1. Introduction

In recent years, propelled by policy support, the advancement of digital technologies, and the exemplary role of successful cases, China's cultural industry has witnessed a development trend marked by accelerated digital transformation, prominent contemporary values, and coordinated internal mechanisms [1]. Notably, Chinese animated films, leveraging policy incentives, commercial aesthetic guidance, and the leadership of "universal" art, have gradually extricated themselves from the "kid-centric" predicament and are now on an "all-age" development trajectory. This path is characterized by a diverse audience base, rich cultural connotations, and the seamless integration of art and commerce [2]. In 2019, Nezha: Birth of the Demon Child shattered domestic industry records with a box office revenue exceeding 5 billion yuan. This achievement not only validated the commercial potential of domestic animated films but also directly led to a more than 30% increase in the stock price of Enlight Media, the film's production company, within 30 days after its release. This clearly demonstrated the immediate impact of blockbuster movies on the capital market.In 2025, the sequel of this IP, Ne Zha 2, announced its release date. The correlation between its box-office performance and the stock price of Enlight Media has once again become a focal point for investors.

The release of a phenomenon-level movie can not only spark extensive discussions at the social and cultural levels but also significantly impact the stock prices of relevant listed companies through mechanisms such as market expectations, investor sentiment, and corporate value re-evaluation [3-5]. Against this backdrop, exploring the actual impact of a single blockbuster movie event on a company's stock price not only holds theoretical value for understanding the capital operation logic of the film and television industry but also provides a basis for decision-making for investors, corporate managers, and policymakers.

The design of this study is of great significance. Its core value lies in breaking through the long-standing limitations of traditional event studies. From the current status of academic research, most relevant literature focuses on exploring the correlation between the film industry and the stock industry. For example, the research conducted by Hu and Han mainly focuses on in-depth analysis of the internal relationship between the stock investment market and the film market. Through rigorous data analysis and research methods, they revealed the complex relationship between the fluctuations in the rate of return of the equity investment market and the change rate of China's film box-office revenue [6]. Although this kind of research has revealed the correlation between the two industries to a certain extent, the research perspective is relatively broad. Another example is the research by Shi, whose focus is relatively single, only centering on the impact of film box-office on corporate stocks [3]. Although this single-dimensional research can clarify the relationship between film box-office and corporate stocks to a certain degree, it lacks comprehensive consideration of other relevant factors, resulting in insufficient comprehensiveness of the research. Meanwhile, existing studies also show an obvious tendency to focus on aspects such as film box-office prediction. Take the research by Zhang as an example. They conducted an empirical analysis of the relationship between film box-office and its influencing factors using imported film box-office data [7]. This empirical analysis mainly explores the rules between box-office and influencing factors based on existing box-office data, which can provide some reference for box-office prediction. And Wang's research used advanced data processing methods such as Python crawlers to systematically analyze the key influencing factors of domestic film box-office revenue from both micro and macro levels [8]. Although these studies have delved into box-office prediction and analysis of influencing factors, they still generally remain within the scope of box-office research. Currently, there are few literature that conduct in-depth exploration of the overall concept of blockbuster movies, and there is also a lack of quantitative analysis and evaluation of the potential consequences of blockbuster movies on a company's stock price changes. This study precisely targets this research gap, aiming to fill the deficiencies in existing academic research and open up new directions for research in relevant fields.

Theoretically, the innovation of this study is mainly reflected in the following three dimensions: First, this study integrates the economic transformation mechanism of film art value into the corporate finance analysis framework. In previous studies, although the interdisciplinary research between cultural economics and finance has been involved, there is still a lack of exploration on how the art value of films is transformed into economic value and incorporated into the scope of corporate finance analysis. Second, in previous relevant studies, multiple factors were often mixed together for analysis, making it difficult to accurately determine the specific impact of the release of a film- a specific factor- on the stock prices of listed films and television companies. This study separates the exogenous factor of film release from numerous influencing factors and conducts a detailed analysis, thus enabling a clearer and more accurate exploration of its impact on the stock prices of listed film and television companies. Third, in terms of research methods, this study achieves innovative integration. It integrates the reverse event study method and uses STATA software to achieve ARIMA forecasting. By combining the two, this study helps to improve the rigor and scientific nature of the analysis of film and television event shocks, providing a more reliable analytical tool for relevant research.

2. Research design

2.1. Data sources

The data for this study are sourced from the Choice Financial Terminal. This research selects the daily and weekly closing price data of Enlight Media's stocks before and after the release of Ne Zha 2. Specifically, the data before the release cover the period from January 1, 2024, to January 29, 2025, and the data after the release span from January 29, 2025, to February 24, 2025. To conduct in-depth analysis of these data, this study employs the STATA data analysis software. First, the obtained daily and weekly closing price data of the stocks are processed to generate the corresponding logarithmic stock sequences. This transformation converts the original data into a form that is more convenient for analysis and comparison, and it can also better capture the changing trends and characteristics in the data. Subsequently, a first-order difference operation is performed on the generated logarithmic stock sequences. Through the first-order difference, the logarithmic stock return rate sequence can be obtained. This sequence can intuitively reflect the changes in the return rate of the stock price over different time periods, providing an important data foundation for subsequent research and analysis.

2.2. Establishment of the counterfactual model

When evaluating the net effect brought about by policy implementation, RUBIN pioneered the counterfactual analysis framework in 1974 [9]. In this framework, the actual state after the policy is fully implemented in the real world is defined as the “factual” scenario. In contrast, the predicted result assuming that the research area has not been affected by the policy intervention is called the “counterfactual” scenario [9]. Policy implementation is regarded as a sudden exogenous variable. By comparing and analyzing the differences between the two situations where the exogenous variable actually occurs and is assumed not to occur, the net effect of policy implementation can be clearly depicted. Drawing on this well-established analytical approach, this study analogizes the release of Ne Zha 2 to a sudden exogenous variable. By comparing the closing prices of Enlight Media's stocks under two different scenarios: the actual release of the movie and the assumed non-release of the movie, the net impact effect of the movie's release on the stock price changes of Enlight Media can be accurately evaluated. Specifically, this study records the closing price of Enlight Media's stock at the moment T0 when Ne Zha 2 starts to be released as X1; the closing price at the moment T0-n before the release is recorded as X0. The closing price at the time point T0 + n after the actual release of the movie is defined as the factual scenario and recorded as X2. The closing price at the time point T0+n assuming that Enlight Media did not release Ne Zha 2 is defined as the counterfactual scenario and recorded as X'2. And X2-X'2 reflects the net impact of Ne Zha 2 on the closing price of Enlight Media's stocks.

2.3. ARIMA model

The ARIMA model is an analytical method that predicts future situations based on past time-series data. Its full name is the Autoregressive Integrated Moving Average model, which is composed of three key components: Autoregressive (AR), Integrated (I), and Moving Average (MA). The basic principle of this model can be reflected by Equation (1).

\( ARIMA(p,d,q)=AR(p)+I(d)+MA(q) \) | (1) |

In the ARIMA model, “P” represents the “Autoregressive” part. Its core idea is that there is a linear relationship between the current observation and some of its past observations. That is to say, the current observation can be regarded as the result of a linear combination of several previous observations with certain weights. Here, “several” refers to the autoregressive order p, which describes the number of lags of the observations used in the model. The precise mathematical expression of the autoregressive model can be referred to Equation (2).

\( {x_{t}}={α_{0}}+{α_{1}}{x_{t-1}}+{α_{2}}{x_{t-2}}+⋯+{α_{n}}{x_{t-n}}+{ε_{t}} \) | (2) |

“Q” reflects the lag situation of the error term in the model. The error term reflects the deviation between the model’s predicted value and the actual observed value. The moving-average model holds that the current value is affected not only by past observations but also by past error terms. It describes the relationship between the current value and past white noises. The specific mathematical expression is shown in Equation (3).

\( {x_{t}}={ε_{t}}-{β_{1}}{ε_{t-1}}-{β_{2}}{ε_{t-2}}-⋯-{β_{n}}{ε_{t-n}}+μ \) | (3) |

In actual time-series data, many data are non-stationary. For example, they may have obvious upward or downward trends or seasonal fluctuations. Non-stationary data can pose difficulties for model analysis and prediction. To eliminate these effects and make the data stationary, the ARIMA model performs a differencing operation. That is, it conducts subtraction operations between adjacent data of the original data and converts the original data into stationary differenced data through multiple differencing operations. The differencing order “I” indicates the number of times the original time-series data needs to be differenced [10].

3. Empirical results and analysis

3.1. ADF unit root test

After completing the processing of the initial data for the model, the next primary task is to conduct a unit root test on the model. The ADF test is a commonly used unit root test method, and the calculation of its test statistic is based on the null hypothesis that “the series has a unit root”. The ADF test compares the actual time-series data at different time points with the linear trend of the series and calculates the absolute difference between them. If the time-series data set exhibits non-stationary characteristics, there will be a significant deviation between the actual data and its linear trend, which will result in a relatively large value of the ADF test statistic. Conversely, when the time-series data set is stationary, the actual data will be relatively close to the linear trend, and the value of the ADF test statistic will be relatively small.

It can be seen from Table 1 that after the first-order differencing of the daily and weekly logarithmic stock returns, the corresponding p-values are both approximately 0, which are significantly less than 0.1. In the field of statistics, such a result is considered to be statistically significant. Based on this result, we have sufficient evidence to reject the hypothesis that “the variable has a unit root”. This indicates that the model constructed based on these data is feasible, and the data is stationary. It is worth mentioning that the daily data in Table 1 has undergone second-order differencing. The main reason for this operation is to facilitate the subsequent prediction process and enable the prediction work to be carried out more accurately and efficiently.

Table 1: Weak stationarity test

t | p | |

Daily | ||

Ln price | -1.757 | 0.7251 |

1st order difference | -11.210 | 0.0000 |

2nd order difference | -18.450 | 0.0000 |

Weekly | ||

Ln price | -1.941 | 0.6334 |

1st order difference | -5.577 | 0.0000 |

3.2. Order determination and residual test

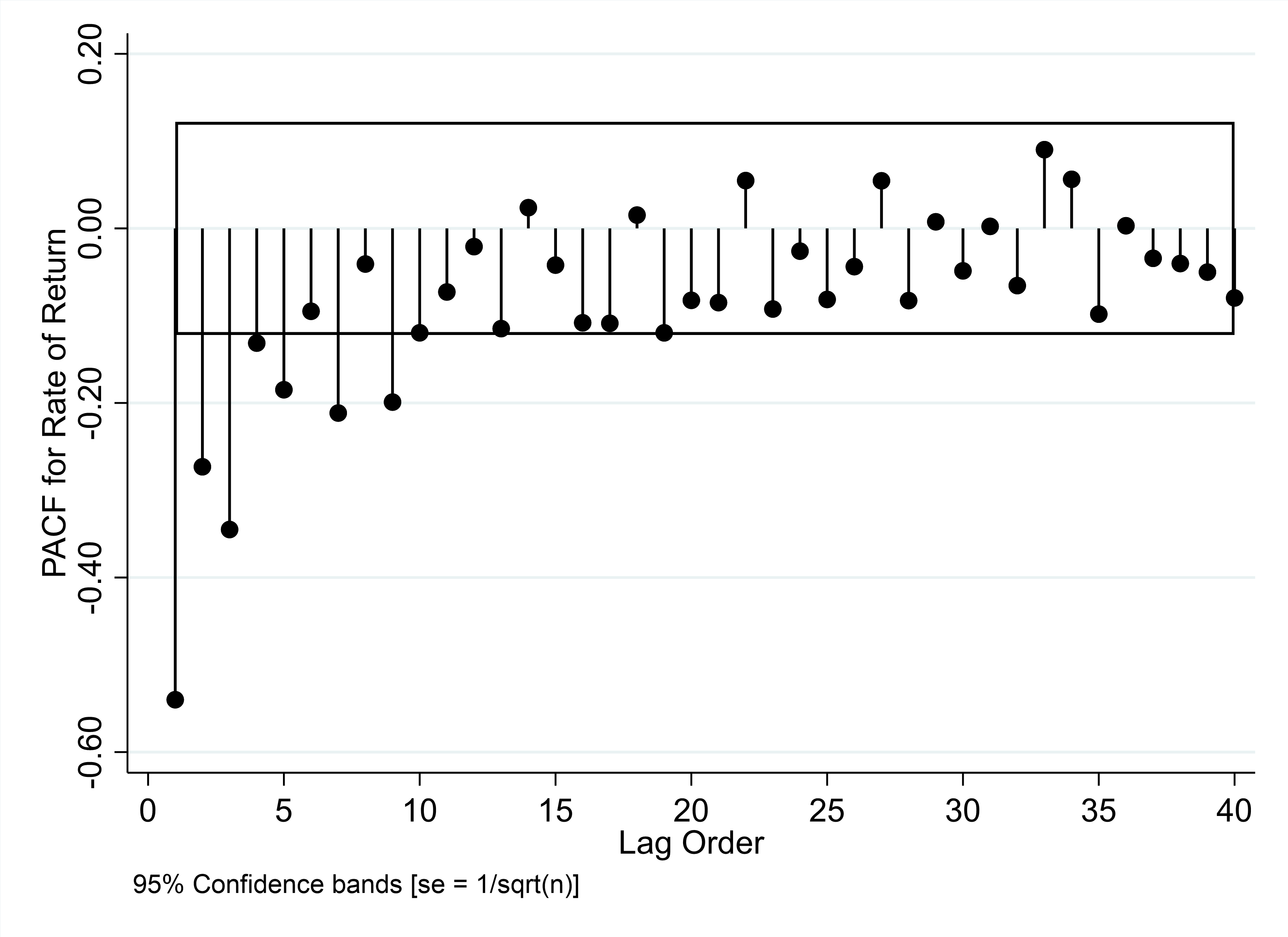

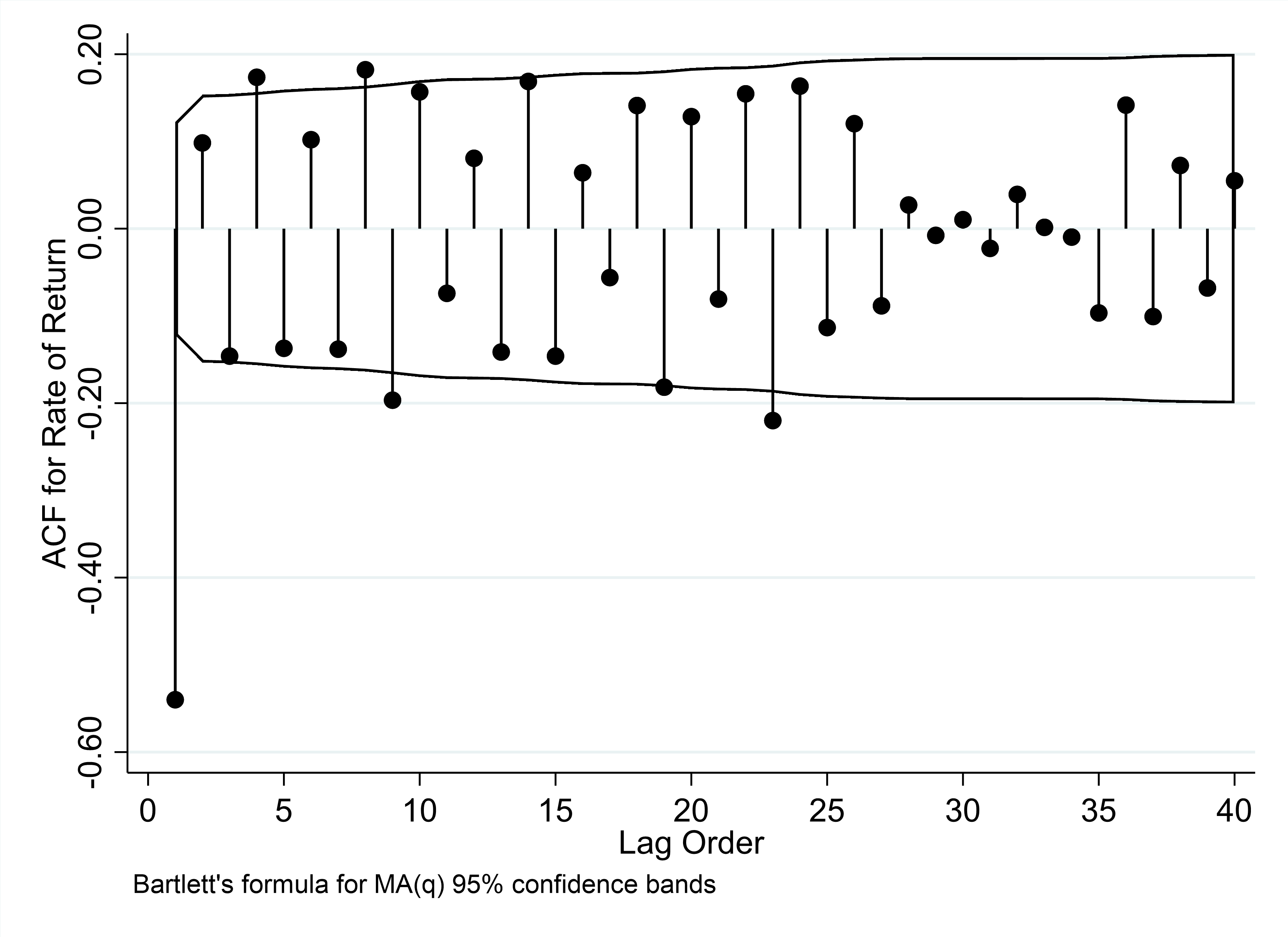

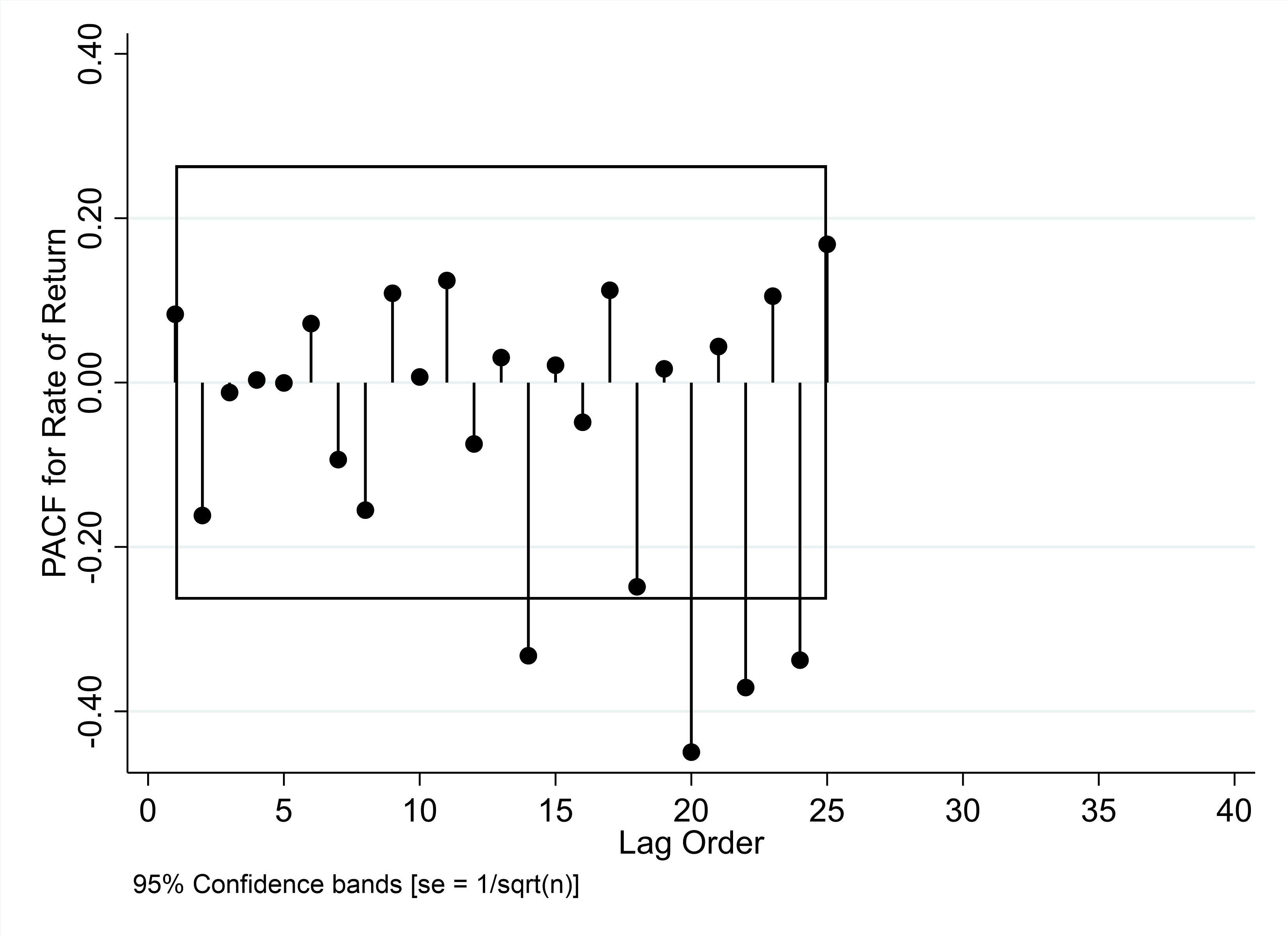

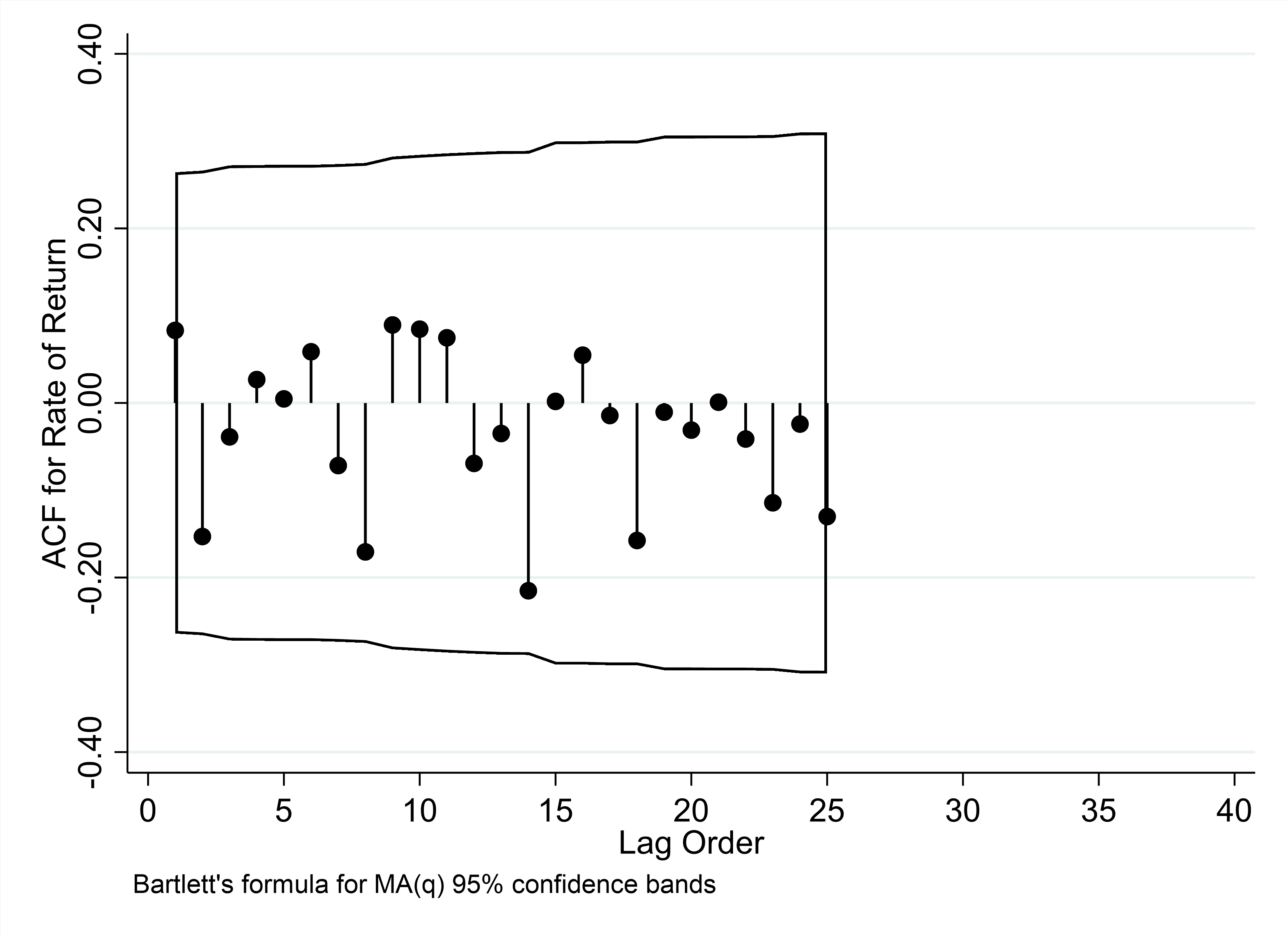

When conducting modeling analysis on time-series data, the autocorrelation function (ACF) plot and the partial autocorrelation function (PACF) plot are important analytical tools that can help determine the applicable model type and the order of the model. In this part of the study, we first need to use the PACF and ACF to analyze the daily and weekly logarithmic returns of Enlight Media’s stocks respectively. The results are shown in Figure 1.

PACF | ACF |

Daily | |

|

|

Weekly | |

|

|

Figure 1: ARMA (p, q) identification | |

Photo credit: Original | |

If the ACF plot of a time-series shows a trailing characteristic, that is, the autocorrelation coefficients decrease slowly as the lag order increases; while the PACF plot shows a truncation characteristic, meaning that after a certain lag order, the partial autocorrelation coefficients rapidly approach zero. In this case, an AR model is a suitable choice to describe the time-series, and the lag order at the truncation point of the PACF is the ideal value for the parameter of the AR model. Conversely, when the PACF plot of a time-series shows a trailing characteristic and the ACF plot shows a truncation characteristic, that is, the autocorrelation coefficients rapidly drop to zero after a certain lag order, a MA model is appropriate. The lag order at the truncation point of the ACF is the expected value for the parameter of the MA model. Based on this, we can process the two sets of data in a predefined order, construct an ARIMA model, and determine the model order according to the PACF and ACF plots.

Observing the research results of this paper (Figure 1), the PACF plot of the daily-frequency data shows a truncation phenomenon at the 9th lag order, and the ACF plot shows a trailing characteristic at the 9th lag order. According to the previous judgment rules, we selected the ARIMA(9, 2, 9) model for the daily-frequency data. For the weekly-frequency data, its PACF plot shows a truncation characteristic at the 14th lag order. Combining with the logic of model selection, we set the model for the weekly-frequency data as ARIMA(14, 1, 0).

After completing the model establishment, the next step is to test the residuals of the model. The specific test situation is described as follows.

Table 2: Residual test

Model | Portmanteau (Q) statistic | Prob > chi2 |

Daily -ARIMA(9,2,9) | 16.2043 | 0.9997 |

Weekly -ARIMA(14,1,0) | 11.1218 | 0.9923 |

From Table 2, it can be observed that the p-values of the Portmanteau Q statistics for both the daily-frequency model and the weekly-frequency model exceed 0.99. This result indicates that these ARIMA models have successfully passed the residual test. In other words, the error terms of the models conform to the characteristics of a white-noise sequence and are unpredictable.

3.3. Prediction results and analysis

After completing the construction of the ARIMA model and the residual test, the study continues to use STATA software to predict the data for a period after January 29, 2025. The prediction results are summarized as follows:

3.3.1. Estimation results of daily data

Based on the estimation results of the daily data (Table 3 and Figure 2), there is a significant difference between the actual stock price of Enlight Media after the release of Ne Zha 2 and the counterfactual stock price assuming it was not released.

Table 3: Actual and counterfactual stock price, daily

Actual stock price | Counterfactual price | Difference | Difference (%) | |

2025-01-15 | 8.9 | |||

2025-01-16 | 8.94 | |||

2025-01-17 | 9.3 | |||

2025-01-20 | 9.38 | |||

2025-01-21 | 9.36 | |||

2025-01-22 | 9.44 | |||

2025-01-23 | 9.52 | |||

2025-01-24 | 9.5 | |||

2025-01-27 | 9.53 | |||

2025-02-05 | 11.44 | 9.56 | 1.88 | 19.66% |

2025-02-06 | 13.5 | 9.59 | 3.91 | 40.76% |

2025-02-07 | 13.96 | 9.62 | 4.34 | 45.10% |

2025-02-10 | 16.75 | 9.65 | 7.10 | 73.55% |

2025-02-11 | 20.1 | 9.68 | 10.42 | 107.59% |

2025-02-12 | 24.12 | 9.71 | 14.41 | 148.32% |

2025-02-13 | 28.94 | 9.74 | 19.20 | 196.98% |

2025-02-14 | 34.73 | 9.78 | 24.95 | 255.26% |

2025-02-17 | 29.66 | 9.81 | 19.85 | 202.42% |

Since February 5, 2025, the actual stock price has risen significantly compared with the counterfactual stock price, with the maximum increase reaching 255.26%. This indicates that after the movie’s release, the market’s future expectations for Enlight Media have changed significantly.

Figure 2: Actual and Counterfactual stock price, daily |

Photo credit: Original |

3.3.2. Estimation Results of Weekly Data

The weekly data (Table 4 and Figure 3) also show a similar trend. During the period from February 7 to February 24, 2025, the actual stock price increased significantly compared with the counterfactual stock price, with the maximum increase reaching 262.34%. This further verifies the positive impact of the movie’s release on the stock price of Enlight Media.

Table 4: Actual and counterfactual stock price, weekly

Actual stock price | Counterfactual price | Difference | Difference (%) | |

2025-01-10 | 8.47 | |||

2025-01-17 | 9.3 | |||

2025-01-24 | 9.5 | |||

2025-01-27 | 9.53 | |||

2025-02-07 | 13.96 | 9.56 | 4.40 | 46.06% |

2025-02-14 | 34.73 | 9.58 | 25.15 | 262.34% |

2025-02-21 | 27.98 | 9.61 | 18.37 | 191.08% |

2025-02-24 | 27.09 | 9.64 | 17.45 | 181.01% |

Figure 3: Actual and Counterfactual stock price, weekly |

Photo credit: Original |

3.3.3. Analysis of prediction results

Both the daily and weekly data indicate that the actual stock price trend of Enlight Media has strengthened after the release of Ne Zha 2.

As a highly anticipated animated film, Ne Zha 2 has attracted a large number of audiences to the cinemas and achieved remarkable box-office results. The high box-office expectations have made investors full of confidence in the future profitability of Enlight Media. As a result, they have bought the company’s stocks one after another, driving up the stock price. From a more macro perspective, the success of a phenomenon-level movie may not only be reflected in the box office but also in its ability to drive the development of related industries, such as the development of peripheral products and copyright sales. These developments have brought additional revenue expectations to Enlight Media and enhanced the company’s overall value, which may also be an important supporting factor for the rise of the stock price.

In addition, the success of Ne Zha 2 has not only brought an excellent visual experience to the audiences but also demonstrated the rising Chinese film-making capabilities and profound cultural heritage to the world. Therefore, it has attracted extensive attention and discussions at the social and cultural levels and also enhanced the brand awareness and reputation of Enlight Media. The establishment of a good image of Enlight Media will help the company gain a more favorable position in future project development, financing, and cooperation with other enterprises, which also indirectly affects investors’ long-term value assessment of the company and promotes the rise of the stock price.

However, it should also be noted that the timeliness of the market reaction reveals the limitations of event-driven investment. The daily-frequency data shows that the half-life of excess returns is approximately 22 trading days, indicating that the stock price fluctuations driven by emotions have the characteristic of rapid attenuation. Relying solely on the popularity of Ne Zha 2 is difficult to support the long-term rise of Enlight Media’s stock price. Investors need to be vigilant against the risks of over-relying on a single stock.

In addition, the film and television industry where Enlight Media is located also has a high degree of uncertainty. The success of a single movie is difficult to replicate completely, and Enlight Media cannot rely solely on a single blockbuster movie to maintain the growth of its stock price. Moreover, the stock price fluctuations are also affected by various factors such as the macro-economic environment, industry competition, and policy changes. For example, if there are negative events in the entire film and television industry during the release period of the movie or the macro-economic situation is unfavorable, even with the support of a blockbuster movie, the increase in Enlight Media’s stock price may be limited.

4. Conclusions

This study conducts a quantitative analysis of the dynamic impact of the release of Ne Zha 2 on the stock price of Enlight Media and conducts an in-depth empirical analysis of the stock price of Enlight Media before and after the movie’s release. It reveals the transmission mechanism and influence boundaries of cultural events in the capital market and finds that the release of a phenomenon-level movie can indeed have a significant positive impact on the stock price of relevant listed companies.

From the perspective of domestic movie cultural products, regarding high-quality movies as an important part of the cultural industry not only has cultural dissemination value but also contains huge commercial potential. A successful movie can drive the development of the entire industrial chain, from production and distribution to the development of peripheral derivative products, creating considerable economic benefits. For a phenomenon-level movie like Ne Zha 2, its IP value plays a key role in the medium- and long- term stock price performance, further demonstrating the importance of high-quality movies in driving the industrial chain and exploring commercial value.

Therefore, for managers of film and television enterprises, they should increase investment in and creation of high-quality content to create culturally competitive products. The success of a work like Ne Zha 2 stems from the innovative interpretation of traditional culture, the accurate grasp of modern audiences’ aesthetic needs, and the application of advanced production technologies. Enterprises should draw lessons from this, focus on scriptwriting, talent cultivation, and technological innovation to enhance the company’s core competitiveness. In addition, it is crucial to establish a systematic IP value release mechanism, including regularly disclosing information on key nodes such as derivative product cooperation and cross-media linkages to stabilize market expectations, and setting up a public opinion response fund to deal with emergencies such as piracy or a decline in word-of-mouth. Enterprises also need to strengthen the integration and expansion of the movie industrial chain, fully explore the commercial value of movies, and reduce the company’s operational risks through diversified operations.

For investors, when considering stock investments in the film and television industry, they should fully take into account the potential influence of movie projects. In addition to paying attention to factors such as the quality of the movie itself, the cast, and the reputation of the director, they also need to conduct in-depth analyses of the IP value on which the movie is based, the intensity of market promotion, and the target audience group. Based on the above research conclusions, investors should make early arrangements during the period when the pre-screening word-of-mouth of the movie is fermenting, and use the law of the half-life of excess returns to exit at an appropriate time to avoid the risk of valuation correction caused by the ebbing of sentiment. At the same time, they can combine cross-market hedging tools to disperse the volatility of a single event. In particular, they need to dynamically track the development progress of IP derivatives and the sequel planning to enhance the foresight of investment decisions. They should recognize the high risks in the film industry, avoid making investment decisions overly reliant on a single movie event, and reduce risks through diversified investments.

From the perspective of policy-makers, they should continue to increase support for the cultural industry, improve relevant policies and regulations, and create a favorable development environment for film and television enterprises. They should encourage enterprises to conduct cultural innovation, promote the in-depth integration of the cultural industry and finance, guide capital to flow reasonably into the cultural field, and promote the healthy and sustainable development of the cultural industry. At the same time, they need to strengthen the supervision of the movie market, standardize market order, protect the rights and interests of consumers, avoid bad phenomena such as box-office fraud, and maintain a good ecosystem in the film industry.

In conclusion, the Chinese film and television industry is in a stage of rapid development, and the impact of phenomenon-level movies on the capital market cannot be ignored. All parties should fully recognize the complexity and importance of this impact, rationally utilize the opportunities it brings, and jointly promote the prosperous development of the Chinese film and television industry.

References

[1]. Feng, T. H., & Wang, F. The Time Value, Internal Mechanism and Contemporary Enlightenment Driven by the Digitalization of the Cultural Industry: A Case Study of *Ne Zha: Rebirth of the Demon Child*. *Academic Exploration*, 1 - 10.

[2]. Men, Z. C. (2022). A Study on the “All - Ages” Phenomenon and Development Strategies of Chinese Animated Films (2013 - 2020) (Master's thesis). Liaoning Normal University. Master. https://link.cnki.net/doi/10.27212/d.cnki.glnsu.2022.000286. doi:10.27212/d.cnki.glnsu.2022.000286.

[3]. Shi, H. M. (2022). The Impact of Movie Box - Office Expectations on the Stock Returns of Film and Television Companies (Master's thesis). University of International Business and Economics. Master. https://link.cnki.net/doi/10.27015/d.cnki.gdwju.2022.000530. doi:10.27015/d.cnki.gdwju.2022.000530.

[4]. Wu, J. J. (2016). The Impact of Positive Emotions on the Stock Market (Master's thesis). Chongqing University. Master. https://kns.cnki.net/kcms2/article/abstract?v=mtmIrHeyR2t2zzr3-J99C8yEuZMSw6zNsOHO67d_ungWQ2DxETqvWok6-ZpfbkFNGvDKB-BffCyaivGp-NDjtsF8x1X2egJx3_fb-23oYsGvQgGCNUSkJTmzyl4Xv3krVudA2xVkre45v0dJ0-VABNVLaXsTI2P7HyGiRsYoYTGh90l3omIQ48Sh0tjxJDmR-b5h6UIoEZ4=&uniplatform=NZKPT&language=CHS

[5]. Huang, X. Z. (2007). The Re - evaluation of the Value of Listed Companies in the Process of Stock Market Development. *Economic & Trade Update*, (05), 117 - 118.

[6]. Hu, X. L., & Han, R. (2016). A Study on the Correlation between the Chinese Film Market and the Stock Market. *Journal of Communication University of China (Natural Science Edition)*, 23(02), 35 - 40. doi:10.16196/j.cnki.issn.1673-4793.2016.02.006.

[7]. Zhang, Y. S., & Zhang, X. (2009). An Analysis of the Influencing Factors of Movie Box Office. *Economic Tribune*, (08), 130 - 132.

[8]. Wang, Q. (2023). A Study on the Box - Office Prediction of Domestic Films Based on Statistical Learning (Master's thesis). Shandong University of Finance and Economics. Master. https://link.cnki.net/doi/10.27274/d.cnki.gsdjc.2023.001173 doi:10.27274/d.cnki.gsdjc.2023.001173.

[9]. Xiong, C. S., Hu, Y. Y., & Gao, H. X. (2022). The Net Effect of Hainan East Ring High - speed Railway Stations on the Expansion of Surrounding Construction Land: A Perspective from the Counterfactual Analysis Framework. *China Land Science*, 36(12), 91 - 102.

[10]. Liu, J. X., Zou, R., & Xu, S. W. (2025). Wind Power Generation Prediction Based on ARIMA. *Modern Information Technology*, 9(04), 157 - 161+166. doi:10.19850/j.cnki.2096-4706.2025.04.030.

Cite this article

Lou,X. (2025). The Impact of the Release of Ne Zha 2 on the Stock Price of Enlight Media. Advances in Economics, Management and Political Sciences,180,96-105.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Feng, T. H., & Wang, F. The Time Value, Internal Mechanism and Contemporary Enlightenment Driven by the Digitalization of the Cultural Industry: A Case Study of *Ne Zha: Rebirth of the Demon Child*. *Academic Exploration*, 1 - 10.

[2]. Men, Z. C. (2022). A Study on the “All - Ages” Phenomenon and Development Strategies of Chinese Animated Films (2013 - 2020) (Master's thesis). Liaoning Normal University. Master. https://link.cnki.net/doi/10.27212/d.cnki.glnsu.2022.000286. doi:10.27212/d.cnki.glnsu.2022.000286.

[3]. Shi, H. M. (2022). The Impact of Movie Box - Office Expectations on the Stock Returns of Film and Television Companies (Master's thesis). University of International Business and Economics. Master. https://link.cnki.net/doi/10.27015/d.cnki.gdwju.2022.000530. doi:10.27015/d.cnki.gdwju.2022.000530.

[4]. Wu, J. J. (2016). The Impact of Positive Emotions on the Stock Market (Master's thesis). Chongqing University. Master. https://kns.cnki.net/kcms2/article/abstract?v=mtmIrHeyR2t2zzr3-J99C8yEuZMSw6zNsOHO67d_ungWQ2DxETqvWok6-ZpfbkFNGvDKB-BffCyaivGp-NDjtsF8x1X2egJx3_fb-23oYsGvQgGCNUSkJTmzyl4Xv3krVudA2xVkre45v0dJ0-VABNVLaXsTI2P7HyGiRsYoYTGh90l3omIQ48Sh0tjxJDmR-b5h6UIoEZ4=&uniplatform=NZKPT&language=CHS

[5]. Huang, X. Z. (2007). The Re - evaluation of the Value of Listed Companies in the Process of Stock Market Development. *Economic & Trade Update*, (05), 117 - 118.

[6]. Hu, X. L., & Han, R. (2016). A Study on the Correlation between the Chinese Film Market and the Stock Market. *Journal of Communication University of China (Natural Science Edition)*, 23(02), 35 - 40. doi:10.16196/j.cnki.issn.1673-4793.2016.02.006.

[7]. Zhang, Y. S., & Zhang, X. (2009). An Analysis of the Influencing Factors of Movie Box Office. *Economic Tribune*, (08), 130 - 132.

[8]. Wang, Q. (2023). A Study on the Box - Office Prediction of Domestic Films Based on Statistical Learning (Master's thesis). Shandong University of Finance and Economics. Master. https://link.cnki.net/doi/10.27274/d.cnki.gsdjc.2023.001173 doi:10.27274/d.cnki.gsdjc.2023.001173.

[9]. Xiong, C. S., Hu, Y. Y., & Gao, H. X. (2022). The Net Effect of Hainan East Ring High - speed Railway Stations on the Expansion of Surrounding Construction Land: A Perspective from the Counterfactual Analysis Framework. *China Land Science*, 36(12), 91 - 102.

[10]. Liu, J. X., Zou, R., & Xu, S. W. (2025). Wind Power Generation Prediction Based on ARIMA. *Modern Information Technology*, 9(04), 157 - 161+166. doi:10.19850/j.cnki.2096-4706.2025.04.030.