is categorised into three components: weak form efficiency, semi-strong form efficiency, and strong form efficiency [7]. The primary foundation for the notion of market efficiency is the rapidity of information dissemination within the market and the level of market rivalry. Information disseminates swiftly in efficient markets, prompting market players to promptly modify their investment decisions according to fresh data, ensuring that asset prices accurately embody all recent information in a timely fashion. Simultaneously, the presence of several rational investors in the market fosters continuous competition to get advantages through informational superiority, hence enhancing market efficiency. Behavioural research indicates that market participants do not consistently exhibit rationality. The idea of market efficiency offers a framework for understanding market operations and has significant ramifications for investment strategies and asset valuation. In the notion of stock market efficiency, public knowledge that has not been completely incorporated into stock prices is akin to gold on the streets. Both are met with similar scepticism. Consider a corporation that reports a $3 rise in yearly earnings per share (EPS), whereas the consensus projection at the year's outset anticipated a $2 increase [8]. We demonstrate that an efficient market is fully defined by the lack of arbitrage possibilities and dominated securities, offering tests for efficiency that are free from the bad-model problem [9].

3. The similarities and differences of anomalies in different financial markets

3.1. Developed markets vs. developing markets

The financial market system in industrialised nations is more advanced, with a more robust corporate governance framework and stricter market oversight. This mitigates the likelihood of information asymmetry and enhances market efficiency. Furthermore, the financial markets of industrialised nations are abundant in financial products, characterised by significant depth and breadth, hence enhancing market liquidity and distributing risks. The financial markets of underdeveloped nations typically exhibit significant information asymmetry, which may result in unethical practices such as price manipulation and insider trading, hence exacerbating market volatility. Furthermore, the market oversight environment is somewhat lax, and there exist regulatory gaps, which heighten the potential of market exploitation. Excessive volatility in the financial market is a symptom of the problem. Markets in emerging economies exhibit greater volatility, while those in advanced economies have reduced volatility. Another mode of expression is herding. The herding effect is especially pronounced in developing nations, because the percentage of individual investors is substantial, and they are readily influenced by the investment choices of others, leading to collective irrational investing behaviours in the market. The herd effect is present in developed nations as well; however, the significant presence of institutional investors among market participants enhances analytical capabilities, hence reducing the effect's impact on the market. Markets in emerging nations are susceptible to asset price bubbles that have resulted in severe market collapses. In the industrialised world, due to the extensive nature of their financial markets and the accessibility of advanced risk-management techniques, bubbles require more time to build, and the consequences of collapses are more controllable. The price fluctuations in the financial markets of industrialised nations are more subdued, exhibiting robust self-adjustment and corrective capabilities that facilitate a quicker restoration of market efficiency. In underdeveloped nations, financial markets exhibit heightened sensitivity and experience prolonged recovery periods following market shocks.

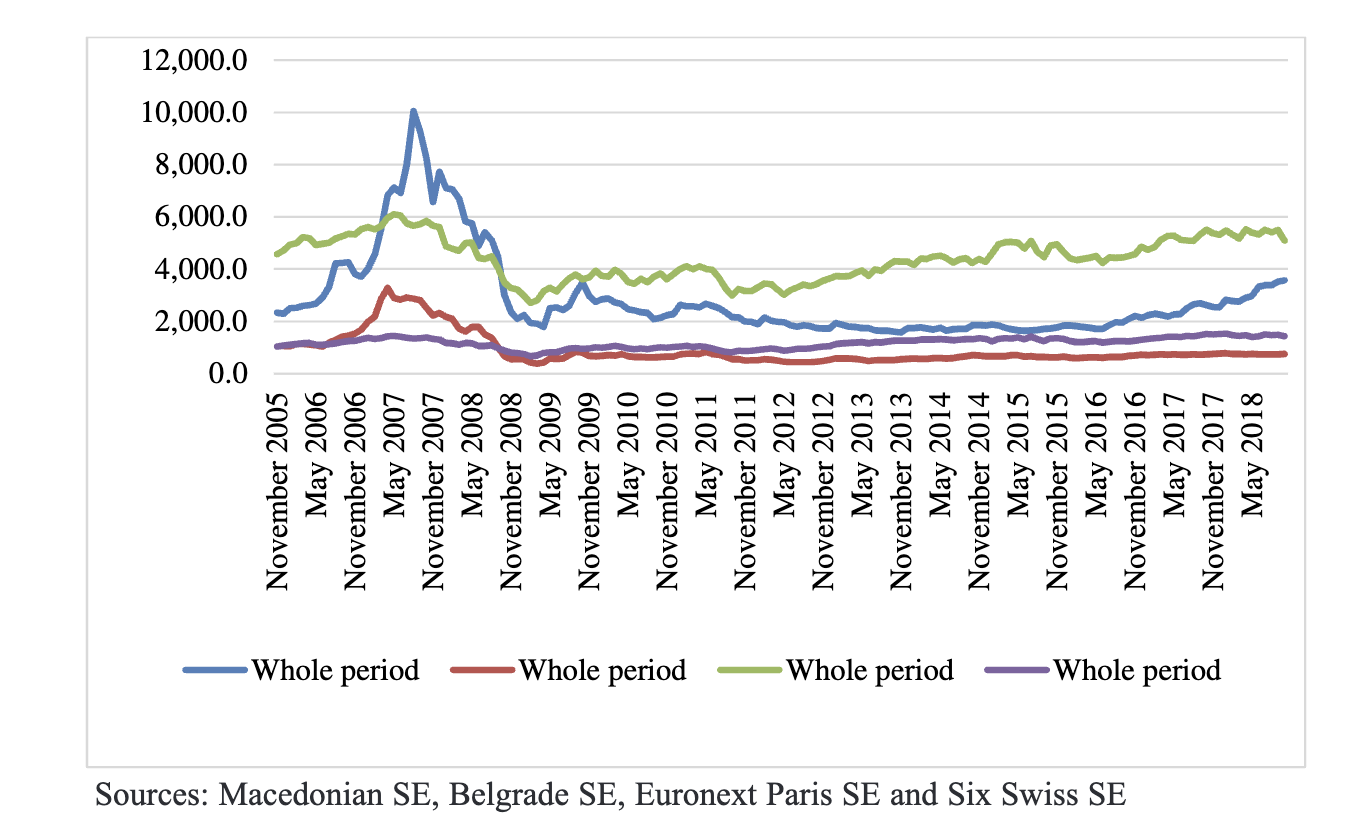

Figure 1 illustrates the movement of the market indices over the entire analyzed time-frame. It clearly shows the dramatic drops of the stock market indices in the period 2007-2008, with the sharpest decline [10].

Figure 1: the movement of the market indices [10].

In accordance with prior research, our regression analysis indicates that assaults in the capital city and the intensity of attacks adversely affect index returns. The findings offer fresh insights about terrorist strikes aimed at strategically advantageous sites, revealing that assaults near the capital have a more significant and detrimental impact on stock market returns. Our comprehensive research utilising event methodology substantiates our primary findings and indicates that the stock market's adverse reaction to terrorist incidents is more pronounced in developing nations, whereas developed capital markets exhibit more resilience to the negative impacts of such events [10].

3.2. Different asset classes

Table 1: Comparison of stock market, bond market and foreign exchange market

Feature | Stock Market | Bond Market | Forex Market |

Main Investors | Individual investors, institutional investors, Investment funds | Individual investors, Institutional investors(e.g. banks, insurance companies),governments | Banks, multinational corporations, individual investors, central banks, investment funds |

Market Characteristics | High volatility, high potential returns, high risk | Relatively low volatility, lower risk, provides stable returns | High liquidity,24-hour trading, strongly influenced by global events |

Risk and Return | High | Low risk investments with relatively stable returns | High risk and high return due to leverage |

Market Participant Behavior | Possibly highly influenced by irrational psychological factors | More rational but still influenced by market sentiment and economic expectations | Highly professionalized, but still subject to extreme reactions to global events or significant news |

Universality | High, many phenomena appear in stock markets around the world | Relatively lower, but specific anomalies like the term premium puzzle are observed in different markets | High, especially anomalies closely related to global macroeconomic policies and events |

Specificity | Anomalies are mostly related to investor psychology and company fundamentals | Anomalies are often related to interest rate environment and credit risk assessment | Anomalies typically relate to macroeconomic policies, international trade differences |

4. Discussion

This article analyses the dissimilar anomalous features of developed and emerging markets, therefore assisting developing nations in enhancing their financial market systems. Moreover, several asset classes, including equities, fixed income securities, and foreign currency, exhibit distinct anomalies, indicative of the divergent risk pricing processes and behavioural patterns of different financial assets within the market. The constraints of data sampling and research methodologies may prevent the findings of this work from accurately representing anomalies across all worldwide marketplaces. Future studies may be broadened, and the evolutionary patterns of financial market anomalies might be further investigated by integrating real-time data with market dynamics.

5. Conclusion

This study conducts a comprehensive investigation of financial market anomalies, examining their presence across various markets and asset classes, while elucidating their parallels and distinctions. The research indicates that financial market anomalies exhibit considerable differences between developed and developing nations, as well as distinct features across various asset markets. These findings enhance the comprehension of market efficiency and behavioural finance theory.This paper has not done a very detailed survey, and the level of comparison is relatively limited, and the data is also very limited, so this research report is only for reference.

Anticipating the future, the ongoing evolution of the global financial market will furnish a more empirical foundation for policy formulation and investment strategies, aiding market participants in comprehending and addressing irregularities within the financial landscape.

References

[1]. Chen Guo-Jin, and Wang Jing." Recent progress in the study of heterogeneous beliefs and financial anomalies." Economic Trends 9 (2007): 75-79.

[2]. Dhankar, Raj, and Supriya Maheshwari. "Behavioural finance: A new paradigm to explain momentum effect." Available at SSRN 2785520 (2016).

[3]. Zhong Chen, and Wu Xiong." The impact of trust companies on the 'stock price anomaly' of listed real estate enterprises from the perspective of Behavioral Finance." Journal of Sichuan Normal University (Social Science Edition) 48.1 (2021).

[4]. Muruganandan, S., V. Santhi, and Arunkumar Jayaraman. "Calendar anomalies: before and after the global financial crisis in emerging BRIC stock markets." Int J Res Humanit Soc Scie 4.1 (2017): 26-30.

[5]. Kocherlakota, Narayana R. "The equity premium: It's still a puzzle." Journal of Economic literature 34.1 (1996): 42-71.

[6]. Statman, Meir. "What is behavioral finance." Handbook of finance 2.9 (2008): 79-84.

[7]. Wang, Jiaying. "The Different Forms of Market Efficiency: Theoretical Arguments and Experimental Evidence." International Journal of Education and Economics: 115.

[8]. Ball, Ray. "The theory of stock market efficiency: accomplishments and limitations." Journal of Financial Education 22 (1996): 1-13.

[9]. Jarrow, Robert A., and Martin Larsson. "The meaning of market efficiency." Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics 22.1 (2012): 1-30.

[10]. Tsenkov, Vladimir. "Crisis influences between developed and developing capital markets–The case of Central and Eastern European countries." Икономически изследвания 3 (2015): 71-107.

Cite this article

Hu,H. (2025). A Global Comparative Study of Financial Market Anomalies. Advances in Economics, Management and Political Sciences,153,16-21.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen Guo-Jin, and Wang Jing." Recent progress in the study of heterogeneous beliefs and financial anomalies." Economic Trends 9 (2007): 75-79.

[2]. Dhankar, Raj, and Supriya Maheshwari. "Behavioural finance: A new paradigm to explain momentum effect." Available at SSRN 2785520 (2016).

[3]. Zhong Chen, and Wu Xiong." The impact of trust companies on the 'stock price anomaly' of listed real estate enterprises from the perspective of Behavioral Finance." Journal of Sichuan Normal University (Social Science Edition) 48.1 (2021).

[4]. Muruganandan, S., V. Santhi, and Arunkumar Jayaraman. "Calendar anomalies: before and after the global financial crisis in emerging BRIC stock markets." Int J Res Humanit Soc Scie 4.1 (2017): 26-30.

[5]. Kocherlakota, Narayana R. "The equity premium: It's still a puzzle." Journal of Economic literature 34.1 (1996): 42-71.

[6]. Statman, Meir. "What is behavioral finance." Handbook of finance 2.9 (2008): 79-84.

[7]. Wang, Jiaying. "The Different Forms of Market Efficiency: Theoretical Arguments and Experimental Evidence." International Journal of Education and Economics: 115.

[8]. Ball, Ray. "The theory of stock market efficiency: accomplishments and limitations." Journal of Financial Education 22 (1996): 1-13.

[9]. Jarrow, Robert A., and Martin Larsson. "The meaning of market efficiency." Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics 22.1 (2012): 1-30.

[10]. Tsenkov, Vladimir. "Crisis influences between developed and developing capital markets–The case of Central and Eastern European countries." Икономически изследвания 3 (2015): 71-107.