1. Introduction

In 1979, Kahneman and Tversky included loss aversion into prospect theory, a fundamental concept in behavioral economics. The concept posits that individuals exhibit a more pronounced response to losses than to gains, which has extensive implications across various disciplines [1]. In particular, loss aversion can lead to irrational decisions, where investors may hold onto losing investments in an attempt to avoid realizing current losses, hoping for greater future gains. This reflects the impact of loss aversion on decision-making biases [2]. In recent years, loss aversion research has focused on its use in financial decision-making, marketing, and policy-making. Despite a significant body of literature, gaps remain in the field. Therefore, the paper intends to describe and critique the research advancements in loss aversion across several domains, while thoroughly analyzing its efficacy and underlying mechanisms in finance, consumer behavior, and policy formulation. Through an analysis of the existing literature, it explores the theoretical basis of loss aversion, main influencing factors and application prospects. In addition, this paper analyzes the limitations in the current research and propose directions for future research, especially in the under-explored areas such as the interaction between loss aversion and other cognitive biases, the role of individual differences, as well as the moderating effect of cultural factors. As such, this paper may contribute to the development of strategies to reduce the negative effects of loss aversion, enabling more rational decision-making in various situations.

2. Overview of loss aversion bias and heuristics

2.1. Loss aversion and decision-making behavior

Loss aversion influences decision-making behavior. For example, most individuals would select the guaranteed $750 rather than an 80% chance of winning $1,000. Similarly, when confronted with the alternative of an 80% likelihood of losing $1,000 most individuals tend to select the former. In addition, research demonstrated that the motivation to avoid loss typically outweighs the motivation to gain. For example, many people buy a new movie ticket after losing one, especially if they think the loss is equal to the ticket price rather than just to enjoy the movie [3]. This shows that emotional responses to losses often outweigh rational assessments of equivalent gains.

2.2. Theoretical extensions of loss aversion and investment behavior

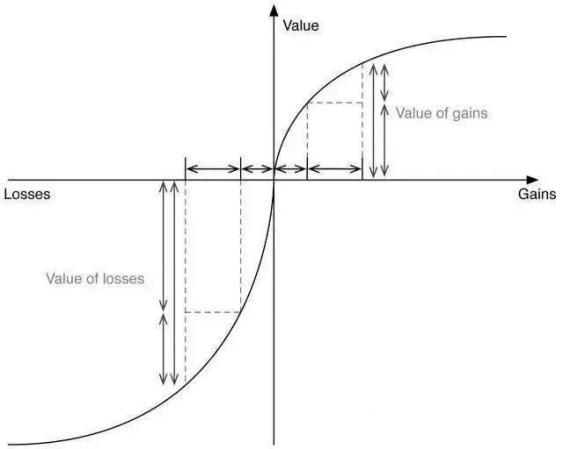

Loss aversion, a central concept in Kahneman and Tversky’s prospect theory, is usually interpreted as the pain from losses being more intense than the pleasure from equivalent gains. This asymmetry in affective responses helps to explain economic decisions, especially investment behavior. In investment decisions, loss aversion implies that investors are more concerned with avoiding losses than pursuing gains, and this psychology affects their risk preferences. Indeed, Benartzi and Thaler applied the loss aversion theory to the equity premium problem, explaining why stocks have higher returns than other less risky assets [4]. They further suggest that due to loss aversion, investors need higher returns from risky assets to compensate for the psychological pain associated with losses. In addition, Barberis showed that investors demand higher returns from risky investments because the discomfort associated with losses outweighs the satisfaction associated with gains, thus they prefer predictable, low-risk assets such as bonds [5]. Berkelaar, Kouwenberg, and Post further examine the portfolio strategies of loss averse investors and reveal how these investors choose to avoid stocks despite their higher returns [6]. And Argen relaxes the assumptions about the distribution of returns and finds evidence to support that loss aversion explains the evidence for the equity premium problem [7]. These studies generally show that loss aversion does play an important role in investor behavior, leading them to adopt more conservative investment strategies [1]. As shown in Figure 1, the degree of loss aversion rises with increasing losses, exacerbating investors' risk-averse behavior.

The asymmetry of the utility function also implies an amplification effect of the loss, or an enhancement of the negative effect. This effect helps to explain why individuals are more inclined to adopt conservative decision strategies when faced with potential losses. Prospect theory links utility function asymmetry to choice weights. Decision makers “distort” probabilities to align with their subjective perceptions; decision weights embody this distortion. Low-probability loss events are assigned greater significance, rendering their consequences more critical in decision-making. The phenomenon of loss aversion can be quantitatively defined by the second-order derivative of the utility function. When the utility function U(x) < 0, it indicates that the individual exhibits loss averse behavior, as noted by Barberis [5].

2.3. The psychological mechanisms of loss aversion and market performance

Loss aversion is a psychological mechanism that involves multiple cognitive and affective factors. Research has shown that loss aversion is associated with neural activity in the prefrontal cortex of the brain, and that activity in this region increases significantly when individuals compare possible loss options [8]. Loss aversion largely explains why people feel strongly bad when they lose, which can lead to conservative or foolish financial actions, supporting the asymmetry of the risk aversion utility function, i.e., when people exhibit risk aversion when making gains and tend to take risks when facing losses. This variation in risk perception is closely related to the shape of the utility function. In addition, loss aversion is associated with asymmetries in market volatility, i.e., stocks are more volatile when the market is falling and less volatile when it is rising. Loss aversion helps explain why people make irrational decisions in the face of losses and why they tend to use psychological heuristics. Loss aversion not only affects individual decisions, but has a significant impact on market performance. It is closely related to market outcomes such as asset prices, trading volume and information efficiency, especially in the context of information asymmetry. Moreover, loss aversion has become a central component of behavioral asset pricing theory. Behavioral asset pricing theory has reconstructed the traditional capital asset pricing model by introducing behavioral characteristics such as wealth preference, habit formation, loss aversion, and envy to form a more complete behavioral asset pricing model. These models provide a more detailed explanation of financial market activities, including phenomena such as asset pricing [9].

3. Applications of loss aversion in various domains

3.1. The application of loss aversion in the financial field

Loss aversion significantly influences investor behavior in financial markets. Research has shown that investors exhibit strong risk aversion in the face of losses and a tendency to take risks in the face of gains. And this is particularly evident among retail investors, who typically delay closing positions in the face of losses and sell prematurely in the face of profits. This behavior stems from the psychology of avoiding realizing losses and expecting prices to recover, but this strategy often fails due to imbalanced risk-return ratios and high opportunity costs [10].

In addition, it has been found that individual variables such as gender, age, and marital status are closely related to the level of loss aversion and risk aversion and affect them in different directions. Investors with different levels of loss aversion adopt different investment strategies when asset risk rises. Investors with lower loss aversion tend to reduce their investments in risky assets, while investors with higher loss aversion may tend to increase their investments in risky assets. Many investors tend to hold on to their investments for long periods of time in the face of floating losses, while looking to exit as early as possible in the face of profits. This behavior often leads to a mismatch between risk and return. For example, an investor may take on the risk of a loss of more than 50%, while may end up with a return of only 10%, a behavior that can be fatal to the investor. This is one of the reasons why bull markets usually have greater trading volumes than bear markets. Studies found that an individual's gender, age, marital status, and other variables are strongly connected to the degree of loss aversion and risk aversion, with various directions of effect. Individual investors with varying levels of loss aversion will have different investment strategies

when asset risk rises. Those with low loss aversion will invest less in risky assets, while those with high loss aversion will invest more in them.

In unleveraged markets (e.g., 100% funded stock purchases), waiting for the price to rally above the purchase price is understandable in some cases. However, in highly leveraged margined trades, such as futures or short selling options, choosing not to close a position and wait for the price to recover can lead to disastrous consequences. Even though the price may recover, if the position is not stopped out in time, the investor may be forced to close the position due to insufficient margin. To make matters worse, many retail investors tend to add to their positions when prices move against the trend in an attempt to break even by lowering their average cost. The main risk of this strategy is that risk accumulates gradually as positions are added, and small initial mistakes can turn into fatal decisions as positions continue to be added, especially when stock prices continue to fall. This behavior is common in the final trades of many failed retail investors [11].

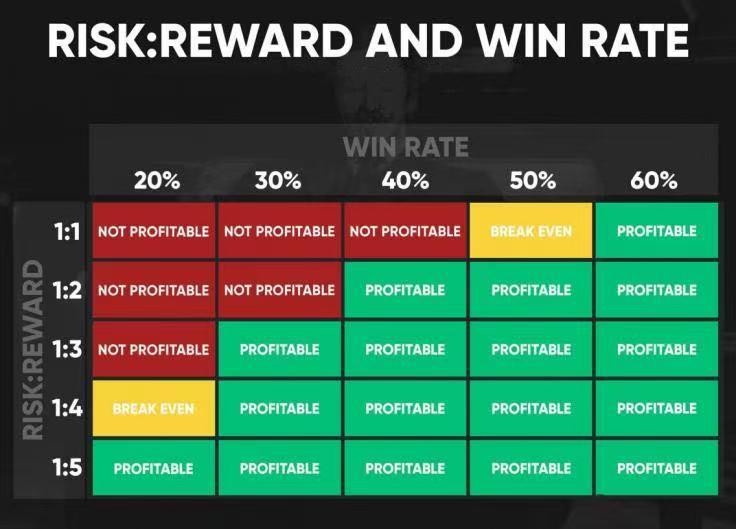

In financial trading, the win rate and the risk-reward ratio are two key factors that govern each other. Increasing the win rate may lower the P/L ratio, while pursuing a higher P/L ratio may result in a lower win rate, as shown in Figure 2. Trading strategy value depends on win rate and breakeven ratio, which indicate long-term profitability. Different strategies balance the two according to their characteristics. For example, trend-following strategies usually accept a lower win rate in exchange for a higher P/L ratio. However, loss aversion causes retail investors to exhibit low win rates and suboptimal risk-reward ratios. When faced with floating losses, investors often delay closing or adding to positions in the hope of avoiding realizing losses. This action leads to a lower profit-loss ratio and a higher risk-return ratio [12]. The act of adding to a position exacerbates the risk because the potential profit is weak and the downside risk is unlimited. Therefore, floating losses indicate that the trade has a low win rate and the strategy has a low probability of success. To avoid the negative effects of loss aversion, investors should stop their losses in time and not add to their positions. Successful traders avoid making irrational decisions due to loss aversion by increasing their win rate and selecting opportunities to trade with a high risk-reward ratio.

3.2. The application of loss aversion in business and marketing

Loss aversion can be a significant determinant of consumer behavior, especially in how consumers evaluate marketing strategies. For instance, research shows that, given symmetric gains, potential losses are valued much more highly by customers. This psychological bias leads consumers to be more eager to avoid a loss than to receive a reward. Marketers can leverage this tendency by presenting offers that highlight potential losses for the customer rather than potential gains.

A common and effective marketing tactic that exploits loss aversion is the use of time-limited offers. And strategies like “Today Only” promotions or flash sales create urgency and tap into the consumer’s fear of missing out. This urgency compels customers to act swiftly to prevent missing a finite opportunity. Events such as Double Eleven Sales or Black Friday promotions use this method to elicit significant consumer engagement by offering a restricted time-frame to obtain discounts. The barter strategy also utilizes the principle of loss aversion. By providing trade-in options for obsolete products, corporations facilitate the relinquishment of these items by consumers, thereby mitigating their perceived loss and consequently enhancing the probability of new acquisitions. This method is prevalent in the electronics and automobile sectors.

In addition, in the beauty industry, loss aversion is also exploited by emphasizing the fear of losing one’s youth or appearance. Advertisements often focus on maintaining or restoring beauty, making consumers feel that the loss of these qualities is a huge threat, which creates an emotional drive to purchase products that promise to preserve or enhance appearance. Similarly, strategies such as “free shipping” or “buy one get one free” reduce consumer sensitivity to additional costs by reducing the psychological burden of additional costs, even though they are included in the price of the product. Thus, it is found that loss aversion is used to manipulate consumer decision-making by highlighting the psychological discomfort of losses and making them feel that taking action now will prevent those losses. This approach drives consumer behavior, increasing the likelihood of purchase and promoting brand loyalty.

3.3. The application of loss aversion in policy making and management

Loss aversion is a fundamental element in policy-making, as it profoundly affects public reactions to policy alterations. Such peculiarities should also consider how individuals tend to exaggerate future costs relative to equivalent advantages. For example, when new policies are publicized, highlighting the potential issues arising from the non-adoption of these measures is one of the most effective methods of engaging the public, often through narratives concerning environmental or economic damage. This pertains to the loss aversion principle, wherein individuals are inclined to take action to avert unfavorable outcomes as they recognize the consequences of inaction.

At the policy level, there is a loss aversion in the decision between the options. For instance, while in the process of pushing through his proposed alterations, the policymakers may opt to take safer strategies that are less risky bearing in mind the fact that people are always likely to backlash were the changes to fail. Yet, it restricts the potential impact of the policy. It is essential to establish policies that incorporate measures reducing perceived risk for both the public and implementers, with clear, specified objectives to ensure maximum efficacy.

In addition, loss aversion can be an equally important tool for developing incentives in business management. Managers may implement a blend of rewards and penalties within the performance appraisal and incentive framework to encourage staff to avert losses. For example, setting up penalties for low-performing employees and giving rewards for good performance is a way to motivate employees to pay more attention to improving work efficiency and reducing inefficient behaviors by linking errors to losses. At the same time, by setting a higher cost of error, employees will be more vigilant in their day-to-day work and avoid making mistakes, which in turn improves overall performance and team productivity.

4. Conclusion

Loss panic plays a key role in individual decision-making, especially in finance, consumer behavior and policy making. Studies have shown that people's psychological reactions to losses are much stronger than those to equivalent price gains, and this unfairness leads to risk-averse behavior under loss of gains and risk-seeking behavior under loss of losses. In investment decisions, disaster epidemics often lead investors to insist on making up for investment or loss of losses and make irrational decisions. At the same time, the principle of disaster epidemics has been widely evaluated in marketing and policy design, emphasizing potential losses to stimulate the purchasing power of consumers and investors. Many research focus on the behavioral manifestations of disaster deaths, but few investigate their brain underpinnings and cognitive repercussions, focusing on individual differences. Future study should focus on identifying the brain mechanisms behind loss aversion and determining how to mitigate its detrimental impact on decision-making, particularly in financial and policy decisions. Furthermore, more research into policy should still be done on how to make effective intervention measures based on the traits of different groups in order to cut down on costs and cause people to act irrationally.

References

[1]. Kahneman, D. and Tversky, A. (2013) Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I, 99-127.

[2]. Hopfensitz, A. and Wranik, T. (2008) Psychological and environmental determinants of myopic loss aversion.

[3]. Shleifer, A. (2012) Psychologists at the gate: a review of Daniel Kahneman’s thinking, fast and slow. Journal of Economic Literature, 50(4), 1080-1091.

[4]. BenartzI, S. and Thaler, R. H. (1995) Myopic loss aversion and the equity. The Quarterly Journal of Economics, 110(1): 73-92.

[5]. Barberis, N. C. (2013) Thirty years of prospect theory in economics: A review and assessment. Journal of economic perspectives, 27(1): 173-196.

[6]. Berkelaar, A. B. , Kouwenberg, R. and Post, T. (2004) Optimal portfolio choice under loss aversion. Review of Economics and Statistics, 86(4): 973-987.

[7]. Ågren, M. (2005) Myopic loss aversion, the equity premium puzzle, and GARCH.

[8]. Genauck, A. , et al. (2017) Reduced loss aversion in pathological gambling and alcohol dependence is associated with differential alterations in amygdala and prefrontal functioning. Scientific reports, 7(1): 16306.

[9]. Grüne, L. and Semmler, W. (2008) Asset pricing with loss aversion. Journal of Economic Dynamics and Control, 32(10): 3253-3274.

[10]. Haigh, M. S. and List, J. A. (2005) Do professional traders exhibit myopic loss aversion? An experimental analysis. The Journal of Finance, 60(1): 523-534.

[11]. Nam, J. , Wang, J. and Zhang, G. (2008) Strategic trading against retail investors with loss-aversion. International Review of Economics & Finance, 17(1): 45-55.

[12]. Sokol-Hessner, P. , et al. (2009). Thinking like a trader selectively reduces individuals' loss aversion. Proceedings of the National Academy of Sciences, 106(13): 5035-5040.

Cite this article

Wang,W. (2025). Loss Aversion and Its Behavioral Implications in Economics and Market Strategies. Advances in Economics, Management and Political Sciences,195,185-191.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kahneman, D. and Tversky, A. (2013) Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I, 99-127.

[2]. Hopfensitz, A. and Wranik, T. (2008) Psychological and environmental determinants of myopic loss aversion.

[3]. Shleifer, A. (2012) Psychologists at the gate: a review of Daniel Kahneman’s thinking, fast and slow. Journal of Economic Literature, 50(4), 1080-1091.

[4]. BenartzI, S. and Thaler, R. H. (1995) Myopic loss aversion and the equity. The Quarterly Journal of Economics, 110(1): 73-92.

[5]. Barberis, N. C. (2013) Thirty years of prospect theory in economics: A review and assessment. Journal of economic perspectives, 27(1): 173-196.

[6]. Berkelaar, A. B. , Kouwenberg, R. and Post, T. (2004) Optimal portfolio choice under loss aversion. Review of Economics and Statistics, 86(4): 973-987.

[7]. Ågren, M. (2005) Myopic loss aversion, the equity premium puzzle, and GARCH.

[8]. Genauck, A. , et al. (2017) Reduced loss aversion in pathological gambling and alcohol dependence is associated with differential alterations in amygdala and prefrontal functioning. Scientific reports, 7(1): 16306.

[9]. Grüne, L. and Semmler, W. (2008) Asset pricing with loss aversion. Journal of Economic Dynamics and Control, 32(10): 3253-3274.

[10]. Haigh, M. S. and List, J. A. (2005) Do professional traders exhibit myopic loss aversion? An experimental analysis. The Journal of Finance, 60(1): 523-534.

[11]. Nam, J. , Wang, J. and Zhang, G. (2008) Strategic trading against retail investors with loss-aversion. International Review of Economics & Finance, 17(1): 45-55.

[12]. Sokol-Hessner, P. , et al. (2009). Thinking like a trader selectively reduces individuals' loss aversion. Proceedings of the National Academy of Sciences, 106(13): 5035-5040.