1. Introduction

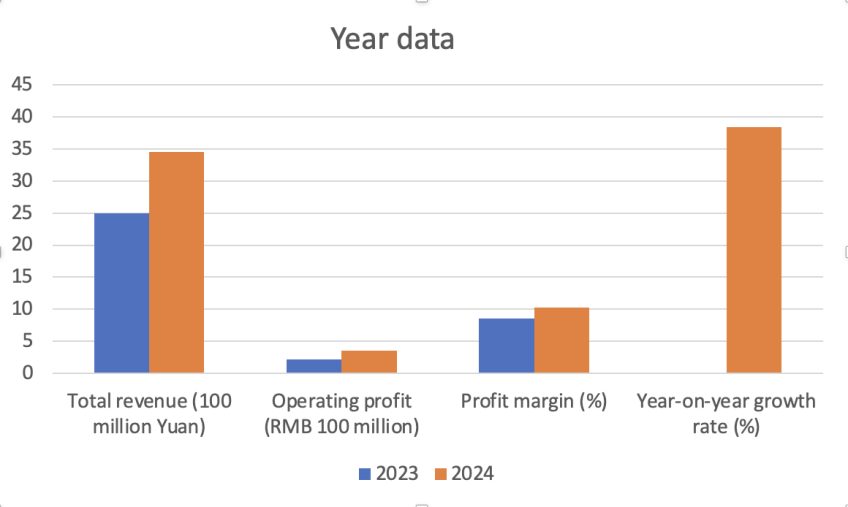

Luckin Coffee has emerged as China's dominant coffee chain through a remarkable transformation following its 2020 financial scandal. The company's success stems from its innovative digital-first approach, targeting urban professionals with compact stores strategically located in business districts. By requiring all orders through its proprietary app, Luckin has created an efficient operational model that combines quick service with valuable customer data collection. The 2024 financial results demonstrate Luckin's strong recovery, with annual revenue reaching ¥34.5 billion, marking a 38.4% year-over-year increase. The fourth quarter alone generated ¥9.61 billion in revenue, including ¥2.05 billion from franchise stores - a 36.1% growth in this segment. Profitability has significantly improved, with annual operating profit hitting ¥3.5 billion at a healthy 10.3% margin, while maintaining robust financials including ¥5 billion in cash reserves and minimal debt.

Looking ahead, Luckin coffee is pursuing aggressive expansion with plans to grow from its current 18,000 stores to over 20,000 locations within three years. The strategy focuses on deepening penetration in China's lower-tier cities while preparing for international expansion into Southeast Asian markets. This growth builds on the company's proven formula of cost-effective operations, digital ordering infrastructure, and data-driven decision making that has reshaped coffee consumption patterns across China. The company's journey from crisis to market leadership offers valuable insights into China's evolving retail landscape, demonstrating how technological innovation and operational efficiency can drive sustainable growth even after significant setbacks. Luckin's transformation has not only restored investor confidence but also positioned it as a formidable competitor to global coffee chains in one of the world's most dynamic consumer markets.

The research on Luckin Coffee can reflect the growth logic of China's new consumer brands. The beginning of Luckin Coffee is due to a subversion of traditional coffee. When Starbucks has been in the Chinese market for as long as 20 years and opened 3,000 stores, Luckin Coffee has realized the number of stores in a short 18 months through the Internet. Behind this extremely exaggerated growth rate is the digital operation and the comprehensive enabling of the new retail industry. From the very beginning, Luckin Coffee has reconstructed the coffee business into a digital business: users have replaced the queue at the counter by scanning the code to order, and social marketing has replaced the traditional advertising (advertising screen). This new retail industry not only changes the way coffee is consumed, but also provides a previous example of a more traditional transformation of coffee.

Luckin coffee fraud crisis after the Jedi rebirth, so that the value of Luckin case more three-dimensional. When the 2.2 billion fake news was broke, the stock price plummeted 80% overnight, and many people felt that the company was finished, but Luckin returned to profit after two years by closing loss-making stores, optimizing the supply chain, and a series of measures. From the perspective of capital markets, the case of Luckin Coffee is particularly important, reflecting the special challenges faced by China Concept stocks, from short selling, forced delisting to return to profitability, this experience is fully presented in the management challenges of cross-border listed companies. Especially under different regulatory background, how Luckin wins the trust of investors through restructuring, this other China concept stock company provides a valuable and important reference.

2. The status of Luckin coffee

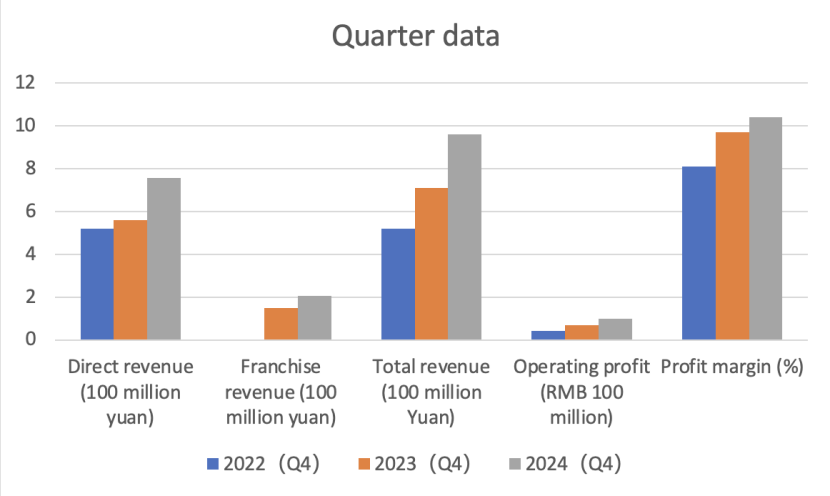

By the end of 2024, Luckin's profit and revenue have been greatly improved. According to the financial report of 2024 given by Luckin Coffee, it can be seen that in the Q4 stage of 2024, the revenue of Luckin Coffee reached 9.613 billion yuan, among which the revenue from franchised stores was 2.046 billion yuan, with a year-on-year increase of 36.1% (Figure 1). Compared with Q4 in 2023 and Q4 in 2022, the increase has fallen a lot. Second, Luckin coffee's annual revenue reached 34.5 billion yuan, up 38.4% year on year. This means luckin's multiple strategic success and market opportunities, and a higher position in the industry. In the Q4 stage of 2024, the operating profit of Luckin Coffee reached 995 million yuan, with a profit margin of 10.4%, a large increase compared with the same period in 2023 and 2024. In 2024, the annual operating profit was 3.5 billion yuan, with a profit margin of 10.3%. From this perspective, the future trend of Luckin coffee will develop in a big direction.

Figure 1: The total revenue, profit and year on year growth rate of Luckin coffee (2023-2024)

Figure 2: The direct revenue, franchise revenue and total revenue and profit of Luckin coffee

The total number of stores increased by 37.5% year-on-year to 22,349, of which 14,591 were directly operated stores and 7,749 were affiliated stores. In 2024, the average number of monthly trading customers was 71.8 million, an increase of 48.5%, while the revenue of self-operated stores in 2024 was 25.592 billion yuan ($3.507 billion), an increase of 43.1%. However, same-store sales growth at self-owned stores declined, from 21% in 2023 to -16.7%, a decline of about 37.7%. Operating profit at the level of self-operated stores in 2024 was 4.836 billion yuan, an increase of 21.7%; The store-level profit margin was 18.9%, compared to 22.2% in 2023, and also affiliate store revenue was 7.745 billion yuan ($1.061 billion) in 2024, an increase of 24.4%.

Furthermore, as can be seen in figure 2, GAAP operating profit for 2024 was 3.538 billion yuan ($485 million), an increase of 16.9%, and operating profit was 10.3%, compared to 12.1% in 2023. Non-GAAP operating profit after adjusting share-based compensation expense was RMB3.903 billion in 2024, an increase of 19.5%. Non-GAAP operating margin was 11.3% and 13.1% in 2023.

2.1. The analysis of stock market in Luckin coffee

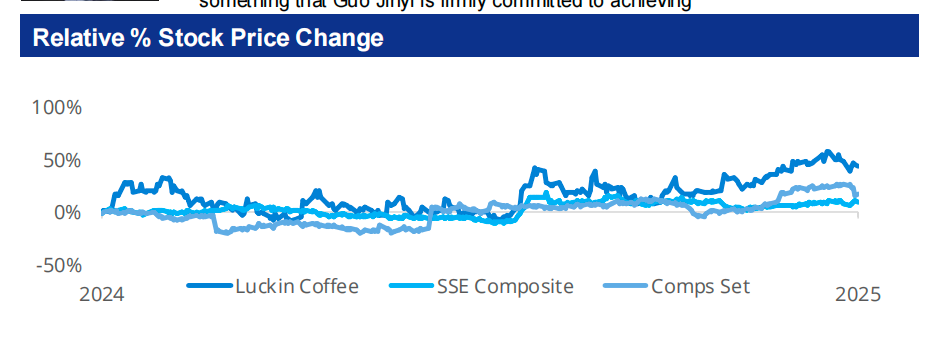

Originally on May 17, 2019, Luckin Coffee was listed in NASDAQ, with an IPO price of 17 cents, and in April 2020, due to the financial fraud incident was revealed, Luckin Coffee's share price plummeted and suspended, but on May 22, 2020, it was officially delisted from Nasdaq. At the beginning, Luckin Coffee opened at $0.965 on the OTC Pink Sheets exchange, with a total share capital of about 350 million shares, and the initial OTC market value was about 338 million US dollars (calculated at the opening price) from May 20, 2020 to April 3, 2025. It went from $8.2 to $36.55, with a high of $37.5 and a low of $36.03. Compared with the low of $22.48 on May 20, 2022, the current share price of $36.55 has risen by 345.73%, which is a relatively strong performance in the long run. Compared with the historical high price, the current share price is only 6% away from the historical high price of $38.88. From 2024, the share price of Luckin Coffee has maintained an upward trend. If calculated on a quarterly basis, the average monthly turnover of Luckin Coffee's stock market in the recent period was about 867 million US dollars, and Luckin Coffee's market value reached 10.368 billion US dollars.

Due to Luckin's strong financial position and store expansion in recent years, Luckin Coffee has been in a state of continuous rise. If Luckin Coffee can still maintain a revenue rate of 30% or more in 2024-2025 and further improve the profit margin, the stock price may continue to rise. In addition, if the number of Luckin Coffee stores and the revenue rate of each store increase, through digital management and operation, it can help promote the improvement of performance in the next 2-3 years. At the same time, if the growth of overseas stores exceeds expectations, it can also pave the way for increasing performance, which will lead to the future stock price of Luckin Coffee rising in the long run, as shown in the figure 3.

Figure 3: The stock price change in Luckin coffee between 2024 and 2025

2.2. Case analysis

However, in 2020, Luckin Coffee had a financial fraud, exposing a financial fraud of 2.2 billion yuan, resulting in an 80% drop in sales that year. It pointed out that such event factors mainly include two potential factors: common risk factors and special risk factors. Common risk factors refer to the means adopted by the company to protect the company's financial affairs. Special risk factors are entities outside the control of a corporate organization or other economic entity [1]. If a company has both of these factors, then the company is likely to have financial fraud. Luckin's fraud at that time included stealing meal codes, exaggerating orders, falsely reporting unit prices, and falsely reporting advertising fees. Also it pointed out that there is another reason for such incidents of Luckin Coffee.

First, Luckin Coffee is a Chinese concept company, and Chinese concept companies usually need to be listed quickly. In order to stand out in the same type of companies, Luckin Coffee needs to have a unique market positioning. This requires Luckin Coffee to open stores near individual office buildings to increase its presence in front of consumers. Therefore, the market positioning that is different from Starbucks has brought Luckin Coffee the pressure of large amount of capital needed for crazy expansion. Thus became one of the motives for financial fraud [2].

The author pointed out that Luckin Coffee's financial fraud means include inflated sales performance, inflated costs and concealed related transactions. In April 2020, Luckin Coffee admitted that the company had engaged in financial fraud. During the second and third quarters of 2019, Luckin Coffee falsely inflated its operating profit by 2 billion yuan through means such as increasing false operating income, exaggerating advertising investment amounts, and hidden transactions [3]. According to the sales data of Luckin Coffee, in Q3 2019, Luckin Coffee's average daily sales volume per store was 444 pieces, which increased to 495 pieces in Q4. However, through long-term observation, Luckin Coffee's sales volume was 444 pieces per day. For example, through the investigation of 981 stores of Luckin Coffee, it is found that in fact, the daily sales volume of each store is only 263, which means that Luckin Coffee's sales volume in Q3 and Q4 has increased by 69% and 88%. Besides, Luckin Coffee also sells other products, such as cakes and snacks. However, these products accounted for only 7% of revenue in Q2 2018, but by Q3 2019, it increased to 22.6%, and sales increased from 6.4% to 21.7%. However, after another round of investigation, it was found that the sales amount of these other products in Luckin Coffee in Q3 2019 was only 6.2%, which was exaggerated by nearly four times [3]. From the research, it found that Luckin Coffee also exaggerated the unit price. For example, by selling coupons, the price of the product purchased could be reduced by using coupons, but the price was higher than the original unit price in Luckin's financial statements at that time.

In fact, during Luckin Coffee's fraud period, there was always huge controversy. After delisting, it did not stop moving forward. Luckin Coffee reorganized its board of directors and reorganized its management team. Guo Jin was appointed as the new CEO and chairman. Subsequently, marketing was carried out through business means such as store closures, price hikes, and focusing on best-selling products also Luckin Coffee has achieved value innovation again by organically integrating cost reduction and differentiation [4, 5]. Finally, through the research on the financial fraud audit case of Luckin Coffee, the research conclusions and prospects are proposed. This can improve the standardization of financial fraud audits, help reduce the possibility of failure in financial fraud audits, and has certain significance for the financial fraud audit work of listed companies in China [6].

2.3. The difference between the Luckin Coffee and competitors

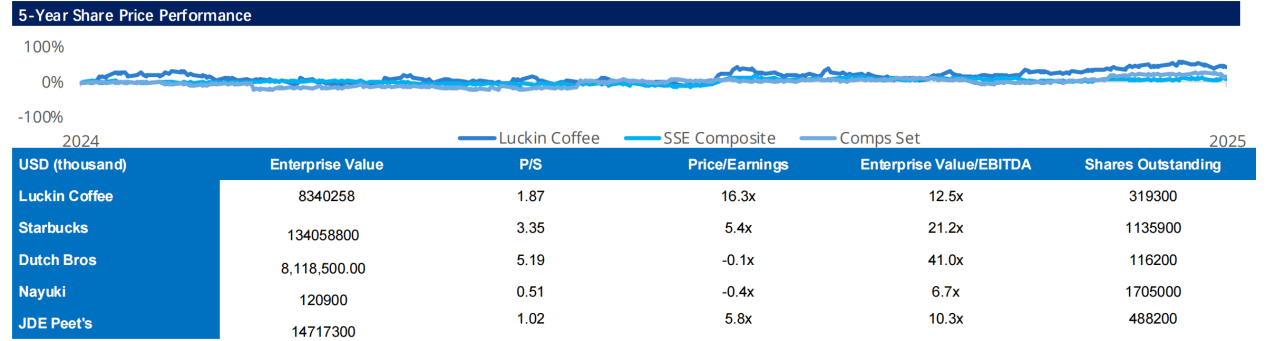

Figure 4: The difference of Luckin coffee and its competitor in different factors

Recently, Starbucks (SBUX.O) and Luckin Coffee (LKNCY.US) have successively released their financial reports. Luckin Coffee's revenue still exceeds that of Starbucks China, and the operating profit margin of Starbucks China is higher. This is mainly due to their different market positioning [7].

Figure 4 shows the difference between luckin coffee and its competitiors, It can be seen that the enterprise value of Luckin Coffee is only 8,340,258 Dollar, compared with other competitors, except Nayuki, the remaining brands have higher enterprise value than Luckin Coffee, which depends on the business model and market positioning of different brands. Luckin Coffee's market positioning is mainly young working people and students. It focuses on high cost performance and convenience, such as reducing the queuing time through online ordering or takeout. In addition, sometimes Luckin Coffee will strengthen its brand image by co-branding with other well-known brands, such as tiktok, Xiaored Book and other software, so as to attract more consumers. At the same time, the price of Luckin coffee is half that of competitors (such as Starbucks), which can be enjoyed by some low-income people. In addition, Luckin Coffee's business model is mainly digital-driven new retail coffee, such as ordering on the APP or picking up shop (Internet), which not only reduces labor costs, but also facilitates customers [8]. It also adopts automated production, such as standardized processes and advanced equipment, to reduce production errors and improve efficiency.

The impact of the new retail business model on Luckin Coffee's financial performance is analyzed from aspects such as profitability, debt-paying ability, growth ability and operational ability. It is found that the business model innovation has a good impact on Luckin Coffee's financial performance and has seen a significant improvement. This can be concluded from Luckin Coffee's income statement in recent years [9, 10].

3. Conclusion

In conclusion, through the analysis of the current situation of Luckin Coffee and the relationship between stock market analysis and capital market, the key findings show that the revenue growth (38.4%) and profit margin growth (10.3) are mainly from the expansion of franchised stores (21.3%) and digital operation to reduce costs. With zero interest bearing liabilities and 500 million cash, it passed the financial health index (liquidity 1.6-1.7) and regained the trust of investors, thereby obtaining investment and capital for redevelopment. Furthermore, the stock price of Luckin Coffee has increased by 67% in 2024, reflecting the market's recognition of Luckin Coffee's profit, but it is still 42% lower than the pre-fraud peak in 2020. If researchers want the stock price to continue to rise in the future, it must ensure food safety and some malicious competition. Lower-priced products such as Cotti coffee are flooding the market, which could hurt Luckin's margins. And the case event in 2020 is also a lesson, which not only tells Luckin Coffee which direction it should go for transformation in the future, but also serves as a fresh sample for China Concept Stock company.

References

[1]. Wang LAN & Wang Luqi. (2025). Research status and development trend of enterprise risk control -- Taking Luckin Coffee as an example. Modern Marketing (Next ten-day issue), (02), 116-118. doi:10.19932/j.cnki.22-1256/F.2025.02.116.

[2]. Eleanor wong. (2025). Based on the theory of the three factors are shares in financial fraud and audit research - rui xing coffee, for example. Hebei enterprises, (02) 103-106. The doi: 10.19885 / j.carol carroll nki hbqy. 2025.02.016.

[3]. Peng Dihan. (2023). Case Study on Financial Fraud in New Retail Industry (Master's Thesis, Chengdu University). Master's https://link.cnki.net/doi/10.27917/d.cnki.gcxdy.2023.000015 doi: 10.27917 /, dc nki. Gcxdy. 2023.000015.

[4]. Tang Wei & Bao Zayshan. (2024). The Impact of new retail business Model on corporate Financial Performance: A case study of Luckin Coffee. Accountants, (23), 46-49.

[5]. Xu P. (2024). How Luckin Coffee "Reborn from Nirvana". Foreign Investment in China, (22), 108-111.

[6]. Huang Caimin. (2024). Research on Problems and Countermeasures of Financial Fraud Audit of Listed Companies (Master's Thesis, Shenyang Jianzhu University). Master's https://link.cnki.net/doi/10.27809/d.cnki.gsjgc.2024.000769 doi: 10.27809 /, dc nki. GSJGC. 2024.000769.

[7]. Xing Hongda. (2021). Case Analysis of Luckin Coffee's Financial Fraud (Master's Thesis, Hunan University). Master's https://link.cnki.net/doi/10.27135/d.cnki.ghudu.2021.001162 doi: 10.27135 /, dc nki. Ghudu. 2021.001162.

[8]. Zheng Yuying & Pan Hongfei. (2024). Research on Luckin Coffee Marketing Strategy under the model of "Internet + New retail". Modern business, (16), 40-43. Doi: 10.14097 / j.carol carroll nki. 5392/2024.16.041.

[9]. Zheng YuXin. (2024-08-05). Competition differentiation in Coffee market: Different Ways of Starbucks, Luckin and Cudi, Economic Observer, 023.

[10]. Guo Xingxin. (2024). Research on Risk Assessment of Material Misstatement in Audit of New Retail Enterprises (Master Thesis, Lanzhou University of Finance and Economics). Master's https://link.cnki.net/doi/10.27732/d.cnki.gnzsx.2024.000402 doi: 10.27732 /, dc nki. GNZSX. 2024.000402.

Cite this article

Zhan,M. (2025). The Research on Luckin Coffee's Financial Situation and Future Trends. Advances in Economics, Management and Political Sciences,186,127-132.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang LAN & Wang Luqi. (2025). Research status and development trend of enterprise risk control -- Taking Luckin Coffee as an example. Modern Marketing (Next ten-day issue), (02), 116-118. doi:10.19932/j.cnki.22-1256/F.2025.02.116.

[2]. Eleanor wong. (2025). Based on the theory of the three factors are shares in financial fraud and audit research - rui xing coffee, for example. Hebei enterprises, (02) 103-106. The doi: 10.19885 / j.carol carroll nki hbqy. 2025.02.016.

[3]. Peng Dihan. (2023). Case Study on Financial Fraud in New Retail Industry (Master's Thesis, Chengdu University). Master's https://link.cnki.net/doi/10.27917/d.cnki.gcxdy.2023.000015 doi: 10.27917 /, dc nki. Gcxdy. 2023.000015.

[4]. Tang Wei & Bao Zayshan. (2024). The Impact of new retail business Model on corporate Financial Performance: A case study of Luckin Coffee. Accountants, (23), 46-49.

[5]. Xu P. (2024). How Luckin Coffee "Reborn from Nirvana". Foreign Investment in China, (22), 108-111.

[6]. Huang Caimin. (2024). Research on Problems and Countermeasures of Financial Fraud Audit of Listed Companies (Master's Thesis, Shenyang Jianzhu University). Master's https://link.cnki.net/doi/10.27809/d.cnki.gsjgc.2024.000769 doi: 10.27809 /, dc nki. GSJGC. 2024.000769.

[7]. Xing Hongda. (2021). Case Analysis of Luckin Coffee's Financial Fraud (Master's Thesis, Hunan University). Master's https://link.cnki.net/doi/10.27135/d.cnki.ghudu.2021.001162 doi: 10.27135 /, dc nki. Ghudu. 2021.001162.

[8]. Zheng Yuying & Pan Hongfei. (2024). Research on Luckin Coffee Marketing Strategy under the model of "Internet + New retail". Modern business, (16), 40-43. Doi: 10.14097 / j.carol carroll nki. 5392/2024.16.041.

[9]. Zheng YuXin. (2024-08-05). Competition differentiation in Coffee market: Different Ways of Starbucks, Luckin and Cudi, Economic Observer, 023.

[10]. Guo Xingxin. (2024). Research on Risk Assessment of Material Misstatement in Audit of New Retail Enterprises (Master Thesis, Lanzhou University of Finance and Economics). Master's https://link.cnki.net/doi/10.27732/d.cnki.gnzsx.2024.000402 doi: 10.27732 /, dc nki. GNZSX. 2024.000402.