Volume 243

Published on November 2025Volume title: Proceedings of CONF-BPS 2026 Symposium: Innovation, Finance, and Governance for Sustainable Global Growth

In recent years, competition in mainstream business sectors such as transportation, accommodation, and office work in China's sharing economy has continued to intensify. The markets in first- and second-tier cities have gradually reached saturation, and enterprises' profit margins have been continuously compressed. Seeking new growth engines has become the core demand for industry development. At the same time, the lower-tier market centered around counties, towns, and rural areas, covering approximately 200 prefecture-level cities, 3,000 county-level cities, and 40,000 towns, accounts for about 70% of the country's population (approximately 1 billion people). Its consumption capacity is steadily increasing and its consumption concepts are highly consistent with the core logic of sharing economy. The lower-tier market not only provides a broad demand space for sharing economy but also, with its low-cost operation advantages and policy support benefits, becomes a key battleground for promoting the continuous growth of sharing economy. Based on the unique attributes of the lower-tier market, this article systematically analyzes the development potential and practical challenges of sharing economy in this market, and then proposes targeted development strategies to provide theoretical and practical support for the high-quality development of the industry.

View pdf

View pdf

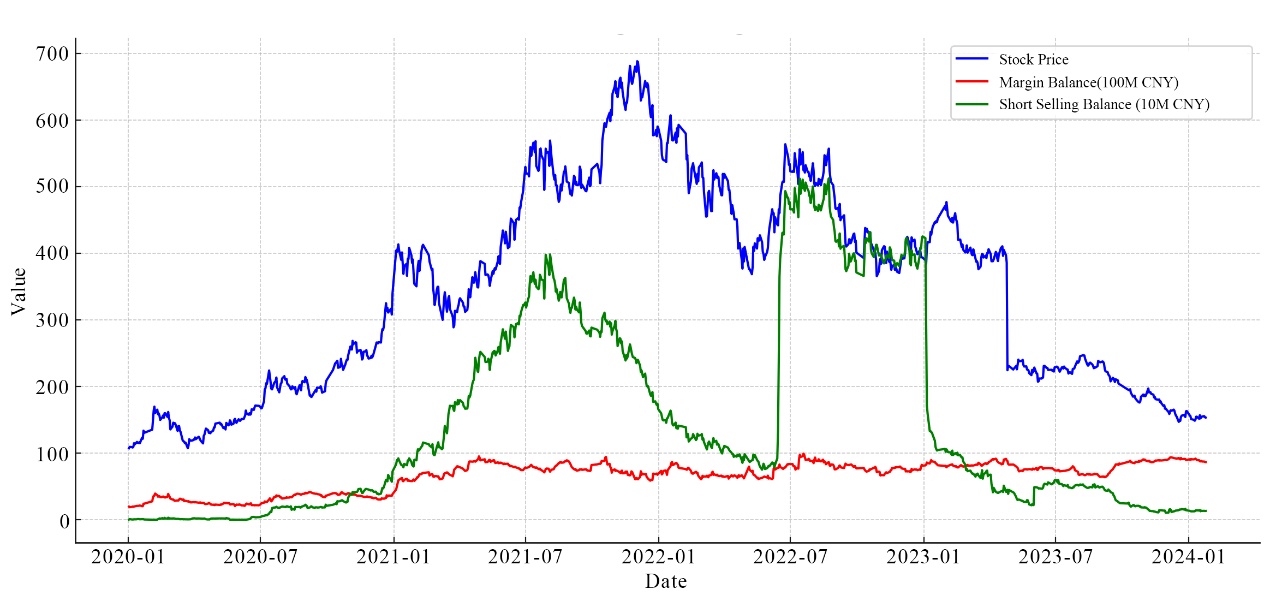

Disposal effect is one of the classic behavioural biases in behavioural finance. The research system on this phenomenon is already quite complete, but few articles focus on the impact of investors' own experiences and the overall market environment on the disposal effect. This paper will fill this gap and take the stock of Contemporary Amperex Technology Co., Limited (CATL) as a case study. CATL is divided into three major stages: 2020-2021, the period of soaring stock price; 2021-2022, the period of stock price fluctuation; 2022-2024, the period of continuous decline in stock price. Three research methods are adopted respectively to collect the emotional feedback of investors in the stock forum, analyse the stock trading data, and infer the intensity of the disposal effect of investors in different periods by calculating the difference between realized profit ratio (PGR) and realized loss ratio (PLR) and the change of margin trading balance with the stock price. It also supplements the explanation of the impact of investment experience and market environment on the disposal effect, and studies the underlying mechanism. Finally, it is found that there is a non-linear correlation between the two, and the mechanism of the disposal effect mainly lies in the overconfidence and risk aversion in investors' psychology.

View pdf

View pdf