1. Introduction

Investor behavior in financial markets is not entirely rational and is prone to interference, leading to wrong decisions. One common phenomenon is the disposition effect: selling profitable assets too early and holding onto losing assets for too long [1]. At the same time, a strong disposition effect can affect an investor's wealth accumulation. Investors with a strong disposition effect suffer greater losses when they trade more frequently, while those with a weak disposition effect make more profits when they trade more [2].

Research on the influencing factors of the disposition effect has made significant progress, and many studies have been conducted and conclusions drawn. One study analyzed the trading records of over 70,000 individual investors to examine the relative importance of the disposition effect and many related factors, such as gender, age, and investment experience etc [3]. Many other studies have focused on a single influencing factor, some of which are social factors: for instance, coronavirus disease 2019 (COVID-19) may weaken the intensity of the disposition effect , others are the impact of transaction types: transactions in local currencies may enhance the manifestation of the disposition effect [4,5].

Research on the influence of investors' own characteristics is also relatively complete. Studies have shown that an investor's background can lead to differences in the manifestation of the disposition effect. Business managers, compared to ordinary investors, have access to more high-quality information, which can weaken the disposition effect to a certain extent [6]. Some literature has also confirmed that personal experience affects an investor's risk-taking, and the degree of risk preference is related to the disposition effect, indirectly indicating that personal experience is associated with the disposition effect [7]. At the same time, there are also studies that take Chinese investors as an example to demonstrate the correlation between the timing of entering the market and the disposition effect of individual investors, suggesting that individual investors who enter the market during periods of market volatility will exhibit a stronger disposition effect [8].

Moreover, due to differences in national conditions and policies, the manifestation and impact of the disposition effect in each country can be quite different. One article analyzed the trading data of a certain securities company in China and proposed the view that "investor sentiment is negatively correlated with the disposition effect." Another study mainly focused on the Chinese Growth Enterprise Market (GEM), demonstrating that the disposition effect still exists in the riskier GEM market and is related to stock returns and market capitalization [9,10]. In summary, the research system on the disposition effect is already quite complete and continues to make new progress, but most of the major studies focus on large-scale markets and rarely start from a single stock market, neglecting individual differences. This paper will take this gap as its main focus and use the leading enterprise in China's GEM, "Contemporary Amperex Technology Co., Limited (CATL)," as a case to analyze the impact of investment experience and market environment on the disposition effect.

This paper takes the investors of CATL's stock as the sample. The stock is divided into three stages: the first stage, the rapid rise period; the second stage, the wide fluctuation period; and the third stage, the long-term decline period. Three research methods are adopted: collecting the emotional feedback of investors in the CATL stock forum during different stock stages to analyze the impact of the market environment on investors' investment sentiment; collecting block trading data to calculate the difference between the proportion of realized gains (PGR) and the proportion of realized losses (PLR), as well as the performance of average return and average loss rate, to directly reflect the intensity of the disposition effect; and analyzing the changes in the balance of margin trading and short selling accounts and establishing correlation tests and regression analyses with stock price changes to verify whether there is a positive or negative correlation between them. The conclusion is that both investment experience and market environment can affect the manifestation of the disposition effect, and the underlying mechanism mainly lies in investors' overconfidence and regret aversion. It warns investors to recognize the existence of the disposition effect and formulate reasonable plans and be vigilant against investment traps.

2. Data and methodology

The stock of CATL can be roughly divided into three major cycles: from 2020 to 2021, the "faith" stage, during which the stock price soared. Three analytical methods are adopted. First, the relationship between the balance of margin trading and short selling and the changes in stock prices is analysed, and a correlation test is conducted. Second, the data of block trades is analysed, and the difference between PGR and PLR is calculated to visually represent the intensity of the disposition effect. Third, the sentiment feedback in the stock forum at different times is mainly crawled to analyse the impact of the market environment on the sentiment of investors.

2.1. Stock market cycles and emotional feedback

From the beginning of 2020 to the end of 2021, the stock price soared rapidly, rising from approximately 38 yuan per share to 306.94 yuan, with an increase of about 706%. The main reason was the explosion of the global new energy market. CATL is a leading battery power company, and the rapid growth of the company's revenue and net profit provided fundamental support for the stock price increase. And at that time, investors were highly optimistic about the future development of new energy vehicles and placed a higher valuation on leading companies.

From the beginning of 2022 to the end of 2022, the stock price entered a high-level, wide-range fluctuation, with the price fluctuating between 200 and 300 yuan throughout the year, closing at 205.68 yuan at the end of the year. At that time, due to fluctuations in raw material prices and supply chain disruptions, the company's profitability declined, and international factors such as trade friction increased market uncertainty.

From the end of 2022 to the end of 2023, the stock price continued to decline. The stock closed at 155.46 yuan at the end of 2023, with a year-end decline of 24.41%. Mainly because the trend of "automakers self-developing batteries" led to the original business model of CATL being challenged, and the market competition intensified, with BYD, Sin ovation Energy and Hexagon Energy, etc., seizing market share.

By collecting the stockholders' sentiment feedback from the stock discussion boards of CATL on both East money and Sina Finance, it was found that the sentiment of stockholders was completely different in the three stages of the stock price performance.

In the first stage, the stock price rose rapidly, and the sentiment of stockholders was generally optimistic and high. "Leading stock in the sector" and "Trillion-dollar CATL" were among the numerous slogan-like comments. Investors firmly believed that CATL, as the leading battery power company, would bring continuous excess returns. At the same time, the company's positive information was extremely sensitive. For example, the release of sodium-ion batteries and other positive information could further push the stock price up. In this context of a highly prosperous industry, there was a risk of short-term overvaluation, and investors tended to overlook the short-term valuation risks.

In 2022, the stock price of CATL fluctuated widely at a high level. Investors' sentiment changed from unanimous optimism to anxiety and indecision. As the stock price fell from its peak, early investors had a strong desire to sell and make profits, while new investors entering the market were afraid of taking a loss at a high price. Discussions about "Can we still buy?" and "Is it the peak?" increased in the stock discussion boards. At the same time, external bearish voices also undermined investors' confidence. Morgan Stanley downgraded its rating, and the chief economist of Securities publicly issued a bearish report, leading to greater market volatility.

In the third stage, from the end of 2022 to the end of 2023, the stock price continued to decline. Complaints such as "Scam" and "Receiving Shares" often appeared in the stock discussion boards. Many automakers began to develop their own batteries, and CATL's original business model faced challenges. The continuous decline and fundamental concerns led to the collapse of some investors' confidence and their choice to leave. Discussions about "Deeply trapped" and "No hope of recovering the investment" increased in stock discussion boards, and pessimism spread.

2.2. Margin and short selling balance

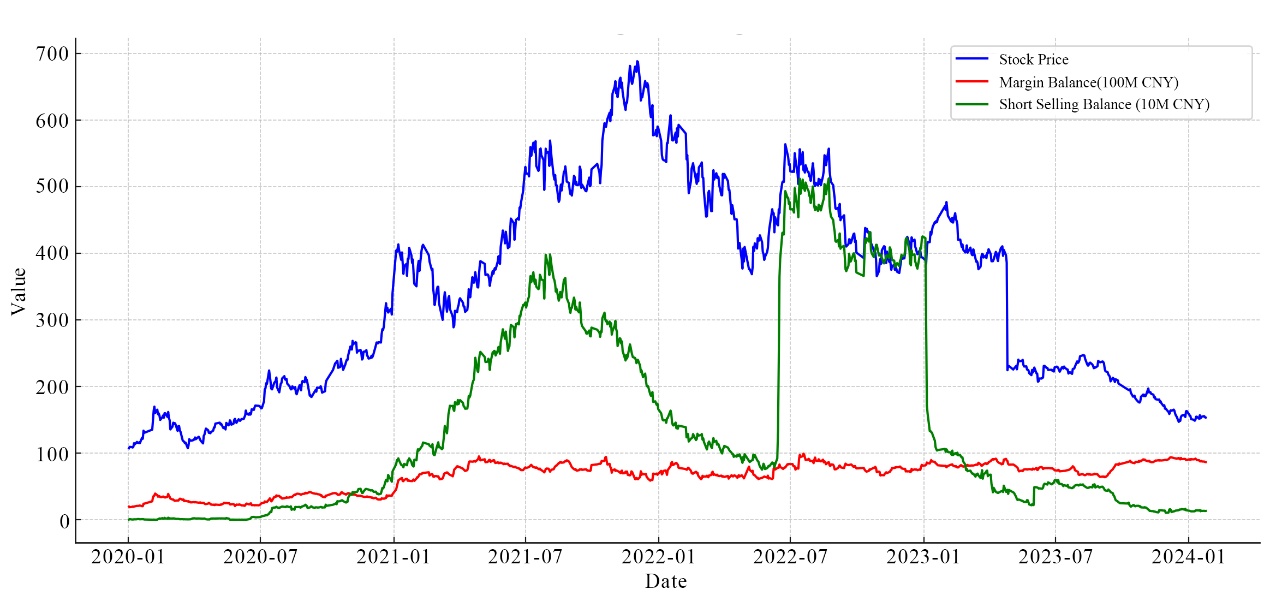

The performance of the disposition effect was analysed by collecting 984 sets of margin trading and short selling data with a five-day data interval from January 2, 2020, to January 24, 2024. In margin trading, the disposition effect is manifested as investors repaying margin loans in advance when stock prices rise and possibly continuing to increase their positions when prices fall, resulting in a non-decreasing margin balance. If there is a negative correlation between stock prices and margin balances, it indicates a strong disposition effect. In short selling, the disposition effect is shown as investors closing their short positions in advance to realize profits when stock prices fall and maintaining their short positions when prices rise, keeping the short selling balance at a high level. If there is a positive correlation between stock prices and short selling balances, it indicates a strong disposition effect.

|

Correlation |

Closing Price |

Margin Balance |

Short-selling Balance |

|

Closing Price |

1.0000 |

0.5099 |

0.7252 |

|

Margin Balance |

0.5099 |

1.0000 |

0.4994 |

|

Short-selling Balance |

0.7252 |

0.4994 |

1.0000 |

According to Figure 1, between January 2021 and August 2021, the positive correlation between the two was relatively strong. During this period, as stock prices rose, the short-selling balance also showed an increasing trend, reflecting a strong disposition effect among investors during this time. Subsequently, at the end of 2021, stock prices declined, and the short-selling balance decreased accordingly, indicating a strong disposition effect among investors. Around July 2022, the short-selling balance experienced a sharp increase, and in the following period, the trends of stock prices and the short-selling balance almost aligned until January 2023, when the short selling balance saw a precipitous drop as shown in table 1.

2.3. Block trade

At the same time, data on 441 large transactions (with the minimum transaction amount being 10,000) from the beginning of 2020 to the end of 2024 (a total of four years) were collected from East Finance Network.

By calculating the discount rate of each transaction. As the formula shown below:

discount rate = (closing price on the day - large transaction price) / closing price on the day(1)

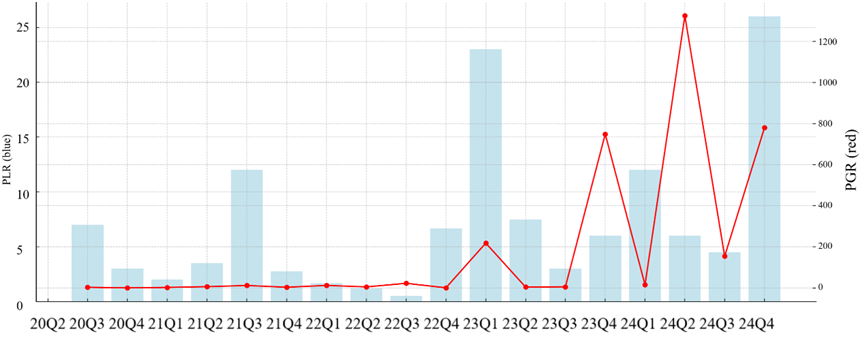

And based on this, the average discount rate for each quarter of the four years and the corresponding average yield rate (average discount rate for profitable transactions) and average loss rate (average premium rate for loss-making transactions) were calculated. Finally, the values of profit realization ratio (PGR) and loss realization ratio (PLR) and the difference between them were analysed. Finally, the values of profit realization ratio (PGR) and loss realization ratio (PLR) and the difference between them were analysed.

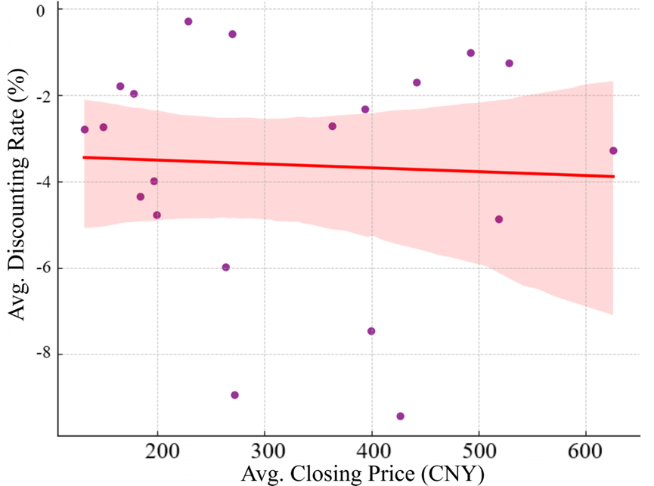

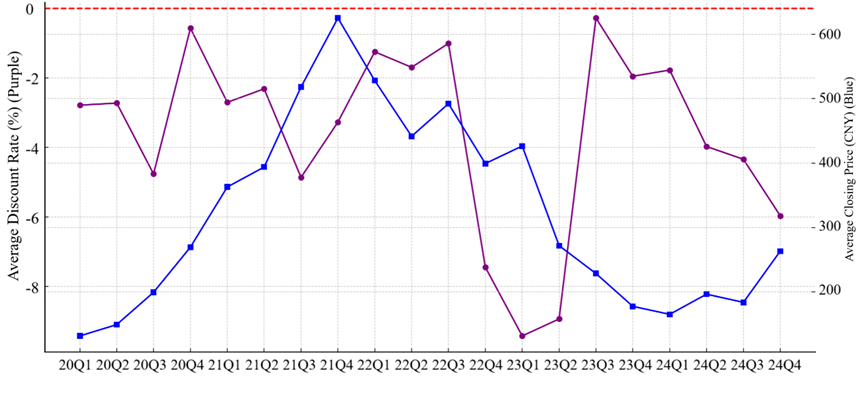

Based on the number of transactions, in 2020, the profit share was approximately 31%, the loss was about 5%, and the parity was about 64%, with an average discount rate of -2.64%; in 2021, the profit share was approximately 38%, the loss was 11%, and the parity was about 51%, with an average discount rate of -3.30%; in 2022, the discount transaction rate was the highest, with a profit of about 45%, a loss of 22%, and a parity of 33%, with an average discount rate of -3.32%; in 2023, the profit was approximately 48%, the loss was 5%, and the parity was 46%, with an average discount rate of -5.75%; in 2024, the profit was 46%, the loss was 4%, and the parity was 50%, with an average discount rate of -3.93%. Excluding 2022, the proportion of loss transactions was very small, approximately 4-11%, and the bulk of transactions were almost all discounted transactions, and the market generally preferred discounted transactions. From 2022 to 2024, the profit share significantly increased, while the parity transaction share continuously decreased. At the same time, the scatter plot figure 2 showed that there was no correlation between the average closing price and the average discount rate for each quarter of these four years, with a correlation of about 0.05.

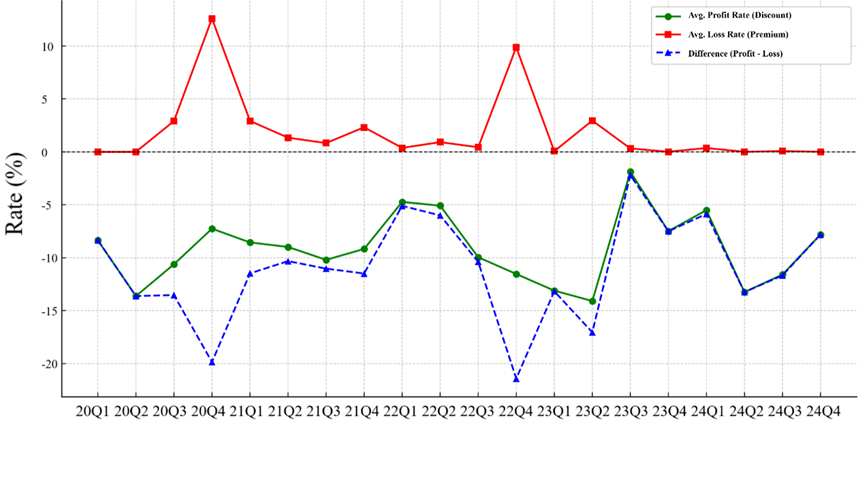

From the first quarter of 2020 to the fourth quarter of 2024, the average return rate consistently remained in a significantly negative range, while the average loss rate has fluctuated around 0%. The difference (average return rate - average loss rate) has always been negative, as the Figure 3 and Figure 4 shown.

In the analysis of bulk trading data, the loss ratio (PLR) is calculated as the number of profitable transactions divided by the number of losing transactions, and the profit ratio is calculated as the average discount rate (in absolute terms) of profitable transactions divided by the average premium rate of losing transactions. The difference is PGR - PLR. If this difference is greater than 0, it indicates the existence of the disposal effect. The larger the positive value, the stronger the disposal effect; conversely, it is weaker.

The entire sample from 2020 to 2024 shows a difference of nearly 0, "0.04". The overall PLR is 4.52, and PGR is 4.56. Overall, the number and magnitude of profitable transactions far exceed those of losing transactions. However, according to Figure 5, in some quarters, such as 2023Q4, 2024Q2, and 2024Q4, extremely high PGR occurred, with a few losing transactions having extremely high premium rates, causing the average to increase. Therefore, in this case, the data for 2024 is ignored, and only the data for the 12 quarters from 2020 to 2023 is analysed.

3. Conclusion

Overall, the disposal effect of investors was most significant from 2021 to 2023. It can be concluded that investors who experienced a rapid rise in stock prices exhibited a stronger disposal effect. The main reason behind this is related to investors' overconfidence and regret aversion.

Investors tend to attribute it to their own stock selection ability or investment decisions rather than the market trend. They are more willing to sell the currently rising stocks to lock in profits and look for the next opportunity. Investors are afraid of regret and worry about losing profits if they do not sell in time, thus they tend to sell early to avoid possible regret in the future. They prefer to sell profitable stocks to obtain certain benefits, get immediate happiness and a sense of achievement, and remember this positive feedback, thereby reinforcing the behaviour pattern of selling early for profit.

At the same time, the fluctuating market environment amplifies the fluctuations in investors' emotions, strengthening the disposal effect. The main reason is the "anchoring effect" and investors' regret aversion. After experiencing the ups and downs in stock price changes, investors hesitate over whether to sell their stocks to reduce the risk of loss. After seeing the short-term rise and fall of stock prices, they regret not selling earlier and gain profits, which reinforces the investors' impulse to obtain certain benefits. At the same time, due to the rapid and continuous fluctuations in stock prices, investors' reference points become confused. At this time, the "anchoring effect" is significant, and investors tend to overly rely on the initial information received as the judgment benchmark, easily making incorrect judgments, which leads to frequent, irrational selling behaviors and a long-term holding of losing positions.

Generally, investors who have experienced a rapidly rising bull market and those operating in a volatile market environment tend to exhibit a stronger disposition effect. Investors should be aware of the existence of this effect and consciously formulate plans to overcome or alleviate it. They should set stop-loss or take-profit limits in advance, reasonably plan their funds, reduce excessive attention to stock price changes, focus on intrinsic value and prospects, conduct timely review and analysis, record their transactions and the emotions at that time, and reflect on whether they are making rational judgments or being driven by emotions. In the face of a changing market environment, investors should learn from past experiences, continuously study, assess risk levels, prevent investment traps, and ensure rational investment decisions.

References

[1]. Fan, Z. & Neupane, S. (2024) Investor Horizon, Experience, and the Disposition Effect. Journal of Behavioral and Experimental Finance, 44, 101-103.

[2]. Cheng, T.Y., Lee, C.I. & Lin, C.H. (2024) Dissecting the Links among Profitability, the Disposition Effect, and Trading Activity. Pacific-Basin Finance Journal, 83, 102-197.

[3]. Ahn, Y. (2022) The Anatomy of the Disposition Effect: Which Factors Are Most Important? Finance Research Letters, 44, 102-104.

[4]. Jin, X.J., Li, H.Z., Yu, B. & Zheng, Y.J. (2023) How Does the COVID-19 Pandemic Change the Disposition Effect in Fund Investors? Pacific-Basin Finance Journal, 81, 102119.

[5]. Han, G.M. & Preda, A. (2025) Does Home Bias Amplify the Disposition Effect? Evidence from Retail Forex Trading. Finance Research Letters, 108-126.

[6]. Wang, K.M., Zhang, G.L. & Zhou, L. (2023) Managerial Disposition Effect: Evidence from China. Pacific-Basin Finance Journal, 78, 101-109.

[7]. Heinke, S., Olschewski, S. & Rieskamp, J. (2024) Experiences, Demand for Risky Investments, and Implications for Price Dynamics. Journal of Behavioral and Experimental Finance, 43, 100-109.

[8]. Zhang, X.T., Wang, Z.Q., Hao, J. & Liu, J.B. (2022) Stock Market Entry Timing and Retail Investors' Disposition Effect. International Review of Financial Analysis, 82, 102-205.

[9]. Wu, J.W., Wang, C.Y., Chen, Z.L. et al. (2020) Disposition Effect of Chinese Individual Investors: A Perspective of Irrational Belief. Journal of Financial Research, 2, 147-166.

[10]. Zhao, W.Q. (2020) Research on the Disposition Effect of Investors in China's Growth Enterprise Market. Economic Research Guide, 10, 73-80.

Cite this article

Cheng,J. (2025). The Impact of Investment Experience and Market Environment on Disposition Effect: A Case Study of CATL. Advances in Economics, Management and Political Sciences,243,9-16.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-BPS 2026 Symposium: Innovation, Finance, and Governance for Sustainable Global Growth

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fan, Z. & Neupane, S. (2024) Investor Horizon, Experience, and the Disposition Effect. Journal of Behavioral and Experimental Finance, 44, 101-103.

[2]. Cheng, T.Y., Lee, C.I. & Lin, C.H. (2024) Dissecting the Links among Profitability, the Disposition Effect, and Trading Activity. Pacific-Basin Finance Journal, 83, 102-197.

[3]. Ahn, Y. (2022) The Anatomy of the Disposition Effect: Which Factors Are Most Important? Finance Research Letters, 44, 102-104.

[4]. Jin, X.J., Li, H.Z., Yu, B. & Zheng, Y.J. (2023) How Does the COVID-19 Pandemic Change the Disposition Effect in Fund Investors? Pacific-Basin Finance Journal, 81, 102119.

[5]. Han, G.M. & Preda, A. (2025) Does Home Bias Amplify the Disposition Effect? Evidence from Retail Forex Trading. Finance Research Letters, 108-126.

[6]. Wang, K.M., Zhang, G.L. & Zhou, L. (2023) Managerial Disposition Effect: Evidence from China. Pacific-Basin Finance Journal, 78, 101-109.

[7]. Heinke, S., Olschewski, S. & Rieskamp, J. (2024) Experiences, Demand for Risky Investments, and Implications for Price Dynamics. Journal of Behavioral and Experimental Finance, 43, 100-109.

[8]. Zhang, X.T., Wang, Z.Q., Hao, J. & Liu, J.B. (2022) Stock Market Entry Timing and Retail Investors' Disposition Effect. International Review of Financial Analysis, 82, 102-205.

[9]. Wu, J.W., Wang, C.Y., Chen, Z.L. et al. (2020) Disposition Effect of Chinese Individual Investors: A Perspective of Irrational Belief. Journal of Financial Research, 2, 147-166.

[10]. Zhao, W.Q. (2020) Research on the Disposition Effect of Investors in China's Growth Enterprise Market. Economic Research Guide, 10, 73-80.