1. Introduction

1.1. Topic

This paper will analyze Chanel in the competitive luxury market and make the strategy of co-branding. In the luxury cosmetics market developing rapidly, co-branding has been a really powerful strategy to improve brand recognition and expand various segmentations of a brand [1]. As the leader in the fashion and beauty industry, Chanel is always the representation of elegance, delicacy and luxury, which play a significant role in the cosmetics market through some peering strategies such as the establishment of some unexpected partnerships. Even so, Chanel’s cosmetics are facing some challenges in the Chinese consumption market. For example, the ascent of the domestic brand possesses cultural resonance and the transformation of consumers’ preferences because young consumers in China gradually cherish the personalized and innovative sensation that forms some conflicts with the brand image of Chanel.

1.2. Literature review

This strategy remains relevant in the competitive market for luxury brands, abstracting traditional consumers and new, young consumption groups [2]. The concept of co-branding about the type of non-traditional partners can enhance interest, promote product differentiation, and boost brand equity [3]. The partnership between Chanel Cosmetics and LEGO represents an intriguing fusion of high fashion and playful, creative design. The attraction increased by this collaboration introduces its products to new consumption groups while it reinforcing to design more innovative legacy [4]. The potential for Chanel and Lego to work together in the Chinese market is particularly high, as it aligns with local consumers' preference for exclusive limited edition products that offer personality and a sense of status [5].

This paper involves seven sections: Introduction, Methodology, qualitative analysis, feasibility, specific plan, risks and conclusion of the collaboration between Chanel Cosmetics and LEGO.

2. Methodology

2.1. Value positioning

The core brand values of Chanel are elegance, simplicity, and timelessness. Chanel is known for high-end products with superior materials and superb techniques, with this type of luxury positioning symbolizing humans’ status and elegance. Meanwhile, the uniqueness boosts its allure. Limited editions and rare designs create a sense of scarcity and desirability. Furthermore, the perpetual elegance of the designs of Chanel’s products is not restricted by updated trends, which can be used in the long term and provides customers with a sense of stability and eternity. In addition, Chanel has a rich heritage and tradition that goes back more than a century. Chanel is conserving the traditions while innovating for products, granting a sense of reality and credibility. Since they represent the link with the past and the continuation of eternal heritage, among these, uniqueness, value preservation, high quality and hereditary nature coincide with LEGO’s brand concepts.

2.2. The sales of Chanel

The sales of Chanel cosmetics in China are considerable. Chanel, as a leading brand, benefited from the strong demand for luxury beauty products from consumers. After 2023 year, the Chinese consumers have had a strong identity for those products with high quality, unique designs and long history [6]. Through the constant innovation of products, Chanel unceasingly extends its consumer groups, which is no longer only a luxurious image but a more playful image suitable for younger customers.

2.3. Segmentation

|

20-30 |

30-40 |

40-50 |

|

|

Income Range |

10,000rmb per month |

40,000rmb per month |

Over 30,000rmb per month |

|

Geographical distributions |

First- and second-tier cities in China(more opportunities to be exposed to these luxury cosmetics ) |

First- and second-tier cities in China(the needs from formal events such as meetings or banquet) |

First- and second-tier cities in China(a habit of those who have high demands on themselves and are extremely refined) |

|

Behavior |

This age group usually have relatively young skins, being in good conditions and more elastic. |

This age group more need skin care products, compared with the younger group. |

The skin begins to show relatively obvious aging phenomena such as wrinkles, sagging and pigmentation. |

|

Purpose |

Thus they would be more inclined to purchase more makeup category, such as lipsticks, eye shadow, powder compact, and a few basic skin care products. |

However, they always have a higher social status, so they also possess some basic make-up products adorn themselves, whether the foundation or the powder compact. |

They need more professional and potent repair and maintenance skin care products, like toner, moisturizing lotion. serum and so on. |

|

5-15 |

25-35 |

Over 45 |

|

|

Income range |

15,000rmb per month from their parents |

25,000rmb per month |

30,000rmb per month |

|

Geographical distributions |

First- and second-tier cities in China |

First- and second-tier cities in China |

First- and second-tier cities in China |

|

Behaviors |

This age group is suitable for fostering the imagination and creativity. |

Their independent incomes can support demands for products are more various and posses higher collecting value. |

Under normal circumstances, they have lost interest in toys. However, they now have some younger relatives. |

|

Purpose |

Deeply understand the meaning of architecture’s art and designs |

Emphasize the quality, collecting value and emotional connection of products, and the complex and high-end sets |

Emphasize the security and interests of products that are suitable for early children, which can have some parent-child interaction |

Tables 1 & 2 above present the coincidence between Chanel’s and LEGO’s consumers in the age group of approximately 25-35 years old; meanwhile, this group’s consumers are the main force possessing trendy aesthetics and the passion of challenging bravely of Chanel’s clientele with the hobby collection. It means that the co-branding between the two brands is a feasible plan and the main clientele is the 25-35 group.

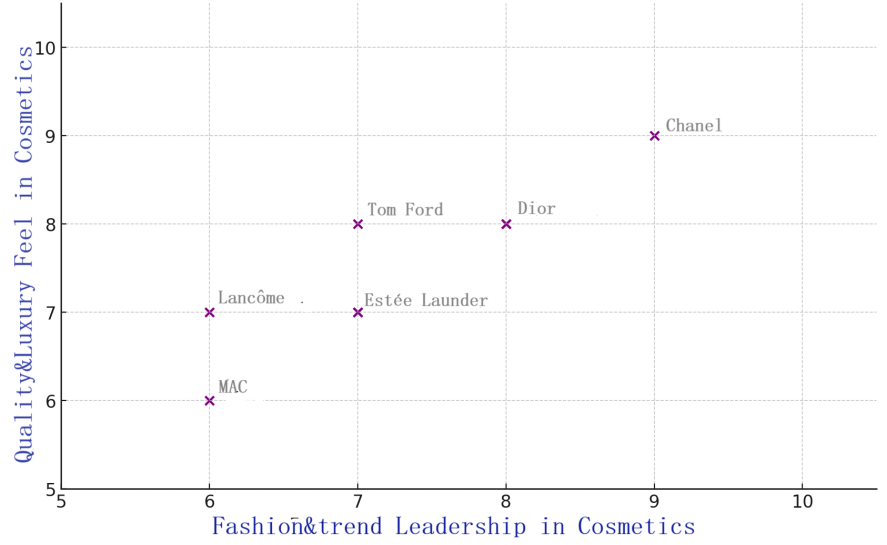

2.4. Perceptual map

As shown in Figure 1, through the Python code, creating a perceptual map for Chanel cosmetics lets the x-axis be the fashion and trend leadership and the y-axis be quality and luxury feel(1=low,10=high). Positioning different cosmetic brands through the two-dimensional space, it can be clearly seen that there are some differences and similarities. Because the meanings of the x-axis and y-axis are the significant factors that are considered by consumers, Chanel can impulse product development and marketing promotion from the two dimensions to boost the brand competitiveness; meanwhile, this map provides an intuitive reference with consumers. Compared with the other brands in this map, we can see that the value of x and y of Chanel is relatively high, which indicates that Chanel not only has high quality and a sense of luxury but also strong fashion and trend leadership. For this reason, it is possible to create the co-branded powder compact series of Chanel and Lego.

2.5. Data analysis

This data analysis surrounds the two aspects, correlation coefficient and regression, to analyze our prospect and the feasibility of this co-branding plan. The source of this set of data is based on the offline questionnaire on three variables of price, durability, and concealing power of the co-branded powder compact series of Chanel and Lego, as well as the powder compacts of Estée Lauder and Givenchy. In this study, each group maintains a single variable.

2.5.1. Correlation coefficient

|

Price |

Buyers |

|

|

Price.1 |

1.000000 |

-0.198949 |

|

Buyers |

-0.198949 |

1.000000 |

|

Price.1 |

Buyers |

|

|

Price.1 |

0,000000 |

0.000053 |

|

Buyers |

0.000053 |

0.000000 |

|

Value.1 |

Buyers |

|

|

Value.1 |

1.000000 |

0.081413 |

|

Buyers |

0.081413 |

1.000000 |

|

Value.1 |

Buyers |

|

|

Value.1 |

0.00000 |

0.10098 |

|

Buyers |

0.10098 |

0.00000 |

|

Variety.1 |

Buyers |

|

|

Value.1 |

1.000000 |

0.100174 |

|

Buyers |

0.100174 |

1.000000 |

|

Variety.1 |

Buyers |

|

|

Variety.1 |

0.000000 |

0.043404 |

|

Buyers |

0.043494 |

0.000000 |

According to the results from the questionnaires, I put these data into Python and gained the analysis of correlation coefficients. Table 3 illustrates the correlation coefficients between different variables, divided into lots of sections. Each section corresponds to a pair of variables (“Price.1”and “Buyers”, “Value.1" and “Buyers”, and “Variety.1” and “Buyers”). In each part, it illustrates the correlation coefficients of the two variables themselves (in the diagonal position, with values all being 1.000000) and the correlation coefficient between them. This group of data indicates the high popularity of Chanel and Lego powder compact co-branded series.

There are three factors:

1) price factor: The correlation coefficient of “Price.1”and “Buyers” is -0.198949; although it is a small value, the negative correlation may not indicate that it is the negative factor leading to popularity. which means that the co-branding powder compact’s value is in the acceptable range of consumers. The high quality and brand value can be sufficient to make up for the higher price.

2) Value factor: The correlation coefficient of “Value1.”and “Buyers” is 0.081413 and 0.100174(There may be some inaccurate expressions in the data. The correlation coefficient of Value.1 appearing in two places is slightly different, but they are all positive correlations), positive correlation means that consumers think this product possess higher value.

3) Type variety factor: The correlation coefficient of “Variety.1”and “Buyers” is 0.100174 and 0.043494; the positive correlation indicates that the variety, such as colors, skin type application range and so on, meets the demands of different consumers.

2.5.2. Regression

|

Dep. Variable: |

Buyers |

P-squared: |

0.049 |

||||

|

Model: |

OLS |

Adj. R-squared: |

0.045 |

||||

|

Method: |

Least Squares |

F-statistic: |

10.45 |

||||

|

Date: |

Fri,09 Aug 2024 |

Prob(F-statistic): |

3.74e-05 |

||||

|

Time: |

09:50:10 |

Log-Likelihood: |

-229.53 |

||||

|

No. Observations: |

407 |

AIC: |

465.1 |

||||

|

Df Residuals: |

404 |

BIC: |

477.1 |

||||

|

Df Model: |

2 |

||||||

|

Covariance Type: |

nonrobust |

||||||

|

coef |

Std err |

t |

P>|t| |

[0.025 0.975] |

|||

|

const |

0.3409 |

0.385 |

0.885 |

0.377 |

-0.417 1.098 |

||

|

Price.1 |

-0.0007 |

0.000 |

-4.080 |

0.000 |

-0.001 -0.000 |

||

|

Variety.1 |

0.0306 |

0.015 |

2.023 |

0.044 |

0.001 0.060 |

||

|

Omnibus: |

66.104 |

Durbin-Watson: |

1.420 |

||||

|

Prob(Omnibus): |

0.000 |

Jarque-Bera(JB): |

84.585 |

||||

|

Skew: |

-1.082 |

Prob(JB): |

4.29e-19 |

||||

|

Kurtosis: |

2.447 |

Cond. No. |

8.86e+03 |

||||

Table 4 shows the result of regression analysis, including the dependent variable (Buyers) and P-valued (0.049) and adopting the OLS model. The R-valued modified is 0.045, and the F-statistic is 10.45, which was analyzed by the least squares method. The number of sample observations is 407, the residual degrees of freedom is 404, the model degrees of freedom is 2, and the covariance type is non-robust. Besides these, there is statistical information such as the Omnibus test value, Durbin-Watson value, Jarque-Bera test value, Skewness, kurtosis and the condition number.

Furthermore, there the regression analysis result:

1) Price.1: the coefficient is -0.0007, t value is -4.080, p>|t| (0.000), it is clear that it is a negative correlation between prices and the number of consumers, which means that the lower price is a factor of popularity.

2) Variety.1: coefficient is 0.0306, t value is 2.023, p>|t| (0.044), it is clear that it is a positive correlation between the variety diversity and the number of consumers, which means different types, styles and features appeal more consumers.

2.5.3. Limitation

Firstly, only a preliminary analysis can be conducted based on these limited data. To gain a more comprehensive understanding of the reasons for its p. The explanatory power of the model is limited. There may be other factors not included in the model that affect the popularity of this powder compact, such as brand image, product quality, advertising, market trends, etc. In addition, some indicators in the data, such as a high condition number (Cond.No. is 8.86e+03), may indicate the presence of multicollinearity or other data issues, which need to be further examined and processed to improve the accuracy of the analysis, further market research and consumer feedback analysis are still needed.

3. Co-branding scheme of the powder compact from Chanel and LEGO

3.1. Concept

Creativity and naughtiness are the synonym of LEGO, elegance, minimalist and eternity is the synonym of Chanel. Therefore, “Forge a fashion that is solely yours” and “YOUTH hold infinite possibilities” as the brand concept of the co-branding powder compact is a flawless integration between the two brands that bring an entirely unexpected experience.

3.2. Features

Based on the brand concept of Lego full of infinite creativity, some movable parts are added. For example, a small amount of concealer is embedded in the upper flip cover of the thickened powder case. The powder puff is improved - the original powder puff is changed into a more elegant black powder puff and a buckle is added on the back (so that it can be transformed into a powder puff of normal size for applying concealer). The original powder compact needs to be added with engraving golden the Hogwarts™ owl shed of the Harry Potter series. This will not conflict with the minimal style of Chanel while improving creativity.

4. Risks

4.1. The difficulty of product integration

It is a serious challenge to successfully integrate two totally different types of products, which needs to give consideration to both functions and aesthetics [7]. If it cannot satisfy the two brands’ criteria and the anticipation of their consumers, they would be weakening brand attraction.

4.2. Market risks

It is tough to promise the degree of acceptance of this type of collaboration in the market, particularly in the luxury field. The excessive co-branding might face the resistance of loyal consumers in Chanel cosmetics.

5. Conclusion

This article demonstrates the Chanel cosmetics market and the feasibility of the co-branding between the series of Chanel powder compacts and LEGO through quantitative analysis and qualitative analysis [8] (segmentation, perceptual map, correlation analysis, regression analysis and so on), indicating that the collaboration with LEGO can help Chanel break the originally serious image and enhance the identity of the young age group [5], and suggesting that the sales method based on limited edition form promote the desire to purchase these co-branding products(the scarcity effect will bring consumption behavior beyond predictions) [9].

References

[1]. Euromonitor International, "Luxury Beauty and Personal Care in China, " Euromonitor International, 2023. Available: https: //www.euromonitor.com/beauty-and-personal-care-in-china/report

[2]. Deloitte, "Global powers of luxury goods 2020: The new age of fashion and luxury, " Deloitte, 2020..Available: https: //www2.deloitte.com/global/en/pages/consumer-business/articles/gx-global-powers-of-luxury-goods.html

[3]. M. A. Alba & J. W. Hutchinson, "Brand Alliances and Consumer Perception of Co-Branding, " Journal of Brand Management, vol. 29, no. 3, pp. 198-215, 2022.

[4]. K. L. Keller, Strategic Brand Management: Building, Measuring, and Managing Brand Equity, 4th ed. Pearson Education, 2013.

[5]. McKinsey & Company, "China luxury report 2022, " McKinsey & Company, 2022. Available: https: //www.mckinsey.com/featured-insights/china/china-luxury-report-2022

[6]. Bain & Company, "Luxury goods worldwide market study, Fall-Winter 2022, " Bain & Company, 2022. Available: https: //www.bain.com/global-luxury-report-2022/

[7]. A. K. Aaker, "The Risks of Co-Branding in Luxury Markets, " Harvard Business Review, 2023. Available: https: //www.euromonitor.com/premium-beauty-and-personal-care-in-china/report

[8]. Bain & Company, "China Luxury Report: Key Trends in Limited Edition and Customization, " Bain & Company, 2023. Available: https: //www.euromonitor.com/personal-luxury-in-china/report

[9]. Deloitte, "Global powers of luxury goods 2020: The new age of fashion and luxury, " Deloitte, 2020. Available: https: //www2.deloitte.com/global/en/pages/consumer-business/articles/gx-global-powers-of-luxury-goods.html

Cite this article

Gao,M. (2025). Chanel’s Cosmetics Market Analysis in China with Its Competing Brands and Its Co-branding Plan with LEGO. Advances in Economics, Management and Political Sciences,213,169-176.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Euromonitor International, "Luxury Beauty and Personal Care in China, " Euromonitor International, 2023. Available: https: //www.euromonitor.com/beauty-and-personal-care-in-china/report

[2]. Deloitte, "Global powers of luxury goods 2020: The new age of fashion and luxury, " Deloitte, 2020..Available: https: //www2.deloitte.com/global/en/pages/consumer-business/articles/gx-global-powers-of-luxury-goods.html

[3]. M. A. Alba & J. W. Hutchinson, "Brand Alliances and Consumer Perception of Co-Branding, " Journal of Brand Management, vol. 29, no. 3, pp. 198-215, 2022.

[4]. K. L. Keller, Strategic Brand Management: Building, Measuring, and Managing Brand Equity, 4th ed. Pearson Education, 2013.

[5]. McKinsey & Company, "China luxury report 2022, " McKinsey & Company, 2022. Available: https: //www.mckinsey.com/featured-insights/china/china-luxury-report-2022

[6]. Bain & Company, "Luxury goods worldwide market study, Fall-Winter 2022, " Bain & Company, 2022. Available: https: //www.bain.com/global-luxury-report-2022/

[7]. A. K. Aaker, "The Risks of Co-Branding in Luxury Markets, " Harvard Business Review, 2023. Available: https: //www.euromonitor.com/premium-beauty-and-personal-care-in-china/report

[8]. Bain & Company, "China Luxury Report: Key Trends in Limited Edition and Customization, " Bain & Company, 2023. Available: https: //www.euromonitor.com/personal-luxury-in-china/report

[9]. Deloitte, "Global powers of luxury goods 2020: The new age of fashion and luxury, " Deloitte, 2020. Available: https: //www2.deloitte.com/global/en/pages/consumer-business/articles/gx-global-powers-of-luxury-goods.html