1. Introduction

The biotechnology industry is a subfield of the biopharmaceutical sector. Biotechnology, short for biological technology, refers to the use of "living organisms (including animals, plants, and microorganisms)" to produce useful substances or to improve biological traits, thus achieving the goals of cost reduction and species innovation [1]. Compared to other countries, Chinese biopharmaceutical industry started later but has seen significant advancements in recent years. According to Stacciarini [1], the number of large pharmaceutical companies in China ranks second only to the United States. The biotechnology industry is a challenging field characterized by long cycles, high risks, substantial investments, and potentially high returns. R&D activities in biotechnology require prolonged time investment, which means companies must endure a lengthy period before reaping benefits [2]. The entire R&D cycle undergoes multiple rigorous tests and demands continuous investment in manpower and resources, representing a massive time commitment. For instance, developing an innovative drug from research to market is expected to take 10 to 15 years, involving stages such as preclinical research, clinical trial approval, clinical trials, market approval, commercial production, and post-market studies [3]. However, once a product is successfully developed and launched first in the market, its subsequent commercial value is immense. The biotech industry relies heavily on Initial Public Offerings (IPOs) to secure substantial capital for long R&D cycles and regulatory hurdles. Unlike many other industries, biotech firms often require large-scale investment before reaching profitability, making IPOs a crucial milestone.

This analysis aims to compare the IPO strategies of Innovent Biologics and Genor Biopharma based on the information provided in the report. By examining their approaches, key financial metrics, and market reception, the study will highlight the strengths and challenges of each company’s IPO execution. The report is structured as follows: first, an overview of the biotech IPO landscape; second, detailed profiles of Innovent Biologics and Genor Biopharma; third, a comparative analysis; followed by a discussion of key findings and conclusions.

2. Theoretical basis

Initial Public Offering (IPO) refers to a company’s first sale of shares to the public through the stock market, aiming to raise funds for its development [4]. Typically, the lead underwriter manages the sale, and brokers publish a prospectus in accordance with relevant regulations, which must be approved by the China Securities Regulatory Commission and the exchange before listing. Once the IPO approval is successful, the company can apply for listing, officially changing its status from a limited liability company to a joint-stock company [4]. IPO and listing are two distinct processes: the public offering comes first, followed by the listing. The companies selected in this article have all gone public through these avenues. Listing financing has become one of the effective ways for biopharmaceutical companies to achieve long-term development goals. Through listing financing, companies can obtain financial support, enhance their visibility, promote standardized management, etc., thereby enhancing their innovation capabilities and core competitive advantages, and achieving sustained growth and development. However, China previously implemented a stock issuance approval system, and the listing conditions for companies on the main board were relatively strict. The comprehensive registration system greatly reduced the difficulty of IPO listing for companies planning to go public, allowing companies with financing needs to obtain financing more smoothly.

3. Company profiles

3.1. Innovent Biologics

Innovent Biologics, founded in 2011, is a company engaged in the research, production, and commercialization of oncology drugs [5]. Before its IPO, the company completed as many as ten rounds of financing and submitted its prospectus to the Hong Kong Stock Exchange on June 28, 2018, officially listing on October 31, 2018. Since its establishment, Innovent Biologics has stood out among 18A companies due to its exceptional capability in innovative drug development and an international operational model. Upholding the philosophy of "Beginning with Trust, achieving through Action," Innovent is committed to developing and selling high-quality medicines that are affordable for the public [5]. After more than a decade of development, Innovent Biologics has established a leading position in the fields of oncology and immune innovative drugs in China.

3.2. Genor Biopharma

Genor Biopharma was registered in Shanghai in December 2007 and currently boasts a strong product pipeline that includes the top three global oncology targets (breast cancer, lung cancer, and gastrointestinal tumors) [6]. The company is dedicated to the discovery, research, development, production, and commercialization of innovative therapies. Genor Biopharma submitted its prospectus to the Hong Kong Stock Exchange on June 30, 2020, and successfully went public on October 7, 2020.

3.3. Reason of case selection

Since the Hong Kong Stock Exchange implemented the 18A listing system over four years ago, the market has experienced a journey through exploration, enthusiasm, and now adjustment, resulting in continued differentiation in the subsequent operations, R&D, and stock performance of various listed companies. As of June 30, 2022, more than 80% of the 18A companies listed on the Hong Kong Stock Exchange have seen their stock prices fall below their issuance prices, with some companies experiencing declines exceeding 50% [7]. However, there are also companies that have performed remarkably well post-listing, attracting positive attention from the capital markets and continually securing financing opportunities. Therefore, this article selects Innovent Biologics and Genor Biopharma as comparative case studies, as both companies operate within the pharmaceutical sub-sector of the biotechnology industry shown in Table 1 [8], focusing on oncology and immune disease drugs, while also having similar financing scales and market capitalizations at issuance.

Table 1: IPO data of two companies

Company | Issue Price: HKD | Total Revenue | Total Market Value | Proportion |

Innovent Biologics | 13.98 | 156.32 | 38.00 | 21% |

Genor Biopharma | 24.00 | 115.46 | 31.12 | 25% |

4. Comparative analysis of IPO strategies

4.1. Core product development approaches

4.1.1. Innovent Biologics

Innovent Biologics has established itself as a leader in novel therapies through a full-scale independent R&D approach [9]. By taking a position of self-sustained innovation, the company converts itself into the competitor of a partner licensing strategy. These strategic elements reflect the company's promotion of frontier discovery, aligning with investors dedicated to enterprises that embrace disruptive life sciences innovation. Innovent's R&D focus on best-in-class and first-in-class monoclonal antibodies enhances its pipeline sustainment diversification factor over time. The adoption of the independent innovation approach, furthermore, shortens the turnaround time for drug discovery and regulatory approvals, and better liquidates its lead advantage [9]. This strategy did deliver the kind of confidence that was reflected with an IPO reception that attracted diverse institutional investors that also validated the innovation-driven growth dimension of the company.

4.1.2. Genor Biopharma

Genor Biopharma adopts an integrated method by adjusting within the laboratory with in-house technologies with licensed technologies. Apart from the efficiency it brings in terms of pipeline development, this approach also promotes possible pitfalls [10]. Even though the company will only be taking a percentage of financial risk with the full-scale R&D, the reducing on its full-scale innovation narrative means that it will be going against the institution on this. The process of the product development is normally used for the longer product development cycles due to the challenges posed by the partnership with third-party and regulatory negotiation [10]. Contrary to Innovent, which managed to clearly show a product distinction, Genor's replica made it very difficult to easily show as one of the industry frontiers.

4.2. Pre-IPO investor structures

4.2.1. Innovent Biologics

Innovent Biologics proved resilient through a large pool of diverse investors, a quality that brought substantial market confidence both before the launch and in the time after. The multiple funding rounds that the company held with financial investors such as the Sequoia Capital and Prime Capital Funds demonstrated the firm's strength, and the strategic scope as they quickly both secured the confidence of these important stakeholders [11]. The partner’s ability to raise funds from diverse sources signaled to the public market the presence of a much stable backing, reducing the risk perception associated with biotech IPOs. Besides that, the diversified pre-IPO structure helped the company in reducing the financial exposure to one single investor by distributing the financial risk across the different multiple stakeholders, hence avoided the excessive volatility in performance after listing [11]. This strategy is in line with the signal theory, which supposes that a firm backed by a high number-of-reputable investors during the Pre-IPO stage earns increased credibility during the new ventures and higher valuation stability in the future.

4.2.2. Genor Biopharma

Genor Biopharma's pre-IPO funding structure was more concentrated as the largest investors were Hillhouse Capital. Having a powerful lead investor who can bring stability to funding is an added advantage, but an over-dependence on a single major source may raise doubts on the markets' strength. The secretive nature and/or elite funders in the pre-IPO episode introduced a lot of uncertainties as regards the capital financing after a company's listing [12]. The fall in Hillhouse Capital's stake after the IPO received a negative reaction from the market since it was seen as a signal of unsatisfactory market confidence in Genor's long-term growth prospects. Through this reaction, it can be illustrated the principal-agent controversy, where the investors get concerned rather about the key stakeholders using their rights for their own benefit rather than prioritizing the overall company health [12]. This situation has been evident in the case of Genor, as even a few points on the growth of the company following IPO been made.

4.3. Market reception and strategic implications

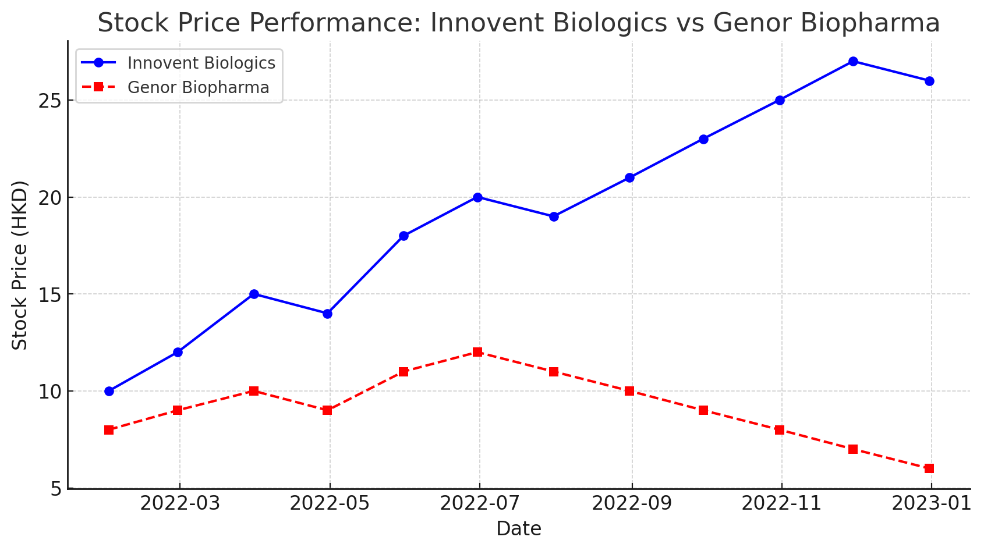

The overall performance of the two companies post-listing reveals a remarkable difference. The stock price of Innovent Biologics has shown generally upward movement from the issuance point period to today with some fluctuations along the way driven by macro issues like policies and the environment. The stock price has been above its issuance price since the second half of 2021, through the ongoing capital market declining. The trend continued despite the persistent decrease; however, it was still hovering above the low point. According to market data by the end of June 2022, the price at the Hong Kong Stock Exchange for Innovent Biologics had increased by 150% from its issuance price, sitting at HKD 34.90, whereas Genor Biopharma's stock price dropped 82% from its issuance price, sitting at HKD 4.28, signifying that the company's market value took a point to be below net assets level in the same month [8].

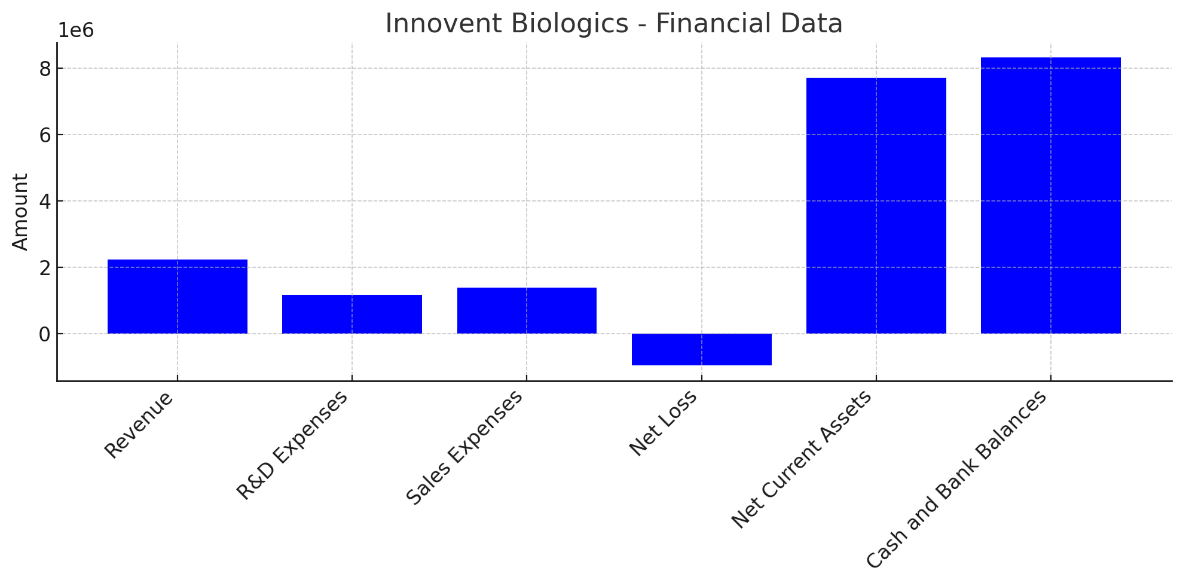

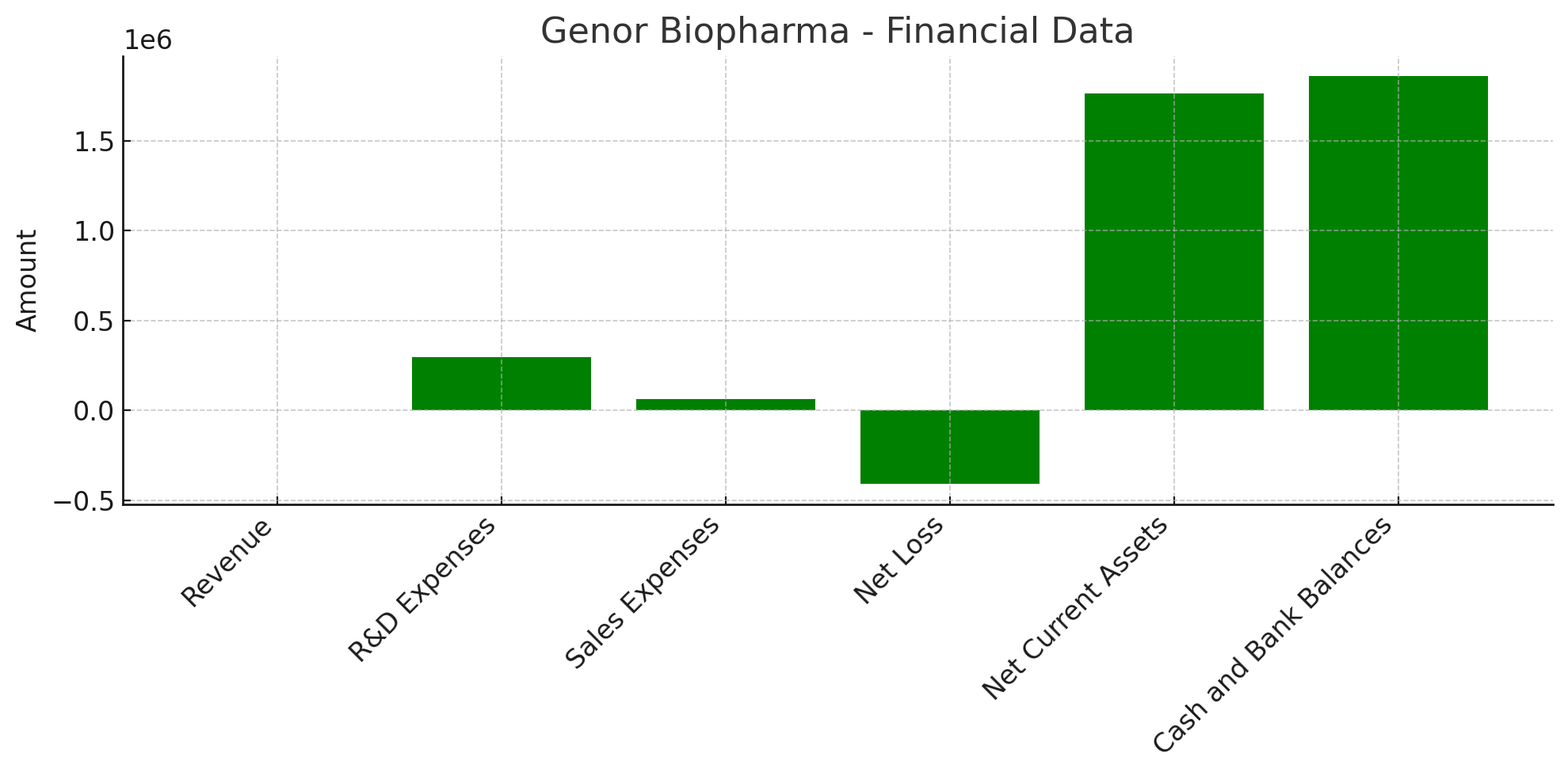

In revenue terms, Innovent Biologics managed to follow the lead of its distinctive R&D functions and a powerful commercialization team that actually yielded an increase in sales [12]. The net current assets, as well as cash and bank balances, are following a very high level with each quarter showing significantly improved reductions while June 2022 should be noted for a strong improvement in net losses. Regarding Genor Biopharma, the company experienced a persistent drop in the net current assets as well as cash and bank balances partly because there was no pharmaceutical trade and other income sources even when the listing was in place [13].

5. Discussion and implications

5.1. Synthesis of findings

The investigations of the IPO processes of Innovent Biologics and Genor Biopharma have crucial implications for how their operation and performance are portrayed, and each one is an indicator of how their future strategies will define their IPO attributes. Innovent R&D's strategic concentration, lean independence, and Investor diversification seem to offer a stronger IPO profile in comparison with Genor's hybrid approach, which accepts only limited support from a small group of investors. This integration will point out how the strategic differentiations are in the outcomes of the IPOs and will be accompanied by graphical data to help the reader quantify the additional value it gives to financial as well as the market implications.

Global investors are keen on investing in innovative drugs and technologies, with Innovent adopting an independent R&D strategy that is concentrated on research. Innovent enjoys a strong research and development pipeline as well as internal research, which has put it in an enviable position of commanding a prominent presence in the biopharmaceutical industry. Innovent's various research lines, funding diversity, and research excellence enable it to build and maintain a good reputation and attract the interest of institutional investors. Thus, the experiences of Innovent with its IPO reflect the strength of this policy, as its financial sufficiency was seen in these variables: financing by different investors, causing significant risks associated with a strong link with a single or a small group of investors. Nevertheless, this diverse investor base not only secured financial stability but also established trusting relations amongst the key market players as Innovent began its journey.

Figure 1: Stock price performance

Figure 1 shows the closing price movements of Innovent Biologics and Genor Biopharma from 2020 up to 2024. As shown in this chart, Innovent's share price growth is stable and follows an upward trend, indicating success of its strategy of research-drivenness and overall support from multiple sectors. The steady upward strength curve seen in the graph may mean the investor's confidence in the future equity options of Innovent looking forward to its abundant R&D pipeline and financial backing. The slope of the graph symbolizes steady investor interest, once again representing that same stock as Genor that had greater instability and inconsistency in their trajectory.

Figure 2: Market performance of Innovent Biologics

Figure 3: Market performance of Genor Biopharma

Besides, Figure 2 and 3 indicate how the actions taken impact the market view but also the risks that could be encountered if these choices are wrong. The reason for choosing these financial categories (R&D expenses, sales expenses, net losses, etc.) is that they can comprehensively reflect the company's innovation capability, market expansion strategy, profit stability, and financial liquidity, thereby directly linking market risk, investor trust, and long-term competitiveness, highlighting Innovent's diversified stability and Genor's high-risk concentration differences. By identifying the different patterns of investment in these two companies shown by the waterfall graph, one could easily conclude that investors in Innovent’s diversified pool experienced lesser market risks that showed predictable performance, while those in Genor experienced the efforts of market concentration that showed the highly risky performance. Hence, such a situation was reflected in the trust issue of the market that built the movement of the stocks. On the other hand, the ability of Innovent to appeal to various types of institutional investors; in addition to having a well-established and above-oriented R&D idea, takes it a step further by offering a much better and balanced IPO framework.

5.2. Strategic insights

The Innovent IPO also had a clear strategic focus on innovation and R&D, which allowed the company to maintain the leadership position in terms of scientific progress, while also providing a good base on which investors can be split. The financial results in the waterfall chart for Innovent, in addition to the aforementioned ones, suggest that the continuous rise in stock of this company is the first sign of firm beliefs of widely diversified investors with the clear adherence of the company's long-term goal [10]. This also strains Innovent on its part by making them insusceptible to the adverse shocks in terms of financial markets, thus, giving it the capacity to defend itself against the fluctuation within the biotech sector.

On the other hand, Genor's hybrid strategy has a different outcome, because it combines its focus on research and drug development along with the advantage of steady financial support from selected major investors. Genor has several breaks in the biopharma business, relying on a concentrated investor support also makes both the good and bad sides of the situation visible. The contribution of a small number of investors to the identified fund has provided a decent allowance above the short-term period, which amongst other things boosted a certain type of loyalty structures. This concentration also generates risks such as exposure to the financial situation and interests of those investors, which restricts the company's adaptability in its future strategic planning. Nevertheless, according to Figure 2, it can be seen that the separation of the Genor's chart by two parts implies that the struggle of the fluctuating trend line, which is mostly affected by the investor opinion though concentrated, was significant. A change in the stock price performance raises questions about the investors' trust, and hence, it leads us to understand that if this situation continues in the long term, then it may result in reducing the funding amount available for startups.

5.3. Recommendations for future IPOs

For the general biotech companies, Research and innovation are critical pathways for biotechnology companies to achieve success. To gain a competitive advantage, biotech companies must strengthen their R&D capabilities, prioritize and support research activities, and recognize that innovation is the source and driving force of enterprise development. Furthermore, during the R&D process, biotech companies should center their efforts around patient needs and clinical value, focusing on innovative drug research in relevant fields rather than merely pursuing speed and success rates by creating various "generic drugs" concentrated on specific indications [11]. The aim should be to maximize patient benefits, reduce the homogenization of innovative drugs, optimize resource allocation, and strengthen core competitive products while avoiding waste of financial and talent resources.

Meanwhile, biotech companies should enhance the efficiency of converting R&D results into practical applications. They can adopt diversified approaches to research while fostering a sense of independent R&D, enabling faster establishment of strategic partnerships with international firms to share risks and reduce the chances of early-stage R&D failures, thereby enhancing mutual brand recognition and influence [13]. Additionally, biotech companies should avoid short-term investment tendencies, reasonably plan both short-term and long-term objectives, allocate R&D investments wisely, and ensure the completion of R&D goals, thereby improving the efficiency of capital utilization.

6. Conclusion

The IPO strategies of Innovent Biologics and Genor Biopharma illustrate the varied approaches biotech firms take to secure capital and market confidence. While both companies leveraged their strengths in R&D and market positioning, differences in timing, investor targeting, and financial structuring influenced their outcomes. This comparison highlights how strategic planning in an IPO can impact long-term growth and investor perception. Ultimately, successful biotech IPOs require balancing financial needs, market conditions, and innovation credibility. Understanding these factors provides valuable insights for future biotech listings and reinforces the importance of tailored strategies in navigating the complexities of public markets.

The two comparative case companies selected in this article are both listed companies, however, the data disclosed by their companies is limited, and the information collected on the research subjects may be incomplete. Meanwhile, although the corresponding analysis was extended to all biotechnology companies when summarizing the comparative analysis of the two companies, it was only qualitative analysis rather than quantitative analysis, which may result in incomplete analysis. Future research can conduct more in-depth studies through quantitative analysis and consideration of more indicators.

References

[1]. Stacciarini, J. H. S. (2025). The consolidation of the pharmaceutical sector in the global economy: Growth, influence, deviations, and marketing. Center for Open Science. https://doi.org/10.31235/osf.io/6728p_v1

[2]. Akram, F., Mir, A. S., Haq, I. ul, & Roohi, A. (2022). An appraisal on prominent industrial and biotechnological applications of bacterial lipases. Molecular Biotechnology. https://doi.org/10.1007/s12033-022-00592-z

[3]. Halwani, A. A. (2022). Development of pharmaceutical nanomedicines: From the bench to the market. Pharmaceutics, 14(1), 106. https://doi.org/10.3390/pharmaceutics14010106

[4]. Megaravalli, A. V. (2023). Initial public offering: A critical review of literature. Qualitative Research in Financial Markets, 15(2), 385–411. https://doi.org/10.1108/qrfm-11-2021-0190

[5]. Innovent. (2025). innovent. https://www.innoventbio.com/

[6]. Genor. (2025). Genor Biopharma Co. Ltd. Genor Biopharma. https://www.genorbio.com/

[7]. Kasbar, M. S. H., Tsitsianis, N., Triantafylli, A., & Haslam, C. (2022). An empirical evaluation of the impact of agency conflicts on the association between corporate governance and firm financial performance. Journal of Applied Accounting Research, 24(2), 235–259. https://doi.org/10.1108/jaar-09-2021-0247

[8]. Kasbar, M. S. H., Tsitsianis, N., Triantafylli, A., & Haslam, C. (2022). An empirical evaluation of the impact of agency conflicts on the association between corporate governance and firm financial performance. Journal of Applied Accounting Research, 24(2), 235–259. https://doi.org/10.1108/jaar-09-2021-0247

[9]. Philippidis, A. (2018). Top 10 biopharma ipos, january–june 2018. Genetic Engineering & Biotechnology News, 38(15), 6–7. https://doi.org/10.1089/gen.38.15.03

[10]. Agten, S., & Wu, B. (2024). The golden age of Chinese biopharma sector, 2014–2021: Explosive growth in a thriving ecosystem. In Biopharma in China (pp. 41–69). Springer Nature Singapore. https://doi.org/10.1007/978-981-97-1471-1_3

[11]. Sharma, A., Mittal, K., Arora, D., & Ganti, S. S. (2021). A comprehensive review on strategies for new drug discovery and enhanced productivity in research and development: Recent advancements and future prospectives. Mini-Reviews in Organic Chemistry, 18(3), 361–382. https://doi.org/10.2174/1570193x17999200529100808

[12]. Klimczak, K. M., & Shachmurove, Y. (2025). Strategic response to turbulence: Lessons from real shocks. Edward Elgar Publishing.

[13]. Shi, C. M., & Zhao, Y. (2024). The interplay between innovation and marketing: Evidence from the pharmaceutical industry. Elsevier BV. https://doi.org/10.2139/ssrn.5010052

Cite this article

Li,J. (2025). Comparison Analysis of IPO of Biotech Companies: Case Study of Innovent Biologics and Genor Biopharma. Advances in Economics, Management and Political Sciences,180,244-251.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Stacciarini, J. H. S. (2025). The consolidation of the pharmaceutical sector in the global economy: Growth, influence, deviations, and marketing. Center for Open Science. https://doi.org/10.31235/osf.io/6728p_v1

[2]. Akram, F., Mir, A. S., Haq, I. ul, & Roohi, A. (2022). An appraisal on prominent industrial and biotechnological applications of bacterial lipases. Molecular Biotechnology. https://doi.org/10.1007/s12033-022-00592-z

[3]. Halwani, A. A. (2022). Development of pharmaceutical nanomedicines: From the bench to the market. Pharmaceutics, 14(1), 106. https://doi.org/10.3390/pharmaceutics14010106

[4]. Megaravalli, A. V. (2023). Initial public offering: A critical review of literature. Qualitative Research in Financial Markets, 15(2), 385–411. https://doi.org/10.1108/qrfm-11-2021-0190

[5]. Innovent. (2025). innovent. https://www.innoventbio.com/

[6]. Genor. (2025). Genor Biopharma Co. Ltd. Genor Biopharma. https://www.genorbio.com/

[7]. Kasbar, M. S. H., Tsitsianis, N., Triantafylli, A., & Haslam, C. (2022). An empirical evaluation of the impact of agency conflicts on the association between corporate governance and firm financial performance. Journal of Applied Accounting Research, 24(2), 235–259. https://doi.org/10.1108/jaar-09-2021-0247

[8]. Kasbar, M. S. H., Tsitsianis, N., Triantafylli, A., & Haslam, C. (2022). An empirical evaluation of the impact of agency conflicts on the association between corporate governance and firm financial performance. Journal of Applied Accounting Research, 24(2), 235–259. https://doi.org/10.1108/jaar-09-2021-0247

[9]. Philippidis, A. (2018). Top 10 biopharma ipos, january–june 2018. Genetic Engineering & Biotechnology News, 38(15), 6–7. https://doi.org/10.1089/gen.38.15.03

[10]. Agten, S., & Wu, B. (2024). The golden age of Chinese biopharma sector, 2014–2021: Explosive growth in a thriving ecosystem. In Biopharma in China (pp. 41–69). Springer Nature Singapore. https://doi.org/10.1007/978-981-97-1471-1_3

[11]. Sharma, A., Mittal, K., Arora, D., & Ganti, S. S. (2021). A comprehensive review on strategies for new drug discovery and enhanced productivity in research and development: Recent advancements and future prospectives. Mini-Reviews in Organic Chemistry, 18(3), 361–382. https://doi.org/10.2174/1570193x17999200529100808

[12]. Klimczak, K. M., & Shachmurove, Y. (2025). Strategic response to turbulence: Lessons from real shocks. Edward Elgar Publishing.

[13]. Shi, C. M., & Zhao, Y. (2024). The interplay between innovation and marketing: Evidence from the pharmaceutical industry. Elsevier BV. https://doi.org/10.2139/ssrn.5010052