1. Introduction

Financing is critical for small and medium-sized listed companies (SMEs) around the world. Because it affects the company's operational capabilities, expansion opportunities and market competitiveness. The occurrence of the financial crisis has affected the capital structure to varying degrees, including increased uncertainty and risk, and lower investor returns [1]. And according to theoretical knowledge, the difference between listed companies and non-listed companies is that the former are more likely to obtain financing from the capital market [2]. However, after the financial crisis in 2007 and the following years, the availability of corporate debt dropped sharply [3]. In the context of a financial crisis, credit is often tightened, and financial institutions and banks will be more stringent in their loan reviews. And as the share prices of many small and medium-sized listed companies fell sharply during the crisis and their market capitalizations shrank, investors' willingness to invest declined significantly.

According to the statistics of the United States International Trade Commission, the proportion of SMEs in total merchandise exports continued to rise from 1997 to 2010, reaching a peak of 10% of all exports [4]. This is enough to illustrate the importance of SMEs in the overall economic production level. The purpose of this paper is to use bibliometrics to analyses research on the financing capabilities of SMEs during the financial crisis in 2007-2012. This paper aims to highlight the lack of literature review data on the impact of financial crises on the financing capabilities of SMEs. There is currently little research on the use of data to analyze SMEs funding, and this paper aims to fill this research gap.

2. Literature Review

2.1. The Relationship Between Financing Costs and Corporate Performance

There is a significant relationship between financing cost and firm performance. And it is related to the trade-off between the cost and benefits of debt financing [5]. An increase in financing costs usually means that the company needs to pay higher interest or fees when obtaining funds, which directly affects its profitability. Theoretical explanations suggest that firms need higher levels of working capital and thus require financing. Therefore, companies face additional financing costs and an increased likelihood of bankruptcy [6]. According to Faulkender and Wang's research, they used a benchmark valuation model to conclude that an increase in the net working capital of listed companies will lead to a decrease in excess shares [7]. This shows that investors' confidence in the company has increased, and rising stock prices have reduced the market's demand for excess shares.

2.2. Capital Structure Theory

Capital structure theory discusses how companies choose the ratio of debt to equity during the financing process, with the goal of optimizing capital costs and risk management. There are generally two types of corporate financing: internal financing and external financing. Internal financing is related to retained earnings, while external financing is carried out in the form of loans or equity [8]. The theory suggests that there is an ideal structure in capital structure called the trade-off model. The role is to maximize the value of the company while balancing the costs and benefits of debt, and the optimal debt will be considered from various perspectives [9]. When choosing capital, companies will weigh the destructive costs brought by debt. Moderate debt reduces a company's overall financing costs, but excessive debt will reduce shareholder returns. According to the pecking order theory, there is no clear upper or lower limit to a firm's optimal debt level. According to the order of corporate financing, companies tend to rely on internal financing followed by external financing. If external financing is chosen, direct debt will be given priority, followed by convertible debt and finally equity issuance. [10]. Market timing theory holds that companies will adjust their financing methods according to changes in market conditions. Firms are more likely to use external equity financing when the cost of equity is lower, according to the market timing theory explained in the study by Huang and Ritter. When the cost of equity is too high, companies tend to use direct debt financing [11]. This proves that companies tend to issue stocks when the market environment is good, but directly use debt financing when the environment is bad.

2.3. The Impact of the Financial Crisis on Investor Confidence

The impact of the financial crisis on consumers and investors is profound and complex. Therefore, many scholars and economists believe that it is the collapse and lack of confidence that have led to the deepening and persistence of the crisis, especially the impact on the global real economy [12]. According to the definition of consumer confidence in psychology: consumer behavior depends not only on purchasing power, but also on purchasing willingness [13]. Investor confidence was further eroded during the financial crisis by the media's frequent emphasis on bad news when reporting on the state of the economy. As financial market instability during the crisis led to rising unemployment, reduced income and monetary inflation. Investors' willingness and ability to invest have been further hit. According to Jansen and Nahuis's research, there is a strong positive correlation between stock returns and changes in stock market sentiment, and the impact cycle is within 2 weeks to 1 month. Therefore, they believe that the relationship between the stock market and investor confidence depends on the overall economic trend [14]. In addition, the impact of financial crises may also be long-term, and investors tend to develop more conservative consumption habits after experiencing a crisis. Research shows that this explains the financial crisis after the subprime mortgage bubble burst. Although the stock market has entered a period of adjustment, the sensitivity of households' future financial expectations to stock market returns has decreased [15].

3. Research Method

This paper aims to systematically analyze relevant research on the relationship between financing costs and corporate performance during the financial crisis through bibliometric methods. This paper will use multiple quantitative indicators, including: the number of articles published and the number of citations, the region where the research was published, keyword cloud maps and citation network analysis. This article will use Web of Science as the database. Academic articles related to financing costs and firm performance in the context of the 2007-2012 financial crisis will be used as data. This paper aims to comprehensively assess the research dynamics and trends in this field. Bibliometric research is a research technique that provides a quantitative overview of a research field [16]. Bibliometrics may involve cluster analysis [17]. These include citation analysis, co-citation analysis, bibliographic coupling, co-author analysis, and co-word analysis [18]. In addition, this paper will use the VOSviewer visualization tool to present the analysis results in the form of a keyword cloud diagram and facilitate understanding and interpretation. The aim is to present the research hotspots and their evolution in an intuitive manner.

4. Results and Discussion

4.1. Analysis of the Number of Research Publications

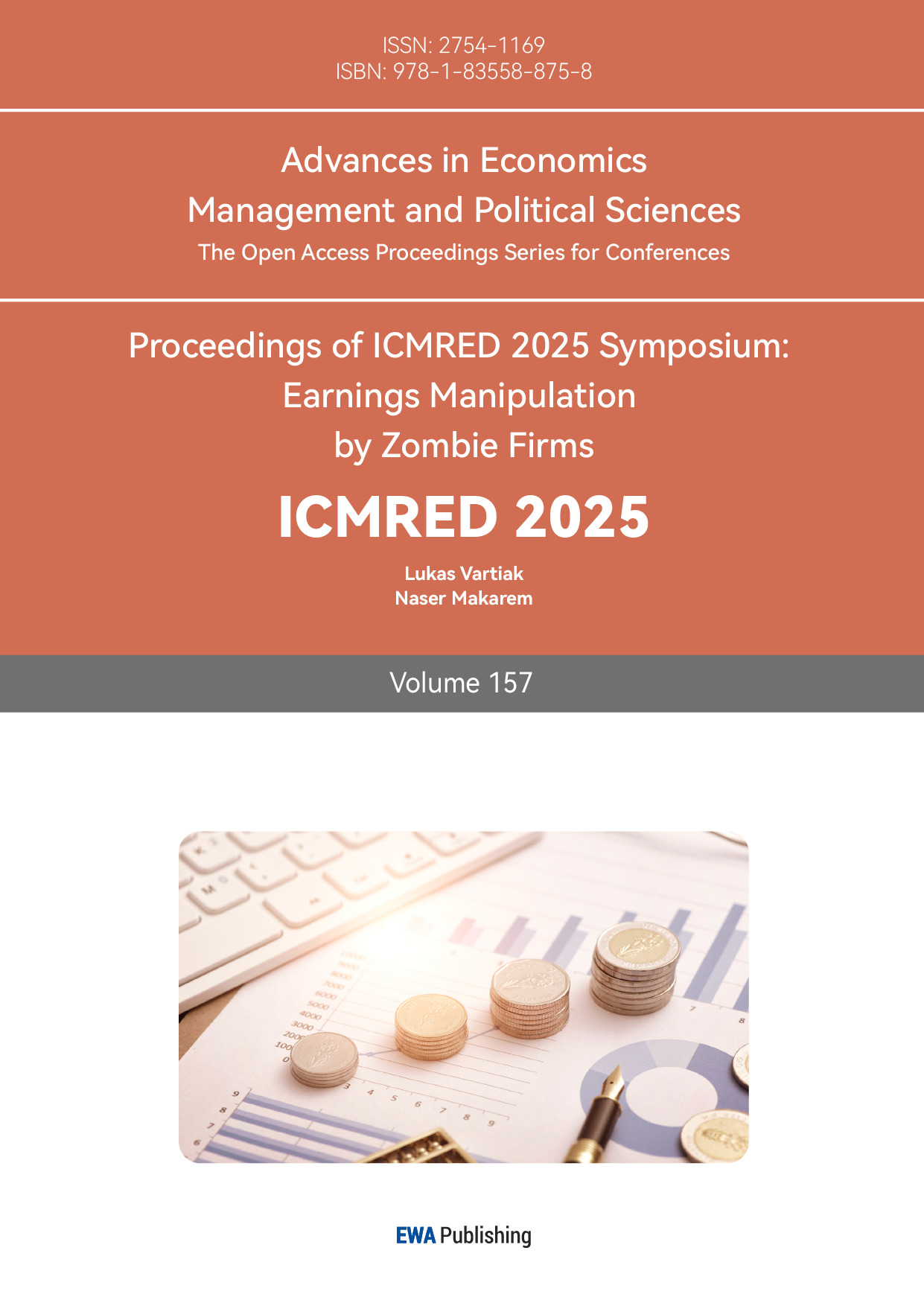

In general, the changes in the number of publications from 2007 to 2012 (Figure 1) show how quickly research activities grew, especially during the busiest time in 2011. This shows that research aims to help SMEs protect their ability to raise funds during financial crises. Preliminary results show that not many scholars paid attention to the economic crisis when it started. Subsequently, it rose slightly to 48 articles in 2008, indicating a gradual increase in research on the impact of the financial crisis on the economy. In 2009, the number of publications further increased to 73. This increase was most evident in 2011, which showed that although the crisis had passed, the impact was far-reaching. This year had the greatest impact on the financing capabilities of SMEs around the world.

In general, the changes in the number of publications from 2007 to 2012 show how quickly research activities grew, especially during the busiest time in 2011. This shows that research on how to help SMEs get money during the crisis grew a lot during this time.

Figure 1: Number of Publications from 2007 – 2012

4.2. Regional Analysis of Research Publications

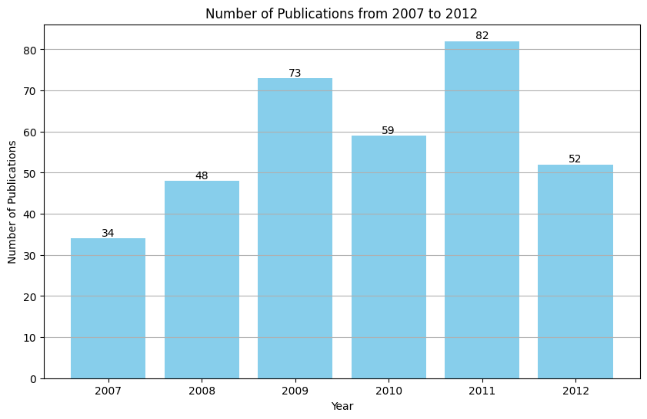

Figure 2 shows the number of academic publications in various countries in the field of financing costs and corporate performance. As other studies do not show the country of publication, the chart below only summarizes 267 of the 350 studies. It is clear from the data that China is far ahead in the research on the impact of financing on SMEs, with a total of 199 articles published, demonstrating its strong activity and academic influence on this research topic. This outcome might show that China is still putting investment into economic research on how SMEs get loans and how important it thinks these issues are, especially since China’s market and access to capital are growing so quickly.

Since the scope of the literature was limited to a sample of 350 articles, the sample size was relatively small. Therefore, in comparison, the number of publications from other countries is significantly lower, such as Latvia, England, and Brazil, which have 4, 3, and 1 publication respectively, indicating a relatively low level of research participation. This difference may be related to the economic development stage, academic resources and research focus of each country. Overall, figure 2 highlights China's important position in this research field, while also pointing out the relative lag of other countries in related research, suggesting that international cooperation and exchanges can be strengthened in the future to promote in-depth exploration of the relationship between financing costs and corporate performance on a global scale.

Figure 2: Number of Publications by Country

4.3. Analysis of Article Citations

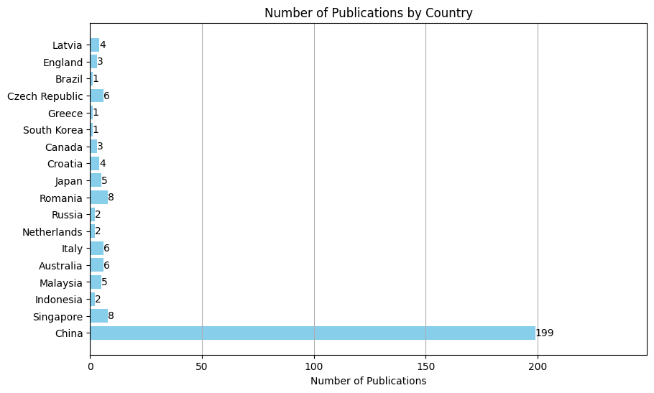

The Figure 3 shows the trend in citations for academic papers from 2007 to 2012. According to the National Bureau of Economic Research, the recession began in December 2007 and ended in June 2009, lasting 18 months [19]. It is worth noting that the highest number of citations was in 2011, reaching 1,351. It still shows that the impact of the 2011 financial crisis is still far-reaching, and the research field on the impact of SMEs financing is deepening. In contrast, the citation counts for 2008 and 2010 were lower, at 780 and 728 respectively, indicating that the research impact in these years was relatively weak. The above data reflect the research influence of SME financing issues in different years. The highest number of citations was in 2011, with 1,351; this may be because SMEs had a harder time getting loans after the financial crisis. This shows how the crisis had different effects, such as making the credit market tighter, companies paying more attention to financial risks and risk control, and government intervention. SMEs are facing higher financing costs and stricter loan conditions. Scholars continue to deepen their research in this field. Overall, this trend may reflect the relevance and importance of the research content in a particular year.

Figure 3: Cited References Count by Publication Year

4.4. Visual Analysis of Research Keyword Density

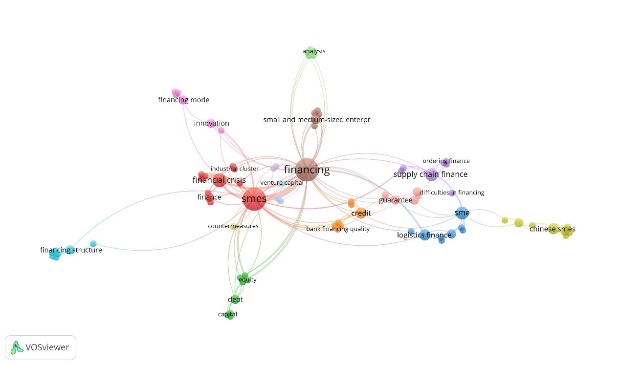

According to Figure 4, the two nodes "financing mode" and "financing structure" show the research on different financing methods and structures during the research period of the financial crisis. This may include traditional financing, supply chain financing and other methods to meet the diverse needs of small and medium-sized enterprises. Keywords such as “credit”, “logistics finance” and “supply chain finance” indicate the interaction of finance research with other fields, emphasizing the importance of finance in supply chain management and logistics. This interaction reflects the close connection between financing and operations management in the modern economy. The emergence of the “immigration” and “industrial structure” nodes indicates that researchers are also exploring how external factors affect SME financing. These factors may include the policy environment, market dynamics and socio-economic conditions. Concerns about the quality of bank loans may affect the availability and cost of loans for SMEs, as shown by the node "bank financing quality." This suggests that researchers should look at the role of banks when they study financing.

Figure 4: Keyword cloud analysis in abstract

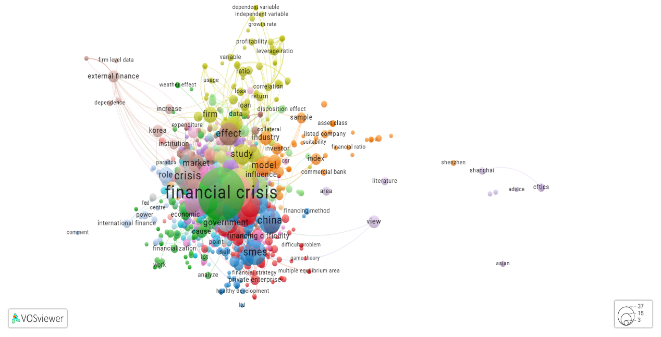

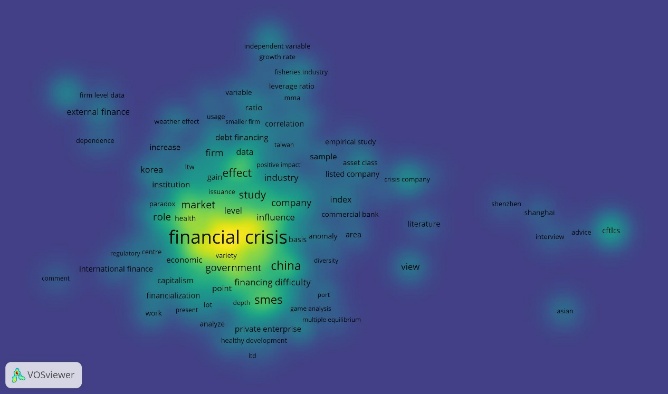

According to Figure 5, “Financial crisis” is the core theme, and a large number of related keywords are gathered around it, such as “SMEs”, “government”, “model” and “study”. This shows that researchers are concerned about the impact of the financial crisis on small and medium-sized enterprises and government policies. Research trends can be seen from the connection and density of nodes (Figure 6): First, the prominent position of small and medium-sized enterprises. "SMEs", as an important theme is closely linked to "financial crisis". This shows that researchers pay special attention to the impact of financial crises on the financing, operation and survival of SMEs, reflecting the importance of SMEs in the economy and their vulnerability. The second is the increase in policy research: the “government” node is closely linked to multiple related topics (such as “crisis”, “effect”, etc.), showing the core role of policy intervention in responding to financial crises. Researchers are interested in how governments formulate policies to support small and medium-sized enterprises and economic recovery, indicating an increasing trend in policy research. Finally, there is the regional issue. The emergence of country-specific keywords (such as “China”) indicates an increasing trend in research on regional impacts in China.

Figure 5: Network visualization of all keywords

Figure 6: Density visualization of all keywords

4.5. Author Co-citation Network View & Number of Citations by Publishing Institution and Scholars

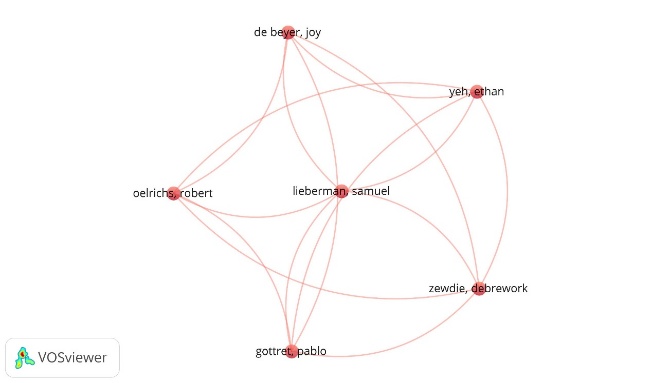

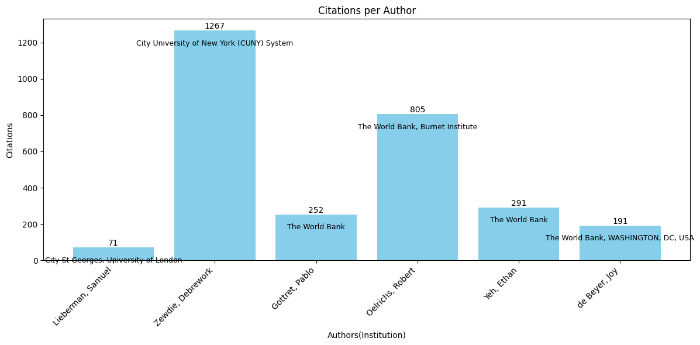

From the following author co-citation chart (Figure 7 and 8), it can be analyzed that the nodes in the chart represent authors and the lines represent the co-citation relationship between authors. The more lines there are, the higher the number of co-citations. The strong connection between Zewdie, Debrework and Oelrichs, Robert indicates that the research of these two authors may have similar themes or viewpoints. The central author is Lieberman, Samuel, indicating that the scholar's research is highly relevant to the research topics of other scholars. The next analysis table shows the number of citations received by the author and the institution to which he or she belongs. Zewdie, Debrework has a significantly high number of citations of 1267, far exceeding other authors. This evidence suggests that his influence and contribution may be the greatest in the research field on the impact of SMEs’ financing capacity. The citation counts of Oelrichs, Robert and Gottret, Pablo were 805 and 252 respectively, indicating that they also made certain contributions to the field, but the contributions were relatively low. And most of the authors are from the World Bank. This shows that the World Bank has invested a lot of money in studying the financing capacity of SMEs, with the aim of helping SMEs get rid of the difficulties of financing.

Figure 7: Scholar co-citation network view

Figure 8: Total Citation Counts of Selected Scholars

5. Conclusion

During financial crises, SMEs often face severe restrictions on access to capital, jeopardizing their operations and growth prospects. This situation is exacerbated by a decline in investor confidence, with market uncertainty causing potential investors to adopt a more conservative approach. To mitigate these adverse effects, it is crucial to restore investor confidence, which requires targeted policies and measures proposed in the literature to enhance the stability and attractiveness of investing in SMEs. Enhancing the financing capabilities of SMEs in the market is also crucial.

To sum up, small and medium-sized enterprises (SMEs) have a harder time getting loans when the economy is bad, but the bibliometric analysis shows that restoring investor confidence and putting in place policies that help SMEs are the only ways to make things better and encourage long-term growth in the sector. This series of analyses not only provides a basis to understand the current research status, but also points out the direction for future policy making and academic research.

References

[1]. Dick, C., et al. (2013). Macro-expectations, aggregate uncertainty, and expected term premia. European Economic Review, 64, 1-19.

[2]. Demirgüç-Kunt, A., Peria, M. S. M., & Tressel, T. (2020). The global financial crisis and the capital structure of firms: Was the impact more severe among SMEs and non-listed firms?. Journal of Corporate Finance, 60, 101514.

[3]. Amon, N. A., & Dorfleitner, G. (2013). The influence of the financial crisis on mezzanine financing of European medium-sized businesses–an empirical study. Journal of Small Business & Entrepreneurship, 26(2), 169-181.

[4]. United States International Trade Commission. (2010). Small and medium-sized enterprises: Overview of participation in U.S. exports (Investigation No. 332-508, USITC Publication 4125). https://www.usitc.gov/publications/332/pub4125.pdf

[5]. Harris, M. and Raviv, A. (1991), “The theory of capital structure”, Journal of Finance, Vol. 46 No. 1, pp. 297-355

[6]. Kieschnick, R. L., Laplante, M., & Moussawi, R. (2011). Working capital management and shareholder wealth. Ssrn.

[7]. Faulkender, M., & Wang, R. (2006). Corporate financial policy and the value of cash. The journal of finance, 61(4), 1957-1990.

[8]. Mostafa, H. T., & Boregowda, S. (2014). A brief review of capital structure theories. Research Journal of Recent Sciences, ISSN, 2277, 2502.

[9]. Ghazouani, T. (2013). The capital structure through the trade-off theory: Evidence from Tunisian firm. International Journal of Economics and Financial Issues, 3(3), 625-636.

[10]. Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

[11]. Huang, R., & Ritter, J. R. (2005). Testing the market timing theory of capital structure. Journal of Financial and Quantitative Analysis, 1(2), 221-246.

[12]. Dees, S., & Brinca, P. S. (2013). Consumer confidence as a predictor of consumption spending: Evidence for the United States and the Euro area. International Economics, 134, 1-14.

[13]. Katona, G. 1968. Consumer Behavior: Theory and Findings on Expectations and Aspirations. The American Economic Review, 58(2), pp.19-30.

[14]. Jansen, W. J., Nahuis, N. J. 2003. The Stock Market and Consumer Confidence: European Evidence. Economics Letters, 79(1), 89-98.

[15]. Ferrer, E., Salaber, J., & Zalewska, A. (2016). Consumer confidence indices and stock markets' meltdowns. The European Journal of Finance, 22(3), 195-220.

[16]. [Fetscherin, M., & Heinrich, D. (2015). Consumer brand relationships research: A bibliometric citation meta-analysis. Journal of Business Research, 68(2), 380-390. https://doi.org/10.1016/j.jbusres.2014.06.010

[17]. Rodríguez, A., & Laio, A. (2014). Clustering by fast search and find of density peaks. Science, 344(6191), 1492-1496. https://doi.org/10.1126/science.1242072

[18]. Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429-472. https://doi.org/10.1177/1094428114562629

[19]. WSJ. (2008). NBER makes it official: Recession started in December 2007. The Wall Street Journal. https://www.wsj.com/articles/BL-REB-2390

Cite this article

Sheng,J. (2025). The Impact of Financial Crises on the Financing Capabilities of Small and Medium-Sized Listed Companies: A Bibliometric Analysis. Advances in Economics, Management and Political Sciences,157,36-43.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Earnings Manipulation by Zombie Firms

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Dick, C., et al. (2013). Macro-expectations, aggregate uncertainty, and expected term premia. European Economic Review, 64, 1-19.

[2]. Demirgüç-Kunt, A., Peria, M. S. M., & Tressel, T. (2020). The global financial crisis and the capital structure of firms: Was the impact more severe among SMEs and non-listed firms?. Journal of Corporate Finance, 60, 101514.

[3]. Amon, N. A., & Dorfleitner, G. (2013). The influence of the financial crisis on mezzanine financing of European medium-sized businesses–an empirical study. Journal of Small Business & Entrepreneurship, 26(2), 169-181.

[4]. United States International Trade Commission. (2010). Small and medium-sized enterprises: Overview of participation in U.S. exports (Investigation No. 332-508, USITC Publication 4125). https://www.usitc.gov/publications/332/pub4125.pdf

[5]. Harris, M. and Raviv, A. (1991), “The theory of capital structure”, Journal of Finance, Vol. 46 No. 1, pp. 297-355

[6]. Kieschnick, R. L., Laplante, M., & Moussawi, R. (2011). Working capital management and shareholder wealth. Ssrn.

[7]. Faulkender, M., & Wang, R. (2006). Corporate financial policy and the value of cash. The journal of finance, 61(4), 1957-1990.

[8]. Mostafa, H. T., & Boregowda, S. (2014). A brief review of capital structure theories. Research Journal of Recent Sciences, ISSN, 2277, 2502.

[9]. Ghazouani, T. (2013). The capital structure through the trade-off theory: Evidence from Tunisian firm. International Journal of Economics and Financial Issues, 3(3), 625-636.

[10]. Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

[11]. Huang, R., & Ritter, J. R. (2005). Testing the market timing theory of capital structure. Journal of Financial and Quantitative Analysis, 1(2), 221-246.

[12]. Dees, S., & Brinca, P. S. (2013). Consumer confidence as a predictor of consumption spending: Evidence for the United States and the Euro area. International Economics, 134, 1-14.

[13]. Katona, G. 1968. Consumer Behavior: Theory and Findings on Expectations and Aspirations. The American Economic Review, 58(2), pp.19-30.

[14]. Jansen, W. J., Nahuis, N. J. 2003. The Stock Market and Consumer Confidence: European Evidence. Economics Letters, 79(1), 89-98.

[15]. Ferrer, E., Salaber, J., & Zalewska, A. (2016). Consumer confidence indices and stock markets' meltdowns. The European Journal of Finance, 22(3), 195-220.

[16]. [Fetscherin, M., & Heinrich, D. (2015). Consumer brand relationships research: A bibliometric citation meta-analysis. Journal of Business Research, 68(2), 380-390. https://doi.org/10.1016/j.jbusres.2014.06.010

[17]. Rodríguez, A., & Laio, A. (2014). Clustering by fast search and find of density peaks. Science, 344(6191), 1492-1496. https://doi.org/10.1126/science.1242072

[18]. Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429-472. https://doi.org/10.1177/1094428114562629

[19]. WSJ. (2008). NBER makes it official: Recession started in December 2007. The Wall Street Journal. https://www.wsj.com/articles/BL-REB-2390