1. Introduction

Spring Airlines made its maiden flight on 18 July 2005 and is one of the first private airlines in China. As of March 2025, Spring Airlines has a fleet of 131 Airbus A320 family aircraft, with an average age of 7.54 years. The destinations cover major business and tourist cities in China, Southeast Asia, and Northeast Asia, with more than 210 routes and 20 million passengers transported annually.

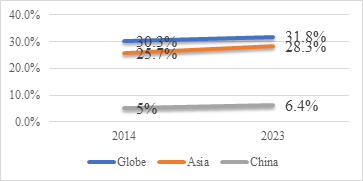

As can be seen from Figure 1, as of 2023, the market share of domestic low-cost airlines is much lower than that of international and Asia-Pacific regions. This is because China's low-cost airlines started later than Western countries, and the first low-cost airlines were established in 2004, and the current market share is low, but it also shows that there is still a lot of room for development in this field [1]. Besides, although the market share of domestic low-cost airlines has steadily increased from 5% to 6.4% since 2014, in the meantime, there have been twists and turns. According to the International Air Transport Association (IATA), global airline losses exceeded $180 billion between 2020 and 2022, with passenger demand plummeting by 60% [2].

This study talks about how Spring Airlines navigated the crisis through three main strategies: low-cost carrier model, diversified income streams, and policy support. The research uses a mixed-methods approach, combining quantitative data from annual reports (2021–2024) with qualitative insights from company financial reports. The findings aim to let other people know the successful and valuable experiences from Spring Airlines, which are helpful for other airline companies.

Figure 1: 2014-2023 Market share of domestic low-cost routes

2. Profitability analysis of domestic airlines

Table 1: Annual income statement of four major domestic airlines

Airline | Year | Total Operating Income | Total Operating Cost | Profit Margin |

Spring Airlines | 2023 | 179.38 | 164.21 | 8% |

2022 | 83.69 | 127.26 | -52% | |

2021 | 108.58 | 121.80 | -12% | |

China Eastern Airlines | 2023 | 1137.41 | 1274.36 | 12% |

2022 | 463.05 | 895.07 | -93% | |

2021 | 671.27 | 904.79 | -35% | |

China Southern Airlines | 2023 | 1,599.29 | 1,654.25 | -3% |

2022 | 870.59 | 1,238.46 | -42% | |

2021 | 1,016.44 | 1,176.71 | -16% | |

Air China | 2023 | 1,411.00 | 1,526.24 | -8% |

2022 | 528.98 | 1,018.77 | -93% | |

2021 | 745.32 | 993.41 | -33% | |

Juneyao Airlines | 2023 | 200.96 | 200.28 | 0.3% |

2022 | 82.1 | 142.43 | -73% | |

2021 | 117.67 | 133.44 | -13% |

Note: All monetary values are in 100 million yuan.

As can be seen from Figure 2, the profitability of domestic aviation giants is much higher than that of low-cost airlines, but the losses have been more serious in recent years, especially in 2021-2022, which is caused by many factors. For example, by the end of 2021, the cumulative number of people infected with the new coronavirus in the world was nearly 290 million, and more than 5 million people have died due to the new coronavirus [3]. After the outbreak of the Russia-Ukraine conflict, China has experienced several price increases in refined oil products, so the energy cost of airlines has risen [4]. Airlines lease aircraft and purchase equipment mostly in US dollars, and the RMB depreciated by more than 9% against the US dollar in 2022, resulting in a surge in foreign exchange losses. In addition, in 2023, most airlines are losing money, among which the representatives of low-cost airlines, Spring Airlines and Juneyao Airlines, have turned losses into profits, especially Spring Airlines. This is due to the effective strategic deployment of Spring Airlines.

3. Spring Airlines' profit strategy: low-cost carrier model

The core concept of a low-cost airline is to provide consumers with highly competitive and low fares through a series of efficient operational strategies and cost control tools [5]. Spring Airlines’ model centers on the “Two Singles, Two Highs, and Two Lows.” Two Singles means a Single aircraft type (Airbus A320 with CFM engines) and a single cabin class (economy only). Two Highs mean high seat occupancy rate (89.4%) and high daily aircraft utilization (8.1 hours in 2023). Two Lows mean Low sales and management costs. The airline relies on direct e-commerce sales (e.g., promotions, mobile app bookings) to reduce agent fees [6].

Operating a single aircraft type (Airbus A320) reduced maintenance and training costs by 15% compared to mixed fleets. A single economy-class configuration increased seat density, achieving an industry-leading occupancy rate of 89.4% in 2023. On the one hand, Spring Airlines takes measures to reduce the workload of cargo transportation in the process of operation, further saves the time and resources of unloading operations, improves the efficiency of aircraft stopovers, and formulates different flight plans according to different customer needs and travel habits, increases the number of flights during off-peak hours (before 8 o'clock or after 21 o'clock), and uses the idle time of aircraft in other time periods, thereby increasing the average daily flight frequency of aircraft, forming a utilization rate of up to 8.1h/day, and further optimizing fixed costs [7].

4. Spring Airlines' profit strategy: diversified income streams

Spring Airlines' main business revenue is still dominated by passenger ticket sales, but it controls costs through low-cost operating models (e.g., single aircraft, high load factor, and point-to-point routes), while diversifying its revenue through additional services and derivative services. According to the financial reports of recent years, the proportion of its non-air ticket revenue has gradually increased, close to the average of international low-cost airlines (about 20-30%).

Non-flight revenue strategies included cargo services during passenger demand slumps and data monetization through customer analytics. For instance, cargo revenue surged by 40% in 2022, offsetting a 22% decline in passenger income. Membership programs also enhanced customer retention, with 1.2 million active subscribers by 2024. Ancillary services revenue includes baggage and seat selection fees: the free baggage allowance is strictly limited, and excess baggage charges are the main source of income; paid seat selection services such as front row seats and emergency exit row seats are available. In-flight sales mean including food and beverages, duty-free goods (e.g., cosmetics, souvenirs), and entertainment products (e.g., Wi-Fi service). Spring Airlines stimulates passenger spending by streamlining its free services. Insurance and other services mean sales of aviation accident insurance, delay insurance, and value-added services such as priority boarding and fast tracking.

Revenue from tourism product integration includes "air ticket + tourism" package sales: relying on the travel agency resources of the parent company Spring and Autumn Group, it provides services such as independent travel, group tours, hotel reservations, and scenic spot tickets, forming a closed loop of air travel ecology. Cross-border travel and charter business mean that before the epidemic, we focused on Japan, South Korea, and Southeast Asian routes; reduced the cost of international routes through the charter model; and shared revenue with destination travel service providers.

Fuselage and cabin advertising: spray advertisements on the exterior of the aircraft, and place commercial advertisements on the display screen and seat headrests in the cabin. For example, in March 2025, Spring Airlines signed a strategic cooperation agreement with Shanghai Dingzhi Dental Co., Ltd., which includes fuselage naming, brand linkage, and innovative service integration. Monetization of traffic on digital platforms means diverting traffic to third parties (car rentals, hotels) through official websites, APPs, and other channels to obtain commission income. The frequent flyer program (membership System) includes Green Wing Membership Points: points can be exchanged for air tickets or goods, promote customer stickiness, expand the use of points through cooperation with banks and retailers, and obtain profit sharing.

Other innovative businesses include Cargo & Charter Services: replenishing revenue with belly cargo and full freighter aircraft (e.g., temporary cargo operations during the pandemic) and undertaking corporate charter flights and business- customized flights. Financial and data services mean exploring potential growth points such as aviation finance (e.g., aircraft leasing) and customer travel data analysis and monetization.

Diversified revenue has improved Spring Airlines' ability to resist cyclical risks and helped Spring Airlines survive the economic downturn. It is conducive to improving customer stickiness and retaining customer groups; optimize profit structure and diversify risks; promote asset-light expansion and expand market share with low capital.

5. Spring Airlines' profit strategy: policy support

Through reading the relevant materials, there are three main types of government policies: pandemic-related subsidies, tax incentives, and local government support.

Pandemic-related subsidies mean that from 2020 to 2022, Spring Airlines received hundreds of millions of RMB in government subsidies for operating international routes (e.g., Shanghai to Japan/Southeast Asia). Tax reductions and employment stabilization funds saved tens of millions of RMB. Tax incentives mean that under the 2020 tax policy, Spring Airlines saved approximately 120 million RMB from VAT exemptions for public transport services. Import tax waivers for aircraft over 25 tons also reduced costs by hundreds of millions. Local government support: Local governments collaborated with Spring Airlines to boost regional economies. For example, Hebei Province subsidized the “Shijiazhuang-Seoul” route (2021), and tourism cities like Zhangjiajie provided off-season flight subsidies.

6. Challenges faced by Spring Airlines

6.1. Uneven recovery of international routes and pressure to match supply and demand

Despite the government's push to return international flights to more than 90% of pre-pandemic levels, Spring Airlines' international flight recovery has been unevenly regional. For example, the Japan-South Korea route has recovered rapidly (the capacity of the South Korean route has exceeded the 2019 level), while the Southeast Asia route has recovered slowly, resulting in a phased mismatch between capacity delivery and market demand, especially in the off-season [8, 9].

The slow recovery of international long-haul routes (such as China-US routes) has led to low utilization of wide-body aircraft, which has increased operating costs and become one of the reasons for the losses of some airlines [9].

6.2. Volume-price equilibrium and the dominance of price-sensitive markets

The proportion of price-sensitive passengers who travel at their own expense has increased significantly, and such passengers are highly sensitive to fares, and the civil aviation industry is facing the dilemma of "Wang Ding is not prosperous." How to find a balance between government price control policies (such as regulating the sale of low-cost tickets) and market demand has become a key problem [9].

The expansion of the high-speed rail network (such as the "eight vertical and eight horizontal" connections) has a substitution effect on short-haul routes, especially the business express market, further compressing the profit margins of airlines.

6.3. Supply chain and capacity expansion constraints

Due to supply chain issues in the global aviation manufacturing industry, Spring Airlines has seen a decline in the number of aircraft introduced in recent years, which may affect future capacity expansion plans. While some of the pressure has been alleviated by optimizing the route network and improving aircraft utilization, supply chain recovery will still be relied upon in the long term [8].

The rapid recovery of international routes has led to a surge in pilot demand, and although the shortage of captains has been gradually alleviated through the promotion of first officers, there are still challenges in matching manpower in the short term [8].

6.4. Difficulties in the implementation of inbound tourism service facilities and policies

Despite the government's expansion of visa-free policies (e.g., a 60% increase in sales on Spring Airlines' related routes driven by visa-free travel to Japan and South Korea), inbound tourists still face problems such as inconvenient payment (such as restrictions on the use of foreign credit cards) and insufficient public facilities (such as a low proportion of toilets), which limit the experience and consumption potential of international travelers [9].

For example, although the "integration of two networks" of air and rail has been recommended to be included in the national plan, in local practice, there is still a separation phenomenon in the coordinated construction of high-speed rail stations and airports, which affects the efficiency of multimodal transport [9].

6.5. Grassroots challenges in the implementation of private economic policies

Although the legislative process of the "Private Economy Promotion Law" has accelerated, Wang Yu pointed out that the effect of policy implementation depends on the implementation at the grassroots level. In some areas, there are still hidden barriers (such as non-standard approvals and market access restrictions), and it is necessary to promote the implementation of policies through social supervision mechanisms [9].

The problems of financing difficulties, expensive financing, and account arrears of private enterprises have not been fully resolved, which may affect Spring Airlines' liquidity during the expansion period.

6.6. Continued investment pressure on technology and service innovation

Spring Airlines' investment in AI customer service, intelligent scheduling, and other fields needs to be supported by continuous funding while balancing the cost-effectiveness of technology applications.

Differentiated Service Disputes

Although ancillary businesses such as paid seat selection are in line with the concept of "pay-as-you-go", it is necessary to clarify the boundaries at the legal level to avoid consumer disputes [8].

6.7. Midwest construction

In recent years, the central and western regions have developed rapidly, but inconvenient transportation is still one of the important factors restricting the development of the central and western regions. The density of airports in the central and western regions is small, and it is still necessary to expand the development of the company's aviation industry in the region [10].

7. Conclusion

Spring Airlines’ pandemic-era profitability demonstrates the effectiveness of integrating cost leadership, revenue diversification, and policy alignment. The airline’s low-cost model, characterized by operational efficiency and high asset utilization, provided a foundation for resilience. Diversified income streams, particularly ancillary services and cargo operations, mitigated revenue volatility, while government subsidies stabilized cash flow during critical periods. These strategies offer broader lessons for the aviation industry. First, LCCs must prioritize technological adoption, such as direct e-commerce platforms, to reduce distribution costs. Second, ancillary revenue models should be expanded beyond traditional offerings—for example, leveraging big data for personalized services. Third, collaboration with governments remains essential, particularly in emerging markets where infrastructure and regulatory frameworks are evolving.

This study’s limitations include its focus on a single airline and the exclusion of competitive analysis tools like Porter’s Five Forces. Future research could explore cross-country comparisons of LCC strategies or assess long-term impacts of ESG initiatives on profitability. Nonetheless, Spring Airlines’ case underscores the viability of adaptive strategies in navigating global crises, providing a roadmap for industry recovery and sustainable growth. Future research will further examine the issues faced by Spring Airlines in the past. In addition, if Spring Airlines implements an excellent new policy, it is also very valuable for research.

References

[1]. Guan, T.X. (2022).. China Science & Technology Information, SWOT analysis and countermeasure research on the development of Spring Airlines, 4.

[2]. IATA. (2023). Annual Global Airline Industry Statistics. https://www.iata.org/en/publications/annual-review/

[3]. Peng, Y., Feng, K.F., Zhou, G.L. (2022). Analysis of the Impact and Countermeasures of the Novel Coronavirus Epidemic on Chinese Airlines: A Case Study of the Three Major Airlines. Logistics Technology, 15-18.

[4]. Cheng, F., Jiang, L.L. (2023). The Impact of the Russia-Ukraine Conflict on China's Energy Security and High-Quality Development. Oil & Gas & New Energy, 1, 33-39.

[5]. Yang, X. (2024)., Low-cost airline economic strategy analysis. Bohai Rim Economic Outlook, 46-49.

[6]. Southern Huijin. (2018). Spring Airlines: Two Orders, Two Highs and Two Lows Leading Low-Cost Airlines. Stock Market Dynamic Analysis, 49, 18-19.

[7]. Xu, Z.Y., Wang, L. (2024). Analysis of Spring Airlines' Profit Model. Cooperative Economy and Technology, 70-73.

[8]. Southern Metropolis Daily. (2025, March, 9). Chairman of Spring Airlines: It is recommended to introduce social supervision to judge the development policy of the private economy. https://baijiahao.baidu.com/s?id=1825765702318273518

[9]. CNR. (2025, March, 7). Entrepreneurs said | Wang Yu, member of the National Committee of the Chinese People's Political Consultative Conference: Reconstruct the new experience of air travel ecology with AI. https://news.qq.com/rain/a/20250307A0AGHW00

[10]. Song, J., (2024). China Economic Weekly, Wang Yu, member of the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and chairman of Spring Airlines: Airport construction should not be greedy for perfection, and the proportion of investment in the central and western regions should be increased, 110-111.

Cite this article

Chen,J. (2025). Analysis of Spring Airlines' Profitability Strategy. Advances in Economics, Management and Political Sciences,186,147-152.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Guan, T.X. (2022).. China Science & Technology Information, SWOT analysis and countermeasure research on the development of Spring Airlines, 4.

[2]. IATA. (2023). Annual Global Airline Industry Statistics. https://www.iata.org/en/publications/annual-review/

[3]. Peng, Y., Feng, K.F., Zhou, G.L. (2022). Analysis of the Impact and Countermeasures of the Novel Coronavirus Epidemic on Chinese Airlines: A Case Study of the Three Major Airlines. Logistics Technology, 15-18.

[4]. Cheng, F., Jiang, L.L. (2023). The Impact of the Russia-Ukraine Conflict on China's Energy Security and High-Quality Development. Oil & Gas & New Energy, 1, 33-39.

[5]. Yang, X. (2024)., Low-cost airline economic strategy analysis. Bohai Rim Economic Outlook, 46-49.

[6]. Southern Huijin. (2018). Spring Airlines: Two Orders, Two Highs and Two Lows Leading Low-Cost Airlines. Stock Market Dynamic Analysis, 49, 18-19.

[7]. Xu, Z.Y., Wang, L. (2024). Analysis of Spring Airlines' Profit Model. Cooperative Economy and Technology, 70-73.

[8]. Southern Metropolis Daily. (2025, March, 9). Chairman of Spring Airlines: It is recommended to introduce social supervision to judge the development policy of the private economy. https://baijiahao.baidu.com/s?id=1825765702318273518

[9]. CNR. (2025, March, 7). Entrepreneurs said | Wang Yu, member of the National Committee of the Chinese People's Political Consultative Conference: Reconstruct the new experience of air travel ecology with AI. https://news.qq.com/rain/a/20250307A0AGHW00

[10]. Song, J., (2024). China Economic Weekly, Wang Yu, member of the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and chairman of Spring Airlines: Airport construction should not be greedy for perfection, and the proportion of investment in the central and western regions should be increased, 110-111.