1.Introduction

Under the current international situation, consumption patterns are changing rapidly, market competition is becoming increasingly fierce, and the challenges faced by enterprises are becoming increasingly severe. Traditional business models are gradually unable to meet market demand. However, with the rapid development of science and technology, especially the high integration and penetration of emerging technologies represented by big data, cloud computing, and artificial intelligence, not only has the current economic landscape been greatly changed, but it has also brought unprecedented opportunities for enterprises to innovate their business models. Business model innovation is not simply innovation in technology or products. Its essence lies in the optimization, improvement, and reintegration of the value chain consisting of value discovery, value creation, and value realization [1]. Scientific business models can help enterprises establish unique competitive advantages, thereby significantly improving corporate performance in multiple dimensions such as finance, market, and operations. Business model innovation is one of the core issues that cannot be avoided in the strategic management of today's enterprises. BYD Co., Ltd. was established in February 1995. It started with the battery business and gradually entered the automotive industry. It has now developed into a Fortune 500 company with businesses spanning four major fields: auto, electronics, renewable energy, and rail transit. It is also the leader in China's new energy vehicle field. In 2023, BYD became the global sales champion of new energy vehicles and ranked among the top ten best-selling automobile brands in the world for the first time. The cumulative sales volume in the first 11 months of 2024 ranked first among all domestic auto companies, and the cumulative total revenue in the first three quarters ranked first in the passenger car industry. BYD's brilliant achievements are inseparable from its innovation in business models. As a company that integrates "innovation" into the core values of its brand, BYD has carried out in-depth technological innovation in the fields of batteries, charging infrastructure, and intelligent driving in recent years. It has also established a full-industry chain business model through "vertical integration" and built a diversified product innovation of the passenger car brand matrix. These practices provide valuable cases for studying the innovation of business models of enterprises and demonstrate their positive impact on corporate performance.

Based on this, this article aims to explore the specific impact of a company's business model innovation on its corporate performance. Taking BYD as an example, this article summarizes BYD's innovative measures in its business model, and analyzes BYD's performance in recent years from both financial and non-financial indicators, revealing the application of business model innovation in practice and its role in enhancing the company's long-term development and market competitiveness, to provide managers of other automobile companies with a practical and feasible path for business model innovation and promote the common development of the automotive industry.

2.BYD's Business Model Innovation Measures

When discussing the composition of business models, Ji Huisheng and others proposed that business models essentially cover a series of continuous processes from value discovery, and value creation to value realization [1]. According to their research, value discovery is a unique value proposition established by analyzing the internal and external environment of the enterprise in combination with the enterprise's strategic direction. Value creation emphasizes the development and production of products or services. This process is inseparable from the enterprise's operating system to ensure that the created value can be reflected through specific products or services. Value realization is centered on the profit model. Through effective marketing management and sales activities, the value constructed in the previous stage is converted into actual economic benefits, thereby verifying the rationality and sustainability of the business model [1]. This article summarizes BYD's business model and innovative measures from three aspects: value discovery, value creation, and value realization.

2.1.Value Discovery Innovation

2.1.1.Energy-saving, Environmentally Friendly and Sustainable Value Proposition

As environmental issues become increasingly severe and global requirements for low-carbon emissions continue to increase, BYD has insight into the huge potential of global environmental protection and new energy trends. In 2022, BYD officially announced the discontinuation of fuel-powered vehicles and shifted its business focus to the research and development and production of energy-saving and environmentally friendly new energy vehicles. BYD established its strategic positioning in the new energy vehicle industry and focused on providing the market with environmentally friendly, energy-saving, and low-emission travel solutions [2]. BYD emphasized that this strategic adjustment is based on China's new development philosophy of "green", aiming to promote sustainable social development with green and low-carbon cycles. This value proposition not only reflects BYD's deep insight into market demand, but also conforms to the long-term trend of global sustainable development.

2.1.2.Development Concept of “Technology is King, Innovation is the Basis”

Against the backdrop of increasingly fierce competition in the new energy vehicle industry, mastering the core technologies of the entire new energy vehicle industry chain is the key to BYD’s continued innovation and competitiveness [3]. BYD has always adhered to the development concept of “Technology is King, Innovation is the Basis” and has continued to increase R&D investment over the years. BYD establishes internal incentive mechanisms and an innovative environment, forms strong innovation capabilities and solid technical barriers, and thus continuously incubates industry-leading technological achievements. The extensive application of self-developed technologies effectively reduces production costs, improves product competitiveness, and ensures BYD’s leading position in the new energy vehicle field.

2.2.Value Creation Innovation

2.2.1.Vertical Integration Model of Batteries and New Energy Vehicles

Unlike traditional automakers that rely on external parts suppliers, BYD uses its industrial advantages to control the entire industrial chain from battery research and development and production to new energy vehicle manufacturing. Through vertical integration, BYD almost master’s all core technologies and manufacturing processes. It achieves self-sufficiency in key components such as batteries. This top-to-bottom full industrial chain layout establishes difficult-to-replicate cost advantages and strategic barriers for BYD in the competition in the new energy vehicle market, enabling it to launch high-quality products at more competitive prices while maintaining continuous improvement in profitability.

2.2.2.Coordinate Global Layout and Release Overseas Production Capacity

Since 2022, BYD has successively built factories in Thailand, Uzbekistan, Brazil, and Hungary, and launched an overseas localized production strategy. This move not only helps to circumvent tariffs and reduce production costs but also adjusts product design according to local consumer needs and responds quickly to market changes. By 2024, the relevant factories will begin to release production capacity one after another. Among them, the factories in Thailand and Uzbekistan were officially completed. The annual production capacity of the Thai factory is expected to reach 150,000 vehicles, and the total production capacity of the first and second phases of the Uzbekistan factory is expected to be 50,000 vehicles. As of now, BYD's total overseas planned production capacity exceeds one million vehicles, demonstrating its importance in the strategic layout of global market expansion. Through this series of production capacity layouts, BYD not only further consolidates its global competitiveness, but also lays a solid foundation for future growth in overseas markets.

2.3.Value Realization Innovation

2.3.1.Product Diversification, Broadening Revenue Sources

BYD built a complete product layout system in the automotive business. Taking passenger cars as an example, its products cover multiple series and brands, with price ranges ranging from hundreds of thousands to more than one million yuan. Models include sedans, off-road vehicles, sports cars, etc., to meet the diverse needs of different consumer groups, effectively promoting the growth of vehicle sales and revenue. In addition, in the field of electronics business, BYD gradually extended from the production and assembly of simple parts to the fields of smartphones, laptops, new smart products and automotive smart systems, forming a diversified business segment [4]. In addition, BYD also actively laid out photovoltaic products and battery energy storage system businesses, further improving its strategic layout in the new energy field and promoting the coordinated development of the overall business. Through this series of business diversification and expansion, BYD's revenue sources become increasingly diversified.

2.3.2.Multi-channel Sales to Increase Product Sales

To better achieve sales targets, BYD adopted a diversified sales strategy. First, the company adopted the "direct sales + dealer partners" channel model to enhance market coverage by expanding the sales network. Dealers not only have strong financial strength, but also have rich sales experience, which helps to alleviate the financial, human and management cost pressures brought by the single self-operated model. Secondly, BYD borrowed from Tesla's sales model and opened sales experience stores in commercial centers or large shopping malls with dense traffic. This model fits BYD's customer group, which is mainly composed of young and middle-aged people, and their habit of leisure consumption in shopping malls, which improves the convenience of customers' contact with products [4]. Through this sales method, BYD can effectively improve the brand's exposure and market appeal, increase customers' willingness to test drive and buy cars, and thus promote the growth of overall sales.

3.The Impact of BYD's Business Model Innovation on Corporate Performance

3.1.Analysis of Financial Indicators

This article selects the financial data from BYD's annual reports from 2019 to 2023, analyzes BYD's financial indicators from four dimensions: profitability, debt-paying ability, operating ability, and growth ability, and evaluates the impact of its business model innovation on financial performance.

3.1.1.Profitability Analysis

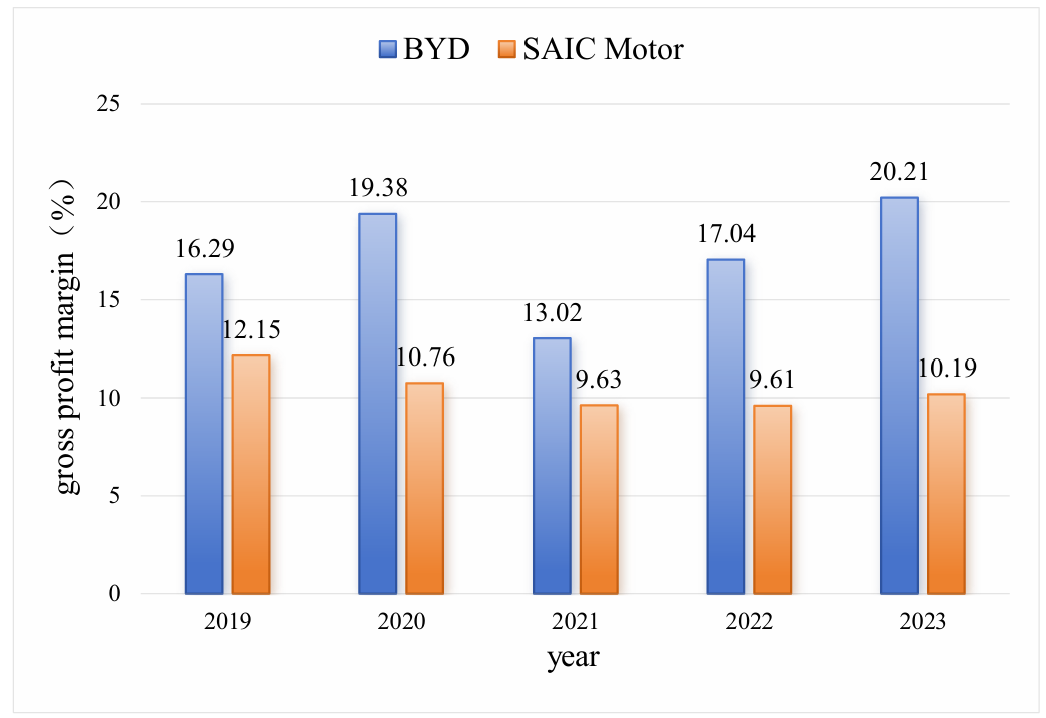

The profitability of an enterprise refers to its ability to obtain profits through operating activities within a certain period. This section selects the key indicator of gross profit margin to compare and analyze the profitability of BYD and SAIC Motor. The main reasons for choosing gross profit margin as an analysis indicator are: first, gross profit margin can directly reflect the efficiency of cost control of enterprises in production and sales, and is an important basic indicator for measuring profitability. Secondly, considering that BYD adopts a vertical integration model, the optimization effect of this model on production costs is most significantly reflected in gross profit margin. Therefore, the author selects gross profit margin to more intuitively reflect the impact of business model innovation on BYD's profitability.

Figure 1: Comparison of gross profit margins between BYD and SAIC Motor from 2019 to 2023

As can be seen from Figure 1, although the epidemic caused general downward pressure on the gross profit margins of global companies, BYD showed a steady growth trend in its gross profit margin from 2019 to 2023. Compared with SAIC Motor, BYD's gross profit margin was always higher than that of SAIC Motor. Behind this significant difference, BYD's vertical integration model plays an important role. Compared with SAIC Motor, most of the power batteries of new energy vehicles need to be purchased from external battery manufacturers. BYD effectively reduces its dependence on external suppliers by producing batteries by itself, which can avoid the pressure brought by market fluctuations and price increases of suppliers. In addition, BYD reduces the cost of battery production through large-scale production and technological optimization, which in turn promotes the reduction of vehicle production costs, expands profit margins, and maintains a high level of gross profit margin in the industry.

3.1.2.Debt-paying Ability Analysis

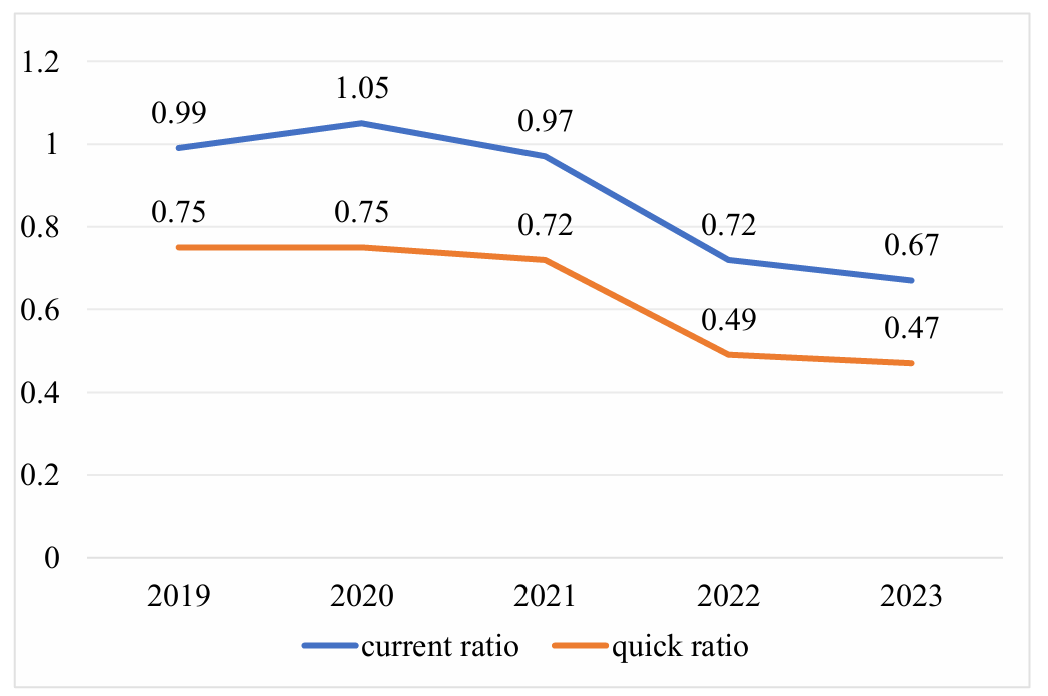

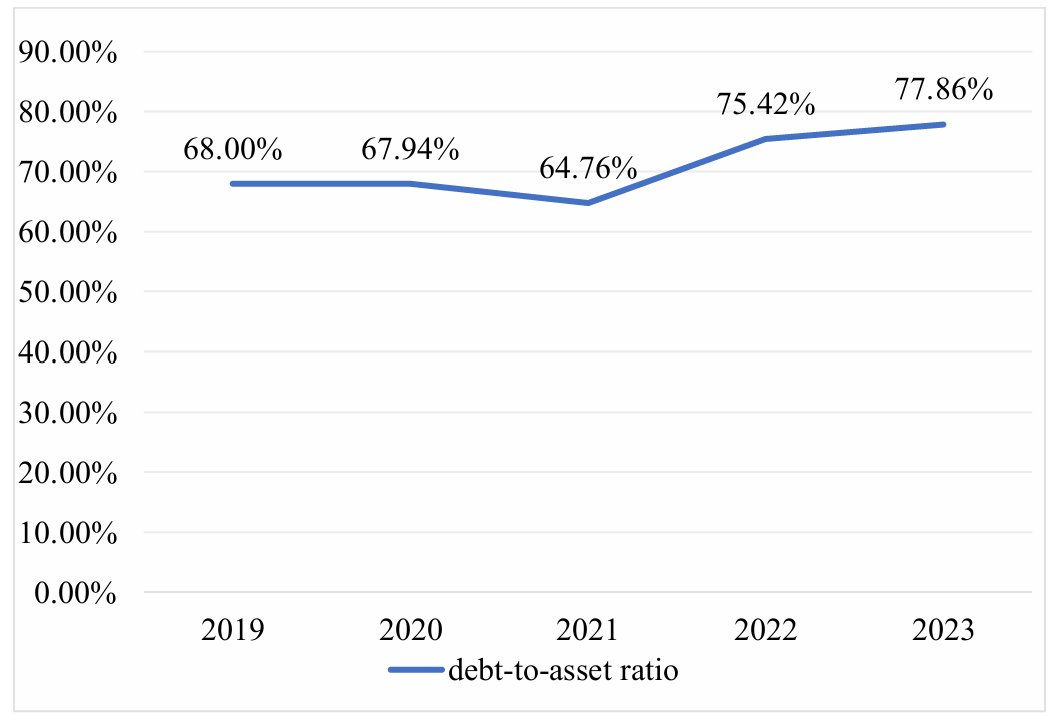

Debt-paying ability refers to the ability of an enterprise to repay its debts with its assets within a certain period. This ability reflects the financial stability and risk level of the enterprise. This article will use the current ratio, quick ratio, and debt-to-asset ratio to analyze BYD's debt-paying ability.

Figure 2: BYD's short-term debt-paying capacity indicators from 2019 to 2023

Figure 3: BYD's debt-to-asset ratio from 2019 to 2023

As shown in Figure 2, BYD's current ratio and quick ratio both showed a downward trend from 2019 to 2023. The decline was particularly significant from 2021 to 2022. As shown in Figure 3, although BYD's debt-to-asset ratio declined slightly from 2019 to 2021, it still showed a downward trend. From 2021 to 2023, BYD's debt-to-asset ratio turned to an upward trend. All three indicators reflect that BYD's debt pressure is increasing overall. Combined with BYD's business model innovation, this article believes that the main reason is the continuous growth of R&D investment and the large amount of capital demand generated by the expansion of the global layout. BYD's value concept of emphasizing technological innovation will inevitably require a large amount of R&D capital investment. As can be seen from Table 1, BYD's R&D investment continued to grow from 2020 to 2023, especially the increase in 2022 and 2023 was obvious, which led to a decrease in current assets. In addition, under the global expansion strategy, BYD has built factories in many overseas locations since 2022 and invested a lot of money in the early stage, which led to an increase in the debt ratio.

Table 1: BYD R&D investment and growth rate from 2020 to 2023

|

Year |

2019 |

2020 |

2021 |

2022 |

2023 |

|

R&D investment (unit: 100 million yuan) |

84.21 |

85.56 |

106.27 |

202.23 |

399.18 |

|

Growth rate |

-1.35% |

1.60% |

24.21% |

90.30% |

97.39% |

Data from https://www.qyyjt.cn/

3.1.3.Operational Capacity Analysis

The operational capacity of an enterprise refers to the ability of the enterprise to use various assets to make profits. It reflects the efficiency of the use of the enterprise's assets and the operating status of the enterprise's operations. This article selects three indicators, inventory turnover rate, accounts receivable turnover rate, and total asset turnover rate, to analyze BYD's operational capacity.

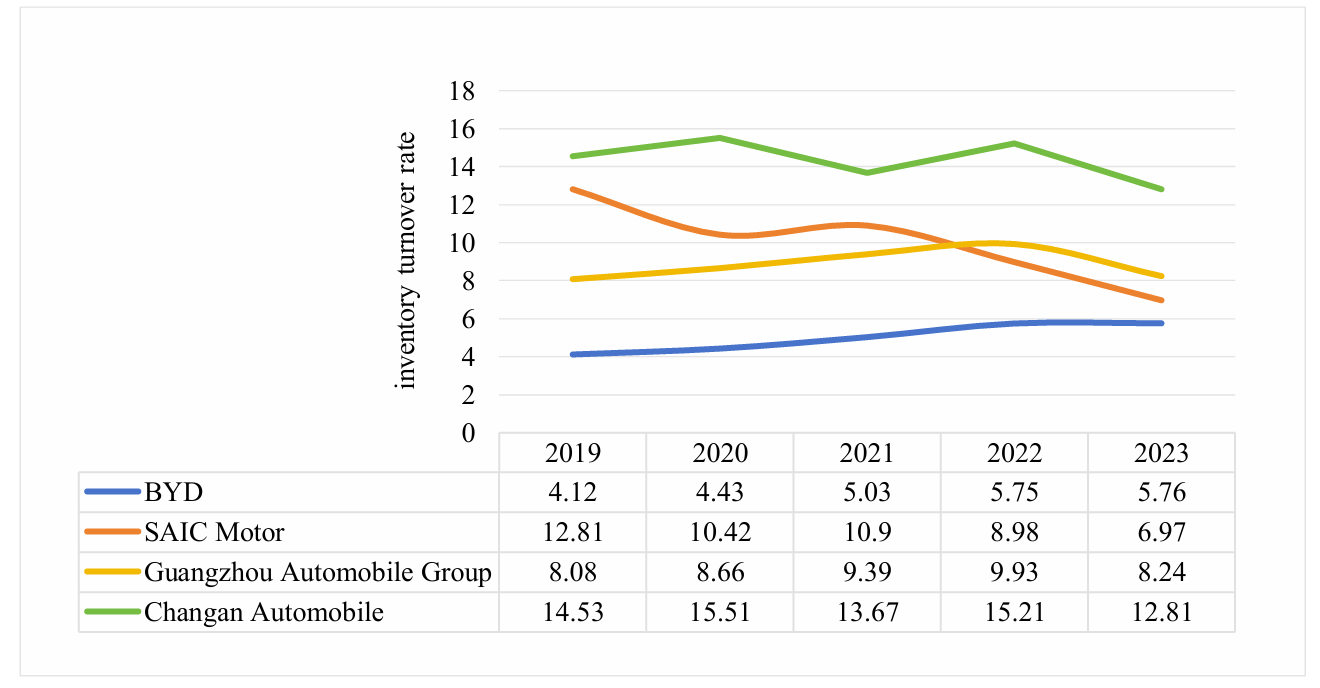

Figure 4: Comparison of inventory turnover rates of various automakers from 2019 to 2023

As can be seen from Figure 4, although BYD's inventory turnover rate continued to grow slightly, it was always at a relatively low level in the industry. On the one hand, this is because the sales of some BYD models were sluggish, resulting in inventory backlogs [5]. On the other hand, it is related to BYD's vertically integrated business model. Under this model, most parts are self-produced, so a large number of raw materials and work-in-progress are stockpiled in the long internal supply chain, causing BYD to have inventory backlogs [4].

Table 2: BYD's accounts receivable turnover rate and total asset turnover rate from 2019 to 2023

|

Year |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Accounts receivable turnover |

2.74 |

3.68 |

5.58 |

11.30 |

11.96 |

|

Total asset turnover |

0.65 |

0.79 |

0.87 |

1.07 |

1.03 |

Data from https://www.qyyjt.cn/

As can be seen from Table 2, BYD's accounts receivable turnover rate and total asset turnover rate from 2019 to 2023 both showed an upward trend, among which the increase in accounts receivable turnover rate was particularly obvious, which shows that BYD has made progress in asset utilization efficiency and accounts receivable management. This article believes that BYD's global production capacity layout enables it to make full use of global resources, optimize production and sales networks, and improve asset utilization. At the same time, through diversified sales strategies, BYD not only reaches friendly cooperation with dealers but also establishes a good brand image in the minds of customers by setting up sales experience stores, which enhances the trust of all parties in the company, which helps BYD to recover funds faster and enhance cash flow.

3.1.4.Growth Capacity Analysis

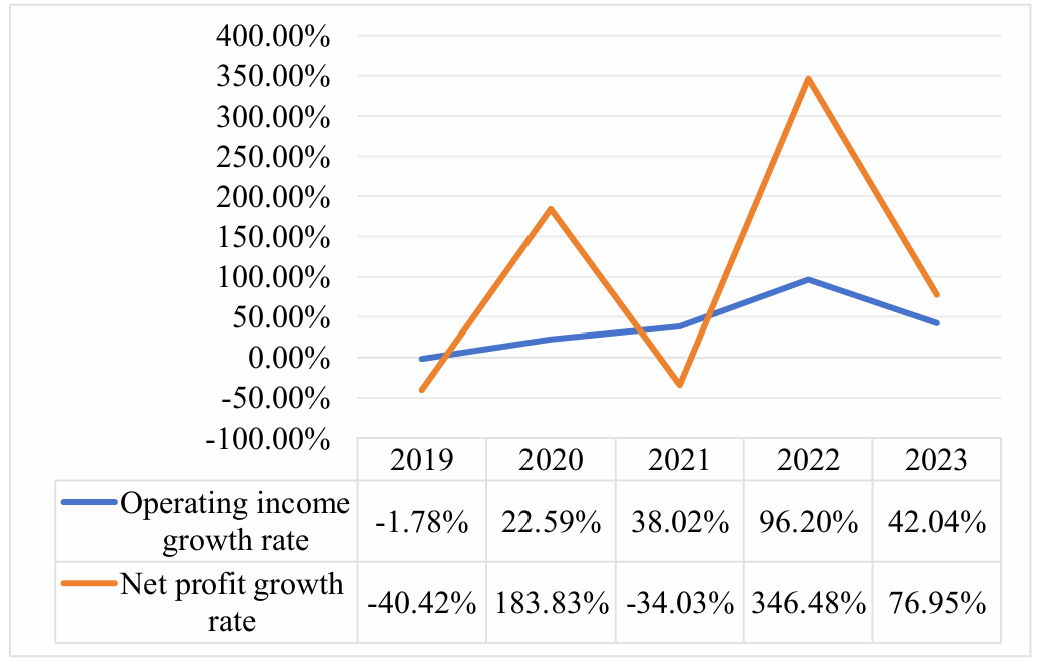

Growth capacity reflects the future development potential and expansion trend of an enterprise. This article selects the operating income growth rate and net profit growth rate to analyze BYD's growth capacity.

Figure 5: BYD's operating income growth rate and net profit growth rate from 2019 to 2023

As can be seen from Figure 5, BYD's operating income growth rate and net profit have fluctuated in the past five years. In 2019, the operating income growth rate was negative, mainly due to the poor overall market environment of the industry and the decline in government subsidy policies. BYD's sales were under certain pressure, resulting in a decline in revenue. In 2021, the net profit growth rate dropped sharply and turned negative. The main reason was the sharp rise in the prices of nickel and cobalt, the key metal resources required for power batteries, which directly led to a significant increase in production costs [6]. However, except for these two special time points, BYD showed strong growth overall, which is closely related to its advantages in business model innovation in cost management optimization and market share increase. BYD's good growth trend reflects the competitive advantages and sustainable development potential brought by its business model innovation.

3.2.Analysis of Non-financial Indicators

At the non-financial level, this article will analyze BYD's performance from the perspectives of brand influence and market share.

3.2.1.Brand Influence

Against the backdrop of increasingly fierce competition in the new energy vehicle industry, a good brand image has become an important bargaining chip for corporate competition.

Table 3: 2022 automotive market brand influence evaluation rankings

|

Ranking |

Brand |

Index |

|

1 |

BYD |

81.8 |

|

2 |

Volkswagen |

78.6 |

|

3 |

Mercedes-Benz |

74.6 |

|

4 |

Toyota |

72.1 |

|

5 |

BMW |

71.7 |

|

6 |

Audi |

68.6 |

|

7 |

Honda |

64.7 |

|

8 |

Wuling |

60.1 |

|

9 |

Hongqi |

59.9 |

|

10 |

Changan |

56 |

Data from https://www.autohome.com.cn/

Table 3 shows the influence index and ranking of various automobile brands calculated by Autohome Research Institute based on the "brand influence evaluation model" created. This model comprehensively measures the influence of automobile brands from three dimensions: brand reach, brand reputation, and brand loyalty [7]. BYD surpassed Volkswagen, Mercedes-Benz, Toyota, and other internationally renowned automobile brands to top the list, demonstrating its strong brand influence. This achievement is closely related to BYD's multiple initiatives in business model innovation.

3.2.2.Market Share

As shown in Table 4, BYD's market share showed a significant growth trend from 2019 to 2022. BYD expanded its market scope and increased its penetration rate in various market segments through its global expansion strategy and product diversification strategy. In addition, the technological advantages brought by its innovation strategy and the cost advantages brought by its vertical integration model made its products more attractive in terms of quality and price, thereby driving continued sales growth [8]. Moreover, under the guidance of its energy-saving, environmentally friendly, and sustainable value proposition, BYD gradually shifted its strategy from focusing on fuel vehicles to comprehensively developing and producing new energy vehicles, which led to a continuous increase in its market share in the new energy vehicle market. This reflects that BYD's business model innovation has a positive impact on its market share overall, helping to enhance BYD's market competitiveness in the new energy vehicle field.

Table 4: BYD market share indicators from 2019 to 2022

|

Year |

2019 |

2020 |

2021 |

2022 |

|

Total sales year-on-year growth rate |

-9.70% |

-7.20% |

67.70% |

164.10% |

|

New energy vehicle market share |

5.20% |

6.60% |

15.70% |

28.10% |

Data from http://cpcaauto.com

4.Conclusion

Taking BYD as an example, this paper summarizes BYD's important business model innovation measures since its establishment from the three perspectives of value discovery, value creation, and value realization, and analyzes the impact of its business model innovation on corporate performance from the financial and non-financial levels, and draws the following conclusions.

First, business model innovation is an important driving force for improving the core competitiveness of enterprises. Taking BYD as an example, its business model innovation measures implemented in multiple links such as R&D, production, marketing, and sales work together to build a systematic innovation system. This innovation system significantly enhances BYD's competitive advantages in terms of technological innovation capabilities, resource integration capabilities, brand and market influence, operational efficiency, and customer service capabilities, and promotes BYD to become an industry-leading leading enterprise. Secondly, scientific and reasonable business model innovation has a positive impact on the performance of enterprises in all aspects. In terms of financial performance, BYD's profitability, growth ability, operating ability, and debt repayment ability are all optimized to varying degrees due to business model innovation. In terms of non-financial performance, BYD's strong brand influence and increasing market share year by year are inseparable from its systematic and effective business model innovation.

Although BYD achieves many remarkable results through business model innovation. However, BYD still has room for improvement in specific operations. For example, BYD's short-term and long-term debt-paying capabilities are relatively weak compared with its peers, and it may face financial risks. In terms of operating indicators, BYD's inventory turnover rate is lower than that of most industry competitors, indicating that BYD still needs to optimize its inventory management and product sales efficiency.

Based on the above problems of BYD, this study makes the following three suggestions to new energy vehicle companies. First, companies should balance the positive effects of business model innovation with the financial pressure brought by large-scale R&D investment, business expansion, and global layout, avoid excessive debt, and focus on the rationality of capital structure. Second, in terms of operations, companies should optimize inventory management, accurately optimize production planning, inventory management, and logistics scheduling through sufficient market research or the introduction of advanced supply chain management technology and reduce the retention time of raw materials and work-in-progress in various links. Third, with the intensification of competition in the global new energy vehicle market, companies need to further improve their market agility and global resource allocation efficiency and formulate differentiated marketing strategies based on the demand characteristics of different regional markets to increase their overall market share.

With the rapid development of the future economy and the continuous changes in the world pattern, companies will face more opportunities and challenges. Enterprises should seize the opportunity of industry change, optimize business models through continuous innovation, explore new growth points, and drive the entire industry forward while improving their performance.

References

[1]. Ji, H.S., Lu, Qi., Wang, H.W. (2010) Business Model and Enterprise Operation System. Business Management. (04), 94-96.

[2]. Zhang, E.H. (2024) Study on the Performance of BYD's New Energy Vehicle Strategy Implementation (Master dissertation, Hunan Institute of Science and Technology).

[3]. Jian, G.Q., Xiao, N.X. (2024) Analysis of the Path and Effect of High-end Disruptive Innovation of Latecomers—a Case Study Based on Tesla Motors. Commercial Economy, (11), 124-127+192.

[4]. Min, J. (2024) Research on BYD's Business Model Innovation and Its Performance (Master's dissertation, Jiangxi Agricultural University).

[5]. Qiu, J.H. (2023) Financial Analysis of New Energy Vehicle Companies from a Strategic Perspective — Taking BYD as an Example. Chinese Market, (36),138-142.

[6]. Teng, H.L., Wang, D. (2024) Research on the Impact of BYD's Digital Transformation on Corporate Financial Performance. Modern Marketing, (11), 134-136.

[7]. Sun, Y.S. (2024) Research on Performance Evaluation of BYD Company in the Context of Digital Transformation (Master's degree thesis, Changjiang University).

[8]. Liu, Y.X. (2024) Research on the Performance of BYD Company's Diversification Strategy (Master degree dissertation, Hebei University of Economics and Business).

Cite this article

Liu,W. (2025). The Impact of Business Model Innovation on Corporate Performance: Taking BYD as an Example. Advances in Economics, Management and Political Sciences,166,46-56.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ji, H.S., Lu, Qi., Wang, H.W. (2010) Business Model and Enterprise Operation System. Business Management. (04), 94-96.

[2]. Zhang, E.H. (2024) Study on the Performance of BYD's New Energy Vehicle Strategy Implementation (Master dissertation, Hunan Institute of Science and Technology).

[3]. Jian, G.Q., Xiao, N.X. (2024) Analysis of the Path and Effect of High-end Disruptive Innovation of Latecomers—a Case Study Based on Tesla Motors. Commercial Economy, (11), 124-127+192.

[4]. Min, J. (2024) Research on BYD's Business Model Innovation and Its Performance (Master's dissertation, Jiangxi Agricultural University).

[5]. Qiu, J.H. (2023) Financial Analysis of New Energy Vehicle Companies from a Strategic Perspective — Taking BYD as an Example. Chinese Market, (36),138-142.

[6]. Teng, H.L., Wang, D. (2024) Research on the Impact of BYD's Digital Transformation on Corporate Financial Performance. Modern Marketing, (11), 134-136.

[7]. Sun, Y.S. (2024) Research on Performance Evaluation of BYD Company in the Context of Digital Transformation (Master's degree thesis, Changjiang University).

[8]. Liu, Y.X. (2024) Research on the Performance of BYD Company's Diversification Strategy (Master degree dissertation, Hebei University of Economics and Business).