1. Introduction

Real estate industry is an important component of the Chinese economy, and the three red lines policy published in August 2020 has a significant influence on the industry. This article will discuss why China published such a policy and what impact it has.

The three red lines policy is a limit to the ability of real estate companies to raise money. The main content is for any real estate company, its asset-liability ratio should not exceed 70%, its net debt ratio should not exceed 100% and its cash short-term debt ratio should not less than 1. If all three red lines are touched, no new interest-bearing liabilities are allowed. If two lines are touched, the annual growth rate of debt must not exceed 5%. If only one line is touched, the annual growth rate of debt must not exceed 10% and if none of the three lines has been met, and the annual growth rate of debt can be allowed to 15%.

2. Literature Review

The booming real estate economy has brought decades of rapid development in China, but under the growth a series of problems shown up, such as high house price and weakness in real economy. Policymakers has tried several approaches to deal with it but brought little effect. A stronger and systematically method is needed. The three red lines policy that published in August 2020 in China undoubtly had a huge impact on the real estate industry. A large growing body of literature has focused on the corresponding effects. For example, some papers have suggested that, in the perspective of investment and financing, the new policy leads to tightened financing channels, etc. And we want to talk about some effects on this whole real estate industry such as the future development. According to the "Prefabrication Construction in Residential Building of Vanke Real Estate Company China", the development history of Vanke's prefabrication was reviewed, and the construction technology and design mode of Vanke in the new project were introduced and evaluated. In the end, it is concluded that compared with the traditional methods, the technical effects adopted in the new projects are all remarkable, and there is still a lot of room for development. However, this new technology also has disadvantages. For example, in terms of transportation, some objects may collide during transportation, which may increase the difficulty of installation and the safety of houses.

3. Discussion

This policy has several purposes. The main goal is to cool down the overheated property market and control the house price. The skyrocketing house price is not a new problem in China. The house prices of central areas of Beijing, Shanghai and Shenzhen are estimated to be 150,000, 143,000 and 141,000 yuan per square meter respectively, exceeding New York (106,000), London (102,000) and second only to Hong Kong (214,000) [1]. And the house price to income ratios in the core area of Beijing, Shanghai, Guangzhou and Shenzhen are 67, 56, 37 and 52 respectively, higher than New York's 11, London's 14 and Tokyo's 11. Although the loan interest rates in China are much higher than most of other major economies, with 1 year LPR of 3.7% and 5 years or more LPR of 4.45% in Jun 2022 [2] and most big city has different restrictions on house purchase, this measures proved failed to control house price. And artificially set the upper bound of the price of house was actually meaningless because it is easy to broken by various edge balls. This forced the policymakers to try another way to reach their goal.

Another purpose is to reduce the scale of the real estate industry and free up money for real economy. The real estate sector has grown to unprecedented proportions in China, with the market value of US$62.6 trillion in 2020, significantly larger than the US$33.6 trillion of the US, the US$10.8 trillion of Japan and the US$31.5 trillion of the UK, France and Germany combined. In terms of the ratio of housing market value to GDP, China is 414% in 2020 [3]. When such a huge market is nearing the top, the policymakers should plan for other alternative growth points, which requires resources to be directed to reduce the real estate sector's use of society's overall resources. Secondly, considering a market of such size, the focus is also on how to divert the large annual surpluses. The return of all the money to the real estate market will inevitably result in a constant mutual push-up effect of land prices, house prices and earnings. This mutual push will certainly create a "vicious circle" and some bad signals have already appeared. Act is still not late now to prevent serious consequences.

The final target is to prevent finance crisis and control systematic risk. Nowadays the "high leverage" development model is still being used by many real estate enterprises. For real estate enterprises, high leverage development can achieve booming development; Also, if the debt is large enough, it is safe enough (creditors dare not press for payment). Last two years have already seen many real estate enterprises meeting a funding or liquid crisis. From the director’s perspective, as the financial attributes of the real estate industry have been strengthened in recent years, the operational problems of large real estate enterprises have affected the safety and stability of the financial system. If one large real estate enterprise bankrupted, it may affect a group of banks, creating piles of debt default and even triggering a domino effect. Disaster like the sub-prime crisis in united states has happened before, and now it seems to be necessary to reduce the likelihood of risks by controlling overall debt ratios.

In Second part, we conducted a case study on Vanke real estate company in China and discuss each of the three aspects of how Vanke has risen, the impact of the “three red lines” on the company's stock, and forecasts for future development.

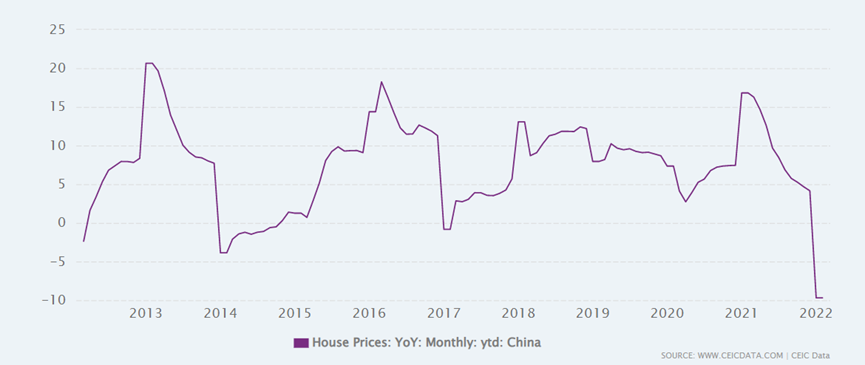

Firstly, for company how to rise, in our opinion there are 2 points: Government policy: four trillion plan and decisions of company leaders. Due to the financial crisis, China's exports rapidly declined from high double-digit growth at the beginning of the year to negative growth in the second half of 2008. And in the first quarter of 2009, industrial production fell, exports turned double-digit negative, energy generation experienced zero growth, a huge number of small and medium-sized export businesses closed, and there was a wave of unemployment in coastal areas. In response the financial crisis, the government launched the “Four trillion” plan, a large amount of investment poured into infrastructure construction, one of these measures is to accelerate the construction of secure housing projects. Support for housing construction has been stepped up to expand the renovation of dangerous houses in rural areas. Thus, real estate ushered in a wave if string growth. The Figure 1 shows the house price growth index in China [4] and we can see that between 2008 and 2014, house prices were basically in a rapid upward phase.

Figure 1: House Price Growth Index in China

At first, the chairman of Vanke was only in the business of reselling corn. He found this opportunity through government policies and used the profits from selling corn to start a real estate business. However, the China house prices began to decline slightly after 2014, at that time, the chairman of Vanke believed that the “golden age” of China real estate had passed, so he began to focus on risk control strategies and let Vanke lose the position of real estate boss [5].

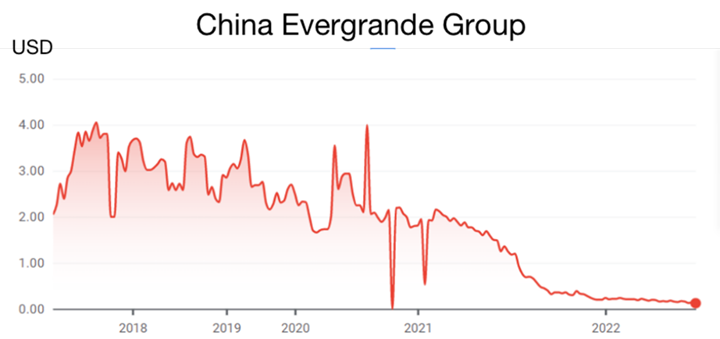

Secondly, during the price decrease period, such as Evergrande group has begun to use the pre-sale method to continue to expand the company scale. The "three red lines" policy has had a significant impact on real estate companies.

Figure 2: China Evergrande Group Stock Changes Yearly.

As required by the policy, Evergrande was put onto the “red file” and had a cash flow crisis, bankruptcy crisis due to the restrictions imposed by the government on loans. As result, from the chart above, the company stock price fell significantly in October 2020 [6].

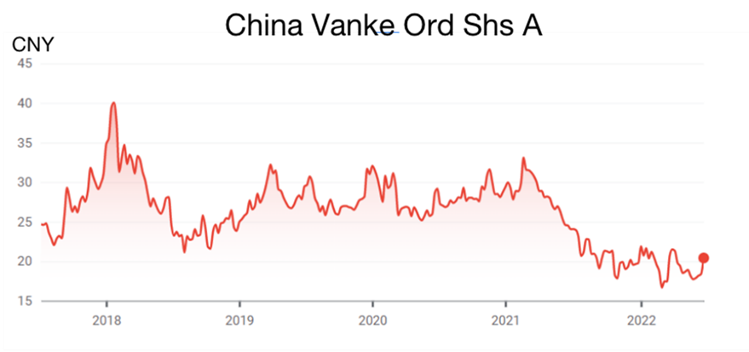

Figure 3: China Vanke Stock Changes Yearly.

For changes in Vanke’s shares, which entered the green file due to its previous development direction, which did not violate the "three red lines"[7]. We could know that the Vanke stock price did not fall after the policy released and even slightly. For the stock decline further down, our opinion is due to the government planning the real estate, which will not make the real estate as highly profitable as before, people are not very positive about the prospects of such companies.

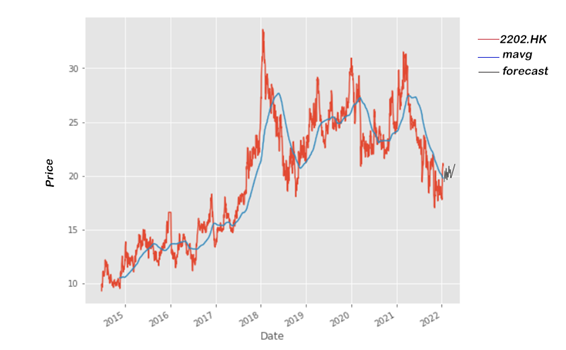

Figure 4: China Vanke Stock (2202.HK) Prediction.

Finally, we would like to analyse the Vanke stock data [7] in python to make two predictions about its future development, the mavg is move average, which helps to reduce the "noise" in the price chart by smoothing out the price data through constant updating of the average price. In addition, the moving average may act as "resistance", representing the downward and upward trend of the stock, from which its future trend can be expected.

Based on the forecasts in the chart above, it is clear that Vanke will rise slightly and then probably stabilise for a while. In our views, Chinese economic development has shifted from high-speed growth to a stage of high-quality development, and the real estate industry also needs to change from scale and speed to quality and efficiency. with development becoming more and more like consumer durable and operation like a service industry. Enterprises can no longer rely on hoarding raw materials and land appreciation to make money, nor can they rely on leveraging to make money. 2. The current sluggish growth of China’s property development business has become an industry trend. However, Vanke as a large company has related businesses in other areas. For example, according to the 2021 annual report released by Vanke, Wanwei Logistics achieved operating revenue of RMB 3.16 billion, an increase of 68.9% year-on-year, of which RMB 2.06 billion was generated from high-standard warehouses [8].

Therefore, Vanke may maintain its “green file” in real estate while actively developing business in other areas to ensure the safety of capital liquidity.

The implementation of the three red lines policy would not only prevent and control the risk in the real estate industry, but also would change the existing industrial structure and development trend. There is no doubt that the three red lines policy would have a profound impact on the future development of the real estate industry.

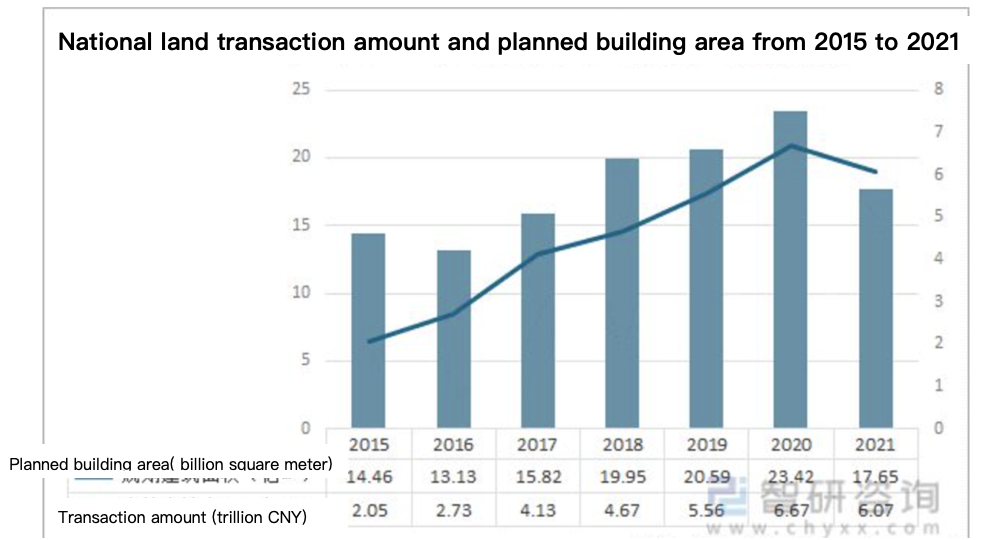

We know that the three red lines policy are financial regulatory guidelines in China introduced in August 2020. So we can first take a look at the data for August 2020 and start with a comparison. In August 2020, the average purchase price of land across the country was approximately 8,687 CNY per square metre and many cities saw an increase of over 10% in the purchase price of land. This is contrary to the national objective of regulating property prices, and real estate companies are over-leveraged. According to information from the National Bureau of Statistics, the liability-to-asset ratio of the real estate industry was approximately 73.6% in 2020, which is far exceeding the reasonable range of 40% to 60% [9].

Figure 5: National land transaction amount and planned building area from 2015 to 2021.

The above diagram [10] is the National land transaction amount and planned building area from 2015 to 2021. The new regulation was proposed in August 2020 and we can see some changes that took place when the new regulations were implemented in 2021. For the first time in almost five years, we can see a decline in both transaction value and square metres. And actually, it decreased a lot. Some people may think about covid: does the pandemic result in this decline? But it was still on the rise even in 2020, when the pandemic was at its worst.

In addition, there are three main impacts on the industry. First of all, The implementation of the "three red lines" will result in a fundamental change in the industry's development trend, and the growth of property companies will slow down. Before the implementation of three red lines policy, the development of real estate enterprises was debt-driven: the larger the scale, the more money they could borrow and the more they could borrow, the faster they could develop; after the implementation of three red lines policy, the industry shifted to profit-driven because the enterprises can not borrow money as before. At the same time, the expansion of the scale of enterprises relies more on the improvement of their operating capacity, and the restricted leverage limits the scale of their future development.

Secondly, it decreases debt to standard. There are three ways to decrease debt: to accelerate sales, reduce land acquisition and other investments, and convert debt relationships to shareholder relationships.

Thirdly, it changes both the sales method and business model. Before the three red lines policy, the more land you buy, the more leverage you can increase. Therefore, the focus of the development of real estate enterprises is to buy more land. After the three red lines policy, they need to care about the liability-to-asset ratio and also the cash-to-short-term debt ratio. Therefore, real estate enterprises would buy as much land as they could sell in the future. Also, because they could not buy any land they want, so they need to judge which land deserves more investment, and which land would be more profitable. So they were more focused on resources such as land and fund before, but now they need to pay more attention to the professional competencies such as research, analysis and judgement skills.

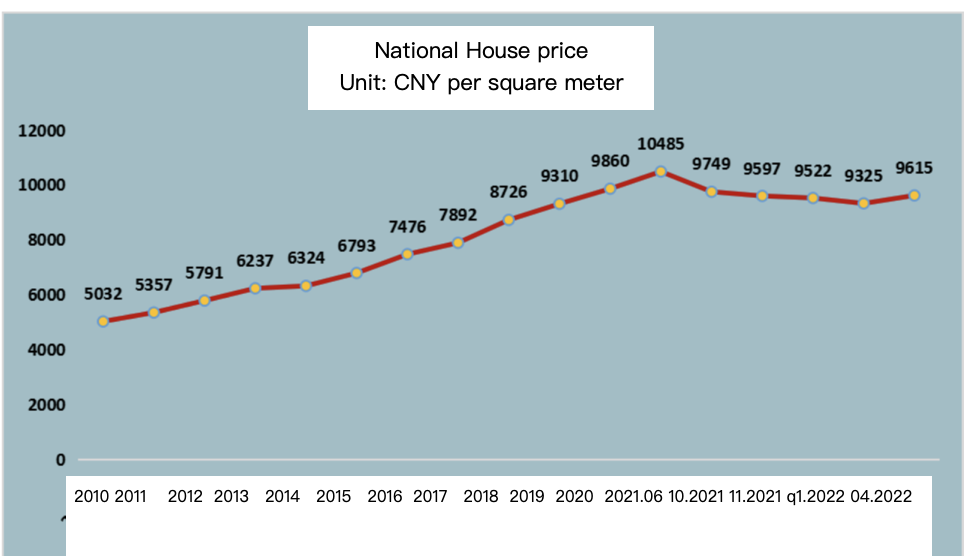

Figure 6: National house price from 2010 to 2022.

For the house price, according to the above diagram [11], there was an obvious decline after June 2021. Although it was not that significant, it was the only decline in the last 10 years. There are some representative phenomena emerged. First of all, the four top-tier cities (Beijing, Shanghai, Guangzhou and Shenzhen) have not been affected. The house prices in Guangzhou and Shenzhen even increased slightly. Then the house prices are falling in most cities. A sample of 70 large and medium-sized cities are collected by the National Bureau of Statistics, which is also a sample of cities across the country, showed that house prices are still falling in most cities, and the number of the cities that have falling house prices are still increasing. The last but not least, house prices in 33 cities are back to at least 3~4 years ago. For example, Mudanjiang, Haerbin….

It has been almost two years since the introduction of the "Three Red Lines" policy, but under the pressure of various regulatory policies, the focus of housing companies has changed significantly. It's not difficult to understand that "safety" and "profit" have been the subject of many performance sessions. The former is an inevitable requirement under supervision, while the latter is a realistic need for the development of real estate enterprises. How to balance the relationship between the two not only tests the adjustment space of real estate enterprises, but also relates to the development potential of the company.

The state of Vanke shows that the entire industry is unspeakably optimistic. In August 2021, Vanke's net profit attributable to its parent was 11.05 billion yuan, a year-on-year decrease of 11.7%. It was the first time in nearly 19 years that interim net profit declined. In the past six months, most listed real estate companies have achieved "downshifts" in accordance with the "three red lines" standard, but they have also paid some costs, such as increasing income but not increasing profits. And even so, during the debt repayment cycle, the risk of the entire industry has not really decreased, and the industry has rarely talked about scale.

In terms of sales, Vanke achieved contracted sales of 354.43 billion yuan, a year-on-year increase of 10.6%. The operating income was 167.11 billion yuan, a year-on-year increase of 14.2%. Under the circumstance that the property market is regulated step by step, the weak scale growth is a common feature of the industry, and the decline in gross profit margin has also become the norm. In the first half of 2021, the gross profit margin of Vanke Real Estate and related businesses was 18.0%, down 6.02 percentage points from the same period in 2020.

4. Conclusion

Most of the diversified businesses of real estate companies belong to "heavy investment and less return", which not only easily puts pressure on the capital chain, but also affects the profit rate and return on assets. However, when traditional businesses are affected, diversification and transformation are essential.

The policy has objectively prompted housing companies to increase their sales efforts and make up for the lack of cash flow through sales receipts. However, the expenditure of enterprises on land acquisition and investment has inevitably been affected. The 21st Century Business Herald found that compared with the end of last year, most real estate companies achieved a "downgrade" in the middle of the year, and the proportion of "green" and "yellow" housing companies also increased.

But overall risk to the industry hasn't really declined. The above-mentioned real estate company said that this year and next are still the debt repayment cycle of real estate, and the financial pressure will continue to exist. At the same time, high-pressure policies will make more and more real estate companies face pressure on the capital chain, and debt defaults and industry mergers and acquisitions may continue to occur frequently. What is certain is that the industry judging standard with scale as the main yardstick is no longer applicable.

Acknowledgement

Chenrui Yang, Xiaojian Zhang, Youzheng Zhu and Yizhuo Sun contributed equally to this work and should be considered co-first authors.

References

[1]. Sina finance (2021), Are house prices high in China's first-tier cities: a global comparison. https://finance.sina.cn/zl/2021-04-22/zl-ikmyaawc1056111.d.html?from=wap.

[2]. The people’s bank of China (2022), National Interbank Offered Rate (NIBOR) Authorized to Publish Loan Market Quotation Rates (LPR) Notice dated 20 June 2022 http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125440/3876551/4580399/index.html.

[3]. Sina finance (2021), Ren Zeping: China Housing Market Value Report 2021 https://finance.sina.cn/zl/2021-10-28/zl-iktzscyy2178849.d.html?vt=4&cid=79615&node_id=79615.

[4]. CEIC Data. (2022) China House Prices Growth.https://www.ceicdata.com/en/indicator/china/house-prices-growth.

[5]. Liu, ZhengYong and Ying, HuiQing (2009) Prefabrication Construction in Residential Building of Vanke Real Estate Company China.https://ieeexplore.ieee.org/abstract/document/5304767.

[6]. Yahoo Finance (2022) China Evergrande Group (EGRNF). https://finance.yahoo.com/quote/EGRNF/history?p=EGRNF.

[7]. Yahoo Finance (2022) China Vanke Co., Ltd shares A(2202.HK). https://finance.yahoo.com/quote/2202.HK/history?p=2202.HK.

[8]. China Vanke Co., Ltd (2021) China Vanke Co.,Ltd Annual Report for 2021. http://static.cninfo.com.cn/finalpage/2022-03-31/1212750450.PDF.

[9]. Dan Song and Qing Bao (2021), The impact of the "three red lines" policy on real estate enterprises and suggested strategies, Time Finance,23: 37-39.

[10]. Wangyi Finance (2022), The analysis of the house price of 2022 https://www.163.com/dy/article/H96K475U52YGNW.html.

[11]. City Finance (2022), The recent change of China’s house price, https://www.sohu.com/a/5581269_120127885

[12]. Finance.sina.com.cn. 2021. Changes in the business behavior of real estate enterprises under the "Three Red Lines" Debt Restriction Policy. [online] Available at: https://finance.sina.com.cn/money/bond/2021-12-22/doc-ikyamrmz0538190.shtml.

[13]. Bloomberg.com. 2020. What China’s Three Red Lines Mean for Property Firms. [online] Available at: https://www.bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake#:~:text=Developers%20wanting%20to%20refinance%20are,equal%20to%20short%2Dterm%20borrowings.

[14]. Chan, D., 2020. China’s ‘three red lines’ policy to safeguard the property sector isn’t working yet – SupChina. [online] SupChina. Available at: https://supchina.com/2022/06/13/chinas-three-red-lines-policy-to-safeguard-the-property-sector-isnt-working-yet/.

Cite this article

Yang,C.;Zhang,X.;Zhu,Y.;Sun,Y. (2023). The Impact of Three Red Lines Policy on China’s Real Estate Industry. Advances in Economics, Management and Political Sciences,7,335-342.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sina finance (2021), Are house prices high in China's first-tier cities: a global comparison. https://finance.sina.cn/zl/2021-04-22/zl-ikmyaawc1056111.d.html?from=wap.

[2]. The people’s bank of China (2022), National Interbank Offered Rate (NIBOR) Authorized to Publish Loan Market Quotation Rates (LPR) Notice dated 20 June 2022 http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125440/3876551/4580399/index.html.

[3]. Sina finance (2021), Ren Zeping: China Housing Market Value Report 2021 https://finance.sina.cn/zl/2021-10-28/zl-iktzscyy2178849.d.html?vt=4&cid=79615&node_id=79615.

[4]. CEIC Data. (2022) China House Prices Growth.https://www.ceicdata.com/en/indicator/china/house-prices-growth.

[5]. Liu, ZhengYong and Ying, HuiQing (2009) Prefabrication Construction in Residential Building of Vanke Real Estate Company China.https://ieeexplore.ieee.org/abstract/document/5304767.

[6]. Yahoo Finance (2022) China Evergrande Group (EGRNF). https://finance.yahoo.com/quote/EGRNF/history?p=EGRNF.

[7]. Yahoo Finance (2022) China Vanke Co., Ltd shares A(2202.HK). https://finance.yahoo.com/quote/2202.HK/history?p=2202.HK.

[8]. China Vanke Co., Ltd (2021) China Vanke Co.,Ltd Annual Report for 2021. http://static.cninfo.com.cn/finalpage/2022-03-31/1212750450.PDF.

[9]. Dan Song and Qing Bao (2021), The impact of the "three red lines" policy on real estate enterprises and suggested strategies, Time Finance,23: 37-39.

[10]. Wangyi Finance (2022), The analysis of the house price of 2022 https://www.163.com/dy/article/H96K475U52YGNW.html.

[11]. City Finance (2022), The recent change of China’s house price, https://www.sohu.com/a/5581269_120127885

[12]. Finance.sina.com.cn. 2021. Changes in the business behavior of real estate enterprises under the "Three Red Lines" Debt Restriction Policy. [online] Available at: https://finance.sina.com.cn/money/bond/2021-12-22/doc-ikyamrmz0538190.shtml.

[13]. Bloomberg.com. 2020. What China’s Three Red Lines Mean for Property Firms. [online] Available at: https://www.bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake#:~:text=Developers%20wanting%20to%20refinance%20are,equal%20to%20short%2Dterm%20borrowings.

[14]. Chan, D., 2020. China’s ‘three red lines’ policy to safeguard the property sector isn’t working yet – SupChina. [online] SupChina. Available at: https://supchina.com/2022/06/13/chinas-three-red-lines-policy-to-safeguard-the-property-sector-isnt-working-yet/.