1. Introduction

The iron and steel industry is a vital component of the national economy's basic raw materials industry, having a significant impact on investment, a strong capacity for creating jobs, and high industrial relevance, making important contributions to China's economic and social development [1]. China was a top player in the world steel producers as early as 1996.With the rapid development of China's iron and steel production, the structural problems of the iron and steel industry have gradually come to the fore, and the industrial concentration is low and the production capacity is unreasonable layout have seriously caused the iron and steel industry to develop in a healthy way. The lack of research and development capability and innovation in steel enterprises also restricts the transformation and upgrade of enterprises and many steel enterprises are in trouble.

China's merger by exchange of shares is relatively late compared with foreign countries [2]. So far, foreign scholars have formed a relatively perfect system on the subject of the use of equity consideration payment in M&A. Luo et al. showed that merger-for-share exchanges can bring about an improvement in firm performance, especially when market uncertainty increases [3]. Wei et al. showed that the use of share swap merger could have a significant impact on the performance of large state-owned enterprises whose parent companies were listed in the reverse share swap merger since 2003 [4]. Fernández et al. argued that share swap mergers positively affect both R&D capacity and profitability of firms [5]. In terms of share swap merger motivation, Tan et al. found that share swap mergers were motivated to achieve success because of the state's advancement in the process and the game of interests between the property rights subjects of SOEs [6]. Fu pointed out that the industry characteristics of the Beijing region were the main driving force for Aluminum Corporation of China's share swap merger with Shandong Aluminum and Lanzhou Aluminum [7]. In terms of internal motivation, Mueller argued that the reason for corporate expansion is to maximize shareholders' equity [8]. According to Majumdar et al., mergers and acquisitions that are driven by internal resource integration and market competitiveness expansion can often have a positive impact [9].

Iron and steel companies before a merger integration was accompanied by a share swap, but there are many cases to merger failure. The domestic iron and steel industry includes two significant central enterprises: Baosteel and Wuhan Iron and Steel, belonging to the rare “strong combination” to form a “giant” type of enterprise.

This paper selects the case of the absorption and the research object for Baosteel's merger is WISCO, with the starting point of Baosteel shares merger of WISCO motivation, the use of case study method, comparative analysis, quantitative analysis and other methods to analyze the merger of Baosteel and WISCO merger event merger program, process and effect, which can be used to the central enterprises to share swap merger by absorption of integration of the theoretical study to play a complementary role, and for the subsequent integration pertaining to the iron and steel industry continues to accumulate valuable experience.

2. Basic Information on Enterprises

2.1. Baoshan Iron & Steel Co.

Baosteel (see Table 1) was established solely by Shanghai Baosteel Group Corporation in February 2017, it was listed on the Shanghai Stock Exchange (stock code: 600019) in December of that year, after completing the merger of WISCO by share swap and absorption, major manufacturing bases owned by Baosteel include Baoshan in Shanghai, Qingshan in Wuhan, Dongshan in Zhanjiang, and Meishan in Nanjing among others. It is the No. 2 steel enterprise in the world in crude steel production.It ranks No. 1 in crude steel production, No. 1 in automobile plate production and No. 1 among the listed steel companies worldwide, it is one of the most comprehensive producers of carbon steel and a leader in silicon steel production [10].

In 1977, founded in 1983 as Shanghai Baoshan Iron and Steel General Factory, the company later changed its name to Baoshan Iron and Steel (Group) Company. In 1998, Baoshan Iron and Steel merged with Shanghai Iron and Steel Meigang to form Shanghai Baosteel Group Company. In 2000, Baoshan Iron and Steel Company Limited was created and listed. In 2016, Baosteel Group and WISCO jointly reorganized to form China Baowu Iron and Steel Group Company Limited. In 2017, Baosteel shares were exchanged to absorb the merger and reorganization of Wuhan Iron and Steel Co.

Table 1: Baosteel Basic Information.

Baoshan Iron & Steel | thrust |

Main Business Segments | Manufacturing, distribution, and processing of iron and steel, as well as chemicals, information technology, finance, and e-commerce |

Main products and services | Automotive plates, electrical steel, tin-plated plates, premium marine and offshore steels, energy and pipeline steels, and other premium thin sheet goods |

Key technologies | Hot and cold processing, hydraulic sensing, electronic control, computer and information communication, iron and steel smelting, etc. |

Main production bases | Shanghai Baoshan, Meigang Company, Zhanjiang Steel |

Source: Baoshan Iron & Steel Company Limited Share Exchange and Merger and Connected Transaction Report

2.2. Wuhan Steel and Iron (Group) Corporation

The first massive iron and steel joint venture established following the establishment of New China is Wuhan Iron and Steel (Group) Company (see Table 2). The firm was placed into service on September 13, 1958, after construction started in 1955. It has contributed significantly to the growth of China's iron and steel sector and national economy during the course of its more than 60 years of existence.

In 1958, Wuhan Iron and Steel Group was finished and put into operation. In 1997, Wuhan Iron and Steel Company Limited was founded, and in 1999, Wuhan Iron and Steel Company Limited went public. In 2016, Baosteel Group and Wuhan Iron and Steel Group jointly reorganized China Baowu Iron and Steel Group Company Limited, and in 2017, Wuhan Iron and Steel.

Table 2: Basic information of Wuhan Iron & Steel.

Wuhan steel and iron | |

Main Business Segments | Manufacture of metallurgical products and by-products, manufacture of iron and steel extension products, technology development of metallurgical products |

Main products and services | Automotive plates, high-performance structural steel, cold-rolled silicon steel sheets, and premium long-term products |

Key technologies | Coking, ironmaking, steelmaking, steel rolling, and related public and auxiliary facilities are all part of the full-stream iron and steel production process. |

Main production bases | Qingshan Base |

Source: Baoshan Iron & Steel Company Limited Share Exchange and Merger and Connected Transaction Report

3. Analysis of the Motivation for the Merger

3.1. Overcapacity, Supply Exceeds Demand

The iron and steel industry has serious overcapacity, and the contradiction of market supply exceeding demand is relatively prominent. Based on the International Iron and Steel Institute's data, China's large steel enterprises accounted for only 34.25% of the domestic market share in 2015.In 2015, China's iron and steel industry produced 804 million tons of crude steel, accounting for 49.5% of the global iron and steel industry's crude steel production, and 67% of the capacity was being used. China's steel consumption has been declining annually since the demand peaked in 2013 at 765 million tons.

Along with China's national economic development into the new normal, unit GDP steel consumption intensity further decline, steel consumption will generally enter a downward channel. The primary obstacles to the long-term growth of China's iron and steel sector will be the low rate of capacity utilization and the severe supply and demand imbalance [11]. For many years to come, the main issues affecting the growth of China's iron and steel sector will be the low rate of capacity utilization and the severe supply and demand imbalance.

3.2. Supply-Side Reforms

State-owned steel businesses become the driving force behind restructuring as the state promotes supply reform. The central economic work conference in 2015 suggested that one of the five main goals of the national economic work in 2016 be to "go to production capacity" by advancing supply-side structural change. The country's crude steel manufacturing capacity must be reduced by 100 million to 150 million tons during a five-year period starting in 2016.The CPC Central Committee and the State Council must take the initiative to address the iron and steel industry's overcapacity and adjust to the new normal of economic development. And properly respond to the challenges of major risks and major strategic plan, is the iron and steel industry out of the difficulties, adjustments, restructuring and upgrading of the primary task, the battle of the war. The state explicitly encourages the steel enterprises to carry out substantial joint restructuring, in particular, “to support the advantageous steel enterprises, the implementation of strategic restructuring”, proposed by 2025, At least 60% of the nation's crude steel production came from the top ten domestic steel companies (groups). There have been 51 significant restructuring events in China's iron and steel industry since 2005, according to the figure's incomplete statistics compiled by the webpage news. The majority of these events were between state-owned enterprises, followed by state-owned private enterprise restructuring and private enterprise restructuring [12]. This indicates that the state-owned iron and steel enterprises have already taken the lead in mergers.

3.3. Improvement in Business Conditions

Improve the operation of WISCO and enhance its market dominance in the steel industry. By means of Baosteel and Wuhan Iron & Steel's merger, It may strengthen Wuhan Iron and Steel's and Baosteel's market dominance. Following the merger, Baosteel and WISCO's crude steel production rose dramatically, placing them first in China and third globally. Following the merger, Baosteel became the world's top producer of silicon steel, producing 1.3 million tons yearly, while WISCO produced 1.92 million tons annually. The merger will increase the market share and pricing power of the products. In 2015, the iron and steel industry entered the development difficulties, then WISCO has lost 7.5 billion yuan, while Baosteel has maintained the profit status, the net profit of 700 million yuan that year, although compared with the decline in 2014, but in 2015 the iron and steel industry trough state is still a very good performance. According to the 2016 quarterly report, WISCO's total liabilities of 68.2 billion yuan, making the debt-to-equity ratio exceeded 70%, and the operational and financial risks increased dramatically at the same time. Under such circumstances, merging with Baosteel is the best choice. Secondly, The State-owned Assets Supervision and Administration Commission (SASAC) of the State Council is in charge of both Baosteel and WISCO. Because they are under the same regulating authority, the obstacles to integration and coordination problems can be effectively solved.

4. Merger Program, Process and Completion of the Share Swap and Absorption Merger of Baosteel with WISCO

4.1. Design of Baosteel's Share Swap and Merger Program with WISCO

The specific manner of the Merger is as follows (see Table 3): All WISCO shareholders will receive A shares from Baosteel in exchange for shares, and the two companies will merge and merge; Baosteel will be the merging and surviving party of the merger, and WISCO will be the merged and non-surviving party; WISCO Limited will assume and succeed all of WISCO's current assets, liabilities, business, personnel, contracts, qualifications, and other rights and obligations, and Baosteel will control 100% of WISCO Limited's equity interest as of the Closing Date. All existing assets and liabilities of WISCO, WISCO Limited will assume and succeed all of WISCO's business, staff, contracts, qualifications, and other rights and obligations. As of the Settlement Date, Baosteel will control all of WISCO Limited's equity. The ratio of the share exchange will be established in accordance with the average trading price of the Baosteel and WISCO shares for the 20 trading days preceding the date of the announcement of the Board of Directors' resolution to consider the transaction as the market reference price, with at least 90% of the market reference price serving as the pricing principle [13]. Based on the above principle, the exchange price of the merger is RMB4.6 per share for the merging party and RMB2.58 per share for the merged party, and then the merger share exchange ratio determined based on the exchange price is 1:0.56, this implies that each WISCO share owned by stockholders can be exchanged for 0.56 Baosteel shares. A total of 5,652,516,701 shares were issued to WISCO's conversion shareholders in the share swap absorption merger and were officially listed and floated on February 27, 2017.

Table 3: Merger and acquisition process.

Time | Specifics of the incident |

2016.06.27 | Wuhan Iron and Steel and Baosteel announced a suspension of trading and announced a strategic reorganization to the public |

2016.09.23 | Baosteel published the Short-form Report on Changes in Equity as well as the Draft Report on Merger by Exchange of Shares with Wuhan Iron and Steel Company Limited and Associated Transaction. |

2016.09.23 | Baosteel released the valuation report of China International Capital Corporation Limited on the connected transaction and the legal opinion of Shanghai Fangda Law Firm on the incident. |

2016.10.01 | Baosteel replied to the inquiry letters from China International Capital Corporation Limited and Deloitte Touche Tohmatsu (Special General Partnership). |

2016.10.10 | Baosteel and Wuhan Iron & Steel respectively made public announcements on resumption of trading. |

2016.10.29 | The State-owned Assets Supervision and Administration Commission of the State Council (SASAC) gave its approval to matters pertaining to the share swap absorption merger of Baosteel with WISCO.,which permitted the implementation of the total program of share swap absorption merger. |

2016.12.01 | The China Securities Regulatory Commission reviewed and approved Baosteel and WISCO, and both companies halted trading once more. |

2016.12.06 | Baosteel's absorption merger with WISCO was authorized by the Ministry of Commerce's Anti-Monopoly Bureau. which allowed the merger by absorption with WISCO, and the two sides resumed trading. |

2016.12.29 | Baosteel share swap and merger with WISCO was approved by the CSRC. |

2016.12.30 | Baosteel released additional matters related to the verification of the merger of Baosteel and Wugang by China International Capital Corporation (CICC) and Shanghai Fangda Law Firm. |

2017.01.24 | Baosteel releases an announcement on the suspension of the company's stock trading, announcing that trading will be suspended continuously until the end of the merger, and that the share swap merger has officially begun. |

2017.02.15 | Baosteel announced that WISCO has been officially delisted on February 14, 2017, and the finalized share swap ratio is 1:0.56. |

2017.02.22 | The Report on the Execution of the Merger by Share Swap and Absorption of Wuhan Iron and Steel Company Limited and Related Transactions was published by Baosteel. |

2017.02.25 | Baosteel announced that the implementation of the share swap for the merger by absorption of WISCO had been completed and issued a resumption announcement. |

2017.02.27 | The merger of Baosteel and Wuhan Iron & Steel proceeded without incident, and the new shares were listed concurrently with the official resumption of trade in Baosteel shares. |

4.2. Basic Information on the Surviving Enterprise after the Completion of the Merger

4.2.1. Profitability

Table 4: Comparison of financial indicators of profitability.

particular year Financial Indicators | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

Return on net assets (100%) | Baosteel | 6.98 | 12.30 | 11.69 | 7.39 | 0.9 | 5.07 | 5.27 |

5.27 | WISCO | - | - | - | 0.39 | -26.56 | 3.47 | 1.19 |

Average of comparable companies in the industry | 3.91 | 10.37 | 10.06 | 2.32 | -7.21 | -1.29 | 0.13 | |

Net profit on sales (%) | Baosteel | 4.62 | 7.64 | 7.06 | 4.96 | 0.44 | 3.25 | 3.18 |

WISCO | - | - | - | 0.22 | -12.87 | 1.30 | 0.49 | |

Average of comparable companies in the industry | 2.01 | 5.81 | 4.96 | 1.47 | -5.51 | -0.08 | -0.41 | |

Cost and expense margin (%) | Baosteel | 5.50 | 9.94 | 9.08 | 6.60 | 1.15 | 4.6 | 4.44 |

WISCO | - | - | - | 0.60 | -11.98 | 1.57 | 0.68 | |

Comparable companies in the industry | 2.60 | 7.25 | 5.78 | 1.54 | -5.15 | -0.05 | -0.36 | |

Source: Cathay Minan database

Before the merger, WISCO's profit margin from its main business had been lower than that of Baosteel, especially in 2015 (see Table 4), when a big inflection point was reached, reaching a negative value. And after the decision to merge, the enterprise's main business profit margin rose sharply, 5 percentage points higher than before the merger; Baosteel's main business profit margin has been fluctuating up and down in the years before the merger, and rose to the highest value in several years of 12.45% in 2016. According to the data after the merger, it can be seen that the profit margin of main business is in a state of continuous growth and no longer fluctuates up and down, which shows that the merger has improved the operating ability of Baosteel enterprises. Combined with the value of 2018, it can be seen that the profit margin of main business has reached the peak in recent years, and although the value has decreased in 2019, It remains greater than the primary business's profit margin prior to the merger. This shows that the merger has expanded the scope of operation of the enterprise, improved the competitiveness of its products in the market, and enhanced the profitability of the enterprise, realizing a strong combination.

4.2.2. Solvency

Table 5: Gearing ratio of Baosteel and WISCO in 2012-2019 Unit: %.

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

Baosteel | 45.26 | 47.03 | 45.68 | 47.83 | 50.96 | 50.18 | 43.53 | 43.7 |

Wuhan Iron and Steel | 62.77 | 60.78 | 61.92 | 69.73 | 68.37 |

According to the gearing ratio data can be seen in Table 5, Wuhan Iron and Steel shares gearing ratio has been in a high state, especially in 2015 and 2016, its value is close to 70%, in this case, the enterprise is very easy to appear insolvency, but also lead to the enterprise's high financial expenses, profits will also be reduced significantly. Baosteel's gearing ratio is lower than that of WISCO, but it has been gradually increasing in recent years, and in 2016 it was close to 51%. However, after the merger, it can be seen that Baosteel's gearing ratio began to decline, although the first year only decreased by 0.8%, but in the second year after the merger, its gearing ratio reached the lowest value of 43.53% in recent years, and in 2019 it will still remain at the level of 43%. It can be seen that the merger has made the enterprise's long-term solvency better, and there is a trend of continuous strengthening.

4.2.3. Market Share

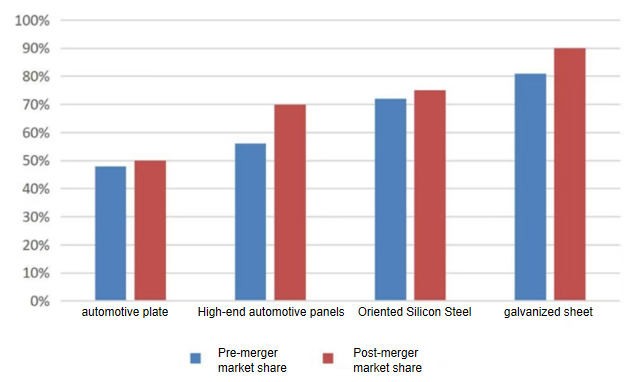

Figure 1: Market share of major products before and after the merger (Source: Baosteel Social Responsibility Report 2016-2017).

According to the data in Figure 1, after the merger, the sales volume of Baosteel's steel products is more than the combined total of the two enterprises, and its market share is also increasing significantly. Baosteel's competitiveness in the domestic market has gradually increased through the development of its core products. On the one hand, Baosteel's production and sales volume of automotive plates has been expanding by covering all strength grades and a full range of automotive plate products as an advantage of automotive plate production. Before the merger, based on the China Steel Association's figures, in 2015, Baosteel produced 7.66 million tons of automobile plates and WISCO produced 2.97 million tons of automobile plates. Through merger and integration, coordinated production and sharing of production technology, Baosteel's output reached 12.25 million tons in 2017, with a market share of more than 50%, second only to ArcelorMittal and Nippon Steel & Sumitomo Metal, it made its maiden appearance in the top three worldwide and has been there ever since. The third-generation advanced high-strength vehicle plates were released globally first and achieved mass manufacturing and application first. The sales volume of high-end automobile plates reached 3.15 million tons, a 5% year-over-year rise, and the market size reached 70%.

4.2.4. Financial Situation

In 2015, the loss of WISCO amounted to 7.46 billion yuan, the gearing ratio was as high as 70.54%, and the net cash flow from operating activities was -2.70 billion yuan. WISCO's operation and management are not good,and its operational income fell 43.8% year over year in 2015. This significant decline in operating income has increased WISCO's financial risk. On the other hand, Baosteel's financial status is far better. At the end of 2015, Baosteel's asset-liability ratio was at 47.83%, and despite a 12.6% year-over-year decline in operating income, the company nevertheless had a net profit of 1.01 billion yuan. Wuhan Iron and Steel's financial strain may be somewhat relieved following the merging of Baosteel and Wuhan Iron and Steel. Based on the initial analysis of 2015 financial data, the combined company's gross profit margin was 5.68% and its gearing ratio was 54.30%.

5. Implications

Merger by exchange of shares is suitable for the integration and reorganization of large-scale central enterprises or state-owned enterprises. The merger by absorption does not need to take up a large amount of cash of the enterprise, is not limited by the size of the transaction, the merging party does not need to pay cash instantly, the capital structure is stable, the financial risk is small, and it can assist the target company's owners in putting off paying taxes in a reasonable manner. Additionally, the merger will have enough cash flow to effectively sustain future operations and output. The above features are suitable for the consolidation of large-scale enterprises in this case.

Suitable payment methods and reasonable share exchange ratios can ensure the smooth implementation of the merger plan and facilitate the realization of the integration effect. The payment method and share exchange ratio adopted for the implementation of the merger is the foundation and support for the successful completion of the merger. When designing the plan, enterprises need to comprehensively consider a variety of factors such as national policies, industries, and the enterprises' own conditions, and decide on a fair share exchange rate and the right payment method to make sure the merger plan satisfies the interests and needs of both parties and ensures a seamless merger of the businesses. Therefore, the path to selecting the appropriate payment method and share exchange ratio for a business combination is that both parties to the merger, on the basis of organizing and unifying their respective motivations for the merger, and after comprehensively considering the basic situation of the enterprise, the purpose of the merger, the strategic plan for the future development of the enterprise, the willingness of the shareholders and managers of both parties, and the merger's impact on the enterprise's capital structure and shareholding structure, as well as on the financial and non-financial impacts of the merger, the merger should be finalized. At the same time, It is important to thoroughly examine the benefits and drawbacks of different payment options, expenses, and operational processes. If the share exchange method is adopted, it is necessary to adopt various methods of calculating the share exchange ratio to obtain a reasonable ratio, and finally, the two companies should reach a consensus to determine the optimal enterprise merger plan. Having a successful merger is just the first step; the next step is integration, which is crucial for businesses to keep increasing their productivity. increase their corporate value, and grow stronger. Enterprise merger is not only a financial merger, but also an integration in the true sense of the word.

6. Conclusion

According to the study's findings, the payment method used for the Baosteel and WISCO merger is appropriate given the state of the iron and steel sector today and the parties' current circumstances, and that the share exchange ratio set in the merger plan is reasonable and does not infringe upon the rights and interests of the shareholders of the two parties, and that the enterprises still maintain a stable shareholding and capital structure, It is going to improve the impact of the Baosteel and WISCO combination. The study found that after the completion of the merger of Baosteel and WISCO, in the short term after the merger, the short-term solvency of the enterprise was stable and progressive, the long-term solvency was stronger, the operating capacity was slightly improved, the profitability was significantly enhanced, and the development capacity was also improved significantly. However, in the long term, the effect of the merger of Baowu and weakened, the financial indicators have been reduced to varying degrees, indicating that the sustainability of the effect of the merger of Baowu is not strong. Subsequently, it needs to continue to tap the merger effect, make up for the shortcomings through the integration and adjustment to play advantage, and strive to solidify the leading position in the iron and steel industry.

Baosteel actively supports supply-side reform and industrial structure adjustment in the execution of national policies, in the “three to one supplement and one down” in the work of the fruitful, environmental protection policies are also being gradually implemented, industrial concentration has increased. In terms of the comprehensive strength of the enterprise. In the comprehensive strength of enterprises, after the merger of Baosteel R & D investment increased, R & D strength, located in the domestic leader position.

References

[1]. Zhu, Y. J. (2019). Research on financial integration of mergers and acquisitions in China’s steel industry: A case study of Baowu Steel merger [Master’s thesis, Hangzhou Dianzi University].

[2]. Shi, L. (2021). Analysis of the payment method and effects of Baosteel's stock exchange absorption merger with Wuhan Steel [Master’s thesis, Shihezi University]. Xinjiang, China.

[3]. Luo, X., Homburg, C., & Wieseke, J. (2010). Customer satisfaction, analyst stock recommendations, and firm value. Journal of Marketing Research, 47(6).

[4]. Wei, C. L., Xu, M., & Zheng, Z. (2011). Analysis of performance and influencing factors of state-owned enterprises' overall listing. China Industrial Economy, 2011(10), 10.

[5]. Fernández, S., Triguero, Á., & Alfaro-Cortés, E. (2018). M&A effects on innovation and profitability in large European firms. Management Decision, 57, 100-114.

[6]. Tan, J. S., Li, W. J., & Tan, Y. (2003). Multi-party interest game in corporate mergers: A study based on 10 stock exchange merger cases. Management World, 2003(3), 11.

[7]. Fu, Z. F. (2007). Research on the motivation and stock exchange ratio of Chalco’s absorption merger with Shandong Aluminum and Lanzhou Aluminum [Master’s thesis, Xiamen University]. Xiamen, China.

[8]. Mueller, D. C. (1969). A theory of conglomerate mergers. Quarterly Journal of Economics, 1969(4), 643-659.

[9]. Majumdar, S. K., Moussawi, R., & Yaylacicegi, U. (2020). Merger motives and technology deployment: A retrospective evaluation. The Antitrust Bulletin, 2020(1), 120-147.

[10]. Baosteel Co., Ltd. (2014, September). Company introduction. Retrieved from http://bg.baosteel.com/contents/3297/43503.html

[11]. Zhang, R. (2020). Analysis of the motives and effects of Baosteel’s stock exchange absorption merger with Wuhan Steel [Master’s thesis, Jilin University]. Jilin, China.

[12]. Zeng, B. H. (2019). Synergy effect analysis of Baosteel’s absorption merger with Wuhan Steel [Master’s thesis, Jiangxi University of Finance and Economics]. Jiangxi, China.

[13]. Lai, X., & He, L. Z. (2015). Research on transaction structure design in mergers and acquisitions: A case study of Lipeng Co.'s merger and reorganization of Huayu Garden. Modernization of Shopping Malls, 2015(12), 262-263.

Cite this article

Jiang,S. (2025). A Case Study of the Merger by Share Swap and Absorption of Baosteel and WISCO Type. Advances in Economics, Management and Political Sciences,161,178-187.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhu, Y. J. (2019). Research on financial integration of mergers and acquisitions in China’s steel industry: A case study of Baowu Steel merger [Master’s thesis, Hangzhou Dianzi University].

[2]. Shi, L. (2021). Analysis of the payment method and effects of Baosteel's stock exchange absorption merger with Wuhan Steel [Master’s thesis, Shihezi University]. Xinjiang, China.

[3]. Luo, X., Homburg, C., & Wieseke, J. (2010). Customer satisfaction, analyst stock recommendations, and firm value. Journal of Marketing Research, 47(6).

[4]. Wei, C. L., Xu, M., & Zheng, Z. (2011). Analysis of performance and influencing factors of state-owned enterprises' overall listing. China Industrial Economy, 2011(10), 10.

[5]. Fernández, S., Triguero, Á., & Alfaro-Cortés, E. (2018). M&A effects on innovation and profitability in large European firms. Management Decision, 57, 100-114.

[6]. Tan, J. S., Li, W. J., & Tan, Y. (2003). Multi-party interest game in corporate mergers: A study based on 10 stock exchange merger cases. Management World, 2003(3), 11.

[7]. Fu, Z. F. (2007). Research on the motivation and stock exchange ratio of Chalco’s absorption merger with Shandong Aluminum and Lanzhou Aluminum [Master’s thesis, Xiamen University]. Xiamen, China.

[8]. Mueller, D. C. (1969). A theory of conglomerate mergers. Quarterly Journal of Economics, 1969(4), 643-659.

[9]. Majumdar, S. K., Moussawi, R., & Yaylacicegi, U. (2020). Merger motives and technology deployment: A retrospective evaluation. The Antitrust Bulletin, 2020(1), 120-147.

[10]. Baosteel Co., Ltd. (2014, September). Company introduction. Retrieved from http://bg.baosteel.com/contents/3297/43503.html

[11]. Zhang, R. (2020). Analysis of the motives and effects of Baosteel’s stock exchange absorption merger with Wuhan Steel [Master’s thesis, Jilin University]. Jilin, China.

[12]. Zeng, B. H. (2019). Synergy effect analysis of Baosteel’s absorption merger with Wuhan Steel [Master’s thesis, Jiangxi University of Finance and Economics]. Jiangxi, China.

[13]. Lai, X., & He, L. Z. (2015). Research on transaction structure design in mergers and acquisitions: A case study of Lipeng Co.'s merger and reorganization of Huayu Garden. Modernization of Shopping Malls, 2015(12), 262-263.