1. Introduction

With the fast-changing financial markets, businesses face various risks, such as liquidity, legal, and operational risks. According to The Treasury (2012), a financial company that calculates the amount of risks it can take and controls these risks is limited, indicating that it is a well-managed firm. Furthermore, the business will benefit from these risks [1]. Thus, managing these risks is vital for enterprises, as it can help them survive and develop in intense competition. In addition, understanding the relationship between risk and return and balancing them according to risk preference is crucial for enterprise risk management. The Capital Asset Pricing Model (CAPM), as a fundamental tool in finance, provides a guide for assessing an investment's expected return in relation to its risk. In addition, according to Wikipedia Contributors (2019), CAPM is used to determine the theoretical return rate of an asset so as to help investors decide whether to include the asset in a diversified portfolio [2]. Moreover, CAPM believes that there is a positive relationship between the expected return of an asset and its systemic risk, which is measured by the beta coefficient. The model helps solve the problem of asset valuation and assists firms in making more beneficial investment choices.

In past studies, many scholars conducted in-depth studies and experiments on CAMP, including analysis of its formula by combing images and verifying its effectiveness with many data. For example, Sharpe (1964) and Lintner (1965) laid the groundwork for CAPM, demonstrating its effectiveness in predicting stock returns. Subsequently, researchers analyzed and expanded CAPM in many aspects, including exploring some abnormal phenomena and trying to improve and supplement the model. Meanwhile, some researchers compared it with other asset pricing models and summarized some rules and differences. For example, the Fama–French three-factor model (Wikipedia Contributors, 2019) proposes a statistical model modified based on the traditional asset pricing model, CAPM, that attempts to explain complex phenomena with three potential factors. Despite these developments, there is still some controversy [3].

However, a significant knowledge gap exists in applying CAPM to corporate investment decisions. On account of more research has been focused on the theoretical knowledge of models and their impact on investors rather than delving into how firms can effectively use CAPM to enhance their risk management framework and make better investments. Especially when a business is in a complex risk environment, insufficient attention has been paid to how CAMP can be used in daily risk assessment and decision-making processes. This omission is particularly important for the steady development of enterprises.

This paper aims to explore the practical application of CAPM in enterprise risk management to fill this knowledge gap. First, the basic knowledge of CAPM and its relationship with risk assessment will be introduced. According to Prisitwantiyasih and Setyawan (2020), CAPM can determine asset risk indicators as a commonly used equilibrium model. At the same time, it is crucial to understand the risk relationship and expected return of assets under equilibrium market conditions [4]. Furthermore, this study will show how industries have applied the model to improve their risk management strategies by analyzing some cases and research, which will help people better understand the usefulness of CAPM. Eventually, the shortcomings of CAPM will be mentioned, particularly its theoretical assumptions, which are too idealistic to align with real-world situations and limit its applicability. In addition, this study will provide some approaches for combining CAPM with other risk management tools, improving the ability of businesses to balance risk and return. Through this roadmap, this study will provide businesses with valuable insights to help them more effectively use CAPM as a foundational tool to address risk so that they improve financial performance and competitiveness.

2. Theoretical knowledge of CAPM

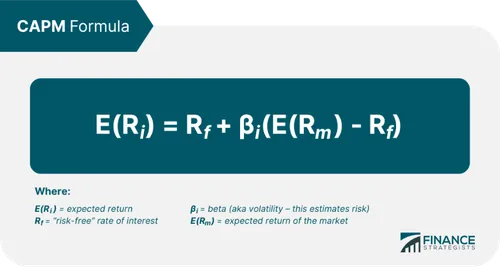

First, Kenton (2024) stated that the CAPM is a financial model that describes the linear relationship between the expected return on investment and the risk. In addition, it was developed as a way to measure systemic risk. Therefore, it is widely used in finance to price risky securities and generate expected returns on assets by considering their cost of capital and risk [5]. Meanwhile, its formula is expressed as the expected return of the investment is equal to the risk-free interest rate plus the beta coefficient times the market risk premium, where the risk premium is the market risk minus the risk-free interest rate. It is shown in Figure 1 below.

Figure 1: CAPM-Formula

https://cdn.swisscows.com/image?url=https%3A%2F%2Fwww.financestrategists.com%2Fuploads%2Ffeatured%2FCAPM-Formula.png

This study will take a closer look at each part of the formula. According to Wall Street Prep (2022), in theory, the risk-free rate is expressed as a government bond's yield to maturity (YTM) with no default risk at the same maturity as each cash flow discounted to today. In fact, the current yield of U.S. Treasury bonds has become the standard proxy for the risk-free rate assumption [6]. Second, in corporate finance, beta measures non-diversifiable risk, known as systemic risk, also named market risk. In contrast to non-systemic risk, it is inherent to the stock market as a whole rather than specific to one company or industry. Therefore, it cannot be mitigated by portfolio diversification. Where the systemic risk of the market is 1, investors often use the value of the beta coefficient to roughly estimate the expected return of an investment relative to the market.

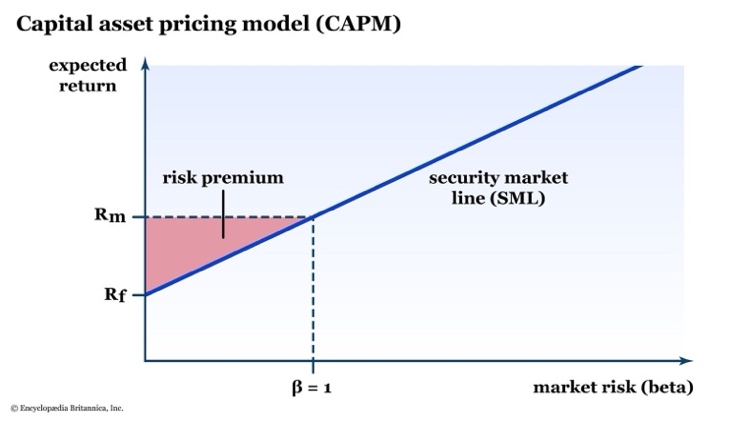

Moreover, the third input is the market risk premium, which refers to the additional compensation investors bear because of the additional risk associated with investing in risky assets such as stocks. In addition, combined with Figure 2, the formula can be understood more vividly and deeply.

Figure 2: A chart showing the capital asset pricing model (CAPM).

https://cdn.britannica.com/28/252328-050-C65E7F72/capital-asset-pricing-model.jpg

As can be seen from the graph, the expected returns have a linear relationship with market risk, where the slope is the market risk premium, and the intercept is the risk-free interest rate.

3. Corporate risk management

Hayes (2020) mentioned that enterprise risk management (ERM) is a top-down management strategy to recognize, evaluate, and address potential risks and losses from the perspective of the entire enterprise or organization that can hinder the operation of the organization and the achievement of its objectives [7]. In implementing enterprise risk management, adjusting according to the company's size, risk appetite, and corporate objectives is necessary. For example, Marker (2021) mentioned that ERM can be used in a variety of industries, starting with the financial sector, where TD Bank organizes risk management around the two main areas of risk management framework and risk appetite statement, and Zurich Insurance Group's enterprise risk management framework focuses on protecting capital, liquidity, income, and reputation. Moreover, for the non-financial sector, ERM experts in pharmaceutical companies primarily emphasize ensuring that strategic objectives do not conflict, thereby avoiding risks surrounding threats to product quality and safety, regulatory actions, and consumer trust. In addition, consumer packaged goods companies such as Mars Inc., an international confectionery and food company, have also implemented ERM processes through workshop programs with geographic, product, and functional teams. At the same time, ERM is used in some agribusiness and technology companies [8]. Regarding risk response, companies usually have four ways: First, by avoiding risks, companies can leave risky activities directly even though it will bring some benefits. Second, by reducing risk, the company strives to minimize risks by reducing exposure, frequency, and severity to ensure maximum profit. Third, by sharing risks, the company can find an independent third party to bear the risk together, such as using derivative products, structured products, or paying a premium. Finally, by accepting risks, the company does not make any changes and operations on risk issues, while retaining the risk within the firm’s risk appetite. In addition, the risks most commonly dealt with by ERM are strategic, operational, and financial risks. Financial risks affect the overall financial condition and health of the company. For instance, Verma (2022) stated that Due to macroeconomic forces, fluctuating market interest rates, and defaults of large organizations or sectors, businesses may face financial risks that are uncontrollable or challenging to overcome. Thus, it may affect the decision of the company's ability to repay debts or income, lead to capital losses, and even spread to different markets or industries. However, it can be identified through several analytical tools and help assess the risk-reward ratio [9]. Furthermore, operational risks impact a company's daily operations, whereas strategic risks affect long-term planning. In light of these considerations, ERM enables organizations to more effectively manage risk and uncertainty, enhance operational efficiency across the enterprise, and ultimately result in improved customer service.

4. Application of CAPM

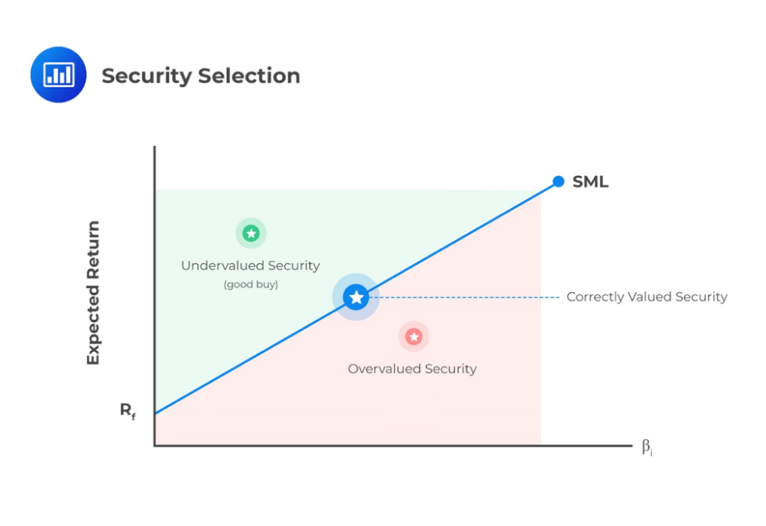

According to Analyst Prep (2019), the securities market line (SML) of the asset pricing model can help investors make securities selections [10]. According to Figure 3, when the asset appears above SML, the expected rate of return is overvalued, and the price is undervalued, the investor should long the asset; when the asset appears below SML, the expected rate of return is undervalued, and the price is overvalued, the asset should be short; when it is just on SML, the securities should be appropriately priced.

Figure 3: Security Selection.

https://analystprep.com/cfa-level-1-exam/wp-content/uploads/2019/09/Security-Selection-Given-CAPM1.png

In addition, CAPM can be used in portfolio construction. Model (2024) stated that when investors' risk appetite and budget constraints are given, they can use CAPM to select the optimal portfolio that maximizes utility [11]. In addition, Gavlaková and Gregová (2013) mentioned that portfolio selection focuses on finding the best allocation of wealth in a variety of assets, among which the Markowitz model gives investors an idea: combining negatively correlated or uncorrelated assets can minimize the risk of the overall portfolio. Therefore, investing in a specific combination of risky and risk-free assets is the main result of portfolio theory [12]. This mix consists of risk-free assets and market portfolios, the proportion of which depends on investors' risk aversion. For example, the more risk-averse investors are, the more they will invest in risk-free assets and the more they will invest in market portfolios. In addition, investors can apply CAPM to the asset valuation. Investors can use CAPM to estimate the fair value of an asset based on its expected cash flow and beta value. The fair value of an asset is the present value of its future cash flows, which can be calculated by discounting cash flows from future to today at the rate of return. The appropriate rate of return is the expected return required by an investor to invest in an asset given the given risk. According to the formula of CAPM, the expected rate of return can be calculated, and compared with the actual situation, which can determine whether it is overvalued or undervalued so as to make investment decisions.

5. Limitations and future research directions

The CAPM have some limitations. According to Financial Data and Calculation Factory (2017), CAPM only focuses on systemic risks, not risks specific to a company or industry. In addition, another limitation is its ability to measure expected market returns accurately. Market returns are usually predicted by assuming the market risk premium aligns with the long-term average. However, there are deviations in the reality [13]. Moreover, the assumption of CAPM limits the use of CAPM in practice. First, CAPM assumes that investors are risk-averse, utility-maximizing, and rational. In addition, they are price takers, have homogeneous expectations, and have a single holding period, lending and borrowing at a common risk-free rate. For markets, there is no friction, and information is costless. At the same time, all investments are infinitely divisible, and all assets are tradable. Analyst Prep (2019) mentioned that in reality, investors are unlikely to have the same expectations, which will result in different kinds of optimal risk portfolios and many security market lines. Additionally, it is improbable that financial markets are entirely efficient, and portfolios often encompass both financial and non-financial assets, which may not be investable or tradable [10]. Moreover, the CAPM may potentially result in inaccurate investment forecasting due to its sole emphasis on systemic risk, as the return on an asset is influenced by a multitude of factors beyond this single variable. Therefore, in future studies, researchers will expand CAPM into a multi-factor model based on facts to cover better factors that affect expected returns. The Fama-French three-factor model is an excellent example, which is more widely used in practice. Tao (2022) stated that FF3F is more accurate than CAPM in calculating expected return and Sharpe ratio because it takes into account not only the market risk premium but also loadings on SMB and HTML. In other words, factors, size, and value should be considered, meaning that size and value risk premiums are also crucial for expected return. Therefore, the FF3F model has a better guiding effect on investment [14]. At the same time, as financial markets become increasingly complex and influenced by various global factors, combining behavioral finance with investment analysis is a fruitful direction to explore how investors' psychology affects risk assessment and asset pricing. For instance, Zhang, Nazir, Farooqi, and Ishfaq (2022) mentioned that anchoring and optimism bias are two main factors that affect cognitive bias in investment decision-making. Anchoring bias means that when people have some prior information, they tend to overestimate the connection between that information and the expected outcome, and optimism bias means that people tend to overestimate their ability to influence the outcome. In addition, risk perception plays an intermediary role in investment decision cognitive bias, which means that if investors have strong confidence in their coping ability when making investment decisions, cognitive bias will positively impact decision-making [15]. However, it will lead investors to ignore significant investing risks because of blind confidence. Thus, an investor with strong beliefs who can effectively deal with emotions when facing decisions is likely to make more rational and successful investments in the investment industry. Moreover, researchers will pay more attention to the applicability of CAPM models in different environments and improve the models through continuous testing and comparison. At the same time, with the development of network technology, researchers will use big data and machine learning technology to carry out more in-depth analyses and predict future trends.

6. Discussion and Conclusion

To conclude, the current research was designed to examine the effectiveness of the CAPM in corporate risk management. Significant views on how companies use the CAPM model to balance expected returns and risks based on investors' risk appetite have been identified. The research suggests that the application of CAPM is limited by the investment strategies of companies and the current economic environment, even though it provides a clear framework for evaluating the expected return of the asset relative to the risks. Several reasons may help interpret these findings, such as the complexity of the financial markets and the idealization of the model assumptions. In fact, many firms try to integrate their risk management system with CAPM. However, this approach is too traditional to cope perfectly with today's dynamic market environment, which indicates that companies urgently need to strengthen and improve CAMP to cope effectively with rapidly changing situations. At the same time, some implications could be indicated from the results. Organizations can benefit significantly from customizing one or more complete models based on CAPM principles and their realities. In addition, companies can continuously improve their overall risk assessment capabilities and make more informed investment decisions by educating and training risk managers and financial analysts on how to effectively combine CAPM with other risk management tools or introduce other risk factors into models. Finally, it is critical to acknowledge the limitations of this study. The study of CAPM may ignore other influential models or factors in risk management in the real world. In addition, changes in the industry context may generate different outcomes that were not explored in this study. Nevertheless, understanding the principles and logic is essential because it is a foundational model in the financial field. Future research may focus on studying these models further and keep trying to integrate multiple models and build more thorough frameworks to enhance risk management practices. Having a better understanding of strategic knowledge and the importance of applying CAPM can enable enterprises to manage risks more effectively and improve financial performance.

References

[1]. Managing risk in financial markets | Treasury.gov.au. (2012). Treasury.gov.au. https://treasury.gov.au/speech/managing-risk-in-financial-markets

[2]. Wikipedia Contributors. (2019, February 13). Capital asset pricing model. Wikipedia; Wikimedia Foundation. https://en.wikipedia.org/wiki/Capital_asset_pricing_model

[3]. Wikipedia Contributors. (2019, March 17). Fama–French three-factor model. Wikipedia; Wikimedia Foundation. https://en.wikipedia.org/wiki/Fama%E2%80%93French_three-factor_model

[4]. Pristiwantiyasih, P., & Setyawan, M. A. (2020). THE IMPORTANCE OF INVESTMENT DECISIONS USING CAPITAL ASSET PRICING MODEL (CAPM) IN STOCK SECTOR TELECOMMUNICATION. Media Mahardhika, 18(3), 387. https://doi.org/10.29062/mahardika.v18i3.177

[5]. Kenton, W. (2024, July 1). Capital Asset Pricing Model (CAPM) and Assumptions Explained. Investopedia. https://www.investopedia.com/terms/c/capm.asp

[6]. Wall Street Prep. (2022). CAPM: Capital Asset Pricing Model Formula and Calculation. Wall Street Prep. https://www.wallstreetprep.com/knowledge/capm-capital-asset-pricing-model/

[7]. Hayes, A. (2020, September 17). Enterprise Risk Management. Investopedia. https://www.investopedia.com/terms/e/enterprise-risk-management.asp

[8]. Marker, A. (2021, April 7). Enterprise Risk Management Examples l Smartsheet. Smartsheet. https://www.smartsheet.com/content/enterprise-risk-management-examples

[9]. Verma, E. (2022, February 23). Financial Risk and Its Types. Simplilearn.com; Simplilearn. https://www.simplilearn.com/financial-risk-and-types-rar131-article

[10]. Applications of CAPM - Portfolio Management | CFA Level 1 - AnalystPrep. (2019, September 1). AnalystPrep | CFA Study Notes. https://analystprep.com/cfa-level-1-exam/portfolio-management/applications-of-capm/

[11]. Model, P. (2024). Capital Asset Pricing Model Report: Applying CAPM to Real World Investments - FasterCapital. FasterCapital. https://fastercapital.com/content/Capital-Asset-Pricing-Model-Report--Applying-CAPM-to-Real-World-Investments.html

[12]. Gavlaková, P., & Gregová, E. (2013). CAPM AND OPTIMAL PORTFOLIO. https://msed.vse.cz/files/2013/201-Gavlakova-Petra-paper.pdf

[13]. Using the CAPM Model to Price Risk and Allocate Capital Efficiently. (2017, September 19). Financial Data and Calculation Factory. https://www.quantilia.com/risk-premium-capm/

[14]. Tao, W. (2022). Comparison of CAPM And Fama-French Three-factor Model. BCP Business & Management, 23, 243–248. https://doi.org/10.54691/bcpbm.v23i.1357

[15]. Zhang, M., Nazir, M. S., Farooqi, R., & Ishfaq, M. (2022). Moderating role of information asymmetry between cognitive biases and investment decisions: A Mediating effect of risk perception. Frontiers in psychology, 13, 828956. https://www.frontiersin.org/journals/psychology/articles/10.3389/fpsyg.2022.828956/full

Cite this article

Li,G. (2025). The Application of the Capital Asset Pricing Model in Corporate Risk Management. Advances in Economics, Management and Political Sciences,158,162-168.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-BPS 2025 Workshop: Sustainable Business and Policy Innovations

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Managing risk in financial markets | Treasury.gov.au. (2012). Treasury.gov.au. https://treasury.gov.au/speech/managing-risk-in-financial-markets

[2]. Wikipedia Contributors. (2019, February 13). Capital asset pricing model. Wikipedia; Wikimedia Foundation. https://en.wikipedia.org/wiki/Capital_asset_pricing_model

[3]. Wikipedia Contributors. (2019, March 17). Fama–French three-factor model. Wikipedia; Wikimedia Foundation. https://en.wikipedia.org/wiki/Fama%E2%80%93French_three-factor_model

[4]. Pristiwantiyasih, P., & Setyawan, M. A. (2020). THE IMPORTANCE OF INVESTMENT DECISIONS USING CAPITAL ASSET PRICING MODEL (CAPM) IN STOCK SECTOR TELECOMMUNICATION. Media Mahardhika, 18(3), 387. https://doi.org/10.29062/mahardika.v18i3.177

[5]. Kenton, W. (2024, July 1). Capital Asset Pricing Model (CAPM) and Assumptions Explained. Investopedia. https://www.investopedia.com/terms/c/capm.asp

[6]. Wall Street Prep. (2022). CAPM: Capital Asset Pricing Model Formula and Calculation. Wall Street Prep. https://www.wallstreetprep.com/knowledge/capm-capital-asset-pricing-model/

[7]. Hayes, A. (2020, September 17). Enterprise Risk Management. Investopedia. https://www.investopedia.com/terms/e/enterprise-risk-management.asp

[8]. Marker, A. (2021, April 7). Enterprise Risk Management Examples l Smartsheet. Smartsheet. https://www.smartsheet.com/content/enterprise-risk-management-examples

[9]. Verma, E. (2022, February 23). Financial Risk and Its Types. Simplilearn.com; Simplilearn. https://www.simplilearn.com/financial-risk-and-types-rar131-article

[10]. Applications of CAPM - Portfolio Management | CFA Level 1 - AnalystPrep. (2019, September 1). AnalystPrep | CFA Study Notes. https://analystprep.com/cfa-level-1-exam/portfolio-management/applications-of-capm/

[11]. Model, P. (2024). Capital Asset Pricing Model Report: Applying CAPM to Real World Investments - FasterCapital. FasterCapital. https://fastercapital.com/content/Capital-Asset-Pricing-Model-Report--Applying-CAPM-to-Real-World-Investments.html

[12]. Gavlaková, P., & Gregová, E. (2013). CAPM AND OPTIMAL PORTFOLIO. https://msed.vse.cz/files/2013/201-Gavlakova-Petra-paper.pdf

[13]. Using the CAPM Model to Price Risk and Allocate Capital Efficiently. (2017, September 19). Financial Data and Calculation Factory. https://www.quantilia.com/risk-premium-capm/

[14]. Tao, W. (2022). Comparison of CAPM And Fama-French Three-factor Model. BCP Business & Management, 23, 243–248. https://doi.org/10.54691/bcpbm.v23i.1357

[15]. Zhang, M., Nazir, M. S., Farooqi, R., & Ishfaq, M. (2022). Moderating role of information asymmetry between cognitive biases and investment decisions: A Mediating effect of risk perception. Frontiers in psychology, 13, 828956. https://www.frontiersin.org/journals/psychology/articles/10.3389/fpsyg.2022.828956/full