Volume 241

Published on November 2025Volume title: Proceedings of ICFTBA 2025 Symposium: Global Trends in Green Financial Innovation and Technology

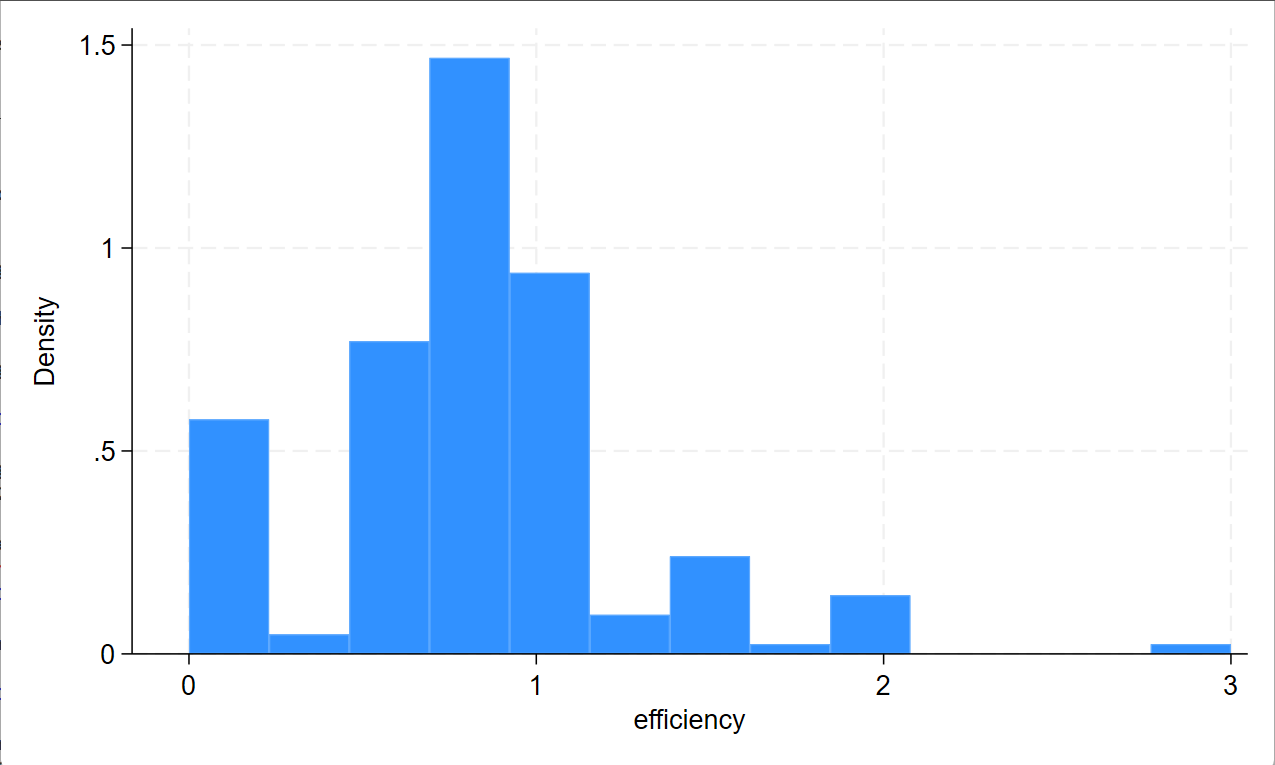

As the phenomenon of overtime working causes significant social harm, especially in China, to effectively make policies against this issue, it became vital to decode the factors that drives people to work overtime. Aside from the “involution” conformity pressure and intrinsic motivation, we believe that supervision from an authoritative figure plays a key role under different conditions. Within our study, by analyzing our data from a questionnaire we distributed on our own with linear regression and entropy weighting, we derived at the conclusion that: (1) supervision can significantly improve the overtime working efficiency and tendency of the employees. (2) Autocratic supervision exerts the strongest influence (+18.45% willingness, +19.59% acceptance) on the employee’s tendency to work overtime. (3) Normative social influence acts as the primary motivator for overtime working among employees generally (64.02 entropy weight), outweighing reciprocity (50.04), signaling (44.31), and intrinsic motivation (21.73). (4) Supervised settings increase predicted overtime efficiency by 5.45%.

View pdf

View pdf

Climate change's escalating threats have propelled carbon neutrality to the forefront of global priorities. With global temperatures having risen 1.1°C above pre-industrial baselines, achieving net-zero emissions demands immediate multilateral action. One of the most important instruments for facilitating the shift to a low-carbon economy is green finance. Nevertheless, the operational pathways through which financial instruments catalyze carbon neutrality require methodical investigation. By methodically investigating how green finance affects carbon neutrality from four key angles—policy tools, market mechanisms, technological innovation, and societal governance—this study aims to deepen the understanding in this field. The research adopts a mixed-methods approach that includes a comprehensive literature review and in-depth case studies. The findings indicate that green finance significantly enhances the feasibility and efficiency of achieving carbon neutrality through market-based incentives, diversified policy instruments, support for technological innovation, and multi-stakeholder governance. The study concludes that increasing investment in green technology, strengthening international cooperation, and optimizing policy design are essential to maximize the impact of green finance.

View pdf

View pdf

The luxury industry has kept its exclusive nature since its first days but contemporary luxury brands now make sustainability and social accountability their main focus. Luxury brands need to endorse the United Nations Sustainable Development Goals from 2015, also known as the SDGs. These goals enable businesses to reach environmental sustainability. The 17 sustainable development goals include SDG 12 for sustainable consumption and production, SDG 13 for climate action, SDG 5 for gender equality and SDG 8 for decent work and Economic growth. This research focus on the 4Ps and 4Cs marketing frameworks serve as foundational elements to start implementing sustainable practices. The "Luxury Sustainable Union" should unite brands under the shared mission to promote "Sustainability is the true luxury" as their common slogan. The UN partnership between Hermès and Gucci and Burberry and Stella McCartney will establish sustainable practices throughout the entire fashion industry. Businesses should implement environmentally friendly materials with traditional handcrafted products while digital platforms demonstrate their circular service models to customers. Luxury brands can establish sustainability as their core business practice by uniting open business models with contemporary technology and customer-oriented approaches. The companies create partnerships with NGOs and their customer base through their environmentally friendly business operations.

View pdf

View pdf

This study aligns with China's “dual carbon” strategy, focusing on A-share companies listed on both the Shanghai and Shenzhen stock exchanges from 2009 to 2023. This timeframe encompasses both the preparatory phase preceding the strategy's implementation and its subsequent impacts. This empirical analysis examines the impact of climate-related risks on corporate debt financing costs, while also investigating the underlying roles of intermediary channels and regional differences in this phenomenon. The study reveals that climate risks significantly elevate corporate debt financing costs, a phenomenon summarized as the “climate risk premium.” This conclusion remains robust across multiple tests—including alternative variable measurements and sample portfolio adjustments. Heterogeneity analysis reveals that enterprises in central and western regions exhibit greater sensitivity to financing cost fluctuations induced by climate risks compared to their eastern counterparts. Mechanistic assessment further confirms that climate risks propagate primarily through two pathways: first, accelerated depreciation of fixed assets diminishes collateral value (asset valuation channel); second, disrupted carbon disclosure exacerbates information opacity (information channel). Notably, the intermediary effect of the asset valuation channel is particularly pronounced at present. This study not only expands the interdisciplinary frontier between climate economics and corporate finance research but also provides critical empirical evidence: it assists governments in formulating specialized green finance regulations, supports financial institutions in building models that reflect dynamic climate pricing, and incentivizes enterprises to strengthen adaptive strategies for addressing the climate crisis.

View pdf

View pdf

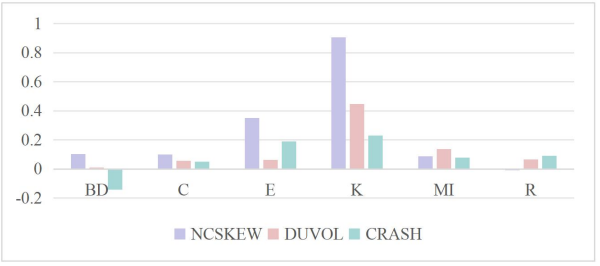

Whether CEO power concentration exacerbates or mitigates stock price crash risk is a critical concern in corporate governance and financial market stability. Using a sample from Chinese A-share listed companies (2018–2022), this study employs a quasi-experimental design by estimating a multi-dimensional fixed effects linear model to empirically examine the impact of CEO power on future crash risk, with a focus on the moderating role of the single-control structure ("One Control One"). The results reveal that: (1) Greater CEO power significantly increases stock price crash risk; (2) Significant industry heterogeneity exists, indicating that industry characteristics moderate this relationship, pointing towards implications for targeted regulation; (3) The "One Control One" governance structure amplifies CEO power’s detrimental impact by weakening internal monitoring mechanisms. These findings indicate that powerful CEOs act as significant contributors to heightened crash risk in China’s emerging market, particularly under concentrated control structures. This research provides critical insights for policymakers and corporations to design industry-specific governance frameworks that balance CEO authority with effective oversight.

View pdf

View pdf

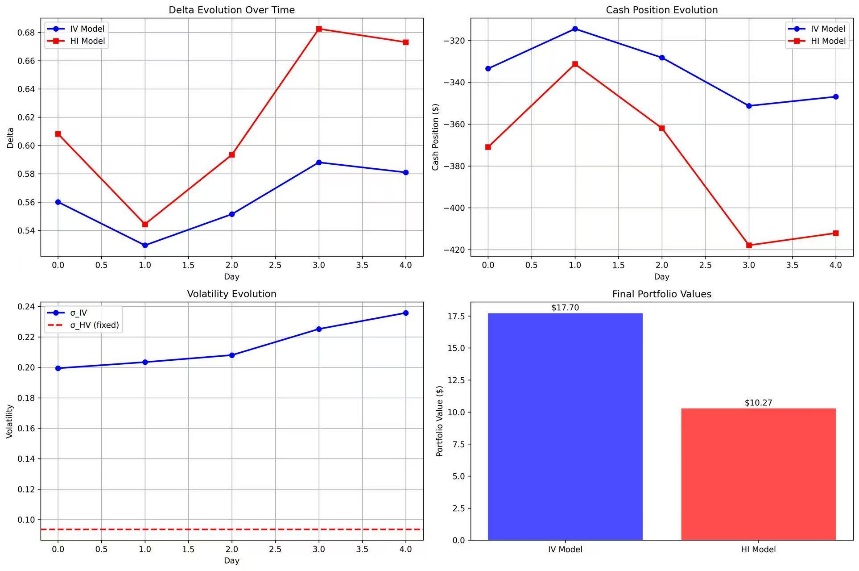

This article investigates hedging efficiency of implied volatility (IV) and historical volatility (HV) for European call options on S&P500 (SPY) using Black–Scholes–Merton pricing model. We implement a five days’ hedging frequency with IV using option prices and HV using 30 days’ rolling return window. The hedging performances of implied volatility and historical volatility are measured with root mean squared error (RMSE), mean absolute error (MAE) and profit and loss (PnL) volatility. We conclude that the speed of IV increases following changes in the market and captures risk due to short-term factors better, but it generates larger errors in times of stable markets, while the HV method, with a much slower reaction, generates better results for calm markets with lower tracking errors and low frequency of rebalancing. Our conclusions lead to the proposal that the time to select between IV and HV is the market conditions and both could also offer better hedging methods when they are combined. Our analysis gives valuable input for both the comprehension of volatility and the construction of new more efficient hedging methods in equity index options.

View pdf

View pdf

With the growing demand for sustainable finance and investment decision-making, the role of artificial intelligence (AI) in environmental, social, and governance (ESG) data collection and analysis has attracted increasing scholarly attention. Nevertheless, challenges such as fragmented data sources and inconsistent standards continue to limit its application. Against this backdrop, this study reviews prior research to outline recent progress in ESG data collection, risk identification, and financial analysis, while also evaluating AI’s role in improving data reliability, guiding investment strategies, and strengthening risk control. The results reveal that techniques such as natural language processing (NLP), machine learning, and generative AI can strengthen ESG data collection and analytical capacity, with practical applications in risk identification, portfolio optimization, and asset pricing. Yet, practical applications are constrained by issues such as inconsistent data standards, algorithmic bias, and the lack of model interpretability. Future research should prioritize the establishment of unified data standards, the enhancement of algorithmic fairness and interpretability, and the advancement of multimodal data integration and cross-regional comparisons to develop a more intelligent and reliable ESG analytical framework.

View pdf

View pdf

With the growing importance of climate change and environmental sustainability in the world, businesses are now understood to play a significant part in reducing emissions and becoming more sustainable. Carbon information disclosure is a major way for companies to disclose their carbon emissions and climate risk, which ultimately affects the cost of capital. This paper examine the association between carbon information disclosure quality and corporate financing costs, based on a sample of listed firms in the Asia-Pacific region. Using fixed-effects models, the study investigates how a carbon disclosure affects financial costs and also examines the nonlinear form of this relationship with regulating factors. The findings show that a high quality level of carbon disclosure generally reduces financing costs but non-linearly, following an inverted U-shape. In particular, over-disclosure may be associated with greater financing costs. Second, the study shows that institutional context is an important moderating factor; stricter environmental disclosure requirements lead to a greater negative relationship between carbon disclosure quality and financing costs.

View pdf

View pdf

In recent years, with the development of e-commerce platforms and the proliferation of short videos and the internet, live-streaming commerce has emerged as a new marketing approach. Generation Z has also moved beyond purely functional consumption, increasingly gravitating towards personalized spending that delivers positive experiences and emotional fulfilment. Based on this, this paper employs the concept of emotional value to explore how the language used in live-streamed sales influences consumer decision-making. This study, grounded in emotional consumption theory and incorporating the customer value model, analyses consumers' purchasing behaviour, habits, and preferences. It aids in understanding the relationship between emotional value and consumer decision-making, while also contributing to practical applications within the live-streaming e-commerce sector. On this basis, it can be concluded that live-streamed sales are fundamentally driven by emotional value, employing multiple methods to create immersive experiences that prompt rapid user decision-making. Furthermore, emotional value influences both consumers' immediate and future purchasing behaviour. This provides a theoretical foundation for relevant e-commerce models and indicates that corporate marketing must balance rational information with emotional experiences. This approach assists brands in building consumer loyalty and securing a differentiated competitive advantage.

View pdf

View pdf

In April 2020, Yuan You Bao, a retail financial derivative product launched by Bank of China, encountered unprecedented losses when the NYMEX WTI May futures contracts settled its price at -$37.63 per barrel. This incident reflects the cruel reality about China’s retail finance ecosystem by revealing the structural weakness in product design, disclosure, and risk controls. This paper aims to apply a qualitative method, combining regulatory documents, media reports, and comparative international frameworks on investor protection and product governance, to analyze. Problems addressed in this research are purposed to conclude why a commodity derivative reached mass-market shares, and how institutional risk management malfunctioned, as well as what measures of reforms are worth considering to align retail-facing derivative products with long-term stability. Methods applied include timeline reconstruction, stakeholder analysis, and comparison to EU MiFID II product-governance and PRIIPs disclosure regimes and U.S. Title VII (Dodd-Frank) conduct standards. The research finds there is a mismatch between product structures and investor capacity, insufficient margining and position-limit safeguards, delayed rollover safety protocols, and limited updated risk communication. From the macro-perspective, this incident indicates that the financial market in China requires further regulatory methods, including robust product-approval committees, negative-price logistics, suitability gating, and pre-contractual information disclosures. The paper draws a conclusion that the financial crisis should catalyze governance and regulation upgrades across Chinese banks and accelerate rule-making that balances financial innovation for protecting investors’ stakes.

View pdf

View pdf