1. Introduction

In China's capital market, the A-share market (the domestic stock market in the Chinese mainland) and the H-share market (Hong Kong stock market) are the two most representative markets. Although both the two markets mainly serve Chinese enterprises, and the two markets are geographically adjacent, and with the acceleration of the opening-up process of China's capital market in recent years, the two markets have achieved interconnection through mechanisms such as the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect, significantly enhancing the flow of funds and information transmission between the two markets. However, for A+H dual-listed companies (companies listed simultaneously on the A-share market and the H-share market), there are long-term systematic differences in valuations between the two markets. Data shows that the price-earnings ratio of A-share market is generally higher than that of the same type of enterprises in the Hong Kong stock market, and the valuation difference in some industries even exceeds 50%. Understanding the reasons for this difference is of great significance for optimizing cross-market asset allocation, preventing systemic risks, and improving the cross-market interconnection mechanism. Traditional financial theory explains this phenomenon from the perspectives of capital control and liquidity premium, but its insufficient attention to investors' irrational behavior has led to a gradual weakening of its explanatory power in the context of deepening cross-market integration. However, the research on market irrational factors in behavioral finance provides a new perspective for this difference. Theories in behavioral finance such as investor sentiment and herd behavior all demonstrate strong explanatory power for this difference. Therefore, this article will explain the reasons for the valuation variance between the two markets from the emerging field of behavioral finance. Specifically, this thesis will analyze the reasons for this difference from three behavioral finance perspectives, namely, how the difference in investor structure, with individual investors dominating the A-share market and institutional investors dominating the H-share market, causes the price difference between the A-share market and the H-share market; how the difference in the degree of herd behavior between the A-share market and the H-share market causes the price difference of the same company's stocks in the A-share market and the H-share market (AH price difference); and how the investor sentiment in the A-share market and the H-share market causes the AH price difference. Theoretically, this paper summarizes various research results in the academic field to provide inspiration and a theoretical basis for subsequent related research. Practically, the conclusions of this paper can provide a basis for policy-making departments to optimize relevant capital market rules such as the interconnection, and at the same time provide investors with a more comprehensive market analysis framework to help them make wiser investment decisions, conduct more effective cross-market asset allocation and risk management, and understand the operation rules and mechanisms of the China stock market in the context of globalization. In addition, the behavioral comparison of the "retail-oriented" feature of the A-share market and the "institutional-oriented" feature of the H-share market can also provide a typical case in the Chinese context for the study of investor structure in global emerging markets.

2. Empirical Evidences on the Existence of Price Differences Between Two Stock Markets

According to the research conducted by Wang Shujie and Wang Junwen, since 2015, the majority of Chinese-funded A-shares have shown a premium compared to H-shares. Meanwhile, there are 125 public companies that issue both A and H shares. As of August 11, 2020, the average ratio of A-share prices to H-share prices of these 125 listed companies is 3.36. The average premium rate of A/H shares for these 125 listed companies is 236.44%, meaning that the average A-share price of these listed companies is 3.36 times the average H-share price. The two also specifically listed the specific situations of 12 A-share and H-share joint-listed companies' stocks, as shown in the table [1]. This disparity not only manifests at the overall market level but also at the specific industry level.

Table 1: A/H Share Price Ratio and premium of 12 Listed Companies [1].

Numerical order | Company name | H-share code | latest price (HKD) | The rise and fall of stock prices (H share) | A-share code | latest price (RMB) | The rise and fall of stock prices (A share) | The ratio of A share price to H share price | Premium ratio (A/H)% |

1 | Ping An Insurance | 2318 | 82.4 | 0.49% | 601318 | 76.77 | -0.31% | 1.04 | 3.95 |

2 | Tigermed | 3347 | 109.6 | -0.63% | 300347 | 103 | -2.42% | 1.05 | 4.85 |

3 | China Merchants Bank | 3968 | 38.9 | 4.57% | 600036 | 37.54 | 1.46% | 1.08 | 7.67 |

4 | WuXi AppTec | 2359 | 117 | -2.66% | 603259 | 113.25 | 0.04% | 1.08 | 7.99 |

5 | Weichai Power | 2338 | 16.54 | -2.13% | 338 | 16.05 | -1.83% | 1.08 | 8.26 |

6 | Anhui Conch Cement | 914 | 59.75 | 0.08% | 600585 | 60.55 | -1.70% | 1.13 | 13.06 |

… | … | … | … | … | … | … | … | … | |

120 | China Suntien Green Energy | 956 | 2.34 | 2.63% | 600956 | 10.61 | -3.28% | 5.06 | 405.88 |

121 | CSC Financial | 6066 | 11.8 | -5.30% | 601066 | 55.08 | -7.07% | 5.21 | 420.79 |

122 | Zhejiang Shibao | 1057 | 1 | 0.00% | 2703 | 5.04 | -3.45% | 5.62 | 462.31 |

123 | Shandong Molong Petroleum Machinery | 568 | 0.71 | 2.90% | 2490 | 3.59 | -2.71% | 5.64 | 464.13 |

124 | Shanghai Fudan-Zhangjiang Bio-Pharmaceutical | 1349 | 5.66 | -2.41% | 688505 | 30.16 | -2.62% | 5.95 | 494.51 |

125 | Luoyang Glass | 1108 | 2.93 | -1.68% | 600876 | 16.91 | -0.12% | 6.44 | 543.91 |

Average | 3.36 | 236.44 |

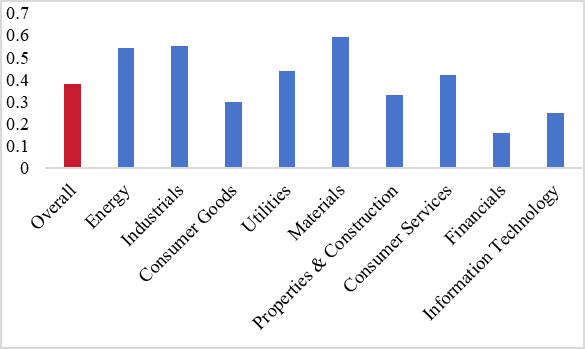

According to the statistics by Bai et al., as shown in the figure, all the stocks of the listed companies in the nine major industries on both A-share and H-share markets exhibited a positive premium of A-share over H-share [2]. As for individual stocks, taking Midea as an example, the issue price of its H-share on the first day of listing was 54.8 HKD, while the A-share price of Midea was 63.51 RMB during the same period.

Figure 1: Summary of Premiums of A-shares and H-shares Classified by Industry [2].

3. Explanation of AH Stock Price Differences from the Perspective of Behavioral Finance

3.1. Differences in Investor Structure

Firstly, the academic community explains the price differences between the two markets by the differences in the composition of investors. According to the research of China International Capital Corporation (CICC), as a market dominated by retail investors, in the free float market value of A-shares, the proportion of institutional investors' holdings is only 19%, while the proportion of individual investors' holdings is as high as 81%; and the proportion of retail trading volume to the total trading volume exceeds 80%. In contrast, in the H-share market, overseas and institutional investors play a dominant role. In terms of trading volume, the proportion of institutional investors' trading is about 77%, far higher than the 23% proportion of individual investors [3]. Generally speaking, individual investors are not very rational. They tend to be overconfident and speculative, overly pursue the maximization of short-term investment returns, and focus more on concept speculation. Therefore, individual investors often make frequent investment decisions based on noise, which often leads to significant asset bubbles. Institutional investors, on the other hand, are often more rational, pursuing the maximization of long-term investment returns, and frequently use value investment and fundamental analysis methods to make investment decisions. Therefore, the bubbles are often smaller. Thus, the significant differences in investor composition have led to the price differences between A-shares market and H-shares market [1]. However, Hu Zhanghong and Wang Xiaokun, when conducting a regression analysis on the two variables of the price difference between A-shares market and H-shares market and the average shareholding ratio of A-share accounts (the higher the average shareholding ratio, the closer it can be approximated to the proportion of institutional investors), found that the two variables were weakly correlated statistically, meaning that the investor structure had no significant impact on the price difference between A-shares and H-shares [4]. Wang Yu and He Enyuan also conducted a similar study. They used the proportion of institutional investors' holdings among the top ten shareholders of companies listed simultaneously on A-shares and H-shares as a variable to reflect the investor structure and regressed it with the price difference between the two markets. They found that the regression coefficient was positive, meaning that as the proportion of institutional investors' holdings in A-shares increased, the premium of A-shares over H-shares actually rose [5]. Both experiments stated that since they used substitute variables to represent the investor structure, which could not accurately represent the investor structure, it might objectively affect the experimental results. However, the two experiments still indicate that the impact of the investor structure on the price difference between the two markets remains a controversial topic.

3.2. Analysis from the Conformity Effect

The herd effect or the conformity effect is another explanation for the differences in AH stock prices. As an important concept in behavioral finance, the herd or conformity effect refers to the phenomenon where individuals ignore their own valuable private information and choose to follow the majority, eventually making their own decision-making behavior homogenized with that of the group [6]. The herd effect causes investors to blindly follow the majority and buy stocks when the stock prices are rising, thus making the stock prices significantly higher than the fundamentals and forming a bubble; when the stock prices are falling, they blindly follow the majority and sell stocks, thus making the stock prices significantly lower than the fundamentals and causing a crash. In summary, the herd effect amplifies the fluctuations in stock prices. Therefore, analyzing the herd effect of A shares and H shares is a prerequisite for explaining the differences in AH stock prices, and there have been many related studies in the academic field. Yih-Wenn Lai quantified the herd effect of the two markets when the stock prices rise and fall using the generalized CKK model. His research shows that A shares exhibit herd behavior during both the rise and fall of the market, while H shares show an opposite pattern to the herd behavior throughout the entire period [7]. This difference in herd behavior between A shares market and H shares market also provides a relatively reasonable explanation for the differences in AH stock prices.

3.3. Analysis from the Investor Sentiment

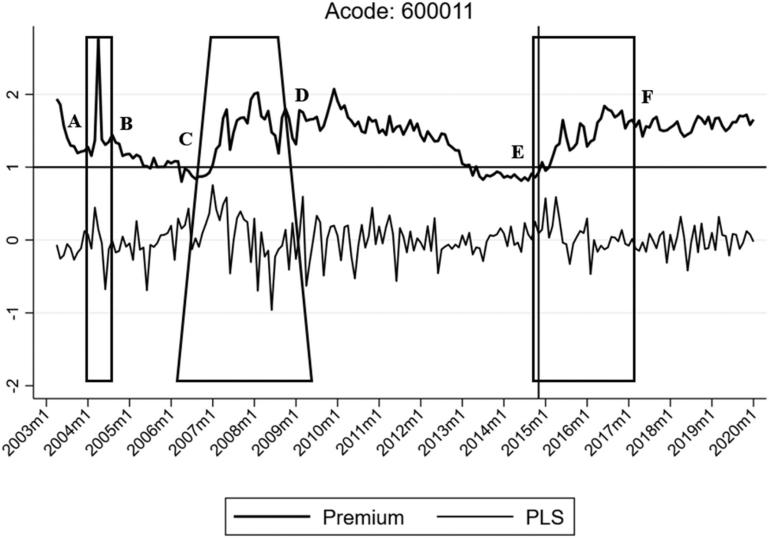

Apart from the influence of differences in investor structure and the herd effect on the price differences of A-share and H-share, the influence of differences in investor sentiment on the price differences of the two markets is also a key research object in the academic community. In traditional finance, investors are regarded as completely rational individuals, and they will value stocks based on the discount of future cash flows. However, the repeated stock bubbles and crashes in reality have proved the fact that investors are not rational. Therefore, behavioral finance has proposed the argument that investor sentiment has a significant impact on stock prices. Lu Jing and Zhou Yuan chose securities investment funds as the data source for constructing the investor sentiment index of the two markets. They constructed the index according to the asymmetric perception of losses and gains by investors (the psychological impact of suffering losses by stock investors is greater than that of obtaining gains), and further adjusted the index based on the phenomenon of the attenuation of the emotion impact index in behavioral finance (the psychological feeling of investors for recent gains and losses will be given greater weight), and ensured that the index satisfied the positive feedback effect. The two authors conducted regressions of this index with the monthly returns of A-share and H-share of cross-listed companies in A-share and H-share respectively, and found that for cross-listed A-share or H-share, investor sentiment has a significant pricing effect, that is, investor sentiment is one of the factors that cannot be ignored in stock pricing [8]. After confirming this point, Zhang Xiaotao et al. constructed a mainland China investor sentiment index using six indicators: new investor accounts, market turnover rate, trading volume, number of new IPOs, market trading value, and consumer confidence index. When conducting regression analysis between this index and AH share price differences, they found a significant positive correlation between domestic investor sentiment and AH stock price difference, meaning higher comprehensive investor sentiment in the mainland market corresponds to greater price differences between the two markets [9]. Bai et al. used the premium rates of ETFs in both markets to represent investor sentiment in each market. By regressing these two variables against the A-share premium over H-shares separately, they discovered that H-share investor sentiment shows a significant positive correlation with the A-share premium over H-shares [2]. Li and Ran conducted similar research by selecting H-share total market capitalization-weighted turnover rate, total IPO scale, and price-earnings ratio as indicators to construct an overall H-share sentiment index. For the A-share sentiment index, they utilized A-share total market capitalization-weighted turnover rate, the number of new individual investor accounts opened on the Shanghai Stock Exchange, mainland China stock market P/E ratio, and mainland consumer confidence index. They employed both Principal Component Analysis and Partial Least Squares Regression to comprehensively evaluate these indicators and construct investor sentiment indices for both the two markets. Their analysis of the relationship between cross-market sentiment index differences and AH share price difference from 2003 to 2019 revealed a strong positive correlation between the sentiment index divergence across markets and the price differences of cross-listed AH companies. Taking a dual-listed AH company as an example, as shown in the figure, they demonstrated that the A-share premium over H-shares fluctuates with sentiment divergence, indicating a clear leading-following relationship between the two variables [10].

Figure 2: Case Analysis of Huaneng Power International, Inc. [10]

Note: The upper curve represents the premium ratio of A-share compared to H-share, while the lower curve indicates the difference in market sentiment between the two markets. The horizontal line signifies a premium ratio of 1. When the upper curve is above the horizontal line, A-share market has a premium compared to H-share market.

4. Conclusion

To sum up, the significant valuation disparity between the A-share and H-share markets, especially the widespread premium of A-shares over H-shares, is the result of the combined effect of multiple factors. This article, by reviewing existing literature and from the perspective of behavioral finance, explores the reasons behind this disparity from three aspects: investor structure, herd effect, and investor sentiment. Firstly, the A-share market is dominated by retail investors, whose behavior tends to be short-term speculative and concept-driven, while the H-share market is mainly composed of institutional investors, who focus more on long-term value investment and fundamental analysis. This investor structure difference leads to greater volatility in the A-share market, which is prone to deviate from fundamentals, thus forming a higher premium. However, some academic research has also reached conclusions that are unrelated or even contrary to this, so the influence of investor structure on the AH stock price differences remains controversial. Secondly, the A-share market has a notable herd effect, where investors tend to follow the masses when the stock price rises or falls, further amplifying the stock price fluctuations. In contrast, the herd effect in the H-share market is weaker, and market behavior is relatively rational. This difference in herd effect is also one of the reasons for the AH stock price differences. Finally, whether investor sentiment in both the two markets has a significant impact on the premium rate of A-shares over H-shares or whether the emotional differences between the two markets and the obvious leadership and follower relationship between AH stock prices reflect the strong explanatory power of investor sentiment on the AH stock price differences. All these reflect the strong explanatory power of investor sentiment on the AH stock price differences.

Based on the above three perspectives of behavioral finance in explaining the differences in AH stock prices, it is suggested that investors, especially individual investors, participate in the market calmly and rationally. They should make decisions based on their own judgment and personal or public information rather than following the crowd blindly. Moreover, investors should control their emotions and participate in stock market transactions with an objective and rational mindset as much as possible to avoid excessive emotionalism. On the one hand, this can help investors reduce unnecessary losses caused by irrationality. On the other hand, it is conducive to building a healthier and more standardized stock market, and helps to realize the modernization of China's capital market.

Although this paper summarizes the explanations of the three behavioral finance perspectives on the AH stock price differences by reviewing previous literature, it is still not comprehensive. Other behavioral finance perspectives that are not included in this paper, such as the anchoring effect, etc., have not been covered. Whether they also have good explanatory power for the AH stock price differences. In addition, this paper does not cite enough research papers on the studies of whether the investor structures, herd effect, and investor sentiment in the two markets gradually converge after the opening of the Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect. This may lead to a one-sided conclusion.

Finally, it is hoped that future research can build upon this foundation and further integrate factors such as the macroeconomic environment, policy changes, and market microstructure to construct a more comprehensive analytical framework. This will help investors make more informed investment decisions in the global context, conduct more effective cross-market asset allocation and risk management, and provide theoretical support for China's financial policymakers. By continuously deepening the understanding of the differences between A-share and H-share markets, it is believed that global investors will better grasp the unique characteristics and development trends of China's capital market, and obtain more comprehensive market analysis tools. This will also facilitate the implementation of market reform and opening-up policies.

References

[1]. Wang Shujie, & Wang Junwen. (2020). Why are the prices of A-shares and H-shares so different Business Economics, 12, 176-196.

[2]. Bai, Y., Tang, W. M., & Yiu, K. F. C. (2019). Analysis of Price Differences Between A and H Shares. Asia-Pacific Financial Markets, 26(4), 529–552.

[3]. CICC. (2014). Similarities and Differences between the Two Stock Markets. Capital Market, 10: 29-35.

[4]. Hu Zhanghong, & Wang Xiaokun. (2008). Empirical Research on the Difference between A-share and H-share Prices of Chinese Listed Companies. Economic Research, 4, 119-131.

[5]. Wang Yu, & He Enyuan. (2021). Research on the Premium of A-share over H-share: From the Perspective of Cross-border Capital Flows. Certified Public Accountants of China, 10, 52-57.

[6]. Sharma, S., & Bikhchandani, S. (2000). Herd Behavior in Financial Markets: A Review. IMF Working Paper, 48, 1.

[7]. Yih-Wenn Lai. (2016). A Study on Herd Behavior in Shanghai A-share and H-share Markets: Taking Extreme Market Changes and the Period of Shanghai-Hong Kong Stock Connect as Examples. Cross-Strait Finance Quarterly, 4(3), 33-49.

[8]. Lu Jing, & Zhou Yuan. (2015). The Impact of Investor Sentiment on Stock Prices: An Empirical Analysis Based on Cross-Listed A and H Shares. Chinese Journal of Management Science, 23(11), 21-28.

[9]. Zhang Xiaotao, Wang Yalin, & Liu Jinming. (2020). Research on the Impact of Mainland Investors' Sentiment on the AH Stock Price Difference. Economic Research Journal, 9, 86-88.

[10]. Li, Y., & Ran, J. (2020). Investor Sentiment and Stock Price Premium Validation with Siamese Twins from China. Journal of Multinational Financial Management, 57–58, 100655.

Cite this article

Zhang,Y. (2025). Explanation of Valuation Variance Between A-shares and H-shares Perspective from Behavioral Finance. Advances in Economics, Management and Political Sciences,178,95-101.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang Shujie, & Wang Junwen. (2020). Why are the prices of A-shares and H-shares so different Business Economics, 12, 176-196.

[2]. Bai, Y., Tang, W. M., & Yiu, K. F. C. (2019). Analysis of Price Differences Between A and H Shares. Asia-Pacific Financial Markets, 26(4), 529–552.

[3]. CICC. (2014). Similarities and Differences between the Two Stock Markets. Capital Market, 10: 29-35.

[4]. Hu Zhanghong, & Wang Xiaokun. (2008). Empirical Research on the Difference between A-share and H-share Prices of Chinese Listed Companies. Economic Research, 4, 119-131.

[5]. Wang Yu, & He Enyuan. (2021). Research on the Premium of A-share over H-share: From the Perspective of Cross-border Capital Flows. Certified Public Accountants of China, 10, 52-57.

[6]. Sharma, S., & Bikhchandani, S. (2000). Herd Behavior in Financial Markets: A Review. IMF Working Paper, 48, 1.

[7]. Yih-Wenn Lai. (2016). A Study on Herd Behavior in Shanghai A-share and H-share Markets: Taking Extreme Market Changes and the Period of Shanghai-Hong Kong Stock Connect as Examples. Cross-Strait Finance Quarterly, 4(3), 33-49.

[8]. Lu Jing, & Zhou Yuan. (2015). The Impact of Investor Sentiment on Stock Prices: An Empirical Analysis Based on Cross-Listed A and H Shares. Chinese Journal of Management Science, 23(11), 21-28.

[9]. Zhang Xiaotao, Wang Yalin, & Liu Jinming. (2020). Research on the Impact of Mainland Investors' Sentiment on the AH Stock Price Difference. Economic Research Journal, 9, 86-88.

[10]. Li, Y., & Ran, J. (2020). Investor Sentiment and Stock Price Premium Validation with Siamese Twins from China. Journal of Multinational Financial Management, 57–58, 100655.