Volume 242

Published on November 2025Volume title: Proceedings of CONF-BPS 2026 Symposium: Sustainability Transitions and Regional Economic Restructuring in New Contexts

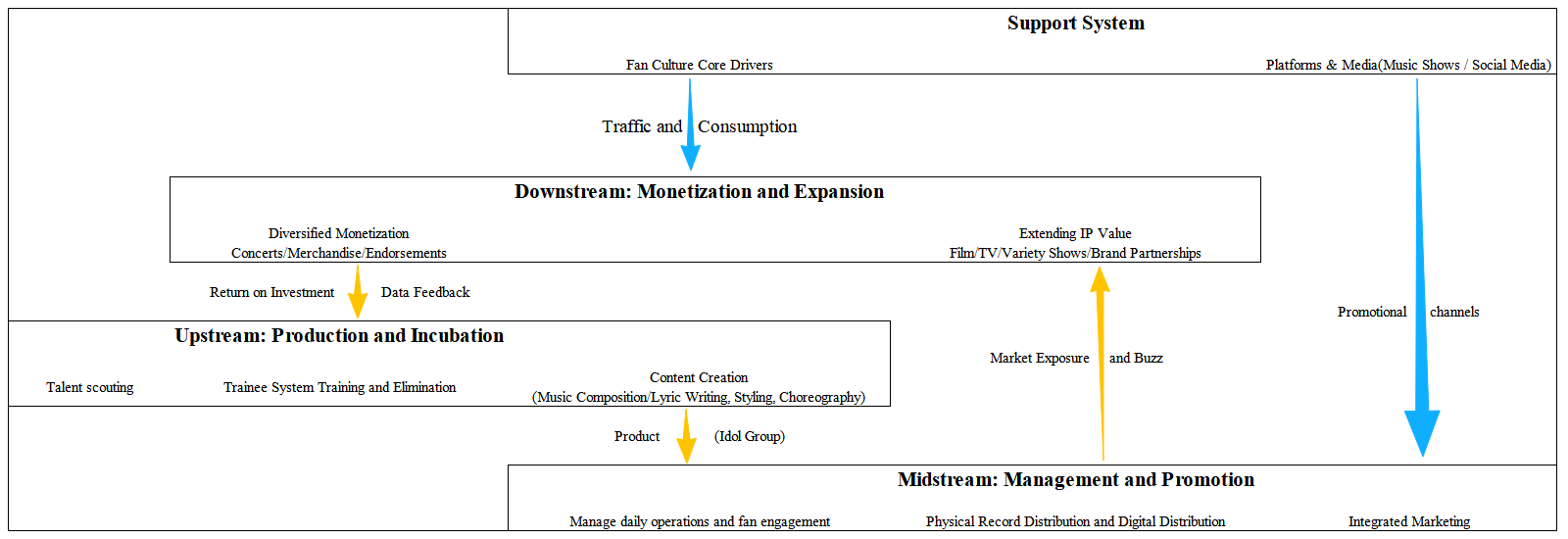

From “Korean Wave” to a worldwide wave, the cultural industry has gradually become the most important soft power and economic engine in the Republic of Korea. In the cultural industry, music industry is the most important industry that exports Korean culture to other countries. By analyzing Korea’s music industry chain and exporting model—industrialized and systematized export model, and analyzing the reasons why Korean music industry can be successfully exported to all over the world, it has important research value and reference value for exporting China’s music industry and internationalization. It is worthy of the deep research and discussion. This paper will analyze the export model of Korea’s music industry chain by its own experience. Try to summarize the experience of Korea’s successful experience in exporting its music industry to all over the world. Based on the current situation of China’s music industry, combining with the situation of the implementation, this paper puts forward several feasible and constructive suggestions for the own export model. It is hoped that this paper can provide some references for the export of China’s music industry and professionals to promote the internationalization of Chinese music.

View pdf

View pdf

Under the backdrop of "dual carbon" goals and the intelligentization of automobiles, the capital demands and valuation fluctuations of new energy vehicle enterprises have been simultaneously magnified. Taking NIO as a core case, and combining its key financing nodes from 2015 to 2025 with the phased changes in market value/PS multiples, this paper establishes an analytical framework of "financing ratio - transmission path - valuation result": Path one is equity dilution and repair speed; path two is the use of funds and conversion efficiency; path three is the stability of investor structure and valuation anchor. The research finds that what determines the intensity of valuation impact is not the ratio value itself, but the functional fit between investor composition and the enterprise's phased demands - state-owned capital brings "quick repair but limited sustainability" during the crisis period, while foreign capital strengthens "channel expansion and long-term space" during the expansion period. The NIO case shows that the impact of financing events on valuation presents phased and structural characteristics, and the efficiency of fund use and the stability of investor structure jointly determine the speed and sustainability of valuation repair. Based on this, this paper puts forward capital operation and governance suggestions for NIO at different development stages.

View pdf

View pdf

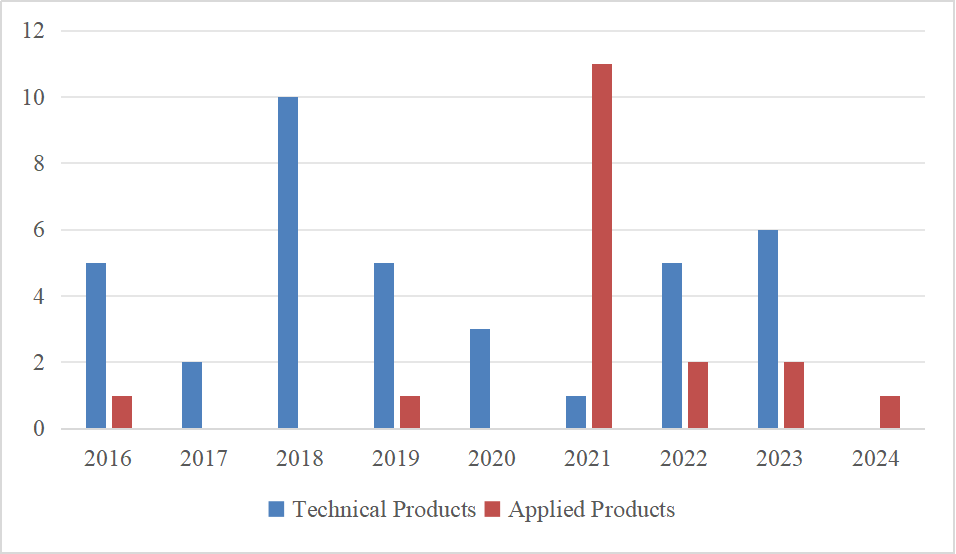

The scale of China's health consumption market is accelerating. The Artificial Intelligence(AI) healthcare industry is rapidly emerging, driving the continuous development of the industry. As a high-tech and highly uncertain emerging industry, the AI healthcare industry requires a large amount of external funding support in the early stages, so private equity needs to be introduced to help the growth of enterprises. This article studied the impact of the introduction of private equity on the strategic decision-making of companies in the AI healthcare sector. The study adopted a longitudinal single case study method and selected Koya Medical Company as the research object. By comparing the changes in strategic focus, product development direction, recruitment of personnel, and Initial Public Offering (IPO) process before and after introducing private equity, it was found that after introducing private equity, the company's strategic focus will shift from technology research and development to commercialization, with an increase in applied product research and development, large-scale construction of commercial teams, and significantly accelerated IPO process.

View pdf

View pdf