1. Introduction

In the past decades, private equity investment, as an emerging financing method, has gradually become an important way for enterprises, especially small or medium-sized enterprises, to obtain financing. Private equity (PE) refers to the investment and financing activities that raise funds through non-public means, make equity investments in unlisted enterprises, and achieve capital appreciation through listing, mergers and acquisitions, management buybacks, etc. The basic process of PE consists of the following steps. First of all, professional private equity firms show investors a solid investment plan and attract investors to provide capital. Next, private-equity firms select and investigate the firms to determine the development potential of unlisted enterprises as investment projects. Then, private equity firms conduct due diligence on the project, evaluate the value, risks and benefits of the project, and negotiate with the enterprise side to reach an investment agreement agree. After that, private equity institutions supervise and manage the invested capital to help enterprises improve operating efficiency and market competitiveness. Finally, when the investment project achieves the expected return, the private equity institution will exit investment through IPO, equity transfer or other means and realize capital return. The exit method of private equity investment is also relatively diverse, which can be based on market conditions and enterprises’ needs or flexibility to choose the most appropriate way.

Since the end of the 20th century, private equity investment has grown rapidly around the world and has become an important part of corporate finance and capital markets [1]. Private equity investment has a profound impact on business development in both developed and developing countries [2]. Therefore, this paper aims to explore the impact of private equity investment on firms from a global perspective, through a literature review method, in order to provide a reference for further theoretical research and practical operation. The paper chooses the factors including the performance, innovation and the employment to evaluate the influence of PE on the companies over the world.

2. Literature Survey

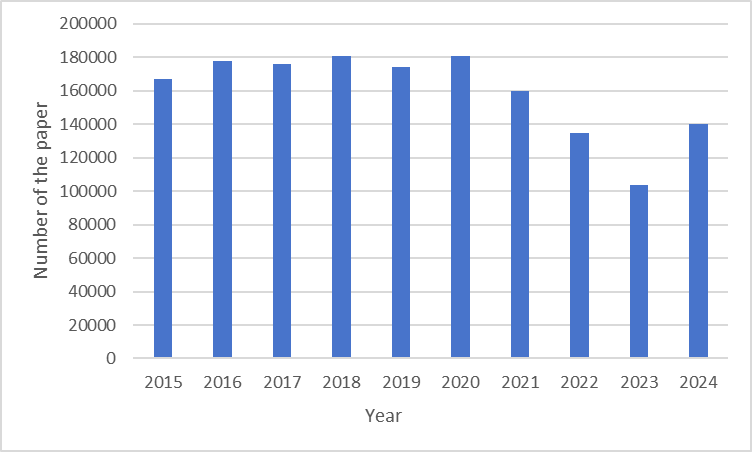

Figure 1 illustrates the annual number of papers retrieved using the search terms “private equity” and “impact” on Google Scholar. In the last decades, there are at least 100000 papers per year about the impact of PE, peaking at about 180000 in 2018 and 2020.This trend means the effect of private equity investment has been a quite heated-discussed field in the past decade.

Figure 1: The number of papers searched using “Private Equity” and “impact” per year

2.1. The impact of PE on performance

PE investment stimulates the growth of the company and PE-backed firms achieve more sales than other firms [3]. Xia and Ma [4] conduct the research through the data of 429 companies listed on Second-board Market in China and find that PE investment has a significant positive correlation with the profitability, growth ability and risk resistance of GEM listed companies. Under the influence of different types of PE, the development of enterprises is significantly different [5]. Shi finds that in China foreign investment and state-owned PE plays an important role in promoting the performance of enterprises, while private PE plays a not so significant role. Bruton et al. [6] compare two different types of PE investment in UK and France and find that the two types of private equity investors have a quite different impact on performance, which is consist with Shi’s finding. Bruton et al. also find that the legal institutions in a given country moderate this impact and this finding may help improve the legislation.

The impact of private equity investment on the development of enterprises needs some time to show up [5]. The time effect of investment plays a positive correlation role on the development of enterprises. To be more specific, the longer the investment time is, the more significant the rate is. Meles et al. [7] find that the length of time that the PE investment is held serves as the indication of its intensity, while too-long investment may cause the side effects.

2.2. The impact of PE on innovation

Lerner et al. examine patents filed by 472 firms that received private equity backing between 1986 and 2005 [8]. The research reveals that patents of private equity-backed companies, which are applied for in the years after PE are cited more often. There is no decline in the uniqueness and broad applicability of these patents, which are indicators of the depth of the research conducted. The overall volume of patent filings does not show consistent changes, but the companies’ patent collections become more specialized in the post-investment period. The areas where these companies focus on their patenting after private equity involvement and the company’s traditional strengths are particularly where the impact on the innovation is great.

The study of Amess et al. [9] indicates that private equity-supported leveraged buyouts (LBOs) have a constructive influence on patent filings and the quality of patents, as indicated by subsequent citations. The research reveals that LBOs stimulate the creation of innovative patents rather than merely increasing the number of strategic patents. This effect is mainly due to private-to-private LBO deals, especially within industries that are heavily reliant on financing and among companies that were likely to face financial limitations prior to the LBO. These findings align with the notion that PE firms alleviate financial restrictions in their portfolio companies, thereby enabling greater investment in innovative endeavors.

The impact of PE on innovation is more obvious in the field of science and technology. PE investment accelerate the process of the development and application of the technologies, which contributes to the economic growth [10]. Cai et al. examine the impact of PE on the innovation of Chinese new energy enterprises in the period of 2010-2017 [11]. The research finds that the PE investment significantly enhance the innovation of the companies, which is manifested in the sharp increase of the patent applications for the new energy companies. According to the research of Wang [12], PE investment plays a crucial role in the development of new energy startups ,enabling innovators advance and enhance society’s technological capabilities and the global environment through a progressive shift towards clean energy. Fabio rt al. also argue that the external PE investment can strongly boost the growth of new technology based firms [13].

2.3. The impact of PE on the employment

The impact of PE on employment has been at the centre of considerable heated policy debate. Davis et al. find that there is a 3% reduction in employment at the target companies within two years, and this decline increases to 6% over a five-year period [14]. The workforce reductions are primarily observed in public-to-private buyouts and in deals involving service and retail businesses. However, these companies also generate more new jobs and engage in quicker establishment acquisitions and divestitures. Taking these additional dynamics into account, the overall net job loss at the target firms is less than 1% of their original employment figures. Therefore, PE buyouts act as a catalyst for the process of creative destruction in the job market, resulting in a relatively minor net effect on employment levels. This response to creative destruction primarily entails a quicker redistribution of jobs across different units within the acquired companies. In another research by Davis et al. [15], PE still causes some labor loss. However, the labor loss in this case can position the company on a more sustainable path, decreasing the probability that the business will fail later with potentially even greater job losses, while establishing a foundation for expansion over the medium term.

Paglia et al. [16] examine the impact of PE on single entity establishments’ subsequent net sales and employment growth rates for small and mid-sized establishments that are free from acquisitions, sale of business divisions, and combinations. The initial effect of private equity financing on the growth of establishments is negligible. This is probably due to a significant time lag between initiating strategic alterations and observing the outcomes. The research indicates that private equity financing boosts the growth rates of establishments for a period of three years following the financing event. This conclusion is consistent with Davis’s theory mentioned before.

Gornall et al. [17] find that in private equity-owned companies, both the quality of jobs and the level of employee incentive pay are more closely linked to firm performance compared to publicly controlled firms. For every 1% increase in the rate of return on deals, there is an associated 0.7% increase in employee incentive pay. Transactions involving high leverage and employees who have less attractive alternative job options contribute to the decrease in job satisfaction following a buyout.

3. Conclusion

Private equity (PE) investment has emerged as a pivotal force shaping corporate development globally, with multifaceted impacts on enterprises in terms of performance, innovation, and employment. Through a synthesis of existing literature, this paper highlights several key findings.

Firstly, PE investment significantly enhances corporate performance, particularly in sales growth, profitability, and risk resilience. Studies indicate that foreign and state-backed PE institutions exert a stronger positive influence compared to private PE, underscoring the role of institutional credibility and resource advantages. Additionally, the time horizon of PE investment plays a critical role, with longer-term investments correlating with more pronounced performance improvements.

Secondly, PE acts as a catalyst for innovation, especially in technology-driven sectors. PE-backed firms demonstrate heightened specialization in patent portfolios and produce innovations with greater scientific depth and broader applicability. This effect is attributed to the alleviation of financial constraints and strategic guidance from PE firms, enabling companies to focus on high-impact R&D activities. Notably, in emerging industries such as China’s new energy sector, PE investment has spurred a surge in patent applications, reflecting its role in accelerating technological advancement.

Thirdly, the impact of PE on employment is nuanced. While short-term job reductions may occur during restructuring—particularly in public-to-private buyouts and service sectors—the long-term effects reveal a dynamic reallocation of labor. PE-backed firms exhibit faster job creation through acquisitions and expansions, ultimately resulting in minimal net employment loss. This aligns with the concept of "creative destruction," where resource reallocation enhances long-term sustainability and positions firms for medium-term growth. Besides the deal rate and the payment increased after the PE investment, which is beneficial to the employment of the enterprises.

However, this review acknowledges limitations in the existing research, including geographical biases (e.g., overrepresentation of developed economies), variations in PE strategies, and the need for longer-term data to assess enduring impacts. Future studies could explore cross-regional comparisons, the interplay between PE ownership structures and corporate governance, and sector-specific dynamics in innovation and employment.

In conclusion, private equity investment serves as a double-edged sword, balancing short-term restructuring with long-term value creation. Policymakers and corporate leaders should leverage its potential by fostering transparent regulatory frameworks and aligning PE strategies with sustainable growth objectives. For academia, this review underscores the necessity of interdisciplinary research to unravel the evolving role of PE in a rapidly changing global economy.

References

[1]. Fenn, G. W., Liang, N., & Prowse, S. (1997). The private equity market: An overveiw. Financial Markets, Institutions & Instruments, 6(4), 1-106.

[2]. Watt, A. (2008). The impact of private equity on European companies and workers: key issues and a review of the evidence. Industrial Relations Journal, 39(6), 548-568.

[3]. Battistin, E., Bortoluzzi, P., Buttignon, F., & Vedovato, M. (2017). Minority and majority private equity investments: firm performance and governance. Journal of Management & Governance, 21, 659-684.

[4]. XiaShu, Q. &MaXiao, J.(2021). Analysis of the impact of private equity investment on business performance - panel data from 429 companies listed on Second-board Market .Modern Finance (36), 119-121.doi:10.14097/j.cnki.5392/2021.36.036.

[5]. ShiDong, J. (2020). Empirical research on the impact of private equity investment funds on enterprise development (master's thesis, Shanghai University of Finance and Economics).master’s degree https://link.cnki.net/doi/10.27296/d.cnki.gshcu.2020.001445doi:10.27296/d.cnki.gshcu.2020.001445. (In Chinese)

[6]. Bruton, G. D., Filatotchev, I., Chahine, S., & Wright, M. (2010). Governance, ownership structure, and performance of IPO firms: The impact of different types of private equity investors and institutional environments. Strategic management journal, 31(5), 491-509.

[7]. Meles, A., Monferra, S., & Verdoliva, V. (2014). Do the effects of private equity investments on firm performance persist over time?. Applied Financial Economics, 24(3), 203-218.

[8]. Lerner, J., Sorensen, M., & Strömberg, P. (2011). Private equity and long‐run investment: The case of innovation. The Journal of Finance, 66(2), 445-477.

[9]. Amess, K., Stiebale, J., & Wright, M. (2016). The impact of private equity on 0firms׳ patenting activity. European Economic Review, 86, 147-160.

[10]. Link, A. N., Ruhm, C. J., & Siegel, D. S. (2014). Private equity and the innovation strategies of entrepreneurial firms: Empirical evidence from the small business innovation research program. Managerial and Decision Economics, 35(2), 103-113.

[11]. Cailou, J., & DeHai, L. (2022). Does venture capital stimulate the innovation of China's new energy enterprises?. Energy, 244, 122704.

[12]. Wang, J. (2023)Investigating the Roles, Influencing Mechanisms, and Outcomes of Private Equity and Venture Capital on Companies in High-Tech Renewable Energy Sectors. Highlights in Business, Economics and Management, Volume 24 (2024)

[13]. Bertoni, F., Colombo, M. G., & Grilli, L. (2005, September). External private equity financing and the growth of new technology based firms: The chicken and egg problem revisited. In Annual Entrepreneurship, Innovation and Small Business (EISB) Conference, Barcelona.

[14]. Davis, S. J., Haltiwanger, J. C., Jarmin, R. S., Lerner, J., & Miranda, J. (2011). Private equity and employment (No. w17399). National Bureau of Economic Research.

[15]. Davis, S. J., Haltiwanger, J., Handley, K., Lipsius, B., Lerner, J., & Miranda, J. (2021). The economic effects of private equity buyouts. Available at SSRN 3465723.

[16]. Paglia, J. K., & Harjoto, M. A. (2014). The effects of private equity and venture capital on sales and employment growth in small and medium-sized businesses. Journal of banking & finance, 47, 177-197.

[17]. Gornall, W., Gredil, O. R., Howell, S. T., Liu, X., & Sockin, J. (2024). Do employees cheer for private equity? the heterogeneous effects of buyouts on job quality. Management Science.

Cite this article

Zhang,J. (2025). The Impact of Private Equity Investment on Enterprises:A Review. Advances in Economics, Management and Political Sciences,174,34-38.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fenn, G. W., Liang, N., & Prowse, S. (1997). The private equity market: An overveiw. Financial Markets, Institutions & Instruments, 6(4), 1-106.

[2]. Watt, A. (2008). The impact of private equity on European companies and workers: key issues and a review of the evidence. Industrial Relations Journal, 39(6), 548-568.

[3]. Battistin, E., Bortoluzzi, P., Buttignon, F., & Vedovato, M. (2017). Minority and majority private equity investments: firm performance and governance. Journal of Management & Governance, 21, 659-684.

[4]. XiaShu, Q. &MaXiao, J.(2021). Analysis of the impact of private equity investment on business performance - panel data from 429 companies listed on Second-board Market .Modern Finance (36), 119-121.doi:10.14097/j.cnki.5392/2021.36.036.

[5]. ShiDong, J. (2020). Empirical research on the impact of private equity investment funds on enterprise development (master's thesis, Shanghai University of Finance and Economics).master’s degree https://link.cnki.net/doi/10.27296/d.cnki.gshcu.2020.001445doi:10.27296/d.cnki.gshcu.2020.001445. (In Chinese)

[6]. Bruton, G. D., Filatotchev, I., Chahine, S., & Wright, M. (2010). Governance, ownership structure, and performance of IPO firms: The impact of different types of private equity investors and institutional environments. Strategic management journal, 31(5), 491-509.

[7]. Meles, A., Monferra, S., & Verdoliva, V. (2014). Do the effects of private equity investments on firm performance persist over time?. Applied Financial Economics, 24(3), 203-218.

[8]. Lerner, J., Sorensen, M., & Strömberg, P. (2011). Private equity and long‐run investment: The case of innovation. The Journal of Finance, 66(2), 445-477.

[9]. Amess, K., Stiebale, J., & Wright, M. (2016). The impact of private equity on 0firms׳ patenting activity. European Economic Review, 86, 147-160.

[10]. Link, A. N., Ruhm, C. J., & Siegel, D. S. (2014). Private equity and the innovation strategies of entrepreneurial firms: Empirical evidence from the small business innovation research program. Managerial and Decision Economics, 35(2), 103-113.

[11]. Cailou, J., & DeHai, L. (2022). Does venture capital stimulate the innovation of China's new energy enterprises?. Energy, 244, 122704.

[12]. Wang, J. (2023)Investigating the Roles, Influencing Mechanisms, and Outcomes of Private Equity and Venture Capital on Companies in High-Tech Renewable Energy Sectors. Highlights in Business, Economics and Management, Volume 24 (2024)

[13]. Bertoni, F., Colombo, M. G., & Grilli, L. (2005, September). External private equity financing and the growth of new technology based firms: The chicken and egg problem revisited. In Annual Entrepreneurship, Innovation and Small Business (EISB) Conference, Barcelona.

[14]. Davis, S. J., Haltiwanger, J. C., Jarmin, R. S., Lerner, J., & Miranda, J. (2011). Private equity and employment (No. w17399). National Bureau of Economic Research.

[15]. Davis, S. J., Haltiwanger, J., Handley, K., Lipsius, B., Lerner, J., & Miranda, J. (2021). The economic effects of private equity buyouts. Available at SSRN 3465723.

[16]. Paglia, J. K., & Harjoto, M. A. (2014). The effects of private equity and venture capital on sales and employment growth in small and medium-sized businesses. Journal of banking & finance, 47, 177-197.

[17]. Gornall, W., Gredil, O. R., Howell, S. T., Liu, X., & Sockin, J. (2024). Do employees cheer for private equity? the heterogeneous effects of buyouts on job quality. Management Science.