1. Introduction

The global crisis had multiple causes, not the least of which was the rapid increase in overall debt levels (especially household debt) and the sharp rise in real estate prices in the U.S. The U.S. financial system underwent a profound transformation in the 1980s with the rise of securitization in the home mortgage market [1]. Banks and other financial institutions could obtain funds quickly through securitization after issuing home mortgages, thus effectively solving the problems of liquidity and capital turnover efficiency of financial institutions. However, in the process of securitization of home mortgages, credit risk was transferred from the original loan-issuing institutions to the securities investors. In order to pursue profits, some financial institutions will relax their credit screening standards for home mortgage applicants. In addition, regulators lacked adequate and effective regulatory tools to oversee the structure and process of traded financial products. In 2008, the subprime mortgage crisis triggered one of the worst economic crises in the history of the United States and the most serious financial crisis faced by mankind in recent times [2]. In order to address the economic problems created by the financial crisis, the United States passed a series of bills and policies, led by the American Dream Down Payment Act, to reduce the down payment ratio and loan interest rates for low-and middle-income families. It also requires government-affiliated financial agencies, such as Freddie MAC and Fannie Mae, to buy more low - and middle-income mortgages [3]. Under this policy, financial institutions began to pay attention to low-income people, using some tricks to make them apply for loans with low initial interest rates but gradually higher interest rates for house purchases. The main objective of this article is to identify the main causes of the worst financial crisis and to analyse the impact of different policies and institutions on economic performance and finance, based on a comparative analysis of the performance of different countries or regions in the financial crisis. Analysing the evolution and root causes of the financial crises that have occurred is useful for learning lessons from them and reducing the likelihood of similar crises in the future.

2. Definition of CDO and CDS

2.1. A collateralized debt obligation (CDO)

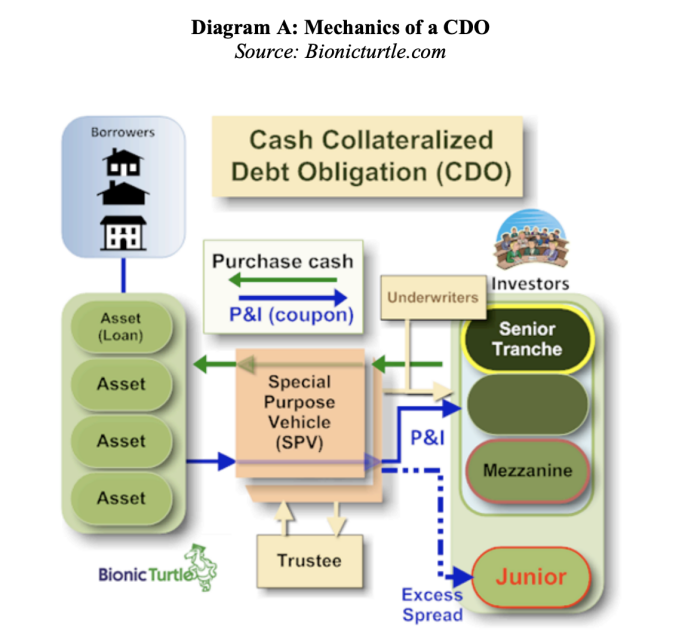

A collateralised debt obligation (CDO) is a structured financial product that consists of a group of debt assets, such as mortgages or bonds. Banks create CDOs in order to sell this debt to investors and thereby reduce their own risk.CDOs divide these assets into ‘tranches’ of different risk levels, with the higher priority tranche having a preferential claim on the defaulted collateral. Figure 1 gives an example of how a typical CDO works. More specifically, a CDO packages debt, such as mortgages, into securities and sells them to investors in stages, transferring risk from the original loan holders to the investors [4]. However, because the risk is underestimated and diversified, many investors do not fully appreciate the actual risk of these securities. In addition, CDOs mix high-risk loans with low-risk loans, making it difficult to assess risk in the normal way. In the event of market turmoil, a large number of low-quality assets in CDOs began to default, which in turn led to mounting losses [5].

Figure 1: Mechanics of a CDO [4]

2.2. The credit default swap (CDS)

Credit default swaps (CDS) were originally insurance sold by insurance companies and financial institutions to investors or companies concerned about the risk of defaulting on their debt holdings. By purchasing insurance on a specific bond, financial institutions and insurance agencies promise a corresponding payout if the product defaults or is downgraded [6]. However, CDSs have the advantage of being able to purchase insurance on bonds that they do not own, and there is no limit to the amount of insurance that can be purchased. For example, $100,000 can be used to purchase $10 million worth of CDS for bonds that are not owned by a financial institution or insurance company.When the bonds fail, the financial institution or insurance company must pay up to $10 million in insurance. Second, many financial institutions can issue CDS that are not owned by the insurance company, opening the door to later abuse. Typically, one must own something to purchase insurance, but CDSs have no such restrictions. It is because of this feature that CDS have gradually become a high-risk bet [7].

2.3. CDO and CDS

A CDS is a financial derivative used to hedge or speculate on the risk of a debt default. Investors can buy CDS to protect themselves against a debt default. And also, the highly leveraged and complex trading structure of the CDS market allows default risk to spread widely throughout the financial system. When a lot of debt defaults, the underlying CDS contracts also trigger a lot of payment demands, causing a ripple effect in financial markets. The relationship between the CDS and CDO were interconnect contributed to systemic risk. Furthermore, Investors in CDOs often use CDS to hedge against the risk of defaults within the underlying asset pool. This creates a layered risk management strategy [8].

3. Cause of the crisis

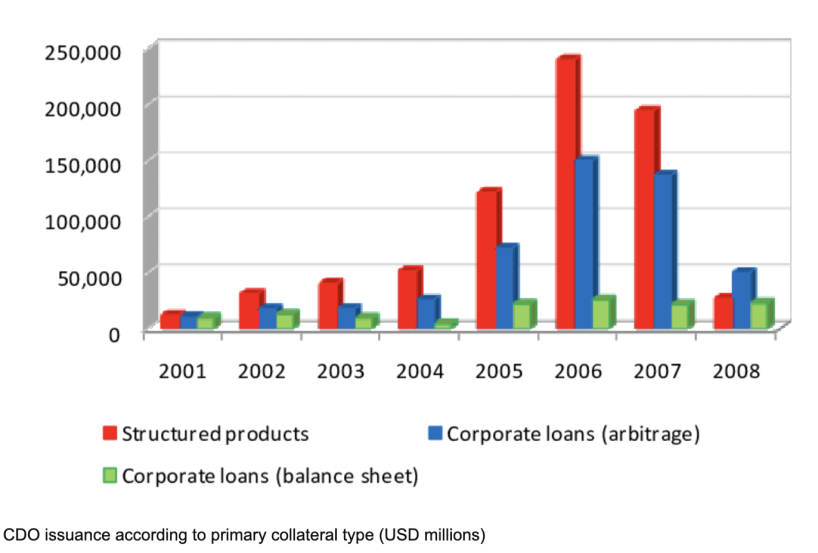

The emergence of subprime lending caused the house prices in the United States to begin to rise, which caused both the middle class and the poor to begin to take out loans to buy houses. In turn, the increase in the number of people taking out loans to buy houses would further stimulate the rise in house prices [9]. But when problems arose, the extremely high default rate of subprime loans would be more than banks could afford, and the huge amount of subprime loans would eventually lead to the emergence of CDOs. Banks packaged these subprime loans and issued them to investors, while transferring and marrying the risk of subprime loans to investors and earning a brokerage fee. The subsequent repayment of the money by the lender is a direct return of the money to the investor. Investment banks only needed the ability to create deals out of thin air to earn fees and service charges on successive trades. Under these circumstances, banks began to use unethical and even illegal tactics to lure low- and moderate-income individuals into applying for subprime loans, while masking the default risk of subprime-based CDOs through a complex grading system. In addition, some subprime loans had favorable interest rates in the first few years. From 2004 to 2007, a total of $1.4 trillion in CDOs were issued, which planted a super time bomb for the subsequent financial crisis. By 2002, risky loans such as subprime loans had become the focus of CDS. In 2003, the GDP of the United States was about $11 trillion and CDS accounted for $3.5 trillion (According to the Bernanke) (Figure 2) [10].

Figure 2: 2002-2008 CDO issuance [10]

4. The trouble of financial market

In the early years of subprime lending, interest incentives existed, but from 2007 onwards, as the interest incentives expired and the Federal Reserve began to raise interest rates, this led to an increasingly tight market in the United States. This was followed by the inability of low-income earners to repay their loans and a fall in house prices [7].

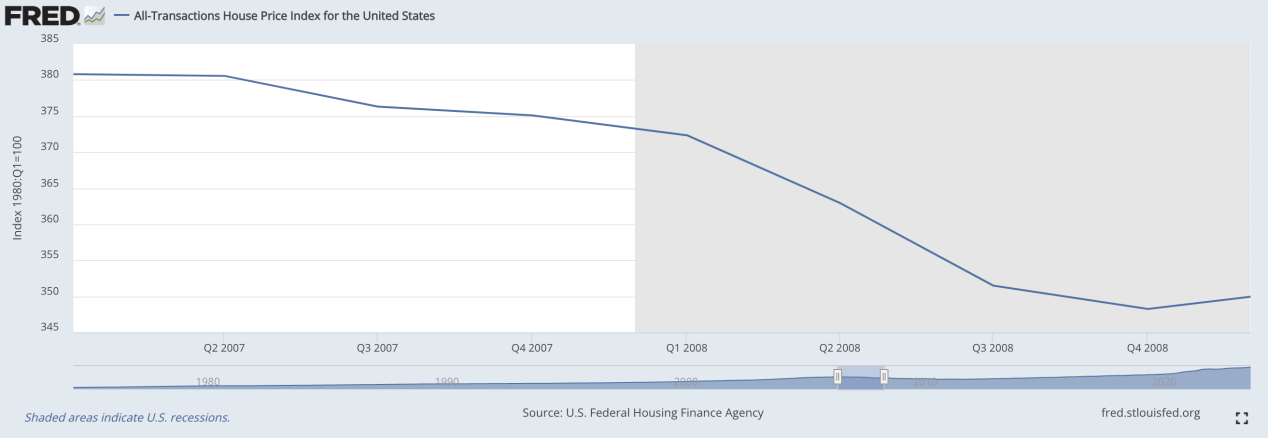

As shown in figure 3, house prices began to fall from the second quarter of 2007 onwards, and many people were unwilling to continue to pay for the depreciating prices. For example, a borrower who took out a $1 million loan from a bank to purchase a home now has a home worth only $700,000 as a result of depreciating home prices.And tracing the cause of the decline in home prices reveals that foreclosed homes are coming back into the market as most people are unable to pay their mortgages, resulting in an imbalance between the supply and demand of homes on the market. In addition, as home prices continued to fall, property holders chose to sell their homes, thus further exacerbating the increase in the number of homes on the market. All of this has led to a frenzied rise in subprime loan defaults [8].

In addition, erroneous ratings issued by the credit rating agencies (CRAs) have led CDS sellers to believe that they are insuring against credit events on financial products with a low probability of default. As CDO and CDS defaults worsened, trust between investors and financial institutions collapsed, exacerbating the market panic that led to the financial crisis.

Figure 3: Trends in U.S. Home Prices [8]

5. Conclusion

This paper analyzes and discusses the global financial crisis triggered by the scope of subprime mortgages and concludes that the cause was mainly subprime loans sort of financial manipulation.

Due to the introduction of the American Housing Act, investment banks found new opportunities in it and started inducing subprime loans to low-income people who could not afford to buy a house. Then, they transferred the capital risk by trading through various financial instruments, such as Cdos, CDS and even highly leveraged loans. And with other financial institutions, including savings banks, insurance companies and pension funds following suit, the risk level was increased indefinitely. It wasn't until low-income borrowers were unable to repay their loans that the whole system began to gradually collapse and eventually caused the financial crisis. In the wake of the financial crisis, low-income borrowers were left with huge debts and lost ownership of their homes. And investors were hit hard. As the financial crisis had a large negative impact on the society, the U.S. government had to bail out the financial market with the use of fiscal and tax revenues. However, the analysis of the subprime crisis in this paper is only based on the finished literature and data, and only through the perspective of CDO, so the comprehensiveness of the article is still to be improved.

References

[1]. Stiglitz, J.E. (2009) 'The current economic crisis and lessons for economic theory,' Eastern Economic Journal, 35(3), pp. 281–296. https://doi.org/10.1057/eej.2009.24.

[2]. Overbeek, H. (2012) 'Sovereign debt crisis in Euroland: root causes and implications for European integration,' The International Spectator, 47(1), pp. 30–48. https://doi.org/10.1080/03932729.2012.655006.

[3]. Adrian, T. and Shin, H.S. (2010) 'The changing nature of financial intermediation and the financial crisis of 2007–2009,' Annual Review of Economics, 2(1), pp. 603–618. https://doi.org/10.1146/annurev.economics.102308.124420.

[4]. Buffet, M. (2016) 'How do CDOs and CDSs influence the crisis of 2008,' Lingnan Journal of Banking, Finance and Economics, 6(1), p. 2. https://commons.ln.edu.hk/cgi/viewcontent.cgi?article=1032&context=ljbfe.

[5]. Oro, O.U. (2018) The nature of finance - growth relationship: Evidence from a Panel of Oil-Producing Countries.

[6]. Felsenheimer, J., & Gisdakis, P. (2008). Credit crises: From Tainted Loans to a Global Economic Meltdown. John Wiley & Sons.

[7]. Barnett-Hart, A. K. (2009). The story of the CDO market meltdown: An Empirical Analysis.

[8]. Chunanuntathum, S. (2002). Official intervention in forward foreign exchange market and the financial loss for the case of the Bank of Thailand in the 1997 currency crisis. Thammasat Review, 7(1), 142–186. https://sc01.tci-thaijo.org/index.php/tureview/article/download/40915/33861

[9]. Muolo, P., & Padilla, M. (2009). Chain of blame: how Wall Street caused the mortgage and credit crisis. Choice Reviews Online, 46(05), 46–2794. https://doi.org/10.5860/choice.46-2794

[10]. Mian, A., & Sufi, A. (2008). The consequences of mortgage credit expansion: Evidence from the 2007 Mortgage Default Crisis.

Cite this article

Tang,Y. (2025). Analysis of the 2008 Financial Crisis in the United States. Advances in Economics, Management and Political Sciences,175,123-127.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Stiglitz, J.E. (2009) 'The current economic crisis and lessons for economic theory,' Eastern Economic Journal, 35(3), pp. 281–296. https://doi.org/10.1057/eej.2009.24.

[2]. Overbeek, H. (2012) 'Sovereign debt crisis in Euroland: root causes and implications for European integration,' The International Spectator, 47(1), pp. 30–48. https://doi.org/10.1080/03932729.2012.655006.

[3]. Adrian, T. and Shin, H.S. (2010) 'The changing nature of financial intermediation and the financial crisis of 2007–2009,' Annual Review of Economics, 2(1), pp. 603–618. https://doi.org/10.1146/annurev.economics.102308.124420.

[4]. Buffet, M. (2016) 'How do CDOs and CDSs influence the crisis of 2008,' Lingnan Journal of Banking, Finance and Economics, 6(1), p. 2. https://commons.ln.edu.hk/cgi/viewcontent.cgi?article=1032&context=ljbfe.

[5]. Oro, O.U. (2018) The nature of finance - growth relationship: Evidence from a Panel of Oil-Producing Countries.

[6]. Felsenheimer, J., & Gisdakis, P. (2008). Credit crises: From Tainted Loans to a Global Economic Meltdown. John Wiley & Sons.

[7]. Barnett-Hart, A. K. (2009). The story of the CDO market meltdown: An Empirical Analysis.

[8]. Chunanuntathum, S. (2002). Official intervention in forward foreign exchange market and the financial loss for the case of the Bank of Thailand in the 1997 currency crisis. Thammasat Review, 7(1), 142–186. https://sc01.tci-thaijo.org/index.php/tureview/article/download/40915/33861

[9]. Muolo, P., & Padilla, M. (2009). Chain of blame: how Wall Street caused the mortgage and credit crisis. Choice Reviews Online, 46(05), 46–2794. https://doi.org/10.5860/choice.46-2794

[10]. Mian, A., & Sufi, A. (2008). The consequences of mortgage credit expansion: Evidence from the 2007 Mortgage Default Crisis.